UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

______________________________________________________________________________________________________

FORM 8-K

________________________________________________________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (date of earliest event reported): August 10, 2015

_____________________________________________________________________________________________________

THE AES CORPORATION

(Exact name of registrant as specified in its charter)

_________________________________________________________________________________________________________________

|

| | | | |

| | | | |

DELAWARE | | 001-12291 | | 54-11263725 |

(State of Incorporation) | | (Commission File No.) | | (IRS Employer Identification No.) |

4300 Wilson Boulevard, Suite 1100

Arlington, Virginia 22203

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code:

(703) 522-1315

NOT APPLICABLE

(Former Name or Former Address, if changed since last report)

_________________________________________________________________________________________________________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

_________________________________________________________________________________________________________________

Item 2.02 Results of Operations and Financial Condition.

On August 10, 2015, The AES Corporation (“AES” or the “Company”) issued a press release announcing its financial results for the quarter ended June 30, 2015. A copy of the press release is being furnished as Exhibit 99.1 attached hereto and is incorporated by reference herein. Such information is furnished pursuant to Item 2.02 and shall not be deemed “filed” for any purpose, including for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section. The information in this Current Report on Form 8-K shall not be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act regardless of any general incorporation language in such filing.

Item 7.01 Regulation FD Disclosure.

On August 10, 2015, AES issued a press release announcing its financial results for the quarter ended June 30, 2015. A copy of the press release is being furnished as Exhibit 99.1 attached hereto and is incorporated by reference herein. Such information is furnished pursuant to Item 7.01 and shall not be deemed “filed” for any purpose, including for the purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that Section. The information in this Current Report on Form 8-K shall not be deemed incorporated by reference into any filing under the Securities Act or the Exchange Act regardless of any general incorporation language in such filing.

Safe Harbor Disclosure

This news release contains forward-looking statements within the meaning of the Securities Act and of the Exchange Act. Such forward-looking statements include, but are not limited to, those related to future earnings, growth and financial and operating performance. Forward-looking statements are not intended to be a guarantee of future results, but instead constitute AES’ current expectations based on reasonable assumptions. Forecasted financial information is based on certain material assumptions. These assumptions include, but are not limited to, our accurate projections of future interest rates, commodity price and foreign currency pricing, continued normal levels of operating performance and electricity volume at our distribution companies and operational performance at our generation businesses consistent with historical levels, as well as achievements of planned productivity improvements and incremental growth investments at normalized investment levels and rates of return consistent with prior experience.

Actual results could differ materially from those projected in our forward-looking statements due to risks, uncertainties and other factors. Important factors that could affect actual results are discussed in AES’ filings with the Securities and Exchange Commission (the “SEC”), including, but not limited to, the risks discussed under Item 1A “Risk Factors” and Item 7: Management’s Discussion & Analysis in AES’ 2014 Annual Report on Form 10-K and in subsequent reports filed with the SEC. Readers are encouraged to read AES’ filings to learn more about the risk factors associated with AES’ business. AES undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Any Stockholder who desires a copy of the Company’s 2014 Annual Report on Form 10-K dated on or about February 25, 2015 with the SEC may obtain a copy (excluding Exhibits) without charge by addressing a request to the Office of the Corporate Secretary, The AES Corporation, 4300 Wilson Boulevard, Arlington, Virginia 22203. Exhibits also may be requested, but a charge equal to the reproduction cost thereof will be made. A copy of the Form 10-K may also be obtained by visiting the Company’s website at www.aes.com.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

Exhibit No. Description

99.1 Press Release issued by The AES Corporation, dated August 10, 2015

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf of the undersigned hereunto duly authorized.

|

| | | |

| | | |

| | | THE AES CORPORATION |

| | | |

Date: | August 10, 2015 | By: | /s/ Thomas M. O’Flynn |

| | Name: | Thomas M. O’Flynn |

| | Title: | Executive Vice President and Chief Financial Officer |

EXHIBIT INDEX

Exhibit No. Description

99.1 Press Release issued by The AES Corporation, dated August 10, 2015

Press Release

Investor Contact: Ahmed Pasha 703-682-6451

Media Contact: Amy Ackerman 703-682-6399

AES Reports Second Quarter 2015 Adjusted Earnings Per Share of $0.25 and Proportional Free Cash Flow of $62 Million; Reaffirms 2015 Guidance Ranges for All Metrics

Highlights

| |

• | Reaffirming 2015 Adjusted EPS guidance range of $1.25-$1.35 and 2015 Proportional Free Cash Flow guidance range of $1,000-$1,350 million |

| |

◦ | In the second half of the year, the Company's financial performance is expected to benefit from lower planned maintenance, improved hydrology and higher collections |

| |

• | 5,839 MW currently under construction and on track to come on-line through 2018 |

| |

◦ | Commissioned the 1,240 MW Mong Duong 2 power plant in Vietnam |

| |

◦ | Broke ground on three new energy storage projects totaling 40 MW in the United States, the Netherlands and the United Kingdom |

| |

• | Year-to-date, invested $335 million in repurchasing 26 million shares |

| |

• | Invested $345 million to prepay and refinance Parent debt |

| |

• | Forming a new 50/50 joint venture with Grupo BAL to co-invest in growth projects in Mexico |

ARLINGTON, Va., August 10, 2015 – The AES Corporation (NYSE: AES) today reported Adjusted Earnings Per Share (Adjusted EPS, a non-GAAP financial measure) of $0.25 for the second quarter of 2015, a decrease of $0.03 from second quarter 2014, mainly due to the timing of planned maintenance at certain businesses, a stronger US Dollar, lower demand and contracting strategy in Brazil, as well as the $0.02 net impact from the reversal of liabilities in Brazil and Europe. These negative impacts were largely offset by improved hydrology in Panama and Colombia, the Company's capital allocations and a lower adjusted effective tax rate of 30% in 2015 versus 40% in 2014.

Second quarter 2015 Diluted Earnings Per Share from Continuing Operations was $0.10, a decrease of $0.10 from second quarter 2014, largely driven by increased debt extinguishment expense of $0.11 primarily related to costs incurred to retire and refinance expensive near-term debt maturities.

Second quarter 2015 Proportional Free Cash Flow (a non-GAAP financial measure) was $62 million, an increase of $15 million from second quarter 2014, primarily driven by lower Parent interest and improved working capital and hydrological conditions at the Company's Mexico, Central America and the Caribbean Strategic Business Unit (MCAC SBU). This was partially offset by a higher tax payment at Chivor in Colombia and unfavorable hydrological conditions at the Company's generation business, Tiete, in Brazil.

"Despite significant macroeconomic challenges, we are on track to achieve our financial and strategic objectives. Earlier this year, we brought on-line our Mong Duong plant in Vietnam six months early. Our remaining 6 GW of projects under construction are on schedule and will drive our earnings and cash flow growth through 2018," said Andrés Gluski, AES President and Chief Executive Officer. "I am very pleased to announce our joint venture with Grupo BAL, one of the largest and most respected business groups in Mexico,

to co-invest in new power and infrastructure projects. We have had a very successful business in Mexico for more than 15 years and now with Grupo BAL, we are poised to take advantage of the opening of the energy market."

"Our year-to-date results, and the reaffirmation of our full year guidance, demonstrate the benefits of our proactive actions to mitigate the impact from currency devaluation and macro factors that we have experienced in the last several months," said Tom O'Flynn, AES Executive Vice President and Chief Financial Officer. "Our portfolio continues to generate strong and growing cash flow. This year, with share repurchases to date and planned dividend payments, we expect to return $700 million to our shareholders."

Table 1: Key Financial Results

|

| | | | | | | | | | | | | | | | |

| Second Quarter | | Year-to-date June 30, | Full Year 2015 Guidance |

$ in Millions, Except Per Share Amounts | 2015 | | 2014 | | 2015 | | 2014 |

Adjusted EPS1 | $ | 0.25 |

| | $ | 0.28 |

| | $ | 0.50 |

| | $ | 0.53 |

| $1.25-$1.35 |

Diluted EPS from Continuing Operations | $ | 0.10 |

| | $ | 0.20 |

| | $ | 0.30 |

| | $ | 0.13 |

| N/A |

Proportional Free Cash Flow1,2 | $ | 62 |

| | $ | 47 |

| | $ | 327 |

| | $ | 176 |

| $1,000-$1,350 |

Consolidated Net Cash Provided by Operating Activities | $ | 153 |

| | $ | 232 |

| | $ | 590 |

| | $ | 453 |

| $1,900-$2,700 |

| |

1 | A non-GAAP financial measure. See “Non-GAAP Financial Measures” for definitions and reconciliations to the most comparable GAAP financial measures. |

| |

2 | Defined as Proportional Net Cash Provided by Operating Activities, less Maintenance Capex, which includes non-recoverable environmental capex. Beginning in Q1 2015, the definition was revised to also exclude cash flows related to service concession assets. |

Discussion of Operating Drivers of Adjusted Pre-Tax Contribution (Adjusted PTC, a non-GAAP financial measure) and Adjusted EPS

The Company manages its portfolio in six market-oriented Strategic Business Units (SBUs): US (United States), Andes (Chile, Colombia and Argentina), Brazil, MCAC (Mexico, Central America and Caribbean), Europe, and Asia.

Table 2: Adjusted PTC1 by SBU and Adjusted EPS1

|

| | | | | | | | | | | | | | | | | | | | | | | |

$ in Millions, Except Per Share Amounts | Second Quarter | | Year-to-date June 30, |

2015 | | 2014 | | Variance | | 2015 | | 2014 | | Variance |

US | $ | 56 |

| | $ | 80 |

| | $ | (24 | ) | | $ | 162 |

| | $ | 155 |

| | $ | 7 |

|

Andes | 81 |

| | 104 |

| | (23 | ) | | $ | 172 |

| | $ | 157 |

| | $ | 15 |

|

Brazil | 41 |

| | 115 |

| | (74 | ) | | $ | 62 |

| | $ | 184 |

| | $ | (122 | ) |

MCAC | 106 |

| | 95 |

| | 11 |

| | $ | 156 |

| | $ | 160 |

| | $ | (4 | ) |

Europe | 41 |

| | 73 |

| | (32 | ) | | $ | 126 |

| | $ | 188 |

| | $ | (62 | ) |

Asia | 30 |

| | 23 |

| | 7 |

| | $ | 42 |

| | $ | 31 |

| | $ | 11 |

|

Total SBUs | $ | 355 |

| | $ | 490 |

| | $ | (135 | ) | | $ | 720 |

| | $ | 875 |

| | $ | (155 | ) |

Corp/Other | (104 | ) | | (150 | ) | | 46 |

| | $ | (217 | ) | | $ | (292 | ) | | $ | 75 |

|

Total AES Adjusted PTC1,2 | $ | 251 |

| | $ | 340 |

| | $ | (89 | ) | | $ | 503 |

| | $ | 583 |

| | $ | (80 | ) |

Adjusted Effective Tax Rate | 30 | % | | 40 | % | | | | 31 | % | | 36 | % | | |

Diluted Share Count | 695 |

| | 728 |

| | | | 701 |

| | 728 |

| | |

Adjusted EPS1 | $ | 0.25 |

| | $ | 0.28 |

| | $ | (0.03 | ) | | $ | 0.50 |

| | $ | 0.53 |

| | $ | (0.03 | ) |

1 A non-GAAP financial measure. See “Non-GAAP Financial Measures” for definitions and reconciliations to the most comparable GAAP financial measures.

2 Includes $5 million and $9 million of after-tax adjusted equity in earnings for second quarter 2015 and 2014, respectively. Includes $18 million and $31 million of after-tax adjusted equity in earnings for year-to-date June 30, 2015 and 2014, respectively.

For the three months ended June 30, 2015, Adjusted EPS decreased $0.03 to $0.25, as described above. Second quarter 2015 Adjusted PTC decreased $89 million to $251 million. Key operating drivers of Adjusted PTC included:

| |

• | US: A decrease of $24 million, primarily driven by planned maintenance in Hawaii, lower wholesale margins at IPL and lower generation at the Company's wind businesses in 2015, partially offset by lower fixed costs and higher capacity prices at DPL. |

| |

• | Andes: A decrease of $23 million, primarily due to the timing of planned maintenance in Argentina and Chile in 2015, as well as a weaker Colombian Peso, partially offset by higher generation at Chivor in Colombia as a result of improved inflows. |

| |

• | Brazil: A decrease of $74 million, primarily driven by a weaker Brazilian Real, the reversal of a $47 million contingency at Sul in 2014, as well as lower spot sales and a higher proportion of contracted sales associated with unfavorable hydrological conditions at Tiete in 2015. This performance was partially offset by the favorable reversal of a contingent liability in 2015 and a favorable tariff adjustment at Eletropaulo of $26 million. |

| |

• | MCAC: An increase of $11 million, primarily driven by improved hydrological conditions, which resulted in higher generation and lower energy purchases, as well as the commencement of operations of the 72 MW fuel oil-fired Estrella de Mar power barge in Panama. These positive results were offset by lower availability in Mexico and the Dominican Republic. |

| |

• | Europe: A decrease of $32 million, driven by lower spot prices, lower dispatch and the timing of planned maintenance and related costs at Kilroot in the United Kingdom and the favorable reversal of a liability in Kazakhstan in 2014. |

| |

• | Asia: An increase of $7 million, due to the early commencement of operations at Mong Duong in Vietnam, partially offset by the sale of a minority interest in Masinloc in the Philippines in the second half of 2014. |

| |

• | Corp/Other: An improvement of $46 million, primarily driven by lower Parent interest expense as a result of the reduction in recourse debt of $770 million, as well as realized foreign currency gains associated with the Company's corporate hedging program. |

For the six months ended June 30, 2015, Adjusted EPS decreased $0.03, to $0.50, largely driven by lower demand and contracting strategy in Brazil, a stronger US Dollar, as well as the $0.02 net impact from the reversal of liabilities in Brazil and Europe. These negative impacts were largely offset by a lower adjusted effective tax rate of 31% in 2015 versus 36% in 2014, the contributions from new businesses that came on-line in the first half of 2015 and the Company's capital allocations. Year-to-date 2015 Adjusted EPS of $0.50 represents 38% of the mid-point of full year guidance of $1.25-$1.35 per share. In the first half of 2014, the Company earned 40% of full year 2014 Adjusted EPS of $1.30.

Year-to-date 2015 Adjusted PTC decreased $80 million to $503 million. Key operating drivers of Adjusted PTC included:

| |

• | US: An increase of $7 million, primarily driven by better availability at DPL as a result of temporary forced outages and a lack of available gas at a couple of its generation plants in 2014 that did not recur, as well as lower fixed costs in 2015. These positive results were offset by lower generation as a result of lower wind resources at the Company's wind businesses in 2015. |

| |

• | Andes: An increase of $15 million, primarily due to higher spot sales in Chile, higher generation at Chivor in Colombia and higher interest on receivables in Argentina, partially offset by a weaker Colombian Peso and higher maintenance costs in Argentina. |

| |

• | Brazil: A decrease of $122 million, primarily due to the reversal of a contingency at Sul in 2014, lower spot sales at Tiete and the devaluation of the Brazilian Real, which accounted for 20% of the decline. These negative drivers were partially offset by the favorable reversal of a contingent liability in 2015 and a favorable tariff adjustment at Eletropaulo. |

| |

• | MCAC: A decrease of $4 million, primarily driven by lower margins and availability in the Dominican Republic, as well as lower availability in Mexico. This negative performance was partially offset by improved hydrological conditions and the commencement of operations of the power barge in Panama. |

| |

• | Europe: A decrease of $62 million, driven by lower spot prices, the timing of planned maintenance and related costs at Kilroot in the United Kingdom, lower contributions as a result of the sales of Ebute in Nigeria and the Company's wind businesses in the United Kingdom, unfavorable foreign currency exchange rates and the favorable reversal of a liability at the Company's generation business in Kazakhstan in 2014. |

| |

• | Asia: An increase of $11 million, primarily due to the early commencement of operations at Mong Duong in Vietnam. |

| |

• | Corp/Other: An improvement of $75 million, primarily driven by lower Parent interest expense, as well as realized foreign currency gains associated with the Company's on-going hedging activities. |

Table 3: Proportional Free Cash Flow1

|

| | | | | | | | | | | | | | | | | | | | | | |

$ in Millions | Second Quarter | Year-to-Date June 30, |

2015 | 2014 | Variance | 2015 | | 2014 | | Variance |

US | $ | 104 |

| | $ | 105 |

| | $ | (1 | ) | $ | 259 |

| | $ | 186 |

| | $ | 73 |

|

Andes | (20 | ) | | 17 |

| | (37 | ) | (3 | ) | | 40 |

| | (43 | ) |

Brazil | (20 | ) | | (2 | ) | | (18 | ) | (67 | ) | | (64 | ) | | (3 | ) |

MCAC | 18 |

| | 6 |

| | 12 |

| 132 |

| | 80 |

| | 52 |

|

Europe | 35 |

| | 32 |

| | 3 |

| 174 |

| | 150 |

| | 24 |

|

Asia | 5 |

| | 7 |

| | (2 | ) | 9 |

| | 48 |

| | (39 | ) |

Corp | (60 | ) | | (118 | ) | | 58 |

| (177 | ) | | (264 | ) | | 87 |

|

Total | $ | 62 |

| | $ | 47 |

| | $ | 15 |

| $ | 327 |

| | $ | 176 |

| | $ | 151 |

|

1 A non-GAAP financial measure. See “Non-GAAP Financial Measures” for definitions and reconciliations to the most comparable GAAP financial measures.

Second quarter 2015 Proportional Free Cash Flow increased $15 million to $62 million, as described above. Key drivers of this improvement included:

| |

• | US: A decrease of $1 million, primarily driven by lower operating performance and higher working capital requirements at IPL and a few of the Company's generation facilities, offset by higher collections and lower interest paid at DPL. |

| |

• | Andes: A decrease of $37 million, mainly driven by a higher tax payment at Chivor in Colombia. |

| |

• | Brazil: A decrease of $18 million, primarily driven by lower spot sales and a higher proportion of contracted sales associated with unfavorable hydrological conditions at Tiete in 2015, partially offset by higher collections as a result of a higher tariff at Eletropaulo. |

| |

• | MCAC: An increase of $12 million, due to lower energy purchases as a result of improved hydrological conditions in Panama and lower purchased energy costs in El Salvador. |

| |

• | Europe: An increase of $3 million, primarily driven by improved working capital at Maritza in Bulgaria, offset by the timing of planned maintenance at Kilroot in the United Kingdom and the sale of Ebute in Nigeria in 2014. |

| |

• | Asia: A decrease of $2 million, due to lower contributions as a result of the sale of a minority interest in Masinloc in the Philippines in the second half of 2014. |

| |

• | Corp/Other: An increase of $58 million, primarily driven by lower Parent interest expense as a result of the reduction in recourse debt, as well as realized foreign currency gains associated with the Company's on-going hedging activities. |

Second quarter 2015 Consolidated Net Cash Provided by Operating Activities decreased $79 million to $153 million, primarily driven by unfavorable hydrological conditions at Tiete in Brazil and higher tax payments at Chivor in Colombia, offset by improved hydrological conditions in Panama, a favorable tariff adjustment at Eletropaulo in Brazil and favorability at Corporate as a result of lower Parent interest expense.

For the six months ended June 30, 3015, Proportional Free Cash Flow increased $151 million to $327 million, primarily due to higher contributions from the Company's US and MCAC SBUs, including higher collections at DP&L and improved hydrological conditions in Panama. Year-to-date 2015 Proportional Free Cash Flow of $327 million represents 28% of the mid-point of full year guidance of $1,000-$1,350 million. In the first half of 2014, the Company generated 20% of full year Proportional Free Cash Flow of $891 million. Key drivers of the improvement in 2015 included:

| |

• | US: An increase of $73 million, driven by higher collections and lower interest paid at DPL. These positive contributions were offset by the impact from lower generation as a result of lower wind resources at the Company's wind businesses, higher working capital requirements at Shady Point in Oklahoma, as well as planned maintenance, lower collections and higher maintenance capital expenditures at IPL. |

| |

• | Andes: A decrease of $43 million, mainly driven by a higher tax payment at Chivor in Colombia. |

| |

• | Brazil: A decrease of $3 million, primarily driven by lower spot sales and a higher proportion of contracted sales associated with unfavorable hydrological conditions at Tiete in 2015, largely offset by higher collections as a result of a higher tariff at Eletropaulo. |

| |

• | MCAC: An increase of $52 million, primarily driven by lower energy and fuel costs in El Salvador and Puerto Rico, as well as lower energy purchases as a result of improved hydrological conditions in Panama. These positive contributions were offset by lower collections, higher spot energy purchases and higher maintenance capital expenditures in the Dominican Republic. |

| |

• | Europe: An increase of $24 million, primarily driven by higher collections and improved working capital at Maritza in Bulgaria, partially offset by the timing of planned maintenance at Kilroot in the United Kingdom and the sale of Ebute in Nigeria in 2014. |

| |

• | Asia: A decrease of $39 million, primarily related to lower contributions from Masinloc in the Philippines, as a result of the partial sell-down mentioned above, as well as the contractual time lag between billing and collections. |

| |

• | Corp/Other: An increase of $87 million, primarily driven by lower Parent interest expense as a result of the reduction in recourse debt, as well as realized foreign currency gains associated with the Company's on-going hedging activities. |

For the six months ended June 30, 2015, Consolidated Net Cash Provided by Operating Activities increased $137 million to $590 million, primarily driven by working capital improvements at DPL in the United States and Panama, El Salvador and Puerto Rico, offset by the payment of a service concession at Mong Duong in Vietnam and lower collections in the Dominican Republic.

Table 4: 2015 Guidance

|

| |

$ in Millions, Except Per Share Amounts | Full Year 2015 Guidance |

Adjusted EPS1 | $1.25-$1.35 |

Proportional Free Cash Flow1 | $1,000-$1,350 |

Consolidated Net Cash Provided by Operating Activities | $1,900-$2,700 |

1 A non-GAAP financial measure. See “Non-GAAP Financial Measures” for definitions and reconciliations to the most comparable GAAP financial measures.

| |

• | The Company's 2015 guidance reflects currency and commodity forward curves as of June 30, 2015. |

| |

• | The Company is reaffirming its Adjusted EPS guidance range of $1.25-$1.35. |

| |

◦ | The Company's guidance incorporates an expected impact of $0.07 per share from poor hydrology in Brazil, consistent with its prior expectations. |

| |

◦ | Consistent with the Company's prior expectations, in the second half of 2015, the Company expects to benefit from improved availability as a result of planned maintenance that was completed earlier in the year in Chile, the Dominican Republic and the US, improved hydrological conditions in Panama and Colombia, seasonality related to certain regulated and contracted businesses in the US and at Gener in Chile, as well as the previously expected benefit from tax opportunities at certain businesses and the contributions from new plants that came on-line in the first half of the year. |

| |

• | The Company is reaffirming its Proportional Free Cash Flow guidance range of $1,000-$1,350 million. |

| |

◦ | The Company expects to generate higher cash flows in the second half of 2015 as a result of: stronger second half 2015 Adjusted EPS as described above; and improved working capital in the US, Andes, MCAC (including higher collections in the Dominican Republic) and Europe (including collection of outstanding receivables at Maritza in Bulgaria). |

| |

• | The Company is reaffirming its Consolidated Net Cash Provided by Operating Activities guidance range of $1,900-$2,700 million. |

Highlights

| |

• | In April, the Company achieved commercial operations of its 1,240 MW coal-fired Mong Duong 2 power plant in Vietnam six months early and under budget. Mong Duong 2 has a 25-year Power Purchase Agreement (PPA) with a state-owned utility. |

| |

• | The Company currently has 5,839 MW under construction and on track to come on-line through 2018. These projects represent $7 billion in total capital expenditures, with the majority of AES' $1.3 billion in equity already funded. |

| |

◦ | In July, the Company broke ground on three new energy storage projects for a total of 40 MW expected to come on-line by the end of 2016: the 20 MW Harding Street facility located at Indianapolis Power and Light in Indiana; the 10 MW Northern Ireland facility located at Kilroot; and the 10 MW Netherlands facility. |

| |

• | Year-to-Date, the Company has repurchased 26 million shares for $335 million. |

| |

◦ | Since its first quarter 2015 earnings call in May 2015, the Company has repurchased 22 million shares for $293 million. This includes the repurchase of 20 million shares from China Investment Corporation in May 2015. |

| |

◦ | The Company expects to utilize the approximately $88 million left on its current share repurchase authorization before year-end |

| |

◦ | Since September 2011, the Company has repurchased 103 million shares, or 14% of its shares outstanding, for $1.3 billion. |

| |

• | In July, the Company signed a Memorandum of Understanding with Grupo BAL to form a 50/50 joint venture that will co-invest in power and related infrastructure projects in Mexico. |

| |

◦ | Grupo BAL is a Mexican business conglomerate with a market cap of $11 billion and companies in different sectors, such as industrial, commercial, agricultural and financial services. Some companies in the Group are: Indiustrias Penoles, Fresnillo FLC, Grupo Nacional Provincial, Palacio de Hierro, Profuturo GNP, Valmex and the newly created PetroBal. |

| |

• | In July, the Company signed an agreement to sell its 50% interest in 31 MW of operating solar in Spain for $32 million. |

Non-GAAP Financial Measures

See Non-GAAP Financial Measures for definitions of Adjusted Earnings Per Share, Adjusted Pre-Tax Contribution, Proportional Free Cash Flow, as well as reconciliations to the most comparable GAAP financial measures.

Attachments

Consolidated Statements of Operations, Consolidated Balance Sheets, Segment Information, Consolidated Statements of Cash Flows, Non-GAAP Financial Measures, Parent Financial Information and 2015 Financial Guidance Elements.

Conference Call Information

AES will host a conference call on Monday, August 10, 2015 at 9:00 a.m. Eastern Daylight Time (EDT). Interested parties may listen to the teleconference by dialing 1-877-201-0168 at least ten minutes before the

start of the call. International callers should dial +1-647-788-4901. The Conference ID for this call is 74217721. Internet access to the presentation materials will be available on the AES website at www.aes.com by selecting “Investors” and then “Presentations and Webcasts.”

A webcast replay, as well as a replay in downloadable MP3 format, will be accessible at www.aes.com beginning shortly after the completion of the call.

About AES

The AES Corporation (NYSE: AES) is a Fortune 200 global power company. We provide affordable, sustainable energy to 18 countries through our diverse portfolio of distribution businesses as well as thermal and renewable generation facilities. Our workforce of 18,500 people is committed to operational excellence and meeting the world’s changing power needs. Our 2014 revenues were $17 billion and we own and manage $39 billion in total assets. To learn more, please visit www.aes.com. Follow AES on Twitter @TheAESCorp.

Safe Harbor Disclosure

This news release contains forward-looking statements within the meaning of the Securities Act of 1933 and of the Securities Exchange Act of 1934. Such forward-looking statements include, but are not limited to, those related to future earnings, growth and financial and operating performance. Forward-looking statements are not intended to be a guarantee of future results, but instead constitute AES’ current expectations based on reasonable assumptions. Forecasted financial information is based on certain material assumptions. These assumptions include, but are not limited to, our accurate projections of future interest rates, commodity price and foreign currency pricing, continued normal levels of operating performance and electricity volume at our distribution companies and operational performance at our generation businesses consistent with historical levels, as well as achievements of planned productivity improvements and incremental growth investments at normalized investment levels and rates of return consistent with prior experience.

Actual results could differ materially from those projected in our forward-looking statements due to risks, uncertainties and other factors. Important factors that could affect actual results are discussed in AES’ filings with the Securities and Exchange Commission (the “SEC”), including, but not limited to, the risks discussed under Item 1A “Risk Factors” and Item 7: Management’s Discussion & Analysis in AES’ 2014 Annual Report on Form 10-K and in subsequent reports filed with the SEC. Readers are encouraged to read AES’ filings to learn more about the risk factors associated with AES’ business. AES undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Any Stockholder who desires a copy of the Company’s 2014 Annual Report on Form 10-K dated on or about February 25, 2015 with the SEC may obtain a copy (excluding Exhibits) without charge by addressing a request to the Office of the Corporate Secretary, The AES Corporation, 4300 Wilson Boulevard, Arlington, Virginia 22203. Exhibits also may be requested, but a charge equal to the reproduction cost thereof will be made. A copy of the Form 10-K may be obtained by visiting the Company’s website at www.aes.com.

#

THE AES CORPORATION

Condensed Consolidated Statements of Operations (Unaudited)

|

| | | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| | 2015 | | 2014 | | 2015 | | 2014 |

| | (in millions, except per share amounts) |

Revenue: | | | | | | | | |

Regulated | | $ | 2,008 |

| | $ | 2,116 |

| | $ | 4,088 |

| | $ | 4,258 |

|

Non-Regulated | | 1,850 |

| | 2,195 |

| | 3,754 |

| | 4,315 |

|

Total revenue | | 3,858 |

| | 4,311 |

| | 7,842 |

| | 8,573 |

|

Cost of Sales: | | | | | | | | |

Regulated | | (1,634 | ) | | (1,844 | ) | | (3,441 | ) | | (3,776 | ) |

Non-Regulated | | (1,470 | ) | | (1,648 | ) | | (2,926 | ) | | (3,184 | ) |

Total cost of sales | | (3,104 | ) | | (3,492 | ) | | (6,367 | ) | | (6,960 | ) |

Operating margin | | 754 |

| | 819 |

| | 1,475 |

| | 1,613 |

|

General and administrative expenses | | (50 | ) | | (52 | ) | | (105 | ) | | (103 | ) |

Interest expense | | (310 | ) | | (323 | ) | | (673 | ) | | (696 | ) |

Interest income | | 133 |

| | 73 |

| | 223 |

| | 136 |

|

Loss on extinguishment of debt | | (122 | ) | | (15 | ) | | (145 | ) | | (149 | ) |

Other expense | | (14 | ) | | (17 | ) | | (34 | ) | | (25 | ) |

Other income | | 15 |

| | 33 |

| | 31 |

| | 45 |

|

Goodwill impairment expense | | — |

| | — |

| | — |

| | (154 | ) |

Asset impairment expense | | (37 | ) | | (63 | ) | | (45 | ) | | (75 | ) |

Foreign currency transaction gains (losses) | | 15 |

| | 7 |

| | (8 | ) | | (12 | ) |

Other non-operating expense | | — |

| | (44 | ) | | — |

| | (44 | ) |

INCOME FROM CONTINUING OPERATIONS BEFORE TAXES AND EQUITY IN EARNINGS OF AFFILIATES | | 384 |

| | 418 |

| | 719 |

| | 536 |

|

Income tax expense | | (120 | ) | | (157 | ) | | (216 | ) | | (211 | ) |

Net equity in earnings of affiliates | | — |

| | 20 |

| | 15 |

| | 45 |

|

INCOME FROM CONTINUING OPERATIONS | | 264 |

| | 281 |

| | 518 |

| | 370 |

|

Income from operations of discontinued businesses, net of income tax expense of $0, $8, $0 and $22, respectively | | — |

| | 7 |

| | — |

| | 27 |

|

Net loss from disposal and impairments of discontinued businesses, net of income tax expense (benefit) of $0, $5, $0 and $4, respectively | | — |

| | (13 | ) | | — |

| | (56 | ) |

NET INCOME | | 264 |

| | 275 |

| | 518 |

| | 341 |

|

Noncontrolling interests: | | | | | | | | |

Less: (Income) from continuing operations attributable to noncontrolling interests | | (195 | ) | | (139 | ) | | (307 | ) | | (275 | ) |

Less: (Income) loss from discontinued operations attributable to noncontrolling interests | | — |

| | (3 | ) | | — |

| | 9 |

|

Total net income attributable to noncontrolling interests | | (195 | ) | | (142 | ) | | (307 | ) | | (266 | ) |

NET INCOME ATTRIBUTABLE TO THE AES CORPORATION | | $ | 69 |

| | $ | 133 |

| | $ | 211 |

| | $ | 75 |

|

AMOUNTS ATTRIBUTABLE TO THE AES CORPORATION COMMON STOCKHOLDERS: | | | | | | | | |

Income from continuing operations, net of tax | | $ | 69 |

| | $ | 142 |

| | $ | 211 |

| | $ | 95 |

|

Loss from discontinued operations, net of tax | | — |

| | (9 | ) | | — |

| | (20 | ) |

Net income | | $ | 69 |

| | $ | 133 |

| | $ | 211 |

| | $ | 75 |

|

BASIC EARNINGS PER SHARE: | | | | | | | | |

Income from continuing operations attributable to The AES Corporation common stockholders, net of tax | | $ | 0.10 |

| | $ | 0.20 |

| | $ | 0.30 |

| | $ | 0.13 |

|

Loss from discontinued operations attributable to The AES Corporation common stockholders, net of tax | | — |

| | (0.02 | ) | | — |

| | (0.03 | ) |

NET INCOME ATTRIBUTABLE TO THE AES CORPORATION COMMON STOCKHOLDERS | | $ | 0.10 |

| | $ | 0.18 |

| | $ | 0.30 |

| | $ | 0.10 |

|

DILUTED EARNINGS PER SHARE: | | | | | | | | |

Income from continuing operations attributable to The AES Corporation common stockholders, net of tax | | $ | 0.10 |

| | $ | 0.20 |

| | $ | 0.30 |

| | $ | 0.13 |

|

Loss from discontinued operations attributable to The AES Corporation common stockholders, net of tax | | — |

| | (0.02 | ) | | — |

| | (0.03 | ) |

NET INCOME ATTRIBUTABLE TO THE AES CORPORATION COMMON STOCKHOLDERS | | $ | 0.10 |

| | $ | 0.18 |

| | $ | 0.30 |

| | $ | 0.10 |

|

DILUTED SHARES OUTSTANDING | | 695 |

| | 728 |

| | 701 |

| | 728 |

|

DIVIDENDS DECLARED PER COMMON SHARE | | $ | 0.10 |

| | $ | 0.05 |

| | $ | 0.10 |

| | $ | 0.05 |

|

|

| | | | | | | | | | | | | | | |

THE AES CORPORATION |

Strategic Business Unit (SBU) Information |

(Unaudited) |

| | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2015 | | 2014 | | 2015 | | 2014 |

| (in millions) | | | | |

REVENUE | | | | | | | |

US | $ | 831 |

| | $ | 893 |

| | $ | 1,828 |

| | $ | 1,894 |

|

Andes | 630 |

| | 724 |

| | 1,242 |

| | 1,344 |

|

Brazil | 1,315 |

| | 1,533 |

| | 2,645 |

| | 2,978 |

|

MCAC | 601 |

| | 692 |

| | 1,199 |

| | 1,330 |

|

Europe | 299 |

| | 305 |

| | 629 |

| | 696 |

|

Asia | 187 |

| | 163 |

| | 306 |

| | 331 |

|

Corporate, Other and Inter-SBU eliminations | (5 | ) | | 1 |

| | (7 | ) | | 0 |

|

| | | | | | | |

Total Revenue | $ | 3,858 |

| | $ | 4,311 |

| | $ | 7,842 |

| | $ | 8,573 |

|

THE AES CORPORATION

Condensed Consolidated Balance Sheets (Unaudited)

|

| | | | | | | | |

| | June 30,

2015 | | December 31,

2014 |

| | (in millions, except share and per share data) |

ASSETS | | | | |

CURRENT ASSETS | | | | |

Cash and cash equivalents | | $ | 1,022 |

| | $ | 1,539 |

|

Restricted cash | | 308 |

| | 283 |

|

Short-term investments | | 439 |

| | 709 |

|

Accounts receivable, net of allowance for doubtful accounts of $94 and $96, respectively | | 2,877 |

| | 2,709 |

|

Inventory | | 734 |

| | 702 |

|

Deferred income taxes | | 213 |

| | 275 |

|

Prepaid expenses | | 115 |

| | 175 |

|

Other current assets | | 1,799 |

| | 1,434 |

|

Current assets of held-for-sale businesses | | 8 |

| | — |

|

Total current assets | | 7,515 |

| | 7,826 |

|

NONCURRENT ASSETS | | | | |

Property, Plant and Equipment: | | | | |

Land | | 801 |

| | 870 |

|

Electric generation, distribution assets and other | | 30,136 |

| | 30,459 |

|

Accumulated depreciation | | (9,996 | ) | | (9,962 | ) |

Construction in progress | | 2,499 |

| | 3,784 |

|

Property, plant and equipment, net | | 23,440 |

| | 25,151 |

|

Other Assets: | | | | |

Investments in and advances to affiliates | | 562 |

| | 537 |

|

Debt service reserves and other deposits | | 403 |

| | 411 |

|

Goodwill | | 1,473 |

| | 1,458 |

|

Other intangible assets, net of accumulated amortization of $130 and $158, respectively | | 241 |

| | 281 |

|

Deferred income taxes | | 571 |

| | 662 |

|

Service concession assets | | 1,538 |

| | — |

|

Other noncurrent assets | | 2,691 |

| | 2,640 |

|

Noncurrent assets of held-for-sale businesses | | 150 |

| | — |

|

Total other assets | | 7,629 |

| | 5,989 |

|

TOTAL ASSETS | | $ | 38,584 |

| | $ | 38,966 |

|

LIABILITIES AND EQUITY | | | | |

CURRENT LIABILITIES | | | | |

Accounts payable | | $ | 1,994 |

| | $ | 2,278 |

|

Accrued interest | | 244 |

| | 260 |

|

Accrued and other liabilities | | 2,317 |

| | 2,326 |

|

Non-recourse debt, including $220 and $240, respectively, related to variable interest entities | | 1,999 |

| | 1,982 |

|

Recourse debt | | — |

| | 151 |

|

Current liabilities of held-for-sale businesses | | 9 |

| | — |

|

Total current liabilities | | 6,563 |

| | 6,997 |

|

NONCURRENT LIABILITIES | | | | |

Non-recourse debt, including $1,058 and $1,030, respectively, related to variable interest entities | | 13,750 |

| | 13,618 |

|

Recourse debt | | 5,014 |

| | 5,107 |

|

Deferred income taxes | | 1,281 |

| | 1,277 |

|

Pension and other post-retirement liabilities | | 1,183 |

| | 1,342 |

|

Other noncurrent liabilities | | 3,110 |

| | 3,222 |

|

Noncurrent liabilities of held-for-sale businesses | | 61 |

| | — |

|

Total noncurrent liabilities | | 24,399 |

| | 24,566 |

|

Contingencies and Commitments (see Note 9) | |

| |

|

Redeemable stock of subsidiaries | | 538 |

| | 78 |

|

EQUITY | | | | |

THE AES CORPORATION STOCKHOLDERS’ EQUITY | | | | |

Common stock ($0.01 par value, 1,200,000,000 shares authorized; 815,558,389 issued and 682,607,128 outstanding at June 30, 2015 and 814,539,146 issued and 703,851,297 outstanding at December 31, 2014) | | 8 |

| | 8 |

|

Additional paid-in capital | | 8,705 |

| | 8,409 |

|

Retained earnings | | 258 |

| | 512 |

|

Accumulated other comprehensive loss | | (3,445 | ) | | (3,286 | ) |

Treasury stock, at cost (132,951,261 shares at June 30, 2015 and 110,687,849 shares at December 31, 2014) | | (1,662 | ) | | (1,371 | ) |

Total AES Corporation stockholders’ equity | | 3,864 |

| | 4,272 |

|

NONCONTROLLING INTERESTS | | 3,220 |

| | 3,053 |

|

Total equity | | 7,084 |

| | 7,325 |

|

TOTAL LIABILITIES AND EQUITY | | $ | 38,584 |

| | $ | 38,966 |

|

THE AES CORPORATION

Condensed Consolidated Statements of Cash Flows

(Unaudited)

|

| | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended

June 30, |

| 2015 | | 2014 | | 2015 | | 2014 |

| (in millions) | | | | |

OPERATING ACTIVITIES: | | | | | | | |

Net income | $ | 264 |

| | $ | 275 |

| | $ | 518 |

| | $ | 341 |

|

Adjustments to net income: | | | | | | | |

Depreciation and amortization | 299 |

| | 319 |

| | 597 |

| | 625 |

|

Impairment expenses | 37 |

| | 107 |

| | 45 |

| | 273 |

|

Deferred income taxes | 29 |

| | (4 | ) | | 17 |

| | 52 |

|

Releases of contingencies | (148 | ) | | (60 | ) | | (134 | ) | | (48 | ) |

Loss on the extinguishment of debt | 122 |

| | 15 |

| | 145 |

| | 149 |

|

Loss on sale of assets | 2 |

| | 5 |

| | 12 |

| | 8 |

|

Loss on disposals and impairments — discontinued operations | — |

| | 7 |

| | — |

| | 51 |

|

Other | 16 |

| | 9 |

| | 70 |

| | 45 |

|

Changes in operating assets and liabilities | | | | | | | |

(Increase) decrease in accounts receivable | (107 | ) | | (93 | ) | | (444 | ) | | (312 | ) |

(Increase) decrease in inventory | (19 | ) | | (27 | ) | | (54 | ) | | (39 | ) |

(Increase) decrease in prepaid expenses and other current assets | 64 |

| | 2 |

| | 132 |

| | (72 | ) |

(Increase) decrease in other assets | (525 | ) | | 128 |

| | (815 | ) | | (316 | ) |

Increase (decrease) in accounts payable and other current liabilities | (94 | ) | | (609 | ) | | 179 |

| | (194 | ) |

Increase (decrease) in income tax payables, net and other tax payables | (116 | ) | | 30 |

| | (131 | ) | | (176 | ) |

Increase (decrease) in other liabilities | 329 |

| | 128 |

| | 453 |

| | 66 |

|

Net cash provided by operating activities | 153 |

| | 232 |

| | 590 |

| | 453 |

|

INVESTING ACTIVITIES: | | | | | | | |

Capital Expenditures | (549 | ) | | (509 | ) | | (1,168 | ) | | (908 | ) |

Acquisitions, net of cash acquired | (1 | ) | | (728 | ) | | (18 | ) | | (728 | ) |

Proceeds from the sale of businesses, net of cash sold | 2 |

| | 861 |

| | 2 |

| | 890 |

|

Proceeds from the sale of assets | 1 |

| | 16 |

| | 1 |

|

| 16 |

|

Sale of short-term investments | 1,384 |

| | 1,149 |

| | 2,460 |

| | 2,198 |

|

Purchase of short-term investments | (1,216 | ) | | (932 | ) | | (2,270 | ) | | (1,925 | ) |

(Increase) decrease in restricted cash, debt service reserves and other assets | 24 |

| | 146 |

| | (51 | ) | | 127 |

|

Other investing | 5 |

| | (68 | ) | | (26 | ) | | (61 | ) |

Net cash used in investing activities | (350 | ) | | (65 | ) |

| (1,070 | ) |

| (391 | ) |

FINANCING ACTIVITIES: | | | | | | | |

Borrowings under the revolving credit facilities | 260 |

| | 520 |

| | 361 |

| | 737 |

|

Issuance of recourse debt | 575 |

| | 775 |

| | 575 |

| | 1,525 |

|

Issuance of non-recourse debt | 1,366 |

| | 1,156 |

| | 1,940 |

| | 1,710 |

|

Repayments under the revolving credit facilities | (297 | ) | | (455 | ) | | (359 | ) | | (607 | ) |

Repayments of recourse debt | (579 | ) | | (797 | ) | | (915 | ) | | (1,663 | ) |

Repayments of non-recourse debt | (1,188 | ) | | (1,000 | ) | | (1,457 | ) | | (1,349 | ) |

Payments for financing fees | (31 | ) | | (27 | ) | | (40 | ) | | (105 | ) |

Distributions to noncontrolling interests | (94 | ) | | (171 | ) | | (113 | ) | | (197 | ) |

Contributions from noncontrolling interests | 30 |

| | 78 |

| | 97 |

| | 110 |

|

Proceeds from the sale of redeemable stock of subsidiaries | 214 |

| | — |

| | 461 |

| | — |

|

Dividends paid on AES common stock | (71 | ) | | (36 | ) | | (141 | ) | | (72 | ) |

Payments for financed capital expenditures | (42 | ) | | (134 | ) | | (84 | ) | | (312 | ) |

Purchase of treasury stock | (272 | ) | | (32 | ) | | (307 | ) | | (32 | ) |

Other financing | 5 |

| | 5 |

| | (29 | ) | | 5 |

|

Net cash used in financing activities | (124 | ) |

| (118 | ) | | (11 | ) | | (250 | ) |

Effect of exchange rate changes on cash | 8 |

| | 8 |

| | (19 | ) | | (14 | ) |

(Decrease) increase in cash of discontinued and held-for-sale businesses | (2 | ) | | 45 |

| | (7 | ) | | 75 |

|

Total decrease in cash and cash equivalents | (315 | ) |

| 102 |

| | (517 | ) | | (127 | ) |

Cash and cash equivalents, beginning | 1,337 |

| | 1,413 |

| | 1,539 |

| | 1,642 |

|

Cash and cash equivalents, ending | $ | 1,022 |

| | $ | 1,515 |

| | $ | 1,022 |

| | $ | 1,515 |

|

SUPPLEMENTAL DISCLOSURES: | | | | | | | |

Cash payments for interest, net of amounts capitalized | $ | 423 |

| | $ | 450 |

| | $ | 665 |

| | $ | 676 |

|

Cash payments for income taxes, net of refunds | $ | 144 |

| | $ | 95 |

| | $ | 247 |

| | $ | 332 |

|

SCHEDULE OF NONCASH INVESTING AND FINANCING ACTIVITIES: | | | | | | | |

Assets received upon sale of subsidiaries | $ | — |

| | $ | 44 |

| | $ | — |

| | $ | 44 |

|

Assets acquired through capital lease | $ | 5 |

| | $ | 2 |

| | $ | 10 |

| | $ | 13 |

|

THE AES CORPORATION

NON-GAAP FINANCIAL MEASURES

(Unaudited)

RECONCILIATION OF ADJUSTED PRE-TAX CONTRIBUTION (PTC) AND ADJUSTED EPS

Adjusted pre-tax contribution (“adjusted PTC”) and Adjusted earnings per share (“adjusted EPS”) are non-GAAP supplemental measures that are used by management and external users of our consolidated financial statements such as investors, industry analysts and lenders.

We define adjusted PTC as pre-tax income from continuing operations attributable to AES excluding gains or losses of the consolidated entity due to (a) unrealized gains or losses related to derivative transactions, (b) unrealized foreign currency gains or losses, (c) gains or losses due to dispositions and acquisitions of business interests, (d) losses due to impairments, and (e) costs due to the early retirement of debt. Adjusted PTC also includes net equity in earnings of affiliates on an after-tax basis adjusted for the same gains or losses excluded from consolidated entities.

We define adjusted EPS as diluted earnings per share from continuing operations excluding gains or losses of both consolidated entities and entities accounted for under the equity method due to (a) unrealized gains or losses related to derivative transactions, (b) unrealized foreign currency gains or losses, (c) gains or losses due to dispositions and acquisitions of business interests, (d) losses due to impairments, and (e) costs due to the early retirement of debt.

The GAAP measure most comparable to adjusted PTC is income from continuing operations attributable to AES. The GAAP measure most comparable to adjusted EPS is diluted earnings per share from continuing operations. We believe that adjusted PTC and adjusted EPS better reflect the underlying business performance of the Company and are considered in the Company’s internal evaluation of financial performance. Factors in this determination include the variability due to unrealized gains or losses related to derivative transactions, unrealized foreign currency gains or losses, losses due to impairments and strategic decisions to dispose of or acquire business interests or retire debt, which affect results in a given period or periods. In addition, for adjusted PTC, earnings before tax represents the business performance of the Company before the application of statutory income tax rates and tax adjustments, including the effects of tax planning, corresponding to the various jurisdictions in which the Company operates. Adjusted PTC and adjusted EPS should not be construed as alternatives to income from continuing operations attributable to AES and diluted earnings per share from continuing operations, which are determined in accordance with GAAP.

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, 2015 | | Three Months Ended June 30, 2014 | | Six Months Ended June 30, 2015 | | Six Months Ended June 30, 2014 | |

| Net of NCI(1) | | Per Share (Diluted) Net of NCI(1) and Tax | | Net of NCI(1) | | Per Share(Diluted) Net of NCI(1) and Tax | | Net of

NCI(1) | | Per Share (Diluted) Net of NCI(1) and Tax | | Net of NCI(1) | | Per Share (Diluted) Net of NCI(1) and Tax | |

| (In millions, except per share amounts) | |

Income (loss) from continuing operations attributable to AES and Diluted EPS | $ | 69 |

| | $ | 0.10 |

| | $ | 142 |

| | $ | 0.20 |

| | $ | 211 |

| | $ | 0.30 |

| | $ | 95 |

| | $ | 0.13 |

| |

Add back income tax expense (benefit) from continuing operations attributable to AES | 46 |

| | | | 99 |

| | | | 96 |

| | | | 74 |

| | | |

Pre-tax contribution | $ | 115 |

| | | | $ | 241 |

| | | | $ | 307 |

| | | | $ | 169 |

| | | |

Adjustments | | | | | | | | | | | | | | | | |

Unrealized derivative (gains)/ losses(2) | $ | (2 | ) | | $ | — |

| | $ | (22 | ) | | $ | (0.02 | ) | | $ | (17 | ) | | $ | (0.02 | ) | | $ | (32 | ) | | $ | (0.03 | ) | |

Unrealized foreign currency transaction (gains)/ losses(3) | (3 | ) | | — |

| | 7 |

| | — |

| | 44 |

| | 0.04 |

| | 33 |

| | 0.03 |

| |

Disposition/ acquisition (gains)/ losses | (4 | ) | | (0.01 | ) | | 2 |

| | — |

| | (9 | ) | | (0.01 | ) | | 1 |

| | — |

| |

Impairment losses | 30 |

| | 0.04 |

| (4) | 99 |

| | 0.09 |

| (5) | 36 |

| | 0.05 |

| (4) | 265 |

| | 0.26 |

| (6) |

Loss on extinguishment of debt | 115 |

| | 0.12 |

| (7) | 13 |

| | 0.01 |

| (8) | 142 |

| | 0.14 |

| (9) | 147 |

| | 0.14 |

| (10) |

Adjusted PTC and Adjusted EPS | $ | 251 |

| | $ | 0.25 |

| | $ | 340 |

| | $ | 0.28 |

| | $ | 503 |

| | $ | 0.50 |

| | $ | 583 |

| | $ | 0.53 |

| |

_____________________________

| |

(1) | NCI is defined as Noncontrolling Interests. |

| |

(2) | Unrealized derivative (gains) losses were net of income tax per share of $0.00 and $(0.01) in the three months ended June 30, 2015 and 2014, and of $(0.01) and $(0.01) in the six months ended June 30, 2015 and 2014, respectively. |

| |

(3) | Unrealized foreign currency transaction (gains) losses were net of income tax per share of $(0.01) and $0.00 in the three months ended June 30, 2015 and 2014, and of $0.02 and $0.01 in the six months ended June 30, 2015 and 2014, respectively. |

| |

(4) | Amount primarily relates to the asset impairment at UK Wind of $37 million ($30 million, or $0.04 per share, net of income tax per share of $0.00). |

| |

(5) | Amount primarily relates to the asset impairment at Ebute of $52 million ($34 million, or $0.05 per share, net of income tax per share of $0.02) and at Newfield of $11 million ($6 million, or $0.00 per share, net of income tax per share of $0.00) and other-than- |

THE AES CORPORATION

NON-GAAP FINANCIAL MEASURES

(Unaudited)

RECONCILIATION OF ADJUSTED PRE-TAX CONTRIBUTION (PTC) AND ADJUSTED EPS

temporary impairment of our equity method investment at Silver Ridge of $44 million ($30 million, or $0.04 per share, net of income tax per share of $0.02).

| |

(6) | Amount primarily relates to the goodwill impairments at DPLER of $136 million ($92 million, or $0.13 per share, net of income tax per share of $0.06), at Buffalo Gap of $18 million ($18 million, or $0.03 per share, net of income tax per share of $0.00) and asset impairments at Ebute of $52 million ($34 million, or $0.05 per share, net of income tax per share of $0.02), at Newfield of $11 million ($6 million, or $0.00 per share, net of income tax per share of $0.00), at DPL of $12 million ($8 million, or $0.01 per share, net of income tax per share of $0.00) and other-than-temporary impairment of our equity method investment at Silver Ridge of $44 million ($30 million, or $0.04 per share, net of income tax per share of $0.02). |

| |

(7) | Amount primarily relates to the loss on early retirement of debt at the Parent Company of $85 million ($58 million, or $0.08 per share, net of income tax per share of $0.04), at IPL of $19 million ($10 million, or $0.01 per share, net of income tax per share of $0.01), at Panama of $16 million ($5 million, or $0.01 per share, net of income tax per share of $0.00) and at Sul of $4 million ($3 million, or $0.00 per share, net of income tax per share of $0.00). |

| |

(8) | Amount primarily relates to the loss on early retirement of debt at the Parent Company of $13 million ($8 million, or $0.01 per share, net of income tax per share of $0.01). |

| |

(9) | Amount primarily relates to the loss on early retirement of debt at the Parent Company of $111 million ($76 million, or $0.11 per share, net of income tax per share of $0.05), at IPL of $19 million ($10 million, or $0.01 per share, net of income tax per share of $0.01), at Panama of $16 million ($5 million, or $0.01 per share, net of income tax per share of $0.00) and at Sul of $4 million ($3 million, or $0.00 per share, net of income tax per share of $0.00). |

| |

(10) | Amount primarily relates to the loss on early retirement of debt at the Parent Company of $145 million ($99 million, or $0.14 per share, net of income tax per share of $0.06). |

THE AES CORPORATION

NON-GAAP FINANCIAL MEASURES

(Unaudited)

|

| | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| June 30, | | June 30, |

| 2015 | | 2014 | | 2015 | | 2014 |

| (in millions) |

Calculation of Maintenance Capital Expenditures for Free Cash Flow (1) Reconciliation Below: | | | | | | | |

Maintenance Capital Expenditures | $ | 157 |

| | $ | 152 |

| | $ | 306 |

| | $ | 289 |

|

Environmental Capital Expenditures | 81 |

| | 77 |

| | 130 |

| | 111 |

|

Growth Capital Expenditures | 353 |

| | 414 |

| | 816 |

| | 820 |

|

Total Capital Expenditures | $ | 591 |

| | $ | 643 |

| | $ | 1,252 |

| | $ | 1,220 |

|

| | | | | | | |

Reconciliation of Proportional Operating Cash Flow(2) | | | | | | |

Consolidated Operating Cash Flow | $ | 153 |

| | $ | 232 |

| | $ | 590 |

| | $ | 453 |

|

Add: capital expenditures related to service concession assets (4) | 51 |

| | 0 |

| | 71 |

| | 0 |

|

Less: Proportional Adjustment Factor (3) (6) | (13 | ) |

| (64 | ) |

| (85 | ) |

| (44 | ) |

Proportional Operating Cash Flow (2) | $ | 191 |

| | $ | 168 |

| | $ | 576 |

| | $ | 409 |

|

| | | | | | | |

Reconciliation of Free Cash Flow(1) | | | | | | | |

Consolidated Operating Cash Flow | $ | 153 |

| | $ | 232 |

| | $ | 590 |

| | $ | 453 |

|

Add: capital expenditures related to service concession assets (4) | 51 |

| | 0 |

| | 71 |

| | 0 |

|

Less: Maintenance Capital Expenditures, net of reinsurance proceeds | (157 | ) | | (152 | ) |

| (306 | ) |

| (289 | ) |

Less: Non-Recoverable Environmental Capital Expenditures | (17 | ) | | (25 | ) | | (26 | ) | | (36 | ) |

Free Cash Flow(1) | $ | 30 |

|

| $ | 55 |

|

| $ | 329 |

|

| $ | 128 |

|

| | | | | | | |

Reconciliation of Proportional Free Cash Flow(1),(2) | | | | | | | |

Proportional Operating Cash Flow | $ | 191 |

| | $ | 168 |

| | $ | 576 |

| | $ | 409 |

|

Less: Proportional Maintenance Capital Expenditures, net of reinsurance proceeds (3) | (117) |

| | (102) |

| | (230) |

| | (206 | ) |

Less: Proportional Non-Recoverable Environmental Capital Expenditures (3) (5) | (12) |

| | (19) |

| | (19) |

| | (27 | ) |

Proportional Free Cash Flow(1),(2) | $ | 62 |

| | $ | 47 |

| | $ | 327 |

| | $ | 176 |

|

| |

(1) | Free cash flow (a non-GAAP financial measure) is defined as net cash from operating activities less maintenance capital expenditures (including non-recoverable environmental capital expenditures), net of reinsurance proceeds from third parties. AES believes that free cash flow is a useful measure for evaluating our financial condition because it represents the amount of cash provided by operations less maintenance capital expenditures as defined by our businesses, that may be available for investing or for repaying debt. |

| |

(2) | AES is a holding company that derives its income and cash flows from the activities of its subsidiaries, some of which may not be wholly-owned by the Company. Accordingly, the Company has presented certain financial metrics which are defined as Proportional (a non-GAAP financial measure). Proportional metrics present the Company's estimate of its share in the economics of the underlying metric. The Company believes that the Proportional metrics are useful to investors because they exclude the economic share in the metric presented that is held by non-AES shareholders. For example, Net Cash from Operating Activities (Operating Cash Flow) is a GAAP metric which presents the Company's cash flow from operations on a consolidated basis, including operating cash flow allocable to noncontrolling interests. Proportional Operating Cash Flow removes the share of operating cash flow allocable to noncontrolling interests and therefore may act as an aid in the v-aluation of the Company. Beginning in Q1 2015, the definition was revised to also exclude cash flows related to service concession assets. Proportional metrics are reconciled to the nearest GAAP measure. Certain assumptions have been made to estimate our proportional financial measures. These assumptions include: (i) the Company's economic interest has been calculated based on a blended rate for each consolidated business when such business represents multiple legal entities; (ii) the Company's economic interest may differ from the percentage implied by the recorded net income or loss attributable to noncontrolling interests or dividends paid during a given period; (iii) the Company's economic interest for entities accounted for using the hypothetical liquidation at book value method is 100%; (iv) individual operating performance of the Company's equity method investments is not reflected and (v) inter-segment transactions are included as applicable for the metric presented. |

| |

(3) | The proportional adjustment factor, proportional maintenance capital expenditures (net of reinsurance proceeds), and proportional non-recoverable environmental capital expenditures are calculated by multiplying the percentage owned by non-controlling interests for each entity by its corresponding consolidated cash flow metric and adding up the resulting figures. For example, the Company owns approximately 71% of AES Gener, its subsidiary in Chile. Assuming a consolidated net cash flow from operating activities of $100 from AES Gener, the proportional adjustment factor for AES Gener would equal approximately $29 (or $100 x 29%). The Company calculates the proportional adjustment factor for each consolidated business in this manner and then adds these amounts together to determine the total proportional adjustment factor used in the reconciliation. The proportional adjustment factor may differ from the proportion of income attributable to noncontrolling interests as a result of (a) non-cash items which impact income but not cash and (b) AES’ ownership interest in the subsidiary where such items occur. |

| |

(4) | Service concession asset expenditures excluded from free cash flow and proportional free cash flow non-GAAP metric. |

THE AES CORPORATION

NON-GAAP FINANCIAL MEASURES

(Unaudited)

| |

(5) | Excludes IPALCO’s proportional recoverable environmental capital expenditures of $47 million and $52 million for the three months ended June 30, 2015 and June 30, 2014, as well as, $86 million and $74 million for the six months ended June 30, 2015 and June 30, 2014, respectively. |

| |

(6) | Includes proportional adjustment amount for service concession asset expenditures of $26 million and $36 million for the three and six months ended June 30, 2015. The Company adopted service concession accounting effective January 1, 2015. |

|

| | | | | | | | | | | | |

The AES Corporation |

Parent Financial Information |

Parent only data: last four quarters | | | | |

(in millions) | Quarters Ended |

Total subsidiary distributions & returns of capital to Parent | June 30, 2015 | March 31, 2015 | December 31, 2014 | September 30, 2014 |

Actual | Actual | Actual | Actual |

Subsidiary distributions(1) to Parent & QHCs | $ | 1,119 |

| $ | 1,094 |

| $ | 1,151 |

| $ | 1,139 |

|

Returns of capital distributions to Parent & QHCs | 57 |

| 75 |

| 85 |

| 96 |

|

Total subsidiary distributions & returns of capital to Parent | $ | 1,176 |

| $ | 1,169 |

| $ | 1,236 |

| $ | 1,235 |

|

Parent only data: quarterly | | | | |

($ in millions) | Quarter Ended |

Total subsidiary distributions & returns of capital to Parent | June 30, 2015 | March 31, 2015 | December 31, 2014 | September 30, 2014 |

Actual | Actual | Actual | Actual |

Subsidiary distributions to Parent & QHCs | $ | 235 |

| $ | 175 |

| $ | 414 |

| $ | 295 |

|

Returns of capital distributions to Parent & QHCs | 8 |

| 0 |

| 18 |

| 31 |

|

Total subsidiary distributions & returns of capital to Parent | $ | 243 |

| $ | 175 |

| $ | 432 |

| $ | 326 |

|

Parent Company Liquidity (2) | |

($ in millions) | Balance at |

| June 30, 2015 | March 31, 2015 | December 31, 2014 | September 30, 2014 |

| Actual | Actual | Actual | Actual |

Cash at Parent & Cash at QHCs (3) | $ | 40 |

| $ | 292 |

| $ | 507 |

| $ | 229 |

|

Availability under credit facilities | 739 |

| 739 |

| 739 |

| 799 |

|

Ending liquidity | $ | 779 |

| $ | 1,031 |

| $ | 1246 |

| $ | 1028 |

|

| |

(1) | Subsidiary distributions should not be construed as an alternative to Net Cash Provided by Operating Activities which are determined in accordance with GAAP. Subsidiary distributions are important to the Parent Company because the Parent Company is a holding company that does not derive any significant direct revenues from its own activities but instead relies on its subsidiaries’ business activities and the resultant distributions to fund the debt service, investment and other cash needs of the holding company. The reconciliation of the difference between the subsidiary distributions and the Net Cash Provided by Operating Activities consists of cash generated from operating activities that is retained at the subsidiaries for a variety of reasons which are both discretionary and non-discretionary in nature. These factors include, but are not limited to, retention of cash to fund capital expenditures at the subsidiary, cash retention associated with non-recourse debt covenant restrictions and related debt service requirements at the subsidiaries, retention of cash related to sufficiency of local GAAP statutory retained earnings at the subsidiaries, retention of cash for working capital needs at the subsidiaries, and other similar timing differences between when the cash is generated at the subsidiaries and when it reaches the Parent Company and related holding companies. |

| |

(2) | Parent Company Liquidity is defined as cash at the Parent Company plus availability under corporate credit facilities plus cash at qualified holding companies (QHCs). AES believes that unconsolidated Parent Company liquidity is important to the liquidity position of AES as a Parent Company because of the non-recourse nature of most of AES’s indebtedness. |

| |

(3) | The cash held at QHCs represents cash sent to subsidiaries of the company domiciled outside of the US. Such subsidiaries had no contractual restrictions on their ability to send cash to AES, the Parent Company. Cash at those subsidiaries was used for investment and related activities outside of the US. These investments included equity investments and loans to other foreign subsidiaries as well as development and general costs and expenses incurred outside the US. Since the cash held by these QHCs is available to the Parent, AES uses the combined measure of subsidiary distributions to Parent and QHCs as a useful measure of cash available to the Parent to meet its international liquidity needs. |

THE AES CORPORATION

2015 FINANCIAL GUIDANCE ELEMENTS(1), (2)

|

| | |

| 2015 Financial Guidance |

| As of 5/11/15 |

| Consolidated | Proportional |

Income Statement Guidance | | |

Adjusted Earnings Per Share (3) | $1.25-$1.35 | |

Cash Flow Guidance | | |

Net Cash Provided by Operating Activities | $1,900-$2,700 million | |

Free Cash Flow (4) | | $1,000-$1,350 million |

Reconciliation of Free Cash Flow Guidance | | |

Net Cash from Operating Activities | $1,900-$2,700 million | $1,600-$1,950 million |

Less: Maintenance Capital Expenditures | $650-$950 million | $450-$750 million |

Free Cash Flow (4) | $1,100-$1,900 million | $1,000-$1,350 million |

| |

(1) | 2015 Guidance is based on expectations for future foreign exchange rates and commodity prices as of June 30, 2015. |

| |

(2) | AES is a holding company that derives its income and cash flows from the activities of its subsidiaries, some of which may not be wholly-owned by the Company. Accordingly, the Company has presented certain financial metrics which are defined as Proportional (a non-GAAP financial measure). Proportional metrics present the Company's estimate of its share in the economics of the underlying metric. The Company believes that the Proportional metrics are useful to investors because they exclude the economic share in the metric presented that is held by non-AES shareholders. For example, Net Cash from Operating Activities (Operating Cash Flow) is a GAAP metric which presents the Company's cash flow from operations on a consolidated basis, including operating cash flow allocable to noncontrolling interests. Proportional Operating Cash Flow removes the share of operating cash flow allocable to noncontrolling interests and therefore may act as an aid in the valuation of the Company. Proportional metrics are reconciled to the nearest GAAP measure. Certain assumptions have been made to estimate our proportional financial measures. These assumptions include: (i) the Company's economic interest has been calculated based on a blended rate for each consolidated business when such business represents multiple legal entities; (ii) the Company's economic interest may differ from the percentage implied by the recorded net income or loss attributable to noncontrolling interests or dividends paid during a given period; (iii) the Company's economic interest for entities accounted for using the hypothetical liquidation at book value method is 100%; (iv) individual operating performance of the Company's equity method investments is not reflected and (v) inter-segment transactions are included as applicable for the metric presented. |

| |

(3) | Adjusted earnings per share (a non-GAAP financial measure) is defined as diluted earnings per share from continuing operations excluding gains or losses of the consolidated entity due to (a) unrealized gains or losses related to derivative transactions, (b) unrealized foreign currency gains or losses, (c) gains or losses due to dispositions and acquisitions of business interests, (d) losses due to impairments, and (e) costs due to the early retirement of debt. The GAAP measure most comparable to Adjusted EPS is diluted earnings per share from continuing operations. AES believes that adjusted earnings per share better reflects the underlying business performance of the Company, and is considered in the Company's internal evaluation of financial performance. Factors in this determination include the variability due to unrealized gains or losses related to derivative transactions, unrealized foreign currency gains or losses, losses due to impairments and strategic decisions to dispose or acquire business interests or retire debt, which affect results in a given period or periods. Adjusted earnings per share should not be construed as an alternative to diluted earnings per share from continuing operations, which is determined in accordance with GAAP. |

| |

(4) | Free Cash Flow is reconciled above. Free cash flow (a non-GAAP financial measure) is defined as net cash from operating activities less maintenance capital expenditures (including environmental capital expenditures), net of reinsurance proceeds from third parties. AES believes that free cash flow is a useful measure for evaluating our financial condition because it represents the amount of cash provided by operations less maintenance capital expenditures as defined by our businesses, that may be available for investing or for repaying debt. |

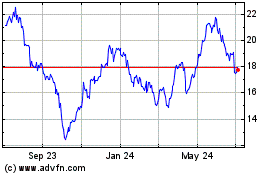

AES (NYSE:AES)

Historical Stock Chart

From Aug 2024 to Sep 2024

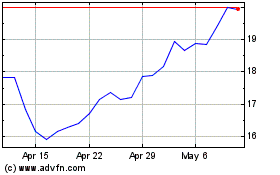

AES (NYSE:AES)

Historical Stock Chart

From Sep 2023 to Sep 2024