By Ellie Ismailidou and Victor Reklaitis, MarketWatch

Dovish Fed speakers, weak data boost sentiment; market shrugs

off drop in oil prices

U.S. stocks pared sharp opening losses to finish nearly

unchanged on Monday, breaking the weeks-long correlation with oil

prices.

The main indexes briefly turned positive after a late-afternoon

rally, but finished roughly flat, despite a 6% drop in oil .

The S&P 500 closed less than a point lower, or less than

0.1%, at 1,939. The Dow Jones Industrial Average reversed a

160-point loss to close 17.12 points, or 0.1%, lower at 16,449.

Meanwhile, the Nasdaq Composite outperformed other indexes and

ended the day up 6.41 points, or 0.1%, at 4,620.

Wall Street opened deep in negative territory on Monday, with

sentiment hit by renewed declines in oil futures,

(http://www.marketwatch.com/story/oil-sags-on-china-data-production-cut-doubts-2016-02-01)

following a 4.4% gain last week, amid fresh signs of sluggishness

in China's economy

(http://www.marketwatch.com/story/china-manufacturing-numbers-indicate-sluggishness-2016-01-31)and

dimming prospects of a coordinated oil production cut by key

producers.

But sentiment for stocks shifted after weak U.S. manufacturing

data were taken as an indication that the Federal Reserve will hold

off on its plans to raise interest rates later this year.

The stock rally gained steam after Fed Vice Chairman Stanley

Fischer suggested the market's expectations of barely any interest

rate increases this year could turn out to be right

(http://www.marketwatch.com/story/feds-fischer-says-markets-might-be-right-after-all-2016-02-01).

Last month, Fischer was more hawkish, saying that the Fed thought

the market expectations, at the time, for two rate increases in

2016 were "too low."

"[Fischer] has always been on the hawkish side. So the fact that

he made these comments has even more significance for the market,"

said Kent Engelke, chief economic strategist at Capitol Securities

Management. The comments, along with the sluggish manufacturing

data helped "turn the market," Engelke added.

U.S. manufacturing activity contracted for the fourth straight

month

(http://www.marketwatch.com/story/weak-tone-to-manufacturing-report-from-ism-in-january-2016-02-01),

albeit at a slower pace in January than economists' expectations.

The Institute for Supply Management said its manufacturing index

rose to 48.2% in January from 48%, above forecasts but still below

the reading of 50% that signals expansion.

The PCE index, the Fed's preferred inflation gauge, fell 0.1% in

December and 1.4% over the past 12 months, remaining well below the

Fed's 2% target

(http://www.marketwatch.com/story/consumer-spending-goes-nowhere-in-december-2016-02-01).

"The lack of inflationary pressure in the PCE deflator measures

of prices is another reason why the Fed could stand pat in March,"

said Paul Ashworth, chief U.S. economist at Capital Economics, in a

note.

The volatility and mixed reactions following the soft data

showed that "a lot of investors are confused, and understandably

so," said Diane Jaffee, a portfolio manager at TCW.

"We haven't been in a normal-interest-rate environment since the

crisis," Jaffee said. She compared the Fed's stance toward market

volatility to a parent helping a toddler get on his feet. "As the

baby takes steps and stumbles, you don't know whether to rush to

hold them up or let them keep walking."

The market-implied probability of a rate increase in March was

at 14% Monday afternoon, down from 21% late morning, according to

the CME Group's FedWatch tool

(http://www.cmegroup.com/trading/interest-rates/countdown-to-fomc.html)that

tracks Fed-fund futures prices.

Also read:Wall Street sees shrinking likelihood of any rate

increase in 2016

(http://www.marketwatch.com/story/wall-street-sees-shrinking-likelihood-of-any-rate-hike-in-2016-2016-01-29)

The energy sector was the worst performer on the S&P 500

Monday, down 1.9% on the day, followed by financials, down 0.6%.

Energy names were among the worst performers on the Dow

industrials, led by Exxon Mobil Corporation (XOM), which closed

down 1.7%.

Read: A big reason it is too late for OPEC to cut production

(http://www.marketwatch.com/story/a-big-reason-its-too-late-for-opec-to-cut-production-2016-02-01)

Google parent Alphabet Inc. (GOOGL) (GOOGL)reported after the

bell

(http://www.marketwatch.com/story/alphabet-stock-surges-on-huge-google-earnings-beat-2016-02-01).

Investors were awaiting a report from toy maker Mattel (MAT).

Read more: Earnings may lift Google parent Alphabet's market

value above Apple's

(http://www.marketwatch.com/story/alphabet-earnings-could-push-google-parent-past-apple-as-worlds-most-valuable-company-2016-01-29)

Of the 207 companies that have reported so far, 142 have beat

analysts' estimates, which equates to a 69% beat rate, better than

the historic average of 66%, according to S&P Capital IQ. But

aggregate S&P 500 earnings are estimated to fall 5.87%

year-over-year.

On Friday, the S&P 500 gained 2.5%

(http://www.marketwatch.com/story/us-stocks-dow-futures-leap-after-surprise-boj-move-joining-in-global-rally-2016-01-29)

for its biggest daily gain since September, with credit going to a

surprise Bank of Japan stimulus effort. The benchmark added nearly

2% last week, yet finished down 5.1% in January.

Read: Bank of Japan's negative rate decision is a mark of

'desperation'

(http://www.marketwatch.com/story/critics-slam-bank-of-japans-negative-interest-rate-move-2016-01-29)

Other markets:Weak Chinese manufacturing data

(http://www.marketwatch.com/story/china-manufacturing-numbers-indicate-sluggishness-2016-01-31)drove

China's Shanghai Composite down by 1.8%

(http://www.marketwatch.com/story/nikkei-soars-for-second-day-following-negative-rate-cut-2016-01-31).

But Japan's Nikkei closed 2% higher, adding to its 2.8% surge on

Friday when the Bank of Japan surprised investors by pushing

interest rates into negative territory

(http://www.marketwatch.com/story/japan-follows-europe-into-negative-interest-rates-2016-01-29).

The Stoxx Europe 600

(http://www.marketwatch.com/story/european-stocks-start-february-in-the-red-as-manufacturing-data-soften-2016-02-01)

and a key dollar index lost ground, while gold futures gained.

Treasury yields inched higher, coming off a nine-month low.

Individual movers: Shares of Chipotle Mexican Grill, Inc. (CMG)

jumped 4.3% after the Centers for Disease Control and Prevention

said E. coli outbreaks "appear to be over."

(http://www.marketwatch.com/story/cdc-says-e-coli-outbreaks-at-chipotle-are-over-2016-02-01)

Aetna (AET) closed up 1.4% after the health insurer posted

better-than-expected quarterly earnings

(http://www.marketwatch.com/story/aetna-profit-jumps-more-than-forecast-in-fourth-quarter-2016-02-01)

ahead of the opening bell.

Shares in natural-gas company Questar Corp. (STR) jumped 22.5%

following news that utility company Dominion Resources Inc. (D)

plans to buy it for $4.4 billion

(http://www.marketwatch.com/story/dominion-resources-agrees-to-buy-questar-in-44-billion-deal-2016-02-01).

Dominion shares closed down 0.9%.

Economic news: Consumer spending was flat in December as

Americans mostly pocketed their income gains, the Commerce

Department said Monday. Outlays were unchanged even though incomes

rose 0.3%--consumers saved more instead. The savings rate rose to

5.5% from 5.3%, to match a three-year high.

Construction spending rose 0.1% in December

(http://www.marketwatch.com/story/construction-spending-edges-up-01-in-december-2016-02-01),

below the 0.6% gain forecast.

(END) Dow Jones Newswires

February 01, 2016 16:24 ET (21:24 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

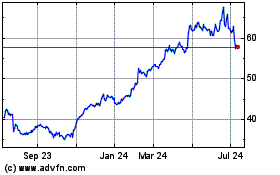

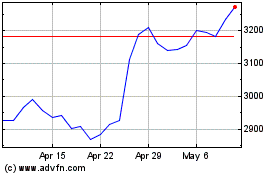

Chipotle Mexican Grill (NYSE:CMG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Chipotle Mexican Grill (NYSE:CMG)

Historical Stock Chart

From Apr 2023 to Apr 2024