Judge Rules for Thornburg Mortgage in Suit Against RBC Capital -- Update

August 28 2015 - 1:16PM

Dow Jones News

By Patrick Fitzgerald

A federal judge has awarded the court-appointed trustee

overseeing the liquidation of Thornburg Mortgage Inc. $45 million

in his crisis-era lawsuit against RBC Capital Markets LLC, finding

the bank shortchanged the mortgage lender when it seized and

subsequently sold some of its assets.

Judge George L. Russell III of the U.S. District Court in

Baltimore ruled Wednesday that RBC Capital, the investment-banking

arm of Royal Bank of Canada, improperly sold the assets backing

repurchase agreements the mortgage lender had used to fund its

business. RBC seized the mortgage securities after Thornburg

defaulted during the turmoil in mortgage market in August 2007.

In granting the Thornburg trustee's motion for summary judgment,

the judge said RBC undervalued the seized mortgage-backed

securities at issue by $26.3 million. With interest, Thornburg is

owed $45 million in damages as result of RBC's actions.

A spokeswoman for RBC Capital couldn't immediately be reached

for comment.

Joel I. Sher, the bankruptcy trustee overseeing Thornburg's

liquidation, sued RBC Capital Markets in a breach-of-contract

lawsuit over what he said were improper margin calls and the

subsequent seizure and sale of $573 million in mortgage-backed

securities Thornburg financed through RBC.

Before its collapse, Thornburg was a publicly traded real-estate

investment trust that invested in residential mortgages and

mortgage-backed securities.

The company financed its business, including its purchase of

mortgage-backed securities, through a series of repurchase, or

repo, agreements and swaps deals with banks and securities firms

like RBC. Those mortgage-backed securities were typically then

pledged as collateral in the deals.

Mr. Sher claimed RBC breached the provisions of the repo deal by

improperly valuing Thornburg's collateral to create deficits that

justified its inflated margin calls.

The trustee filed similar lawsuits against other banks,

including Barclays Capital Inc. and Goldman Sachs Group Inc.,

alleging they made improper margin calls that helped drive the

mortgage lender into bankruptcy. BarCap, the investment-banking

division of British bank Barclays PLC, settled last year for $23

million. The Goldman suit has been dismissed.

Mr. Sher also sued some of the biggest players in Wall Street's

mortgage-finance assembly line for nearly $2 billion, claiming a

number of banks--including J.P. Morgan Chase Co., Citigroup Inc.

and Credit Suisse Group--engaged in series of "collusive" and

"predatory" schemes that resulted in Thornburg's demise. The banks,

in court papers, have denied wrongdoing.

A judge last year dismissed the bulk of that lawsuit but said

Thornburg could still go after the banks for breach of contract and

other claims totaling around $1 billion. The suit is pending.

Thornburg, based in Santa Fe, N.M., filed for chapter 11

bankruptcy-court protection in May 2009. Mr. Sher was named the

chapter 11 trustee of Thornburg, now named TMST Inc., in 2009 after

it was discovered the company's former managers had used the

lender's employees and assets to launch a new company.

Write to Patrick Fitzgerald at patrick.fitzgerald@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

August 28, 2015 13:01 ET (17:01 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

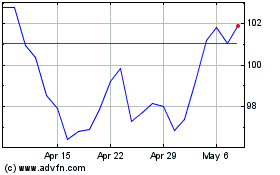

Royal Bank of Canada (NYSE:RY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Royal Bank of Canada (NYSE:RY)

Historical Stock Chart

From Apr 2023 to Apr 2024