TIDMWCW

RNS Number : 4947X

Walker Crips Group plc

20 November 2014

20(th) November 2014

Walker Crips Group plc

Results for the six months ended 30 September 2014

Walker Crips Group plc ("Walker Crips", the "Company" or the

"Group"), the financial services group with activities covering

stockbroking, investment and wealth management services today

announces unaudited results for the six months ended 30 September

2014 (the "Period").

Highlights

-- Revenue for the Period increased 12.4% to GBP10.9 million

(2013: GBP9.7 million)

-- Gross profit (Net Revenue) for the Period increased 10.4% to

GBP7.4 million (2013: GBP6.7 million) reflecting considerable

progress made in investment and wealth management businesses

-- Excluding uncontrollable FSCS levy costs and despite volatile

markets, Group operating profit of GBP0.28 million in the Period

compares with GBP0.36 million in the prior period

-- Group operating profit of GBP0.13 million in the Period

(2013: operating profit of GBP0.26 million) after FSCS levy costs

of GBP0.15 million (2013: GBP0.10 million)

-- Administrative expenses of GBP7.3 million (2013: GBP6.4

million) reflect growth costs incurred expanding the number of

investment managers whose revenue benefits are expected to accrue

in future periods

-- Interim dividend up 3.9% to 0.53 pence per share (2013: 0.51

pence per share)

-- Discretionary and Advisory Assets under Management (AUM) at

Period end increased 26.1% to GBP1.45 billion year on year (30

September 2013: GBP1.15 billion) and 9.4% over the period (31 March

2014: GBP1.32 billion)

-- Total Assets under Management and Administration increased

24.9% year on year to GBP2.66 billion (30 September 2013; GBP2.13

billion) and 6.0% over the period (31 March 2014: GBP2.51

billion)

-- Fees and non-broking income up 23.5% to GBP6.3 million (2013:

GBP5.1 million) representing 57% of total income (2013: 52%)

Commenting, David Gelber, Chairman of Walker Crips, says:

"As we approach the end of our centenary year in 2014, the

implementation of our strategic plan continues to strengthen the

business and evidences our ability and commitment to expand.

The successful execution of the strategy is becoming

increasingly recognised by market participants. We remain committed

to increasing shareholder value and to growing the dividend for

shareholders not only by focusing on organic growth but also

through expansion in London, York and targeted regions through new

hires. In each of these earnings enhancing initiatives we are ahead

of expectations. We also continue to evaluate target companies and

businesses for suitably measured and value-added acquisitions."

For further information, please contact:

Walker Crips Goupr plc Telephone: +44 (0)20 3100 8000

Louie Perry, Media Relations

Broadgate Mainland Telephone: +44 (0)20 7726 6111

Roland Cross, Director

Roddi Vaughan-Thomas

Cantor Fitzgerald Europe Telephone: +44 (0)20 7894 7667

Rishi Zaveri

Further information on Walker Crips Group plc is available on

the Company's website: www.wcgplc.co.uk

Chairman's Statement

Introduction

I am very pleased to report a continuation of the successful

implementation of our strategy for expansion reflected by a rise in

Revenue of 12.4% to GBP10.9 million for the first half of our

current year.

Development through organic growth and recruitment in our

investment and wealth management divisions has been continuing

apace. The steady influx of additional Investment Managers with

strong revenue bases now exceeds 40 since April 2012. The full

impact of the new revenues of the most recent seven such

individuals will be felt materially in the second half year, most

of whom have commenced towards the end of the period being

reported. They have strong backgrounds and expertise having

transferred from some of our peers such as Barclays Wealth, JM

Finn, Charles Stanley and EFG Harris Allday with the attraction

being a combination of the Group's committed advisory offering, a

strong control and reporting framework and a traditional approach

to client relationship management.

Notwithstanding the increase in revenue, after recording an

increase in administrative expenses, a material proportion of which

relate to the development and growth of existing businesses

referred to above from which future revenues will emerge. The

operating profit for the period consequently showed a reduction,

which we believe to be temporary, of 51% to GBP128,000 from

GBP263,000 for the prior period. These results also include

uncontrollable half year costs levied by the Financial Services

Compensation scheme of GBP155,000 (2013: GBP102,000) being an

increase of 52% over the prior period levy. Nevertheless the

overall trend is encouraging given the full year loss of GBP1.1

million in year ended 31 March 2012.

The Board is further encouraged by growth of 26.1% in

Discretionary and Advisory Assets under Management over the six

month period during which the value of the FTSE Index recorded a

material decrease.

Trading

Revenue for the Period was GBP10.9 million (2013: GBP9.7

million), an increase of 12.4%.

Gross Profit (Net Revenue) in the Period increased by 10.4% to

GBP7.4 million (2013: GBP6.7 million), further demonstrating the

pleasing rate of growth driven by our strategy for our Investment

and Wealth Management businesses in the last three years.

Non-broking income as a proportion of total income increased to

57% (2013: 52%) as the conversion of our client base to

discretionary or portfolio-managed mandates gathers pace, fuelled

by incoming new advisers whose clients already provide

predominantly fee driven revenue streams and a further shift by

existing clients to fee-based charging.

Higher employment costs, particularly in revenue generating

areas, will yield corresponding higher revenues after the

inevitable delay in transferring new clients and assets across.

Overall administrative expenses in the Period were GBP7.3 million

(2013: GBP6.4 million).

After payment of the final and special dividends in relation to

the previous year end, at the Period end, the Group had net assets

of GBP20.9 million (31 March 2014: GBP21.5 million) including net

cash of GBP7.8 million (31 March 2014: GBP8.2 million), a very

strong balance sheet from which to generate further growth in line

with the Board's Strategic Plan.

Operations

Investment Management

Discretionary and Advisory assets under management at the Period

end were GBP1.45 billion (30 September 2013: GBP1.15 billion; 31

March 2014: GBP1.33 billion). This increase is a clear reflection

of the Company's greater emphasis on fee generation rather than

transactional brokerage. Discretionary assets were GBP0.57 billion

(30 September 2013: GBP0.47 billion) and Advisory assets were

GBP0.88 billion (30 September 2013: GBP0.68 billion).

Revenues from the Investment Management division increased by

10.5% during the Period to GBP9.5 million (2013: GBP8.6 million), a

significant improvement considering the uncertainty in investment

sentiment and lower market volumes of recent months.

Despite challenging market conditions for structured products,

continued low interest rates and low equity market volatility, our

Structured Investments business has continued to deliver consistent

results both in terms of revenue for the firm but moreover,

consistent returns for investors.

Wealth Management

Revenues and profits increased materially by 27% and 115%

respectively at our York-managed wealth management division

following a strong contribution from our recently acquired

Inverness branch, improving joint venture profits and a significant

overall increase in AUM.

Dividend

A 3.9% increase in the interim dividend to 0.53 pence per share

(2013: 0.51 pence per share) recognises the encouraging progress

being made in the Group's trading performance and the confidence of

much greater profitability in the near future. The interim dividend

will be paid on 19 December 2014 to those shareholders on the

register at the close of business on 5 December 2014.

Directors, Account Executives and Staff

I would like to thank all my fellow directors, account

executives and members of staff for their continued support. Their

professionalism, diligence and loyalty give the Company every

reason to be regarded as a special place to work in this most

exciting phase of our long history.

Outlook

As we approach the end of our centenary year in 2014, the

implementation of our strategic plan continues to strengthen the

business and evidences our ability and commitment to expand.

The successful execution of the strategy is becoming

increasingly recognised by market participants. We remain committed

to increasing shareholder value and to growing the dividend for

shareholders not only by focusing on organic growth but also

through expansion in London, York and targeted regions through new

hires. In each of these earnings enhancing initiatives we are ahead

of expectations. We also continue to evaluate target companies and

businesses for suitably measured and value-added acquisitions.

The Group has continued trading profitably since the Period end

and remains in a strong financial position. Since the reporting

date, encouragement has been gained from revenues of the newly

recruited investment managers which are now coming through and we

remain cautiously optimistic in volatile markets.

D. M. Gelber

Chairman

20 November 2014

Walker Crips Group plc

Walker Crips Group plc

Condensed Consolidated Income Statement

For the six months ended 30

September 2014

Unaudited Unaudited Audited

Notes Six months Six months Year to

to to

30 September 30 September 31 March

2014 2013 2014

GBP'000 GBP'000 GBP'000

Continuing operations

Revenue 2 10,881 9,722 20,688

Commission payable (3,507) (3,052) (6,584)

------------- ------------- ---------

Gross profit 7,374 6,670 14,104

Share of after tax profit of

joint venture 7 4 17

Administrative expenses (7,253) (6,411) (13,651)

Operating profit 128 263 470

Gain on disposal of investments 3 - 1,836 1,836

Loss on disposal of subsidiary

undertaking 4 - (8) (13)

Investment revenues 143 141 240

Finance costs (1) (2) (4)

Profit before tax 270 2,230 2,529

Taxation (65) (524) (495)

Profit for the period attributable

to equity holders of the company 205 1,706 2,034

------------- ------------- ---------

Earnings per share 5

Basic 0.55p 4.62p 5.50p

Diluted 0.55p 4.52p 5.39p

Walker Crips Group plc

Condensed Consolidated Statement of Comprehensive Income

For the six months ended 30 September 2014

Unaudited Unaudited Audited

Six months Six months Year to

to to

30 September 30 September 31 March

2014 2013 2014

GBP'000 GBP'000 GBP'000

Profit for the period 205 1,706 2,034

Other comprehensive income:

Profit on revaluation of available-for-sale

investments taken to equity - 62 243

Deferred tax on profit on available-for-sale

investments - (13) (35)

Long Term Incentive Plan (LTIP)

credit to equity - - 13

Total comprehensive income for

the period

attributable to equity holders

of the company 205 1,755 2,255

Walker Crips Group plc

Condensed Consolidated Statement of Financial Position

As at 30 September 2014

Unaudited Unaudited Audited

30 September 30 September 31 March

2014 2013 2014

GBP'000 GBP'000 GBP'000

Non-current Assets

Goodwill 2,901 2,901 2,901

Other intangible assets 1,148 1,279 1,168

Property, plant and equipment 801 846 872

Investment in joint ventures 34 30 38

Available for sale investments 2,458 1,142 2,404

------------- ------------- ---------

7,342 6,498 7,383

Current Assets

Trade and other receivables 29,568 41,388 46,648

Trading Investments 2,015 1,071 1,670

Deferred tax asset - 16 -

Cash and cash equivalents 7,857 9,970 8,173

------------- ------------- ---------

39,440 52,445 56,491

Total assets 46,782 58,943 63,874

------------- ------------- ---------

Current liabilities

Trade and other payables (25,238) (37,148) (41,801)

Current tax liabilities (388) (544) (330)

Bank Overdrafts (40) (91) (70)

Deferred tax liabilities (202) - (202)

------------- ------------- ---------

(25,868) (37,783) (42,403)

Net current assets 13,572 14,662 14,088

------------- ------------- ---------

Net assets 20,914 21,160 21,471

============= ============= =========

Equity

Share capital 2,515 2,515 2,515

Share premium account 1,818 1,818 1,818

Own shares (312) (312) (312)

Revaluation reserve 827 668 827

Other reserves 4,668 4,668 4,668

Retained earnings 11,398 11,803 11,955

Equity attributable to

equity holders of the company 20,914 21,160 21,471

============= ============= =========

Walker Crips Group plc

Condensed Consolidated Statement of Cash Flows

For the six months ended 30 September 2014

Unaudited Unaudited Audited

Six months Six months Year to

to to

30 September 30 September 31 March

2014 2013 2014

GBP'000 GBP'000 GBP'000

Operating activities

Cash generated/(used) by operations 953 (3,149) (3,074)

Interest received 46 157 229

Interest paid (1) (2) (4)

Tax paid - - -

Net cash generated/(used) by operating

activities 998 (2,994) (2,849)

------------------- ------------------- -------------------------

Investing activities

Purchase of property, plant and

equipment (104) (345) (542)

Purchase of intangible assets (116) (474) (602)

Net (purchase)sale of investments

held for trading (345) (408) (1,036)

Net sale of available for sale investments - 6,248 5,466

Net cash received on disposal of

subsidiary - 292 292

Dividends received 43 39 42

Net cash (used)/generated by from

investing activities (522) 5,352 3,620

------------------- ------------------- -------------------------

Financing activities

Proceeds on issue of shares - 6 6

Dividends paid (762) (333) (522)

Net cash used in financing activities (762) (327) (516)

------------------- ------------------- -------------------------

Net (decrease)/increase in cash

and cash equivalents (286) 2,031 255

Net cash and cash equivalents at

the start of the period 8,103 7,848 7,848

Net Cash and cash equivalents at

the end of the period 7,817 9,879 8,103

Cash and cash equivalents 7,857 9,970 8,173

Bank overdrafts (40) (91) (70)

------------------- ------------------- -------------------------

7,817 9,879 8,103

------------------- ------------------- -------------------------

Walker Crips Group plc

Condensed Consolidated Statement Of Changes In Equity

For the six months ended 30 September 2014 (GBP000's)

Called Share Own shares Capital Other Revaluation Retained Total

up share premium held Redemption earnings Equity

capital

Equity as at 31 March 2013 2,470 1,630 (312) 111 4,557 619 10,430 19,505

Revaluation of investment

at fair value 62 62

Deferred tax credit to

equity (13) (13)

Profit for the 6 months

ended 30 September 2013 1,706 1,706

--------- -------- ---------- ----------- ----- ----------- --------- -------

Total recognised income

and expense for the period 49 1,706 1,755

March 2013 final dividend (333) (333)

Issue of shares on exercise

of options 1 5 6

Issue of shares on acquisition

of intangible asset 44 183 227

Equity as at 30 September

2013 2,515 1,818 (312) 111 4,557 668 11,803 21,160

Revaluation of investment

at fair value 181 181

Deferred tax credit to

equity (22) (22)

Long Term Incentive Plan

(LTIP) credit to equity 13 13

Profit for the 6 months

ended 31 March 2014 328 328

--------- -------- ---------- ----------- ----- ----------- --------- -------

Total recognised income

and expense for the period 159 341 500

September 2013 interim

dividend (189) (189)

Equity as at 31 March 2014 2,515 1,818 (312) 111 4,557 827 11,955 21,471

Profit for the 6 months

ended 30 September 2014 205 205

--------- -------- ---------- ----------- ----- ----------- --------- -------

Total recognised income

and expense for the period 205 205

March 2014 final dividend (392) (392)

Special final dividend (370) (370)

Equity as at 30 September

2014 2,515 1,818 (312) 111 4,557 827 11,398 20,914

Walker Crips Group plc

Notes to the condensed consolidated financial statements

For the six months ended 30 September 2014

1. Basis of preparation and accounting policies

The Group's consolidated financial statements are prepared in

accordance with International Financial Reporting Standards as

adopted by the EU (IFRS). These condensed financial statements are

presented in accordance with IAS 34 Interim Financial

Reporting.

The condensed consolidated financial statements have been

prepared on the basis of the accounting policies and methods of

computation set out in the Group's consolidated financial

statements for the year ended 31 March 2014.

The condensed consolidated financial statements should be read

in conjunction with the Group's audited financial statements for

the year ended 31 March 2014.The interim financial information is

unaudited and does not constitute statutory accounts as defined in

section 434 of the Companies Act 2006.The Group's financial

statements for the year ended 31 March 2014 have been reported on

by the auditors and delivered to the Registrar of Companies. The

report of the auditors was unqualified and did not draw attention

to any matters by way of emphasis. They also did not contain a

statement under section 498 (2) or (3) of the Companies Act

2006.

Going Concern

As both the net asset base and cash position remain healthy, the

directors are satisfied that the Group has sufficient resources to

continue in operation for the foreseeable future, a period of not

less than 12 months from the date of this report. Accordingly, they

also conclude in accordance with guidance from the Financial

Reporting Council, that the use of the going concern basis for the

preparation of the financial statements continues to be

appropriate.

Interests in joint ventures

The Group's share of the assets, liabilities, income and

expenses of jointly controlled entities are accounted for in the

consolidated financial statements under the equity method.

Income from the sale or use of the Group's share of the output

of jointly controlled assets, and its share of the joint venture

expenses, are recognised when it is probable that the economic

benefits associated with the transactions will flow to / from the

Group and their amount can be measured accurately.

Goodwill

Goodwill arising on consolidation represents the excess of the

cost of acquisition over the Group's interest in the fair value of

the identifiable assets and liabilities of a subsidiary or jointly

controlled entity at the date of acquisition. Goodwill is initially

recognised as an asset at cost and reviewed for impairment at least

annually. Any impairment is recognised immediately in the income

statement and is not subsequently reversed in future periods.

Intangible assets

At each period end date, the Group reviews the carrying amounts

of its intangible assets to determine whether there is any

indication that those assets have suffered an impairment loss. If

any such indication exists, the recoverable amount of the asset is

estimated in order to determine the extent of the impairment loss

(if any). Where the asset does not generate cash flows that are

independent from other assets, the Group estimates the recoverable

amount of the cash-generating unit to which the assets belong.

Deferred tax

Deferred tax is the tax expected to be payable or recoverable on

differences between the carrying amounts of assets and liabilities

in the financial statements and the corresponding tax bases used in

the computation of taxable profits, and is accounted for using the

balance sheet liability method. Deferred tax liabilities are

generally recognised for all taxable temporary differences and

deferred tax assets are recognised to the extent that is probable

that taxable profits will be available against which deductible

temporary differences can be utilised.

Principal risks and uncertainties

Under the Financial Conduct Authority's Disclosure and

Transparency Rules, the Directors are required to identify those

material risks to which the company is exposed and take appropriate

steps to mitigate those risks. The principal risks and

uncertainties faced by the Group are discussed in detail in the

Annual Report for the year ended 31 March 2014.

Related party transactions

No transactions took place in the period that would materially

or significantly affect the financial position or performance of

the group.

2. Segmental analysis

Investment Wealth Total

Management Management

Revenue (GBP'000)

6m to 30 September

2014 9,514 1,367 10,881

------------ ------------- ----------

6m to 30 September

2013 8,645 1,077 9,722

------------ ------------- ----------

Year to 31 March 2014 18,290 2,398 20,688

------------ ------------- ----------

Unallocated Operating

Result (GBP'000) Costs Profit

6m to 30 September

2014 319 247 (438) 128

------------ ------------- ------------ ----------

6m to 30 September

2013 574 115 (426) 263

------------ ------------- ------------ ----------

Year to 31 March 2014 1,150 221 (901) 470

------------ ------------- ------------ ----------

Subsequent to the sale of subsidiary Keith Bayley Rogers &

Co Ltd in the prior period, the Directors have determined that

Corporate Finance is no longer a segment of continuing significance

and has therefore been omitted from current and prior periods which

have been restated. The immaterial amounts involved have been

included within the Investment Management segment for all

periods.

3. Gain on disposal of investments

There were no disposals of investments during the period.

During the prior period, conversion and disposal of Liontrust

Convertible Unsecured Loan Stock (CULS) with a nominal value of

GBP3.03million and the redemption of the remaining holding with a

nominal value of GBP0.07m, yielded a profit of GBP1,836,000.

4. Loss on disposal of subsidiary undertaking

There were no disposals of subsidiary undertakings during the

period.

During the prior period, on 31 May 2013 the Group completed the

disposal of its subsidiary Keith Bayley Rogers & Co Limited

(following FCA approval) resulting in a loss of GBP8,000.

5. Earnings per share

The calculation of basic earnings per share for continuing

operations is based on the post-tax profit for the period of

GBP205,000 (2013: GBP1,706,000) and on 36,996,187 (2013:

36,938,203) ordinary shares of 6 2/3p, being the weighted average

number of ordinary shares in issue during the period.

The effect of the exercise of outstanding options would be to

reduce the reported earnings per share. The calculation of diluted

earnings per share is based on 37,607,437 (2013: 37,752,011)

ordinary shares, being the weighted average number of ordinary

shares in issue during the period adjusted for dilutive potential

ordinary shares.

6. Dividends

The interim dividend of 0.53 pence per share (2013: 0.51 pence)

is payable on 19 December 2014 to shareholders on the register at

the close of business on 5 December 2014. The interim dividend has

not been included as a liability in this interim report.

7. Total Income (GBP'000)

Six months Ended Six months Ended Year Ended

30 September 30 September 31 March 2014

2014 2013

Revenue 10,881 9,722 20,688

Investment revenues 143 141 240

----------------- ----------------- ---------------

11,024 9,863 20,928

----------------- ----------------- ---------------

The Group's income can also be categorised as follows for the

purpose of measuring a Key Performance Indicator, non-broking

income to total income.

Six months % Six months % Year Ended %

Income (GBP'000) Ended Ended 31 March

30 September 30 September 2014

2014 2013

Broking 4,719 43 4,722 48 9,904 47

Non-Broking 6,305 57 5,141 52 11,024 53

-------------- ---- -------------- ---- ----------- ----

11,024 100 9,863 100 20,928 100

-------------- ---- -------------- ---- ----------- ----

Directors' Responsibility Statement

The Directors confirm that to the best of their knowledge:

(a) The condensed set of financial statements contained within

the half yearly financial report has been prepared in accordance

with IAS 34 'Interim Financial Reporting' as adopted by the EU;

(b) The half yearly report from the Chairman (constituting the

interim management report) includes a fair review of the

information required by DTR 4.2.7R; and

(c) The half yearly report from the Chairman includes a fair

review of the information required by DTR 4.2.8R as far as

applicable.

On Behalf of the Board

Rodney FitzGerald

Chief Executive Officer

20 November 2014

This information is provided by RNS

The company news service from the London Stock Exchange

END

IMSBRBDBUBBBGSC

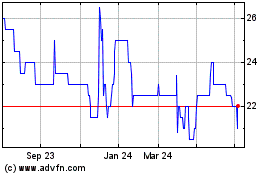

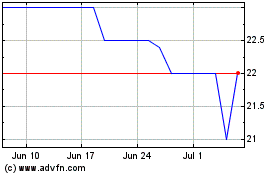

Walker Crips (LSE:WCW)

Historical Stock Chart

From Aug 2024 to Sep 2024

Walker Crips (LSE:WCW)

Historical Stock Chart

From Sep 2023 to Sep 2024