Dick's Sporting Goods Seeks Court Approval to Buy Sports Authority Name -- Week Ahead

July 08 2016 - 1:24PM

Dow Jones News

By Katy Stech

Dick's Sporting Goods Inc. (DKS) could get official approval

from a federal judge to take over Sports Authority's brand

name.

Next Friday, U.S. Bankruptcy Court Judge Mary Walrath is

scheduled to look over the sporting-goods retailer's $15 million

purchase offer for the intellectual property of its now-defunct

competitor, which once operated 450 stores.

Sports Authority employed about 13,000 people at the time that

it filed for bankruptcy on March 2, blaming the growth of online

sales channels and increased competition in sporting-goods

retailing for its mounting losses. It became one of the largest

sporting-goods retailers following a merger in 2003 but struggled

with debt from a leveraged buyout a decade ago.

The brand names of collapsed retailers can sell for millions of

dollars after its stores go dark.

Some investors keep the brand alive online for loyal shoppers,

while competitors redirect customers to their own site. Bookseller

Barnes & Noble Inc. (BKS), for example, won a 2011 auction for

fallen competitor Borders Group Inc.'s intellectual property,

offering nearly $14 million. The Borders.com website now redirects

visitors to Barnes & Noble's site.

Oil and gas driller SandRidge Energy Inc. (SDOCQ) could get

clearance next Friday to send their reorganization plan to the

Oklahoma City company's creditors for a vote.

SandRidge officials have asked U.S. Bankruptcy Court Judge David

R. Jones to look over the company's explanation of how lenders who

are owed part of $3.7 billion would trade that debt for a majority

ownership stake in the company, which drills for oil and gas in

Oklahoma, Kansas and Texas.

The 657-worker company, which has struggled to profit after

natural-gas prices crashed, has 4,411 gross producing wells and

more than two million gross acres under lease, according to

documents filed in U.S. Bankruptcy Court in Houston. As of Dec. 31,

SandRidge Energy had four rigs in operation.

SandRidge was founded in 2006 by Tom Ward, who had previously

co-founded Chesapeake Energy Corp. (CHK) with Aubrey McClendon, who

died in March.

After leaving Chesapeake, Mr. Ward paid $500 million to take

control of a natural-gas producer, which he renamed SandRidge and

built into a leading shale producer with a market capitalization of

more than $11 billion. Activist investors replaced Mr. Ward a few

years ago, after it stumbled during the financial crisis and

struggled to recover.

SandRidge Energy officials laid off hundreds of workers prior to

putting the company into chapter 11 protection on May 16. It listed

assets of $7 billion and debts of about $4 billion in its chapter

11 petition filed with the bankruptcy court.

On Wednesday, a Wilmington, Del., judge could clear

oilfield-services provider Seventy Seven Energy Inc. (SSEIQ) to get

out of bankruptcy.

U.S. Bankruptcy Court Judge Laurie Selber Silverstein is

scheduled to look over the reorganization plan for the struggling

Oklahoma company, which provides drilling, hydraulic fracturing and

oilfield rental services to exploration and production companies.

The energy market downturn prompted it to turn to bankruptcy on

June 7, a move meant to help it eliminate $1.1 billion in debt.

Prior to the chapter 11 filing, Seventy Seven Energy officials

negotiated a deal with lenders and bondholders. The proposed

restructuring plan would allow a group of unsecured bondholders

owed $650 million to forgive their debt in exchange for a 96.75%

ownership stake in the company.

Shareholders would receive warrants for 20% of new common stock

if all the debtholders vote for the plan.

--Patrick Fitzgerald contributed to this article.

Write to Katy Stech at katy.stech@wsj.com

(END) Dow Jones Newswires

July 08, 2016 13:09 ET (17:09 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

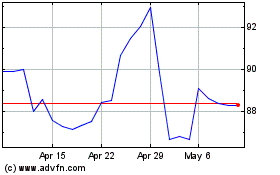

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Mar 2024 to Apr 2024

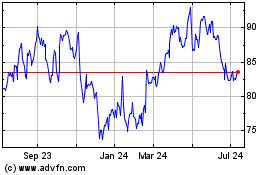

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Apr 2023 to Apr 2024