Gresham House PLC Approval of Investment Advisory Agreement (3461V)

August 06 2015 - 8:52AM

UK Regulatory

TIDMGHE

RNS Number : 3461V

Gresham House PLC

06 August 2015

6 August 2015

Gresham House plc (AIM: GHE)

Approval of Investment Advisory Agreement

The Board of Gresham House plc ("Gresham House") is pleased that

today the shareholders of SPARK Ventures plc (AIM: SPK "SPARK")

have approved the change in SPARK's Investing Policy to pursue a

new Strategic Public Equity ("SPE") investment strategy in

partnership with Gresham House, as set out in the Gresham House

announcement on 21 July 2015 and Notice of General Meeting

circulated to SPARK shareholders on 22 July 2015.

Gresham House will invest a total of GBP6.4 million in SPARK

following which Gresham House will have an interest in 706,806 of

SPARK's issued ordinary shares ("Shares") representing

approximately 18.39 per cent. of SPARK's Shares and approximately

19.17 per cent. of SPARK's total voting rights following completion

of the placing, open offer and asset swaps. The following key

members of the Gresham House management team, SPE investment team

and investment committee have acquired Shares pursuant to the

Fundraising:

New Ordinary Shares subscribed pursuant to the % of Total Voting Rights following Admission

Fundraising*

Tony Dalwood 11,111 0.30%

Graham Bird 19,444 0.53%

Bruce Carnegie Brown 11,111 0.30%

Michael Phillips 2,778 0.08%

Rupert Robinson 2,778 0.08%

Under the Investment Management Agreement, Gresham House Asset

Management Ltd ("GHAM"), the Company's specialist asset management

subsidiary, will receive initially as adviser and then as manager

(when regulatory approval is received), a fee of 0.125 per cent.

per month of the net asset value of the SPARK portfolio. The

initial portfolio value will be approximately GBP39.1 million. In

addition, GHAM will be entitled to a performance fee of 15 per

cent. of the increase in net asset value per share of SPARK over a

7 per cent. hurdle rate.

Anthony Dalwood, Chief Executive of Gresham House commented:

"We are pleased that the proposed change to the investing policy

has been approved by the SPARK shareholders. This mandate

represents an important step for Gresham House as we deliver on our

plans to develop as a specialist asset manager of differentiated

and illiquid alternative investment strategies. SPARK is the first

fund that our SPE investment team will manage and we will target

superior returns by focusing on inefficient areas of the market,

taking block stakes in smaller companies and constructively

engaging to identify and support significant value creation

catalysts."

Enquiries:

Montfort Communications

Gay Collins / Rory King 07798 626282 / 07917 086227

Gresham House plc

Anthony (Tony) Dalwood 020 3837 6270

Gresham House Asset Management

Graham Bird 020 3757 5613

Westhouse Securities Ltd

Robert Finlay / Richard Johnson 020 7601 6100

This information is provided by RNS

The company news service from the London Stock Exchange

END

AGRUGURWRUPAGPQ

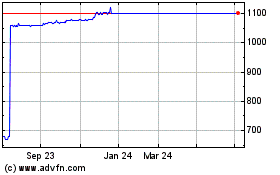

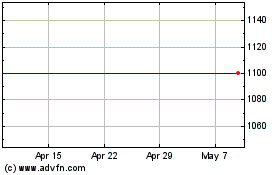

Gresham House (LSE:GHE)

Historical Stock Chart

From Aug 2024 to Sep 2024

Gresham House (LSE:GHE)

Historical Stock Chart

From Sep 2023 to Sep 2024