Bombardier Near Deal to Sell Up to 125 Jetliners to Delta

April 14 2016 - 6:10PM

Dow Jones News

Delta Air Lines Inc. is in the final stages of completing a deal

to acquire up to 125 Bombardier Inc. CSeries jetliners in what

would be a major victory for the struggling Canadian plane maker,

according to three people familiar with the negotiations.

A final agreement for 75 firm orders and options for 50 more is

expected by the end of April, when the carrier's board meets to

review the proposed deal, the people said.

Delta, which released its first-quarter earnings Thursday, is

seeking to replace its aging fleet of single-aisle McDonnell

Douglas MD-88 jets, as it moves to fly some domestic routes with

larger jets.

A Delta spokesman said no final decision has been made. A

Bombardier spokeswoman said it is in discussions with a number of

airlines, and it will disclose deals as they are completed.

The proposed deal would also represent the single largest order

by number of aircraft in 2016. The deal would be worth anywhere

between $5.3 billion and $6.2 billion, depending on the mix of

aircraft purchased, based on list price. A deal of this magnitude

would, however, carry steep price discounts.

A sale would make Delta the largest customer by far for the

Canadian jet, providing it a significant stake in the future of the

program. Delta is a shrewd buyer of aircraft and a deal would be a

potentially a major boost to Bombardier that fortifies the Canadian

plane maker's credibility in its global challenge to Airbus Group

SE and Boeing Co., currently the only manufacturers of large,

single-aisle jets.

The airline has a history of upsetting established jet makers

and providing new entrants a foothold into its fleet. The carrier's

Northwest Airlines predecessor was the first U.S. airline to

purchase Airbus A320 aircraft in 1986.

Ed Bastian, Delta's incoming chief executive, said Thursday that

the company's 2016 capital expenditure guidance remains unchanged.

He said Delta is focusing on a five-year domestic fleet renewal

because "the MD-88s do need to retire and we have roughly 115 of

them current." He said he hoped to have more information when the

company holds an investor meeting in New York on May 16.

Bombardier's foray into the market for single-aisle jets with

100 to 160 seats has left it with a heavy debt load after repeated

delays and technical setbacks. The aircraft will enter service with

Swiss International Air Lines in June, roughly 2½ years after

Bombardier first intended.

In February, Bombardier cut nearly 10% of its global workforce

and reported a fourth-quarter loss of $677 million. Still, the

plane maker has said that it had enough cash over the next tree

years to ramp up production of the CSeries, benefiting from a total

of $2.5 billion it has raised since October after agreeing to sell

almost half its stake in the CSeries jet program to the government

of Quebec, Bombardier's home province, and selling a stake of its

train manufacturing business to a big Quebec pension fund.

Under its new management, Bombardier has sought well-established

airlines to buy its CSeries in a bid to generate commercial

momentum. The plane maker, however, has suffered recent setbacks as

United Continental Holdings Inc. this year ordered

current-generation Boeing 737s.

After about 17 months without a new order, the potential Delta

deal would be Bombardier's second major CSeries sale agreement

since February with a flagship North American carrier. That month,

Air Canada, Canada's biggest airline, agreed to buy as many as 75

of the aircraft. The firm order, for 45 planes, could be worth

about $3.8 billion at list prices. Including options for an

additional 30 jets, the deal would be valued at about $6.4 billion,

Bombardier said, before any discounts.

Bombardier earlier this week added seven more CS300 jets for

Latvian airline Air Baltic, giving it a backlog of 250 firm

orders.

Ben Dummett and Susan Carey contributed to this article.

Write to Jon Ostrower at jon.ostrower@wsj.com and Jacquie McNish

at Jacquie.McNish@wsj.com

(END) Dow Jones Newswires

April 14, 2016 17:55 ET (21:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

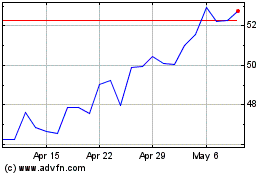

Delta Air Lines (NYSE:DAL)

Historical Stock Chart

From Apr 2024 to May 2024

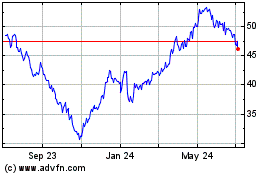

Delta Air Lines (NYSE:DAL)

Historical Stock Chart

From May 2023 to May 2024