By Katy Burne and Telis Demos

A Federal Reserve-sponsored task force is preparing to unveil

proposals by financial institutions, payments providers, trade

groups and others to improve the decades-old U.S. systems for

moving money electronically.

The faster payments task force, which is set to publish a

summary report of the work on Friday, rated 16 proposals that met

or exceeded predetermined criteria for speed and security,

developed in consultation with the central bank, according to a

copy viewed Thursday by The Wall Street Journal.

The task force includes more than 300 representatives taken from

federal agencies, banks, consumer groups, technology firms and

merchants such as Wal-Mart Stores Inc. and Lyft Inc. Consulting

firm McKinsey & Company helped assess the proposals, which come

from industry groups such as The Clearing House, a payments

operator owned by U.S. banks that is working with International

Business Machines Corp. and Mastercard's VocaLink, and the

Independent Community Bankers of America as well as payments

software startups Dwolla Inc., nanoPay Corp. and Ripple.

The report caps a two-year effort to identify safer and speedier

ways to transfer money digitally between bank accounts. The new

approaches, many of which are designed to settle transfers in real

time, could allow companies to collect funds or pay employees

instantaneously and save money by bypassing intermediaries.

Already, debit cards using networks operated by Visa Inc. and

Mastercard Inc. offer instant transfer options. And a group of the

biggest banks recently expanded a network, Zelle, for instant

transfers between consumers. But many of the older payment systems

remain much slower.

"Our goal is to ensure that anyone, anywhere, is able to pay and

be paid quickly and securely," said Sean Rodriguez, the Fed's

faster payments strategy leader and chair of the task force. "In

real terms, that means people will not have to wait hours or days

to deliver and access their money."

While the current system is viewed as both reliable and

universal, this process aims to spur the U.S. to keep pace with

similar upgrades to domestic payments systems in such countries as

Australia and the U.K.

"Innovators have built new systems and services that ride on top

of the old rails but with mixed results, and over time our system

has grown more fragmented," said Fed governor Jerome Powell in a

March speech.

The Fed doesn't have the legal power to mandate changes to the

U.S. payment system. Its interest in the matter stems from its

regulation of big banks, as well as its operation of parts of the

existing system, such as Fedwire, a same-day funds transfer service

for banks and businesses, and check clearing.

The Fed has said the task force didn't set out to pick winners

and losers and that the central bank wasn't endorsing any one

provider.

"The next step will be, OK, you've these 16 pieces, now how do

we tie them together?" said Cary Whaley, first vice president at

Independent Community Bankers of America.

Industry and task force participants hope the new report will

serve as a sort of starting gun for the adoption of newer systems.

It could encourage a shift away from some used today by banks,

including one called the Automated Clearing House, or ACH. The ACH

network handles more than $40 trillion of direct deposits, bill

payments and other transfers each year, and traces its roots to the

1970s.

Janet Estep, chief executive of ACH administrator NACHA and a

member of the task force's steering committee, said ACH has some

"core competencies that are hard to duplicate" and added that it

introduced some same-day settlements last year.

"All electronic payments today are focused on the same goal:

taking cash and checks out of the payments ecosystem," she

added.

A side benefit of the task force's work could be the development

of systems better protected from cyberattacks, and with more

granular data, enabling businesses and bill payers to embed

invoices and other detailed information in electronic

transfers.

Faster transfers could also help companies pay so-called "gig"

workers instantly, and reduce the need for underbanked consumers,

those without bank accounts or credit, to seek expensive payday

loans while waiting for their paychecks to clear.

"Faster payments can help ensure increased control over cash

flow, better money management, and decreased reliance on short-term

credit," said Christina Tetreault, a staff attorney with Consumers

Union and a task force steering committee member.

It remains to be seen how any new system will evolve, and

whether any of the proposals would be widely adopted, or how costly

it could be to do so.

The 16 proposals were drawn from 19 that had been received as of

January.

Write to Katy Burne at katy.burne@wsj.com and Telis Demos at

telis.demos@wsj.com

(END) Dow Jones Newswires

July 20, 2017 18:47 ET (22:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

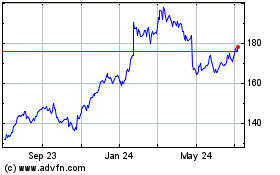

International Business M... (NYSE:IBM)

Historical Stock Chart

From Aug 2024 to Sep 2024

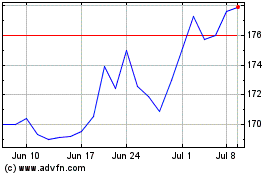

International Business M... (NYSE:IBM)

Historical Stock Chart

From Sep 2023 to Sep 2024