- Full year total revenue growth of 39%,

including wearable growth of 44%

- Strategic transition on track

Kopin Corporation (NASDAQ: KOPN), a leading developer of

innovative wearable computing technologies and solutions, today

provided an update on its business initiatives and reported

financial results for the fourth quarter and fiscal year

ended December 27, 2014.

“2014 was an important year for Kopin and we have made

substantial progress since announcing our strategy to reinvent the

Company as the leading provider of technologies and solutions for

the coming wearable world,” said Dr. John Fan, Kopin’s President

and Chief Executive Officer. “And with a strong cash position and a

debt-free balance sheet, we have the means to execute our strategy

and maintain our level of investment in the growing wearable

systems market as we head into 2015.”

Dr. Fan continued. “The wearable industry seems to have shifted

more towards enterprise applications. At Kopin we have always

believed that enterprise applications are the logical initial entry

point for smart headsets and we have focused our Golden-i headsets

for enterprise applications over the past five years. We have been

the pioneer in this enterprise segment and we are extremely well

positioned for this enterprise category. We expect the market will

see products from two tier-one customers this year which include

Kopin products. Additionally, two years ago, we added our focus to

consumer applications. We believe that for consumer applications,

the device must be different from that of enterprise applications.

Along with developing smaller, more efficient optical engines, we

have placed significant emphasis on voice, which we believe will

become the new touch. We have made great progress in these key

enabling technologies and we are confident that consumer smart

headsets are very viable and are close to reality.”

Fourth Quarter Results

Total revenues for the fourth quarter ended December 27,

2014, were $10.6 million, compared with $5.5

million for the fourth quarter of 2013.

Net loss for the fourth quarter of 2014 was $5.3 million,

or $0.08 per share, compared with net loss of $9.7

million, or $0.16 per share, for the same period of 2013.

The fourth quarter of 2013 included noncash charges to write-down

certain intangible assets of approximately $1.5 million and an

equity investment of approximately $2.5 million.

Full Year Results

Total revenues for the 12 months ended December 27, 2014,

were $31.8 million, compared with $22.9 million in

the same period of 2013.

Research and development expenses for the year 2014

were $20.7 million compared with $17.5

million in the same period of 2013, reflecting an increase in

costs to develop our wearable and military technologies.

Selling, general and administrative expenses were $19.9

million in 2014, compared with $19.1 million in the same

period of 2013.

Included in the 2013 results of operations are noncash charges

to write-down certain intangible assets of approximately $1.5

million and impairment charges in investments of

approximately $5.0 million.

On January 16, 2013 we sold our III-V product line and

investment in Kopin Taiwan Corporation (KTC). The gain on

the sale and the results of operations of our III-V product line

and KTC through the date of sale are shown as discontinued

operations in our financial statements. Our net loss for the 12

months ended December 27, 2014 was $28.2 million,

or $0.45 per share. For the year ended December 28, 2013

our net loss from continuing operations was $24.9 million,

or $0.40 per share, our net income from discontinued

operations was $20.1 million, or $0.32 per share,

and our net loss for the year ended December 28,

2013 was $4.7 million, or $0.08 per share.

Cash used in operating activities for the fiscal year 2014

was $19.6 million and we used $0.3 million for

the repurchase of our common stock. Kopin’s cash, equivalents and

marketable securities was $90.9 million at December

27, 2014. Kopin has no long-term debt.

Financial Results Conference Call

In conjunction with its fourth quarter and fiscal year end 2014

financial results, Kopin will host a teleconference call

for investors and analysts at 5:00 p.m. ET today. To

participate, please dial (877) 709-8150 (U.S. and Canada) or

(201) 689-8354 (International). The call will also be available as

a live and archived audio webcast on the “Investors” section of

the Kopin website, www.kopin.com.

About Kopin

Kopin Corporation is a leading developer and provider of

innovative wearable technologies and solutions for integration into

head-worn computing and display systems to military, industrial and

consumer customers. Kopin’s technology portfolio includes

ultra-small displays, optics, speech enhancement technology, system

and hands-free control software, low-power ASICs, and ergonomically

designed smart headset reference systems. Kopin’s proprietary

components and technology are protected by more than 285 global

patents and patents pending. For more information, please visit

Kopin’s website at www.kopin.com.

Kopin, CyberDisplay, Pupil and Golden-i are trademarks

of Kopin Corporation.

Forward-Looking Statements

Statements in this press release may be considered

“forward-looking” statements under the “Safe Harbor” provisions of

the Private Securities Litigation Reform Act of 1995. These

include, without limitation, statements relating to our belief that

we have the means to execute our strategy and maintain our level of

investment in the growing wearable systems market as we head into

2015; our belief that the wearable systems market is growing; our

belief that the wearable industry seems to have shifted more

towards enterprise applications; our belief that enterprise

applications are the logical initial entry point for smart

headsets; our belief that we are extremely well positioned for

enterprise category; our expectation that the market will see

products from two tier-one customers this year; our belief that

voice technology will become the new touch; our belief that the

device for consumer applications must be different from that of

enterprise applications; and our belief that consumer smart

headsets are very viable and are close to reality. These statements

involve a number of risks and uncertainties that could cause actual

results to differ materially from those expressed in the

forward-looking statements. These risks and uncertainties include,

but are not limited to, the following: we may not have sufficient

funds to continue our investment level; the wearable systems market

may not grow; the enterprise market for wearable headsets may not

develop; our competitors may have superior products to ours and

therefore we may not be well positioned in the enterprise or

commercial wearable headset market; our tier-one or any customers

may not introduce products this year; voice technology may not be

the new touch because the technology does not work or if it works

it may not be accepted by the market, it may not be manufacturable

or competitors products may be superior; it may take longer than

the Company estimates to develop products; the Company’s

products may not be accepted by the market place; there may be

issues that prevent the adoption or further development of the

Company’s wearable computing technologies; manufacturing,

marketing or other issues may prevent either the adoption or

acceptance of products; the Company might be adversely affected by

competitive products and pricing; new product initiatives and other

research and development efforts may be unsuccessful; the Company

could experience the loss of significant customers; costs to

produce the Company’s products might increase significantly, or

yields could decline; the Company’s customers might be unable

to ramp production volumes of their products, or the Company’s

product forecasts could turn out to be wrong; manufacturing delays,

technical issues, economic conditions or external factors may

prevent the Company from achieving its goals; and other risk

factors and cautionary statements listed in the Company’s periodic

reports and registration statements filed with the Securities

and Exchange Commission, including the Annual Report on Form 10-K

for the 12 months ended December 28, 2013, and the Company’s

subsequent filings with the Securities and Exchange

Commission. You should not place undue reliance on any

forward-looking statements, which are based only on information

currently available to the Company and only as of the date on which

they are made. The Company undertakes no obligation to update any

of these forward-looking statements to reflect events or

circumstances occurring after the date of this report.

Kopin Corporation Supplemental Information

(Unaudited) Three Months

Ended Twelve Months Ended

December 27,

2014

December 28,

2013

December 27,

2014

December 28,

2013

Display Revenues

by Category (in millions)

Military Applications $ 6.0 $ 1.1 $ 14.3 $ 8.6 Consumer Electronics

Applications 0.4 1.3 2.8 5.3 Industrial Applications 0.9 0.6 3.7

2.4 Wearable Applications 1.4 1.5 6.2 4.3 Research and Development

1.9 1.0 4.8 2.3 Total $ 10.6 $ 5.5 $

31.8 $ 22.9

Stock-Based

Compensation Expense

Continuing Operations Cost of component revenues $ 186,000 $

160,000 $ 777,000 $ 415,000 Research and development 194,000

166,000 967,000 423,000 Selling, general and administrative

892,000 229,000 3,084,000 3,365,000 $

1,272,000 $ 555,000 $ 4,828,000 $ 4,203,000

Other Financial

Information

Depreciation and amortization $ 414,000 $ 568,000 $ 3,002,000 $

3,646,000

Capital expenditures $ - $ 217,000 $ 1,490,000 $

742,000

Treasury stock purchases $ - $ 2,005,000 $ 299,000 $ 7,992,000

Kopin Corporation

Condensed Consolidated Statements of Operations

(Unaudited) Three Months Ended Twelve

Months Ended

December 27,

2014

December 28,

2013

December 27,

2014

December 28,

2013

Revenues: Revenues $ 8,756,290 $ 4,509,219 $ 26,956,741 $

20,574,812 Research and development revenues

1,881,095 1,040,712

4,850,724 2,322,897

10,637,385 5,549,931 31,807,465 22,897,709 Expenses: Cost of

component revenues 6,054,836 3,864,598 19,638,149 20,655,216

Research and development 5,680,298 4,041,767 20,736,021 17,534,020

Selling, general and administrative 4,974,597 3,472,961 19,908,020

19,124,750 Impairment of intangibles assets and goodwill

- 1,511,414

- 1,511,414

16,709,731 12,890,740 60,282,190 58,825,400 Loss from

operations (6,072,346 ) (7,340,809 ) (28,474,725 ) (35,927,691 )

Other income (expense), net

635,267

(2,340,162 )

10,378 (2,133,968

)

Loss before benefit for income taxes,

equity loss in unconsolidated affiliate and net loss from

noncontrolling interest

(5,437,079 ) (9,680,971 ) (28,464,347 ) (38,061,659 )

Benefit for income taxes

118,000

54,000 180,000

12,933,209

Loss before equity loss in unconsolidated

affiliate and net loss from noncontrolling interest

(5,319,079 ) (9,626,971 ) (28,284,347 ) (25,128,450 ) Equity

loss in unconsolidated affiliate

(126,568

) (216,907 )

(386,442 ) (625,098

) Loss from continuing operations (5,445,647 )

(9,843,878 ) (28,670,789 ) (25,753,548 ) Income from discontinued

operations, net of tax

-

- -

20,147,532 Net loss (5,445,647 ) (9,843,878 )

(28,670,789 ) (5,606,016 ) Net loss attributable to

noncontrolling interest

143,401

184,041 458,745

896,400 Net loss

$

(5,302,246 ) $

(9,659,837 ) $

(28,212,044 ) $

(4,709,616 ) Net (loss) income per

share: Basic Continuing operations $ (0.08 ) $ (0.16 ) $ (0.45 ) $

(0.40 ) Discontinued operations

-

- -

0.32 Net (loss) income per share

$

(0.08 ) (0.16

) $ (0.45 )

$ (0.08 ) Diluted Continuing

operations $ (0.08 ) $ (0.16 ) $ (0.45 ) $ (0.40 ) Discontinued

operations

- -

- 0.32

Net (loss) income per share

$ (0.08

) $ (0.16 )

$ (0.45 ) $

(0.08 ) Weighted average

number of common shares outstanding: Basic

62,734,237 61,528,968

62,638,675

62,347,852 Diluted

62,734,237 61,528,968

62,638,675

62,347,852 Kopin

Corporation Condensed Consolidated Balance Sheets

(Unaudited) December 27, 2014

December 28, 2013 ASSETS Current assets: Cash and marketable

securities $ 90,858,936 $ 112,729,201 Accounts receivable, net

3,802,324 2,388,461 Inventory 4,081,886 3,078,055 Prepaid and other

current assets

1,181,474

1,412,285 Total current assets 99,924,620

119,608,002 Equipment and improvements, net 4,589,421

6,034,963 Goodwill and intangible assets 1,593,210 2,597,634 Other

assets 1,900,828 3,024,458 Note receivable

14,933,335 14,866,666

Total assets $ 122,941,414 $ 146,131,723

LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities: Accounts

payable $ 5,503,734 $ 3,868,865 Accrued expenses 5,870,719

5,309,785 Deferred income taxes 1,282,000 1,512,771 Billings in

excess of revenue earned

586,471

547,681 Total current liabilities 13,242,924

11,239,102 Lease commitments 311,187 329,435 Total

Kopin Corporation stockholders' equity 109,846,959 134,553,247

Noncontrolling interest (459,656 ) 9,939 Total

stockholders' equity 109,387,303 134,563,186

Total liabilities and stockholders' equity $ 122,941,414 $

146,131,723

Kopin CorporationRichard Sneider, 508-870-5959Treasurer

and Chief Financial OfficerRSneider@kopin.comorMarket Street

PartnersJoAnn Horne,

415-445-3233PartnerJHorne@marketstreetpartners.com

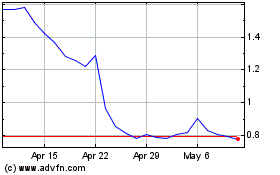

Kopin (NASDAQ:KOPN)

Historical Stock Chart

From Aug 2024 to Sep 2024

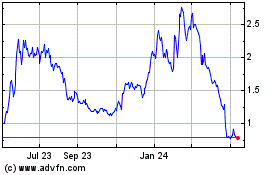

Kopin (NASDAQ:KOPN)

Historical Stock Chart

From Sep 2023 to Sep 2024