AptarGroup, Inc. (NYSE:ATR) today reported record fourth quarter

and annual net income and earnings per share.

Summary

- Reported record annual and fourth

quarter net income and earnings per share despite foreign currency

headwinds.

- Reported earnings per share rose 8% for

the year and fourth quarter over prior year levels.

- Comparable adjusted earnings per share

increased 21% for the year and 18% in the fourth quarter over prior

year levels.

- Improved operating margins across each

business segment drove adjusted EBITDA(1) margin to 20% for 2015

compared to 18% in the prior year (19% in the fourth quarter

compared to 17% in the prior year fourth quarter).

- Achieved adjusted ROIC(2) of 14% for

2015 compared to 13% in the prior year.

- Paid increased annual dividends for the

22nd consecutive year (current annualized dividend is $1.20 per

share).

- Fourth quarter adjusted earnings per

share were $0.67 compared to currency-adjusted earnings per share

of $0.57 in the prior year (fourth quarter 2015 adjusted earnings

per share exclude a positive impact of $0.03 per share ($2.9

million of pre-tax income) related to a gain on an insurance

recovery, and a negative impact of $0.02 per share ($1.9 million of

pre-tax expense) related to costs associated with the Mega Airless

acquisition).

(1) Adjusted EBITDA is earnings excluding unusual items before net

interest, taxes, depreciation and amortization; see “Presentation

of Non-GAAP Information” and accompanying tables for further

information. (2) ROIC is return on invested capital calculated by

taking adjusted after-tax EBIT (earnings before net interest and

taxes) and dividing it by average net capital; see “Presentation of

Non-GAAP Information” and accompanying tables for further

information.

Fourth Quarter Results

For the quarter ended December 31, 2015, reported sales

decreased 9% to $547 million from $599 million a year ago. Core

sales, which exclude impacts from changes in currency exchange

rates, increased by approximately 1%.

Fourth Quarter Segment Sales Analysis

(Change Over Prior Year)

Beauty +

Home

Pharma

Food +

Beverage

Total

AptarGroup

Sales Growth Before Currency Effects (Core Sales) (1%) 6%

(1%) 1% Currency Effects (1) (11%) (10%)

(6%) (10%) Total Reported Sales Growth (12%)

(4%) (7%) (9%) (1) - Currency effects are

approximated by translating last year's amounts at this year's

foreign exchange rates.

Commenting on the quarter, Stephen Hagge, President and CEO,

said, “Despite several challenging conditions, including softness

in several markets, we performed very well operationally. We

achieved record fourth quarter earnings driven by operating margin

improvements across each business segment compared to a year ago.

Our Beauty + Home segment continued to see softness in the personal

care market although we were encouraged to see year over year

quarterly core sales increase in the beauty market for the first

time in 2015. Our Pharma segment had another excellent quarter,

driven by strong demand for our delivery solutions for the

prescription drug and injectables markets that offset weak demand

from the consumer healthcare market. Our Food + Beverage segment

was negatively impacted by beverage demand seasonality. While we

continued to benefit from lower input costs, we also remained

focused on containing costs and improving operating efficiencies

across each segment. These factors drove adjusted EBITDA margin to

19 percent and resulted in comparable adjusted earnings per share

growth of 18 percent.”

AptarGroup reported earnings per share of $0.68 compared to

$0.63 per share a year ago. Excluding unusual items from the

current period and assuming a comparable foreign currency exchange

environment, comparable earnings per share would have been $0.67

compared to $0.57 for the prior year. A reconciliation of adjusted

earnings per diluted share to the most directly comparable GAAP

measure is provided in the tables that accompany this press

release.

Annual Results

For the year ended December 31, 2015, reported sales decreased

11% to approximately $2.3 billion from $2.6 billion a year ago.

Core sales, which exclude impacts from changes in currency exchange

rates, increased by approximately 1%.

Annual Segment Sales Analysis

(Change Over Prior Year)

Beauty +

Home

Pharma

Food +

Beverage

Total

AptarGroup

Sales Growth Before Currency Effects (Core Sales) (2%) 8%

2% 1% Currency Effects (1) (13%) (13%)

(7%) (12%) Total Reported Sales Growth (15%) (5%)

(5%) (11%) (1) - Currency effects are

approximated by translating last year's amounts at this year's

foreign exchange rates.

Hagge commented on the annual results, “It was a challenging

year with sluggish macroeconomic conditions, foreign currency

translation headwinds and softness in several key markets. Even

though we faced these issues, we grew the top line on a core basis,

adapted to the softer market conditions with a company-wide focus

on cost containment and benefited from lower input costs. As a

result, we achieved an adjusted EBITDA margin of 20 percent, return

on invested capital of 14 percent and grew comparable adjusted

earnings per share by 21 percent. We also executed our balanced

capital allocation strategy and completed our accelerated share

repurchase program, increased our dividend and announced a

strategic acquisition just after the end of the year.”

AptarGroup reported earnings per share of $3.09 compared to

$2.85 a year ago. Excluding exceptional items from the current

period and assuming a comparable foreign currency exchange

environment, comparable earnings per share would have been $3.00

compared to $2.48 for the prior year. A reconciliation of adjusted

earnings per diluted share to the most directly comparable GAAP

measure is provided in the tables that accompany this press

release.

Outlook

Commenting on AptarGroup’s outlook, Hagge said, “We don’t

anticipate significant changes in the various macro challenges that

we are facing in the coming quarter. The foreign currency exchange

environment is expected to have a negative impact on our reported

results. We will remain flexible to adapt to changing market

conditions with a continued focus on containing costs while we

invest in innovation and new solutions that are designed to help

our customers grow their businesses. We also look forward to

closing the Mega Airless transaction and moving forward with our

plans to grow our expanded airless platform globally.”

AptarGroup expects earnings per share for the first quarter,

excluding any impacts from costs associated with the Mega Airless

acquisition, to be in the range of $0.69 to $0.74 per share

compared to $0.70 per share reported in the prior year. Assuming a

comparable foreign currency exchange rate environment, comparable

earnings per share for the prior year would have been approximately

$0.68 per share.

Open Conference Call

There will be a conference call on Friday, February 5, 2016 at

8:00 a.m. Central Time to discuss AptarGroup’s fourth quarter and

annual results for 2015. The call will last approximately one hour.

Interested parties are invited to listen to a live webcast by

visiting the Investor Relations page at www.aptar.com. A replay of

the conference call can also be accessed on the Investor Relations

page of the website.

AptarGroup, Inc. is a leading global supplier of a broad range

of innovative dispensing solutions for the beauty, personal care,

home care, prescription drug, consumer health care, injectables,

food, and beverage markets. AptarGroup is headquartered in Crystal

Lake, Illinois, with manufacturing facilities in North America,

Europe, Asia and South America. For more information, visit

www.aptar.com.

Presentation of Non-GAAP Information

This press release refers to certain non-GAAP financial

measures, including adjusted earnings per share, adjusted EBITDA

and adjusted ROIC, which exclude the impact of costs related to an

acquisition and a gain from an insurance recovery that were

recorded in the fourth quarter of 2015, and income from a change in

the method of valuing inventory (from LIFO to FIFO) that was

recorded in the second quarter of 2015. Comparable adjusted

earnings per share also excludes the impact of foreign currency

effects. Non-GAAP financial measures may not be comparable to

similarly titled non-GAAP financial measures provided by other

companies. AptarGroup's management believes it is useful to present

these non-GAAP financial measures because they allow for a better

period over period comparison of operating results by removing the

impact of items that, in management’s view, do not reflect

AptarGroup’s core operating performance. These non-GAAP financial

measures should not be considered in isolation or as a substitute

for GAAP financial results, but should be read in conjunction with

the unaudited condensed consolidated statements of income and other

information presented herein. A reconciliation of each non-GAAP

financial measure to the most directly comparable GAAP measure is

included in the accompanying tables.

This press release contains forward-looking statements. Words

such as “expects,” “anticipates,” “believes,” “estimates,” “future”

and other similar expressions or future or conditional verbs such

as “will,” “should,” “would” and “could” are intended to identify

such forward-looking statements. Forward-looking statements are

made pursuant to the safe harbor provisions of Section 27A of the

Securities Act of 1933 and Section 21E of the Securities Exchange

Act of 1934 and are based on management’s beliefs as well as

assumptions made by and information currently available to

management. Accordingly, AptarGroup’s actual results may differ

materially from those expressed or implied in such forward-looking

statements due to known or unknown risks and uncertainties that

exist including, but not limited to, the ability to complete the

Mega Airless acquisition; economic conditions worldwide as well as

potential deflationary conditions in regions we rely on for growth;

political conditions worldwide; significant fluctuations in foreign

currency exchange rates; changes in customer and/or consumer

spending levels; financial conditions of customers and suppliers;

consolidations within our customer or supplier bases; fluctuations

in the cost of raw materials, components and other input costs; the

availability of raw materials and components; our ability to

increase prices, contain costs and improve productivity; changes in

capital availability or cost, including interest rate fluctuations;

volatility of global credit markets; cybersecurity threats that

could impact our networks and reporting systems; fiscal and

monetary policies and other regulations, including changes in tax

rates; direct or indirect consequences of acts of war or terrorism;

work stoppages due to labor disputes; and competition, including

technological advances. For additional information on these and

other risks and uncertainties, please see AptarGroup’s filings with

the Securities and Exchange Commission, including its Form 10-Ks

and Form 10-Qs. AptarGroup undertakes no obligation to update any

forward-looking statements, whether as a result of new information,

future events or otherwise.

AptarGroup, Inc. Condensed Consolidated Financial

Statements (Unaudited) (In Thousands, Except Per Share Data)

Consolidated Statements of Income

Three Months Ended Year Ended December 31,

December 31,

2015

2014

2015

2014

Net Sales $ 546,773 $ 599,185 $ 2,317,149 $ 2,597,809 Cost

of Sales (exclusive of depreciation shown below) (1) 359,969

407,284 1,502,650 1,755,266 Selling, Research & Development and

Administrative (2) 84,592 89,100 351,461 383,909 Depreciation and

Amortization

35,229

38,347 138,893

152,218 Operating Income 66,983 64,454

324,145 306,416 Other Income/(Expense): Interest Expense (9,169 )

(5,570 ) (34,615 ) (21,029 ) Interest Income 998 1,348 5,596 4,797

Equity in results of affiliates 17 (49 ) (718 ) (1,917 )

Miscellaneous, net (3)

2,915

(1,384 ) 163

(1,966 ) Income before Income

Taxes 61,744 58,799 294,571 286,301 Provision for Income Taxes

18,351 17,287

95,276 94,677

Net Income $ 43,393 $ 41,512 $ 199,295 $ 191,624 Net Loss

Attributable to Noncontrolling Interests

(2

) 86 53

34 Net Income Attributable to

AptarGroup, Inc.

$ 43,391

$ 41,598 $

199,348 $ 191,658

Net Income Attributable to AptarGroup, Inc. Per Common

Share: Basic

$ 0.69 $

0.65 $ 3.19

$ 2.95 Diluted

$

0.68 $ 0.63

$ 3.09 $

2.85 Average Numbers of Shares

Outstanding: Basic 62,461 64,368 62,585 65,009 Diluted 64,266

66,121 64,492 67,292

Notes to Condensed Consolidated Financial

Statements:

(1) Cost of Sales for the year ended December 31, 2015 included

approximately $7.4 million of income related to a change in

inventory valuation methodology recorded in the second quarter of

2015. (2) Selling, Research & Development and Administrative

for the quarter and year ended December 31, 2015 included

approximately $1.9 million of costs related to the Mega Airless

acquisition. (3) Miscellaneous, net for the quarter and year ended

December 31, 2015 included approximately $2.9 million of gain on an

insurance recovery.

AptarGroup, Inc. Condensed

Consolidated Financial Statements (Unaudited) (continued) (In

Thousands)

Consolidated Balance Sheets

December 31, 2015 December 31, 2014

ASSETS Cash and Equivalents $ 489,901 $ 399,762 Short-term

Investments

29,816 - Total

Cash and Equivalents, and Short-term Investments 519,717 399,762

Receivables, net 377,038 406,976 Inventories 294,912 311,072 Other

Current Assets

88,795

96,128 Total Current Assets 1,280,462 1,213,938 Net

Property, Plant and Equipment 765,383 811,655 Goodwill, net 310,240

329,741 Other Assets

68,109

81,856 Total Assets

$

2,424,194 $ 2,437,190

LIABILITIES AND EQUITY Short-Term Obligations $ 56,972 $

251,976 Accounts Payable and Accrued Liabilities

340,396 352,762 Total Current

Liabilities 397,368 604,738 Long-Term Obligations 762,524 588,892

Deferred Liabilities

114,596

139,644 Total Liabilities 1,274,488 1,333,274

AptarGroup, Inc. Stockholders' Equity 1,149,411 1,103,407

Noncontrolling Interests in Subsidiaries

295

509 Total Equity

1,149,706

1,103,916 Total Liabilities and Equity

$ 2,424,194 $

2,437,190 AptarGroup, Inc. Condensed

Consolidated Financial Statements (Unaudited) (continued) (In

Thousands)

Segment Information Three Months

Ended Year Ended December 31,

December 31,

2015

2014

2015

2014

NET SALES

Beauty + Home $ 302,770 $ 342,930 $ 1,272,946 $ 1,498,297 Pharma

174,824 181,996 712,220 751,226 Food + Beverage

69,179 74,259

331,983 348,286

Total Net Sales $ 546,773

$ 599,185 $

2,317,149 $ 2,597,809

SEGMENT INCOME

(1)

Beauty + Home $ 20,178 $ 17,990 $ 98,707 $ 98,368 Pharma 50,105

50,109 210,509 204,698 Food + Beverage 5,454 4,519 42,731 37,728

Corporate and Other (2)

(5,822 )

(9,597 )

(28,357 ) (38,261

) Total Income Before Interest and Taxes $ 69,915 $

63,021 $ 323,590 $ 302,533 Interest Expense, Net

(8,171 ) (4,222

) (29,019 )

(16,232 ) Income before Income

Taxes $ 61,744 $

58,799 $ 294,571

$ 286,301

SEGMENT INCOME AS %

OF NET SALES

Beauty + Home 6.7 % 5.2 % 7.8 % 6.6 % Pharma 28.7 % 27.5 % 29.6 %

27.2 % Food + Beverage 7.9 % 6.1 % 12.9 % 10.8 % Notes to Condensed

Consolidated Financial Statements: (1) The Company evaluates

performance of its business units and allocates resources based

upon segment income, defined as earnings before net interest

expense, certain corporate expenses and income taxes. (2) Corporate

and Other for the quarter and year ended December 31, 2015 included

approximately $1.9 million of costs related to the Mega Airless

acquisition and approximately $2.9 million of gain on an insurance

recovery, and the year ended December 31, 2015 also included

approximately $7.4 million of income related to a change in

inventory valuation methodology recorded in the second quarter of

2015.

AptarGroup, Inc. Reconciliation of Adjusted EBIT

and Adjusted EBITDA to Net Income (Unaudited) (In Thousands)

Three Months Ended Year Ended December 31,

December 31,

2015

2014

2015

2014

Reported net income $ 43,393 $

41,512 $ 199,295 $ 191,624

Reported income taxes 18,351

17,287 95,276

94,677 Reported income before income

taxes 61,744 58,799 294,571 286,301

Adjustments: Change in inventory valuation method (from LIFO to

FIFO) (7,427 ) Costs associated with Mega Airless acquisition 1,892

1,892 Gain on insurance recovery (2,900 )

(2,900 ) Adjusted earnings before

income taxes 60,736 58,799 286,136 286,301 Interest expense 9,169

5,570 34,615 21,029 Interest income (998 )

(1,348 ) (5,596 ) (4,797 ) Adjusted

earnings before net interest and taxes (Adjusted EBIT) 68,907

63,021 315,155 302,533 Depreciation and amortization 35,229

38,347 138,893

152,218 Adjusted earnings before net interest,

taxes, depreciation and amortization (Adjusted EBITDA) $ 104,136

$ 101,368 $ 454,048 $

454,751 Adjusted EBITDA margin (Adjusted EBITDA /

Reported Net Sales) 19 % 17 % 20 % 18 % Adjusted earnings

before net interest and taxes (Adjusted EBIT) $ 315,155 $ 302,533

Effective income tax rate (reported income taxes / reported income

before income taxes) 32.3 % 33.1 % Taxes on

Adjusted EBIT 101,795 100,138

Adjusted EBIT After Taxes $ 213,360 $ 202,395

AptarGroup, Inc. Reconciliation of Capital to

Stockholders' Equity (Unaudited) (In Thousands)

2015

2014

Total AptarGroup, Inc. Stockholders' Equity $

1,149,411 $ 1,103,407 Long-term

obligations 762,524 588,892 Short-term

obligations 56,972 251,976

1,968,907 1,944,275 Less: Cash and

equivalents, and short-term investments 519,717

399,762 Total Capital $ 1,449,190

$ 1,544,513

Average Capital (average of

beginning of year and end of year capital) $ 1,496,852 $

1,604,496 Adjusted EBIT After Taxes $ 213,360 $ 202,395 ROIC

(Adjusted EBIT After Taxes / Average Capital) 14 % 13 %

AptarGroup, Inc. Reconciliation of Adjusted Earnings Per

Diluted Share (Unaudited) Three Months Ended

Year Ended December 31, December 31,

2015

2014

2015

2014

Net Income Attributable to AptarGroup, Inc. Per Diluted

Share $ 0.68 $ 0.63 $ 3.09 $ 2.85

Adjustments

(1):

Cost related to the Mega Airless acquisition 0.02 0.02 Gain on an

insurance recovery (0.03 ) (0.03 ) Income from change in inventory

valuation method (0.08 ) Foreign currency effects (2)

(0.06 ) (0.37 ) Adjusted

Earnings Per Diluted Share $ 0.67 $ 0.57

$ 3.00 $ 2.48 (1) Tax

effects of the after-tax adjustments noted above are as follows:

Three Months Ended Year Ended December 31, December 31,

2015

2014

2015

2014

Cost related to the Mega Airless acquisition $ 0.01 $ 0.01 Gain on

an insurance recovery $ (0.01 ) $ (0.01 ) Income from change in

inventory valuation method $ (0.03 ) Foreign currency effects $

(0.02 ) $ (0.18 ) (2) Foreign currency effects are

approximations of the adjustment necessary to state the prior year

earnings per share using current period exchange rates.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160204006667/en/

AptarGroup, Inc.Matthew DellaMaria815-477-0424

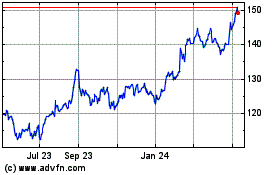

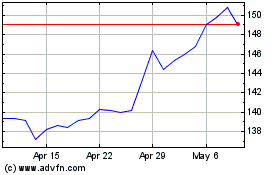

AptarGroup (NYSE:ATR)

Historical Stock Chart

From Mar 2024 to Apr 2024

AptarGroup (NYSE:ATR)

Historical Stock Chart

From Apr 2023 to Apr 2024