UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report

November 9,

2015

(Date of earliest event reported)

Callon Petroleum Company

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-14039 |

|

64-0844345 |

| (State or other jurisdiction of |

|

(Commission File Number) |

|

(I.R.S. Employer |

| incorporation or organization) |

|

|

|

Identification Number) |

200 North Canal St.

Natchez, Mississippi 39120

(Address of principal executive offices, including zip code)

(601) 442-1601

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Section 7 — Regulation FD

Item 7.01. Regulation FD Disclosure.

On November 9, 2015, Callon Petroleum Company (the “Company”) issued a press release announcing that it had launched an

underwritten public offering of 10,000,000 shares of the Company’s common stock.

On November 9, 2015, the Company issued a

press release announcing that it had acquired additional working interests in the Carpe Diem and Casselman-Bohannon fields in the Central Midland Basin.

Copies of the press releases are furnished as Exhibits 99.1 and 99.2 hereto and are incorporated herein by reference. The information set

forth in each of the attached Exhibits 99.1 and 99.2 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing

under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in each such filing.

Section 9 — Financial Statements and Exhibits

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

|

|

|

| Exhibit Number |

|

Title of Document |

|

|

| 99.1 |

|

Press release announcing launch of underwritten public offering dated November 9, 2015. |

|

|

| 99.2 |

|

Press release announcing acquisition dated November 9, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

Callon Petroleum Company

(Registrant) |

|

|

|

|

| November 9, 2015 |

|

|

|

By: |

|

/s/ Joseph C. Gatto, Jr. |

|

|

|

|

Joseph C. Gatto, Jr. |

|

|

|

|

Chief Financial Officer, Senior Vice President and Treasurer |

Exhibit Index

|

|

|

Exhibit

Number |

|

Title of Document |

|

|

| 99.1 |

|

Press release announcing launch of underwritten public offering dated November 9, 2015. |

|

|

| 99.2 |

|

Press release announcing acquisition dated November 9, 2015. |

Exhibit 99.1

Callon Petroleum Company Announces Common Stock Offering

NATCHEZ, Miss., November 9, 2015 — Callon Petroleum Company (NYSE: CPE) (“Callon” or the “Company”) today announced that it has

commenced, subject to market and other conditions, an underwritten public offering of 10,000,000 shares of its common stock. The underwriters will have an option to purchase up to an additional 1,500,000 shares of common stock from the Company.

Proceeds from the offering are expected to be used to repay amounts outstanding under Callon’s credit facility, which were used in part to finance recent acquisitions, with any remainder being used for general corporate purposes, which may

include future acquisitions.

J.P. Morgan and Credit Suisse are acting as joint book-running managers for the offering. The offering will be made only by

means of a preliminary prospectus supplement and the accompanying base prospectus, copies of which may be obtained on the Securities and Exchange Commission’s website at www.sec.gov. Alternatively, the underwriters will arrange to send you the

preliminary prospectus supplement and related base prospectus if you request them by contacting J.P. Morgan Securities LLC, c/o Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood, NY 11717, Attention: Prospectus Department, via

telephone at 866.803.9204, or by e-mailing prospectus-eq_fi@jpmchase.com; or Credit Suisse Securities (USA) LLC, Attention: Prospectus Department, One Madison Avenue, New York, New York 10010, via telephone at 1-800-221-1037, or by e-mailing

newyork.prospectus@credit-suisse.com.

The common stock will be issued and sold pursuant to an effective shelf registration statement on Form S-3

previously filed with the SEC.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy these securities, nor

shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such state or jurisdiction. This offering may

only be made by means of a prospectus supplement and related base prospectus.

About Callon Petroleum Company

Callon is an independent energy company focused on the acquisition, development, exploration, and operation of oil and gas properties in the Permian Basin in

West Texas.

Cautionary Statement Regarding Forward Looking Statements

This news release contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of

the Securities Exchange Act of 1934. All statements, other than historical facts, that address activities that the Company assumes, plans, expects, believes, intends or anticipates (and other similar expressions) will, should or may occur in the

future are forward-looking statements. The forward-looking statements are based on management’s current beliefs, based on currently available information, as to the outcome and timing of future events. These forward-looking statements involve

certain risks and uncertainties that could cause the results to differ materially from those expected by the Company’s management. Information concerning these risks and other factors can be found in the Company’s filings with the

Securities and Exchange Commission, including its Annual Reports on Form 10-K, available on the Company’s website or the SEC’s website at www.sec.gov.

For further information contact:

Joe Gatto

Chief Financial Officer, Senior Vice President and Treasurer

1-800-451-1294

Exhibit 99.2

Callon Petroleum Company Announces Acquisition of Additional Working Interests in Core Fields

Natchez, MS (November 9, 2015)—Callon Petroleum Company (NYSE: CPE) (“Callon” or the “Company”) today announced it has acquired

additional working interests in the Carpe Diem and Casselman-Bohannon fields in the Central Midland Basin for an approximate aggregate price of $29.5 million in cash. The acquisition was funded with borrowings from its revolving credit facility.

Transaction highlights include:

| |

• |

|

Average working interest of approximately 15.24% (12.07% net revenue interest) in the Carpe Diem field (2,586 gross acres), increasing Callon’s working interest to approximately 100.00% (79.19% net revenue

interest) |

| |

• |

|

Average working interest of approximately 3.75% (2.81% net revenue interest) in the Casselman-Bohannon fields (6,238 gross acres), increasing Callon’s working interest to approximately 66.45% (49.83% net revenue

interest) |

| |

• |

|

628 net surface acres, predominantly in Midland and Andrews Counties, Texas |

| |

• |

|

Estimated net daily production of 360 Boe/d (84% oil) for the month of October 2015 |

Following the

Company’s recent operational shift to focus exclusively on the Central Midland Basin, Callon has dedicated both of its two horizontal rigs to this area. The Company plans to direct approximately 80% of its preliminary 2016 operational capital

program to the Carpe Diem and Casselman-Bohannon fields. Callon estimates that the 360 Boe/d of current net daily production acquired will increase at a similar rate as the Company’s preliminary forecast of approximately 20% annual growth in

2016 for total Company production volumes.

“These core fields form the foundation of our current drilling plans and are currently producing from the

Lower Spraberry, Middle Spraberry and Wolfcamp B zones.” stated Fred Callon, Chairman and CEO. “Our investment in additional working interests will immediately contribute to value creation through our drilling plan focused on the Lower

Spraberry in the near-term, with future opportunities in multiple delineated zones.”

About Callon Petroleum Company

Callon is an independent energy company focused on the acquisition, development, exploration, and operation of oil and gas properties in the Permian Basin in

West Texas.

Cautionary Statement Regarding Forward Looking Statements

This news release contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of

the Securities Exchange Act of 1934. Forward-looking statements include all statements regarding reserve quantities, production estimates, planned capital expenditures, the implementation of the Company’s business plans and strategy, as well as

statements including the words “believe,” “expect,” “plans” and words of similar meaning. These statements reflect the Company’s current views with respect to future events and financial performance. No assurances

can be given, however, that these events will occur or that these projections will be achieved, and actual results could differ materially from those projected as a result of certain factors. Some of the factors which could affect our future results

and could cause results to differ materially from those expressed in our forward-looking statements include the Company’s ability to realize the anticipated benefits of the pending acquisition, the forfeiture of our deposit under the

acquisition agreement, the volatility of oil and gas prices, ability to drill and complete wells, operational, regulatory and environment risks, our ability to finance our activities and other risks more fully discussed in our filings with the

Securities and Exchange Commission, including our Annual Reports on Form 10-K, available on our website or the SEC’s website at www.sec.gov.

This

news release is posted on the Company’s website at www.callon.com and will be archived there for subsequent review. It can be accessed from the “News” link on the top of the homepage.

For further information contact:

Joe Gatto

Chief Financial Officer, Senior Vice President and Treasurer

1-800-451-1294

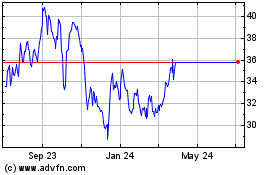

Callon Petroleum (NYSE:CPE)

Historical Stock Chart

From Aug 2024 to Sep 2024

Callon Petroleum (NYSE:CPE)

Historical Stock Chart

From Sep 2023 to Sep 2024