ETF Scorecard – December 12th Edition

December 12 2014 - 9:00AM

ETFDB

Profit taking pressures finally swept over Wall Street this week

following a prolonged stretch of major equity indexes posting fresh

all-time highs. On the home front, some investors stepped to the

sidelines following a hint that the Fed might soon change its

forward guidance, with regards to the timing of the first rate

hike. On the global stage, crude oil’s seemingly never-ending slide

remained the headline story, dragging down energy-related assets

for another week [see also WisdomTree Launches Unique Emerging

Market ETF; Deutsche Bank Debuts Euro Hedged Fund].

To help investors keep up with markets, we present our ETF

Scorecard, which takes a step back and looks at how various asset

classes across the globe are performing. For most of the return

comparisons below, we reference trailing 1-week and trailing

1-month returns; this offers a good insight into the prevailing

sentiment in the markets by capturing the performances across

short-term and longer-term time intervals [for more ETF news and

analysis subscribe to our free newsletter].

Risk Appetite Review

Profit taking pressures suppressed the bulls’ risk appetite as

evidenced by High Beta stocks losing the most over the past week

from this group:

// // Major Index Review

Emerging markets turned in the worst performance for a

second week in a row, although all other major equity indexes also

posted declines for the week:

// // Domestic Sector Review

Financials and Utilities were the best performers over the last

week, while Energy came in at the bottom of the barrel as crude oil

prices continued their descent:

// // Foreign Equity Review

On the international front, Brazil and Russia posted the

steepest losses for a second week in a row, largely due to

continued weakness in the energy market:

google.load('visualization', '1', {packages: ['corechart']});

function drawVisualization() { // Create and populate the data

table. var data = google.visualization.arrayToDataTable([ ['Index',

'1-Week Return', '1-Month Return'], ['Brazil (EWZ)', -6.13, -7.36],

['Russia (RSX)', -12.43, -19.86], ['India (EPI)', -4.9, -3.45],

['China (FXI)', -3.32, 1.13], ['Japan (EWJ)', -2.04, -2.29],

['Australia (EWA)', -4.16, -8.96], ['Germany (EWG)', -0.81, 5.13],

['United Kingdom (EWU)', -3.64, -3.29], ]); var formatter = new

google.visualization.NumberFormat( {suffix: "%"});

formatter.format(data,1); formatter.format(data,2); var options = {

title:"", width:700, height:400, title: "Geographic Review:

Comparing Single Countries", colors: ["green", "orange"] }; //

Create and draw the visualization. new

google.visualization.ColumnChart(document.getElementById('visualization105624')).

draw(data, options); } google.setOnLoadCallback(drawVisualization);

Alternatives Review

Commodities

Crude oil was the biggest loser over the past week and the

commodity remains at the bottom of the barrel from a monthly

perspective as well:

// //

Currencies

On the currency front, the U.S. dollar took a breather from

its ascent while the Aussie dollar and emerging market currencies

turned in the worst performances for the week:

// //

*All data as of market close 12/11/2014.

Follow me on Twitter @Sbojinov.

[For more ETF analysis, make sure to sign up for our free ETF

newsletter]

Disclosure: No positions at time of writing.

Click here to read the original article on ETFdb.com.

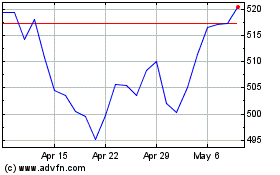

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

From Mar 2024 to Apr 2024

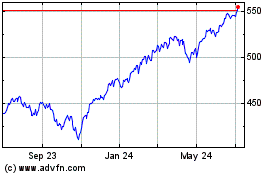

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

From Apr 2023 to Apr 2024