Enterprise Products Partners L.P. (“Enterprise”) (NYSE: EPD)

today announced its financial results for the three and six months

ended June 30, 2014.

Second Quarter 2014

Highlights

Three months ended Six

months ended June 30, June 30, 2014 2013 2014

2013 ($ in millions, except per unit amounts)

Gross operating margin (1) $ 1,263 $ 1,142 $ 2,593 $ 2,373 Net

income (2) (3) $ 647 $ 553 $ 1,453 $ 1,309 Fully diluted earnings

per unit (2) (3) $ 0.68 $ 0.60 $ 1.53 $ 1.43 Adjusted EBITDA (1) $

1,243 $ 1,104 $ 2,602 $ 2,354 Distributable cash flow (1) $ 954 $

925 $ 2,041 $ 1,822

(1) Gross operating margin, adjusted earnings

before interest, taxes, depreciation and amortization (“Adjusted

EBITDA”) and distributable cash flow are non-generally accepted

accounting principle (“non-GAAP”) financial measures that are

defined and reconciled later in this press release.

(2) Net income and fully diluted earnings per

unit for the second quarter of 2014 include net gains of $7

million, or $0.01 per unit, attributable to asset sales, whereas

net income and fully diluted earnings per unit for the second

quarter of 2013 include net losses of $6 million, or $0.01 per

unit, attributable to asset sales. For the six months ended June

30, 2014 and 2013, net income and fully diluted earnings per unit

include net gains of $96 million, or $0.10 per unit, and $58

million, or $0.06 per unit, respectively, attributable to asset

sales and insurance recoveries.

(3) Net income and fully diluted earnings per

unit include non-cash asset impairment charges for the second

quarters of 2014 and 2013 of $4 million, or less than $0.01 per

unit, and $27 million, or $0.03 per unit, respectively. Non-cash

asset impairment charges for the six months ended June 30, 2014 and

2013 were $13 million, or $0.01 per unit, and $38 million, or $0.04

per unit, respectively, with both amounts on a fully diluted

basis.

- Enterprise increased its cash

distribution with respect to the second quarter of 2014 to $0.72

per unit, or $2.88 per unit on an annualized basis, which

represents a 5.9 percent increase from the distribution paid with

respect to the second quarter of 2013. This is the 40th consecutive

quarterly increase and the 49th increase since the partnership’s

initial public offering in 1998. The distribution with respect to

the second quarter of 2014 will be paid on August 7, 2014 to

unitholders of record as of the close of business on July 31,

2014;

- Enterprise reported distributable cash

flow of $954 million for the second quarter of 2014, which provided

1.4 times coverage of the $0.72 per unit cash distribution that

will be paid to common unitholders. Enterprise retained

approximately $293 million of distributable cash flow for the

second quarter of 2014;

- Enterprise’s natural gas liquid

(“NGL”), crude oil, refined products and petrochemical pipeline

volumes for the second quarter of 2014 increased 7 percent to a

record 5.2 million barrels per day (“BPD”) compared to the second

quarter of 2013. Total natural gas pipeline volumes decreased 6

percent to 13.2 trillion British thermal units per day (“TBtud”)

for the second quarter of 2014 compared to the second quarter of

2013. NGL fractionation volumes for the second quarter of 2014

increased 25 percent to a record 845 thousand barrels per day

(“MBPD”). Fee-based natural gas processing volumes for the second

quarter of 2014 increased 8 percent to a record 4.9 billion cubic

feet per day (“Bcfd”), while equity NGL production for the second

quarter of 2014 increased 15 percent to 136 MBPD;

- Enterprise made capital investments of

approximately $697 million during the second quarter of 2014,

including $77 million of sustaining capital expenditures;

- Affiliates of privately-held Enterprise

Products Company (“EPCO”), which collectively own our general

partner and approximately 36 percent of our outstanding limited

partner interests, expect to purchase an additional $25 million of

common units from Enterprise in August 2014 through the

distribution reinvestment plan. This purchase would bring total

purchases by these affiliates in 2014 to $75 million. EPCO had

previously stated an interest in purchasing up to $100 million of

Enterprise common units in 2014; and

- On July 15, 2014, Enterprise announced

a two-for-one split of its common units. The split will be

accomplished by distributing one additional common unit for each

common unit outstanding. The additional common units will be

distributed on August 21, 2014 to holders of record as of the close

of business on August 14, 2014. All earnings per unit and other

unit-related information contained in this press release are on a

pre-split basis.

Review of Second Quarter 2014

Results

Net income for the second quarter of 2014 was $647 million

versus $553 million for the second quarter of 2013. On a fully

diluted basis, net income attributable to limited partners for the

second quarter of 2014 was $0.68 per unit compared to $0.60 per

unit for the second quarter of 2013. Net income for the second

quarter of 2013 was reduced by a non-cash charge of $27 million, or

$0.03 per unit on a fully diluted basis, associated with the

impairment of certain assets.

On July 10, 2014, Enterprise announced an increase in the

partnership’s quarterly cash distribution with respect to the

second quarter of 2014 to $0.72 per unit, representing a 5.9

percent increase over the $0.68 per unit that was paid with respect

to the second quarter of 2013. Enterprise generated distributable

cash flow of $954 million for the second quarter of 2014 compared

to $925 million for the second quarter of 2013. Distributable cash

flow for the second quarters of 2014 and 2013 included proceeds

from the sales of assets of $17 million and $69 million,

respectively.

Enterprise’s distributable cash flow for the second quarter of

2014 provided 1.4 times coverage of the cash distribution that will

be paid on August 7, 2014 to unitholders of record on July 31,

2014. The partnership retained approximately $293 million of

distributable cash flow for the second quarter of 2014, which is

available to reinvest in growth capital projects, reduce debt, and

decrease the need to issue additional equity. For the first six

months of 2014, Enterprise has retained approximately $730 million

of distributable cash flow.

“Enterprise reported another solid quarter driven by record

volumes transported on our liquid pipelines, fee-based natural gas

processing volumes and NGL fractionation volumes in a quarter that

is typically a seasonally weaker quarter,” said Michael A. Creel,

chief executive officer of Enterprise’s general partner. “This

volume growth and strong demand for NGLs, natural gas, crude oil

and petrochemicals led to an 11 percent increase in gross operating

margin and a 9 percent increase in distributable cash flow,

excluding proceeds from asset sales, in the second quarter of 2014

compared to the second quarter of last year.”

“We benefitted from cash flow and volume growth associated with

$5.7 billion of new assets that have begun operations since the

beginning of 2013. Volumes transported on our liquids pipelines

increased by 7 percent attributable to volume growth on our NGL and

crude oil pipelines serving production from the Eagle Ford,

Rockies, Permian, and Marcellus regions and the Gulf of Mexico. NGL

fractionation volumes increased 25 percent due to new facilities

that began service in the second half of 2013. Some of our projects

that were recently completed, such as the ATEX ethane pipeline and

Front Range NGL pipeline, have volume commitments that increase

over a multi-year period,” added Creel.

“During the second quarter of 2014, we completed construction on

three new infrastructure projects totaling almost $1 billion of

capital investment - the loop of the Seaway crude oil pipeline, our

refined products marine terminal in Beaumont, Texas and three

additional tanks at our ECHO crude oil storage facility. Our

backlog of projects still under construction is approximately $6

billion with expected completion dates extending through 2016. Our

large integrated system continues to create new business

opportunities. We are working hard to further our success in

turning these opportunities into capital projects that will provide

new streams of cash flow to support future distribution growth,”

stated Creel.

Review of Second Quarter 2014 Segment

Performance

NGL Pipelines & Services – Gross operating margin for

the NGL Pipelines & Services segment increased 25 percent to

$681 million for the second quarter of 2014 compared to $545

million for the same quarter of 2013.

Enterprise’s natural gas processing and related NGL marketing

business generated gross operating margin of $266 million for the

second quarter of 2014 compared to $264 million for the second

quarter of 2013. Gross operating margin from the partnership’s

natural gas processing plants increased by $26 million primarily

due to higher fee-based processing volumes and equity NGL

production. Enterprise’s natural gas processing plants reported

record fee-based processing volumes of 4.9 Bcfd in the second

quarter of 2014 compared to 4.6 Bcfd in the second quarter of 2013.

Enterprise’s equity NGL production was 136 MBPD for the second

quarter of 2014 compared to 118 MBPD for the second quarter of

2013. Gross operating margin from Enterprise’s NGL marketing

activities decreased $24 million primarily due to lower margins and

the effects of downtime associated with maintenance and activities

preparing for the 2015 expansion of the LPG export terminal on the

Houston Ship Channel. The LPG export terminal resumed operations on

July 7, 2014 after a 10-day outage.

Gross operating margin from the partnership’s NGL pipelines and

storage business increased $73 million, or 39 percent, to $261

million for the second quarter of 2014 from $188 million for the

second quarter of 2013. NGL pipeline volumes increased by 122 MBPD

in the second quarter of 2014 to 2.9 million BPD compared to the

second quarter of 2013. The partnership’s ATEX ethane pipeline,

which began commercial service in January 2014, generated gross

operating margin of $35 million for the second quarter of 2014.

ATEX transported approximately 44 MBPD of ethane during the second

quarter of 2014.

The Mid-America and Seminole NGL pipeline systems reported a $19

million increase in gross operating margin in the second quarter of

2014 compared to the same quarter of 2013 due to higher revenues

from deficiency fees and an increase in tariffs, which was

partially offset by higher operating expenses. Volumes on the

Mid-America and Seminole pipelines were 983 MBPD in the second

quarter of 2014 compared to 982 MBPD in the second quarter of last

year. The South Texas NGL pipeline systems reported an $11 million

increase in gross operating margin compared to the second quarter

of 2013 primarily due to a 78 MBPD increase in volume attributable

to production growth from the Eagle Ford shale.

Enterprise’s NGL fractionation business reported record gross

operating margin of $154 million for the second quarter of 2014, a

$61 million increase compared to $93 million reported for the

second quarter of last year. Gross operating margin for the

partnership’s fractionators at Mont Belvieu increased $63 million

to $126 million for the second quarter of 2014 compared to the

second quarter of 2013. This increase in gross operating margin was

primarily attributable to a 179 MBPD increase in volume as

Fractionators VII and VIII began commercial operations during the

second half of 2013. Fractionation volumes for the second quarter

of 2014 increased 25 percent to a record 845 MBPD compared to the

same quarter in 2013.

Onshore Natural Gas Pipelines & Services –

Enterprise’s Onshore Natural Gas Pipelines & Services segment

reported gross operating margin of $203 million for the second

quarter of 2014 compared to $198 million for the second quarter of

2013. Total onshore natural gas pipeline volumes were 12.6 TBtud in

the second quarter of 2014 compared to 13.3 TBtud in the second

quarter of 2013.

The Texas Intrastate system reported a $3 million increase in

gross operating margin for the second quarter of 2014 compared to

the second quarter of last year primarily due to higher fees. Our

natural gas marketing activities reported a $2 million increase in

gross operating margin for the second quarter of 2014 compared to

the second quarter of 2013 primarily due to higher sales margins.

Aggregate gross operating margin for the Haynesville, Jonah and

Piceance Basin gathering systems declined by $5 million and

aggregate volume on these systems declined by 0.5 TBtud in the

second quarter of 2014 compared to the second quarter of 2013 due

to the effects of reduced drilling activities and production

declines in the regions served by these systems.

Onshore Crude Oil Pipelines & Services – Gross

operating margin from the partnership’s Onshore Crude Oil Pipelines

& Services segment decreased by $13 million to $184 million for

the second quarter of 2014 from $197 million for the second quarter

of 2013. Total onshore crude oil pipeline volumes increased 13

percent to 1.3 million BPD for the second quarter of 2014 from 1.1

million BPD for the second quarter of 2013. Enterprise’s South

Texas and West Texas crude oil pipeline systems and Eagle Ford

joint venture pipeline reported an aggregate $34 million increase

in gross operating margin in the second quarter of 2014 compared to

the second quarter of 2013 on a 177 MBPD increase in volume.

Enterprise’s crude oil marketing business reported a $55 million

decrease in gross operating margin in the second quarter of 2014

compared to the second quarter of 2013 due to lower margins that

were primarily caused by the substantial decrease in regional price

spreads for crude oil. For example, the average indicative price

spread between the benchmark Louisiana Light Sweet and West Texas

Intermediate crude oil was $10.41 per barrel for the second quarter

of 2013 compared to $2.56 per barrel for the second quarter of

2014.

Petrochemical & Refined Products Services – Gross

operating margin for the Petrochemical & Refined Products

Services segment was $162 million for the second quarter of 2014

compared to $163 million for the second quarter of 2013.

The partnership’s propylene business reported gross operating

margin of $42 million for the second quarter of 2014 compared to

$26 million for the second quarter of 2013 primarily due to higher

sales margins. Propylene fractionation volumes were 71 MBPD for the

second quarters of both 2014 and 2013.

Gross operating margin for Enterprise’s octane enhancement and

high-purity isobutylene business was $46 million in the second

quarter of 2014 compared to $43 million for the same quarter in

2013. Total plant production volumes were 20 MBPD for the second

quarters of both 2014 and 2013.

Enterprise’s refined products pipelines and related services

business reported gross operating margin of $24 million for the

second quarter of 2014 compared to $49 million for the second

quarter of 2013. Gross operating margin for the second quarter of

2013 included a $24 million benefit from a rate case settlement.

Total pipeline volumes for this business were 616 MBPD for the

second quarter of 2014 compared to 555 MBPD for the second quarter

of 2013.

Enterprise’s butane isomerization business reported gross

operating margin of $32 million in the second quarter of 2014

compared to $27 million in the second quarter of 2013. Butane

isomerization volumes were 105 MBPD for the second quarter of 2014

compared to 97 MBPD for the second quarter of 2013.

Enterprise’s marine transportation and other services business

reported $18 million of gross operating margin for the second

quarter of 2014 compared to $17 million for the same quarter of

2013.

Offshore Pipelines & Services – Gross operating

margin for the Offshore Pipelines & Services segment was $34

million for the second quarter of 2014 compared to $40 million for

the same quarter of 2013.

Gross operating margin from Enterprise’s offshore crude oil

pipeline business was $22 million for the second quarter of 2014

compared to $23 million for the second quarter of 2013. Total

offshore crude oil pipeline volumes were 318 MBPD in the second

quarter of 2014 compared to 311 MBPD for the second quarter of

2013.

The Independence Hub platform and Independence Trail pipeline

reported aggregate gross operating margin of $8 million for the

second quarter of 2014 compared to $13 million for the second

quarter of 2013 attributable to lower volumes. Natural gas volumes

on the Independence Trail pipeline were 198 billion British thermal

units per day (“BBtud”) for the second quarter of 2014 compared to

296 BBtud in the second quarter of 2013. Total offshore natural gas

pipeline volumes (including those for Independence Trail) were 609

BBtud for the second quarter of 2014 compared to 720 BBtud in the

second quarter of 2013.

Capitalization

Total debt principal outstanding at June 30, 2014 was

approximately $18.4 billion, including $1.5 billion of junior

subordinated notes to which the nationally recognized debt rating

agencies ascribe partial equity content. At June 30, 2014,

Enterprise had consolidated liquidity of approximately $3.7

billion, which was comprised of $242 million of unrestricted cash

on hand and approximately $3.5 billion of available borrowing

capacity under our revolving credit facility.

Total capital spending in the second quarter of 2014 was $697

million, which includes $77 million of sustaining capital

expenditures.

Conference Call to Discuss Second

Quarter 2014 Earnings

Today, Enterprise will host a conference call to discuss second

quarter 2014 earnings. The call will be broadcast live over the

Internet beginning at 9:00 a.m. CT and may be accessed by visiting

the company’s website at www.enterpriseproducts.com.

Use of Non-GAAP Financial

Measures

This press release and accompanying schedules include the

non-GAAP financial measures of gross operating margin,

distributable cash flow and Adjusted EBITDA. The accompanying

schedules provide definitions of these non-GAAP financial measures

and reconciliations to their most directly comparable financial

measure calculated and presented in accordance with GAAP. Our

non-GAAP financial measures should not be considered as

alternatives to GAAP measures such as net income, operating income,

net cash flows provided by operating activities or any other

measure of financial performance calculated and presented in

accordance with GAAP. Our non-GAAP financial measures may not be

comparable to similarly-titled measures of other companies because

they may not calculate such measures in the same manner as we

do.

Company Information and Use of

Forward-Looking Statements

Enterprise Products Partners L.P. is one of the largest publicly

traded partnerships and a leading North American provider of

midstream energy services to producers and consumers of natural

gas, NGLs, crude oil, refined products and petrochemicals. Our

midstream energy operations include: natural gas gathering,

treating, processing, transportation and storage; NGL

transportation, fractionation, storage and import and export

terminals; crude oil gathering, transportation, storage and

terminals; offshore production platforms; petrochemical and refined

products transportation and services; and a marine transportation

business that operates primarily on the U.S. inland and

Intracoastal Waterway systems and in the Gulf of Mexico. The

partnership’s assets include approximately 51,000 miles of onshore

and offshore pipelines; 200 million barrels of storage capacity for

NGLs, crude oil, refined products and petrochemicals; and 14

billion cubic feet of natural gas storage capacity. Additional

information regarding Enterprise can be found on its website,

www.enterpriseproducts.com.

This press release includes forward-looking statements. Except

for the historical information contained herein, the matters

discussed in this press release are forward-looking statements that

involve certain risks and uncertainties, such as the partnership’s

expectations regarding future results, capital expenditures,

project completions, liquidity and financial market conditions.

These risks and uncertainties include, among other things,

insufficient cash from operations, adverse market conditions,

governmental regulations and other factors discussed in

Enterprise’s filings with the U.S. Securities and Exchange

Commission. If any of these risks or uncertainties materialize, or

should underlying assumptions prove incorrect, actual results or

outcomes may vary materially from those expected. The partnership

disclaims any intention or obligation to update publicly or reverse

such statements, whether as a result of new information, future

events or otherwise.

Enterprise Products Partners L.P.

Exhibit A Condensed Statements of Consolidated Operations

– UNAUDITED ($ in millions, except per unit amounts)

For the Three Months For the Six

Months Ended June 30, Ended June

30, 2014 2013

2014 2013

Revenues

$ 12,520.8 $ 11,149.3 $ 25,430.7

$ 22,532.4

Costs and

expenses:

Operating costs and expenses 11,639.1 10,367.2 23,519.6 20,787.6

General and administrative costs 47.7

45.5 100.9

95.0 Total costs and expenses

11,686.8 10,412.7

23,620.5

20,882.6

Equity in income of

unconsolidated affiliates

50.3 37.6

106.8 82.1

Operating

income

884.3 774.2 1,917.0 1,731.9

Other income

(expense):

Interest expense (228.9 ) (200.2 ) (449.8 ) (396.1 ) Other, net

1.1 (0.3 )

0.8 (0.4 ) Total

other expense (227.8 ) (200.5 )

(449.0 )

(396.5 )

Income before income

taxes

656.5 573.7 1,468.0 1,335.4 Provision for income taxes (10.0

) (20.4 )

(14.8 ) (26.8 )

Net

income

646.5 553.3 1,453.2 1,308.6

Net income

attributable to noncontrolling interests

(8.8 ) (0.8 )

(16.7 ) (2.6 )

Net income

attributable to limited partners

$ 637.7 $ 552.5

$ 1,436.5 $ 1,306.0

Per unit data (fully

diluted): (1)

Earnings per unit $ 0.68 $ 0.60

$ 1.53 $ 1.43

Average limited partner units outstanding (in millions)

940.2 918.5

939.1 914.8

Supplemental

financial data:

Net cash flows provided by operating activities $ 467.8

$ 531.0 $ 1,871.9

$ 1,530.9 Cash used in investing

activities $ 693.4 $ 955.4

$ 1,554.9 $

1,802.6 Cash provided by (used in) financing activities $

(520.8 ) $ (810.6 ) $

(131.9 ) $ 300.9 Depreciation,

amortization and accretion $ 331.1 $

307.8 $ 651.0

$ 599.8 Distributions received from unconsolidated

affiliates $ 85.4 $ 68.0

$ 157.1 $ 119.3

Total debt principal outstanding at end of period $ 18,382.7

$ 16,967.7 $

18,382.7 $ 16,967.7

Non-GAAP gross operating margin by segment: (2) NGL Pipelines &

Services $ 680.9 $ 544.9 $ 1,460.9 $ 1,137.4 Onshore Natural Gas

Pipelines & Services 203.0 197.7 423.4 388.5 Onshore Crude Oil

Pipelines & Services 184.0 197.2 343.7 433.6 Offshore Pipelines

& Services 33.6 39.7 72.9 80.2 Petrochemical & Refined

Products Services 161.7 162.7

292.1 333.6 Total gross operating margin $

1,263.2 $ 1,142.2

$ 2,593.0 $ 2,373.3

Non-GAAP distributable cash flow (3) $ 953.8

$ 924.7 $ 2,040.8

$ 1,821.7 Non-GAAP Adjusted

EBITDA (4) $ 1,242.9 $ 1,103.8

$ 2,601.6 $

2,353.9 Capital spending: Capital expenditures, net

(5) $ 477.1 $ 809.5 $ 1,172.5 $ 1,432.4 Investments in

unconsolidated affiliates 214.1 256.5 498.8 547.9 Other investing

activities 6.0 --

6.0

-- Total capital spending $ 697.2

$ 1,066.0 $ 1,677.3

$ 1,980.3

(1)

On July 15, 2014, the Partnership announced that its general

partner had approved a two-for-one unit split. The additional

common units will be distributed on August 21, 2014. All per unit

amounts and number of units outstanding presented on this Exhibit A

are on a pre-split basis. (2) See Exhibit D for reconciliation to

GAAP operating income. (3) See Exhibit E for reconciliation to net

cash flows provided by operating activities. (4) See Exhibit F for

reconciliation to net cash flows provided by operating activities.

(5) Capital expenditures for property, plant and equipment are

presented net of contributions in aid of construction cost.

Enterprise Products Partners

L.P.

Exhibit B Selected Operating Data – UNAUDITED

For the Three Months For the Six Months Ended June

30, Ended June 30, 2014

2013 2014

2013

Selected operating

data: (1)

NGL Pipelines & Services, net: NGL transportation volumes

(MBPD) 2,866 2,744 2,855 2,641 NGL fractionation volumes (MBPD) 845

678 819 693 Equity NGL production (MBPD) (2) 136 118 136 120

Fee-based natural gas processing (MMcf/d) (3) 4,941 4,581 4,829

4,553 Onshore Natural Gas Pipelines & Services, net: Natural

gas transportation volumes (BBtus/d) 12,617 13,307 12,569 13,189

Onshore Crude Oil Pipelines & Services, net: Crude oil

transportation volumes (MBPD) 1,297 1,145 1,279 1,073 Offshore

Pipelines & Services, net: Natural gas transportation volumes

(BBtus/d) 609 720 589 726 Crude oil transportation volumes (MBPD)

318 311 326 303 Platform natural gas processing (MMcf/d) 152 224

150 234 Platform crude oil processing (MBPD) 9 14 13 14

Petrochemical & Refined Products Services, net: Butane

isomerization and deisobutanizer volumes (MBPD) 188 165 171 150

Propylene fractionation volumes (MBPD) 71 71 72 70 Octane additive

and related plant production volumes (MBPD) 20 20 13 18

Transportation volumes, primarily refined products and

petrochemicals (MBPD) 756 688 730 684 Total, net: NGL, crude oil,

refined products and petrochemical transportation volumes (MBPD)

5,237 4,888 5,190 4,701 Natural gas transportation volumes

(BBtus/d) 13,226 14,027 13,158 13,915 Equivalent transportation

volumes (MBPD) (4) 8,718 8,579 8,653 8,363

(1) Operating rates are

reported on a net basis, which takes into account our ownership

interests in certain joint ventures, and include volumes for newly

constructed assets from the related in-service dates and for

recently purchased assets from the related acquisition dates. (2)

Represents the NGL volumes we earn and take title to in connection

with our processing activities. (3) Volumes reported correspond to

the revenue streams earned by our gas plants. (4) Represents total

NGL, crude oil, refined products and petrochemical transportation

volumes plus equivalent energy volumes where 3.8 MMBtus of natural

gas transportation volumes are equivalent to one barrel of NGLs

transported.

Enterprise Products Partners

L.P. Exhibit C Selected Commodity Price

Information

Polymer

Refinery Natural Normal

Natural Grade Grade WTI LLS

Gas, Ethane, Propane, Butane,

Isobutane, Gasoline, Propylene,

Propylene, Crude Oil, Crude Oil,

$/MMBtu $/gallon

$/gallon $/gallon

$/gallon $/gallon

$/pound $/pound

$/barrel $/barrel (1) (2) (2) (2) (2)

(2) (3) (3) (4) (4)

2013 by quarter: 1st Quarter $ 3.34 $

0.26 $ 0.86 $ 1.58 $ 1.65 $ 2.23 $ 0.75 $ 0.65 $ 94.37 $ 113.93 2nd

Quarter $ 4.10 $ 0.27 $ 0.91 $ 1.24 $ 1.27 $ 2.04 $ 0.63 $ 0.53 $

94.22 $ 104.63 3rd Quarter $ 3.58 $ 0.25 $ 1.03 $ 1.33 $ 1.35 $

2.15 $ 0.68 $ 0.58 $ 105.82 $ 109.89 4th Quarter $ 3.60

$ 0.26 $ 1.20

$ 1.43 $ 1.45 $

2.10 $ 0.68 $ 0.56

$ 97.46 $ 100.94

YTD

2013 Averages $ 3.65 $ 0.26

$ 1.00 $ 1.39 $

1.43 $ 2.13 $ 0.69

$ 0.58 $ 97.97

$ 107.34

2014 by quarter: 1st Quarter $ 4.95 $

0.34 $ 1.30 $ 1.39 $ 1.42 $ 2.12 $ 0.73 $ 0.61 $ 98.68 $ 104.43 2nd

Quarter $ 4.68 $ 0.29 $

1.06 $ 1.25 $ 1.30

$ 2.21 $ 0.70

$ 0.57 $ 102.99 $

105.55

YTD 2014 Averages $ 4.81

$ 0.31 $ 1.18 $ 1.32

$ 1.36 $ 2.17

$ 0.72 $ 0.59

$ 100.84 $ 104.99

(1) Natural

gas prices are based on Henry-Hub Inside FERC commercial index

prices as reported by Platts, which is a division of McGraw Hill

Financial, Inc. (2) NGL prices for ethane, propane, normal butane,

isobutane and natural gasoline are based on Mont Belvieu Non-TET

commercial index prices as reported by Oil Price Information

Service. (3) Polymer-grade propylene prices represent average

contract pricing for such product as reported by Chemical Market

Associates, Inc. (“CMAI”). Refinery grade propylene prices

represent weighted-average spot prices for such product as reported

by CMAI. (4) Crude oil prices are based on commercial index prices

for West Texas Intermediate (“WTI”) as measured on the New York

Mercantile Exchange (“NYMEX”) and for Louisiana Light Sweet (“LLS”)

as reported by Platts.

Period-to-period fluctuations in our consolidated revenues and

cost of sales amounts are explained in large part by changes in

energy commodity prices. Energy commodity prices fluctuate for a

variety of reasons, including supply and demand imbalances and

geopolitical tensions.

The weighted-average indicative market price for NGLs (based on

prices for such products at Mont Belvieu, Texas, which is the

primary industry hub for domestic NGL production) was $1.03 per

gallon during the second quarter of 2014 versus $0.95 per gallon

for the second quarter of 2013.

The market price of natural gas (as measured at the Henry Hub in

Louisiana) averaged $4.68 per MMBtu during the second quarter of

2014 versus $4.10 per MMBtu during the second quarter of 2013 – a

14 percent increase. The increase in prices is generally due to

higher natural gas demand for power generation.

The market price of WTI crude oil (as measured on the NYMEX)

averaged $102.99 per barrel during the second quarter of 2014

compared to $94.22 per barrel during the second quarter of 2013. As

a result of our recent crude oil pipeline infrastructure

improvements, we have greater access to U.S. Gulf Coast refiners.

Typically, these refining customers purchase crude oil based on LLS

prices, which averaged $105.55 per barrel during the second quarter

of 2014 compared to $104.63 per barrel during the second quarter of

2013.

A decrease in our consolidated marketing revenues due to lower

energy commodity sales prices may not result in a decrease in gross

operating margin or cash available for distribution, since our

consolidated cost of sales amounts would also be lower due to

comparable decreases in the purchase prices of the underlying

energy commodities. The same correlation would be true in the case

of higher energy commodity sales prices and purchase costs.

Enterprise Products Partners

L.P.

Exhibit D Gross Operating Margin – UNAUDITED

($ in millions)

For the Three Months For the Six

Months Ended June 30, Ended June

30, 2014 2013

2014 2013 Total gross operating margin

(non-GAAP) $ 1,263.2 $ 1,142.2 $ 2,593.0 $ 2,373.3 Adjustments

to reconcile non-GAAP gross operating margin to GAAP operating

income: Subtract depreciation, amortization and accretion expense

amounts not reflected in gross operating margin (312.4 ) (289.7 )

(613.8 ) (566.5 ) Subtract impairment charges not reflected in

gross operating margin (3.7 ) (27.1 ) (12.5 ) (38.1 ) Add gains or

subtract losses attributable to asset sales and insurance

recoveries not reflected in gross operating margin 6.8 (5.7 ) 96.4

58.2 Subtract non-refundable deferred revenues attributable to

shipper make-up rights on new pipeline projects included in gross

operating margin (21.9 ) -- (45.2 ) -- Subtract general and

administrative costs not reflected in gross operating margin

(47.7 ) (45.5 ) (100.9 )

(95.0 )

Operating income (GAAP) $ 884.3

$ 774.2 $ 1,917.0

$ 1,731.9 We evaluate segment performance based on

the non-GAAP financial measure of gross operating margin. Gross

operating margin (either in total or by individual segment) is an

important performance measure of the core profitability of our

operations. This measure forms the basis of our internal financial

reporting and is used by our executive management in deciding how

to allocate capital resources among business segments. We believe

that investors benefit from having access to the same financial

measures that our management uses in evaluating segment results.

The GAAP financial measure most directly comparable to total

segment gross operating margin is operating income. In

total, gross operating margin represents operating income exclusive

of (1) depreciation, amortization and accretion expenses, (2)

impairment charges, (3) gains and losses attributable to asset

sales and insurance recoveries and (4) general and administrative

costs. In addition, gross operating margin includes equity in

income of unconsolidated affiliates and non-refundable deferred

transportation revenues relating to the make-up rights of committed

shippers associated with certain pipelines. Gross operating margin

by segment is calculated by subtracting segment operating costs and

expenses (net of the adjustments noted above) from segment

revenues, with both segment totals before the elimination of

intercompany transactions. In accordance with GAAP, intercompany

accounts and transactions are eliminated in consolidation. Gross

operating margin is exclusive of other income and expense

transactions, income taxes, the cumulative effect of changes in

accounting principles and extraordinary charges. Gross operating

margin is presented on a 100 percent basis before any allocation of

earnings to noncontrolling interests.

Enterprise Products Partners L.P. Exhibit

E Distributable Cash Flow - UNAUDITED

($ in millions)

For the Three Months For the Six Months

Ended June 30, Ended June 30,

2014 2013

2014 2013 Net income

attributable to limited partners (GAAP) $ 637.7 $ 552.5 $

1,436.5 $ 1,306.0 Adjustments to GAAP net income attributable to

limited partners to derive non- GAAP distributable cash flow: Add

depreciation, amortization and accretion expenses 331.1 307.8 651.0

599.8 Add distributions received from unconsolidated affiliates

85.4 68.0 157.1 119.3 Subtract equity in income of unconsolidated

affiliates (50.3 ) (37.6 ) (106.8 ) (82.1 ) Sustaining capital

expenditures (76.9 ) (74.8 ) (155.2 ) (132.1 ) Add losses or

subtract gains attributable to asset sales and insurance recoveries

(6.8 ) 5.7 (96.4 ) (58.2 ) Add cash proceeds from asset sales and

insurance recoveries 16.9 68.7 113.2 199.2 Subtract losses from the

monetization of interest rate derivative instruments -- -- --

(168.8 ) Add deferred income tax expense or subtract benefit, as

applicable 0.4 21.3 0.6 14.8 Add impairment charges 3.7 27.1 12.5

38.1 Subtract other miscellaneous adjustments to derive non-GAAP

distributable cash flow 12.6

(14.0 ) 28.3

(14.3 )

Distributable cash flow

(non-GAAP) 953.8 924.7 2,040.8 1,821.7 Adjustments to non-GAAP

distributable cash flow to derive GAAP net cash flows provided by

operating activities: Add sustaining capital expenditures reflected

in distributable cash flow 76.9 74.8 155.2 132.1 Subtract cash

proceeds from asset sales and insurance recoveries reflected in

distributable cash flow (16.9 ) (68.7 ) (113.2 ) (199.2 ) Add

losses from the monetization of interest rate derivative

instruments -- -- -- 168.8 Add or subtract the net effect of

changes in operating accounts, as applicable (541.1 ) (401.2 )

(198.6 ) (409.2 ) Add miscellaneous non-cash and other amounts to

reconcile non-GAAP distributable cash flow with GAAP net cash flows

provided by operating activities (4.9 )

1.4 (12.3 )

16.7

Net cash flows provided by operating

activities (GAAP) $ 467.8 $ 531.0

$ 1,871.9 $

1,530.9

(1) Sustaining capital expenditures are capital

expenditures (as defined by GAAP) resulting from improvements to

and major renewals of existing assets. Such expenditures serve to

maintain existing operations but do not generate additional

revenues. Our management compares the distributable cash

flow we generate to the cash distributions we expect to pay our

partners. Using this metric, management computes our distribution

coverage ratio. Distributable cash flow is an important non-GAAP

financial measure for our limited partners since it serves as an

indicator of our success in providing a cash return on investment.

Specifically, this financial measure indicates to investors whether

or not we are generating cash flows at a level that can sustain or

support an increase in our quarterly cash distributions.

Distributable cash flow is also a quantitative standard used by the

investment community with respect to publicly traded partnerships

because the value of a partnership unit is, in part, measured by

its yield, which is based on the amount of cash distributions a

partnership can pay to a unitholder. The GAAP measure most directly

comparable to distributable cash flow is net cash flows provided by

operating activities.

Enterprise Products Partners

L.P.

Exhibit F Adjusted EBITDA - UNAUDITED

($ in millions)

For the

TwelveMonthsEndedJune 30,

For the Three Months Ended June

30,

For the Six Months Ended June

30,

2014 2013

2014 2013

2014 Net income (GAAP) $ 646.5 $

553.3 $ 1,453.2 $ 1,308.6 $ 2,751.7 Adjustments to GAAP net income

to derive non-GAAP Adjusted EBITDA: Subtract equity in income of

unconsolidated affiliates (50.3 ) (37.6 ) (106.8 ) (82.1 ) (192.0 )

Add distributions received from unconsolidated affiliates 85.4 68.0

157.1 119.3 289.4 Add interest expense, including related

amortization 228.9 200.2 449.8 396.1 856.2 Add provision for income

taxes 10.0 20.4 14.8 26.8 45.5 Add depreciation, amortization and

accretion in costs and expenses 322.4

299.5 633.5

585.2

1,233.7

Adjusted EBITDA (non-GAAP) 1,242.9

1,103.8 2,601.6 2,353.9 4,984.5 Adjustments to non-GAAP Adjusted

EBITDA to derive GAAP net cash flows provided by operating

activities: Subtract interest expense, including related

amortization, reflected in Adjusted EBITDA (228.9 ) (200.2 ) (449.8

) (396.1 ) (856.2 ) Subtract provision for income taxes reflected

in Adjusted EBITDA (10.0 ) (20.4 ) (14.8 ) (26.8 ) (45.5 ) Add

losses or subtract gains attributable to asset sales and insurance

recoveries (6.8 ) 5.7 (96.4 ) (58.2 ) (121.5 ) Add deferred income

tax expense or subtract benefit, as applicable 0.4 21.3 0.6 14.8

23.7 Add impairment charges 3.7 27.1 12.5 38.1 67.0 Add or subtract

the net effect of changes in operating accounts, as applicable

(541.1 ) (401.2 ) (198.6 ) (409.2 ) 113.0 Add miscellaneous

non-cash and other amounts to reconcile non-GAAP Adjusted EBITDA

with GAAP net cash flows provided by operating activities

7.6 (5.1 )

16.8 14.4

41.5

Net cash flows provided by

operating activities (GAAP) $ 467.8

$ 531.0 $ 1,871.9

$ 1,530.9 $ 4,206.5

Adjusted EBITDA is commonly used as a supplemental financial

measure by our management and external users of our financial

statements, such as investors, commercial banks, research analysts

and rating agencies, to assess the financial performance of our

assets without regard to financing methods, capital structures or

historical cost basis; the ability of our assets to generate cash

sufficient to pay interest and support our indebtedness; and the

viability of projects and the overall rates of return on

alternative investment opportunities. Since adjusted EBITDA

excludes some, but not all, items that affect net income or loss

and because these measures may vary among other companies, the

adjusted EBITDA data presented in this press release may not be

comparable to similarly titled measures of other companies. The

GAAP measure most directly comparable to adjusted EBITDA is net

cash flows provided by operating activities.

Enterprise Products Partners L.P.Randy Burkhalter, (713)

381-6812Vice President, Investor RelationsorRick Rainey, (713)

381-3635Vice President, Media Relations

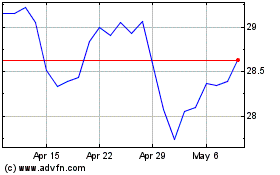

Enterprise Products Part... (NYSE:EPD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Enterprise Products Part... (NYSE:EPD)

Historical Stock Chart

From Apr 2023 to Apr 2024