UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report: January 29, 2016

|

| | |

Exact Name of Registrant | Commission | I.R.S. Employer |

as Specified in Its Charter | File Number | Identification No. |

Hawaiian Electric Industries, Inc. | 1-8503 | 99-0208097 |

State of Hawaii

(State or other jurisdiction of incorporation)

1001 Bishop Street, Suite 2900, Honolulu, Hawaii 96813

(Address of principal executive offices and zip code)

Registrant’s telephone number, including area code:

(808) 543-5662

None

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

[ ] | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

[ ] | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

[ ] | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

[ ] | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 7.01 Regulation FD Disclosure.

On January 29, 2016, HEI issued a news release, “American Savings Bank Reports 2015 and Fourth Quarter Earnings.” This news release is furnished as HEI Exhibit 99.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

| |

HEI Exhibit 99 | News release, dated January 29, 2016, “American Savings Bank Reports 2015 and Fourth Quarter Earnings” |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

| | |

HAWAIIAN ELECTRIC INDUSTRIES, INC. | | |

(Registrant) | | |

| | |

James A. Ajello | | |

Executive Vice President and | | |

Chief Financial Officer | | |

(Principal Financial and Accounting Officer) | | |

| | |

Date: January 29, 2016 | | |

| | |

EXHIBIT INDEX

|

| |

Exhibit No. | Description |

HEI Exhibit 99 | News release, dated January 29, 2016, “American Savings Bank Reports 2015 and Fourth Quarter Earnings |

HEI Exhibit 99

January 29, 2016

|

| | |

Contact: | Clifford H. Chen | |

| Manager, Investor Relations & | Telephone: (808) 543-7300 |

| Strategic Planning | E-mail: ir@hei.com |

AMERICAN SAVINGS BANK REPORTS 2015 AND FOURTH QUARTER EARNINGS

2015 Net Income of $54.7 Million - Return on Assets of 0.95%

Fourth Quarter 2015 Net Income of $15.0 Million

Solid Profitability In Line with Expectations

Selected 2015 Highlights

| |

• | Achieved 2015 earnings and profitability targets consistent with guidance ranges |

| |

• | ROA of 0.95% vs. target of ~0.95% |

| |

• | NIM of 3.53% vs. target of ~3.45% to 3.55% |

| |

• | Loan growth of 4.1% led by commercial real estate, residential mortgages and home equity lending |

| |

• | Strong deposit growth of 8.7% including low-cost core deposit growth of 8.5% |

| |

• | Continued favorable trends in asset quality from 2015 |

| |

• | Net charge-off to average loans ratio of 0.04% |

| |

• | Nonperforming assets of 1.02% of total loans and other real estate owned |

| |

• | Strong capital levels: 8.8% leverage ratio; 13.3% total capital ratio |

| |

• | Named one of Hawaii Business “Best Places to Work” for the 6th consecutive year; American Banker “Best Banks to Work For” list for the 3rd consecutive year; Fortune Magazine as one of the 100 Best Workplaces for Women in America in 2015 and No. 3 on Fortune’s list of 50 Best Workplaces for Diversity in America |

| |

• | Contributed over 4,000 volunteer hours and over $1 million of charitable contributions to community organizations |

| |

• | Filed SEC Form 10 for spin-off of ASB Hawaii, Inc. the parent company of American Saving Bank, into an independent publicly traded company, mutually contingent upon the closing of the proposed combination of NextEra Energy, Inc. and Hawaiian Electric Industries, Inc. (HEI) |

Hawaiian Electric Industries, Inc. Ÿ American Savings Bank, F.S.B.

January 29, 2016

Page 2

HONOLULU - American Savings Bank, F.S.B. (American), a wholly-owned indirect subsidiary of Hawaiian Electric Industries, Inc. (NYSE - HE) today reported net income for the full year of 2015 of $54.7 million compared to $51.3 million in 2014. Net income for the fourth quarter of 2015 was $15.0 million, compared to $13.5 million in the third, or linked, quarter of 2015 and $12.1 million in the fourth quarter of 2014.

“We met our key financial and operational objectives in 2015 and continue to position the bank for good performance for our customers and HEI shareholders in 2016. Our investments in electronic banking platforms, data and risk management capabilities, and process improvement should help us deliver a continuously better experience for our customers, healthy growth, and a more efficient bank,” said Richard Wacker, president and chief executive officer of American.

Full Year Net Income:

Net income for 2015 of $54.7 million was $3.4 million higher than 2014, reflecting solid revenue and asset growth. The most significant drivers impacting the net income increase for 2015 were as follows on an after-tax basis:

| |

• | $5 million higher net interest income as contributions from loan and investment portfolio growth more than offset the lower yield on earning assets; and |

| |

• | $4 million higher noninterest income primarily due to higher mortgage banking income ($2 million) resulting from selling a larger portion of low rate mortgage loan originations and higher deposit-related fee initiatives ($2 million) |

These increases were partially offset by $6 million higher noninterest expense primarily due to higher pension and benefits expense.

______________

Note: Amounts indicated as “after-tax” in this earnings release are based upon adjusting items for the composite statutory tax rate of 40% for the bank.

Hawaiian Electric Industries, Inc. Ÿ American Savings Bank, F.S.B.

January 29, 2016

Page 3

Fourth Quarter Net Income:

Fourth quarter 2015 net income of $15.0 million was $1.5 million higher than the third, or linked quarter and $2.8 million higher than the fourth quarter of 2014.

Compared to the linked quarter of 2015, the $1.5 million increase in the fourth quarter of 2015 was primarily driven by the following on an after-tax basis:

| |

• | $1 million lower provision for loan losses primarily related to the recovery during the fourth quarter of 2015 of previously charged-off loans; and |

| |

• | $1 million higher net interest income due to strong loan and investment portfolio growth. |

These increases were partially offset by $1 million (after-tax) of lower noninterest income primarily due to the gain on sale of the American service center building vacated as part of the campus consolidation plan in the linked quarter.

Compared to the fourth quarter of 2014, the $2.8 million higher net income in the fourth quarter of 2015 was primarily driven by the following on an after-tax basis:

| |

• | $1 million higher net interest income due to strong loan and investment portfolio growth; |

| |

• | $1 million higher provision for loan losses in the fourth quarter of 2014 primarily due to the downgrade of one performing commercial real estate loan; and |

| |

• | $1 million higher noninterest income. |

Financial Highlights:

Net interest income (pretax) was $188.6 million in 2015, higher than the $180.5 million in 2014 primarily due to loan and investment portfolio growth in 2015. Net interest margin was 3.53% in 2015 compared to 3.62% in 2014, in line with the bank’s net interest margin target of 3.45% to 3.55% for 2015. The decline in net interest margin was primarily attributable to lower yields on interest-earning assets as loan portfolios continued to re-price down in this continued low interest rate environment. The fourth quarter 2015 net interest income (pretax) was $48.7 million, compared to $47.8 million in the linked quarter and $46.7 million in the prior year quarter. Net interest margin was 3.55% in the fourth quarter of 2015 compared to 3.53% in the linked quarter and 3.65% in the fourth quarter of 2014.

The provision for loan losses (pretax) was $6.3 million in 2015 compared to $6.1 million in 2014. The fourth quarter of 2015 provision for loan losses was $0.8 million compared to $3.0 million in the linked quarter and $2.6 million in the fourth quarter of 2014. The lower fourth quarter of 2015 provision was attributable to

Hawaiian Electric Industries, Inc. Ÿ American Savings Bank, F.S.B.

January 29, 2016

Page 4

the recovery of previously charged-off loans. The 2015 net charge-off ratio was 0.04% compared to 0.01% in 2014. The fourth quarter of 2015 net charge-off ratio was a net recovery of 0.08%, lower than the 0.10% in the linked quarter and lower than the prior year quarter ratio of 0.04%.

Noninterest income (pretax) for 2015 was $67.8 million, up from $61.2 million in 2014. The increase was primarily driven by $3.4 million higher mortgage banking income, higher deposit-related fee initiatives and the gain on sale of real estate which were partially offset by the gain on sale of securities in 2014. In the fourth quarter of 2015, noninterest income (pretax) was $16.8 million, compared to $18.5 million in the linked quarter and $15.3 million in the prior year quarter. The linked quarter was positively impacted by the $2 million gain on sale of real estate.

Noninterest expense (pretax) for 2015 was $166.3 million, compared to $156.3 million in 2014. The increase was primarily due to higher pension and benefits expense. In the fourth quarter of 2015, noninterest expense (pretax) was $42.0 million compared to $42.4 million in the linked quarter and $41.1 million in the fourth quarter of 2014.

American achieved loan growth of 4.1% in 2015, consistent with the bank’s target and growth strategies, operating in the competitive Hawaii market environment. Loan growth was primarily driven by commercial real estate, residential and home equity loans that helped to offset the impact of the decline in net interest margin.

Total deposits were $5.0 billion at December 31, 2015, an increase of $199 million or 4.1% from September 30, 2015, and $402 million or 8.7% from December 31, 2014. Low-cost core deposits increased $185 million or 4.2% from September 30, 2015, and $357 million or 8.5% from December 31, 2014. The average cost of funds was 0.22% for the full year 2015, down 1 basis point from the prior year. For the fourth quarter of 2015, the average cost of funds was 0.22%, unchanged from the linked quarter and prior year quarter.

Overall, American’s return on average equity for the full year remained solid at 9.9% in 2015 compared to 9.6% in 2014 and the return on average assets for the full year was 0.95% in 2015 consistent with 2014. For the fourth quarter of 2015, the return on average equity was 10.7%, up from 9.7% in the linked quarter and 8.9% in the fourth quarter last year. Return on average assets was 1.01% for the fourth quarter of 2015, compared to 0.92% from the linked quarter and 0.88% in the same quarter last year.

In 2015, American paid dividends of $30 million to HEI while maintaining healthy capital levels -- leverage ratio of 8.8% and total capital ratio of 13.3% at December 31, 2015.

Hawaiian Electric Industries, Inc. Ÿ American Savings Bank, F.S.B.

January 29, 2016

Page 5

HEI EARNINGS RELEASE, HEI WEBCAST AND CONFERENCE CALL TO DISCUSS EARNINGS AND 2016 EPS GUIDANCE

Concurrent with American’s regulatory filing 30 days after the end of the quarter, American announced its fourth quarter 2015 financial results today. Please note that these reported results relate only to American and are not necessarily indicative of HEI’s consolidated financial results for the fourth quarter and full year 2015.

HEI plans to announce its fourth quarter and 2015 consolidated financial results on Thursday, February 11, 2016 and will conduct a webcast and conference call to discuss its consolidated earnings, including American’s earnings, and 2016 EPS guidance on Thursday, February 11, 2016, at 12:00 noon Hawaii time (5:00 p.m. Eastern time).

Interested parties within the United States may listen to the conference by calling (888) 311-8190 and entering passcode: 15902422. International parties may listen to the conference by calling (330) 863-3378 and entering passcode: 15902422 or by accessing the webcast on HEI’s website at www.hei.com under the heading “Investor Relations.” HEI and Hawaiian Electric Company, Inc. (Hawaiian Electric) intend to continue to use HEI’s website, www.hei.com, as a means of disclosing additional information. Such disclosures will be included on HEI’s website in the Investor Relations section. Accordingly, investors should routinely monitor such portions of HEI’s website, in addition to following HEI’s, Hawaiian Electric’s and American’s press releases, HEI’s and Hawaiian Electric’s Securities and Exchange Commission (SEC) filings and HEI’s public conference calls and webcasts. The information on HEI’s website is not incorporated by reference in this document or in HEI’s and Hawaiian Electric’s SEC filings unless, and except to the extent, specifically incorporated by reference. Investors may also wish to refer to the Public Utilities Commission of the State of Hawaii (PUC) website at dms.puc.hawaii.gov/dms in order to review documents filed with and issued by the PUC. No information on the PUC website is incorporated by reference in this document or in HEI’s and Hawaiian Electric’s SEC filings.

An on-line replay of the February 11, 2016 webcast will be available on HEI’s website beginning about two hours after the event. Audio replays of the teleconference will also be available approximately two hours after the event through February 25, 2016, by dialing (855) 859-2056 or (404) 537-3406 and entering passcode: 15902422.

HEI supplies power to approximately 95% of Hawaii’s population through its electric utilities, Hawaiian Electric, Hawaii Electric Light Company, Inc. and Maui Electric Company, Limited and provides a wide array

Hawaiian Electric Industries, Inc. Ÿ American Savings Bank, F.S.B.

January 29, 2016

Page 6

of banking and other financial services to consumers and businesses through American, one of Hawaii’s largest financial institutions.

FORWARD-LOOKING STATEMENTS

This release may contain “forward-looking statements,” which include statements that are predictive in nature, depend upon or refer to future events or conditions, and usually include words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “predicts,” “estimates” or similar expressions. In addition, any statements concerning future financial performance, ongoing business strategies or prospects or possible future actions are also forward-looking statements. Forward-looking statements are based on current expectations and projections about future events and are subject to risks, uncertainties and the accuracy of assumptions concerning HEI and its subsidiaries, the performance of the industries in which they do business and economic and market factors, among other things. These forward-looking statements are not guarantees of future performance.

Forward-looking statements in this release should be read in conjunction with the “Forward-Looking Statements” and “Risk Factors” discussions (which are incorporated by reference herein) set forth in HEI’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2015 and HEI’s future periodic reports that discuss important factors that could cause HEI’s results to differ materially from those anticipated in such statements. These forward-looking statements speak only as of the date of the report, presentation or filing in which they are made. Except to the extent required by the federal securities laws, HEI, Hawaiian Electric, American and their subsidiaries undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

###

American Savings Bank, F.S.B.

STATEMENTS OF INCOME DATA

(Unaudited) |

| | | | | | | | | | | | | | | | | | | | |

| | Three months ended | | Years ended December 31, |

(in thousands) | | December 31, 2015 | | September 30, 2015 | | December 31, 2014 | | 2015 | | 2014 |

Interest and dividend income | | |

| | |

| | |

| | | | |

Interest and fees on loans | | $ | 47,136 |

| | $ | 46,413 |

| | $ | 46,276 |

| | $ | 184,782 |

| | $ | 179,341 |

|

Interest and dividends on investment securities | | 4,550 |

| | 4,213 |

| | 3,187 |

| | 15,120 |

| | 11,945 |

|

Total interest and dividend income | | 51,686 |

| | 50,626 |

| | 49,463 |

| | 199,902 |

| | 191,286 |

|

Interest expense | | | | |

| | | | | | |

Interest on deposit liabilities | | 1,467 |

| | 1,355 |

| | 1,303 |

| | 5,348 |

| | 5,077 |

|

Interest on other borrowings | | 1,510 |

| | 1,515 |

| | 1,468 |

| | 5,978 |

| | 5,731 |

|

Total interest expense | | 2,977 |

| | 2,870 |

| | 2,771 |

| | 11,326 |

| | 10,808 |

|

Net interest income | | 48,709 |

| | 47,756 |

| | 46,692 |

| | 188,576 |

| | 180,478 |

|

Provision for loan losses | | 839 |

| | 2,997 |

| | 2,560 |

| | 6,275 |

| | 6,126 |

|

Net interest income after provision for loan losses | | 47,870 |

| | 44,759 |

| | 44,132 |

| | 182,301 |

| | 174,352 |

|

Noninterest income | | | | |

| | | | | | |

Fees from other financial services | | 5,667 |

| | 5,639 |

| | 5,760 |

| | 22,211 |

| | 21,747 |

|

Fee income on deposit liabilities | | 5,746 |

| | 5,883 |

| | 5,074 |

| | 22,368 |

| | 19,249 |

|

Fee income on other financial products | | 2,006 |

| | 2,096 |

| | 1,806 |

| | 8,094 |

| | 8,131 |

|

Bank-owned life insurance | | 1,016 |

| | 1,021 |

| | 1,004 |

| | 4,078 |

| | 3,949 |

|

Mortgage banking income | | 1,003 |

| | 1,437 |

| | 1,164 |

| | 6,330 |

| | 2,913 |

|

Gains on sale of investment securities | | — |

| | — |

| | — |

| | — |

| | 2,847 |

|

Other income, net | | 1,387 |

| | 2,389 |

| | 455 |

| | 4,750 |

| | 2,375 |

|

Total noninterest income | | 16,825 |

| | 18,465 |

| | 15,263 |

| | 67,831 |

| | 61,211 |

|

Noninterest expense | | | | |

| | | | | | |

Compensation and employee benefits | | 23,705 |

| | 22,728 |

| | 19,835 |

| | 90,518 |

| | 79,885 |

|

Occupancy | | 4,115 |

| | 4,128 |

| | 4,238 |

| | 16,365 |

| | 17,197 |

|

Data processing | | 3,002 |

| | 3,032 |

| | 2,975 |

| | 12,103 |

| | 11,690 |

|

Services | | 2,474 |

| | 2,556 |

| | 2,561 |

| | 10,204 |

| | 10,269 |

|

Equipment | | 1,578 |

| | 1,608 |

| | 1,638 |

| | 6,577 |

| | 6,564 |

|

Office supplies, printing and postage | | 1,452 |

| | 1,511 |

| | 1,602 |

| | 5,749 |

| | 6,089 |

|

Marketing | | 844 |

| | 934 |

| | 1,309 |

| | 3,463 |

| | 3,999 |

|

FDIC insurance | | 881 |

| | 809 |

| | 820 |

| | 3,274 |

| | 3,261 |

|

Other expense | | 3,991 |

| | 5,116 |

| | 6,116 |

| | 18,067 |

| | 17,314 |

|

Total noninterest expense | | 42,042 |

| | 42,422 |

| | 41,094 |

| | 166,320 |

| | 156,268 |

|

Income before income taxes | | 22,653 |

| | 20,802 |

| | 18,301 |

| | 83,812 |

| | 79,295 |

|

Income taxes | | 7,700 |

| | 7,351 |

| | 6,188 |

| | 29,082 |

| | 27,994 |

|

Net income | | $ | 14,953 |

| | $ | 13,451 |

| | $ | 12,113 |

| | $ | 54,730 |

| | $ | 51,301 |

|

Comprehensive income | | $ | 9,477 |

| | $ | 17,678 |

| | $ | 5,419 |

| | $ | 54,017 |

| | $ | 46,940 |

|

OTHER BANK INFORMATION (annualized %, except as of period end) | | | | | | | | |

Return on average assets | | 1.01 |

| | 0.92 |

| | 0.88 |

| | 0.95 |

| | 0.95 |

|

Return on average equity | | 10.66 |

| | 9.73 |

| | 8.93 |

| | 9.93 |

| | 9.60 |

|

Return on average tangible common equity | | 12.48 |

| | 11.43 |

| | 10.52 |

| | 11.68 |

| | 11.35 |

|

Net interest margin | | 3.55 |

| | 3.53 |

| | 3.65 |

| | 3.53 |

| | 3.62 |

|

Net charge-offs to average loans outstanding | | (0.08 | ) | | 0.10 |

| | 0.04 |

| | 0.04 |

| | 0.01 |

|

As of period end | | | | | | | | | | |

Nonperforming assets to loans outstanding and real estate owned * | | 1.02 |

| | 1.00 |

| | 0.85 |

| | | | |

Allowance for loan losses to loans outstanding | | 1.08 |

| | 1.06 |

| | 1.03 |

| | | | |

Tangible common equity to tangible assets | | 8.05 |

| | 8.23 |

| | 8.23 |

| | | | |

Tier-1 leverage ratio * | | 8.8 |

| | 8.8 |

| | 8.9 |

| | | | |

Total capital ratio * | | 13.3 |

| | 13.4 |

| | 12.3 |

| | | | |

Dividend paid to HEI (via ASB Hawaii, Inc.) ($ in millions) | | $ | 7.5 |

| | $ | 7.5 |

| | $ | 8.8 |

| | $ | 30.0 |

| | $ | 36.0 |

|

* Regulatory basis. Capital ratios as of December 31, 2015 and September 30, 2015 calculated under Basel III rules, which became effective January 1, 2015.

Prior period financial statements reflect the retrospective application of ASU No. 2014-01, “Investments-Equity Method and Joint Ventures (Topic 323): Accounting for Investments in Qualified Affordable Housing Projects,” which was adopted as of January 1, 2015 and did not have a material impact on ASB’s financial condition or results of operations.

This information should be read in conjunction with the consolidated financial statements and the notes thereto in HEI’s Annual Report on SEC Form 10-K for the year ended December 31, 2015 (when filed), ASB Hawaii, Inc.'s Form 10 for the year ended December 31, 2015 (when filed) and HEI's Quarterly Reports on SEC Form 10-Q /A for the quarters ended March 31, 2015 and June 30, 2015 and HEI's Quarterly Report on SEC Form 10-Q for the quarter ended September 30, 2015, as updated by SEC Forms 8-K.

American Savings Bank, F.S.B.

BALANCE SHEETS DATA

(Unaudited)

|

| | | | | | | | | | | | |

December 31 | 2015 | | 2014 | |

(in thousands) | | |

| | |

|

Assets | | |

| | |

|

Cash and due from banks | | $ | 127,201 |

| | $ | 107,233 |

|

Interest-bearing deposits | | 93,680 |

| | 54,230 |

|

Available-for-sale investment securities, at fair value | | 820,648 |

| | 550,394 |

|

Stock in Federal Home Loan Bank, at cost | | 10,678 |

| | 69,302 |

|

Loans receivable held for investment | | 4,615,819 |

| | 4,434,651 |

|

Allowance for loan losses | | (50,038 | ) | | (45,618 | ) |

Net loans | | 4,565,781 |

| | 4,389,033 |

|

Loans held for sale, at lower of cost or fair value | | 4,631 |

| | 8,424 |

|

Other | | 309,946 |

| | 305,416 |

|

Goodwill | | 82,190 |

| | 82,190 |

|

Total assets | | $ | 6,014,755 |

| | $ | 5,566,222 |

|

Liabilities and shareholder’s equity | | | | |

Deposit liabilities–noninterest-bearing | | $ | 1,520,374 |

| | $ | 1,342,794 |

|

Deposit liabilities–interest-bearing | | 3,504,880 |

| | 3,280,621 |

|

Other borrowings | | 328,582 |

| | 290,656 |

|

Other | | 101,029 |

| | 118,363 |

|

Total liabilities | | 5,454,865 |

| | 5,032,434 |

|

Common stock | | 1 |

| | 1 |

|

Additional paid in capital | | 340,496 |

| | 338,411 |

|

Retained earnings | | 236,664 |

| | 211,934 |

|

Accumulated other comprehensive loss, net of tax benefits | | | | |

Net unrealized gains (losses) on securities | $ | (1,872 | ) | |

| $ | 462 |

| |

Retirement benefit plans | (15,399 | ) | (17,271 | ) | (17,020 | ) | (16,558 | ) |

Total shareholder’s equity | | 559,890 |

| | 533,788 |

|

Total liabilities and shareholder’s equity | | $ | 6,014,755 |

| | $ | 5,566,222 |

|

Prior period financial statements reflect the retrospective application of ASU No. 2014-01, “Investments-Equity Method and Joint Ventures (Topic 323): Accounting for Investments in Qualified Affordable Housing Projects,” which was adopted as of January 1, 2015 and did not have a material impact on ASB’s financial condition or results of operations.

This information should be read in conjunction with the consolidated financial statements and the notes thereto in HEI’s Annual Report on SEC Form 10-K for the year ended December 31, 2015 (when filed), ASB Hawaii, Inc.'s Form 10 for the year ended December 31, 2015 (when filed) and HEI's Quarterly Reports on SEC Form 10-Q /A for the quarters ended March 31, 2015 and June 30, 2015 and HEI's Quarterly Report on SEC Form 10-Q for the quarter ended September 30, 2015, as updated by SEC Forms 8-K.

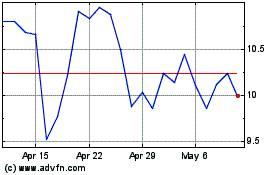

Hawaiian Electric Indust... (NYSE:HE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Hawaiian Electric Indust... (NYSE:HE)

Historical Stock Chart

From Apr 2023 to Apr 2024