ADR Report: Shares Slide As Greek Fears Trigger Bank Losses

February 10 2012 - 4:55PM

Dow Jones News

International companies trading in New York closed lower Friday,

in line with the broader markets, as uncertainty over Greece

intensified after euro-zone finance ministers held off on approving

the country's second bailout.

The Bank of New York Index of ADRs dropped 1.8% to 129.85, with

banks driving the losses.

National Bank of Greece SA's (NBG, ETE.AT) shares tumbled 9.2%

to $3.44, and France's three largest banks all posted sharp

declines. Societe Generale SA (SCGLY, GLE.FR) closed 8.5% lower at

$6.06, Credit Agricole SA (CRARY, ACA.FR) slipped 7.6% to $3.42,

and BNP Paribas SA (BNPQY, BNP.FR) fell 6.1% to $22.91.

UBS lowered its stock-investment rating on ING Groep NV (ING,

INGA.AE) to neutral from buy, citing a strong share performance

relative to the sector in the past year. "With asset quality

worsening and our concerns over the Dutch mortgage market, the risk

to earnings estimates is to the downside," the firm said. ING

shares slid 7% to $8.54.

The European index fell 1.5% to 119.09.

Demand for diamonds will be lower this year due to the dismal

global economic climate, diamond mining company De Beers SA said.

The announcement weighed on the shares of fellow mining company

Anglo American PLC (AAUKY, AAL.LN), whose shares lost 5.1% to close

at $21.55.

J.P. Morgan Cazenove downgraded Britain's National Grid PLC

(NGG, NG.LN) to neutral from overweight, noting that the 2012

outlook for Europe's second-best performing utility over the past

12 months is more challenging given upcoming regulatory reviews.

Shares closed down 1.6% at $50.

The Latin American index slipped 2.4% to 375.48.

Heavy fuel imports, dry oil wells and impairment charges

combined to send fourth-quarter net profit at Brazilian federal oil

company Petroleo Brasileiro (PBR, PETR4.BR), or Petrobras,

plummeting more than 50% year-on-year, falling well short of

analysts' expectations. Shares slumped 7.6% to $29.57.

Crude oil futures prices fell in line with broader market

declines as the International Energy Agency cut its estimates for

global oil demand this year. That led to losses for other South

American oil and gas companies. Argentina's YPF SA (YPF, YPFD.BA)

fell 1.5% to $34.32, and Colombia's Ecopetrol SA (EC, ECP.T,

ECOPETROL.BO) declined 1% to $52.91.

The Asian index closed 2.2% lower at 126.70, and the emerging

markets index dropped 2.1% to 309.84.

Advanced Semiconductor Engineering Inc. (ASX, 2311.TW), the

world's largest chip-packaging and testing company by revenue, saw

its fourth-quarter net profit fall 46% because of weaker global

demand. The Taiwan-based company's shares slid 3.2% to $4.79.

Taiwan Semiconductor Manufacturing Co. (TSM, 2330.TW) said its

unconsolidated revenue in January fell 1.1% from the same month

last year. The world's largest contract chip maker by revenue also

said consolidated revenue slipped 2.3% from a year earlier. Shares

closed 3.1% lower at $13.84.

Citigroup suggested the recent rally in solar stocks may be

getting ahead of itself, arguing that margins may not snap back as

quickly and noting demand is coming from China and India, where

prices are "very, very low." China's solar companies slumped, with

Yingli Green Energy Holding Co. (YGE) tumbling 9.5% to $5.34, Trina

Solar Ltd. (TSL, K3KD.SG) closing 7.3% lower at $10.15 and Hanwha

SolarOne Co. (HSOL) falling 5.6% to $2.20.

-By Ian Thomson, Dow Jones Newswires; 212-416-2314;

ian.thomson@dowjones.com

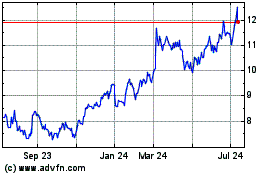

ASE Technology (NYSE:ASX)

Historical Stock Chart

From Aug 2024 to Sep 2024

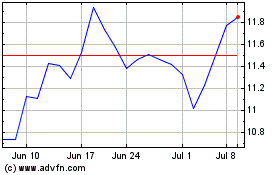

ASE Technology (NYSE:ASX)

Historical Stock Chart

From Sep 2023 to Sep 2024