Walmart Reports Strong Quarterly Results Amid Economic Challenges, Announces Vizio Acquisition and Dividend Hike

February 20 2024 - 10:37AM

IH Market News

Walmart (NYSE:WMT) delivered another quarter of impressive

results, concluding the year on a strong note as its competitive

pricing continues to draw consumers seeking value in a challenging

economic climate marked by recent inflationary pressures.

However, with inflation quickly subsiding, Walmart has observed

a decrease in customer spending per visit and, on Tuesday, issued a

conservative earnings outlook.

In a strategic move to enhance its advertising business, Walmart

has confirmed its acquisition of smart TV manufacturer Vizio for

$2.3 billion. This acquisition grants Walmart access to Vizio’s

SmartCast operating system, enabling the retail giant to offer its

vendors opportunities to showcase advertisements on streaming

platforms. Walmart highlighted that Vizio’s SmartCast system boasts

18 million active accounts.

Additionally, Walmart announced its most significant dividend

increase in over a decade, prompting a surge in its shares by more

than 5% prior to Tuesday’s market opening.

Despite economic uncertainties, the American consumer has shown

resilience, supported by a robust job market and stable income

levels. However, a noticeable pullback in spending was observed in

January following the holiday spending spree.

As one of the initial major U.S. retailers to disclose quarterly

figures, Walmart’s report could shed further light on consumer

sentiment, especially in the wake of the government’s announcement

of a marked decline in consumer spending last month.

Economists have attributed this spending reduction partly to

adverse weather conditions, but also suggest that Americans might

be feeling the strain of heightened interest rates and other

financial challenges, with potential implications extending beyond

Walmart. Consumer spending constitutes approximately two-thirds of

U.S. economic activity.

Walmart has leveraged its influence to collaborate with

suppliers in managing inflationary pressures. CEO Doug McMillon

informed industry analysts on Tuesday that prices for general

merchandise are currently lower than they were a year or even two

years ago in certain categories. The grocery sector presents a

mixed picture, with items such as eggs, apples, and deli snacks

being more affordable than the previous year, while prices for

asparagus and blackberries have seen an increase.

McMillon noted that prices for dry groceries and consumables,

including paper products and cleaning supplies, have risen by

mid-single-digit percentages compared to last year and by high

teens compared to two years ago.

Walmart continues to serve customers in need of essentials, but

it is also attracting households with annual incomes exceeding

$100,000. Notably, two-thirds of Walmart’s market share gains in

general merchandise have come from this higher-income group.

For the quarter ending January 31, Walmart reported earnings of

$5.49 billion, or $2.03 per share, down from $6.27 billion, or

$2.32 per share, in the same quarter of the previous year. Adjusted

earnings were $1.80 per share.

Revenue increased by 5.7% to $173.38 billion, surpassing

analysts’ expectations of $1.64 per share on sales of $170.85

billion, according to FactSet.

Comparable store sales, a critical measure of retail

performance, grew by 4%, a slowdown from the 4.9% growth seen in

the Walmart U.S. division in the preceding quarter and the 6.4%

growth in the second quarter. Global e-commerce sales climbed by

23%, a significant increase from the 15% growth in the prior

quarter.

However, the average spending per shopping trip dipped by 0.3%

from the previous year, despite a 4.3% increase in the number of

transactions. The decline in inflation is positive, but it

necessitates Walmart and other retailers to intensify their efforts

to sell more products.

The company’s global advertising revenue experienced a roughly

28% increase, reaching $3.4 billion.

Walmart recently unveiled plans to construct or transform over

150 stores in the next five years, alongside remodeling existing

locations. This marks a significant shift from 2016 when Walmart

announced a slowdown in new store openings to focus more on online

sales and technological advancements to compete with Amazon.

Notably, Walmart has not inaugurated a new store since late

2021.

Walmart remains committed to its stores, evidenced by enhanced

benefits for its U.S. store managers announced last month.

Starting with the current fiscal year, Walmart has introduced

stock grants of up to $20,000 annually for U.S. store managers.

For the first quarter, Walmart anticipates earnings per share to

range between $1.48 and $1.56, below the analysts’ forecast of

$1.60 per share. The company expects a 4% to 5% increase in net

sales.

For the entire fiscal year, Walmart projects earnings to be

between $6.70 and $7.12 per share, with analysts having anticipated

$7.06 per share, according to FactSet. The company foresees a 3% to

4% rise in sales for the year, a deceleration from the previous

year.

Walmart’s shares experienced a nearly 6% increase, climbing by

$9.51 per share to $179.87 on Tuesday.

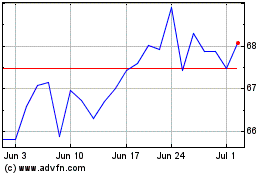

Walmart (NYSE:WMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

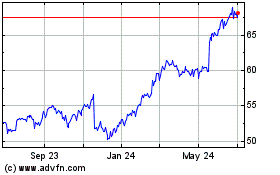

Walmart (NYSE:WMT)

Historical Stock Chart

From Apr 2023 to Apr 2024