UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 30, 2015

Autoliv, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-12933 |

|

51-0378542 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

Vasagatan 11, 7th Floor, SE-111 20

Box 70381,

SE-107 24,

Stockholm, Sweden

(Address and Zip Code of principal executive offices)

+46 8 587 20 600

(Registrant’s telephone number, including area code)

Not Applicable

(Former

name or former address, if changed since last report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| |

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 7.01 Regulation FD Disclosure.

Autoliv, Inc. (“Autoliv” or the “Company”) today published certain recast, unaudited historical financial information for

the operating segments which became operational on January 1, 2015. Autoliv previously announced on August 13, 2014 that it intended to implement a new operating structure with two operating segments in order to more effectively manage its

business operations and allow for future growth.

The Company will report its results under the two new segments, Passive Safety and

Electronics, commencing with its quarterly report for the period ending March 31, 2015. Passive Safety includes Autoliv’s airbag and seatbelt businesses, while Electronics joins all of Autoliv’s electronics resources and expertise in

both passive safety electronics and active safety in one organization.

Under this new operating structure, Autoliv will report segment

information for: sales, operating income, capital expenditures and depreciation & amortization in its quarterly earnings releases and periodic reports.

The figures are available in pdf format as an attachement to the press release and as a downloadable excel file at Autoliv’s corporate

website: http://www.autoliv.com/Investors/Pages/Financials. Autoliv intends to publish the quarterly earnings report for the first quarter 2015 on Wednesday, April 22, 2015. The recast information does not revise or restate our previously

reported consolidated financial statements.

A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K

and is incorporated herein by reference.

The information in this Form 8-K and the exhibit attached hereto shall not be deemed

“filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any

filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d)

EXHIBITS

|

|

|

| 99.1 |

|

Press Release of Autoliv, Inc. dated March 30, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

| AUTOLIV, INC. |

|

|

| By: |

|

/s/ Fredrik Peyron |

| Name: |

|

Fredrik Peyron |

| Title: |

|

Group Vice President for Legal Affairs, |

|

|

General Counsel and Secretary |

Date: March 30, 2015

EXHIBIT INDEX

|

|

|

| Exhibit No. |

|

Description |

|

|

| 99.1 |

|

Press Release of Autoliv, Inc. dated March 30, 2015. |

Exhibit 99.1

Autoliv presents recast historical financial information for new operating segments

(Stockholm, Sweden, March 30, 2015) — Autoliv, Inc. (NYSE: ALV and SSE: ALIVsdb) today published certain recast, unaudited historical

financial information for the operating segments which became operational on January 1, 2015. Autoliv previously announced on August 13, 2014 that it intended to implement a new operating structure with two operating segments in order to

more effectively manage its business operations and allow for future growth.

The Company will report its results under the two new segments, Passive

Safety and Electronics, commencing with its quarterly report for the period ending March 31, 2015. Passive Safety includes Autoliv’s airbag and seatbelt businesses, while Electronics joins all of Autoliv’s electronics resources and

expertise in both passive safety electronics and active safety in one organization.

Under this new operating structure, Autoliv will report segment

information for: sales, operating income, capital expenditures and depreciation & amortization in its quarterly earnings releases and periodic reports.

The figures are available in pdf format as an attachement to this press release and as a downloadable excel file at Autoliv’s corporate website:

http://www.autoliv.com/Investors/Pages/Financials. Autoliv intends to publish the quarterly earnings report for the first quarter 2015 on Wednesday, April 22, 2015. The recast information does not revise or restate our previously reported

consolidated financial statements.

Inquiries:

Thomas Jönsson, Group Vice President Communications Tel +46 (8) 58 72 06 27

About Autoliv

Autoliv, Inc., the

worldwide leader in automotive safety systems, develops and manufactures automotive safety systems for all major automotive manufacturers in the world. Together with its joint ventures, Autoliv has more than 80 facilities with more than 60,000

employees in 28 countries. In addition, the Company has ten technical centers in nine countries around the world, with 20 test tracks, more than any other automotive safety supplier. Sales in 2014 amounted to US $9.2 billion. The Company’s

shares are listed on the New York Stock Exchange (NYSE: ALV) and its Swedish Depository Receipts on the OMX Nordic Exchange in Stockholm (ALIVsdb). For more information about Autoliv, please visit our company website at www.autoliv.com.

Safe Harbor Statement

This report contains statements that are not historical facts but rather forward-looking statements within the meaning of the Private Securities Litigation

Reform Act of 1995. Such forward-looking statements include those that address activities, events or developments that Autoliv, Inc. or its management believes or anticipates may occur in the future. All forward-looking statements, including without

limitation, management’s examination of historical operating trends and data, as well as estimates of future sales, operating margin, cash flow, effective tax rate or other future operating performance or financial results, are based upon our

current expectations, various assumptions and data available from third parties. Our expectations and assumptions are expressed in good faith and we believe there is a reasonable basis for them. However, there can be no assurance that such

forward-looking statements will materialize or prove to be correct as forward-looking statements are inherently subject to known and unknown risks, uncertainties and other factors which may cause actual future results, performance or achievements to

differ materially from the future results, performance or achievements expressed in or implied by such forward-looking statements. Because these forward-looking statements involve risks and uncertainties, the outcome could differ materially from

those set out in the forward-looking statements for a variety of reasons, including without limitation, changes in global light vehicle production; fluctuation in vehicle production schedules for which the Company is a supplier, changes in general

industry and market conditions, changes in and the successful execution of our capacity alignment, restructuring and cost reduction initiatives discussed herein and the market reaction thereto; loss of business from increased competition; higher raw

material, fuel and energy costs; changes in consumer and customer preferences for end products; customer losses; changes in regulatory conditions; customer bankruptcies or divestiture of customer brands; unfavorable fluctuations in currencies or

interest rates among the various jurisdictions in which we operate; component shortages; market acceptance of our new products; costs or difficulties related to the integration of any new or acquired businesses and technologies; continued

uncertainty in pricing negotiations with customers, our ability to be awarded new business; product liability, warranty and recall claims and other litigation and customer reactions thereto; higher expenses for our pension and other postretirement

benefits; work stoppages or other labor issues; possible adverse results of pending or future litigation or infringement claims; negative impacts of antitrust investigations or other governmental investigations and associated litigation (including

securities litigation) relating to the conduct of our business; tax assessments by governmental authorities and changes in our effective tax rate; dependence on key personnel; legislative or regulatory changes limiting our business; political

conditions; dependence on and relationships with customers and suppliers; and other risks and uncertainties identified under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results

of Operations” in our Annual Reports and Quarterly Reports on Forms 10-K and 10-Q and any amendments thereto. The Company undertakes no obligation to update publicly or revise any forward-looking statements in light of new information or future

events. For any forward-looking statements contained in this or any other document, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995, and we assume no

obligation to update any such statement.

Segment Information (unaudited)

Sales, including Intersegment Sales

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Dollars in millions) |

|

Q1 2014 |

|

|

Q2 2014 |

|

|

Q3 2014 |

|

|

Q4 2014 |

|

|

FY 2014 |

|

|

FY 2013 |

|

| Passive Safety |

|

$ |

1,951.5 |

|

|

$ |

2,013.9 |

|

|

$ |

1,862.9 |

|

|

$ |

1,971.8 |

|

|

$ |

7,800.1 |

|

|

$ |

7,575.1 |

|

| Electronics |

|

|

354.8 |

|

|

|

380.5 |

|

|

|

356.9 |

|

|

|

396.7 |

|

|

|

1,488.9 |

|

|

|

1,258.6 |

|

| Total segment sales |

|

$ |

2,306.3 |

|

|

$ |

2,394.4 |

|

|

$ |

2,219.8 |

|

|

$ |

2,368.5 |

|

|

$ |

9,289.0 |

|

|

$ |

8,833.7 |

|

| Corporate and other |

|

|

4.0 |

|

|

|

5.1 |

|

|

|

5.0 |

|

|

|

6.0 |

|

|

|

20.1 |

|

|

|

21.5 |

|

| Intersegment sales |

|

|

(14.5 |

) |

|

|

(16.5 |

) |

|

|

(16.8 |

) |

|

|

(20.8 |

) |

|

|

(68.6 |

) |

|

|

(51.8 |

) |

| Net sales |

|

$ |

2,295.8 |

|

|

$ |

2,383.0 |

|

|

$ |

2,208.0 |

|

|

$ |

2,353.7 |

|

|

$ |

9,240.5 |

|

|

$ |

8,803.4 |

|

Income before income taxes

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Dollars in millions) |

|

Q1 2014 |

|

|

Q2 2014 |

|

|

Q3 2014 |

|

|

Q4 2014 |

|

|

FY 2014 |

|

|

FY 2013 |

|

| Passive Safety |

|

$ |

155.8 |

|

|

$ |

110.3 |

|

|

$ |

144.6 |

|

|

$ |

187.5 |

|

|

$ |

598.1 |

|

|

$ |

619.9 |

|

| Electronics |

|

|

18.7 |

|

|

|

18.1 |

|

|

|

14.8 |

|

|

|

24.4 |

|

|

|

76.0 |

|

|

|

84.0 |

|

| Segment operating income |

|

$ |

174.5 |

|

|

$ |

128.4 |

|

|

$ |

159.4 |

|

|

$ |

211.9 |

|

|

$ |

674.1 |

|

|

$ |

703.9 |

|

| Corporate and other |

|

|

17.2 |

|

|

|

11.0 |

|

|

|

15.4 |

|

|

|

4.8 |

|

|

|

48.5 |

|

|

|

57.5 |

|

| Interest and other non-operating expenses, net |

|

|

(9.1 |

) |

|

|

(19.2 |

) |

|

|

(19.7 |

) |

|

|

(14.5 |

) |

|

|

(62.5 |

) |

|

|

(34.7 |

) |

| Income from equity method investments |

|

|

1.7 |

|

|

|

2.7 |

|

|

|

1.4 |

|

|

|

1.1 |

|

|

|

6.9 |

|

|

|

7.3 |

|

| Income before income taxes |

|

$ |

184.3 |

|

|

$ |

122.9 |

|

|

$ |

156.5 |

|

|

$ |

203.3 |

|

|

$ |

667.0 |

|

|

$ |

734.0 |

|

Capital Expenditures

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Dollars in millions) |

|

Q1 2014 |

|

|

Q2 2014 |

|

|

Q3 2014 |

|

|

Q4 2014 |

|

|

FY 2014 |

|

|

FY 2013 |

|

| Passive Safety |

|

$ |

80.4 |

|

|

$ |

97.1 |

|

|

$ |

97.3 |

|

|

$ |

114.2 |

|

|

$ |

389.0 |

|

|

$ |

326.8 |

|

| Electronics |

|

|

12.5 |

|

|

|

18.0 |

|

|

|

19.8 |

|

|

|

13.8 |

|

|

|

64.1 |

|

|

|

57.4 |

|

| Corporate and other |

|

|

0.4 |

|

|

|

0.1 |

|

|

|

1.3 |

|

|

|

1.1 |

|

|

|

2.9 |

|

|

|

1.4 |

|

| Total capital expenditures |

|

$ |

93.3 |

|

|

$ |

115.2 |

|

|

$ |

118.4 |

|

|

$ |

129.1 |

|

|

$ |

456.0 |

|

|

$ |

385.6 |

|

Depreciation and Amortization

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Dollars in millions) |

|

Q1 2014 |

|

|

Q2 2014 |

|

|

Q3 2014 |

|

|

Q4 2014 |

|

|

FY 2014 |

|

|

FY 2013 |

|

| Passive Safety |

|

$ |

61.9 |

|

|

$ |

64.3 |

|

|

$ |

64.5 |

|

|

$ |

63.9 |

|

|

$ |

254.6 |

|

|

$ |

238.1 |

|

| Electronics |

|

|

10.4 |

|

|

|

11.1 |

|

|

|

11.5 |

|

|

|

12.2 |

|

|

|

45.2 |

|

|

|

38.6 |

|

| Corporate and other |

|

|

1.5 |

|

|

|

1.4 |

|

|

|

1.4 |

|

|

|

1.3 |

|

|

|

5.6 |

|

|

|

9.3 |

|

| Total depreciation and amortization |

|

$ |

73.8 |

|

|

$ |

76.8 |

|

|

$ |

77.4 |

|

|

$ |

77.4 |

|

|

$ |

305.4 |

|

|

$ |

286.0 |

|

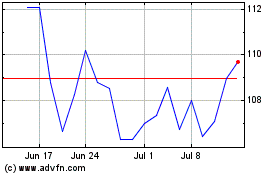

Autoliv (NYSE:ALV)

Historical Stock Chart

From Mar 2024 to Apr 2024

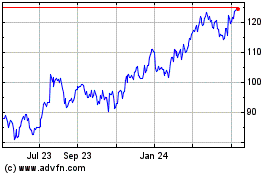

Autoliv (NYSE:ALV)

Historical Stock Chart

From Apr 2023 to Apr 2024