Telefó nica Profit Plunges on Currency Moves

July 28 2016 - 3:40AM

Dow Jones News

MADRID—Spanish telecommunications giant Telefó nica SA said

second-quarter net profit fell by more than half from a year

earlier on lower revenue and currency fluctuations.

The Madrid-based company said Thursday that net profit was €693

million ($766.46 million) in the quarter versus €1.52 billion a

year earlier. The company said a decline in the currencies of

Brazil, Argentina and the U.K. versus the euro, as well as other

currency fluctuations, had shaved 9.1 percentage points off revenue

in the second quarter.

Revenue in the quarter was €12.72 billion, a 7.7% decline from a

year earlier. Operating income excluding depreciation and

amortization was €3.92 billion, a 7.1% drop.

Telefó nica reiterated its targets with a dividend of €0.75

euros a share for 2016 because of what the company said was an

expected improvement in cash flow in the second half of the

year.

While the Argentine peso and the Brazilian real, for instance,

have been a drag on earnings and Telefó nica's share price, Latin

American currencies are bouncing back because of an increase in

commodity prices, more market-friendly governments and an expected

delay in a U.S. rate rise after Britons voted to leave the European

Union, said Javier Borrachero, a telecommunications analyst at

Kepler Cheuvreux. That has brightened the company's outlook, he

said.

Net debt increased €1.98 billion to €52.5 billion in the second

quarter versus the first three months of the year. Investors and

analysts are eager to see Telefó nica whittle down its massive debt

load to avoid a credit-rating downgrade.

To reduce debt, the company had tried to sell its British mobile

operator O2, but that deal was blocked by the European Commission,

which said it would have resulted in higher prices and fewer

choices for U.K. customers. After the U.K. referendum in support of

Brexit, Telefó nica said it would consolidate O2 back into its

financial statements.

"Telefó nica should establish its deleveraging road map as soon

as possible, combining it with a credible and sustainable dividend

policy that would restore investor confidence," Mr. Borrachero

wrote in a July 11 research report.

Write to Jeannette Neumann at jeannette.neumann@wsj.com

(END) Dow Jones Newswires

July 28, 2016 03:25 ET (07:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

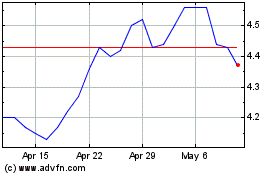

Telefonica (NYSE:TEF)

Historical Stock Chart

From Aug 2024 to Sep 2024

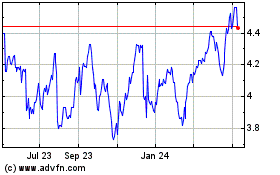

Telefonica (NYSE:TEF)

Historical Stock Chart

From Sep 2023 to Sep 2024