SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE

SECURITIES EXCHANGE ACT OF 1934

April 20, 2016

Commission File Number: 001-32827

MACRO BANK INC.

(Translation of registrant’s name

into English)

Sarmiento 447

Buenos Aires C1 1041

Tel: 54 11 5222 6500

(Address of registrant’s principal

executive offices)

Indicate by check mark whether the registrant files or will

file annual reports under cover of Form 20-F or Form 40-F.

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Indicate by check mark whether by furnishing the information

contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b)

under the Securities Exchange Act of 1934.

If “Yes” is marked, indicate below the file number

assigned to the registrant in connection with Rule 12g3-2(b): 82-

N/A

INDEX

|

|

1.

|

Translation of a submission from Banco Macro to the CNV dated

on April 20, 2016.

|

Buenos Aires, April 20

th

2016

To

Comisión Nacional de Valores

(Argentine Securities Exchange Commission)

Please find attached hereto the letter

sent on the date hereof to the

Ministerio De Economía y Finanzas Públicas

(Argentine Treasury Department)

to answer such authority’s request of information regarding the General and Special Shareholders’ Meeting of Banco

Macro S.A. called for April 26

th

2016.

Sincerely,

|

|

Juan Pablo Brito Devoto

|

|

|

Director

|

|

|

Banco Macro S.A.

|

Buenos Aires, April

20th 2016

To

Dirección Nacional de

Empresas con Participación del Estado

Lic. Martín Lanfranco

Hipólito Yrigoyen 250 Piso 8º Of. 826

S __________ /__ ___________D

Re.: NOTE DNEPE N° 135/16

Dear Sir,

We write to you in reply to your request

of information regarding the General and Special Shareholders’ Meeting of Banco Macro S.A. called for April 26

th

2016. In that respect, please be advised as follows:

1. Executed copy of the Minutes of the

Board of Directors’ Meeting calling the General and Special Shareholders’ Meeting.

Please be advised that the wording of the

minutes of the Board of Directors’ Meeting calling a General and Special Shareholders’ Meeting for April 26

th

2016 is available in the Financial Information Highway (or AIF for its acronym in Spanish) of the CNV or Securities Exchange Commission

of the Republic of Argentina.

2. Copy of the last version of the revised

By-laws.

Please be advised that the last version

of the revised By-laws is available in the AIF.

3. Current composition of the Board

of Directors (regular and alternate members) including the designation dates and effective term of office.

Please be advised that in the AIF you may

access the list of members of the Board of Directors and the minutes of the shareholders’ meetings by which each member was

designated to hold office as director, including the designation dates and term of office of each member of the Board.

The current composition of the Board of

Directors is as follows:

|

POSITION

|

NAME/S AND LAST NAME

|

EXPIRATION DATE

|

DESIGNATION DATE

|

|

CHAIRMAN

|

Jorge Horacio Brito

|

12/31/2017

|

04/23/2015

|

|

VICE CHAIRMAN

|

Guillermo Eduardo Stanley

|

12/31/2015

|

04/11/2013

|

|

REGULAR DIRECTOR

|

Jorge Pablo Brito

|

12/31/2017

|

04/23/2015

|

|

REGULAR DIRECTOR

|

Marcos Brito

|

12/31/2017

|

04/23/2015

|

|

REGULAR DIRECTOR

|

Delfín Federico Ezequiel Carballo

|

12/31/2017

|

04/23/2015

|

|

REGULAR DIRECTOR

|

Juan Pablo Brito Devoto

|

12/31/2016

|

04/29/2014

|

|

REGULAR DIRECTOR

|

Luis Carlos Cerolini

|

12/31/2016

|

04/29/2014

|

|

REGULAR DIRECTOR

|

Carlos Enrique Videla

|

12/31/2015

|

04/11/2013

|

|

REGULAR DIRECTOR

|

Alejandro Macfarlane

|

12/31/2015

|

04/11/2013

|

|

REGULAR DIRECTOR

|

Constanza Brito

|

12/31/2015

|

04/11/2013

|

|

ALTERNATE DIRECTOR

|

Santiago Horacio Seeber

|

12/31/2017

|

04/23/2015

|

|

ALTERNATE DIRECTOR

|

Ernesto Eduardo Medina

|

12/31/2017

|

04/23/2015

|

|

ALTERNATE DIRECTOR

|

Santiago Brito

|

12/31/2017

|

04/23/2015

|

|

ALTERNATE DIRECTOR

|

Matías Eduardo Carballo

|

12/31/2017

|

04/23/2015

|

4. Detailed description of the shareholders

structure to date.

Please be advised that last February 17

th

we posted in the AIF the note provided for in section 62 of the Rules and Regulations of the Buenos Aires Stock Exchange, informing

the Bank’s current ownership structure for the financial statements ended December 31

st

2015, to wit:

|

Shareholders

|

Class A Shares

|

Class B Shares

|

Capital Stock

|

Participating

Interest

%

|

|

Controlling Group

|

10,551,332

|

219,959,835

|

230,511,167

|

39.43

|

|

Others

|

684,338

|

353,367,523

|

354,051,861

|

60.57

|

|

Total

|

11,235,670

|

573,327,358

|

584,563,028

|

100.00

|

5. As to the following items of the

Agenda, please be advised as follows:

a. (Item 2) “Evaluate the documentation

provided for in section 234, subsection 1 of Law No. 19550, for the fiscal year ended December 31st 2015”. Copy of the accounting

documents provided for in section 234 of Law No. 19550 as approved and executed by the Board, Syndics and Independent Auditor,

as well as any other supporting information that may accompany this item.

The documentation provided for in section

234, subsection 1 of Law 19550 to be submitted to and evaluated by the next General Shareholders’ Meeting was unanimously

approved by the members of the Board at the meetings of the Board held last February 17

th

, in which the Board members

approved the financial statements for the year ended 31 December 2015, and on March 9

th

2016, in which the Board members

approved the annual report for the above mentioned fiscal year.

In addition, please be advised that the

financial statements and annual report mentioned in the preceding paragraph were made available to the public in due time and manner

and are currently available in the AIF.

b. (Item 3) “Application of the

retained earnings for the fiscal year ended 31 December 2015. Total Retained Earnings: AR$ 5,133,481,933.66 which the Board proposes

may be applied as follows: a) AR$ 1,001,682,786.73 to Legal Reserve Fund; b) AR $ 190,198,125 to Statutory Reserve Fund –

Special Statutory Reserve Fund for Subordinated Debt Instruments under the global program of Negotiable Obligations approved by

the general shareholders’ meeting held on September 1

st

2006; c) AR$ 38,009,241.64 to tax on corporate personal

assets and participating interests; d) AR$ 3,903,591,780.29 to the optional reserve fund for future distributions, pursuant to

Communication “A” 5273 issued by the Central Bank of the Republic of Argentina. Please provide information regarding

this item.

Retained earnings for the year 2015 arise from the

financial statements prepared for such fiscal year, which, as expressed in item 5.a. above, were unanimously approved by the directors

at the Board’s meeting held last February 17

th

and published in the AIF in due time and manner according to law.

The Board’s proposal as to the application

of retained earnings for the fiscal year ended 31 December 2015 was submitted in compliance with the rules of the Central Bank

of the Republic of Argentina applicable to this matter.

c. (Item 4) Separate a portion of the

optional reserve fund for future distributions in order to allow the application of the amount of AR$ 643,019,330.80 to the payment

of a cash dividend, subject to prior authorization of the Central Bank of the Republic of Argentina.” Please provide proposal

and information regarding this item. In particular, please identify the source of the separated portion of the optional reserve

fund, providing detailed information of all the activity from the creation thereof to date.

As evidenced by the minutes of the General

and Special Shareholders’ Meeting dated April 16th 2012 and duly published in the AIF, we created an “Optional Reserve

for Future Distributions” on the amount of AR$ 2,443,140,742.68. In addition, please be advised that the “Optional

Reserve Fund for Future Distributions” account was increased as a result of the resolutions adopted at the General Shareholders’

Meeting held on April 11

th

2013, the General and Special Shareholders’ Meeting held on April 29

th

2014

and the General and Special Shareholders’ Meeting held on April 23

rd

2015 in AR$ 1,170,680,720, 1,911,651,322.50

y 2,736,054,342.94, respectively. Moreover, the Shareholders’ Meetings dated April 29

th

2014 and April 23

rd

2015 resolved to separate a portion of such reserve fund equal to AR$ 596,254,288.56 and 596,254,288.56 for the payment of a cash

dividend. All the above mentioned resolutions were as well published in the AIF in due time and manner.

Furthermore, below please find a table

containing the information provided for in the preceding paragraph:

|

Description

|

|

Amounts in AR$

|

|

|

Approved by the Shareholders’ Meeting dated 04/16/2012

|

|

|

2,443,140,742.68

|

|

|

Approved by the Shareholders’ Meeting dated 04/11/2013

|

|

|

1,170,680,720.00

|

|

|

Approved by the Shareholders’ Meeting dated 04/29/2014

|

|

|

1,911,651,322.50

|

|

|

Distribution of Dividends approved at Shareholders’ Meeting dated 04/29/2014

|

|

|

-596,254,288.56

|

|

|

Approved by the Shareholders’ Meeting dated 04/23/2015

|

|

|

2,736,054,342.94

|

|

|

Distribution of Dividends approved at Shareholders’ Meeting dated 04/23/2015

|

|

|

-596,254,288.56

|

|

|

Total

|

|

|

7,069,018,551.00

|

|

d. (Item 5) “Full reorganization

of the Board of Directors. Establish the new composition of the Board with 13 Regular Directors and 3 Alternate Directors.”

Please provide information regarding this item.

Please be advised that last March 17

th

,

the shareholders Jorge Horacio Brito and Delfín J. Ezequiel Carballo communicated the Board that, in connection with the

next General Shareholders’ Meeting at which the shareholders shall discuss, among other issues, the appointment of new members

of the Board, they intend to propose the following:

1.- Full reorganization of the Board.

2.- Establish the new composition of the

Board with 13 Regular Directors and 3 Alternate Directors.

3.- Pursuant to Section 14 of the Bylaws,

establish 5 directors shall hold office for 3 fiscal years, other 5 directors for 2 fiscal years and the 3 remaining directors

for 1 fiscal year.

At the Meeting of the Board of Directors

held on the same date, the members of the Board resolved the following, as evidenced by the minutes published in the AIF: i) to

include the above described issues in the Agenda of the General Shareholders’ Meeting to be held on the 26

th

day

of April 2016, at 11 am; ii) to communicate to the Bank of New York the list of Directors proposed by the shareholders in order

to be distributed to the owners of ADRs of the company together with the notice of the General Shareholders’ Meeting; and

iii) to disclose the proposed list as a relevant event.

e. (Item 6) “Appoint five regular

directors and three alternate directors who shall hold office for three fiscal years.” Please provide the relevant proposal

and information regarding this item.

In connection with paragraph d. above and

pursuant to the letter received on March 17

th

2016 from the Secretary of Economic Policy and Development Planning, Lic.

Pedro Lacoste, through a letter published as relevant event in the AIF on that same date, the Bank communicated that the list of

nominees proposed to participate in the Board, for 3 fiscal years, is as follows:

Regular Directors

:

|

|

5.

|

Mr. Martín Gorosito (FGS-ANSES)

|

Alternate Directors

:

|

|

3.

|

The shareholders propose this place be filled by the first minority.

|

l (Item 7) “Appoint five regular

directors who shall hold office for two fiscal years.” Please provide the relevant proposal and information regarding this

item.

In connection with paragraph d.5 above

and pursuant to the letter received on March 17th 2016 from the Secretary of Economic Policy and Development Planning, Lic. Pedro

Lacoste, through a letter published as relevant event in the AIF on that same date, the Bank communicated that the list of nominees

proposed to participate in the Board, for 2 fiscal years, is as follows:

Regular Directors

:

|

|

1.

|

Mr. Jorge Horacio Brito

|

|

|

2.

|

Mr. Delfín J. Ezequiel Carballo

|

|

|

5.

|

Mr. Luis María Blaquier (FGS-ANSES)

|

f. (Item 8) “Appoint three regular

directors who shall hold office for one fiscal year.” Please provide the relevant proposal and information regarding this

item.

In connection with paragraph d.5 above

and pursuant to the letter received on March 17th 2016 from the Secretary of Economic Policy and Development Planning, Lic. Pedro

Lacoste, through a letter published as relevant event in the AIF on that same date, the Bank communicated that the list of nominees

proposed to participate in the Board, for 1 fiscal year, is as follows:

Regular Directors

:

|

|

3.

|

Mr. Alejandro Fargosi (FGS-ANSES)

|

On April 18th 2016, we received a notice

from ANSES-FGS informing its intention to exercise the right to vote on a cumulative basis at the next shareholders’ meeting.

g. (Item 9) “Designate the new

regular and alternate members of the Supervisory Committee who shall hold office for one fiscal year.” Please provide the

relevant proposal and information regarding this item.

The proposal shall be made by the shareholders

at the General and Special Shareholders’ Meeting called for April 26

th

2016.

In the notices mentioned in the preceding

paragraph, ANSES-FGS also informed it will exercise the right to vote on a cumulative basis at the next shareholders’ meeting.

h. (Item 10) “Evaluate the remunerations

of the members of the Board of Directors for the fiscal year ended 31 December 2015 within the limits as to profits, pursuant to

section 261 of Law 19550 and the Rules of the

Comisión Nacional de Valores

(Argentine Securities Exchange Commission).”

Please provide proposal regarding this item. In addition, please provide the amounts paid as remuneration to the members of the

Board in the years 2014, 2013 and 2012; breaking down such amounts by description (directors’ remunerations, remunerations

to the members of the audit committee, fees paid for executive functions, etc.) and by director. Also please inform whether there

are Directors employed by the Bank and the salary amount paid in each case. Finally, provide a breakdown of the amounts advanced

to each director during the year 2015 and the proposal of advance payments for the year 2016, as well as any other information

supporting this item.

The proposed remuneration for the directors

for the above mentioned fiscal year was made available to the public in due time and manner according to law through the publication

of the proposed remuneration in the AIF, pursuant to the Rules of the Argentine Securities Exchange Commission.

In the financial statements for the year

ended 31 December 2015 the amount of AR$ 207,714,294.46 is recorded in the Statement of Income as fees payable to the Board of

Directors. The remuneration proposed, as in previous years, does not exceed the limits established under section 261 of Law 19550.

The remuneration of the directors for the

fiscal years 2014, 2013 and 2012 are evidenced in the minutes of the shareholders’ meetings that evaluated all aspects of

such fiscal years, which were duly published in the AIF.

No member of the Board is employed by the

Bank.

As to the breakdown of the amount to be

paid separately to each director, we shall comply with all the provisions set forth in section 75 of Decree No. 1023/2013, as provided

under the Interpretation Criterion No. 45 of the CNV.

There is no proposal as the advance payments

for the year ending 31 December 2016, which will be considered by the shareholders’ meeting evaluating the remunerations

of the directors for that same fiscal year.

i.

(Item 11)

“

Evaluate

the remunerations of the members of the Supervisory Committee for the fiscal year ended 31 December 2015. Please provide proposal

and information regarding this item, with express identification of the members of the Supervisory Committee. In addition, please

inform the amounts paid as remuneration to the Supervisory Committee during the fiscal years 2014, 2013 and 2012, as well as any

other information supporting this item.

The financial statements for the year ended

31 December 2015 contemplate a provision of AR$ 981,604.80 for the payment of remunerations to the members of the Supervisory Committee

for the services rendered during the above mentioned fiscal year.

The remuneration of the members of the

supervisory committee for the fiscal years 2014, 2013 and 2012 are evidenced in the minutes of the shareholders’ meetings

that evaluated all aspects of such fiscal years, which were duly published in the AIF.

j. (Item 12) “Evaluate both the

management of the Board of Directors and the Supervisory Committee.” Please provide the relevant information regarding this

item.

The proposal shall be made by the shareholders

at the General and Special Shareholders’ Meeting called for April 26th 2016.

k. (Item 13) “Extension of the

term of rotation of the audit company Pistrelli, Henry Martin y Asociados S.R.L. to three years, for the fiscal years ending 31

December 2016, 2017 and 2018, as provided for in section 28, subsection c), Article IV, Chapter III, Title II, of the Rules of

the

Comisión Nacional de Valores

(Argentine Securities Exchange Commission) (Revised 2013), as amended and supplemented

by the General Resolution No 639/2015. Appoint the regular and alternate independent auditor for the fiscal year ending 31 December

2016. Please provide a copy of the Minutes of the Shareholders’ Meeting appointing the Independent Auditor; as well as a

copy of the minutes in which the Board, the Supervisory Committee and the Audit Committee describe the reasons leading to the extension

of the term of rotation of the designated audit company. On the other hand, please provide any additional information supporting

this item. Finally, provide the proposal of the independent auditor to be designated for the fiscal year to end 31 December 2016.

Please be advised that the following documents

are available in the AIF: Minutes of the Shareholders’ Meeting appointing the Independent Auditor and minutes of the Board

of Directors’ Meetings, the Audit Committee and the Supervisory Committee describing the reasons leading to the extension

of the term of rotation of the designated audit company.

Pursuant to the sworn statements published

in the AIF, the Accountants Norberto N. Nacuzzi and Ernesto Mario San Gil, members of the audit company Pistrelli, Henry Martin

y Asociados S.R.L., shall be proposed as candidates to be designated as Regular Independent Auditor and Alternate Independent Auditor,

respectively.

l. (Item 14) “Evaluate the remuneration

of the independent auditor for the fiscal year ended 31 December 2015. Please provide the proposal of the remuneration to be paid

to the independent auditor to be appointed for the fiscal year ended 31 December 2015 as well as the amounts actually paid as remuneration

during the fiscal years ended 12/31/2014, 12/31/2013 and 12/31/2012.

The remuneration to be paid to the independent

auditor for the year ended 31 December 2015 amounts to AR$ 9,448,800. The amounts actually paid as remunerations to the independent

auditor for the fiscal years ended 31 December 2014, 2013 and 2012 arise from the minutes of the shareholders’ meeting dealing

with such issues, which are available in the AIF.

m. (Item 15) “Define the audit

committee’s budget.” Please inform the amount of the Budget in connection herewith, as well as the amounts paid under

this description during the fiscal years ended 12/31/2015, 12/31/2014 and 12/31/2013.

The proposal shall be made by the shareholders

at the General and Special Shareholders’ Meeting called for next April 26

th

.

The audit committee’s budget for

each of the years ended December 31

st

2013, 2014 and 2015 was fixed in the amounts of AR$ 600,000, AR$ 720,000.00 and

AR$ 750,000.00, respectively.

For the fiscal year 2016 and, as in previous

years, the budget shall suffer no adjustments exceeding 20% of the budget approved the previous year.

n. (Item 16) “Evaluate the authorization

to extend the Bank’s Global Program of Negotiable Obligations. Delegate to the Board of Directors the necessary powers to

(i) define and establish all the terms and conditions of the Program, of each of the series to be duly issued and of the negotiable

obligations to be issued under such Program; (ii) carry out before the CNV (Argentine Securities Exchange Commission) and/or any

similar foreign entities all necessary proceedings to obtain the authorization for the Program’s extension; (iii) carry out

before MERVAL, MAE and/or any market of Argentina and/or foreign market all necessary proceedings to obtain the authorization for

the Program’s extension, for the possible listing and/or negotiation of the negotiable obligations issued under such Program;

(iv) if applicable, negotiate with the entity to be determined in the relevant Price Supplement, the terms and conditions (including

the determination of the fees for its services) for it to act as payment agent and/or registration agent and, ultimately, as depository

of the global certificate; and (v) the hiring of one or more independent rating companies to rate the Program and/or series to

be issued thereunder. Authorize the Board to sub-delegate to one or more of its members, or to whom they deem convenient, the exercise

of the powers described above.” Please provide a report on the reasons for the extension of the Bank’s Global Program

of Negotiable Obligations and the application thereof, as well as additional information on the general conditions thereof, such

as the effective term, form and denomination, issuance price, amortization, interest accrual, and other elements to be mentioned

in the prospectus. In addition, please provide any other information related to this item. Finally, as to the delegation of powers

to the Board referred to in this paragraph, please provide the relevant proposal and related information.

The Global Program of Negotiable Obligations

as authorized by the CNV on 09/28/2006 through Resolution No. 15480.

Debt Instrument Programs have a duration

of 5 years, except when extended by the Issuer.

This Program was extended in 2011 and now

it’s time to extend it again in order to make it available in case during the next five years the Issuer decides to go into

the capital markets with debt instruments. The delegation of powers described above is only a delegation of forms, as in previous

opportunities and in accordance with market practices.

The general conditions of the Program are

as follows:

|

Issuer

|

Banco Macro S.A.

|

|

|

|

|

Arranger

|

Credit Suisse Securities (USA) LLC

|

|

|

|

|

Dealers

|

Credit Suisse Securities (USA) LLC, Credit Suisse Securities (Europe) Limited, Raymond James Argentina Sociedad de Bolsa S.A., Raymond James & Associates Inc. and/or such other dealers as may be set forth in the applicable pricing supplement for each series of notes.

|

|

|

|

|

Program Size

|

The Bank may issue up to US$700,000,000 aggregate principal amount of notes (or the equivalent in other currencies) outstanding at any time.

|

|

|

|

|

Emisión en Clases

|

Unless otherwise specified in the applicable pricing supplement, the Bank will issue notes in series under the indenture. Within each series, the Bank may issue tranches of notes, subject to terms identical to those of other tranches in that series, except that the issue date, the issue price, the restrictive legends and the initial interest payment date may vary.

|

|

|

|

|

|

The Bank will set out the specific terms of each tranche in a pricing supplement to this offering circular.

|

|

|

|

|

Status and Ranking

|

The notes issued under this program will

qualify as “obligaciones

negociables” under Argentine law

and will be issued pursuant to, and in compliance with, all of the requirements of the Negotiable Obligations Law and any other

applicable Argentine laws and regulations.

|

|

|

|

|

|

Unless otherwise specified in the applicable pricing supplement, the notes will constitute our direct, unconditional, unsecured and unsubordinated obligations and will rank at all times at least

pari passu

in right of payment with all our other existing and future unsecured and unsubordinated indebtedness (other than obligations preferred by statute or by operation of law).

|

|

|

|

|

|

If so specified in the applicable pricing

supplement, the Bank may issue, under a separate indenture, subordinated notes that will rank at all times junior in right of payment

to its secured indebtedness and, to the extent set forth therein, certain of its unsecured and unsubordinated indebtedness (as

well as obligations preferred by statute or by operation of law).

Pursuant to section 29 of the Argentine

Law on Obligaciones Negociables, in the event of default by the Bank in the payment of any amounts payable under a Note, those

holding a certificate issued by a clearing system evidencing such holder’s participation in the global Note, then such holder

shall be entitled to bring an executive action in Argentina to recover payment of such amount. To such effect, any common depositary

may issue an account balance certificate in order to allow the holder of any Note to bring an executive proceeding, for which purpose

such Note certificate shall be enough evidence, with no need of further proof or certification, pursuant to section 4 of the Decree

677/01. The issuance thereof shall freeze the account, except for the registration of any act of disposition by the holder, during

thirty (30) days, unless the holder returns the Note certificate o receives within such term an order to extend the account freezing

period issued by the judge or the arbitration court before which such certification should have been submitted.

|

|

|

|

|

Issue Price

|

The Bank may issue notes at their principal amount or at a discount or premium to their principal amount as specified in the applicable pricing supplement.

|

|

|

|

|

Currencies

|

The Bank may issue notes in any currency as specified in the applicable pricing supplement. We may also issue notes with principal and interest payable, to the extent permitted by Argentine law, in one or more currencies different from the currency in which such notes are denominated.

|

|

|

|

|

Maturities

|

The Bank may issue notes with maturities of no less than 30 days from the date of issue as set forth in the applicable pricing supplement.

|

|

|

|

|

Interest

|

Notes may bear interest at a fixed rate or at a margin above or below a floating rate based on LIBOR, U.S. Treasury rates or any other base rate, as the Bank will specify in the applicable pricing supplement and in accordance with the provisions set forth in the Argentine laws, rules and regulations. The Bank may also issue notes on a non-interest bearing basis, as may be specified in the applicable pricing supplement.

|

|

|

|

|

Redemption

|

The applicable pricing supplement may provide that the notes of a series will be redeemable at the Bank’s option and/or the option of the holders, in whole or part, at a price or prices as set forth in the applicable pricing supplement. Partial redemption will be made on a pro rata basis

.

|

|

|

|

Redemption for

Taxation Reasons

|

Notes may be redeemed by the Bank, in whole but not in part, at a price equal to 100% of the principal amount plus accrued and unpaid interest upon the occurrence of specified Argentine tax events. See “Description of the Notes—Redemption and Repurchase—Redemption for Taxation Reasons.”

|

|

|

|

|

Covenants

|

The indenture contains certain covenants that limit the Bank’s ability to incur certain liens and, unless the Bank complies with certain requirements, merge, consolidate or transfer all or substantially all our assets.

|

|

|

|

|

Use of Proceeds

|

The Bank will use the net proceeds, if

any, from the issuance of notes under this program in compliance with the requirements set forth in Article 36 of the Negotiable

Obligations Law, Communication “A” 3046, as amended, of the Central Bank and other applicable regulations, as specified

in the applicable pricing supplement. Under such law and regulations, the use of

proceeds is restricted to certain purposes,

including making loans in accordance with Central Bank regulations, working capital in Argentina and investment in tangible assets

located in Argentina. See “Use of Proceeds.”

|

|

|

|

|

Withholding Taxes;

Additional

Amounts

|

The Bank will make its payments in respect of notes without withholding or deduction for any taxes or other governmental charges imposed by Argentina, or any political subdivision or any taxing authority thereof. In the event that such withholdings or deductions are required by law, the Bank will, subject to certain exceptions, pay such additional amounts to ensure that the holders receive the same amount as the holders would otherwise have received in respect of payments on the notes in the absence of such withholdings or deductions. See “Description of the Notes—Additional Amounts.”

|

|

|

|

|

Denominations

|

The Bank will issue notes in the minimum denominations and other denominations specified in the applicable pricing supplement.

|

|

|

|

|

Form

|

Unless otherwise permitted by the applicable law and the Pricing Supplement, Notes shall be issued in the form of registered certificates without interest coupon (the “Registered Notes”). Notes offered in the United States to qualified institutional buyers in reliance on Rule 144A under the Securities Act will be represented by one or more Rule 144A global notes. Notes offered in reliance on Regulation S will be represented by one or more Regulation S global notes.

|

|

|

|

|

Transfer Restrictions

|

The Bank has not registered the notes under the US Securities Act, and the notes may not be transferred except in compliance with the transfer restrictions set forth under “Transfer Restrictions.”

|

|

|

|

|

Registration Rights

|

If so specified in the applicable pricing supplement, the Bank may provide holders of a series of notes registration rights.

|

|

|

|

|

|

Pursuant to a Registration Rights Agreement, the Bank may agree to file with the SEC and use our reasonable best efforts to cause to become effective a registration statement with respect to an offer to exchange the relevant notes for notes (“Exchange Notes”) with substantially identical terms (but without transfer restrictions and certain other terms concerning increased interest, as described below). Upon the registration statement becoming effective, the Bank would offer to holders of such notes who are able to make certain representations the opportunity to exchange their notes for an equal principal amount of Exchange Notes. Under certain circumstances, the Bank may instead be required to file a registration statement to cover resales of notes by the holders. Failure to file or cause the exchange offer registration statement to become effective or to consummate the exchange offer, or, if required, failure to file or cause the resale registration statement to become and remain effective, within time periods specified in the applicable pricing supplement, will result in an increase in the interest rate borne by the relevant notes. See “Description of the Notes— Registration Rights.”

|

|

|

|

|

Listing

|

The Bank may apply to have the notes of a series listed on the Luxembourg Stock Exchange for trading on the EuroMTF and listed on the Buenos Aires Stock Exchange. The Bank cannot assure you, however, that these applications will be accepted. Notes may be issued under this program that will not be listed on any securities exchange, and the pricing supplement applicable to a series of notes will specify whether or not the notes in such series have been listed on the Luxembourg Stock Exchange for trading on the EuroMTF, on the Buenos Aires Stock Exchange or on any other securities exchange. We expect that certain series of Notes, as described in the applicable pricing supplement, will be eligible for trading on the PORTAL Market or on the MAE.

|

|

|

|

|

Governing Law

|

The Negotiable Obligations Law establishes the requirements for the notes to qualify as

Obligaciones Negociables

thereunder, and Argentine laws and regulations will govern the Bank’s capacity and corporate authorization to establish this program and offer the notes in Argentina and to execute and deliver the notes. All other matters with respect to the indenture and the notes will be governed by, and construed in accordance with, the laws of the State of New York.

|

|

|

|

Placement of the

Notes in Argentina

|

Notes to be issued under this Program may be offered to the public in Argentina in accordance with General Resolution No. 368/2001 of the CNV, as amended. This offering circular will be available to the general public in Argentina. The placement of notes in Argentina will take place in accordance with the provisions set forth in Article 16 of Argentine Law No. 17,811, as amended (the “Argentine Public Offering Law”), and with the applicable CNV regulations, through, among other things: (i) publication of a summary of the terms of this offering circular and the applicable pricing supplement in the Boletín de la Bolsa de Comercio de Buenos Aires (Gazette of the Buenos Aires Stock Exchange) and in a newspaper of general circulation in Argentina; (ii) distribution of this offering circular and the applicable pricing supplement to the public in Argentina; (iii) road shows in Argentina for prospective investors; and (iv) conference calls with prospective investors in Argentina. The pricing supplements will detail the placement efforts to be undertaken pursuant to the Argentine Public Offering Law, as described above, with respect to each note issuance.

|

|

|

|

|

Trustee, Co-

Registrar, Principal

Paying Agent and

Transfer Agent.

|

HSBC Bank USA, National Association

|

|

|

|

|

Registrar, Paying

Agent, Transfer

Agent, and

representative of the

Trustee in Argentina

|

HSBC Bank Argentina S.A.

|

|

|

|

Luxembourg Paying

Agent and Transfer

Agent

|

Dexia Banque Internationale à Luxembourg

, société anonyme

.

|

|

|

Sincerely,

|

|

|

|

|

|

|

|

|

|

|

|

María

José Van Morlegan

|

|

|

|

Attorney-in-fact

|

|

|

|

Banco Macro

S.A.

|

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act

of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereto duly authorized.

Date: April 20, 2016

|

|

MACRO BANK INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Juan Pablo Brito Devoto

|

|

|

|

Name: Juan Pablo Brito Devoto

|

|

|

|

Title: Director

|

|

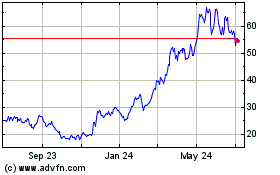

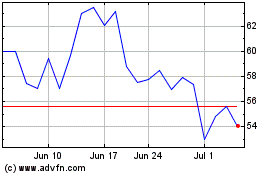

Banco Macro (NYSE:BMA)

Historical Stock Chart

From Aug 2024 to Sep 2024

Banco Macro (NYSE:BMA)

Historical Stock Chart

From Sep 2023 to Sep 2024