Vodafone Considers A Merger In India -- WSJ

January 31 2017 - 3:03AM

Dow Jones News

U.K. firm's local unit, Idea Cellular discuss possible

combination as upstart moves in

By Stu Woo in London and Newley Purnell in New Delhi

Vodafone Group PLC's India unit is in talks to merge with rival

Idea Cellular Ltd., a move that would combine two of India's three

wireless biggest carriers and catapult the proposed company into

the top ranks of the global telecommunications industry.

For Vodafone, a combination would represent a risky doubling

down on India, a large and promising market that has nonetheless

proven to be much more expensive than the British carrier initially

expected. Flush with cash from the 2014 sale of its Verizon

Wireless stake, Vodafone has spent heavily around the world,

including in India. But in November, it took a EUR5 billion ($5.3

billion) write-down there, stung by intense competition.

Currently, Vodafone's business is India's second-largest mobile

operator by subscribers. Idea, owned by Aditya Birla Group, is No.

3. Both trail Bharti Airtel Ltd. All three carriers have been on

the defensive against an upstart formed late last year by India's

richest man, Mukesh Ambani, who has offered cut-rate data plans and

months of free services to sign up new subscribers.

Vodafone and Idea called discussions over a combination

preliminary. Vodafone said Monday that it was discussing an

all-share merger, but that it wasn't certain it would complete a

deal.

A merger between Idea and Vodafone's India unit would fit with

Vodafone's strategy of trying to be the clear No. 1 or No. 2

competitor in each of the company's markets.

Idea is listed in Mumbai, with a market capitalization of about

$5 billion before the discussions were disclosed. Vodafone said in

November that it had been planning to prepare an initial public

offering of its India business, but was waiting for market

conditions to improve.

Should a combination result in an independent carrier, the new

company would boast 379 million subscribers, leapfrogging Airtel,

and setting itself up as the world's second-largest carrier by

subscribers, the title Vodafone itself currently holds. The No. 1

spot is held by China Mobile Ltd.

Idea shares closed up 26% in Mumbai. Shares in Vodafone were up

1.5% in afternoon trading in London.

Vodafone could boost profitability by consolidating in the face

of stiff competition, said Morningstar analyst Allan Nichols: "We

like the idea of the merger, as we believe there are far too many

operators in the country, which has prevented good returns," he

said.

Mobile carriers have long viewed India as one of the most

promising markets for growth. Vodafone Chief Executive Vittorio

Colao told reporters in November that 700 million people in India

don't have cellphones, while 600 million people do. He said of

those 600 million, only 250 million have smartphones.

But Mr. Colao's push to capitalize hasn't been smooth. A

significant challenge for everyone in India is the market's

typically low incomes, with many consumers paying for mobile-phone

minutes and data only when they have spare change. The country's

average per-capita income is about $1,500 a year. That can make

competition for new subscribers fierce.

In November, Vodafone cited Mr. Ambani's Reliance Jio Infocomm

Ltd. when it disclosed its big India write-down. Mr. Colao said at

the time that Vodafone wasn't losing customers, but added that more

people were buying service plans from competitors. He called

Reliance Jio's promotional offers "unprecedented," and said it was

difficult to compete with a business offering free products.

Mr. Colao said at the time he expected consolidation in India,

but also signaled Vodafone was committed to the market. "The guys

who will stay and be successful will take the benefits, and the

benefits will be 10, 15 years down the road," he said in

November.

Vodafone and Idea "would have been thinking about [a merger] in

any case, but Jio coming in has accelerated the process," said Shiv

Putcha, a Mumbai-based analyst with research firm IDC.

Write to Stu Woo at Stu.Woo@wsj.com and Newley Purnell at

newley.purnell @wsj.com

(END) Dow Jones Newswires

January 31, 2017 02:48 ET (07:48 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

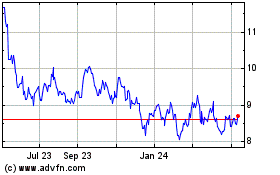

Vodafone (NASDAQ:VOD)

Historical Stock Chart

From Mar 2024 to Apr 2024

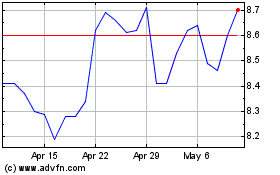

Vodafone (NASDAQ:VOD)

Historical Stock Chart

From Apr 2023 to Apr 2024