U.S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): December 16, 2015

ADVANCED EMISSIONS SOLUTIONS, INC.

(Name of registrant as specified in its charter)

|

| | | | |

Delaware | | 000-54992 | | 27-5472457 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification Number) |

|

| | |

9135 South Ridgeline Boulevard, Suite 200, Highlands Ranch, CO | | 80129 |

(Address of principal executive offices) | | (Zip Code) |

Registrant's telephone number, including area code: (720) 598-3500

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| | |

o | | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| | |

o | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| | |

o | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| | |

o | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

|

| | |

Item 1.01 | | Entry into a Material Definitive Agreement. |

On December 16, 2015, Advanced Emissions Solutions, Inc. (the “Company”), entered into the First Amendment to Rights Agreement (the “Amendment”) between the Company and Computershare Trust Company, N.A. (the “Rights Agent”) that amends the Rights Agreement dated February 1, 2015 (the “Rights Agreement”) between the Company and the Rights Agent.

The Amendment amends the definition of an “Acquiring Person” under the Rights Agreement to increase the beneficial ownership threshold of the Company's common stock in such definition from 10% to 20% and to make conforming changes in the “Summary of Rights” included in Exhibit C of the Rights Agreement. No other changes were made to the Rights Agreement. A copy of the Rights Agreement was previously filed as Exhibit 4.1 to the Company’s Current Report on Form 8-K filed on February 2, 2015.

The foregoing description of the Amendment is qualified in its entirety by reference to the full text of the Amendment, attached hereto as Exhibit 4.2 and incorporated herein by reference.

|

| | |

Item 3.03 | | Material Modification to Rights of Security Holders. |

See the description set out under “Item 1.01 - Entry into a Material Definitive Agreement,” which is incorporated by reference into this Item 3.03.

|

| | |

Item 9.01 | | Financial Statements and Exhibits. |

(d) Exhibits

|

| | |

Exhibit No. | | Description |

4.2 | | First Amendment to Rights Agreement, dated as of December 16, 2015 by and between the Company and Computershare Trust Company, N.A., as rights agent. |

99.1 | | Press release dated December 16, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: December 17, 2015

|

| |

| Advanced Emissions Solutions, Inc. |

| Registrant |

|

| |

| /s/ L. Heath Sampson |

| L. Heath Sampson |

| President and Chief Executive Officer |

EXHIBIT INDEX

|

| | |

Exhibit No. | | Description |

4.2 | | First Amendment to Rights Agreement, dated as of December 16, 2015 by and between the Company and Computershare Trust Company, N.A., as rights agent. |

99.1 | | Press release dated December 16, 2015. |

FIRST AMENDMENT TO

RIGHTS AGREEMENT

This FIRST AMENDMENT TO RIGHTS AGREEMENT (this “Amendment”) entered into as of December 16, 2015, by and between Advanced Emissions Solutions, Inc., a Delaware corporation (the “Company”) and Computershare Trust Company, N.A. a federally chartered trust company (“Rights Agent”). All capitalized terms used herein and not otherwise defined shall have the meaning ascribed to them in that certain Rights Agreement dated as of February 1, 2015 by and between the Company and the Rights Agent (the “Rights Agreement”).

RECITALS

WHEREAS, the Company and the Rights Agent are parties to the Rights Agreement;

WHEREAS, the Board of Directors of the Company has authorized an amendment of the definition of “Acquiring Person” in the Rights Agreement to increase the beneficial ownership threshold in such definition from 10% to 20%;

WHEREAS, pursuant to Section 27 of the Rights Agreement, the Company and the Rights Agent desire to amend the Rights Agreement as set forth in this Amendment.

AGREEMENT

NOW, THEREFORE, in consideration of the promises and the mutual agreements herein set forth, the parties hereby agree as follows:

1.Amendment of Section 1(a). The definition of “Acquiring Person” set forth in Section 1(a) of the Rights Agreement is hereby amended and restated to read in its entirety as follows:

(a) “Acquiring Person” shall mean any Person who or which, together with all Affiliates and Associates of such Person, shall be the Beneficial Owner of 20% or more of the Common Stock then outstanding, but shall not include an Exempt Person. Notwithstanding the foregoing:

(i) any Person who or which, together with all Affiliates and Associates of such Person, becomes the Beneficial Owner of 20% or more of the Common Stock then outstanding as a result of a reduction in the number of shares of Common Stock outstanding due to the repurchase of Common Stock by the Company shall not be deemed an “Acquiring Person” unless and until such Person, together with all Affiliates and Associates of such Person, acquires Beneficial Ownership of any additional shares of Common Stock (other than as a result of a stock dividend, stock split, or similar transaction effected by the Company in which all registered holders of Common Stock are treated substantially equally) while the Beneficial Owner of 20% or more of the Common Stock then outstanding;

(ii) if the Board determines in good faith that a Person who would otherwise be an “Acquiring Person” has become such inadvertently (including, without limitation, because (A) such Person was unaware that it beneficially owned a percentage of Common Stock that would otherwise cause such Person to be an “Acquiring Person” or (B) such Person was aware of the extent of its Beneficial Ownership of Common Stock but had no actual knowledge of the consequences of such Beneficial Ownership under this Agreement and had no intention of changing or influencing control of the Company), and such Person divests as promptly as practicable (as determined by the Board in its sole discretion) a sufficient number of shares of Common Stock (without exercising or retaining any power, including, without limitation, voting power, with respect to such shares) (or, in the case solely of shares of Common Stock beneficially owned, directly or indirectly, by such Person pursuant to Section 1(f)(v) hereof, such Person terminates the subject Derivatives Contract(s) or disposes of the subject derivative security or securities, or establishes to the satisfaction of the Board that such shares of Common Stock are not held with any intention of changing or influencing control of the Company) so that such Person is no longer the Beneficial Owner of 20% or more of the Common Stock then outstanding, then such Person shall not be deemed to be or ever to have been an “Acquiring Person” for any purposes of this Agreement as a result of such inadvertent acquisition;

(iii) if a bona fide swaps dealer who would otherwise be an “Acquiring Person” has become so as a result of its actions in the ordinary course of its business that the Board determines, in its sole discretion, were taken without the intent or effect of evading or assisting any other Person to evade the purposes and intent of this Agreement, or otherwise seeking to control or influence the management or policies of the Company, then, and unless and until the Board shall otherwise determine, such person shall not be deemed to be an “Acquiring Person” for any purposes of this Agreement; and

(iv) if a Person would otherwise be deemed an “Acquiring Person” upon the execution of this Agreement, such Person (herein referred to as a “Grandfathered Stockholder”) shall not be deemed an “Acquiring Person” for purposes of this Agreement unless and until, subject to Section 1(a)(i) and Section 1(a)(ii) above, such Grandfathered Stockholder acquires Beneficial Ownership of additional shares of Common Stock representing 1.0% of the shares of Common Stock then outstanding (other than as a result of a stock dividend, stock split, or similar transaction effected by the Company in which all registered holders of Common Stock are treated substantially equally) after execution of this Agreement and while the Beneficial Owner of 20% or more of the Common Stock then outstanding, in which case such Person shall no longer be deemed a Grandfathered Stockholder and shall be deemed an “Acquiring Person”.

For all purposes of this Agreement, any calculation of the number of shares of Common Stock outstanding at any particular time, including for purposes of determining the particular percentage of such outstanding Common Stock of which any Person is the Beneficial Owner, shall include the number of shares of Common Stock not outstanding at the time of such calculation that such Person is otherwise deemed to beneficially own for purposes of this Agreement. The number of shares of Common Stock not outstanding that such Person is otherwise deemed to beneficially own for purposes of this Agreement shall be deemed to be outstanding for the purpose of computing the percentage of the outstanding number of shares of Common Stock beneficially owned by such Person but shall not be deemed to be outstanding for the purpose of computing the percentage of outstanding Common Stock beneficially owned by any other Person.

2.Amendment of Exhibit C (Summary of Rights to Purchase Preferred Stock). Exhibit C to the Rights Agreement is hereby amended such that references in Section 2 thereof (Distribution Date; Beneficial Ownership) to “10%” are changed to “20%.”

3.Agreement as Amended. The term “Agreement” as used in the Rights Agreement shall be deemed to refer to the Rights Agreement as amended hereby. Except as set forth herein, the Rights Agreement shall remain in full force and effect and otherwise shall be unaffected hereby, and each of the Company and the Rights Agent shall continue to be subject to its terms and conditions.

4.Severability. If any term, provision, covenant, or restriction of this Amendment is held by a court of competent jurisdiction or other authority to be invalid, void, or unenforceable, the remainder of the terms, provisions, covenants, and restrictions of this Amendment shall remain in full force and effect and shall in no way be affected, impaired, or invalidated; provided, however, that if such excluded terms provisions, covenants or restrictions shall affect the rights, immunities, liabilities, duties, responsibilities or obligations of the Rights Agent, the Rights Agent shall be entitled to resign immediately.

5.Governing Law. This Amendment shall be deemed to be a contract made under the laws of the State of Delaware and for all purposes shall be governed by and construed in accordance with the laws of such State applicable to contracts made and to be performed entirely within such State

6.Counterparts. This Amendment may be executed in any number of counterparts and each of such counterparts shall for all purposes be deemed to be an original, and all such counterparts shall together constitute but one and the same instrument. A facsimile or .pdf signature delivered electronically shall constitute an original signature for all purposes.

7.Descriptive Headings. Descriptive headings of the several Sections of this Amendment are inserted for convenience only and shall not control or affect the meaning or construction of any of the provisions hereof.

[Signature Pages Follow]

IN WITNESS WHEREOF, each of the parties hereto has caused this Amendment to be executed as of the date first above written.

ADVANCED EMISSIONS SOLUTIONS, INC.

By: /s/ L. Heath Sampson

Name: L. Heath Sampson

Title: President and Chief Executive Officer

COMPUTERSHARE TRUST COMPANY, N.A.

Name: Patrick Hayes

Title: VP & Manager

FOR IMMEDIATE RELEASE

ADVANCED EMISSIONS SOLUTIONS AMENDS LIMITED DURATION STOCKHOLDER RIGHTS PLAN

Threshold increased to 20%

Company expects to become current with its filings in early 1Q 2016

HIGHLANDS RANCH, Colorado, December 16, 2015 - Advanced Emissions Solutions, Inc. (OTC:ADES) (the “Company” or “ADES”) today announced that its Board of Directors has voted to increase the threshold of its stockholder rights plan (the “Rights Plan”) that was implemented in February 2015. Under the amended Rights Plan, the purchase rights distributed to stockholders in February 2015 will now become exercisable only if a person or group becomes an “Acquiring Person” by acquiring beneficial ownership of 20% or more of the Company’s common stock (up from 10%). The Rights Plan will expire on February 1, 2016, unless redeemed or terminated by the Board of Directors before that date.

The Company expects to be current with all of its SEC filings by early Q1 2016 and to file its 2015 Form 10-K on-time in March 2016. Upon filing its Form 10-Qs for 2015, the Company intends to apply for relisting on the NASDAQ Stock Market.

About Advanced Emissions Solutions, Inc.

Advanced Emissions Solutions, Inc. serves as the holding entity for a family of companies that provide emissions solutions to customers in the power generation and other industries. |

| |

| ADA-ES, Inc. (“ADA”) supplies Activated Carbon Injection (“ACI”) systems for mercury control, Dry Sorbent Injection (“DSI”) systems for acid gases, and technology services and other offerings in support of our customers’ emissions compliance strategies. ADA’s M-ProveTM technology, which reduces emissions of mercury and other metals from PRB coal, is applied directly to coal at power plants, or offered through a licensing agreement with Arch Coal for application at their mines. In addition, we are developing technologies to advance cleaner energy, including CO2 emissions control technologies through projects funded by the U.S. Department of Energy (“DOE”) and industry participants. |

| Clean Coal Solutions, LLC (“CCS”) is a 42.5% owned joint venture by ADA that provides ADA’s patented Refined Coal (“RC”) CyClean™ technology to enhance combustion of and reduce emissions of NOx and mercury from coals in cyclone boilers and ADA’s patent pending M-45™ and M-45-PC™ technologies for Circulating Fluidized boilers and Pulverized Coal boilers respectively. |

| Advanced Clean Energy Solutions, LLC (“ACES”) is a wholly owned subsidiary of ADES that is focused on supporting and improving the Company’s existing products and identifying, developing and commercializing new solutions to advance cleaner energy and to help our customers meet existing and future regulatory and business challenges. Building off the success of M-45™ and M-45-PC™ Technologies for Refined Coal, ACES is currently working to develop and commercialize new technologies to reduce a range of emissions associated with power generation and oil & gas production. ACES has assembled a strong team and follows a rigorous process focused on development and maximizing the return on investment. |

| BCSI, LLC is a custom designer and fabricator of engineered emissions control technologies, bulk material handling equipment, bulk storage systems, water/waste water treatment equipment, and custom components. BCSI supplies Dry Sorbent Injection (“DSI”) systems for acid gas control using its technologically advanced cool, dry conditioned conveying air systems. BCSI’s technical solutions serve a wide range of industrial clients including; coal fired utilities, water treatment, wastewater, cement kilns, food processing and industrial boilers. BCSI employs engineers and trade professionals at a 190,000+sq. ft. fabrication and office facility located in McKeesport, PA. |

This press release contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, which provides a “safe harbor” for such statements in certain circumstances. The forward-looking statements include statements or expectations regarding timing and ability to regain SEC reporting compliance and relisting on the NASDAQ Stock Market. These statements are based on current expectations, estimates, projections, beliefs and assumptions of the Company’s management. Such statements involve significant risks and uncertainties. Actual events or results could differ materially from those discussed in the forward-looking statements as a result of various factors, including but not limited to the restatement and re-audit efforts taking longer than expected and other factors discussed in greater detail in the Company’s filings with the SEC. You are cautioned not to place undue reliance on such statements and to consult the Company’s SEC filings for additional risks and uncertainties that may apply to the Company’s business and the ownership of its securities. The Company’s forward-looking statements are presented as of the date made, and the Company disclaims any duty to update such statements unless required by law to do so.

Graham Mattison

Vice President, Strategic Initiatives and Investor Relations

(720) 889-6206

graham.mattison@adaes.com

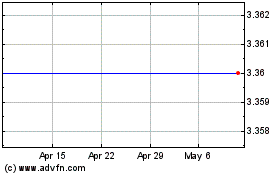

Advanced Emissions Solut... (NASDAQ:ADES)

Historical Stock Chart

From Mar 2024 to Apr 2024

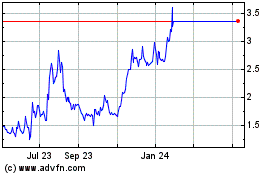

Advanced Emissions Solut... (NASDAQ:ADES)

Historical Stock Chart

From Apr 2023 to Apr 2024