Current Report Filing (8-k)

January 12 2015 - 4:38PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT

REPORT PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of Earliest Event Reported): January 12, 2015

AMERICAN TOWER CORPORATION

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

| Delaware |

|

001-14195 |

|

65-0723837 |

| (State or Other Jurisdiction of

Incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

116 Huntington Avenue

Boston, Massachusetts 02116

(Address of Principal Executive Offices) (Zip Code)

(617) 375-7500

(Registrant’s telephone number, including area code)

Not Applicable

(Former

name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| |

¨ |

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 8.01 Other Events.

On January 12, 2015, American Tower Corporation (the “Company”) issued a press release (the “Press Release”)

announcing its election to call for redemption all of its outstanding 4.625% senior unsecured notes due 2015 (the “Notes”). In accordance with the redemption provisions of the Notes and the Indenture dated as of October 20, 2009 (the

“Indenture”) between the Company and The Bank of New York Mellon Trust Company, N.A., as trustee, the Notes will be redeemed at a price equal to the principal amount of the Notes plus a make-whole premium calculated pursuant to the terms

of the Indenture, together with accrued and unpaid interest, if any, up to, but excluding, the redemption date, which has been set for February 11, 2015.

A copy of the Press Release announcing the redemption of the Notes is filed herewith as Exhibit 99.1 and incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

|

|

| Exhibit No. |

|

Description |

|

|

| 99.1 |

|

Press Release, dated January 12, 2015. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

AMERICAN TOWER CORPORATION |

|

|

|

|

|

|

|

(Registrant) |

|

|

|

|

| Date: January 12, 2015 |

|

|

|

By: |

|

/s/ THOMAS A.

BARTLETT |

|

|

Thomas A. Bartlett |

|

|

Executive Vice President and Chief Financial Officer |

EXHIBIT INDEX

|

|

|

| Exhibit No. |

|

Description |

|

|

| 99.1 |

|

Press Release, dated January 12, 2015. |

Exhibit 99.1

Contact: Leah Stearns

Senior Vice President, Investor Relations and Treasurer

Telephone: (617) 375-7500

AMERICAN TOWER CORPORATION CALLS FOR REDEMPTION

OF ALL OUTSTANDING 4.625% SENIOR NOTES

Boston, Massachusetts – January 12, 2015: American Tower Corporation (NYSE: AMT) announced today its election to call for redemption all of

its outstanding 4.625% senior unsecured notes due 2015. The redemption date has been set for February 11, 2015. In accordance with the redemption provisions of the notes and the indenture dated as of October 20, 2009, the notes will be

redeemed at a price equal to the principal amount of the notes plus a make-whole premium calculated pursuant to the terms of the indenture, together with accrued and unpaid interest, if any, up to, but excluding, the redemption date. The Company

intends to fund the redemption with borrowings under its credit facilities.

About American Tower

American Tower is a leading independent owner, operator and developer of wireless and broadcast communications real estate with a global portfolio of

approximately 70,000 communications sites. For more information about American Tower, please visit www.americantower.com.

Cautionary Language Regarding Forward-Looking Statements

This press release contains “forward-looking statements” concerning the Company’s goals, beliefs, expectations, strategies, objectives, plans,

future operating results and underlying assumptions and other statements that are not necessarily based on historical facts. Actual results may differ materially from those indicated in the Company’s forward-looking statements as a result of

various factors, including those factors set forth in Item 1A of its Form 10-Q for the quarter ended September 30, 2014 under the caption “Risk Factors.” The Company undertakes no obligation to update the information contained in

this press release to reflect subsequently occurring events or circumstances.

# # #

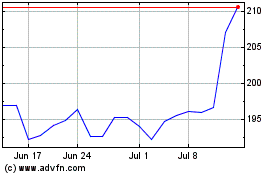

American Tower (NYSE:AMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

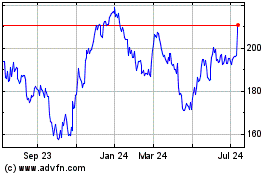

American Tower (NYSE:AMT)

Historical Stock Chart

From Apr 2023 to Apr 2024