UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the Month of August, 2014

Commission file number 0-30070

AUDIOCODES LTD.

(Translation of registrant’s name

into English)

1 Hayarden Street • Airport City,

Lod 7019900 • ISRAEL

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ý Form 40-F

¨

Indicate by check mark if the registrant is

submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ____

Note: Regulation S-T Rule 101(b)(1)

only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is

submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ____

Note: Regulation S-T Rule 101(b)(7)

only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant

foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated,

domiciled or legally organized (the registrant's "home country"), or under the rules of the home country exchange on

which the registrant's securities are traded, as long as the report or other document is not a press release, is not required to

be and has not been distributed to the registrant's security holders, and, if discussing a material event, has already been the

subject of a Form 6-K submission or other Commission filing on EDGAR.

The following documents are attached hereto

and incorporated by reference herein:

| Exhibit 99.1. | Interim Condensed Consolidated Financial Statements as

of June 30, 2014. |

| Exhibit 99.2. | Operating Results and Financial Review in connection

the Interim Condensed Consolidated Financial Statements for the six months ended June 30, 2014. |

The Interim Condensed Consolidated Financial

Statements of AudioCodes Ltd. as of June 30, 2014 attached as Exhibit 99.1 and the Operating Results and Financial Review in connection

with the Interim Condensed Consolidated Financial Statements of AudioCodes Ltd. for the six months ended June 30, 2014 attached

as Exhibit 99.2 to this Report on Form 6-K are hereby incorporated by reference into (i) the Registrant’s Registration Statement

on Form S-8, File No. 333-11894; (ii) the Registrant’s Registration Statement on Form S-8, File No. 333-13268; (iii) the

Registrant’s Registration Statement on Form S-8, File No. 333-105473; (iv) the Registrant’s Registration Statement

on Form S-8, File No. 333-144825; (v) the Registrant’s Registration Statement on Form S-8, File No. 333-160330; (vi) the

Registrant’s Registration Statement on Form S-8, File No. 333-170676; (vii) the Registrant’s Registration Statement

on Form S-8, File No. 333-190437; and (viii) the Registrant’s Registration Statement on Form F-3, File No. 333-193209.

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

AUDIOCODES LTD.

(Registrant)

By: /s/

GUY AVIDAN

Guy Avidan

Chief Financial Officer

Dated: August 27, 2014

EXHIBIT INDEX

|

Exhibit

No. |

Description |

| |

|

| 99.1 |

Interim Unaudited Condensed Consolidated Financial Statements of AudioCodes Ltd. as of June 30, 2014 |

| |

|

| 99.2 |

Operating Results and Financial Review in connection with the Interim Condensed Consolidated Financial Statements of AudioCodes Ltd. for the six months ended June 30, 2014 |

Exhibit 99.1

AUDIOCODES LTD.

INTERIM CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

AS OF JUNE 30, 2014

IN U.S. DOLLARS

UNAUDITED

INDEX

| |

Page |

| |

|

|

Interim Condensed Consolidated

Balance Sheets |

2 - 3 |

| |

|

| Interim Condensed Consolidated Statements of Operations |

4 |

| |

|

| Interim Condensed Consolidated Statements of Comprehensive Income (Loss) |

5 |

| |

|

| Interim Condensed Statements of Changes in Equity |

6 |

| |

|

| Interim Condensed Consolidated Statements of Cash Flows |

7 - 8 |

| |

|

| Notes to Interim Condensed Consolidated Financial Statements |

9 - 17 |

- - - - - - - - -

- -

INTERIM

CONDENSED CONSOLIDATED BALANCE SHEETS

U.S. dollars in thousands

| | |

June 30, | | |

December 31, | |

| | |

2014 | | |

2013 | |

| | |

Unaudited | | |

Audited | |

| | |

| | |

| |

| ASSETS | |

| | | |

| | |

| | |

| | | |

| | |

| CURRENT ASSETS: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 18,201 | | |

$ | 30,763 | |

| Short-term and restricted bank deposits | |

| 8,101 | | |

| 9,101 | |

| Short-term marketable securities and accrued interest | |

| 535 | | |

| 15,706 | |

| Trade receivables (net of allowance for doubtful accounts of $ 2,363 (unaudited) and $ 2,347 at June 30, 2014 and December 31, 2013, respectively) | |

| 30,794 | | |

| 26,431 | |

| Other receivables and prepaid expenses | |

| 6,220 | | |

| 3,922 | |

| Deferred tax assets, net | |

| 2,283 | | |

| 2,277 | |

| Inventories | |

| 14,045 | | |

| 13,811 | |

| | |

| | | |

| | |

| Total

current assets | |

| 80,179 | | |

| 102,011 | |

| | |

| | | |

| | |

| LONG-TERM ASSETS: | |

| | | |

| | |

| Long-term and restricted bank deposits and accrued interest | |

| 5,382 | | |

| 6,697 | |

| Long-term marketable securities | |

| 59,582 | | |

| - | |

| Deferred tax assets, net | |

| 3,888 | | |

| 4,855 | |

| Severance pay funds | |

| 19,579 | | |

| 19,549 | |

| | |

| | | |

| | |

| Total

long-term assets | |

| 88,431 | | |

| 31,101 | |

| | |

| | | |

| | |

| PROPERTY AND EQUIPMENT, NET | |

| 2,959 | | |

| 3,191 | |

| | |

| | | |

| | |

| INTANGIBLE ASSETS, NET | |

| 3,574 | | |

| 4,252 | |

| | |

| | | |

| | |

| GOODWILL | |

| 33,749 | | |

| 33,749 | |

| | |

| | | |

| | |

| Total

assets | |

$ | 208,892 | | |

$ | 174,304 | |

The accompanying notes are an integral

part of the interim condensed consolidated financial statements.

INTERIM

CONDENSED CONSOLIDATED BALANCE SHEETS

U.S. dollars in thousands, except per

share data

| | |

June 30, | | |

December 31, | |

| | |

2014 | | |

2013 | |

| | |

Unaudited | | |

Audited | |

| LIABILITIES AND EQUITY | |

| | | |

| | |

| | |

| | | |

| | |

| CURRENT LIABILITIES: | |

| | | |

| | |

| Short-term loan and current maturities of long-term bank loans | |

$ | 4,686 | | |

$ | 4,686 | |

| Trade payables | |

| 7,761 | | |

| 7,215 | |

| Senior convertible notes | |

| 53 | | |

| 353 | |

| Other payables and accrued expenses | |

| 18,887 | | |

| 17,958 | |

| Deferred revenues | |

| 9,872 | | |

| 6,940 | |

| | |

| | | |

| | |

| Total

current liabilities | |

| 41,259 | | |

| 37,152 | |

| | |

| | | |

| | |

| LONG-TERM LIABILITIES: | |

| | | |

| | |

| Accrued severance pay | |

| 19,689 | | |

| 19,845 | |

| Long-term banks loans | |

| 7,448 | | |

| 9,791 | |

| Deferred revenues and other liabilities | |

| 2,839 | | |

| 2,707 | |

| | |

| | | |

| | |

| Total

long-term liabilities | |

| 29,976 | | |

| 32,343 | |

| | |

| | | |

| | |

| COMMITMENTS AND CONTINGENT LIABILITIES | |

| | | |

| | |

| | |

| | | |

| | |

| EQUITY: | |

| | | |

| | |

| Share capital - | |

| | | |

| | |

| Ordinary shares of NIS 0.01 par value - | |

| | | |

| | |

| Authorized: 100,000,000 shares at June 30, 2014 and December 31, 2013; Issued: 54,647,213 shares at June 30, 2014 and 50,090,696 shares at December 31, 2013; Outstanding: 43,290,506 shares at June 30, 2014 and 38,733,989 shares at December 31, 2013 | |

| 128 | | |

| 114 | |

| Additional paid-in capital | |

| 234,406 | | |

| 201,248 | |

| Treasury stock at cost- 11,356,707 shares as of June 30, 2014 and December 31, 2013 | |

| (35,768 | ) | |

| (35,768 | ) |

| Accumulated deficit | |

| (61,109 | ) | |

| (60,785 | ) |

| | |

| | | |

| | |

| Total equity | |

| 137,657 | | |

| 104,809 | |

| | |

| | | |

| | |

| Total

liabilities and equity | |

$ | 208,892 | | |

$ | 174,304 | |

The accompanying notes are an integral

part of the interim condensed consolidated financial statements.

INTERIM

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

U.S. dollars in thousands, except per

share data

| | |

Six months ended

June 30, | |

| | |

2014 | | |

2013 | |

| | |

Unaudited | |

| Revenues: | |

| | | |

| | |

| Products | |

$ | 57,917 | | |

$ | 53,712 | |

| Services | |

| 15,600 | | |

| 12,243 | |

| | |

| | | |

| | |

| Total

revenues | |

| 73,517 | | |

| 65,955 | |

| | |

| | | |

| | |

| Cost of revenues: | |

| | | |

| | |

| Products | |

| 26,193 | | |

| 24,706 | |

| Services | |

| 3,961 | | |

| 3,104 | |

| | |

| | | |

| | |

| Total

cost of revenues | |

| 30,154 | | |

| 27,810 | |

| | |

| | | |

| | |

| Gross profit | |

| 43,363 | | |

| 38,145 | |

| | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | |

| Research and development, net | |

| 16,228 | | |

| 14,280 | |

| Selling and marketing | |

| 22,895 | | |

| 18,956 | |

| General and administrative | |

| 3,716 | | |

| 4,116 | |

| | |

| | | |

| | |

| Total

operating expenses | |

| 42,839 | | |

| 37,352 | |

| | |

| | | |

| | |

| Operating income | |

| 524 | | |

| 793 | |

| Financial income (expenses), net | |

| 102 | | |

| (122 | ) |

| | |

| | | |

| | |

| Income before taxes on income | |

| 626 | | |

| 671 | |

| Income tax expenses, net | |

| (950 | ) | |

| (138 | ) |

| Equity in losses of affiliated company, net | |

| - | | |

| (21 | ) |

| | |

| | | |

| | |

| Net income (loss) | |

$ | (324 | ) | |

$ | 512 | |

| | |

| | | |

| | |

| Basic net earnings (loss) per share | |

$ | (0.01 | ) | |

$ | 0.01 | |

| Diluted net earnings (loss) per share | |

$ | (0.01 | ) | |

$ | 0.01 | |

The accompanying notes are an integral

part of the interim condensed consolidated financial statements.

INTERIM

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

U.S. dollars in thousands

| | |

Six months ended

June 30, | |

| | |

2014 | | |

2013 | |

| | |

Unaudited | |

| | |

| | |

| |

| Net income (loss) | |

$ | (324 | ) | |

$ | 512 | |

| | |

| | | |

| | |

| Other comprehensive income (“OCI”), related to: | |

| | | |

| | |

| Gain on derivatives recognized in OCI | |

| - | | |

| 934 | |

| Gain on derivatives (effective portion) recognized in income | |

| - | | |

| (891 | ) |

| Other comprehensive income, related to unrealized gains on cash flow hedges | |

| - | | |

| 43 | |

| | |

| | | |

| | |

| Total comprehensive income (loss) | |

$ | (324 | ) | |

$ | 555 | |

The accompanying notes are an integral

part of the interim condensed consolidated financial statements.

INTERIM

CONDENSED STATEMENTS OF CHANGES IN EQUITY

U.S. dollars in thousands

| | |

| | |

| | |

| | |

Accumulated | | |

| | |

| |

| | |

| | |

Additional | | |

| | |

other | | |

| | |

| |

| | |

Share | | |

paid-in | | |

Treasury | | |

comprehensive | | |

Accumulated | | |

Total | |

| | |

capital | | |

capital | | |

stock | | |

income (loss) | | |

deficit | | |

equity | |

| Balance as of December 31, 2012 (audited) | |

| 112 | | |

| 197,653 | | |

| (35,768 | ) | |

| 1,303 | | |

| (65,003 | ) | |

| 98,297 | |

| Issuance of shares upon exercise of options (audited) | |

| 2 | | |

| 1,894 | | |

| - | | |

| - | | |

| - | | |

| 1,896 | |

| Stock compensation related to options granted to employees (audited) | |

| - | | |

| 1,701 | | |

| - | | |

| - | | |

| - | | |

| 1,701 | |

| Other comprehensive loss (audited) | |

| - | | |

| - | | |

| - | | |

| (1,303 | ) | |

| - | | |

| (1,303 | ) |

| Net income (audited) | |

| - | | |

| - | | |

| - | | |

| - | | |

| 4,218 | | |

| 4,218 | |

| Balance as of December 31, 2013 (audited) | |

$ | 114 | | |

$ | 201,248 | | |

$ | (35,768 | ) | |

$ | - | | |

$ | (60,785 | ) | |

$ | 104,809 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Issuance of shares upon exercise of options (unaudited) | |

| 2 | | |

| 2,110 | | |

| - | | |

| - | | |

| - | | |

| 2,112 | |

| Stock compensation related to options granted to employees (unaudited) | |

| - | | |

| 1,316 | | |

| - | | |

| - | | |

| - | | |

| 1,316 | |

| Issuance of ordinary shares (unaudited) | |

| 12 | | |

| 29,732 | | |

| - | | |

| - | | |

| - | | |

| 29,744 | |

| Net loss (unaudited) | |

| - | | |

| - | | |

| - | | |

| - | | |

| (324 | ) | |

| (324 | ) |

| Balance as of June 30, 2014 (unaudited) | |

$ | 128 | | |

$ | 234,406 | | |

$ | (35,768 | ) | |

$ | - | | |

$ | (61,109 | ) | |

$ | 137,657 | |

The accompanying notes are an integral

part of the interim condensed consolidated financial statements.

INTERIM

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

U.S. dollars in thousands

| | |

Six months ended

June 30, | |

| | |

2014 | | |

2013 | |

| | |

Unaudited | |

| Cash flows from operating activities: | |

| | | |

| | |

| | |

| | | |

| | |

| Net income (loss) | |

$ | (324 | ) | |

$ | 512 | |

| Adjustments required to reconcile net income (loss) to net cash provided by operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 1,629 | | |

| 1,379 | |

| Amortization of marketable securities premiums and accretion of discounts, net | |

| 195 | | |

| 192 | |

| Equity in losses of affiliated companies, net and interest on loans to affiliate company | |

| - | | |

| 21 | |

| Stock-based compensation expenses | |

| 1,316 | | |

| 717 | |

| Decrease in accrued interest on loans, convertible notes, marketable securities, bank deposits and structured notes | |

| 159 | | |

| 52 | |

| Decrease in deferred tax assets, net | |

| 961 | | |

| - | |

| Increase in trade receivables, net | |

| (4,363 | ) | |

| (2,229 | ) |

| Increase in other accounts receivable and prepaid expenses | |

| (2,364 | ) | |

| (736 | ) |

| Decrease (increase) in inventories | |

| (234 | ) | |

| 3,331 | |

| Increase (decrease) in trade payables | |

| 546 | | |

| (535 | ) |

| Increase in other accounts payable and accrued expenses | |

| 953 | | |

| 726 | |

| Increase in deferred revenues | |

| 3,273 | | |

| 3,200 | |

| Increase (decrease) in accrued severance pay, net | |

| (186 | ) | |

| 114 | |

| | |

| | | |

| | |

| Net cash provided by operating activities | |

| 1,561 | | |

| 6,744 | |

The accompanying notes are

an integral part of the interim condensed consolidated financial statements.

INTERIM

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

U.S. dollars in thousands

| | |

Six months ended

June 30, | |

| | |

2014 | | |

2013 | |

| | |

Unaudited | |

| Cash flows from investing activities: | |

| | | |

| | |

| | |

| | | |

| | |

| Purchase of marketable securities | |

| (60,170 | ) | |

| - | |

| Proceeds from redemption of marketable securities upon maturity | |

| 15,390 | | |

| 4,000 | |

| Decrease (increase) short-term deposits | |

| 1,000 | | |

| (269 | ) |

| Investment in affiliated company | |

| - | | |

| (1,211 | ) |

| Proceeds from redemption of long-term bank deposits | |

| 1,381 | | |

| 1,312 | |

| Purchase of property and equipment | |

| (719 | ) | |

| (673 | ) |

| | |

| | | |

| | |

| Net cash provided by (used in) investing activities | |

| (43,118 | ) | |

| 3,159 | |

| | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | |

| | |

| | | |

| | |

| Repayment of senior convertible notes | |

| (285 | ) | |

| - | |

| Repayment of long-term bank loans | |

| (2,343 | ) | |

| (5,343 | ) |

| Consideration related to

acquisition of NSC non- controlling interest | |

| - | | |

| (515 | ) |

| Proceeds from issuance of shares upon exercise of stock options and warrants | |

| 2,112 | | |

| 210 | |

| Proceeds from issuance of shares,

net of issuance cost in the amount of $ 2,456 (unaudited) | |

| 29,744 | | |

| - | |

| Consideration related to payment of acquisition of Mailvision | |

| (233 | ) | |

| - | |

| | |

| | | |

| | |

| Net cash provided by (used in) financing activities | |

| 28,995 | | |

| (5,648 | ) |

| | |

| | | |

| | |

| Increase (decrease) in cash and cash equivalents | |

| (12,562 | ) | |

| 4,255 | |

| Cash and cash equivalents at the beginning of the period | |

| 30,763 | | |

| 15,219 | |

| | |

| | | |

| | |

| Cash and cash equivalents at the end of the period | |

$ | 18,201 | | |

$ | 19,474 | |

| | |

| | | |

| | |

| Supplemental disclosure of cash flow activities: | |

| | | |

| | |

| | |

| | | |

| | |

| Cash paid during the period for income taxes | |

$ | 185 | | |

$ | 172 | |

| | |

| | | |

| | |

| Cash paid during the period for interest | |

$ | 229 | | |

$ | 320 | |

The accompanying notes are an integral

part of the interim condensed consolidated financial statements.

NOTES TO INTERIM CONDENSED

CONSOLIDATED FINANCIAL STATEMENTS

U.S. dollars in thousands, except share

and per share data

AudioCodes Ltd. (the "Company")

and its subsidiaries (together the "Group") design, develop and market products and services for voice, data and video

over IP networks to service providers and channels (such as distributors), OEMs, network equipment providers and systems integrators.

The Company operates through

its wholly-owned subsidiaries in the United States, Europe, Asia, Latin America and Israel.

| b. | The Group's major customer in the six months ended June 30, 2014, and 2013, accounted for 14.3%

(unaudited) and 17.7% (unaudited) of the Group's revenues in those periods, respectively. No other customer accounted for more

than 10% of the Group's revenues in those periods. |

| c. | Asset Purchase Agreement with Mailvision Ltd ("Mailvision"): |

In April 2013, the Company entered

into an asset purchase agreement with Mailvision, an Israeli company which develops, markets and licenses VoIP solutions for mobile,

PC and tablet devices for telecom operators and service providers, in which the Company held 29.2% of the outstanding share capital.

Pursuant to the agreement, in May 2013, the Company acquired certain assets and assumed certain liabilities of Mailvision.

The purchase agreement

provides that, under certain limited circumstances, if the Company were to sell the acquired assets and assumed liabilities

of Mailvision to a third party prior to May 2014, the proceeds from such sale in excess of a specified amount would be

payable to Mailvision, and, if the purchase price offered by a third party prior to May 2014 exceeds a specified amount,

subject to a number of conditions, the Company would be required to sell the acquired assets and assumed liabilities (the

"Sale Option"). In May 2014, the Sale Option expired. In addition, the Company paid the liability with respect to

the commitment for future payment in the amount of $ 233 (unaudited). (See also Note 5 for changes in the fair value of

contingent consideration liabilities related to Mailvision's acquisition).

| d. | The Group is dependent upon sole source suppliers for certain key components used in its products,

including certain digital signal processing chips. Although there are a limited number of manufacturers of these particular components,

management believes that other suppliers could provide similar components at comparable terms. A change in suppliers, however,

could cause a delay in manufacturing and a possible loss of sales, which could adversely affect the operating results of the Group

and its financial position. |

NOTES TO INTERIM CONDENSED

CONSOLIDATED FINANCIAL STATEMENTS

U.S. dollars in thousands, except share

and per share data

| NOTE 2:- | SIGNIFICANT ACCOUNTING POLICIES |

The significant

accounting policies applied in the annual financial statements of the Company as of December 31, 2013, are applied consistently

in these financial statements. For further information refer to the consolidated financial statements as of December 31, 2013.

| a. | Interim financial statements: |

The interim

condensed consolidated balance sheet as of June 30, 2014 and the related interim condensed consolidated statements of operations,

comprehensive income (loss) and cash flows for the six months ended June 30, 2014 and 2013, and the statement of equity for the

six months ended June 30, 2014, are unaudited. This unaudited information has been prepared by the Company in accordance with accounting

principles generally accepted in the United States of America ("U.S. GAAP") for interim financial statements, and on

the same basis as the audited annual consolidated financial statements and in management's opinion, reflects all adjustments (consisting

only of normal recurring accruals) necessary for a fair presentation of the financial information, in accordance with generally

accepted accounting principles, for interim financial reporting for the periods presented and accordingly, they do not include

all of the information and footnotes required by generally accepted accounting principles for audited financial statements. However,

the Company believes that the disclosures are adequate to make the information presented not misleading. These Interim Condensed

Consolidated Financial Statements should be read in conjunction with the 2013 Annual Consolidated Financial Statements and the

notes thereto. The Interim Condensed Consolidated Balance Sheet Data as of December 31, 2013 was derived from the 2013 Annual Consolidated

Financial Statements, but does not include all disclosures required by U.S. GAAP.

The

preparation of financial statements in conformity with U.S. GAAP requires management to make estimates, judgments and

assumptions that affect the amounts reported in the financial statements and accompanying notes. The Company's management

believes that the estimates, judgments and assumptions used are reasonable based upon information available at the time they

are made. As applicable to these interim condensed consolidated financial statements, the most significant estimates and

assumptions relate to revenue recognition and allowance for sales returns, allowance for doubtful accounts, inventories,

intangible assets, goodwill, income taxes and valuation allowance, stock-based compensation and contingent liabilities and

certain liabilities related to the acquisition of Mailvision. Actual results could differ from those estimates.

| c. | New accounting guidance recently adopted: |

In July 2013,

the Financial Accounting Standards Board ("FASB") issued ASU 2013-11, Topic 740, " Income Taxes", which limits

the situations in which unrecognized tax benefits are offset against a deferred tax asset for a net operating loss carryforward,

similar tax loss or tax credit carryforward. The relevant presentation and disclosures have been applied retrospectively for all

periods presented.

NOTES TO INTERIM CONDENSED

CONSOLIDATED FINANCIAL STATEMENTS

U.S. dollars in thousands, except share

and per share data

| NOTE 2:- | SIGNIFICANT ACCOUNTING POLICIES (Cont.) |

| d. | Impact of recently issued accounting standard not yet

adopted: |

In May 2014,

the FASB issued Accounting Standards Update No. 2014-09 (ASU 2014-09) "Revenue from Contracts with Customers." ASU 2014-09

supersedes the revenue recognition requirements in “Revenue Recognition (Topic 605)”, and requires entities to recognize

revenue when it transfers promised goods or services to customers in an amount that reflects the consideration to which the entity

expects to be entitled to in exchange for those goods or services. ASU 2014-09 is effective for annual reporting periods beginning

after December 15, 2016, including interim periods within that reporting period. Early adoption is not permitted. The Company is

currently in the process of evaluating the impact of the adoption of ASU 2014-09 on its consolidated financial statements.

| NOTE 3:- | MARKETABLE SECURITIES AND ACCRUED INTEREST |

The following is a summary of

held to maturity marketable securities:

| | |

December 31, 2013 | |

| | |

Amortized | | |

Unrealized | | |

Fair | |

| | |

cost | | |

gains | | |

Value | |

| | |

Audited | |

| Corporate debentures: | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | |

| Maturing within one year | |

$ | 15,438 | | |

$ | 35 | | |

$ | 15,473 | |

| Accrued interest | |

| 268 | | |

| - | | |

| 268 | |

| | |

| | | |

| | | |

| | |

| | |

$ | 15,706 | | |

$ | 35 | | |

$ | 15,741 | |

| | |

June 30, 2014 | |

| | |

Amortized | | |

Unrealized | | |

Unrealized | | |

Fair | |

| | |

cost | | |

gains | | |

losses | | |

Value | |

| | |

Unaudited | |

| Corporate debentures: | |

| | | |

| | | |

| | | |

| | |

| Maturing between one to five years | |

$ | 59,582 | | |

$ | 27 | | |

$ | (220 | ) | |

$ | 59,389 | |

| Accrued interest | |

| 535 | | |

| - | | |

| - | | |

| 535 | |

| | |

| | | |

| | | |

| | | |

| | |

| | |

$ | 60,117 | | |

$ | 27 | | |

$ | (220 | ) | |

$ | 59,924 | |

These investments were issued

by highly rated corporations. Accordingly, it is expected that the securities would not be settled at a price less than the amortized

cost of the Company's investment. As of June 30, 2014 and December 31, 2013, the Group did not have any investment in marketable

securities that was in an unrealized loss position for twelve months period or greater. Since the Company had the ability and intent

to hold these investments until an anticipated recovery of fair value, which may be until maturity, the Company did not consider

these investments to be other-than-temporarily impaired as of June 30, 2014. Unrealized gains (losses) are valued using alternative

pricing sources and models utilizing market observable inputs.

NOTES TO INTERIM CONDENSED

CONSOLIDATED FINANCIAL STATEMENTS

U.S. dollars in thousands, except share

and per share data

| | |

June 30, | | |

December 31, | |

| | |

2014 | | |

2013 | |

| | |

Unaudited | | |

Audited | |

| | |

| | | |

| | |

| Raw materials | |

$ | 6,417 | | |

$ | 5,931 | |

| Finished products | |

| 7,628 | | |

| 7,880 | |

| | |

| | | |

| | |

| | |

$ | 14,045 | | |

$ | 13,811 | |

In the six months ended June

30, 2014 and 2013, the Group wrote-off inventories in a total amount of $ 60 (unaudited) and $ 561 (unaudited), respectively.

| NOTE 5:- | FAIR VALUE MEASUREMENTS |

In accordance

with ASC No. 820, the Group measures its foreign currency derivative instruments, its contingent consideration to NSC's former

shareholders and its contingent consideration to Mailvision, at fair value. Investments in foreign currency derivative instruments

are classified within Level 2 value hierarchy. This is because these assets are valued using alternative pricing sources and models

utilizing market observable inputs. The contingent consideration to NSC's former shareholders and the Earn Out and the Sale Option

provided to Mailvision are classified within Level 3 value hierarchy because these liabilities are based on present value calculations

and an external valuation models whose inputs include market interest rates, estimated operational capitalization rates and volatilities.

Unobservable inputs used in these models are significant.

The Group's

financial assets and liabilities measured at fair value on a recurring basis, consisted of the following types of instruments as

of the following dates:

| | |

December 31, 2013 | |

| | |

Fair value measurements using input type | |

| | |

Level 2 | | |

Level 3 | | |

Total | |

| | |

Audited | |

| | |

| | |

| | |

| |

| Contingent consideration related to Mailvision's acquisition | |

$ | - | | |

$ | (556 | ) | |

$ | (556 | ) |

| | |

| | | |

| | | |

| | |

| Total Financial liability | |

$ | - | | |

$ | (556 | ) | |

$ | (556 | ) |

| | |

June 30, 2014 | |

| | |

Fair value measurements using input type | |

| | |

Level 2 | | |

Level 3 | | |

Total | |

| | |

Unaudited | |

| Contingent consideration related to Mailvision's acquisition | |

$ | - | | |

$ | (459 | ) | |

$ | (459 | ) |

| | |

| | | |

| | | |

| | |

| Total Financial liability | |

$ | - | | |

$ | (459 | ) | |

$ | (459 | ) |

NOTES TO INTERIM CONDENSED

CONSOLIDATED FINANCIAL STATEMENTS

U.S. dollars in thousands, except share

and per share data

| NOTE 5:- | FAIR VALUE MEASUREMENTS (Cont.) |

Fair

value measurements using significant unobservable inputs (Level 3):

| Balance at January 1, 2014 (audited) | |

$ | (556 | ) |

| Adjustment due to time change value (unaudited) | |

| 97 | |

| | |

| | |

| Balance at June 30, 2014 (unaudited) | |

$ | (459 | ) |

| NOTE 6:- | SENIOR CONVERTIBLE NOTES |

In November

2004, the Company issued an aggregate of $ 125,000 principal amount of its 2% Senior Convertible Notes due November 9,

2024 (the "Notes"). As of December 31, 2013, there was $ 353 (audited) in principal amount of the Notes outstanding.

In January 2014, the Company repurchased Notes in the principal amount of $300 (unaudited).

| NOTE 7:- | COMMITMENTS AND CONTINGENT LIABILITIES |

The Company's

facilities are rented under several lease agreements in Israel, Europe and the U.S. for periods ending in 2024.

As of June

30, 2014, future minimum rental commitments under non-cancelable operating leases are as follows:

| Year ending June 30, | |

| |

| | |

Unaudited | |

| 2015 | |

$ | 6,708 | |

| 2016 | |

| 6,442 | |

| 2017 | |

| 6,571 | |

| 2018 | |

| 6,414 | |

| 2019 and on | |

| 33,571 | |

| | |

| | |

| Total minimum lease payments *) | |

$ | 59,706 | |

| *) | Minimum payments have been reduced by minimum sublease rental of $ 1,218 (unaudited) due in

the future under non-cancelable subleases. |

In connection

with the Company's offices lease agreement in Israel, the lessor has a lien of approximately $ 5,500 (unaudited) which is

included in short-term and restricted bank deposits.

Rent expenses

for the six months ended June 30, 2014 and 2013, were approximately $ 3,150 (unaudited) and $ 2,591 (unaudited), respectively.

NOTES TO INTERIM CONDENSED

CONSOLIDATED FINANCIAL STATEMENTS

U.S. dollars in thousands, except share

and per share data

| NOTE 8:- | COMMITMENTS AND CONTINGENT LIABILITIES (Cont.) |

The Company

is obligated under certain agreements with its suppliers to purchase specified items of excess inventory. Non-cancelable obligations

as of June 30, 2014, were $ 13,547 (unaudited).

| c. | Royalty commitment to the Office of the Chief Scientist of the Israeli Ministry of Economy ("OCS"): |

As of June

30, 2014 and December 31, 2013 , the Company and its Israeli subsidiaries have a contingent obligation to pay royalties in the

amount of $ 36,058 (unaudited) and $ 34,034 (audited), respectively.

As of June

30, 2014 and December 31, 2013, the Company and its Israeli subsidiaries have paid or accrued royalties to the OCS in the amount

of $ 2,733 (unaudited) and $ 2,408 (audited), respectively, which was recorded as cost of revenues.

| 1. | In January 2013, one of the Company’s former senior executives sent a letter of demand claiming

an amount of NIS 4 million (approximately $ 1,200) relating to the termination of his employment (the "Letter").

The Company has denied his allegations and believes that it has valid defenses to this claim. In May 2014, the former senior executive

filed a claim to court with similar allegations to those described in the Letter. The Company believes it has good grounds to contest

the claim. At this early stage, the Company cannot predict the outcome of this claim. |

| 2. | In February 2013, a patent infringement action was commenced against AudioCodes Inc. and other

defendants, in Federal Court in California alleging that AudioCodes Inc. infringed the plaintiff’s intellectual property

rights in one patent. One of the other defendants is a customer of the Group that has informed the Group that it believes it is

entitled to indemnification from the Group with respect to this litigation. AudioCodes Inc. has filed an answer to the complaint

and the parties have exchanged a first set of discovery requests. The parties are currently negotiating a settlement. The Group

recorded an appropriate provision for this claim. |

| 3. | In May 2013, the Company received letters from two of its customers who have been sued for alleged

patent infringement. The customers may seek to be indemnified by the Company. At this early stage, the Company cannot predict the

outcome of these demands. |

NOTES TO INTERIM CONDENSED

CONSOLIDATED FINANCIAL STATEMENTS

U.S. dollars in thousands, except share

and per share data

| NOTE 8:- | COMMITMENTS AND CONTINGENT LIABILITIES (Cont.) |

| 4. | In October 2013, the Company filed a claim against a customer and one of its employees in Hong

Kong for damages in connection with a breach of a supply agreement, infringement of intellectual property and breach of confidentiality.

In January 2014, a counterclaim was filed by that customer against the Company for an indeterminate amount. At this early stage,

the Company cannot predict the outcome of this counterclaim. |

| 5. | In November 2013, a former employee filed a claim against the Company’s subsidiary in Brazil

alleging that he is entitled to approximately $ 600 as a result of the termination of his employment by the subsidiary. The Group

believes that it has valid defenses to the claim and a provision is not required. |

| 6. | In February 2014, the Company received a letter offering a license to some or all of the patent

portfolio of the demanding Company (suggesting alleged infringement of patents if a license is not obtained). At this early stage,

the Company cannot predict the outcome of these demands. |

| NOTE 9:- | SHAREHOLDERS EQUITY |

Issuance

of ordinary shares:

On March 10,

2014, the Company sold in a public offering 4,025,000 (unaudited) of its ordinary shares, including 525,000 (unaudited) shares

sold pursuant to the underwriters’ full exercise of their over-allotment option, at a price of $ 8.00 per share. The Company’s

net proceeds from this offering were approximately $ 29,744 (unaudited), after deducting underwriting discounts, commissions and

other offering expenses in the total amount of $ 2,456 (unaudited).

| NOTE 10:- | BASIC AND DILUTED NET EARNINGS (LOSS) PER SHARE |

| | |

Six months ended

June 30, | |

| | |

2014 | | |

2013 | |

| | |

Unaudited | |

| Numerator: | |

| | | |

| | |

| | |

| | | |

| | |

| Net earnings (loss) available to ordinary shareholders | |

$ | (324 | ) | |

$ | 512 | |

| | |

| | | |

| | |

| Denominator: | |

| | | |

| | |

| | |

| | | |

| | |

| Denominator for basic earnings per share - weighted average number of ordinary shares, net of treasury stock | |

| 41,599,731 | | |

| 38,034,532 | |

| Effect of dilutive securities: | |

| | | |

| | |

| Employee stock options | |

| *)- | | |

| 580,560 | |

| Senior convertible notes | |

| **)- | | |

| *)- | |

| | |

| | | |

| | |

| Denominator for diluted net earnings per share - adjusted weighted average number of shares | |

| 41,599,731 | | |

| 38,615,092 | |

**)

Insignficant.

NOTES TO INTERIM CONDENSED

CONSOLIDATED FINANCIAL STATEMENTS

U.S. dollars in thousands, except share

and per share data

| NOTE 11:- | DERIVATIVE INSTRUMENTS |

As of June

30, 2014 and December 31, 2013, there was no deferred gain associated with cash flow hedges recorded in other comprehensive

income.

The Group

entered into forward contracts to hedge the fair value of assets denominated in New Israeli Shekels that did not meet the requirement

for hedge accounting. The Group measured the fair value of the contracts in accordance with ASC No. 820 at level 2. The net gain

(loss) recognized in "financial and other expenses, net" during the six months ended June 30, 2014 and 2013 was $ 165

(unaudited) and $ (58) (unaudited), respectively.

As of June

30, 2014 and December 31, 2013, the Group did not hold any outstanding foreign exchange forward or option collar (cylinder).

The effect of derivative instruments

in cash flow hedging relationship on income for the six months ended June 30, 2013 is $ 934 (unaudited) gain recognized in OCI

and $ 891 (unaudited) gain recognized in income as a decrease to operating expenses (effective portion).

| NOTE 12:- | GEOGRAPHIC INFORMATION |

| a. | Summary information about geographic areas: |

The Group

manages its business on a basis of one reportable segment (see Note 1 for a brief description of the Group's business). The data

is presented in accordance with ASC 280, "Segment Reporting". Revenues in the table below are attributed to geographical

areas based on the location of the end customers.

The following

presents total revenues for the six months ended June 30, 2014 and 2013.

| | |

Six months ended

June 30, | |

| | |

2014 | | |

2013 | |

| | |

Unaudited | |

| | |

| | |

| |

| Israel Israel | |

$ | 4,483 | | |

$ | 3,858 | |

| Americas | |

| 37,170 | | |

| 34,629 | |

| Europe | |

| 21,093 | | |

| 17,572 | |

| Far East | |

| 10,771 | | |

| 9,896 | |

| | |

| | | |

| | |

| | |

$ | 73,517 | | |

$ | 65,955 | |

NOTES TO INTERIM CONDENSED

CONSOLIDATED FINANCIAL STATEMENTS

U.S. dollars in thousands, except share

and per share data

| NOTE 12:- | GEOGRAPHIC INFORMATION (Cont.) |

The following

presents long-lived assets as of June 30, 2014 and December 31, 2013.

| | |

June 30,

2014 | | |

December 31,

2013 | |

| | |

Unaudited | | |

Audited | |

| | |

| | |

| |

| Israel | |

$ | 2,746 | | |

$ | 2,941 | |

| Americas | |

| 126 | | |

| 147 | |

| Europe | |

| 54 | | |

| 74 | |

| Far East | |

| 33 | | |

| 29 | |

| | |

| | | |

| | |

| | |

$ | 2,959 | | |

$ | 3,191 | |

Total revenues

from external customers divided on the basis of the Company's product lines are as follows:

| | |

Six months ended

June 30, | |

| | |

2014 | | |

2013 | |

| | |

Unaudited | |

| | |

| | |

| |

| Technology | |

$ | 9,414 | | |

$ | 10,454 | |

| Networking | |

| 64,103 | | |

| 55,501 | |

| | |

| | | |

| | |

| | |

$ | 73,517 | | |

$ | 65,955 | |

| |

NOTE 13:- |

SUBSEQUENT EVENT |

In

August 2014, the Company’s Board of Directors approved a share repurchase plan pursuant to which the Company is authorized

to repurchase up to $ 3,000 of the Company's ordinary shares. In addition, the Company intends to apply to the court in Israel

for authorization to repurchase an additional amount of ordinary shares for an aggregate purchase price of between $ 10,000 to

$ 15,000.

- -

- - - - - - - - - - - - - - - - - - -

Exhibit 99.2

OPERATING RESULTS AND FINANCIAL REVIEW

IN CONNECTION WITH THE INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS FOR THE SIX MONTHS ENDED JUNE 30, 2014.

The following discussion and analysis

should be read in conjunction with our interim condensed consolidated financial statements as of and for the six months ended June

30, 2014, appearing elsewhere in this Form 6-K, our audited consolidated financial statements and other financial information for

the year ended December 31, 2013 appearing in our Annual Report on Form 20-F for the year ended December 31, 2013 and Item 5—"Operating

and Financial Review and Prospects" of that Annual Report.

Statements in this Report on Form 6-K concerning

our business outlook or future economic performance; anticipated revenues, expenses or other financial items; product introductions

and plans and objectives related thereto; and statements concerning assumptions made or expectations as to any future events, conditions,

performance or other matters, are “forward-looking statements” as that term is defined under the United States Federal

securities laws. Forward-looking statements are subject to various risks, uncertainties and other factors that could cause actual

results to differ materially from those stated in such statements. Factors that could cause or contribute to such differences include,

but are not limited to, those set forth under “Risk Factors” in our Annual Report on Form 20-F for the year ended December

31, 2013, as well as those discussed elsewhere in that Annual Report and in our other filings with the Securities and Exchange

Commission.

Overview

We design, develop

and sell advanced voice over IP, or VoIP, and converged VoIP and data networking products and applications to service providers

and enterprises. We are a VoIP technology leader focused on VoIP communications, applications and networking elements. Our products

are deployed globally in broadband, mobile, cable, and enterprise networks. We provide a range of innovative, cost-effective products

including media gateways, multi-service business gateways, residential gateways, IP phones, media servers, session border controllers,

and value-added applications. Our underlying technology, VoIPerfectHD, relies primarily on our leadership in digital signal processing,

or DSP, voice coding and voice processing technologies. Our high definition (“HD”) VoIP technologies and products provide

enhanced intelligibility and a better end user communication experience in emerging voice networks.

Our headquarters and

research and development facilities are located in Israel with research and development extensions in the U.S., China and U.K.

We have other offices located in Europe, the Far East, and Latin America.

The identities of

our principal customers have changed and we expect that they will continue to change, from year to year. Historically, a substantial

portion of our revenue has been derived from large purchases by a limited number of original equipment manufacturers, or OEMs,

and network equipment providers, or NEPs, systems integrators and distributors. ScanSource Communications, our largest customer,

accounted for 14.3% of our revenues in the six months ended June 30, 2014 and 17.7% of our revenues in the same period in 2013.

Our top five customers accounted for 32.5% of our revenues in the six months ended June 30, 2014 and 34.1% of our revenues in the

same period in 2013. If we lose a large customer and fail to add new customers to replace lost revenue, our operating results may

be materially adversely affected.

Revenues based on

the location of our customers for the six months ended September 30, 2013 and 2014 are as follows:

| | |

Six Months Ended June 30, | |

| | |

2014 | | |

2013 | |

| Americas | |

| 50.5 | % | |

| 52.5 | % |

| Far East | |

| 14.7 | | |

| 15.0 | |

| Europe | |

| 28.7 | | |

| 26.6 | |

| Israel | |

| 6.1 | | |

| 5.9 | |

| Total | |

| 100.0 | % | |

| 100.0 | % |

In March 2014,

we sold in a public offering 4,025,000 of our ordinary shares, including 525,000 shares sold pursuant to the exercise in full of

an over-allotment option granted to the underwriters, at a purchase price of $8.00 per share. Our net proceeds from this offering

were approximately $29.7 million, after deducting underwriting commissions and other offering expenses.

In April, 2014, the

Israeli Office of the Chief Scientist (OCS) has approved in principle a three-year program (2014-2016) for approximately NIS100

million (equal to approximately $29 million) to enable us to establish an advanced innovative research and development center for

cloud computing technologies and Unified Communications. The new research and development center is expected to increase its staff

to 100 engineers by 2016. We expect that a significant portion of the cost of this project will be reimbursed to us through grants

from the Office of the Chief Scientist pursuant to this program. The grants are subject to conditions relating to grants by the

Office of the Chief Scientist. Funding for the whole term of the program is subject to the continued review and approval of the

progress of the project by the Office of the Chief Scientist.

Results of Operations

The following table

sets forth the percentage relationships of certain items from our consolidated statements of operations, as a percentage of total

revenues for the periods indicated:

| | |

Six Months Ended June 30, | |

| Statement of Operations Data: | |

2014 | | |

2013 | |

| | |

| | |

| |

| Revenues | |

| 100.0 | % | |

| 100.0 | % |

| Cost of revenues | |

| 41.0 | | |

| 42.2 | |

| Gross profit | |

| 59.0 | | |

| 57.8 | |

| Operating expenses: | |

| | | |

| | |

| Research and development, net | |

| 22.1 | | |

| 21.7 | |

| Selling and marketing | |

| 31.1 | | |

| 28.7 | |

| General and administrative | |

| 5.1 | | |

| 6.2 | |

| Total operating expenses | |

| 58.3 | | |

| 56.6 | |

| | |

| | | |

| | |

| Operating income | |

| 0.7 | | |

| 1.2 | |

| Financial income (expenses), net | |

| 0.2 | | |

| (0.2 | ) |

| Income before taxes on income | |

| 0.9 | | |

| 1.0 | |

| Income tax expense | |

| (1.3 | ) | |

| (0.2 | ) |

| Equity in losses of affiliated companies, net | |

| 0.0 | | |

| 0.0 | |

| | |

| | | |

| | |

| Net income (loss) | |

| (0.4 | )% | |

| 0.8 | % |

Revenues. Revenues

increased 11.5% to $73.5 million in the six months ended June 30, 2014 from $66.0 million in the same period in 2013. The increase

in revenues was primarily attributable to an increase in revenues from our networking product line.

Our revenues from

products in the six months ended June 30, 2014 increased by 7.8% to $57.9 million, or approximately 79% of total revenues, from

$53.7 million, or 81% of total revenues, in the same period in 2013. The increase in revenues from products was primarily attributable

to the increase in our networking product line, particularly with respect to our Session Boarder Controller and Multi Service Business

Router (MSBR) product lines, as well as due to the growing demand for our networking product line in the Unified Communications

market.

Our revenues from services

in the six months ended June 30, 2014 increased by 27.4% to $15.6 million, or approximately 21% of total revenues, from $12.2 million,

or 19% of total revenues, in the same period in 2013. The increase in revenues from services was predominantly driven by the growth

in support services related to the increase in revenues from products.

Cost of Revenues

and Gross Profit. Cost of revenues includes the manufacturing cost of hardware, quality assurance, overhead related

to manufacturing activity, technology licensing and royalty fees payable to third parties and royalties payables to the Office

of the Chief Scientist of the Israeli Ministry of Economy. Gross profit increased to $43.4 million in the six months ended September

30, 2014 from $38.1 million in the same period in 2013. Gross profit as a percentage of revenues increased to 59.0% in the six

months ended June 30, 2014 from 57.8% in the same period in 2013.

Cost of revenues from

products increased by 6.0% to $26.2 million in the six months ended June 30, 2014 from $24.7 million in the same period in 2013.

This increase is primarily attributable to an increase in the procurement of materials, in line with the increase in revenues from

products. Gross margin percentage from products was 55% in the six-month periods ended June 30, 2014 and 54% in the same period

in 2013.

Cost of revenues from

services increased by 27.6% to $4.0 million in the six months ended June 30, 2014 from $3.1 million in the same period in 2014.

This increase is primarily attributable to higher support personnel expenses associated with providing services and implementation

of our products with service providers as well as enterprise customers. Gross margin percentage from services was 75% in each of

the six-month periods ended June 30, 2014 and 2013.

Research and Development

Expenses, net. Research and development expenses, net consist primarily of compensation and related costs of employees

engaged in ongoing research and development activities, development-related raw materials and the cost of subcontractors less grants

from the Office of the Chief Scientist of the Israeli Ministry of Economy. Research and development expenses, net increased by

13.6% to $16.2 million in the six months ended June 30, 2014 from $14.3 million in the same period in 2013 and increased as a percentage

of revenues to 22.1% in the six months ended June 30, 2014 from 21.7% in the same period in 2013. Research and development expenses

increased primarily as a result of adding personnel in connection with our continued development of new products and as a result

of the NIS appreciation against the U.S. dollar. We expect that research and development expenses will increase on an absolute

dollar basis in 2014 as a result of our continued development of new products and adding the new research and development center

focusing on cloud computing and Unified Communications.

Selling and Marketing

Expenses. Selling and marketing expenses consist primarily of compensation for selling and marketing personnel,

as well as exhibition, travel and related expenses. Selling and marketing expenses increased by 20.8% in the six months ended June

30, 2014 to $22.9 million from $19.0 million in the same period in 2013 and increased as a percentage of revenues to 31.1% in the

six months ended June 30, 2014 from 28.7% in the same period in 2013. These expenses increased on an absolute basis as a result

of an increase in our sales force and marketing activities.

General and Administrative

Expenses. General and administrative expenses consist primarily of compensation for finance, human resources, general

management, rent, network and bad debt reserve, as well as insurance and consultant services expenses. General and administrative

expenses decreased by 9.7% to $3.7 million in in the six months ended June 30, 2014 from $4.1 million in the same period in 2013.

As a percentage of revenues, general and administrative expenses decreased to 5.1% in the six months ended June 30, 2014 from 6.2%

in the same period in 2013.

Financial Income

(expenses), Net. Financial income, net consists primarily of interest derived on cash and cash equivalents, marketable

securities and bank deposits, net of interest accrued in connection with our bank loans and bank charges, as well as our remaining

senior convertible notes outstanding. Financial income, net, in the six months ended June 30, 2014 was $102,000 compared to financial

expenses, net of $122,000 in the same period in 2013. The increase in financial income, net in the six months ended June 30, 2014

was primarily due to lower expenses recorded with respect to our bank loans interest and lower expenses related to exchange rate

fluctuations.

Taxes on Income. We

had a net income tax expenses of $950,000 in the six months ended June 30, 2014 compared to $138,000 in the same period in 2013.

The increase in the net income tax expenses in the six months ended June 30, 2014 is primarily a result of utilization of deferred

tax assets.

LIQUIDITY

AND CAPITAL RESOURCES

We finance our operations

primarily from our cash and cash equivalents, bank deposits, bank borrowings and cash from operations. In addition, in March 2014

we realized net proceeds of approximately $29.7 million as a result of the sale by us of 4,025,000 of our ordinary shares in a

public offering.

As of June 30, 2014,

we had $91.8 million in cash and cash equivalents, marketable securities and bank deposits compared to $62.3 million at December

31, 2013. This increase is the result of the proceeds from our public offering in March 2014. As of June 30, 2014, we were restricted

with respect to using approximately $12.6 million of our cash as a result of provisions in our loan agreements, a lease agreement

and foreign exchange derivatives transactions.

In August 2014, our Board

approved a program to allow us to repurchase up to $3.0 million of our ordinary shares. Purchases would be made from time-to-time

at the discretion of management subject, among other things, to our share price, market conditions, trading volume and other factors.

Repurchases, if any, would be funded from available working capital. Under applicable Israeli law and based on current market prices,

we are permitted to purchase up to approximately $3.0 million of our ordinary shares without further approval. In addition, we

intend to apply to the competent court in Israel for authorization to repurchase an additional amount of our ordinary shares for

an aggregate purchase price of $10-15 million. We expect that the approval process will take approximately three months from August

2014.

Cash Flows from Operating Activities

Our operating activities

provided cash in the amount of $1.6 million in the six months ended June 30, 2014, primarily due to an increase in deferred revenues

of $3.3 million, non-cash depreciation and amortization in the amount $1.6 million, non-cash stock-based compensation expenses

of $1.3 million utilization of deferred tax asset of $1.0 million and an increase in other payables and accrued expenses in the

amount of $1.0 million, partly offset by an increase in trade receivables in the amount of $4.4 million and in other receivables

in the amount of $2.4 million.

Cash Flows from Investing Activities

In the six months

ended June 30, 2014, we used cash in investing activities in the amount of $43.1 million, primarily due to the purchase of marketable

securities of $60.2 million offset, in part, by proceeds from redemption of marketable securities of $15.4 million and a decrease

in bank deposits of 2.4 million.

Cash Flows from Financing Activities

In the six months

ended June 30, 2014, our financing activities provided cash in the amount of $29.0 million, primarily due to the $29.7 million

of proceeds from the sale of our ordinary shares in a public offering and $2.1 million of proceeds from the issuance of shares

upon exercise of stock options, offset, in part, by $2.6 million used for repayment of loans.

Financing Needs

We anticipate that our operating expenses will be a material

use of our cash resources for the foreseeable future. We believe that our current working capital is sufficient to meet

our operating cash requirements for at least the next twelve months, including payments required under our existing bank loans. Part

of our strategy is to pursue acquisition opportunities. If we do not have available sufficient cash to finance our operations and

the completion of additional acquisitions, we may be required to obtain additional debt or equity financing. We cannot be certain

that we will be able to obtain, if required, additional financing on acceptable terms or at all.

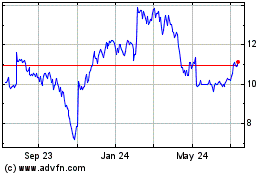

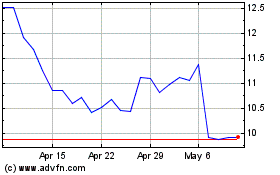

AudioCodes (NASDAQ:AUDC)

Historical Stock Chart

From Aug 2024 to Sep 2024

AudioCodes (NASDAQ:AUDC)

Historical Stock Chart

From Sep 2023 to Sep 2024