TIDMIPO

IP Group PLC

19 June 2015

19 June 2015

IP Group plc - OSI plc closes funding of GBP320m partnership

IP Group plc (LSE: IPO) ("IP Group" or "the Group"), the

developer of intellectual property-based businesses, is pleased to

note that Oxford Sciences Innovation plc ("OSI") has completed the

second close of its fundraising, raising an additional GBP110m and

bringing the total amount raised to GBP320m. Investors in the

second close included Google Ventures and Charles Dunstone.

As announced on 14 May 2015, IP Group committed GBP40m of

funding in the initial round along with other investors including

Invesco Asset Management Limited, Lansdowne Partners (UK) LLP,

Oxford University Endowment Fund, the Wellcome Trust and Woodford

Investment Management LLP. Following completion of the financing,

IP Group will have an undiluted beneficial equity stake of 11.8% in

OSI.

Alan Aubrey, Chief Executive of IP Group and Non-executive

Director of OSI, said: "IP Group is proud to be a cornerstone

investor in OSI and we are delighted by the quality and range of

investors who have participated in both financing rounds. The

support that the partnership has received is excellent news for

everyone involved and we are excited by OSI's future

prospects."

The full text of the announcement issued by OSI is set out

below.

For more information, please contact:

IP Group plc www.ipgroupplc.com

Alan Aubrey, Chief Executive

Officer

Greg Smith, Chief Financial

Officer

Vicki Bradley, Communications +44 (0) 20 7444 0050

FTI Consulting

James Melville-Ross/Simon

Conway/

Victoria Foster Mitchell +44 (0)20 3727 1000

Notes for editors

About IP Group

IP Group is a leading UK intellectual property commercialisation

company, developing technology innovations primarily from its

research intensive partner universities. The Group offers more than

traditional venture capital, providing its companies with access to

business building expertise, networks, recruitment and business

support.

IP Group's portfolio comprises holdings in around 90 early-stage

to mature businesses across the Healthcare, Biotech, Cleantech and

Technology sectors. These businesses include Oxford Nanopore

Technologies, the DNA sequencing development company, Revolymer,

best known for its removable chewing gum, and Xeros, which has

received many accolades for its revolutionary clothes washing

techniques with a much reduced requirement for water.

For more information, please visit our website at

www.ipgroupplc.com.

OXFORD SCIENCES INNOVATION PLC

Demis Hassabis, Tom Hulme, and Dr. Krishna Yeshwant join

Advisory Board of Oxford Sciences Innovation as it closes the

funding of its landmark GBP320m partnership

- Investment from Google Ventures and Charles Dunstone help to

complete the funding of the GBP320m partnership first announced on

14th May, 2015

- Demis Hassabis (DeepMind), Tom Hulme and Dr. Krishna Yeshwant

(Google Ventures General Partners) and Charles Dunstone join the

Advisory Board of OSI as it aims to develop the University's

world-leading scientific research and work with its academics to

commercialise their ideas into market-leading companies.

19 June 2015: A month after the University of Oxford and Isis

Innovation launched a new partnership with Oxford Sciences

Innovation plc (OSI), the funding has been fully secured. Aiming to

become a market leader in scientific innovation and

entrepreneurship, the joint venture has also welcomed Demis

Hassabis of DeepMind, and Tom Hulme and Dr. Krishna Yeshwant of

Google Ventures to its Advisory Board.

Other investors in the GBP320m OSI partnership include Invesco

Asset Management Limited, IP Group plc, Lansdowne Partners (UK)

LLP, Oxford University Endowment Fund, the Wellcome Trust, Woodford

Investment Management LLP and Charles Dunstone.

OSI has been contractually established as the University's

preferred partner for the provision of capital for spinout

companies based on research from the Mathematical, Physical, Life

Sciences and Medical Sciences divisions. This will include

establishing new IP-driven businesses together with Isis Innovation

and providing investment capital, as well as advice in order to

create commercial success.

David Norwood, Chairman of OSI, said:

"We are building a very special and unique partnership at OSI.

We are now in a position to combine Oxford University's proud

history, with cornerstone investors and Board-level advice from

some of the best minds in the tech industry to turn world-leading

science into market-leading companies."

Demis Hassabis, Founder of DeepMind, said:

"OSI combines world-class research with world-class business

minds. It is going to be very exciting to see the great companies

that will undoubtedly come out of this partnership."

Tom Hulme, General Partner of Google Ventures, said:

'Google Ventures' investment in OSI represents our faith in

Oxford University's ability to develop the next generation of

scientific breakthroughs, and OSI's drive to turn those

breakthroughs into successful commercial enterprises.'

For more information, please contact:

Oxford Sciences Innovation plc

Ben Novick, Milltown Partners LLP

bnovick@milltownpartners.com

+44 7712 675 635

NOTES TO EDITORS

1. The formation of OSI was announced on 14th May 2015.

2. In order to fund the next generation of spinout companies

from the University, OSI announced it would raise an initial

GBP300m. Due to its popularity with investors the partnership has

managed to exceed its initial target and raised a total of

GBP320m.

3. Investors in the GBP320m partnership include Google Ventures,

Charles Dunstone, Invesco Asset Management Limited, IP Group plc,

Lansdowne Partners (UK) LLP, Oxford University Endowment Fund, the

Wellcome Trust and Woodford Investment Management LLP.

4. OSI will be chaired by David Norwood, Founder of IP Group. He

will be joined on the board by Deputy Chairman Alex Snow (Lansdowne

Partners LLP). OSI will be supported by an Advisory Board made up

of experts with backgrounds in science, technology, finance,

industry and academia. The Advisory Board will include Demis

Hassabis (Founder of DeepMind, acquired by Google in 2014), Dr.

Krishna Yeshwant and Tom Hulme of Google Ventures as well as

Charles Dunstone and Peter Davies (Senior Partner at Lansdowne

Partners UK LLP)

5. Oxford University staff have won a total of 32 Nobel prizes

across Chemistry, Physics and Medicine.

6. The University also has a long track-record of developing

global science and technology businesses through Isis Innovation.

Isis has established over 100 spinout companies based on technology

developed by University of Oxford researchers since 2000, including

eight in the last year. Spinouts valued in excess of GBP200m

include Oxford Nanopore Technologies Limited and NaturalMotion.

Others include AIM and Nasdaq listed companies such as Velocys and

Oxford Immunotec.

ENDS

This information is provided by RNS

The company news service from the London Stock Exchange

END

NRADKLBFEQFBBBF

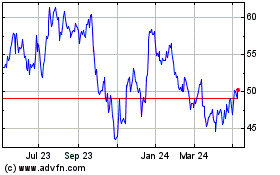

Ip (LSE:IPO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ip (LSE:IPO)

Historical Stock Chart

From Apr 2023 to Apr 2024