Physicians Realty Trust Announces Closing of the First Tranche of the Catholic Health Initiatives Acquisition With a Total In...

May 12 2016 - 8:15AM

Business Wire

Highlights:

- 26 medical office facilities totaling

1,390,646 rentable square feet with 90.4% occupancy

- Catholic Health Initiatives (CHI)

affiliated hospitals and physicians lease 75% of the rentable

square feet in these facilities

- 82% of the rentable square feet of

these facilities are on a CHI hospital campus

- Additional medical office facilities

under executed Purchase and Sale Agreements to be acquired from CHI

later in the second quarter of 2016

Physicians Realty Trust (NYSE:DOC) (the “Company,” the “Trust,”

“we,” “our” and “us”), a self-managed healthcare real estate

investment trust, today announced that it has closed the first

tranche of its previously announced pending purchase of medical

office facilities from Catholic Health Initiatives (“CHI”). The

first tranche included 26 medical office facilities for a purchase

price of approximately $324 million. These 26 facilities are 90.4%

occupied, with 75% of the space leased by CHI affiliated hospitals

and physicians.

John T. Thomas, President and Chief Executive Officer of the

Trust, commented, “We are honored to have been chosen by Catholic

Health Initiatives to acquire 51 mission-critical medical office

buildings leased primarily to CHI’s affiliated hospitals in 10

markets. This was not only the largest ever hospital

monetization of medical office buildings, but also the first step

toward establishing a long term partnership with CHI. Our team

has worked closely with CHI and its affiliates in each market over

the past three months to complete this acquisition, and

with today’s acquisition, we have taken over property

management in the multi-tenant CHI facilities. We

are working closely with our partners at CHI

to complete the final purchase of the remaining

medical office facilities as soon as reasonably practical after CHI

receives consent from the Vatican for the sale. Except for one

project that is currently under construction, we expect the closing

on the remainder of the portfolio to occur by the end of the second

quarter, but we cannot provide any assurance that any or all of

these follow-on acquisitions will be completed.”

About Physicians Realty Trust

Physicians Realty Trust is a self-managed healthcare real estate

company organized to acquire, selectively develop, own and manage

healthcare properties that are leased to physicians, hospitals and

healthcare delivery systems. The Company invests in real estate

that is integral to providing high quality healthcare. The Company

conducts its business through an UPREIT structure in which its

properties are owned by Physicians Realty L.P., a Delaware limited

partnership (the “operating partnership”), directly or through

limited partnerships, limited liability companies or other

subsidiaries. The Company is the sole general partner of the

operating partnership and, as of March 31, 2016, owned

approximately 96.5% of the partnership interests in our operating

partnership (“OP Units”).

Investors are encouraged to visit the Investor Relations portion

of the Company’s website (www.docreit.com) for additional information,

including annual reports on Form 10-K, quarterly reports on Form

10-Q, current reports on Form 8-K and amendments to those reports

filed or furnished pursuant to Section 13(a) or 15(d) of the

Securities Exchange Act of 1934, as amended, press releases,

supplemental information packages and investor presentations.

Forward-Looking Statements

This press release contains statements that are “forward-looking

statements” within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended, pursuant to the safe harbor provisions of the

Private Securities Litigation Reform Act of 1995. Forward-looking

statements may be identified by the use of words such as

“anticipate”, “believe”, “expect”, “estimate”, “plan”, “outlook”,

and “project” and other similar expressions that predict or

indicate future events or trends or that are not statements of

historical matters. These forward looking statements may include

statements regarding the Company’s strategic and operational plans,

the Company’s ability to generate internal and external growth, the

future outlook, anticipated cash returns, cap rates or yields on

properties, anticipated closing of property acquisitions, and

ability to execute its business plan. While forward-looking

statements reflect our good faith beliefs, they are not guarantees

of future performance. Forward looking statements should not be

read as a guarantee of future performance or results, and will not

necessarily be accurate indications of the times at, or by, which

such performance or results will be achieved. Forward looking

statements are based on information available at the time those

statements are made and/or management’s good faith belief as of

that time with respect to future events, and are subject to risks

and uncertainties that could cause actual performance or results to

differ materially from those expressed in or suggested by the

forward looking statements. These forward-looking statements are

subject to various risks and uncertainties, not all of which are

known to the Company and many of which are beyond the Company’s

control, which could cause actual results to differ materially from

such statements. These risks and uncertainties are described in

greater detail in the Company’s filings with the Securities and

Exchange Commission (the “Commission”), including, without

limitation, the Company’s annual and periodic reports and other

documents filed with the Commission. Unless legally required, the

Company disclaims any obligation to update any forward-looking

statements after the date of this release, whether as a result of

new information, future events or otherwise. For a description of

factors that may cause the Company’s actual results or performance

to differ from its forward-looking statements, please review the

information under the heading “Risk Factors” included in the

Company’s Annual Report on Form 10-K for the fiscal year ended

December 31, 2015 filed by the Company with the Commission on

February 29, 2016.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160512005401/en/

Physicians Realty TrustJohn T. Thomas, 214-549-6611President and

CEOjtt@docreit.comJeffrey N. Theiler, 414-367-5610Executive Vice

President and CFOjnt@docreit.com

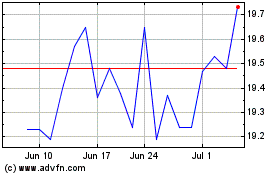

Healthpeak Properties (NYSE:DOC)

Historical Stock Chart

From Mar 2024 to Apr 2024

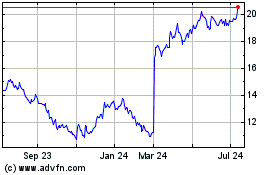

Healthpeak Properties (NYSE:DOC)

Historical Stock Chart

From Apr 2023 to Apr 2024