Telefónica Considers O2 IPO -- Update

September 05 2016 - 8:39AM

Dow Jones News

By Jeannette Neumann

MADRID--Telefónica SA is laying the groundwork for a potential

initial public offering of its British mobile operator O2, and is

also planning to float a minority stake of its Telxius

infrastructure unit, in a bid by the Spanish telecommunications

giant to raise funds to whittle down its debt.

Telefónica has "begun the preparatory work" for a potential IPO

of O2 and is also considering other options, the company said on

Monday. Telefónica would remain the main shareholder in all of the

options the Madrid-based company is considering.

Analysts say O2 could be valued at around the GBP10.25 billion

($13.6 billion) offered by CK Hutchison Holdings Ltd. last year, a

deal which was eventually quashed by the European Commission.

The company said separately on Monday that it plans to float a

minority stake of at least 25% of its Telxius infrastructure unit.

The IPO is likely to happen before the end of the year, the company

said, after it receives regulatory approval for the deal.

Some analysts said Telefónica's double-barreled confirmation on

Monday is a sign the company is stepping up its efforts to ensure

investors and credit-rating firms that it is tackling its debt load

of more than EUR50 billion ($55.78 billion).

Credit-rating firms such as Moody's Investors Service have said

they want to see Telefónica make progress on paring down its debt

to maintain its credit rating. Investors have been concerned that

the company's debt could jeopardize its dividend. Telefónica has

said its dividend this year is covered.

Telefónica had previously tried to sell O2 to cut its debt load,

but the European Commission said the acquisition by Hutchison would

have resulted in higher prices and fewer choices for U.K. customers

and blocked the deal.

After the deal was scuttled in May, Telefónica executives went

back to the drawing board to figure out what to do with O2. Then,

Britons voted to leave the European Union. The following week the

telecoms company announced it would consolidate the British

operator back into its financial statements. Telefónica executives

later said the company was weighing its options with O2, such as a

minority divestment or a private transaction.

Kepler Cheuvreux analyst Javier Borrachero says O2's revenue has

been resilient since Hutchison made its GBP10.25 billion ($13.6

billion) offer in 2015 and he expects the unit could fetch roughly

the same price in pounds this autumn if current market conditions

hold up. The fall in sterling against the euro after the Brexit

vote means the valuation in euros would drop a bit, he added.

He expects Telefónica to focus first on its IPO of Telxius,

which it officially launched on Monday, and then turn to the share

sale of part of O2 between October and November--if the company

ultimately decides to move forward with that option.

"It would be a bit complicated for executives to be involved in

two IPOs at the same time," Mr. Borrachero said. The sale of some

O2 shares could help Telefónica value its British unit, allowing

the company to do a subsequent stake sale to a specific investor,

he added.

Some analysts note that the valuation of O2 depends largely on

the timing of the potential IPO and made the case that Telefónica

should try to close the deal before BT, a former U.K. state-run

monopoly known as British Telecom, provides details on how it plans

to price its services following its purchase of EE. Regulators

approved the deal earlier this year.

If BT were to launch an aggressive pricing campaign, for

instance, forcing U.K. telecommunications companies to match its

lower prices, that could hit revenue for companies like O2 and

decrease the valuation of a potential IPO, analysts said.

Write to Jeannette Neumann at jeannette.neumann@wsj.com

(END) Dow Jones Newswires

September 05, 2016 08:24 ET (12:24 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

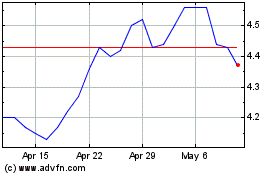

Telefonica (NYSE:TEF)

Historical Stock Chart

From Aug 2024 to Sep 2024

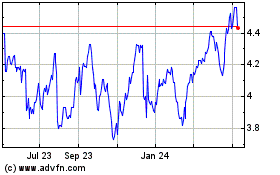

Telefonica (NYSE:TEF)

Historical Stock Chart

From Sep 2023 to Sep 2024