Telefó nica Prepares Possible Sale of Non-Core Assets

January 12 2016 - 4:40AM

Dow Jones News

MADRID—Spain's Telefó nica SA is preparing a possible sale of

non-core assets worth €5 billion-€6 billion ($5.43 billion-$6.52

billion) including telephony towers, a person close to the

situation said Tuesday.

The well-flagged move, first announced by Telefó nica officials

in November, would look to help the telecom company cut its debt

pile, which currently stands at €49.7 billion—slightly above the

company's market value.

Telefó nica is trying to complete the $14 billion sale of its O2

U.K. unit to rival CK Hutchison Holdings Ltd., which is now being

reviewed by the European Commission. The company is aiming to seal

the deal in the second quarter, but analysts have expressed concern

that Europe's top antitrust regulator may set stringent conditions

on the sale, effectively making it less profitable for Telefó

nica.

Telefó nica officials have previously said that they are

considering alternatives to raise additional funds in such case,

also including a possible listing of the company's Mexican unit.

The person close to the situation said the company hasn't yet

decided which specific assets may be sold or listed, adding that

any move would take place in coming months.

Telefó nica has often signaled its strategy is now focused on

cutting debt while maintaining a strong dividend policy that is a

top draw for institutional investors such as pension and investment

funds.

In a recent note to investors, analysts at Bankinter said that,

if the O2 deal is scrapped, Telefó nica may be forced to switch

from a cash dividend to a less appealing scrip dividend, to be paid

in company shares.

Write to Carlos Lopez Perea at carlos.perea@wsj.com and David

Roman at david.roman@wsj.com

(END) Dow Jones Newswires

January 12, 2016 04:25 ET (09:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

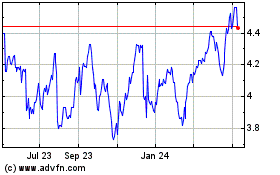

Telefonica (NYSE:TEF)

Historical Stock Chart

From Aug 2024 to Sep 2024

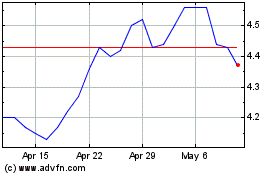

Telefonica (NYSE:TEF)

Historical Stock Chart

From Sep 2023 to Sep 2024