NuStar Energy Beats on Q1 Earnings, Revs - Analyst Blog

April 24 2014 - 11:00AM

Zacks

San Antonio-based publicly traded

partnership NuStar Energy L.P. (NS) reported

better-than-expected first-quarter results, owing to improved

performance from the pipeline business unit. Decrease in total

operating expenses also favored the results.

The partnership’s first-quarter results were out before the opening

bell on Apr 23, 2014. NuStar closed at $56.95 per unit on that day,

reflecting a marginal increase from the previous day’s closing

price, owing to the favorable results.

NuStar’s earnings per unit (EPU) – from continuing operations –

came in at 40 cents, beating the Zacks Consensus Estimate of 37

cents. The bottom line also increased from the year-ago figure of

10 cents per unit.

Revenues of $849.2 million surpassed the Zacks Consensus Estimate

of $766.0 million. However, the top line was 14.9% below the

year-ago level, mainly due to lower quarterly sales from the

Storage segment.

Quarterly Distribution

NuStar announced quarterly distribution of $1.095 per unit ($4.38

per unit annualized), which remains unchanged from the previous

quarter’s distribution. The distribution is payable on May 12,

2014, to unitholders of record as on May 7, 2014.

Distributable cash flow (DCF) available to limited partners for the

first quarter was $77.9 million or $1.00 per unit (providing 0.91x

distribution coverage), compared with $57.1 million or 73 cents per

unit in the year-earlier quarter.

Segmental Performance

Pipeline: Total quarterly throughput

volumes in the Pipeline segment were 832,389 barrels per day

(Bbl/d) representing a marginal increase of 1.2% from the year-ago

period.

The throughput volumes in the crude oil pipelines increased 2.3%

from the year-ago quarter to 359,418 Bbl/d. Moreover, throughput

revenues rose 10.4% to $103.0 million. The segment’s operating

income increased 32.9% year over year to $53.0 million on an

increase in throughput volumes and a drop in operating expenses.

Storage: Throughput volumes in the

Storage segment improved 22.7% year over year to 821,338 Bbl/d.

However, quarterly revenues were down 6.4% to $132.6 million from

the first quarter of the previous year. The segment reported profit

of $42.0 million, indicating deterioration from $54.0 million in

the year-ago quarter, owing to the segment’s higher operational

costs.

Fuels Marketing: The unit reported an

income of $10.0 million, against the year-ago quarter loss of about

$1.6 million. A decrease in operating expenses led to the

improvement.

Operating Expense

The partnership recorded total

operating costs of $106.1 million, down 6.6% year over year.

Balance Sheet

As of Mar 31, 2014, the partnership had total debt of $2,710.1

million, representing a debt-to-capitalization ratio of 59.5%.

Guidance

NuStar expects its second-quarter 2014 EPU to come in ahead of the

year-ago quarter’s profit. Moreover, the partnership continues to

believe that 2014 operating profits from its pipeline business unit

will register a $40.0 to $60.0 million increase from the 2013

level. Additionally, the adjusted 2014 operating profit from

storage business is likely to be in line with 2013.

In 2014, NuStar plans to invest $350 million to $370 million in

growth projects. The key focus of the investment will be on the

pipeline segment.

Stocks to Consider

NuStar currently carries a Zacks Rank #4 (Sell), implying that it

is expected to underperform the broader U.S. equity market over the

next one to three months.

Meanwhile, one can look at better-ranked players from the same

industry like Energy Transfer Equity LP (ETE),

Boardwalk Pipeline Partners LP (BWP) and

Enterprise Products Partners LP (EPD). Energy

Transfer Equity sports a Zacks Rank #1 (Strong Buy), while

Boardwalk Pipeline Partners and Enterprise Products Partners hold a

Zacks Rank #2 (Buy).

BOARDWALK PIPLN (BWP): Free Stock Analysis Report

ENTERPRISE PROD (EPD): Free Stock Analysis Report

ENERGY TRAN EQT (ETE): Free Stock Analysis Report

NUSTAR ENERGY (NS): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

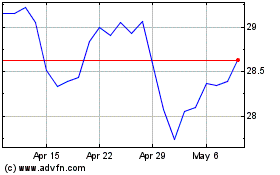

Enterprise Products Part... (NYSE:EPD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Enterprise Products Part... (NYSE:EPD)

Historical Stock Chart

From Apr 2023 to Apr 2024