Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

[X] QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE QUARTERLY PERIOD ENDED SEPTEMBER 30, 2014

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE TRANSITION PERIOD FROM TO

____________________________________________________________________________

COMMISSION FILE NUMBER 1-11846

AptarGroup, Inc.

|

DELAWARE |

|

36-3853103 |

|

(State of Incorporation) |

|

(I.R.S. Employer Identification No.) |

475 WEST TERRA COTTA AVENUE, SUITE E, CRYSTAL LAKE, ILLINOIS 60014

815-477-0424

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer þ |

|

Accelerated filer ¨ |

|

Non-accelerated filer ¨ |

|

Smaller reporting company ¨ |

|

|

|

|

|

(Do not check if a smaller reporting company) |

|

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date

|

Class |

|

Outstanding at November 3, 2014 |

|

Common Stock, $.01 par value per share |

|

64,727,773 shares |

Table of Contents

AptarGroup, Inc.

Form 10-Q

Quarter Ended September 30, 2014

INDEX

i

Table of Contents

PART I – FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS (UNAUDITED)

AptarGroup, Inc.

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(Unaudited)

In thousands, except per share amounts

|

|

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

|

|

2014 |

|

2013 |

|

2014 |

|

2013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Sales |

|

$ |

651,942 |

|

$ |

623,644 |

|

$ |

1,998,624 |

|

$ |

1,882,718 |

|

|

Operating Expenses: |

|

|

|

|

|

|

|

|

|

|

Cost of sales (exclusive of depreciation and amortization shown below) |

|

443,520 |

|

424,011 |

|

1,347,982 |

|

1,273,848 |

|

|

Selling, research & development and administrative |

|

91,649 |

|

86,917 |

|

294,809 |

|

269,335 |

|

|

Depreciation and amortization |

|

38,158 |

|

37,222 |

|

113,871 |

|

112,007 |

|

|

Restructuring initiatives |

|

-- |

|

2,180 |

|

-- |

|

8,758 |

|

|

|

|

573,327 |

|

550,330 |

|

1,756,662 |

|

1,663,948 |

|

|

Operating Income |

|

78,615 |

|

73,314 |

|

241,962 |

|

218,770 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Income (Expense): |

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

(5,332 |

) |

(4,841 |

) |

(15,459 |

) |

(15,364 |

) |

|

Interest income |

|

1,386 |

|

576 |

|

3,449 |

|

2,271 |

|

|

Equity results of affiliates |

|

(124 |

) |

(286 |

) |

(1,868 |

) |

(609 |

) |

|

Miscellaneous, net |

|

(429 |

) |

(437 |

) |

(582 |

) |

(1,070 |

) |

|

|

|

(4,499 |

) |

(4,988 |

) |

(14,460 |

) |

(14,772 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Income before Income Taxes |

|

74,116 |

|

68,326 |

|

227,502 |

|

203,998 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for Income Taxes |

|

25,496 |

|

23,094 |

|

77,390 |

|

68,908 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income |

|

$ |

48,620 |

|

$ |

45,232 |

|

$ |

150,112 |

|

$ |

135,090 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (Income) Loss Attributable to Noncontrolling Interests |

|

$ |

(25 |

) |

$ |

32 |

|

$ |

(52 |

) |

$ |

5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income Attributable to AptarGroup, Inc. |

|

$ |

48,595 |

|

$ |

45,264 |

|

$ |

150,060 |

|

$ |

135,095 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income Attributable to AptarGroup, Inc. per Common Share: |

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.75 |

|

$ |

0.68 |

|

$ |

2.30 |

|

$ |

2.04 |

|

|

Diluted |

|

$ |

0.73 |

|

$ |

0.67 |

|

$ |

2.21 |

|

$ |

1.98 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Average Number of Shares Outstanding: |

|

|

|

|

|

|

|

|

|

|

Basic |

|

64,886 |

|

66,092 |

|

65,225 |

|

66,222 |

|

|

Diluted |

|

66,845 |

|

67,986 |

|

67,761 |

|

68,273 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends per Common Share |

|

$ |

0. 28 |

|

$ |

0.25 |

|

$ |

0. 81 |

|

$ |

0.75 |

|

See accompanying Unaudited Notes to Condensed Consolidated Financial Statements.

1

Table of Contents

AptarGroup, Inc.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(Unaudited)

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

|

|

September 30, |

|

September 30, |

|

|

|

|

2014 |

|

2013 |

|

2014 |

|

2013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income |

|

$ |

48,620 |

|

$ |

45,232 |

|

$ |

150,112 |

|

$ |

135,090 |

|

|

Other Comprehensive Income: |

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustments |

|

(118,758 |

) |

45,344 |

|

(123,359 |

) |

16,282 |

|

|

Changes in treasury locks, net of tax |

|

6 |

|

9 |

|

18 |

|

39 |

|

|

Defined benefit pension plan, net of tax |

|

|

|

|

|

|

|

|

|

|

Amortization of prior service cost included in net income, net of tax |

|

51 |

|

61 |

|

157 |

|

183 |

|

|

Amortization of net loss included in net income, net of tax |

|

658 |

|

1,039 |

|

1,987 |

|

3,111 |

|

|

Total defined benefit pension plan, net of tax |

|

709 |

|

1,100 |

|

2,144 |

|

3,294 |

|

|

Total other comprehensive (loss) income |

|

(118,043 |

) |

46,453 |

|

(121,197 |

) |

19,615 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive (Loss) Income |

|

(69,423 |

) |

91,685 |

|

28,915 |

|

154,705 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive (Income) Loss Attributable To Noncontrolling Interests |

|

(29 |

) |

30 |

|

(47 |

) |

(2 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive (Loss) Income Attributable To AptarGroup, Inc. |

|

$ |

(69,452 |

) |

$ |

91,715 |

|

$ |

28,868 |

|

$ |

154,703 |

|

See accompanying Unaudited Notes to Condensed Consolidated Financial Statements.

2

Table of Contents

AptarGroup, Inc.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

|

|

|

September 30, |

|

December 31, |

|

|

|

|

2014 |

|

2013 |

|

|

|

|

|

|

|

|

|

Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Assets: |

|

|

|

|

|

|

Cash and equivalents |

|

$ |

347,394 |

|

$ |

309,861 |

|

|

Accounts and notes receivable, less allowance for doubtful accounts of $4,215 in 2014 and $4,416 in 2013 |

|

468,182 |

|

438,221 |

|

|

Inventories |

|

340,952 |

|

353,159 |

|

|

Prepaid and other |

|

102,644 |

|

97,170 |

|

|

|

|

1,259,172 |

|

1,198,411 |

|

|

|

|

|

|

|

|

|

Property, Plant and Equipment: |

|

|

|

|

|

|

Buildings and improvements |

|

362,485 |

|

377,300 |

|

|

Machinery and equipment |

|

1,951,876 |

|

1,982,195 |

|

|

|

|

2,314,361 |

|

2,359,495 |

|

|

Less: Accumulated depreciation |

|

(1,505,822 |

) |

(1,518,894 |

) |

|

|

|

808,539 |

|

840,601 |

|

|

Land |

|

22,475 |

|

24,061 |

|

|

|

|

831,014 |

|

864,662 |

|

|

|

|

|

|

|

|

|

Other Assets: |

|

|

|

|

|

|

Investments in affiliates |

|

6,053 |

|

8,243 |

|

|

Goodwill |

|

339,275 |

|

358,865 |

|

|

Intangible assets, net |

|

42,551 |

|

49,951 |

|

|

Miscellaneous |

|

21,174 |

|

17,630 |

|

|

|

|

409,053 |

|

434,689 |

|

|

Total Assets |

|

$ |

2,499,239 |

|

$ |

2,497,762 |

|

See accompanying Unaudited Notes to Condensed Consolidated Financial Statements.

3

Table of Contents

AptarGroup, Inc.

CONDENSED CONSOLIDATED BALANCE SHEETS (continued)

(Unaudited)

In thousands, except per share amounts

|

|

|

September 30, |

|

December 31, |

|

|

|

|

2014 |

|

2013 |

|

|

|

|

|

|

|

|

|

Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Liabilities: |

|

|

|

|

|

|

Notes payable |

|

$ |

243,983 |

|

$ |

138,445 |

|

|

Current maturities of long-term obligations |

|

2,547 |

|

1,325 |

|

|

Accounts payable and accrued liabilities |

|

385,343 |

|

403,051 |

|

|

|

|

631,873 |

|

542,821 |

|

|

|

|

|

|

|

|

|

Long-Term Obligations |

|

355,583 |

|

354,814 |

|

|

|

|

|

|

|

|

|

Deferred Liabilities and Other: |

|

|

|

|

|

|

Deferred income taxes |

|

29,501 |

|

42,072 |

|

|

Retirement and deferred compensation plans |

|

66,545 |

|

71,883 |

|

|

Deferred and other non-current liabilities |

|

4,859 |

|

5,864 |

|

|

Commitments and contingencies |

|

-- |

|

-- |

|

|

|

|

100,905 |

|

119,819 |

|

|

|

|

|

|

|

|

|

Stockholders’ Equity: |

|

|

|

|

|

|

AptarGroup, Inc. stockholders’ equity |

|

|

|

|

|

|

Common stock, $.01 par value, 199 million shares authorized; 86.0 and 85.4 million shares issued as of September 30, 2014 and December 31, 2013, respectively |

|

859 |

|

853 |

|

|

Capital in excess of par value |

|

539,055 |

|

493,947 |

|

|

Retained earnings |

|

1,716,536 |

|

1,619,419 |

|

|

Accumulated other comprehensive (loss) income |

|

(11,441 |

) |

109,751 |

|

|

Less treasury stock at cost, 21.3 and 20.0 million shares as of September 30, 2014 and December 31, 2013, respectively |

|

(834,729 |

) |

(744,213 |

) |

|

Total AptarGroup, Inc. Stockholders’ Equity |

|

1,410,280 |

|

1,479,757 |

|

|

Noncontrolling interests in subsidiaries |

|

598 |

|

551 |

|

|

|

|

|

|

|

|

|

Total Stockholders’ Equity |

|

1,410,878 |

|

1,480,308 |

|

|

Total Liabilities and Stockholders’ Equity |

|

$ |

2,499,239 |

|

$ |

2,497,762 |

|

See accompanying Unaudited Notes to Condensed Consolidated Financial Statements.

4

Table of Contents

AptarGroup, Inc.

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

(Unaudited)

|

|

|

AptarGroup, Inc. Stockholders’ Equity |

|

|

|

|

|

|

|

|

|

|

Accumulated |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other |

|

Common |

|

|

|

Capital in |

|

Non- |

|

|

|

|

|

|

Retained |

|

Comprehensive |

|

Stock |

|

Treasury |

|

Excess of |

|

Controlling |

|

Total |

|

|

|

|

Earnings |

|

Income/(Loss) |

|

Par Value |

|

Stock |

|

Par Value |

|

Interest |

|

Equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance – December 31, 2012: |

|

$ |

1,513,558 |

|

$ |

60,683 |

|

$ |

840 |

|

$ |

(625,401 |

) |

$ |

430,210 |

|

$ |

608 |

|

$ |

1,380,498 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) |

|

135,095 |

|

|

|

|

|

|

|

|

|

(5 |

) |

135,090 |

|

|

Foreign currency translation adjustments |

|

|

|

16,275 |

|

|

|

|

|

|

|

7 |

|

16,282 |

|

|

Changes in unrecognized pension gains/losses and related amortization, net of tax |

|

|

|

3,294 |

|

|

|

|

|

|

|

|

|

3,294 |

|

|

Changes in treasury locks, net of tax |

|

|

|

39 |

|

|

|

|

|

|

|

|

|

39 |

|

|

Stock option exercises & restricted stock vestings |

|

|

|

|

|

12 |

|

1 |

|

55,523 |

|

|

|

55,536 |

|

|

Cash dividends declared on common stock |

|

(49,674 |

) |

|

|

|

|

|

|

|

|

|

|

(49,674 |

) |

|

Treasury stock purchased |

|

|

|

|

|

|

|

(80,222 |

) |

|

|

|

|

(80,222 |

) |

|

Balance – September 30, 2013: |

|

$ |

1,598,979 |

|

$ |

80,291 |

|

$ |

852 |

|

$ |

(705,622 |

) |

$ |

485,733 |

|

$ |

610 |

|

$ |

1,460,843 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance – December 31, 2013: |

|

$ |

1,619,419 |

|

$ |

109,751 |

|

$ |

853 |

|

$ |

(744,213 |

) |

$ |

493,947 |

|

$ |

551 |

|

$ |

1,480,308 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

150,060 |

|

|

|

|

|

|

|

|

|

52 |

|

150,112 |

|

|

Foreign currency translation adjustments |

|

|

|

(123,354 |

) |

|

|

|

|

|

|

(5 |

) |

(123,359 |

) |

|

Changes in unrecognized pension gains/losses and related amortization, net of tax |

|

|

|

2,144 |

|

|

|

|

|

|

|

|

|

2,144 |

|

|

Changes in treasury locks, net of tax |

|

|

|

18 |

|

|

|

|

|

|

|

|

|

18 |

|

|

Stock option exercises & restricted stock vestings |

|

|

|

|

|

6 |

|

1 |

|

45,108 |

|

|

|

45,115 |

|

|

Cash dividends declared on common stock |

|

(52,943 |

) |

|

|

|

|

|

|

|

|

|

|

(52,943 |

) |

|

Treasury stock purchased |

|

|

|

|

|

|

|

(90,517 |

) |

|

|

|

|

(90,517 |

) |

|

Balance – September 30, 2014: |

|

$ |

1,716,536 |

|

$ |

(11,441 |

) |

$ |

859 |

|

$ |

(834,729 |

) |

$ |

539,055 |

|

$ |

598 |

|

$ |

1,410,878 |

|

See accompanying Unaudited Notes to Condensed Consolidated Financial Statements.

5

Table of Contents

AptarGroup, Inc.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

In thousands, brackets denote cash outflows

|

Nine Months Ended September 30, |

|

2014 |

|

2013 |

|

|

|

|

|

|

|

|

|

Cash Flows from Operating Activities: |

|

|

|

|

|

|

Net income |

|

$ |

150,112 |

|

$ |

135,090 |

|

|

Adjustments to reconcile net income to net cash provided by operations: |

|

|

|

|

|

|

Depreciation |

|

109,821 |

|

108,259 |

|

|

Amortization |

|

4,050 |

|

3,748 |

|

|

Stock based compensation |

|

15,025 |

|

11,538 |

|

|

Provision for doubtful accounts |

|

228 |

|

(516 |

) |

|

Deferred income taxes |

|

(12,701 |

) |

(5,612 |

) |

|

Defined benefit plan expense |

|

12,622 |

|

14,531 |

|

|

Equity in results of affiliates in excess of cash distributions received |

|

1,868 |

|

609 |

|

|

Changes in balance sheet items, excluding effects from foreign currency adjustments: |

|

|

|

|

|

|

Accounts receivable |

|

(57,220 |

) |

(42,531 |

) |

|

Inventories |

|

(11,386 |

) |

(27,168 |

) |

|

Prepaid and other current assets |

|

(14,984 |

) |

(15,416 |

) |

|

Accounts payable and accrued liabilities |

|

5,236 |

|

8,544 |

|

|

Income taxes payable |

|

(13,334 |

) |

10,312 |

|

|

Retirement and deferred compensation plans |

|

(9,803 |

) |

(18,717 |

) |

|

Other changes, net |

|

20,426 |

|

11,850 |

|

|

Net Cash Provided by Operations |

|

199,960 |

|

194,521 |

|

|

|

|

|

|

|

|

|

Cash Flows from Investing Activities: |

|

|

|

|

|

|

Capital expenditures |

|

(125,465 |

) |

(110,350 |

) |

|

Disposition of property and equipment |

|

1,002 |

|

2,207 |

|

|

Investment in unconsolidated affiliate |

|

-- |

|

(13 |

) |

|

Notes receivable, net |

|

(2,820 |

) |

(159 |

) |

|

Net Cash Used by Investing Activities |

|

(127,283 |

) |

(108,315 |

) |

|

|

|

|

|

|

|

|

Cash Flows from Financing Activities: |

|

|

|

|

|

|

Proceeds from notes payable |

|

106,455 |

|

31,908 |

|

|

Proceeds from long-term obligations |

|

2,816 |

|

-- |

|

|

Repayments of long-term obligations |

|

-- |

|

(25,491 |

) |

|

Dividends paid |

|

(52,943 |

) |

(49,674 |

) |

|

Credit facility costs |

|

(299 |

) |

(498 |

) |

|

Proceeds from stock option exercises |

|

24,564 |

|

38,368 |

|

|

Purchase of treasury stock |

|

(90,517 |

) |

(80,222 |

) |

|

Excess tax benefit from exercise of stock options |

|

4,959 |

|

5,058 |

|

|

Net Cash Used by Financing Activities |

|

(4,965 |

) |

(80,551 |

) |

|

|

|

|

|

|

|

|

Effect of Exchange Rate Changes on Cash |

|

(30,179 |

) |

12,441 |

|

|

|

|

|

|

|

|

|

Net Increase in Cash and Equivalents |

|

37,533 |

|

18,096 |

|

|

Cash and Equivalents at Beginning of Period |

|

309,861 |

|

229,755 |

|

|

Cash and Equivalents at End of Period |

|

$ |

347,394 |

|

$ |

247,851 |

|

See accompanying Unaudited Notes to Condensed Consolidated Financial Statements.

6

Table of Contents

AptarGroup, Inc.

Notes to Condensed Consolidated Financial Statements

(Amounts in Thousands, Except Share and per Share Amounts, or Otherwise Indicated)

(Unaudited)

NOTE 1 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

BASIS OF PRESENTATION

The accompanying Unaudited Condensed Consolidated Financial Statements include the accounts of AptarGroup, Inc. and our subsidiaries. The terms “AptarGroup” or “Company” as used herein refer to AptarGroup, Inc. and our subsidiaries. All significant intercompany accounts and transactions have been eliminated.

In the opinion of management, the Unaudited Condensed Consolidated Financial Statements include all adjustments, consisting of only normal recurring adjustments, necessary for a fair statement of consolidated financial position, results of operations, comprehensive income, changes in equity and cash flows for the interim periods presented. The accompanying Unaudited Condensed Consolidated Financial Statements have been prepared by the Company, pursuant to the rules and regulations of the Securities and Exchange Commission (“SEC”). Certain information and footnote disclosure normally included in financial statements prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) have been condensed or omitted pursuant to such rules and regulations, although the Company believes that the disclosures made are adequate to make the information presented not misleading. Also, certain financial position data included herein was derived from the Audited Consolidated Financial Statements included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2013 but does not include all disclosures required by GAAP. Accordingly, these Unaudited Condensed Consolidated Financial Statements and related notes should be read in conjunction with the Audited Consolidated Financial Statements and notes thereto included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2013. The results of operations of any interim period are not necessarily indicative of the results that may be expected for the year.

ADOPTION OF RECENT ACCOUNTING PRONOUNCEMENTS

Changes to GAAP are established by the Financial Accounting Standards Board (“FASB”) in the form of accounting standards updates to the FASB’s Accounting Standards Codification.

In July 2013, the FASB issued authoritative guidance on the presentation of an unrecognized tax benefit when a net operating loss carryforward, a similar tax loss, or a tax credit carryforward exists. This standard requires an entity to present an unrecognized tax benefit, or a portion of an unrecognized tax benefit, in the financial statements as a reduction to a deferred tax asset for a net operating loss carryforward, a similar tax loss, or a tax credit carryforward. The guidance is effective for the Company’s fiscal years beginning after December 15, 2013. This standard did not impact our current year financial statements as this was already the Company’s existing reporting treatment.

In March 2013, the FASB issued authoritative guidance which permits an entity to release cumulative translation adjustments into net income when a reporting entity (parent) ceases to have a controlling financial interest in a subsidiary or group of assets that is a business within a foreign entity. Accordingly, the cumulative translation adjustment should be released into net income only if the sale or transfer results in the complete or substantially complete liquidation of the foreign entity in which the subsidiary or group of assets had resided, or if a controlling financial interest is no longer held. The guidance is effective for the Company’s fiscal years beginning after December 15, 2013. This standard has only a minimal impact on our current year financial statements.

In February 2013, the FASB issued authoritative guidance that amends the presentation of accumulated other comprehensive income and clarifies how to report the effect of significant reclassifications out of accumulated other comprehensive income. The guidance requires footnote disclosures regarding the changes in accumulated other comprehensive income by component and the line items affected in the statements of earnings. The adoption of this standard had no impact on the Unaudited Condensed Consolidated Financial Statements other than disclosure. Additional information can be found in Note 6 of the Unaudited Notes to the Condensed Consolidated Financial Statements.

In January 2013, the FASB issued authoritative guidance requiring new asset and liability offsetting disclosures for derivatives, repurchase agreements and security lending transactions to the extent that they are offset in the financial statements or are subject to an enforceable master netting arrangement or similar agreement. We do not have any repurchase agreements and do not participate in securities lending transactions. Our derivative instruments are not offset in the financial statements. Accordingly, the adoption of this standard had no impact on the Unaudited Condensed Consolidated Financial Statements other than disclosure. Additional information can be found in Note 7 of the Unaudited Notes to the Condensed Consolidated Financial Statements.

Other accounting standards that have been issued by the FASB or other standards-setting bodies are not expected to have a material impact on our Unaudited Condensed Consolidated Financial Statements.

INCOME TAXES

The Company computes taxes on income in accordance with the tax rules and regulations of the many taxing authorities where income is earned. The income tax rates imposed by these taxing authorities may vary substantially. Taxable income may differ from pretax income for financial accounting purposes. To the extent that these differences create differences between the tax basis of an asset or liability and our reported amount in the financial statements, an appropriate provision for deferred income taxes is made.

In our determination of which foreign earnings are permanently reinvested in foreign operations, the Company considers numerous factors, including the financial requirements of the U.S. parent company and those of our foreign subsidiaries, the U.S. funding needs for dividend payments and stock repurchases, and the tax consequences of remitting earnings to the U.S. From this analysis, current year repatriation decisions are made in an attempt to provide a proper mix of debt and stockholder capital both within the U.S. and for non-U.S. operations. The Company’s policy is to permanently reinvest our accumulated foreign earnings and will only make a distribution out of current year earnings to meet the cash needs at the parent company.

7

Table of Contents

As such, the Company does not provide for taxes on earnings that are deemed to be permanently reinvested. Since no distribution to the U.S. of foreign earnings is expected in 2014, the effective tax rate for 2014 includes no tax cost of repatriation. Although the Company does not expect to repatriate foreign earnings back to the U.S. in 2014, dividends on certain earnings within Europe to our European holding company are expected to increase in 2014 as part of a legal reorganization of our non-U.S. subsidiaries. Due to this legal reorganization, additional tax costs in the third quarter of 2014 were approximately $3.1 million, of which $2.8 million related to the change in our reinvestment assertion within Europe.

The Company provides a liability for the amount of tax benefits realized from uncertain tax positions. This liability is provided whenever the Company determines that a tax benefit will not meet a more-likely-than-not threshold for recognition. See Note 4 of the Unaudited Notes to the Condensed Consolidated Financial Statements for more information.

NOTE 2 - INVENTORIES

At September 30, 2014 and December 31, 2013, approximately 19% and 20%, respectively, of the total inventories are accounted for by using the LIFO method. Inventories, by component, consisted of:

|

|

|

September 30, |

|

December 31, |

|

|

|

|

2014 |

|

2013 |

|

|

|

|

|

|

|

|

|

Raw materials |

|

$ |

115,575 |

|

$ |

114,501 |

|

|

Work in process |

|

103,262 |

|

108,924 |

|

|

Finished goods |

|

130,055 |

|

137,591 |

|

|

Total |

|

348,892 |

|

361,016 |

|

|

Less LIFO Reserve |

|

(7,940 |

) |

(7,857 |

) |

|

Total |

|

$ |

340,952 |

|

$ |

353,159 |

|

NOTE 3 – GOODWILL AND OTHER INTANGIBLE ASSETS

The changes in the carrying amount of goodwill since the year ended December 31, 2013 are as follows by reporting segment:

|

|

|

Beauty + |

|

|

|

Food + |

|

Corporate |

|

|

|

|

|

|

Home |

|

Pharma |

|

Beverage |

|

& Other |

|

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Goodwill |

|

$ |

181,002 |

|

$ |

159,949 |

|

$ |

17,914 |

|

$ |

1,615 |

|

$ |

360,480 |

|

|

Accumulated impairment losses |

|

-- |

|

-- |

|

-- |

|

(1,615 |

) |

(1,615 |

) |

|

Balance as of December 31, 2013 |

|

$ |

181,002 |

|

$ |

159,949 |

|

$ |

17,914 |

|

$ |

-- |

|

$ |

358,865 |

|

|

Acquisition |

|

-- |

|

-- |

|

-- |

|

-- |

|

-- |

|

|

Foreign currency exchange effects |

|

(6,574 |

) |

(12,383 |

) |

(633 |

) |

-- |

|

(19,590 |

) |

|

Goodwill |

|

$ |

174,428 |

|

$ |

147,566 |

|

$ |

17,281 |

|

$ |

1,615 |

|

$ |

340,890 |

|

|

Accumulated impairment losses |

|

-- |

|

-- |

|

-- |

|

(1,615 |

) |

(1,615 |

) |

|

Balance as of September 30, 2014 |

|

$ |

174,428 |

|

$ |

147,566 |

|

$ |

17,281 |

|

$ |

-- |

|

$ |

339,275 |

|

The table below shows a summary of intangible assets as of September 30, 2014 and December 31, 2013.

|

|

|

|

|

September 30, 2014 |

|

December 31, 2013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted Average |

|

Gross |

|

|

|

|

|

Gross |

|

|

|

|

|

|

Amortization |

|

Carrying |

|

Accumulated |

|

Net |

|

Carrying |

|

Accumulated |

|

Net |

|

|

Period (Years) |

|

Amount |

|

Amortization |

|

Value |

|

Amount |

|

Amortization |

|

Value |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amortized intangible assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Patents |

|

7 |

|

$ |

18,282 |

|

$ |

(18,067 |

) |

$ |

215 |

|

$ |

20,165 |

|

$ |

(19,732 |

) |

$ |

433 |

|

|

Acquired technology |

|

15 |

|

37,260 |

|

(5,589 |

) |

31,671 |

|

40,546 |

|

(4,055 |

) |

36,491 |

|

|

License agreements and other |

|

5 |

|

33,490 |

|

(22,825 |

) |

10,665 |

|

35,259 |

|

(22,232 |

) |

13,027 |

|

|

Total intangible assets |

|

10 |

|

$ |

89,032 |

|

$ |

(46,481 |

) |

$ |

42,551 |

|

$ |

95,970 |

|

$ |

(46,019 |

) |

$ |

49,951 |

|

Aggregate amortization expense for the intangible assets above for the quarters ended September 30, 2014 and 2013 was $1,283 and $1,266, respectively. Aggregate amortization expense for the intangible assets above for the nine months ended September 30, 2014 and 2013 was $4,050 and $3,748, respectively.

Future estimated amortization expense for the years ending December 31 is as follows:

|

2014 |

|

$ |

1,291 |

(remaining estimated amortization for 2014) |

|

|

2015 |

|

4,960 |

|

|

|

2016 |

|

4,024 |

|

|

|

2017 |

|

3,338 |

|

|

|

2018 and thereafter |

|

28,938 |

|

|

8

Table of Contents

Future amortization expense may fluctuate depending on changes in foreign currency rates. The estimates for amortization expense noted above are based upon foreign exchange rates as of September 30, 2014.

NOTE 4 – INCOME TAX UNCERTAINTIES

The Company had approximately $6.6 and $8.0 million recorded for income tax uncertainties as of September 30, 2014 and December 31, 2013, respectively. The $1.4 million change in income tax uncertainties is primarily the result of an audit settlement and the lapse in the statute of limitations for certain tax items. The amount, if recognized, that would impact the effective tax rate is $6.4 and $7.8 million, respectively. The Company estimates that it is reasonably possible that the liability for uncertain tax positions will decrease by no more than $5 million in the next twelve months from the resolution of various uncertain positions as a result of the completion of tax audits, litigation and the expiration of the statute of limitations in various jurisdictions.

NOTE 5 – RETIREMENT AND DEFERRED COMPENSATION PLANS

Components of Net Periodic Benefit Cost:

|

|

|

Domestic Plans |

|

Foreign Plans |

|

|

Three months ended September 30, |

|

2014 |

|

2013 |

|

2014 |

|

2013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Service cost |

|

$ |

2,011 |

|

$ |

2,135 |

|

$ |

1,043 |

|

$ |

974 |

|

|

Interest cost |

|

1,482 |

|

1,248 |

|

676 |

|

668 |

|

|

Expected return on plan assets |

|

(1,647 |

) |

(1,443 |

) |

(494 |

) |

(454 |

) |

|

Amortization of net loss |

|

718 |

|

1,276 |

|

303 |

|

353 |

|

|

Amortization of prior service cost |

|

-- |

|

-- |

|

78 |

|

93 |

|

|

Net periodic benefit cost |

|

$ |

2,564 |

|

$ |

3,216 |

|

$ |

1,606 |

|

$ |

1,634 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Domestic Plans |

|

Foreign Plans |

|

|

Nine months ended September 30, |

|

2014 |

|

2013 |

|

2014 |

|

2013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Service cost |

|

$ |

6,032 |

|

$ |

6,405 |

|

$ |

3,203 |

|

$ |

2,902 |

|

|

Interest cost |

|

4,446 |

|

3,744 |

|

2,074 |

|

1,991 |

|

|

Expected return on plan assets |

|

(4,939 |

) |

(4,331 |

) |

(1,514 |

) |

(1,353 |

) |

|

Amortization of net loss |

|

2,152 |

|

3,827 |

|

929 |

|

1,053 |

|

|

Amortization of prior service cost |

|

-- |

|

2 |

|

239 |

|

278 |

|

|

Net periodic benefit cost |

|

$ |

7,691 |

|

$ |

9,647 |

|

$ |

4,931 |

|

$ |

4,871 |

|

EMPLOYER CONTRIBUTIONS

Although the Company has no minimum funding requirement, the Company contributed $10.0 million to our U.S. plan during the third quarter and the first nine months of 2014 and does not expect to make any contribution to the U.S. plan in the last quarter of 2014. The Company expects to contribute approximately $5.6 million to our foreign defined benefit plans in 2014 and, as of September 30, 2014, we have contributed approximately $2.0 million.

NOTE 6 – ACCUMULATED OTHER COMPREHENSIVE INCOME

Changes in Accumulated Other Comprehensive Income by Component:

|

|

|

Foreign

Currency |

|

Defined Benefit

Pension Plans |

|

Other |

|

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance – December 31, 2012 |

|

$ |

120,097 |

|

$ |

(59,248 |

) |

$ |

(166 |

) |

$ |

60,683 |

|

|

Other comprehensive income before reclassifications |

|

16,275 |

|

-- |

|

-- |

|

16,275 |

|

|

Amounts reclassified from accumulated other comprehensive income |

|

-- |

|

3,294 |

|

39 |

|

3,333 |

|

|

Net current-period other comprehensive income |

|

16,275 |

|

3,294 |

|

39 |

|

19,608 |

|

|

Balance – September 30, 2013 |

|

$ |

136,372 |

|

$ |

(55,954 |

) |

$ |

(127 |

) |

$ |

80,291 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance – December 31, 2013 |

|

$ |

149,965 |

|

$ |

(40,093 |

) |

$ |

(121 |

) |

$ |

109,751 |

|

|

Other comprehensive loss before reclassifications |

|

(123,014 |

) |

-- |

|

-- |

|

(123,014 |

) |

|

Amounts reclassified from accumulated other comprehensive income |

|

(340 |

) |

2,144 |

|

18 |

|

1,822 |

|

|

Net current-period other comprehensive (loss) income |

|

(123,354 |

) |

2,144 |

|

18 |

|

(121,192 |

) |

|

Balance – September 30, 2014 |

|

$ |

26,611 |

|

$ |

(37,949 |

) |

$ |

(103 |

) |

$ |

(11,441 |

) |

9

Table of Contents

Reclassifications Out of Accumulated Other Comprehensive Income:

|

Details about Accumulated Other |

|

Amount Reclassified from Accumulated |

|

Affected Line in the Statement |

|

|

Comprehensive Income Components |

|

Other Comprehensive Income |

|

Where Net Income is Presented |

|

|

Three months ended September 30, |

|

2014 |

|

2013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Defined Benefit Pension Plans |

|

|

|

|

|

|

|

|

Amortization of net loss |

|

$ |

1,021 |

|

$ |

1,629 |

|

(a) |

|

|

Amortization of prior service cost |

|

78 |

|

93 |

|

(a) |

|

|

Total before tax |

|

1,099 |

|

1,722 |

|

|

|

|

|

|

(390 |

) |

(622 |

) |

Tax benefit |

|

|

Net of tax |

|

$ |

709 |

|

$ |

1,100 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Other |

|

|

|

|

|

|

|

|

Changes in treasury locks |

|

9 |

|

14 |

|

Interest Expense |

|

|

Total before tax |

|

9 |

|

14 |

|

|

|

|

|

|

(3 |

) |

(5 |

) |

Tax benefit |

|

|

Net of tax |

|

$ |

6 |

|

$ |

9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total reclassifications for the period |

|

$ |

715 |

|

$ |

1,109 |

|

|

|

(a) These accumulated other comprehensive income components are included in the computation of net periodic benefit costs, net of tax (see Note 5 – Retirement and Deferred Compensation Plans for additional details).

|

Details about Accumulated Other |

|

Amount Reclassified from Accumulated |

|

Affected Line in the Statement |

|

|

Comprehensive Income Components |

|

Other Comprehensive Income |

|

Where Net Income is Presented |

|

|

Nine months ended September 30, |

|

2014 |

|

2013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Defined Benefit Pension Plans |

|

|

|

|

|

|

|

|

Amortization of net loss |

|

$ |

3,081 |

|

$ |

4,880 |

|

(b) |

|

|

Amortization of prior service cost |

|

239 |

|

280 |

|

(b) |

|

|

Total before tax |

|

3,320 |

|

5,160 |

|

|

|

|

|

|

(1,176 |

) |

(1,866 |

) |

Tax benefit |

|

|

Net of tax |

|

$ |

2,144 |

|

$ |

3,294 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign Currency |

|

|

|

|

|

|

|

|

Foreign currency gain |

|

(340 |

) |

-- |

|

Miscellaneous, net |

|

|

Total before tax |

|

(340 |

) |

-- |

|

|

|

|

|

|

-- |

|

-- |

|

Tax benefit |

|

|

Net of tax |

|

$ |

(340 |

) |

$ |

-- |

|

|

|

|

|

|

|

|

|

|

|

|

|

Other |

|

|

|

|

|

|

|

|

Changes in treasury locks |

|

28 |

|

60 |

|

Interest Expense |

|

|

Total before tax |

|

28 |

|

60 |

|

|

|

|

|

|

(10 |

) |

(21 |

) |

Tax benefit |

|

|

Net of tax |

|

$ |

18 |

|

$ |

39 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total reclassifications for the period |

|

$ |

1,822 |

|

$ |

3,333 |

|

|

|

(b) These accumulated other comprehensive income components are included in the computation of net periodic benefit costs, net of tax (see Note 5 – Retirement and Deferred Compensation Plans for additional details).

10

Table of Contents

NOTE 7 – DERIVATIVE INSTRUMENTS AND HEDGING ACTIVITIES

The Company maintains a foreign exchange risk management policy designed to establish a framework to protect the value of the Company’s non-functional denominated transactions from adverse changes in exchange rates. Sales of the Company’s products can be denominated in a currency different from the currency in which the related costs to produce the product are denominated. Changes in exchange rates on such inter-country sales or intercompany loans can impact the Company’s results of operations. The Company’s policy is not to engage in speculative foreign currency hedging activities, but to minimize our net foreign currency transaction exposure, defined as firm commitments and transactions recorded and denominated in currencies other than the functional currency. The Company may use foreign currency forward exchange contracts, options and cross currency swaps to economically hedge these risks.

The Company maintains an interest rate risk management strategy to minimize significant, unanticipated earnings fluctuations that may arise from volatility in interest rates.

For derivative instruments designated as hedges, the Company formally documents the nature and relationships between the hedging instruments and the hedged items, as well as the risk management objectives, strategies for undertaking the various hedge transactions, and the method of assessing hedge effectiveness. Additionally, in order to designate any derivative instrument as a hedge of an anticipated transaction, the significant characteristics and expected terms of any anticipated transaction must be specifically identified, and it must be probable that the anticipated transaction will occur.

HEDGE OF NET INVESTMENTS IN FOREIGN OPERATIONS

A significant number of the Company’s operations are located outside of the United States. Because of this, movements in exchange rates may have a significant impact on the translation of the financial condition and results of operations of the Company’s foreign subsidiaries. A strengthening U.S. dollar relative to foreign currencies has a dilutive translation effect on the Company’s financial condition and results of operations. Conversely, a weakening U.S. dollar has an additive effect. The Company in some cases maintains debt in these subsidiaries to offset the net asset exposure. The Company does not otherwise actively manage this risk using derivative financial instruments. In the event the Company plans on a full or partial liquidation of any of our foreign subsidiaries where the Company’s net investment is likely to be monetized, the Company will consider hedging the currency exposure associated with such a transaction.

OTHER

As of September 30, 2014, the Company has recorded the fair value of foreign currency forward exchange contracts of $0.8 million in prepaid and other, $0.1 million in miscellaneous other assets, $3.0 million in accounts payable and accrued liabilities, and $0.3 million in deferred and other non-current liabilities in the balance sheet. All forward exchange contracts outstanding as of September 30, 2014 had an aggregate contract amount of $155 million.

Fair Value of Derivative Instruments in the Condensed Consolidated Balance Sheets as of September 30, 2014

and December 31, 2013

|

Derivative Contracts Not Designated

as Hedging Instruments |

|

Balance Sheet

Location |

|

September

30, 2014 |

|

December

31, 2013 |

|

|

|

|

|

|

|

|

|

|

|

Derivative Assets |

|

|

|

|

|

|

|

|

Foreign Exchange Contracts |

|

Prepaid and other |

|

$ |

801 |

|

$ |

3,003 |

|

|

Foreign Exchange Contracts |

|

Miscellaneous Other Assets |

|

62 |

|

985 |

|

|

|

|

|

|

$ |

863 |

|

$ |

3,988 |

|

|

|

|

|

|

|

|

|

|

|

Derivative Liabilities |

|

|

|

|

|

|

|

|

Foreign Exchange Contracts |

|

Accounts payable and accrued liabilities |

|

$ |

3,044 |

|

$ |

522 |

|

|

Foreign Exchange Contracts |

|

Deferred and other non-current liabilities |

|

345 |

|

110 |

|

|

|

|

|

|

$ |

3,389 |

|

$ |

632 |

|

The Effect of Derivative Instruments on the Condensed Consolidated Statements of Income

for the Quarters Ended September 30, 2014 and September 30, 2013

|

Derivatives Not Designated as

Hedging Instruments |

|

Location of (Loss) or Gain Recognized in

Income on Derivative |

|

Amount of (Loss) or Gain

Recognized in Income on

Derivative |

|

|

|

|

|

|

2014 |

|

2013 |

|

|

|

|

|

|

|

|

|

|

|

Foreign Exchange Contracts |

|

Other Income (Expense) Miscellaneous, net |

|

$ |

(1,965 |

) |

$ |

2,894 |

|

|

|

|

|

|

$ |

(1,965 |

) |

$ |

2,894 |

|

The Effect of Derivative Instruments on the Condensed Consolidated Statements of Income

for the Nine Months Ended September 30, 2014 and September 30, 2013

|

Derivatives Not Designated as

Hedging Instruments |

|

Location of (Loss) or Gain Recognized in

Income on Derivative |

|

Amount of (Loss) or Gain

Recognized in Income on

Derivative |

|

|

|

|

|

|

2014 |

|

2013 |

|

|

|

|

|

|

|

|

|

|

|

Foreign Exchange Contracts |

|

Other Income (Expense) Miscellaneous, net |

|

$ |

(3,459 |

) |

$ |

2,851 |

|

|

|

|

|

|

$ |

(3,459 |

) |

$ |

2,851 |

|

11

Table of Contents

|

|

|

|

|

|

|

Net Amounts |

|

Gross Amounts not Offset in the |

|

|

|

|

|

|

|

|

Gross Amounts |

|

Presented in |

|

Statement of Financial Position |

|

|

|

|

|

|

Gross |

|

Offset in the |

|

the Statement of |

|

Financial |

|

Cash Collateral |

|

Net |

|

|

|

|

Amount |

|

Financial Position |

|

Financial Position |

|

Instruments |

|

Received |

|

Amount |

|

|

Description |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2014 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Derivative Assets |

|

$ |

863 |

|

-- |

|

$ |

863 |

|

-- |

|

-- |

|

$ |

863 |

|

|

Total Assets |

|

$ |

863 |

|

-- |

|

$ |

863 |

|

-- |

|

-- |

|

$ |

863 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Derivative Liabilities |

|

$ |

3,389 |

|

-- |

|

$ |

3,389 |

|

-- |

|

-- |

|

$ |

3,389 |

|

|

Total Liabilities |

|

$ |

3,389 |

|

-- |

|

$ |

3,389 |

|

-- |

|

-- |

|

$ |

3,389 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Derivative Assets |

|

$ |

3,988 |

|

-- |

|

$ |

3,988 |

|

-- |

|

-- |

|

$ |

3,988 |

|

|

Total Assets |

|

$ |

3,988 |

|

-- |

|

$ |

3,988 |

|

-- |

|

-- |

|

$ |

3,988 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Derivative Liabilities |

|

$ |

632 |

|

-- |

|

$ |

632 |

|

-- |

|

-- |

|

$ |

632 |

|

|

Total Liabilities |

|

$ |

632 |

|

-- |

|

$ |

632 |

|

-- |

|

-- |

|

$ |

632 |

|

NOTE 8 – FAIR VALUE

Authoritative guidelines require the categorization of assets and liabilities into three levels based upon the assumptions (inputs) used to price the assets or liabilities. Level 1 provides the most reliable measure of fair value, whereas Level 3 generally requires significant management judgment. The three levels are defined as follows:

· Level 1: Unadjusted quoted prices in active markets for identical assets and liabilities.

· Level 2: Observable inputs other than those included in Level 1. For example, quoted prices for similar assets or liabilities in active markets or quoted prices for identical assets or liabilities in inactive markets.

· Level 3: Unobservable inputs reflecting management’s own assumptions about the inputs used in pricing the asset or liability.

As of September 30, 2014, the fair values of our financial assets and liabilities were categorized as follows:

|

|

|

Total |

|

Level 1 |

|

Level 2 |

|

Level 3 |

|

|

Assets |

|

|

|

|

|

|

|

|

|

|

Forward exchange contracts (a) |

|

$ |

863 |

|

$ |

-- |

|

$ |

863 |

|

$ |

-- |

|

|

Total assets at fair value |

|

$ |

863 |

|

$ |

-- |

|

$ |

863 |

|

$ |

-- |

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

|

|

|

|

Forward exchange contracts (a) |

|

$ |

3,389 |

|

$ |

-- |

|

$ |

3,389 |

|

$ |

-- |

|

|

Total liabilities at fair value |

|

$ |

3,389 |

|

$ |

-- |

|

$ |

3,389 |

|

$ |

-- |

|

As of December 31, 2013, the fair values of our financial assets and liabilities were categorized as follows:

|

|

|

Total |

|

Level 1 |

|

Level 2 |

|

Level 3 |

|

|

Assets |

|

|

|

|

|

|

|

|

|

|

Forward exchange contracts (a) |

|

$ |

3,988 |

|

$ |

-- |

|

$ |

3,988 |

|

$ |

-- |

|

|

Total assets at fair value |

|

$ |

3,988 |

|

$ |

-- |

|

$ |

3,988 |

|

$ |

-- |

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

|

|

|

|

Forward exchange contracts (a) |

|

$ |

632 |

|

$ |

-- |

|

$ |

632 |

|

$ |

-- |

|

|

Total liabilities at fair value |

|

$ |

632 |

|

$ |

-- |

|

$ |

632 |

|

$ |

-- |

|

(a) Market approach valuation technique based on observable market transactions of spot and forward rates

The carrying amounts of the Company’s other current financial instruments such as cash and equivalents, notes payable and current maturities of long-term obligations approximate fair value due to the short-term maturity of the instrument. The Company considers our long-term obligations a Level 2 liability and utilizes the market approach valuation technique based on interest rates that are currently available to the Company for issuance of debt with similar terms and maturities. The estimated fair value of the Company’s long-term obligations was $370 million as of September 30, 2014 and $363 million as of December 31, 2013.

12

Table of Contents

NOTE 9 – COMMITMENTS AND CONTINGENCIES

The Company, in the normal course of business, is subject to a number of lawsuits and claims both actual and potential in nature. While management believes the resolution of these claims and lawsuits will not have a material adverse effect on the Company’s financial position or results of operations or cash flows, claims and legal proceedings are subject to inherent uncertainties, and unfavorable outcomes could occur that could include amounts in excess of any accruals which management has established. Were such unfavorable final outcomes to occur, it is possible that they could have a material adverse effect on our financial position, results of operations and cash flows.

NOTE 10 – STOCK REPURCHASE PROGRAM

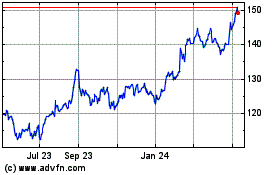

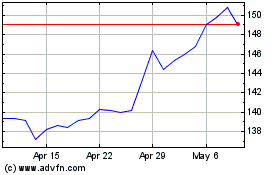

During the three and nine months ended September 30, 2014, the Company repurchased approximately 600 thousand and 1.4 million shares for approximately $37.6 million and $90.5 million, respectively. As of September 30, 2014, the Company has a remaining authorization to repurchase 2.6 million additional shares. The timing of and total amount expended for the share repurchases depends upon market conditions. On October 30, 2014, the Company announced a new share repurchase authorization of up to $350 million of common stock. This new authorization replaces previous authorizations. AptarGroup may repurchase shares through the open market, privately negotiated transactions or other programs, subject to market conditions.

NOTE 11 – STOCK-BASED COMPENSATION

The Company issues stock options and restricted stock units to employees under Stock Awards Plans approved by stockholders. Stock options are issued to non-employee directors under Director Stock Option Plans approved by stockholders. Options are awarded with the exercise price equal to the closing market price on the date of grant and generally become exercisable over three years and expire 10 years after grant. Restricted stock units generally vest over three years.

Compensation expense recorded attributable to stock options for the first nine months of 2014 was approximately $15.0 million ($9.8 million after tax). The income tax benefit related to this compensation expense was approximately $5.2 million. Approximately $13.4 million of the compensation expense was recorded in selling, research & development and administrative expenses and the balance was recorded in cost of sales. Compensation expense recorded attributable to stock options for the first nine months of 2013 was approximately $11.5 million ($7.7 million after tax). The income tax benefit related to this compensation expense was approximately $3.8 million. Approximately $10.2 million of the compensation expense was recorded in selling, research & development and administrative expenses and the balance was recorded in cost of sales.

The Company uses historical data to estimate expected life and volatility of stock options. The weighted-average fair value of stock options granted under the Stock Awards Plans was $14.82 and $10.16 per share during the first nine months of 2014 and 2013, respectively. These values were estimated on the respective dates of grant using the Black-Scholes option-pricing model with the following weighted-average assumptions:

|

Stock Awards Plans: |

|

|

|

|

|

|

Nine months ended September 30, |

|

2014 |

|

2013 |

|

|

|

|

|

|

|

|

|

Dividend Yield |

|

1.7 |

% |

1.8 |

% |

|

Expected Stock Price Volatility |

|

22.1 |

% |

22.7 |

% |

|

Risk-free Interest Rate |

|

2.3 |

% |

1.3 |

% |

|

Expected Life of Option (years) |

|

6.9 |

|

6.9 |

|

The fair value of stock options granted under the Director Stock Option Plan was $14.07 and $10.89 per share during the first nine months of 2014 and 2013, respectively. These values were estimated on the respective dates of grant using the Black-Scholes option-pricing model with the following weighted-average assumptions:

|

Director Stock Option Plans: |

|

|

|

|

|

|

Nine months ended September 30, |

|

2014 |

|

2013 |

|

|

|

|

|

|

|

|

|

Dividend Yield |

|

1.8 |

% |

1.9 |

% |

|

Expected Stock Price Volatility |

|

22.2 |

% |

23.0 |

% |

|

Risk-free Interest Rate |

|

2.2 |

% |

1.3 |

% |

|

Expected Life of Option (years) |

|

6.9 |

|

6.9 |

|

A summary of option activity under the Company’s stock option plans during the nine months ended September 30, 2014 is presented below:

13

Table of Contents

|

|

|

Stock Awards Plans |

|

Director Stock Option Plans |

|

|

|

|

|

|

Weighted Average |

|

|

|

Weighted Average |

|

|

|

|

Shares |

|

Exercise Price |

|

Shares |

|

Exercise Price |

|

|

|

|

|

|

|

|

|

|

|

|

|

Outstanding, January 1, 2014 |

|

7,815,932 |

|

$ |

41.26 |

|

313,834 |

|

$ |

48.85 |

|

|

Granted |

|

1,379,850 |

|

67.93 |

|

95,000 |

|

66.59 |

|

|

Exercised |

|

(665,671 |

) |

32.23 |

|

(40,166 |

) |

47.96 |

|

|

Forfeited or expired |

|

(31,417 |

) |

49.86 |

|

-- |

|

-- |

|

|

Outstanding at September 30, 2014 |

|

8,498,694 |

|

$ |

46.27 |

|

368,668 |

|

$ |

53.52 |

|

|

Exercisable at September 30, 2014 |

|

5,832,623 |

|

$ |

39.94 |

|

188,159 |

|

$ |

45.98 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-Average Remaining Contractual Term (Years): |

|

|

|

|

|

|

|

|

Outstanding at September 30, 2014 |

|

6.1 |

|

|

|

7.5 |

|

|

|

|

Exercisable at September 30, 2014 |

|

5.0 |

|

|

|

6.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Aggregate Intrinsic Value: |

|

|

|

|

|

|

|

|

|

|

Outstanding at September 30, 2014 |

|

$ |

132,612 |

|

|

|

$ |

3,208 |

|

|

|

|

Exercisable at September 30, 2014 |

|

$ |

121,124 |

|

|

|

$ |

2,769 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Intrinsic Value of Options Exercised During the Nine Months Ended: |

|

|

|

|

|

|

September 30, 2014 |

|

$ |

22,386 |

|

|

|

$ |

741 |

|

|

|

|

September 30, 2013 |

|

$ |

33,123 |

|

|

|

$ |

732 |

|

|

|

The fair value of options vested during the nine months ended September 30, 2014 and 2013 was $14.1 million and $12.9 million, respectively. Cash received from option exercises was approximately $24.6 million and the actual tax benefit realized for the tax deduction from option exercises was approximately $7.0 million in the nine months ended September 30, 2014. As of September 30, 2014, the remaining valuation of stock option awards to be expensed in future periods was $16.1 million and the related weighted-average period over which it is expected to be recognized is 1.5 years.

The fair value of restricted stock unit grants is the closing market price of the underlying shares on the grant date. A summary of restricted stock unit activity during the nine months ended September 30, 2014 is presented below:

|

|

|

|

|

Weighted-Average |

|

|

|

|

Shares |

|

Grant-Date Fair Value |

|

|

|

|

|

|

|

|

|

Nonvested at January 1, 2014 |

|

25,681 |

|

$ |

53.49 |

|

|

Granted |

|

47,671 |

|

67.08 |

|

|

Vested |

|

(11,602 |

) |

52.96 |

|

|

Nonvested at September 30, 2014 |

|

61,750 |

|

$ |

64.09 |

|

Compensation expense recorded attributable to restricted stock unit grants for the first nine months of 2014 and 2013 was approximately $1.4 million and $574 thousand, respectively. The fair value of units vested during the nine months ended September 30, 2014 and 2013 was $614 thousand and $571 thousand, respectively. The intrinsic value of units vested during the nine months ended September 30, 2014 and 2013 was $761 thousand and $661 thousand, respectively. As of September 30, 2014 there was $2.3 million of total unrecognized compensation expense relating to restricted stock unit awards which is expected to be recognized over a weighted-average period of 1.6 years.

During the first quarter of 2014, the Company approved a new long-term incentive program for certain employees. The program is based on the cumulative total stockholder return of our common stock during a three year performance period. Total expense related to this program is expected to be approximately $1.2 million over the performance period, of which $480 thousand was recognized in the first nine months of 2014.

NOTE 12 – EARNINGS PER SHARE

AptarGroup’s authorized common stock consists of 199 million shares, having a par value of $.01 each. Information related to the calculation of earnings per share is as follows:

|

|

|

Three months ended |

|

|

|

|

September 30, 2014 |

|

September 30, 2013 |

|

|

|

|

Diluted |

|

Basic |

|

Diluted |

|

Basic |

|

|

Consolidated operations |

|

|

|

|

|

|

|

|

|

|

Income available to common stockholders |

|

$ |

48,595 |