TIDMSL.

RNS Number : 9573U

Standard Life plc

04 August 2015

Standard Life plc

Half year results 2015

4 August 2015

Part 1 of 4

Focus on fee business driving growth and performance

-- Fee based revenue, including Ignis, up 17% to GBP761m with 95% of income now fee based

-- Assets under administration(1) up to GBP302.1bn (FY 2014:

GBP296.6bn; H1 2014: GBP223.9bn) in volatile markets, driven by

increased demand for our investment solutions and acquisition of

Ignis

-- Standard Life Investments meeting the investment needs of customers across the globe:

o Strong 3rd party net inflows of GBP5.2bn despite outflow from

low revenue margin mandate of GBP1.7bn

o Wholesale and institutional net inflows of GBP7.1bn of which

70% from outside of the UK

o Continuing excellent investment performance with 3rd party AUM

above benchmark(2) - 1 year 79%; 3 years 95%; 5 years 97%

-- UK business building momentum and well placed in a changing long-term savings environment:

o Workplace and retail new fee business net inflows up 23% to

GBP2.9bn, representing annualised 8% of opening AUA

o Added 120,000 new customers in the UK through auto enrolment

in H1 2015 contributing to 15% increase in regular contributions

into workplace pensions

o Increased Wrap assets by 11% to GBP23.3bn with Wrap net

inflows up 17% to GBP2.1bn

-- Group underlying performance*(,1) up 9% to GBP299m and

operating profit(1,3) before tax up 6% to GBP290m after a GBP39m

reduction in spread/risk margin

-- Group underlying cash generation(1) up 17% to GBP223m

-- Interim dividend up 7.5% to 6.02p

David Nish, Chief Executive, commented:

"Standard Life has performed well during the first half of 2015

driven by a focus on providing value for our customers, clients and

shareholders. We have increased the assets that we administer on

behalf of our customers to GBP302bn helped by strong demand for our

propositions.

"Standard Life Investments actively manages GBP250bn of assets

across the globe driven by consistently strong investment

performance. We are continuing to see the benefits of our expanding

distribution capabilities and strategic relationships with 70%(4)

of net inflows from outside the UK and strong growth in net inflows

through the wholesale channel.

"Our UK fee based propositions continue to build momentum with

regular contributions into our workplace pensions up 15%. The

strength of these propositions, investment solutions and our market

positioning means we have been able to help our customers with the

new pensions regulations and continue to support them as saving for

their futures becomes increasingly front of mind.

"It has been an absolute privilege to lead Standard Life for the

last six years and to help build our business into the strong

global player it is today. I wish Keith and the inspirational

people across all of our Group every success for the future.

Standard Life is very well positioned to deliver ongoing growth and

to help our customers and clients to save and invest, so that they

can look forward to their financial futures with confidence."

Unless otherwise stated, all figures are reported on a

continuing operations basis(1) .

* Group underlying performance is Group operating profit before

tax from continuing operations after excluding the impact of

spread/risk operating actuarial assumption changes and specific

management actions in the reporting period. A full reconciliation

to profit for the period attributable to equity holders of Standard

Life plc is presented on page 2 of this release.

Financial highlights

H1 2015 H1 2014

Group profitability GBPm GBPm

============================================= ====== ========== =========

Fee based revenue 761 652

Spread/risk margin 40 79

====================================================== ========== =========

Total income 801 731

Total operating expenses (533) (473)

Capital management 1 (4)

Share of associates' and joint

ventures' profit before tax 30 20

====================================================== ========== =========

Group underlying performance

from continuing operations(1) 299 274

====================================================== ========== =========

One-off contribution to with-profits

business in Germany (9) -

Group operating profit before

tax from continuing operations(1) 290 274

====================================================== ========== =========

Tax on operating profit (37) (46)

Share of associates' and joint

ventures' tax expense (5) (1)

====================================================== ========== =========

Operating profit after tax 248 227

Non-operating items (158) (36)

Tax on non-operating items 19 11

Dubai and Singapore included

in discontinued operations segment(5) (40) (6)

====================================================== ========== =========

Profit for the period attributable to

equity holders of Standard Life plc from

continuing operations(1) 69 196

====================================================== ========== =========

IFRS profit from discontinued operations(5) 1,142 79

================================================= ========== =========

Total IFRS profit for the period

attributable to equity holders of

Standard Life plc 1,211 275

================================================= ========== =========

Group underlying performance from continuing H1 2015 H1 2014

operations(1) GBPm GBPm

====================================================== ========== =========

Standard Life Investments 154 102

UK 141 165

Europe 15 23

India and China 21 12

Other (32) (28)

=============================================== ==== ========== =========

Group underlying performance from

continuing operations(1) 299 274

=============================================== ==== ========== =========

Other Group performance indicators

from continuing operations(1) H1 2015 H1 2014

=============================================== ==== ========== =========

Group operating profit before tax

(GBPm) 290 274

Group underlying cash generation

(GBPm) 223 191

Group assets under administration

(GBPbn) 302.1 296.6(6)

Group net inflows (GBPbn) 3.4 4.3

=============================================== ==== ========== =========

Other Group financial highlights H1 2015 H1 2014

=============================================== ==== ========== =========

Group IGD surplus (GBPbn) 2.6 2.9(6)

Group diluted operating EPS from

continuing operations (p) 13.6 11.4

Group diluted EPS from continuing

operations (p) 3.2 8.2

Interim dividend per share (p) 6.02 5.60

=============================================== ==== ========== =========

Group performance

Standard Life continues to perform well driven by a focus on

delivering value for money for our customers and clients.

Group assets under administration (AUA)(1) increased to

GBP302.1bn (FY 2014: GBP296.6bn) in volatile markets, benefiting

from strong net inflows of GBP3.4bn and small but positive market

movements of GBP2.1bn.

Net inflows of GBP3.4bn included outflows from spread/risk

business of GBP0.5bn which were more than offset by net inflows

into our fee propositions of GBP3.8bn. Excluding natural run-off

from conventional with profits of GBP0.4bn and net outflows from

assets managed for the Phoenix Group of GBP2.2bn, adjusted net

inflows into our fee based propositions were strong at GBP6.4bn (H1

2014: GBP5.1bn).

Standard Life Investments continued to deliver strong investment

performance and saw total assets under management (AUM) increase to

GBP250.0bn (FY 2014: GBP245.9bn). Within this, third party AUM

(excluding strategic partner life business) increased to GBP124.4bn

(FY 2014: GBP117.5bn) benefiting from net inflows of GBP7.1bn into

our institutional and wholesale propositions which were partially

offset by outflows from our Ignis business of GBP1.9bn including a

divestment of GBP1.7bn from one large low revenue margin mandate.

Strategic partner life business AUM of GBP125.6bn (FY 2014:

GBP128.4bn), which includes assets managed on behalf of Standard

Life Group and the Phoenix Group, reflects scheduled outflows from

annuities and conventional with profits as well as the expected

outflows from the assets managed for the Phoenix Group.

AUA in the UK of GBP130.4bn (FY 2014: GBP128.1bn) benefited from

a 15% increase in regular contributions into UK workplace pensions

as well as strong inflows into our retail new propositions driven

by ongoing growth in assets on our Wrap platform and strong demand

for our market-leading drawdown proposition. Total UK workplace and

retail new net inflows of GBP2.9bn were up 23% and represented

annualised 8% of opening AUA.

Steady net inflows in Europe and India and China also

contributed to the growth in AUA. Positive market movements at the

start of the year were mostly offset by market volatility in June

and the strength of Sterling against other currencies including the

Euro.

Group operating profit(1) increased by 6% to GBP290m (H1 2014:

GBP274m) after a GBP39m reduction in spread/risk margin due to

lower annuity sales and the reduced benefit from asset liability

management. This was more than offset by strong growth in our fee

business with fee based revenue up 17% to GBP761m driven by growth

in AUA including the acquisition of Ignis in the second half of

2014. Group operating expenses as a proportion of average AUA

reduced by 5bps to 42bps (FY 2014: 47bps). In the UK, demand for

our auto enrolment solutions, including from SMEs, helped us to add

in excess of 120,000 new customers during H1 2015 and we have

secured over 3,700 new schemes with 680,000 joiners since the start

of auto enrolment. Standard Life Investments revenue increased by

40% to GBP402m (H1 2014: GBP288m), which included a 31% increase in

revenue from third party assets (excluding strategic partner life

business) to GBP298m (H1 2014: GBP227m).

IFRS profit after tax attributable to equity holders(1) was

GBP69m (H1 2014: GBP196m) reflecting an increase in non-operating

items. This includes a one-off charge of GBP46m for the

acceleration of DAC amortisation in Hong Kong due to regulatory

change, GBP38m due to the closure of our Singapore insurance

business, GBP20m related to the restructuring of the UK defined

benefit staff pension scheme and GBP17m of Ignis integration costs.

Total IFRS profit of GBP1,211m (H1 2014: GBP275m) includes IFRS

profit from discontinued operations of GBP1,142m (H1 2014: GBP79m)

reflecting the gain on the sale of our Canadian business to

Manulife.

Following the sale of our Canadian business and the return of

value to shareholders of GBP1.75bn in April 2015 our capital

position remains strong with an IGD surplus of GBP2.6bn (FY 2014:

GBP2.9bn). We expect our capital position to remain strong

following the implementation of the Solvency 2 regime.

The Board has proposed an interim dividend of 6.02p per share

(H1 2014: 5.60p), an increase of 7.5%. The Group will continue to

apply its existing progressive dividend policy taking account of

market conditions and the Group's financial performance.

Outlook

We continue to deliver our clear and consistent strategy.

Standard Life Investments remains focused on delivering

excellent investment performance and continuing to respond to the

needs of our customers and clients through new and innovative

investment solutions. We will continue to expand our geographic

reach by building on success in overseas markets through

strengthening our own distribution as well as relationships with

global distribution partners in the US, Canada, India, Japan and

across the Standard Life Group. The integration of Ignis is on

track and we expect to achieve GBP50m of planned annual cost

savings and our EBITDA margin target of 45% by 2017.

Following changes announced in the Budget in March 2014 and in

line with guidance given at our Full year results 2014 in February

we expect the full year contribution from annuity new business to

reduce by between GBP10m-GBP15m and the contribution from asset

liability management to reduce by between GBP30m-GBP40m compared to

full year 2014.

The investments we have made in our UK business in recent years

leave us well positioned to benefit from evolving customer needs

and regulatory changes. This, combined with the investment

expertise of Standard Life Investments and our focus on providing

value for our customers, continues to drive demand for our

propositions across the retail, workplace, institutional and

wholesale channels. Our fee business, including our leading income

drawdown proposition, is well placed for future growth.

As our business in Germany continues to accelerate its

transition away from with profits to unit linked products, we

expect a similar level of underlying performance from our German

and Irish savings businesses in the second half of the year.

In Hong Kong, our wholly owned operation continues to adapt to

regulatory change. Our JV in China is continuing to focus on

profitable growth and in India, HDFC Life and HDFC AMC continue to

perform strongly. We welcome the developments in respect of foreign

direct investment rules in India.

We are very well placed for the future. We have the products,

experience and proven investment performance to help our customers

and clients in all of our markets to save and invest, so that they

can look forward to their financial futures with confidence.

Business highlights - continuing operations(1)

Our goal is to create shareholder value through being a leading

customer-driven business focused on long-term investment savings

propositions in our chosen markets. This is underpinned by a simple

business model: increasing assets, maximising revenue and lowering

unit costs while optimising the balance sheet.

We continue to make good progress in each of our businesses:

Consistently strong performance by Standard Life Investments

-- Benefiting from the acquisition of Ignis, strong investment

performance, ongoing product innovation, high levels of client

service, and an expanding global distribution capability and

footprint

-- Operating profit before tax increased by 51% to GBP154m,

benefiting from a 31% rise in third party revenue (excluding

strategic partner life business) to GBP298m, the acquisition of

Ignis, increased profit from HDFC AMC and a continuing shift in mix

towards higher margin products including UK mutual funds and

multi-asset investment solutions

-- EBITDA margin increased to 40% (H1 2014: 36%) and we are on

track to achieve EBITDA margin of 45% by 2017

-- Strong third party net inflows (excluding strategic partner

life business) of GBP5.2bn (H1 2014: GBP4.0bn) were impacted by the

disinvestment of GBP1.7bn from one large low revenue margin mandate

from our Ignis business

-- Excluding Ignis, third party net inflows increased to GBP7.1bn (H1 2014: GBP4.0bn)

-- Net inflows into higher margin wholesale channel of GBP5.3bn

(H1 2014: GBP2.5bn) with strong demand for MyFolio, equities, fixed

income, real estate and our suite of multi-asset investment

solutions

-- GBP5.0bn (H1 2014: GBP2.2bn) of third party net inflows

(excluding strategic partner life business) from outside the UK as

we begin to see traction in Asia Pacific with net inflows of

GBP0.8bn (H1 2014: GBP0.1bn) and strong net inflows of GBP2.2bn

from Europe (H1 2014: GBP0.6bn)

-- Strong investment performance in volatile market conditions

with third party AUM (excluding strategic partner life business)

above benchmark: one year 79%; three years 95%; and five years

97%

Continuing growth in UK fee business

-- Our UK business continues to benefit from structural market

changes, careful strategic positioning, as well as its attractive

propositions and investment solutions

-- UK operating profit of GBP141m (H1 2014: GBP165m) reflects

ongoing momentum in fee business offset by an expected GBP37m

reduction in spread/risk margin due to lower annuity sales and

reduced benefit from asset liability management

-- Fee revenue increased 4% to GBP314m (H1 2014: GBP303m)

benefiting from higher AUA offset by a GBP6m reduction in revenue

earned on client cash balances

-- Added over 120,000 (H1 2014: 180,000) new customers during

the period driven by auto enrolment and the success of our "Good to

Go" proposition for SMEs

-- Our Wrap platform continued to attract advisers and assets

with AUA up 11% to GBP23.3bn (FY 2014: GBP20.9bn), while the number

of adviser firms using our Wrap platform increased to 1,405, an

increase of 65 adviser firms in H1 2015

-- Assets in our market-leading drawdown proposition increased

by 12% to GBP12.9bn (FY 2014: GBP11.5bn)

-- GBP6.0bn (86%) of total MyFolio AUM of GBP6.9bn is

distributed through the UK business and a quarter of total platform

AUA of GBP24.3bn is managed by Standard Life Investments

Continued progress in India and China

-- Operating profit before tax from JV business up 67% to GBP15m

(H1 2014: GBP9m) reflecting continued growth in premium income

-- HDFC Life ranked 2(nd) for new business sales in the private

life insurance market and leads the market in online sales(7)

-- Heng An Standard Life new business sales up 28%

-- Hong Kong business continues to adapt to regulatory changes

-- Announced closure of Singapore insurance business in June 2015

Business highlights - discontinued operations

Sale of business in Canada to Manulife for GBP2.2bn

The sale of our Canadian business, comprising Canadian long-term

savings and retirement, individual and group insurance business and

Canadian investment management business to Manulife was completed

on 30 January 2015:

-- Gain on sale of GBP1,097m included within non-operating items

-- IFRS profit after tax for the Canadian business, which in H1

2015 included the results for the month of January, was GBP45m (H1

2014: GBP79m)

-- Return of GBP1.75bn of value to shareholders in April 2015,

and share consolidation (9 for 11 shares) to maintain comparability

of share metrics completed on 16 March 2015

Business segment performance

Standard Life Investments

Strategy

We remain very well positioned to deliver profitable growth. We

are increasing our domestic and global presence and expertise

across a range of asset classes while delivering consistently

strong investment performance and strengthening relationships with

our distribution partners. We also continue to leverage our

investment expertise to maximise opportunities and revenues for the

wider Group.

Operating profit

H1 2015 H1 2014

GBPm GBPm

--------------------------------------------- -------- --------

Fee based revenue 402 288

Expenses (263) (197)

Share of associates' and joint ventures'

profit before tax 15 11

Operating profit before tax 154 102

--------------------------------------------- -------- --------

Interest, depreciation, amortisation(8) 7 3

============================================= ======== ========

Earnings before interest, tax, depreciation

and amortisation (EBITDA) 161 105

--------------------------------------------- -------- --------

-- Operating profit up 51% to GBP154m (H1 2014: GBP102m) driven

by acquisition of Ignis and strong net inflows into higher margin

products including UK mutual funds and multi-asset investment

solutions

-- EBITDA up 53% to GBP161m (H1 2014: GBP105m) while EBITDA

margin increased to 40% (H1 2014: 36%)

-- Average fee revenue yield from third party business

(excluding strategic partner life business) maintained at 53bps (FY

2014: 53bps)

-- Operating expense bps expressed as a proportion of average

AUM maintained at 22bps (FY 2014: 22bps), reflecting higher AUM and

ongoing investment in expanding our distribution and geographic

reach as we increase the scale of our business

-- Our associate, HDFC AMC, remains the largest mutual fund

company in India with AUM of GBP15.8bn (FY 2014: GBP15.1bn)

contributing GBP15m (H1 2014: GBP11m) to operating profit

AUM and flows

-- Total AUM increased by 2% to GBP250.0bn (FY 2014: GBP245.9bn)

in volatile markets, benefiting from strong net inflow momentum and

small but positive market movements

-- Third party AUM (excluding strategic partner life business)

increased to GBP124.4bn (FY 2014: GBP117.5bn), representing 50% of

total AUM, while the reduction in strategic partner life business

AUM to GBP125.6bn (FY 2014: GBP128.4bn) was in line with

expectations

-- Third party net inflows (excluding strategic partner life

business) of GBP5.2bn were impacted by the disinvestment of

GBP1.7bn from one large low revenue margin mandate from our Ignis

business

-- Excluding Ignis, third party net inflows increased 78% to

GBP7.1bn (H1 2014: GBP4.0bn) driven by strong sales of MyFolio,

equities, fixed income, real estate and multi-asset strategies

through our wholesale distribution channel

-- 70% of third party net inflows (excluding Ignis) from outside

the UK reflecting the increasingly global nature of our business

with strong net inflows from Europe and North America of GBP2.2bn

(H1 2014: GBP0.6bn) and GBP1.5bn (H1 2014: GBP1.1bn) respectively,

while growing demand from Asia Pacific generated net inflows of

GBP0.8bn (H1 2014: GBP0.1bn)

-- Increased institutional client base to 2,371 (H1 2014: 1,695)

across 48 countries, including around 400 institutional clients

through Ignis

Operational highlights

-- Strong investment performance from Standard Life Investments

with third party AUM (excluding strategic partner life business)

above benchmark: one year 79%; three years 95%; and five years

97%

-- Collaborating across the Group to maximise the Group's share

of the value chain - AUM across our market-leading range of MyFolio

risk-based funds has reached GBP6.9bn (FY 2014: GBP5.9bn) of which

86% has been distributed through the UK business

-- Continued investment to expand our geographical footprint

with offices in 23 cities across 14 countries providing close

support to our clients

-- Strong pipeline of new investment initiatives, including new

innovative customer and client multi-asset and fixed income

solutions

-- We successfully converted our award-winning Property Income

Trust into a Real Estate Investment Trust to ensure greater

accessibility and tax efficiency for investors

UK and Europe

Strategy

We continue to strengthen the business by building on our

innovative propositions and investment solutions. We remain focused

on meeting the needs of our customers in an evolving regulatory and

economic environment. Our market-leading solutions make effective

use of technology to offer individual customers, advisers, employee

benefit consultants and employers the choices and support necessary

to meet their long-term savings objectives. This multi-channel

approach, strengthened by a direct digital offering and recent

launch of a UK-wide advice business, and ability to leverage the

close relationship with Standard Life Investments continues to

benefit not only customers but also our business and Standard Life

Group as a whole.

Operating profit

H1 2015 H1 2014

GBPm GBPm

----------------------------------- -------- -----------

Fee based revenue 314 303

Spread/risk margin 38 75

----------------------------------- -------- -----------

UK total income 352 378

Operating expenses (172) (173)

Investment management fees to SLI (47) (41)

Capital management 8 1

----------------------------------- -------- -----------

UK operating profit before tax 141 165

----------------------------------- -------- -----------

-- UK operating profit of GBP141m (H1 2014: GBP165m) reflects

ongoing momentum in fee business offset by expected GBP37m

reduction in spread/risk margin due to lower annuity sales and

reduced benefit from asset liability management

-- UK fee revenue increased by 4% to GBP314m (H1 2014: GBP303m)

benefiting from growth in AUA and demand for newer style

propositions partially offset by a GBP6m reduction in revenue

earned on client cash balances

-- Average UK fee revenue yield broadly stable at 61bps (FY

2014: 62bps) reflecting the impact of changes in business mix

including a growing proportion of newer style propositions

-- Total UK operating expenses of GBP219m (H1 2014: GBP214m), up

only GBP5m, include a GBP6m increase in investment fees paid to

Standard Life Investments

-- Europe operating profit of GBP6m (H1 2014: GBP23m) reflecting

a one-off GBP9m contribution to with-profits business in Germany,

adverse foreign exchange movements and a reduction in benefit from

asset liability management

AUA and flows

-- UK AUA up 2% to GBP130.4bn (FY 2014: GBP128.1bn) driven by

demand for our newer style retail and workplace propositions and

positive market movements

-- UK fee retail new net inflows increased by 21% to GBP1.8bn

(H1 2014: GBP1.5bn) with gross inflows up 17% to GBP3.6bn (H1 2014:

GBP3.1bn) as Wrap continued to lead the adviser platform

market(9)

-- UK workplace net inflows increased by 26% to GBP1.1bn (H1

2014: GBP0.9bn) reflecting our success in securing new schemes and

the positive impact of auto enrolment which drove a 15% increase in

regular contributions

-- Our distribution capabilities continue to benefit the Group,

with MyFolio assets sold through our UK business up 15% to GBP6.0bn

(FY 2014: GBP5.2bn) and a quarter of assets on our Wrap platform

managed by Standard Life Investments

-- Europe AUA of GBP17.4bn (FY 2014: GBP17.8bn) up 5% in

constant currency with net inflows of GBP0.5bn (H1 2014: GBP0.6bn)

up 4% in constant currency

Operational highlights

-- Increased Wrap platform assets by 11% to GBP23.3bn (FY 2014:

GBP20.9bn) with the highest net sales in the advised platform

market during Q1(9)

-- Number of adviser firms using our Wrap platform increased by

5% to 1,405 firms (FY 2014: 1,340) and number of adviser firms with

assets on Wrap greater than GBP20m up 5% to 271 firms (FY 2014:

259)

-- Added over 120,000 (H1 2014: 180,000) new customers during

the period driven by auto enrolment and the success of our "Good to

Go" proposition for SMEs

-- Drawdown AUA up 12% to GBP12.9bn (FY 2014: GBP11.5bn) with

our newly launched non-advised drawdown proposition attracting

GBP140m of assets largely managed by Standard Life Investments

-- In Germany the proportion of net inflows from unit linked

business continues to grow and increased to 19% (H1 2014: 9%)

Business segment performance continued

India and China

Strategy

Our India and China business consists of life joint ventures in

India and China, and our wholly owned operation in Hong Kong. We

continue to support the development of our joint ventures and

wholly owned business, including identifying opportunities across

Asia that can benefit our wider group, including asset management

opportunities for Standard life Investments.

Operating profit

H1 2015 H1 2014

GBPm GBPm

--------------------------------------------- --------- --------

Insurance JV businesses 15 9

Hong Kong 6 3

Operating profit before tax from continuing

operations(1) 21 12

--------------------------------------------- --------- --------

-- Operating profit increased to GBP21m (H1 2014: GBP12m) due to

growth in premium income in our joint ventures:

-- Ranked 2nd by new business sales in the private life

insurance market in India(7) with almost 20m customers

-- Heng An Standard Life now operates across 40 cities in China

with over 320,000 in-force policies

-- Strong net inflows and investment performance driving 7%

constant currency increase in AUA in our joint venture businesses

to GBP2.2bn (FY 2014: GBP2.1bn)

-- Hong Kong underlying performance expected to be lower in the

second half of the year reflecting changing regulatory

environment

-- We have announced the closure of our insurance business in

Singapore, subject to regulatory approval, which has been

classified as a discontinued operation

For a PDF version of the full half year results announcement,

including this Press Release, please click here:

http://www.rns-pdf.londonstockexchange.com/rns/9573U_1-2015-8-3.pdf

For further information please contact:

Institutional Equity Investors Retail Equity Investors

0131 245 8028 / Capita Asset 0845 113

Jakub Rosochowski* 07515 298 608 Services* 0045

0131 245 6466 /

Neil Longair* 07711 357 595

0131 245 2176 /

Chris Stewart* 07525 149 377

Media Debt Investors

0131 245 1365 / 0131 245

Steve Hartley* 07702 934 651 Stephen Percival* 1571

0131 245 2737 / 0131 245

Nicki Lundy* 07515 298 302 Nick Mardon* 6371

Tulchan Communications 020 7353 4200

* Calls may be monitored and/or recorded to protect both you and

us and help with our training. Call charges will vary.

Newswires and online publications

A conference call for newswires and online publications will

take place on Tuesday 4 August at 7.45am (UK time). Participants

should dial +44 (0)20 3059 8125 and quote Standard Life half year

results 2015. A replay facility will be available for seven days

after the event. To access the replay please dial +44 (0)121 260

4861. The pass code is 1128166#.

Investors and Analysts

A presentation for investors and analysts will take place at 9am

(UK time) at Deutsche Bank, Winchester House, 1 Great Winchester

Street, London EC2N 2DB. There will also be a live webcast and

teleconference at 9am (UK Time), both of which will have the

facility to ask questions at the end of the formal presentation.

Participants should dial +44 (0)20 3059 8125 and quote Standard

Life half year results 2015. A replay facility will be available

for seven days after the event. To access the reply please dial +44

(0)121 260 4861 followed by 4450213#.

Notes to Editors:

1. Continuing operations excludes the Canada and Dubai

businesses and our Singapore insurance business, the closure of

which we announced in June 2015.

2. Excluding strategic partner life business.

3. Operating profit is IFRS profit before tax adjusted to remove

the impact of short-term market driven fluctuations in investment

return and economic assumptions, restructuring costs, impairment of

intangible assets, amortisation of intangible assets acquired in

business combinations, profit or loss on the sale of a subsidiary,

associate or joint venture and other significant one-off items

outside the control of management and not indicative of the

long-term operating performance of the Group.

4. Excluding Ignis.

5. Under IFRS 5, Singapore and Dubai do not constitute

discontinued operations and are included under continuing

operations in the consolidated income statement. Therefore the

analysis of Group operating profit by segment includes the

reclassification of Dubai and Singapore results between

discontinued and continuing operations.

6. As at 31 December 2014.

7. As at 31 March 2015.

8. Excludes amortisation of intangibles acquired in business

combinations which is excluded from operating profit before

tax.

9. Source: Fundscape latest available data.

10. In order to be consistent with the presentation of new

business information, certain products are included in both life

and pensions AUA and investment operations. Therefore, at a Group

level an elimination adjustment is required to remove any

duplication, in addition to other necessary consolidation

adjustments. Comprises GBP17.1bn (FY14: GBP15.2bn) related to fee

business eliminations and GBP0.4bn (FY14: GBP0.4bn) related to

other eliminations.

11. Comprises suite of global absolute return strategies and balanced funds.

12. Comprises cash, private equity and Wealth. Net inflows from

India cash funds GBP0.2bn (H1 2014: net inflow GBP0.1bn).

13. Net inflows from Ignis liquidity funds GBP0.7bn (H1 2014: GBPnil).

14. For more detailed information on the statutory results of

the Group refer to the Half year results 2015.

Assets and flows

Group assets under administration - six months ended 30 June

2015

Opening Closing

AUA Market AUA

at and at

1 Jan Gross Net other 30 Jun

2015 flows Redemptions flows movements 2015

------------------

Fee

(F)

Spread/risk

(S/R)

Other

(O) GBPbn GBPbn GBPbn GBPbn GBPbn GBPbn

--------------------------- -------- ------------------ ------------------ ------------------ --------------------- --------

Total fee 268.6 21.3 (17.5) 3.8 3.0 275.4

Total spread/risk 16.1 0.1 (0.6) (0.5) (0.2) 15.4

Total other 11.9 0.3 (0.2) 0.1 (0.7) 11.3

-------------------- ------ -------- ------------------ ------------------ ------------------ --------------------- --------

Total AUA 296.6 21.7 (18.3) 3.4 2.1 302.1

-------------------- ------ -------- ------------------ ------------------ ------------------ --------------------- --------

By business:

Standard Life

Investments

Third party(2) 117.5 16.0 (10.8) 5.2 1.7 124.4

Third party

strategic

partner life

business 43.8 - (2.2) (2.2) 0.5 42.1

------------------- ------- -------- ------------------ ------------------ ------------------ --------------------- --------

Standard Life

Investments

total third party F 161.3 16.0 (13.0) 3.0 2.2 166.5

-------------------- ------ -------- ------------------ ------------------ ------------------ --------------------- --------

UK

UK retail new fee

business 37.3 3.6 (1.8) 1.8 1.3 40.4

UK retail old fee

business 33.5 0.4 (1.6) (1.2) 1.1 33.4

Workplace 32.0 2.1 (1.0) 1.1 0.1 33.2

-------------------- ------ -------- ------------------ ------------------ ------------------ --------------------- --------

UK retail and

workplace

fee F 102.8 6.1 (4.4) 1.7 2.5 107.0

-------------------- ------ -------- ------------------ ------------------ ------------------ --------------------- --------

Conventional with

profits F 2.1 - (0.4) (0.4) - 1.7

Annuities S/R 15.5 0.1 (0.6) (0.5) (0.1) 14.9

Assets not backing

products O 7.7 - - - (0.9) 6.8

-------------------- ------ -------- ------------------ ------------------ ------------------ --------------------- --------

UK total 128.1 6.2 (5.4) 0.8 1.5 130.4

-------------------- ------ -------- ------------------ ------------------ ------------------ --------------------- --------

Europe

Fee F 17.2 1.1 (0.6) 0.5 (0.8) 16.9

Spread/risk S/R 0.6 - - - (0.1) 0.5

-------------------- ------ -------- ------------------ ------------------ ------------------ --------------------- --------

Europe total 17.8 1.1 (0.6) 0.5 (0.9) 17.4

-------------------- ------ -------- ------------------ ------------------ ------------------ --------------------- --------

UK and Europe total 145.9 7.3 (6.0) 1.3 0.6 147.8

-------------------- ------ -------- ------------------ ------------------ ------------------ --------------------- --------

India and China

Hong Kong F 0.4 - - - - 0.4

Joint ventures O 2.1 0.3 (0.2) 0.1 - 2.2

-------------------- ------ -------- ------------------ ------------------ ------------------ --------------------- --------

India and China

total 2.5 0.3 (0.2) 0.1 - 2.6

-------------------- ------ -------- ------------------ ------------------ ------------------ --------------------- --------

Other corporate

assets O 2.5 - - - 0.2 2.7

Consolidation and

eliminations(10) F/O (15.6) (1.9) 0.9 (1.0) (0.9) (17.5)

Group AUA -

continuing

operations 296.6 21.7 (18.3) 3.4 2.1 302.1

-------------------- ------ -------- ------------------ ------------------ ------------------ --------------------- --------

Standard Life Investments assets under management - six months

ended 30 June 2015

Opening Closing

AUA Market AUA

at and at

1 Jan Gross Net other 30 Jun

2015 flows Redemptions flows movements 2015

----------------------

GBPbn GBPbn GBPbn GBPbn GBPbn GBPbn

-------------------- ---------------------- --------------- ------- ------------ ------- ----------- --------

Third party AUM(2) UK 75.5 7.7 (5.6) 2.1 2.5 80.1

--------------------

Europe 11.3 3.1 (0.9) 2.2 (1.0) 12.5

North America 8.1 2.3 (0.8) 1.5 0.1 9.7

Asia Pacific 2.0 1.1 (0.3) 0.8 0.1 2.9

India 6.1 0.5 - 0.5 (0.3) 6.3

Ignis 14.5 1.3 (3.2) (1.9) 0.3 12.9

------------------------------------------- --------------- ------- ------------ ------- ----------- --------

By geography of client 117.5 16.0 (10.8) 5.2 1.7 124.4

------------------------------------------- --------------- ------- ------------ ------- ----------- --------

Equities 15.5 1.3 (1.4) (0.1) 0.9 16.3

Fixed Income 22.0 1.9 (1.5) 0.4 (1.2) 21.2

Multi Asset(11) 38.6 8.9 (3.3) 5.6 1.7 45.9

Real Estate 7.4 0.5 (0.3) 0.2 0.4 8.0

MyFolio 5.9 1.3 (0.4) 0.9 0.1 6.9

Other(12) 13.6 0.8 (0.7) 0.1 (0.5) 13.2

Ignis(13) 14.5 1.3 (3.2) (1.9) 0.3 12.9

------------------------------------------- --------------- ------- ------------ ------- ----------- --------

By asset class 117.5 16.0 (10.8) 5.2 1.7 124.4

------------------------------------------- --------------- ------- ------------ ------- ----------- --------

Wholesale 35.5 8.9 (3.6) 5.3 (0.2) 40.6

Institutional 61.4 5.4 (3.6) 1.8 1.4 64.6

Wealth 6.1 0.4 (0.4) - 0.2 6.3

Ignis 14.5 1.3 (3.2) (1.9) 0.3 12.9

------------------------------------------- --------------- ------- ------------ ------- ----------- --------

By channel 117.5 16.0 (10.8) 5.2 1.7 124.4

------------------------------------------- --------------- ------- ------------ ------- ----------- --------

Standard Life Group 84.6 2.3 (3.5) (1.2) 0.1 83.5

Phoenix Group 43.8 - (2.2) (2.2) 0.5 42.1

-------------------------------------------- --------------- ------- ------------ ------- ----------- --------

Strategic partner life

business AUM 128.4 2.3 (5.7) (3.4) 0.6 125.6

-------------------------------------------- --------------- ------- ------------ ------- ----------- --------

Standard Life Investment

AUM - continuing operations 245.9 18.3 (16.5) 1.8 2.3 250.0

-------------------------------------------- --------------- ------- ------------ ------- ----------- --------

Group assets under management net flows - 15 months ended 30

June 2015

Fee 3 months 3 months

(F) 3 months to 3 months to 3 months

Spread/risk to 31 to 30 to

(S/R) 30 Jun Mar 31 Dec Sep 30 Jun

2015 2015 2014 2014 2014

Other

(O) GBPbn GBPbn GBPbn GBPbn GBPbn

--------------------------- -------------- -------------------- ------------------ --------- --------- ---------

Total fee 0.8 3.0 (3.1) 0.2 2.3

Total spread/risk (0.3) (0.2) (0.3) (0.2) (0.2)

Total other - 0.1 0.1 - -

------------------------------------------- -------------------- ------------------ --------- --------- ---------

Total net flows 0.5 2.9 (3.3) - 2.1

------------------------------------------- -------------------- ------------------ --------- --------- ---------

By business:

Standard Life Investments

Third party(2) 1.5 3.7 (2.9) 0.6 2.1

Third party strategic

partner life business (0.9) (1.3) (0.9) (0.7) -

------------------------------------------- -------------------- ------------------ --------- --------- ---------

Standard Life Investments

total third party F 0.6 2.4 (3.8) (0.1) 2.1

--------------------------- -------------- -------------------- ------------------ --------- --------- ---------

UK

UK retail new fee

business 0.9 0.9 0.8 0.6 0.7

UK retail old fee

business (0.7) (0.5) (0.5) (0.6) (0.5)

Workplace 0.5 0.6 0.6 0.7 0.4

------------------------------------------- -------------------- ------------------ --------- --------- ---------

UK retail and workplace

fee F 0.7 1.0 0.9 0.7 0.6

--------------------------- -------------- -------------------- ------------------ --------- --------- ---------

Conventional with

profits F (0.2) (0.2) (0.3) (0.2) (0.3)

Annuities S/R (0.3) (0.2) (0.3) (0.2) (0.2)

Assets not backing O

products - - - - -

--------------------------- -------------- -------------------- ------------------ --------- --------- ---------

UK total 0.2 0.6 0.3 0.3 0.1

------------------------------------------- -------------------- ------------------ --------- --------- ---------

Europe

Fee F 0.2 0.3 0.3 0.2 0.3

Spread/risk S/R - - - - -

--------------------------- -------------- -------------------- ------------------ --------- --------- ---------

Europe total 0.2 0.3 0.3 0.2 0.3

------------------------------------------- -------------------- ------------------ --------- --------- ---------

UK and Europe total 0.4 0.9 0.6 0.5 0.4

------------------------------------------- -------------------- ------------------ --------- --------- ---------

India and China

Hong Kong F - - - 0.1 -

Joint ventures O - 0.1 0.1 - -

--------------------------- -------------- -------------------- ------------------ --------- --------- ---------

India and China

total - 0.1 0.1 0.1 -

------------------------------------------- -------------------- ------------------ --------- --------- ---------

Consolidation and

eliminations(10) F (0.5) (0.5) (0.2) (0.5) (0.4)

Group net flows

- continuing operations 0.5 2.9 (3.3) - 2.1

------------------------------------------- -------------------- ------------------ --------- --------- ---------

Standard Life Investments assets under management net flows - 15

months ended 30 June 2015

3 months 3 months

3 months to 3 months to 3 months

to 31 to 30 to

30 Jun Mar 31 Dec Sep 30 Jun

2015 2015 2014 2014 2014

GBPbn GBPbn GBPbn GBPbn GBPbn

----------------------- ------------------------ --------------------- --------- --------- --------- ---------

Third party net

flows(2) UK 1.1 1.0 0.4 (0.3) 1.4

-----------------------

Europe 1.0 1.2 0.5 0.2 0.1

North America 0.7 0.8 0.3 0.1 0.4

Asia Pacific 0.6 0.2 0.1 0.2 -

India - 0.5 0.3 0.2 0.2

Ignis (1.9) - (4.5) 0.2 -

------------------------------------------------ --------------------- --------- --------- --------- ---------

By geography of client 1.5 3.7 (2.9) 0.6 2.1

------------------------------------------------ --------------------- --------- --------- --------- ---------

Equities - (0.1) (1.0) (0.5) -

Fixed Income - 0.4 - (0.9) (0.1)

Multi Asset(11) 2.9 2.7 1.4 1.0 1.4

Real Estate 0.1 0.1 0.3 0.2 0.2

MyFolio 0.5 0.4 0.5 0.3 0.4

Other(12) (0.1) 0.2 0.4 0.3 0.2

Ignis(13) (1.9) - (4.5) 0.2 -

------------------------------------------------ --------------------- --------- --------- --------- ---------

By asset class 1.5 3.7 (2.9) 0.6 2.1

------------------------------------------------ --------------------- --------- --------- --------- ---------

Wholesale 2.7 2.6 1.5 1.2 1.1

Institutional 0.7 1.1 0.1 (0.8) 0.9

Wealth - - - - 0.1

Ignis (1.9) - (4.5) 0.2 -

------------------------------------------------ --------------------- --------- --------- --------- ---------

By channel 1.5 3.7 (2.9) 0.6 2.1

------------------------------------------------ --------------------- --------- --------- --------- ---------

Standard Life Group (0.7) (0.5) (0.5) (0.8) (0.7)

Phoenix Group (0.9) (1.3) (0.9) (0.7) -

------------------------------------------------- --------------------- --------- --------- --------- ---------

Strategic partner life

business net flows (1.6) (1.8) (1.4) (1.5) (0.7)

------------------------------------------------- --------------------- --------- --------- --------- ---------

Standard Life Investment

net flows - continuing

operations (0.1) 1.9 (4.3) (0.9) 1.4

------------------------------------------------- --------------------- --------- --------- --------- ---------

Assets and flows continued

Group assets under administration - six months ended 30 June

2014

Opening Closing

AUA Market AUA

at and at

1 Jan Gross Net other 30 Jun

2014 flows Redemptions flows movements 2014

---------------------------

Fee

(F)

Spread/risk

(S/R)

Other

(O) GBPbn GBPbn GBPbn GBPbn GBPbn GBPbn

----------------------------------- -------- ------- ------------ ------- ----------- --------

Total fee 190.7 15.4 (10.8) 4.6 3.2 198.5

Total spread/risk 15.1 0.2 (0.6) (0.4) 0.6 15.3

Total other 8.9 0.2 (0.1) 0.1 1.1 10.1

----------------------------- ----- -------- ------- ------------ ------- ----------- --------

Total AUA 214.7 15.8 (11.5) 4.3 4.9 223.9

----------------------------- ----- -------- ------- ------------ ------- ----------- --------

By business:

Standard Life Investments

Third party(2) 89.8 10.8 (6.8) 4.0 1.5 95.3

Third party strategic

partner life business - - - - - -

---------------------------- ------ -------- ------- ------------ ------- ----------- --------

Standard Life Investments

total third party F 89.8 10.8 (6.8) 4.0 1.5 95.3

----------------------------- ----- -------- ------- ------------ ------- ----------- --------

UK

UK retail new fee

business 33.8 3.1 (1.6) 1.5 0.9 36.2

UK retail old fee

business 33.5 0.3 (1.4) (1.1) 0.6 33.0

Workplace 29.2 1.8 (0.9) 0.9 (0.2) 29.9

----------------------------- ----- -------- ------- ------------ ------- ----------- --------

UK retail and workplace

fee F 96.5 5.2 (3.9) 1.3 1.3 99.1

----------------------------- ----- -------- ------- ------------ ------- ----------- --------

Conventional with

profits F 2.9 - (0.5) (0.5) 0.1 2.5

Annuities S/R 14.6 0.2 (0.6) (0.4) 0.5 14.7

Assets not backing

products O 5.7 - - - 0.5 6.2

----------------------------- ----- -------- ------- ------------ ------- ----------- --------

UK total 119.7 5.4 (5.0) 0.4 2.4 122.5

----------------------------- ----- -------- ------- ------------ ------- ----------- --------

Europe

Fee F 14.9 1.1 (0.5) 0.6 0.3 15.8

Spread/risk S/R 0.5 - - - 0.1 0.6

----------------------------- ----- -------- ------- ------------ ------- ----------- --------

Europe total 15.4 1.1 (0.5) 0.6 0.4 16.4

----------------------------- ----- -------- ------- ------------ ------- ----------- --------

UK and Europe total 135.1 6.5 (5.5) 1.0 2.8 138.9

----------------------------- ----- -------- ------- ------------ ------- ----------- --------

India and China

Hong Kong F 0.3 - - - - 0.3

Joint ventures O 1.6 0.2 (0.1) 0.1 0.1 1.8

----------------------------- ----- -------- ------- ------------ ------- ----------- --------

India and China

total 1.9 0.2 (0.1) 0.1 0.1 2.1

----------------------------- ----- -------- ------- ------------ ------- ----------- --------

Other corporate

assets O 2.0 - - - 0.5 2.5

Consolidation and

eliminations(10) F/O (14.1) (1.7) 0.9 (0.8) - (14.9)

Group AUA - continuing

operations 214.7 15.8 (11.5) 4.3 4.9 223.9

----------------------------- ----- -------- ------- ------------ ------- ----------- --------

Standard Life Investments assets under management - six months

ended 30 June 2014

Opening Closing

AUA Market AUA

at and at

1 Jan Gross Net other 30 Jun

2014 flows Redemptions flows movements 2014

----------------------

GBPbn GBPbn GBPbn GBPbn GBPbn GBPbn

-------------------- ---------------------- --------------- ------- ------------ ------- ----------- --------

Third party AUM(2) UK 68.3 6.8 (5.0) 1.8 0.8 70.9

--------------------

Europe 10.4 1.5 (0.9) 0.6 (0.5) 10.5

North America 5.2 1.7 (0.6) 1.1 0.7 7.0

Asia Pacific 1.8 0.4 (0.3) 0.1 (0.2) 1.7

India 4.1 0.4 - 0.4 0.7 5.2

Ignis - - - - - -

---------------------- --------------- ------- ------------ ------- ----------- --------

By geography of client 89.8 10.8 (6.8) 4.0 1.5 95.3

------------------------------------------- --------------- ------- ------------ ------- ----------- --------

Equities 15.1 1.5 (1.3) 0.2 0.3 15.6

Fixed Income 20.2 1.4 (1.5) (0.1) 0.6 20.7

Multi Asset(11) 31.4 5.7 (3.0) 2.7 (0.1) 34.0

Real Estate 6.1 0.5 (0.3) 0.2 0.3 6.6

MyFolio 4.0 1.0 (0.2) 0.8 - 4.8

Other(12) 13.0 0.7 (0.5) 0.2 0.4 13.6

Ignis(13) - - - - - -

---------------------- --------------- ------- ------------ ------- ----------- --------

By asset class 89.8 10.8 (6.8) 4.0 1.5 95.3

------------------------------------------- --------------- ------- ------------ ------- ----------- --------

Wholesale 28.9 6.0 (3.5) 2.5 0.4 31.8

Institutional 55.1 4.5 (3.0) 1.5 1.0 57.6

Wealth 5.8 0.3 (0.3) - 0.1 5.9

Ignis - - - - - -

---------------------- --------------- ------- ------------ ------- ----------- --------

By channel 89.8 10.8 (6.8) 4.0 1.5 95.3

------------------------------------------- --------------- ------- ------------ ------- ----------- --------

Standard Life Group 80.3 2.1 (3.2) (1.1) 1.5 80.7

Phoenix Group - - - - - -

-------------------------------------------- --------------- ------- ------------ ------- ----------- --------

Strategic partner life

business AUM 80.3 2.1 (3.2) (1.1) 1.5 80.7

-------------------------------------------- --------------- ------- ------------ ------- ----------- --------

Standard Life Investment

AUM - continuing operations 170.1 12.9 (10.0) 2.9 3.0 176.0

-------------------------------------------- --------------- ------- ------------ ------- ----------- --------

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR EAAPDESKSEAF

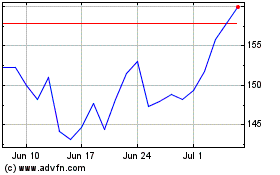

Abrdn (LSE:ABDN)

Historical Stock Chart

From Aug 2024 to Sep 2024

Abrdn (LSE:ABDN)

Historical Stock Chart

From Sep 2023 to Sep 2024