UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of April

1, 2015

Commission File Number 001-34984

FIRST

MAJESTIC SILVER CORP.

(Translation of registrant's name into English)

925 West Georgia Street,

Suite 1805, Vancouver BC V6C 3L2

(Address of principal executive offices)

Indicate by check mark whether

the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Indicate by check mark if the

registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the

registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

SUBMITTED HEREWITH

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| FIRST MAJESTIC SILVER CORP. |

|

| |

|

| By: |

|

| |

|

| /s/ Connie Lillico |

|

| Connie Lillico |

|

| Corporate Secretary |

|

| |

|

| April 1, 2015 |

|

Exhibit 99.1

FIRST MAJESTIC SILVER CORP.

Suite 1805 - 925 West Georgia

Street

Vancouver, B.C., Canada V6C 3L2

Telephone: (604) 688-3033 Fax: (604) 639-8873

Toll Free: 1-866-529-2807

Web site: www.firstmajestic.com; E-mail: info@firstmajestic.com

NEWS RELEASE

| New York - AG |

|

|

|

April 1, 2015 |

| Toronto - FR |

|

|

|

|

| Frankfurt - FMV |

|

|

|

|

| Mexico - AG |

|

|

|

|

First Majestic Updates Mineral

Reserve and Resource Estimates for Year End 2014 and Files Form 40-F Annual Report

FIRST MAJESTIC SILVER CORP. (the "Company"

or “First Majestic”) is pleased to announce its 2014 Mineral Reserve and Resource estimates for its existing mineral

property assets in Mexico as of December 31, 2014. Silver metal content in the Proven and Probable Reserve category totaled 101.1

million ounces of silver, down 7% from 108.6 million as of December 31, 2013. Metal prices used to estimate the 2014 Reserve estimates

were lowered compared to the prior year to: $20.00/oz of silver, $1,200/oz of gold, $0.95/lb of lead and $1.00/lb of zinc.

The following table shows the total tonnage mined from

each of the Company’s five producing properties during 2014, including total ounces of silver and silver equivalent ounces

produced from each property and the tonnage mined from delineated reserves and resources at each property.

2014 Production Table

| |

LA

ENCANTADA |

LA

PARRILLA |

DEL

TORO |

SAN

MARTIN |

LA

GUITARRA |

TOTAL |

| TONNES

OF ORE PROCESSED |

721,172 |

711,915 |

629,492 |

363,952 |

186,881 |

2,613,412 |

| OZ OF

SILVER PRODUCED |

3,711,633 |

2,876,450 |

2,690,717 |

1,833,618 |

636,301 |

11,748,719 |

| OZ OF

SILVER EQ. PRODUCED FROM OTHER METALS |

20,019 |

1,796,742 |

988,066 |

284,644 |

419,777 |

3,509,248 |

| TOTAL

OZ OF SILVER EQ. PRODUCED |

3,731,652 |

4,673,192 |

3,678,783 |

2,118,262 |

1,056,078 |

15,257,967 |

| TONNES MINED FROM MATERIAL IN

RESERVES |

416,591 |

708,211 |

608,260 |

320,812 |

125,487 |

2,179,360 |

| TONNES

MINED FROM MATERIAL NOT IN RESERVES |

304,582 |

3,704 |

21,233 |

43,140 |

61,393 |

434,051 |

(1) Silver-equivalent grade is estimated considering: metal price assumptions,

metallurgical recovery for the corresponding mineral type/mineral process and the metal payable of the corresponding contract of

each mine.

The Company completed over 44,000 metres of diamond drilling

at its five operating mines in 2014, representing a 25% reduction in metres drilled compared to the prior year. For 2015, First

Majestic is planning to drill approximately 50,000 metres to further define known mineralized ore bodies at its operating mines.

A combination of surface and underground drill rigs will focus on assisting mining activities, definition drilling and to support

future updates to the Company’s NI 43-101 Technical Reports.

Starting this year, First Majestic is reporting Mineral

Resources inclusive of Mineral Reserves; readers are cautioned of this change since the Company had previously reported Mineral

Resources exclusive of Mineral Reserves.

The largest change to Mineral Reserves occurred at La

Encantada where the old tailings were downgraded from Proven and Probable Reserves to Inferred Resources after the Company’s

decision to suspend the reprocessing of the old tailings due to the low metal price environment. This resulted in a 76% increase

in the Reserves silver grade, a 57% decrease in total Reserve tonnes and a 24% decrease in Reserve silver metal content. However,

the underground Proven and Probable Mineral Reserves increased by 56% to 3.2 million tonnes containing 28.4 million ounces of silver

with average silver grade of 276 g/t.

Silver metal content in the Measured and Indicated Resource

category totaled 152.4 million ounces. In addition, the silver metal content in the Inferred Resource totaled 170.4 million ounces,

a decrease of 18% compared to the prior year due mainly to the impact of lower metal price assumptions, the adoption of the stricter

CIM Definition Standards, and the subtraction of Resources for the Peñasco Quemado and La Frazada projects, which were disposed

of during 2014.

The complete 2014 Mineral Reserve and Resource estimates

for all metals, tonnage and grades are shown below in the following tables:

| Mine |

Category |

Mineral Type |

k tonnes |

Ag (g/t) |

Au (g/t) |

Pb (%) |

Zn (%) |

Ag-Eq (g/t) |

Ag (k Oz) |

Ag-Eq (k Oz) |

| |

|

|

|

|

|

|

|

|

|

|

| LA ENCANTADA |

Proven (UG) |

Oxides |

1,084 |

248 |

- |

- |

- |

248 |

8,639 |

8,639 |

| |

Probable (UG) |

Oxides |

2,115 |

291 |

- |

- |

- |

291 |

19,754 |

19,754 |

| |

Total Proven and Probable (UG) |

Oxides |

3,199 |

276 |

- |

- |

- |

276 |

28,393 |

28,393 |

| |

|

|

|

|

|

|

|

|

|

|

| LA PARRILLA |

Proven (UG) |

Oxides |

302 |

219 |

- |

- |

- |

219 |

2,119 |

2,119 |

| |

Probable (UG) |

Oxides |

1,025 |

213 |

0.02 |

- |

- |

214 |

7,032 |

7,061 |

| |

Total Proven and Probable (UG) |

Oxides |

1,327 |

215 |

0.01 |

- |

- |

215 |

9,152 |

9,181 |

| |

Proven (UG) |

Sulphides |

585 |

201 |

- |

1.8 |

1.9 |

304 |

3,784 |

5,714 |

| |

Probable (UG) |

Sulphides |

1,473 |

157 |

0.04 |

1.5 |

2.4 |

261 |

7,436 |

12,369 |

| |

Total Proven and Probable (UG) |

Sulphides |

2,057 |

170 |

0.03 |

1.6 |

2.3 |

273 |

11,220 |

18,083 |

| |

Total Proven and Probable (UG) |

Oxides + Sulphides |

3,384 |

187 |

0.02 |

1.0 |

1.4 |

251 |

20,371 |

27,264 |

| |

|

|

|

|

|

|

|

|

|

|

| SAN MARTÍN |

Proven (UG) |

Oxides |

1,024 |

224 |

0.18 |

- |

- |

237 |

7,359 |

7,790 |

| |

Probable (UG) |

Oxides |

1,813 |

188 |

0.04 |

- |

- |

191 |

10,960 |

11,107 |

| |

Total Proven and Probable (UG) |

Oxides |

2,837 |

201 |

0.09 |

- |

- |

207 |

18,319 |

18,897 |

| |

|

|

|

|

|

|

|

|

|

|

| DEL TORO |

Proven (UG) |

Transition |

511 |

156 |

0.03 |

2.0 |

2.1 |

231 |

2,560 |

3,792 |

| |

Probable (UG) |

Transition |

589 |

157 |

0.06 |

2.6 |

1.6 |

224 |

2,964 |

4,248 |

| |

Total Proven and Probable (UG) |

Transition |

1,100 |

156 |

0.05 |

2.3 |

1.8 |

227 |

5,523 |

8,040 |

| |

Proven (UG) |

Sulphides |

1,097 |

148 |

0.08 |

2.7 |

1.8 |

229 |

5,206 |

8,063 |

| |

Probable(UG) |

Sulphides |

1,991 |

218 |

0.18 |

4.0 |

3.9 |

347 |

13,931 |

22,218 |

| |

Total Proven and Probable (UG) |

Sulphides |

3,088 |

193 |

0.15 |

3.5 |

3.2 |

305 |

19,138 |

30,281 |

| |

Total Proven and Probable (UG) |

Transition + Sulphides |

4,187 |

183 |

0.12 |

3.2 |

2.8 |

285 |

24,661 |

38,321 |

| |

|

|

|

|

|

|

|

|

|

|

| LA GUITARRA |

Proven (UG) |

Sulphides |

91 |

153 |

1.84 |

- |

- |

256 |

446 |

745 |

| |

Probable (UG) |

Sulphides |

1,217 |

228 |

1.00 |

- |

- |

284 |

8,911 |

11,098 |

| |

Total Proven and Probable (UG) |

Sulphides |

1,308 |

223 |

1.06 |

- |

- |

282 |

9,358 |

11,843 |

| |

|

|

|

|

|

|

|

|

|

|

| |

Total Proven and Probable (UG) |

All mineral types |

14,915 |

211 |

0.15 |

1.1 |

1.1 |

260 |

101,102 |

124,718 |

(1) Mineral Reserves have been classified in accordance

with the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) Definition Standards on Mineral Resources and

Mineral Reserves, whose definitions are incorporated by reference into National Instrument 43-101 - Standards of Disclosure for

Mineral Projects (“NI 43-101”).

(2) In all cases, metal prices considered for Mineral Reserves

estimates were $20 USD/oz Ag, $1,200 USD/oz Au, $0.95 USD/lb Pb, and $1.00 USD/lb Zn.

(3) The Mineral Reserves information provided above for

La Encantada, La Parrilla, Del Toro and San Martín is based on internal estimates prepared as of December 31, 2014. The

information provided was reviewed and validated by the Company’s internal Qualified Person, Mr. Ramon Mendoza Reyes, P.Eng.,

who has the appropriate relevant qualifications, and experience in mining and reserves estimation practices.

(4) Mineral Reserve estimates for La Guitarra are based

on the 2015 La Guitarra Silver Mine Technical Report compiled by First Majestic with contribution of Amec Foster Wheeler Americas

Ltd.

(5) Silver-equivalent grade is estimated considering: metal

price assumptions, metallurgical recovery for the corresponding mineral type/mineral process and the metal payable of the corresponding

contract of each mine. Estimation details are listed in each mine section of the 2014 Annual Information Form.

(6) The cut-off grades and modifying factors used to convert

Mineral Reserves from Mineral Resources are different for all mines. The cut-off grades are listed in each mine section of the

2014 Annual Information Form.

| Mine / Project |

Category |

Mineral Type |

k tonnes |

Ag (g/t) |

Au (g/t) |

Pb (%) |

Zn (%) |

Ag-Eq (g/t) |

Ag (k Oz) |

Ag-Eq (k Oz) |

| |

|

|

|

|

|

|

|

|

|

|

| LA ENCANTADA |

Measured (UG) |

Oxides |

1,086 |

283 |

- |

- |

- |

283 |

9,878 |

9,878 |

| |

Indicated (UG) |

Oxides |

2,289 |

321 |

- |

- |

- |

321 |

23,623 |

23,623 |

| |

Total Measured and Indicated (UG) |

Oxides |

3,375 |

309 |

- |

- |

- |

309 |

33,501 |

33,501 |

| |

|

|

|

|

|

|

|

|

|

|

| LA PARRILLA |

Measured (UG) |

Oxides |

344 |

255 |

- |

- |

- |

255 |

2,817 |

2,817 |

| |

Indicated (UG) |

Oxides |

953 |

254 |

- |

- |

- |

255 |

7,774 |

7,807 |

| |

Total Measured and Indicated (UG) |

Oxides |

1,298 |

254 |

- |

- |

- |

255 |

10,591 |

10,624 |

| |

Measured (UG) |

Sulphides |

703 |

240 |

- |

2.2 |

2.1 |

347 |

5,415 |

7,845 |

| |

Indicated (UG) |

Sulphides |

1,310 |

188 |

0.05 |

1.8 |

2.8 |

302 |

7,939 |

12,705 |

| |

Total Measured and Indicated (UG) |

Sulphides |

2,013 |

206 |

0.03 |

1.9 |

2.6 |

318 |

13,355 |

20,550 |

| |

Total Measured and Indicated (UG) |

Oxides + Sulphides |

3,311 |

225 |

0.0 |

1.2 |

1.6 |

293 |

23,946 |

31,175 |

| |

|

|

|

|

|

|

|

|

|

|

| SAN MARTÍN |

Measured (UG) |

Oxides |

1,240 |

254 |

0.26 |

- |

- |

273 |

10,128 |

10,882 |

| |

Indicated (UG) |

Sulphides |

1,819 |

220 |

0.11 |

- |

- |

228 |

12,878 |

13,360 |

| |

Total Measured and Indicated (UG) |

Oxides + Sulphides |

3,059 |

234 |

0.17 |

- |

- |

246 |

23,006 |

24,242 |

| |

|

|

|

|

|

|

|

|

|

|

| DEL TORO |

Measured (UG) |

Transition |

538 |

185 |

0.04 |

2.6 |

2.6 |

257 |

3,198 |

4,450 |

| |

Indicated (UG) |

Transition |

549 |

180 |

0.06 |

2.9 |

1.9 |

258 |

3,176 |

4,544 |

| |

Total Measured and Indicated (UG) |

Transition |

1,087 |

182 |

0.05 |

2.7 |

2.2 |

257 |

6,373 |

8,994 |

| |

Measured (UG) |

Sulphides |

1,150 |

182 |

0.08 |

3.3 |

2.3 |

272 |

6,726 |

10,048 |

| |

Indicated(UG) |

Sulphides |

1,747 |

255 |

0.21 |

4.6 |

4.6 |

394 |

14,315 |

22,128 |

| |

Total Measured and Indicated (UG) |

Sulphides |

2,897 |

226 |

0.16 |

4.1 |

3.7 |

345 |

21,041 |

32,176 |

| |

Total Measured and Indicated (UG) |

Transition + Sulphides |

3,984 |

214 |

0.13 |

3.7 |

3.3 |

321 |

27,414 |

41,169 |

| |

|

|

|

|

|

|

|

|

|

|

| LA GUITARRA |

Measured (UG) |

Sulphides |

121 |

170 |

2.37 |

- |

- |

305 |

660 |

1,185 |

| |

Indicated (UG) |

Sulphides |

1,029 |

335 |

1.56 |

- |

- |

424 |

11,078 |

14,029 |

| |

Total Measured and Indicated (UG) |

Sulphides |

1,150 |

318 |

1.65 |

- |

- |

412 |

11,738 |

15,214 |

| |

|

|

|

|

|

|

|

|

|

|

| LA LUZ |

Measured (UG) |

Oxides |

2,614 |

221 |

- |

- |

- |

221 |

18,559 |

18,559 |

| |

Measured (Tailings) |

Oxides (Tailings) |

1,403 |

90 |

- |

- |

- |

90 |

4,075 |

4,075 |

| |

Indicated (UG) |

Sulphides |

988 |

321 |

- |

- |

- |

321 |

10,202 |

10,202 |

| |

Total Measured + Indicated |

All material types |

5,005 |

204 |

- |

- |

- |

204 |

32,836 |

32,836 |

| |

|

|

|

|

|

|

|

|

|

|

| |

Total Measured and Indicated |

All mineral types |

19,885 |

238 |

0.15 |

0.94 |

0.92 |

279 |

152,442 |

178,137 |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| INFERRED MINERAL RESOURCES WITH AN EFFECTIVE DATE OF DECEMBER 31, 2014 |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| Mine / Project |

Category |

Mineral Type |

k tonnes |

Ag (g/t) |

Au (g/t) |

Pb (%) |

Zn (%) |

Ag-Eq (g/t) |

Ag (k Oz) |

Ag-Eq (k Oz) |

| |

|

|

|

|

|

|

|

|

|

|

| LA ENCANTADA |

Inferred (UG) |

Oxides |

899 |

340 |

- |

- |

- |

340 |

9,832 |

9,832 |

| |

Inferred (Tailings) |

Tailings |

6,026 |

107 |

- |

- |

- |

107 |

20,731 |

20,731 |

| |

Inferred Total |

Oxides + Tailings |

6,926 |

137 |

- |

- |

- |

137 |

30,562 |

30,562 |

| |

|

|

|

|

|

|

|

|

|

|

| LA PARRILLA |

Inferred (UG) |

Oxides |

3,422 |

259 |

- |

- |

- |

259 |

28,477 |

28,477 |

| |

Inferred (UG) |

Sulphides |

5,848 |

190 |

- |

2.4 |

3.1 |

324 |

35,676 |

60,997 |

| |

Inferred Total (UG) |

Oxides + Sulphides |

9,270 |

215 |

- |

1.5 |

2.0 |

300 |

64,153 |

89,475 |

| |

|

|

|

|

|

|

|

|

|

|

| SAN MARTÍN |

Inferred Total (UG) |

Oxides |

5,541 |

216 |

- |

- |

- |

216 |

38,502 |

38,502 |

| |

|

|

|

|

|

|

|

|

|

|

| DEL TORO |

Inferred (UG) |

Transition |

1,457 |

186 |

0.04 |

2.6 |

2.2 |

257 |

8,699 |

12,031 |

| |

Inferred (UG) |

Sulphides |

4,211 |

176 |

0.13 |

3.8 |

5.3 |

297 |

23,821 |

40,156 |

| |

Inferred Total (UG) |

Transition + Sulphides |

5,669 |

178 |

0.11 |

3.5 |

4.5 |

286 |

32,520 |

52,187 |

| |

|

|

|

|

|

|

|

|

|

|

| LA GUITARRA |

Inferred Total (UG) |

Sulphides |

739 |

197 |

1.23 |

- |

- |

267 |

4,674 |

6,343 |

| |

|

|

|

|

|

|

|

|

|

|

| |

Total Inferred |

All mineral types |

28,145 |

188 |

0.05 |

1.2 |

1.6 |

240 |

170,412 |

217,070 |

(1) Mineral Resources have been classified in accordance

with CIM Definition Standards on Mineral Resources and Mineral Reserves, whose definitions are incorporated by reference into NI

43-101.

(2) In all cases, metal prices considered for Mineral Resource

estimates were $22 USD/oz Ag, $1,350 USD/oz Au, $0.95 USD/lb Pb, and $1.00 USD/lb Zn.

(3) The Mineral Resources information provided above for

La Encantada, La Parrilla, Del Toro and San Martín is based on internal estimates prepared as of December 31, 2014. The

information provided was reviewed and validated by the Company’s internal Qualified Person, Mr. Jesus M. Velador Beltran,

Ph.D. Geology, who has the appropriate relevant qualifications, and experience in mining and resource geology.

(4) Mineral Resource estimates for La Guitarra Silver Mine

are based on the 2015 Technical Report compiled by First Majestic with contribution of Amec Foster Wheeler Americas Ltd.

(5) Silver-equivalent grade is estimated considering: metal

price assumptions, metallurgical recovery for the corresponding mineral type/mineral process and the metal payable of the corresponding

contract of each mine. Estimation details are listed in each mine section of the 2014 Annual Information Form.

(6) The cut-off grades for Mineral Resources are different

for all mines. The cut-off grades are listed in each mine section of the 2014 Annual Information Form.

(7) Measured and Indicated Mineral Resources are reported

inclusive of Mineral Reserves.

(8) The La Luz resource estimates are taken from the Real

de Catorce Property Technical Report dated July 25, 2008 and the Real de Catorce Property Technical Report dated July 30, 2007.

The Company’s Qualified Persons are working on applying similar economic inputs to the La Luz Silver Project to those applied

to the other properties.

| Project |

Category |

Mineral Type |

k tonnes |

Ag (g/t) |

Au (g/t) |

Pb (%) |

Zn (%) |

Ag (k Oz) |

Ag-Eq (k Oz) |

| |

|

|

|

|

|

|

|

|

|

| PLOMOSAS |

Not in accordance with

CIM Standards |

Sulphides (UG) |

896 |

192 |

0.8 |

2.1 |

3.4 |

5,500 |

11,000 |

| |

|

|

|

|

|

|

|

|

|

(1) Plomosas historical estimates are taken from Grupo

Mexico’s estimates prepared in 2001.

(2) Tonnage is expressed in thousands of tonnes, metal

content is expressed in thousands of ounces.

(3) The Company’s Qualified Persons have been coordinating

the work for the verification of the information supporting the historical estimates at Plomosas. The historical estimates at Plomosas

do not conform to NI 43-101 for reporting purposes; as such, the Company is not treating these historical estimates as current

Mineral Reserves or Mineral Resources. Since the historical estimates do not have demonstrated current economic viability, these

estimates should not be relied upon until the verification process and due diligence in progress by the Company's Qualified Person

is completed.

(4) In order to verify or upgrade the historical estimates,

the Company will need to complete a diamond drilling program at the Rosario and San Juan mines. The drilling program is designed

to confirm the historical estimates reported by Grupo Mexico and will allow the Company to plan a second exploration program focused

on locating extensions of the known mineralization. Other work required to verify the historical estimates as current includes,

but it is not limited to: re-survey of underground workings, re-survey of available exploration drill-hole monuments, review of

drilling, sampling and assays databases, and the re-assessment of the estimates following CIM Estimation of Mineral Resources and

Mineral Reserves Best Practice Guidelines and CIM Definition Standards on Mineral Resources and Mineral Reserves.

The Company also announces that its 2014 audited

financial statements have been filed on SEDAR. In addition, a Form 40-F report has been filed with the United States Securities

and Exchange Commission and is available on EDGAR. Both documents are also available on the Company’s website at www.firstmajestic.com.

Shareholders may also receive a copy of First Majestic’s

audited financial statements, without charge, upon request to First Majestic, Suite 1805 - 925 West Georgia Street Vancouver, B.C.,

Canada, V6C 3L2 or to info@firstmajestic.com.

Mr. Ramon Mendoza Reyes, Vice President Technical Services

for First Majestic, is a "qualified person" as such term is defined under National Instrument 43-101, and has reviewed

and approved the technical information disclosed in this news release.

First Majestic is a mining company focused on silver production

in México and is aggressively pursuing the development of its existing mineral property assets and the pursuit through acquisition

of additional mineral assets which contribute to the Company achieving its corporate growth objectives.

FOR FURTHER INFORMATION contact info@firstmajestic.com,

visit our website at www.firstmajestic.com or call our toll free number 1.866.529.2807.

FIRST MAJESTIC SILVER CORP.

“signed”

Keith Neumeyer, President & CEO

SPECIAL NOTE REGARDING FORWARD-LOOKING INFORMATION

This news release includes certain "Forward-Looking

Statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and applicable Canadian

securities laws. When used in this news release, the words “anticipate”, “believe”, “estimate”,

“expect”, “target”, “plan”, “forecast”, “may”, “schedule”

and similar words or expressions, identify forward-looking statements or information. These forward-looking statements or information

relate to, among other things: the price of silver and other metals; the accuracy of mineral reserve and resource estimates and

estimates of future production and costs of production at our properties; estimated production rates for silver and other payable

metals produced by us, the estimated cost of development of our development projects; the effects of laws, regulations and government

policies on our operations, including, without limitation, the laws in Mexico which currently have significant restrictions related

to mining; obtaining or maintaining necessary permits, licences and approvals from government authorities; and continued access

to necessary infrastructure, including, without limitation, access to power, land, water and roads to carry on activities as planned.

These statements reflect the Company’s

current views with respect to future events and are necessarily based upon a number of assumptions and estimates that, while considered

reasonable by the Company, are inherently subject to significant business, economic, competitive, political and social uncertainties

and contingencies. Many factors, both known and unknown, could cause actual results, performance or achievements to be materially

different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements

or information and the Company has made assumptions and estimates based on or related to many of these factors. Such factors include,

without limitation: fluctuations in the spot and forward price of silver, gold, base metals or certain other commodities (such

as natural gas, fuel oil and electricity); fluctuations in the currency markets (such as the Canadian dollar and Mexican peso

versus the U.S. dollar); changes in national and local government, legislation, taxation, controls, regulations and political

or economic developments in Canada, Mexico; operating or technical difficulties in connection with mining or development activities;

risks and hazards associated with the business of mineral exploration, development and mining (including environmental hazards,

industrial accidents, unusual or unexpected formations, pressures, cave-ins and flooding); risks relating to the credit worthiness

or financial condition of suppliers, refiners and other parties with whom the Company does business; inability to obtain adequate

insurance to cover risks and hazards; and the presence of laws and regulations that may impose restrictions on mining, including

those currently enacted in Mexico; employee relations; relationships with and claims by local communities and indigenous populations;

availability and increasing costs associated with mining inputs and labour; the speculative nature of mineral exploration and

development, including the risks of obtaining necessary licenses, permits and approvals from government authorities; diminishing

quantities or grades of mineral reserves as properties are mined; the Company’s title to properties; and the factors identified

under the caption “Risk Factors” in the Company’s Annual Information Form, under the caption “Risks Relating

to First Majestic's Business”.

Investors are cautioned against attributing undue certainty

to forward-looking statements or information. Although the Company has attempted to identify important factors that could cause

actual results to differ materially, there may be other factors that cause results not to be anticipated, estimated or intended.

The Company does not intend, and does not assume any obligation, to update these forward-looking statements or information to reflect

changes in assumptions or changes in circumstances or any other events affecting such statements or information, other than as

required by applicable law.

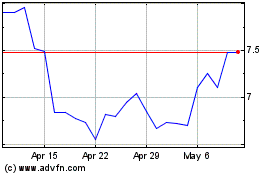

First Majestic Silver (NYSE:AG)

Historical Stock Chart

From Mar 2024 to Apr 2024

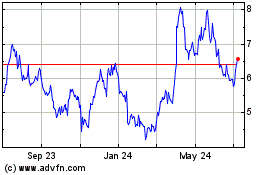

First Majestic Silver (NYSE:AG)

Historical Stock Chart

From Apr 2023 to Apr 2024