UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_____________________________________________

FORM 8-K

_____________________________________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): January 7, 2015

_____________________________________________

ACUITY BRANDS, INC.

(Exact name of registrant as specified in its charter)

_____________________________________________

|

| | | | |

Delaware | | 001-16583 | | 58-2632672 |

(State or other jurisdiction of Company or organization) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

|

| | |

1170 Peachtree St., N.E., Suite 2300, Atlanta, GA | | 30309 |

(Address of principal executive offices) | | (Zip Code) |

Registrant's telephone number, including area code: 404-853-1400

None

(Former Name or Former Address, if Changed Since Last Report)

_____________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02. Results of Operations and Financial Condition.

On January 9, 2015, Acuity Brands, Inc. (the “Company”) issued a press release containing information about the Company's results of operations for its fiscal quarter ended November 30, 2014. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K, which is incorporated herein by reference. The information contained in this paragraph, as well as Exhibit 99.1 referenced herein, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933.

The press release includes the following non-GAAP financial measures: “adjusted selling, distribution, and administrative (“SD&A”) expenses,” “adjusted operating profit,” “adjusted operating profit margin,” “adjusted net income,” and “adjusted diluted earnings per share” (“EPS”). These non-GAAP financial measures are provided to enhance the reader's overall understanding of the Company's current financial performance and prospects for the future. Specifically, management believes that adjusted SD&A expenses, adjusted operating profit, adjusted operating profit margin, adjusted net income, and adjusted diluted EPS provide useful information to investors by excluding or adjusting items for special charges associated with efforts to streamline the organization as well as the incremental recoveries associated with previously disclosed fraud perpetrated at the freight payment and audit service firm formerly retained by the Company. Management believes these items impacted the comparability of the Company's results and that they are not reflective of the fixed costs or benefits that the Company will incur over the long term. However, the Company has incurred similar charges associated with streamlining activities in prior fiscal years and continually evaluates streamlining measures which could result in additional charges in future periods. These non-GAAP financial measures should be considered in addition to, and not as a substitute for or superior to, results prepared in accordance with GAAP. The most directly comparable GAAP measure for adjusted SD&A expenses is “SD&A expenses” which includes the benefit of the insurance recovery related to the previously reported fraud. The most directly comparable GAAP measures for adjusted operating profit, adjusted operating profit margin, adjusted net income, and adjusted diluted EPS are “operating profit,” “operating profit margin,” “net income,” and “diluted EPS,” respectively, which include the impact of the special charges as well as the incremental recoveries associated with the aforementioned fraud.

Item 8.01. Other Events.

On January 7, 2015, the Board of Directors declared a quarterly dividend of 13 cents per share. A copy of the related press release is attached as exhibit 99.2 to this Current Report on Form 8-K, which is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

|

| | |

99.1 | | Press Release dated January 9, 2015 |

99.2 | | Press Release dated January 7, 2015 |

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

Date: January 9, 2015

|

| | |

| | |

ACUITY BRANDS, INC. |

| |

By: | | /s/ Richard K. Reece |

| | Richard K. Reece |

| | Executive Vice President and Chief Financial Officer |

|

| | |

EXHIBIT INDEX |

99.1 | Press Release dated January 9, 2015 | (Filed with the Commission as part of this Form 8-K). |

99.2 | Press Release dated January 7, 2015 | (Filed with the Commission as part of this Form 8-K). |

Exhibit 99.1

Company Contact:

Dan Smith

Acuity Brands, Inc.

(404) 853-1423

Acuity Brands Reports Record First Quarter Results

Net Sales Rise 13 percent; Adjusted Diluted EPS Increases 38 Percent

ATLANTA, January 9, 2015 - Acuity Brands, Inc. (NYSE: AYI) (“Company”) today announced record first quarter net sales, net income, and diluted earnings per share (“EPS”). Fiscal 2015 first quarter net sales of $647.4 million increased $72.7 million, or 13 percent, compared with the year-ago period. Net income for the first quarter of fiscal 2015 was $51.1 million, an increase of 15 percent compared with the prior-year period. Fiscal 2015 first quarter diluted EPS of $1.17 increased 14 percent compared with $1.03 for the year-ago period.

Fiscal 2015 first quarter adjusted net income of $57.4 million increased $16.0 million, or 39 percent, compared with adjusted net income of $41.4 million for the prior-year period. Adjusted diluted EPS for the first quarter of fiscal 2015 increased 38 percent to $1.32 compared with adjusted diluted EPS of $0.96 for the year-ago period. Adjusted results for the first quarter of fiscal 2015 exclude a $10.0 million pre-tax special charge, or $0.15 diluted EPS, related to streamlining activities. Adjusted results for the prior-year fiscal first quarter exclude the benefit of a $5.0 million pre-tax insurance recovery, or $0.07 diluted EPS, associated with a fiscal 2013 loss resulting from fraud perpetrated at a freight payment and audit service firm formerly retained by the Company. Management believes these items impacted the comparability of the Company's results and that the adjusted financial measures enhance the reader’s overall understanding of the Company's current financial performance. A reconciliation of adjusted financial measures to the most directly comparable GAAP measure is provided in the tables at the end of this release.

Vernon J. Nagel, Chairman, President, and Chief Executive Officer of Acuity Brands, commented, “We were extremely pleased with our record fiscal 2015 first quarter results. Gross profit margin of 42.2 percent increased 90 basis points over prior year’s first quarter, while adjusted operating profit margin of 14.9 percent increased 230 basis points over last year’s first quarter adjusted operating profit margin. Our variable contribution margin, i.e., the incremental adjusted operating profit as a percentage of the increase in net sales, was over 33 percent. We believe our record first quarter results reflect our ability to provide customers truly differentiated value from our industry-leading portfolio of innovative lighting and control solutions along with superior service.”

The year-over-year growth in fiscal 2015 first quarter net sales was due primarily to an increase in volume of more than 14 percent, partially offset by an estimated 1 percentage point net unfavorable change in product prices and mix of products sold (“price/mix”) and, to a lesser degree, an unfavorable impact from changes in foreign currency exchange rates. The increase in volume was broad-based across most product categories and key sales channels. Sales of LED-based products increased more than 70 percent from the year-ago period and represented approximately 42 percent of fiscal 2015 first quarter net sales.

Operating profit for the first quarter of fiscal 2015 was $86.7 million, an increase of $9.3 million, or 12 percent, over the year-ago period. Adjusted operating profit (excluding the impact of the special charge) for the first quarter of fiscal 2015 increased $24.3 million, or 34 percent, to $96.7 million compared with the year-ago period adjusted operating profit (excluding the impact of the insurance recovery) of $72.4 million. Adjusted operating profit margin for the first quarter of fiscal 2015 increased 230 basis points to 14.9 percent compared with 12.6 percent adjusted operating profit margin for the prior-year period.

During the first quarter of fiscal 2015, the Company recorded a pre-tax special charge of $10 million associated with actions to streamline the organization by realigning certain responsibilities, primarily within various selling, distribution, and administrative departments, as well as for the consolidation of certain production activities. The special charge consisted primarily of severance and employee-related costs. Management expects to incur production transfer expenses and additional costs associated with these streamlining actions totaling approximately $1.0 million during the next two fiscal quarters. Management expects to achieve net cost savings in fiscal 2015 in excess of the pre-tax charges.

Cash and cash equivalents at the end of the first quarter of fiscal 2015 totaled $583.0 million, an increase of $30.5 million since the beginning of the fiscal year. Net cash provided by operating activities totaled $46.7 million for the first quarter of fiscal 2015 compared with $43.4 million for the year-ago period.

Outlook

Mr. Nagel commented, “We remain very bullish about our prospects for continued future profitable growth. Third-party forecasts as well as key leading indicators suggest that the growth rate for the North American lighting market, which includes renovation and retrofit activity, will be in the mid-to-upper single digit range for fiscal 2015 with expectations that overall demand in our end markets will continue to experience solid growth over the next several years. Our order rates through the month of December reflect this favorable trend. Further, we expect to continue to outperform the growth rates of the markets we serve due to benefits from growing renovation and tenant improvement projects, further expansion in underpenetrated geographies and channels, and growth from the introduction of new products and lighting solutions. Additionally, we expect to continue to pursue growth opportunities enabled by newer technologies which require additional resources, including talent with specific skill sets, to drive innovation and accelerate commercialization of these evolving digital lighting solutions.”

Mr. Nagel concluded, “We believe the lighting and lighting-related industry will experience solid growth over the next decade, particularly as energy and environmental concerns come to the forefront along with emerging opportunities for digital lighting to play a key role in the Internet of Things. We believe we are well positioned to fully participate in this exciting industry.”

Non-GAAP Financial Measures

This news release contains non-GAAP financial measures such as “adjusted selling, distribution, and administrative expenses” (“adjusted SD&A expenses”), “adjusted operating profit”, “adjusted operating profit margin”, “adjusted net income”, and “adjusted diluted EPS”. These measures are provided to enhance the reader's overall understanding of the Company's current financial performance and prospects for the future. However, the Company’s non-GAAP financial measures may not be comparable to similarly titled non-GAAP financial measures used by other companies, have limitations as an analytical tool and should not be considered in isolation or as a substitute for GAAP financial measures.

A reconciliation of each measure to the most directly comparable GAAP measure is available in this news release. In addition, the Current Report on Form 8-K furnished to the SEC concurrent with the issuance of this press release includes a more detailed description of each of these non-GAAP financial measures, together with a discussion of the usefulness and purpose of such measures.

Conference Call

As previously announced, the Company will host a conference call to discuss first quarter results today, January 9, 2014, at 10:00 a.m. ET. Interested parties may listen to this call live today or hear a replay at the Company's Web site: www.acuitybrands.com.

About Acuity Brands

Acuity Brands, Inc. is a North American market leader and one of the world's leading providers of lighting solutions for both indoor and outdoor applications. With fiscal year 2014 net sales of $2.4 billion, Acuity Brands employs approximately 7,000 associates and is headquartered in Atlanta, Georgia with operations throughout North America, and in Europe and Asia. The Company’s lighting solutions are sold under various brands, including Lithonia Lighting®, Holophane®, Peerless®, Gotham®, Mark Architectural Lighting™, Winona® Lighting, Healthcare Lighting®, Hydrel®, American Electric Lighting®, Carandini®, Antique Street Lamps™, Sunoptics®, RELOC® Wiring Solutions, Acculamp®, eldoLED® and Acuity Controls.

Forward Looking Information

This release contains forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995. Statements that may be considered forward-looking include statements incorporating terms such as "expects," "believes," "intends," “estimates”, “forecasts,” "anticipates," “may,” “should”, “suggests”, “remain”, and similar terms that relate to future events, performance, or results of the Company and specifically include statements made in this press release regarding: prospects for future profitable growth; third-party forecasts of a mid-to-upper single digit growth rate for the North American lighting market for fiscal 2015 and expections that demand in the Company’s end markets will continue to experience solid growth over the next several years; expectation that opportunities exist that will allow the Company to outperform the growth rates of the markets it serves; expectation of solid growth over the next decade for the lighting and lighting-related industry and the Company’s position to fully participate; additional costs of approximately $1.0 million associated with streamlining activities to be incurred during the next two fiscal quarters; and achievement of cost savings in fiscal 2015 in excess of pre-tax special charges and plans to reinvest a portion of the savings over the next twelve months. Forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from the historical experience of Acuity Brands and management's present expectations or projections. These risks and uncertainties include, but are not limited to, customer and supplier relationships and prices; competition; ability to realize anticipated benefits from initiatives taken and timing of benefits; market demand; litigation and other contingent liabilities; and economic, political, governmental, and technological factors affecting the Company. Please see the other risk factors more fully described in the Company’s SEC filings including risks discussed in Part I, “Item 1a. Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended August 31, 2014. The discussion of those risks is specifically incorporated herein by reference. Management believes these forward-looking statements are reasonable; however, undue reliance should not be placed on any forward-looking statements, which are based on current expectations. Further, forward-looking statements speak only as of the date they are made, and management undertakes no obligation to update publicly any of them in light of new information or future events.

ACUITY BRANDS, INC.

CONSOLIDATED BALANCE SHEETS

(In millions, except share and per-share data)

|

| | | | | | | |

| November 30, 2014 | | August 31, 2014 |

| (unaudited) | | |

ASSETS | | | |

Current Assets: | |

| | |

|

Cash and cash equivalents | $ | 583.0 |

| | $ | 552.5 |

|

Accounts receivable, less reserve for doubtful accounts of $1.6 and $1.9 as of November 30, 2014 and August 31, 2014, respectively | 371.8 |

| | 373.4 |

|

Inventories | 214.2 |

| | 212.0 |

|

Deferred income taxes | 20.8 |

| | 21.5 |

|

Prepayments and other current assets | 35.7 |

| | 27.3 |

|

Total Current Assets | 1,225.5 |

| | 1,186.7 |

|

Property, Plant, and Equipment, at cost: | |

| | |

|

Land | 7.3 |

| | 7.8 |

|

Buildings and leasehold improvements | 115.8 |

| | 116.0 |

|

Machinery and equipment | 390.4 |

| | 375.8 |

|

Total Property, Plant, and Equipment | 513.5 |

| | 499.6 |

|

Less — Accumulated depreciation and amortization | 352.8 |

| | 347.1 |

|

Property, Plant, and Equipment, net | 160.7 |

| | 152.5 |

|

Other Assets: | |

| | |

|

Goodwill | 567.9 |

| | 569.4 |

|

Intangible assets, net | 227.6 |

| | 231.6 |

|

Deferred income taxes | 3.4 |

| | 3.0 |

|

Other long-term assets | 21.0 |

| | 24.9 |

|

Total Other Assets | 819.9 |

| | 828.9 |

|

Total Assets | $ | 2,206.1 |

| | $ | 2,168.1 |

|

LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

Current Liabilities: | |

| | |

|

Accounts payable | $ | 277.5 |

| | $ | 287.4 |

|

Accrued compensation | 41.1 |

| | 54.8 |

|

Accrued pension liabilities, current | 1.2 |

| | 1.2 |

|

Other accrued liabilities | 133.8 |

| | 127.1 |

|

Total Current Liabilities | 453.6 |

| | 470.5 |

|

Long-Term Debt | 353.6 |

| | 353.6 |

|

Accrued Pension Liabilities, less current portion | 62.1 |

| | 65.1 |

|

Deferred Income Taxes | 58.4 |

| | 58.4 |

|

Self-Insurance Reserves, less current portion | 7.2 |

| | 6.8 |

|

Other Long-Term Liabilities | 60.5 |

| | 50.2 |

|

Total Liabilities | 995.4 |

| | 1,004.6 |

|

Stockholders’ Equity: | |

| | |

|

Preferred stock, $0.01 par value; 50,000,000 shares authorized; none issued | — |

| | — |

|

Common stock, $0.01 par value; 500,000,000 shares authorized; 52,824,677 issued and 43,105,422 outstanding at November 30, 2014; 52,581,917 issued and 42,862,662 outstanding at August 31, 2014 | 0.5 |

| | 0.5 |

|

Paid-in capital | 770.5 |

| | 761.5 |

|

Retained earnings | 939.1 |

| | 893.6 |

|

Accumulated other comprehensive loss | (79.2 | ) | | (71.9 | ) |

Treasury stock, at cost, 9,719,255 shares at November 30, 2014 and August 31, 2014 | (420.2 | ) | | (420.2 | ) |

Total Stockholders’ Equity | 1,210.7 |

| | 1,163.5 |

|

Total Liabilities and Stockholders’ Equity | $ | 2,206.1 |

| | $ | 2,168.1 |

|

ACUITY BRANDS, INC.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (Unaudited)

(In millions, except per-share data)

|

| | | | | | | |

| Three Months Ended |

| November 30, 2014 | | November 30, 2013 |

Net Sales | $ | 647.4 |

| | $ | 574.7 |

|

Cost of Products Sold | 374.4 |

| | 337.6 |

|

Gross Profit | 273.0 |

| | 237.1 |

|

Selling, Distribution, and Administrative Expenses | 176.3 |

| | 159.7 |

|

Special Charge | 10.0 |

| | — |

|

Operating Profit | 86.7 |

| | 77.4 |

|

Other Expense (Income): | |

| | |

|

Interest Expense, net | 7.9 |

| | 8.0 |

|

Miscellaneous (Income)/Expense, net | (0.9 | ) | | 0.6 |

|

Total Other Expense | 7.0 |

| | 8.6 |

|

Income before Provision for Income Taxes | 79.7 |

| | 68.8 |

|

Provision for Income Taxes | 28.6 |

| | 24.3 |

|

Net Income | $ | 51.1 |

| | $ | 44.5 |

|

| | | |

Earnings Per Share: | |

| | |

|

Basic Earnings per Share | $ | 1.18 |

| | $ | 1.03 |

|

Basic Weighted Average Number of Shares Outstanding | 43.0 |

| | 42.6 |

|

Diluted Earnings per Share | $ | 1.17 |

| | $ | 1.03 |

|

Diluted Weighted Average Number of Shares Outstanding | 43.3 |

| | 42.9 |

|

Dividends Declared per Share | $ | 0.13 |

| | $ | 0.13 |

|

| | | |

Comprehensive Income: | | | |

Net Income | $ | 51.1 |

| | $ | 44.5 |

|

Other Comprehensive Income/(Expense) Items: | | | |

Foreign currency translation adjustments | (7.2 | ) | | 2.3 |

|

Defined benefit pension plans, net of tax | (0.1 | ) | | 0.6 |

|

Other Comprehensive Income/(Expense), net of tax | (7.3 | ) | | 2.9 |

|

Comprehensive Income | $ | 43.8 |

| | $ | 47.4 |

|

| | | |

ACUITY BRANDS, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited)

(In millions)

|

| | | | | | | |

| Three Months Ended |

| November 30, 2014 | | November 30, 2013 |

Cash Provided by/(Used for) Operating Activities: | | | |

Net income | $ | 51.1 |

| | $ | 44.5 |

|

Adjustments to reconcile net income to net cash provided by (used for) operating activities: | | | |

Depreciation and amortization | 11.3 |

| | 10.6 |

|

Share-based compensation expense | 4.1 |

| | 4.5 |

|

Excess tax benefits from share-based payments | (9.2 | ) | | (5.2 | ) |

Deferred income taxes | 0.4 |

| | 0.8 |

|

Change in assets and liabilities, net of effect of acquisitions, divestitures and effect of exchange rate changes: | | | |

Accounts receivable | (0.7 | ) | | (14.0 | ) |

Inventories | (2.9 | ) | | (5.0 | ) |

Prepayments and other current assets | (8.8 | ) | | (4.7 | ) |

Accounts payable | (8.8 | ) | | (5.4 | ) |

Other current liabilities | 6.7 |

| | 19.8 |

|

Other | 3.5 |

| | (2.5 | ) |

Net Cash Provided by Operating Activities | 46.7 |

| | 43.4 |

|

Cash Provided by/(Used for) Investing Activities: | |

| | |

|

Purchases of property, plant, and equipment | (18.5 | ) | | (8.5 | ) |

Proceeds from sale of property, plant, and equipment | — |

| | 0.9 |

|

Net Cash Used for Investing Activities | (18.5 | ) | | (7.6 | ) |

Cash Provided by/(Used for) Financing Activities: | |

| | |

|

Proceeds from stock option exercises and other | 4.9 |

| | 2.6 |

|

Excess tax benefits from share-based payments | 9.2 |

| | 5.2 |

|

Dividends paid | (5.6 | ) | | (5.6 | ) |

Other financing activities | (3.2 | ) | | — |

|

Net Cash Provided by Financing Activities | 5.3 |

| | 2.2 |

|

Effect of Exchange Rate Changes on Cash | (3.0 | ) | | 1.0 |

|

Net Change in Cash and Cash Equivalents | 30.5 |

| | 39.0 |

|

Cash and Cash Equivalents at Beginning of Period | 552.5 |

| | 359.1 |

|

Cash and Cash Equivalents at End of Period | $ | 583.0 |

| | $ | 398.1 |

|

ACUITY BRANDS, INC.

Reconciliation of Non-U.S. GAAP Measures

The tables below reconcile certain GAAP financial measures to the corresponding non-GAAP measures:

|

| | | | | | | | | | | | | |

(In millions, except per-share data) | Three Months Ended November 30, |

| 2014 | | 2013 |

| | | % of Net Sales | | | | % of Net Sales |

Net Sales | $ | 647.4 |

| | | | $ | 574.7 |

| | |

| | | | | | | |

Selling, Distribution, and Administrative Expenses (GAAP) | $ | 176.3 |

| | 27.2 | % | | $ | 159.7 |

| | 27.8 | % |

Add-back: Fraud-Related Recovery | — |

| | | | 5.0 |

| | |

Adjusted Selling, Distribution and Administrative Expenses (Non-GAAP) | $ | 176.3 |

| | 27.2 | % | | $ | 164.7 |

| | 28.7 | % |

| | | | | | | |

Operating Profit (GAAP) | $ | 86.7 |

| | 13.4 | % | | $ | 77.4 |

| | 13.5 | % |

Less: Fraud-Related Recovery | — |

| | | | (5.0 | ) | | |

Add-back: Special Charge | 10.0 |

| | | | — |

| | |

Adjusted Operating Profit (Non-GAAP) | $ | 96.7 |

| | 14.9 | % | | $ | 72.4 |

| | 12.6 | % |

| | | | | | | |

Net Income (GAAP) | $ | 51.1 |

| | | | $ | 44.5 |

| | |

Less: Fraud-Related Recovery, net of tax | — |

| | | | (3.1 | ) | | |

Add-back: Special Charge, net of tax | 6.3 |

| | | | — |

| | |

Adjusted Net Income (Non-GAAP) | $ | 57.4 |

| | | | $ | 41.4 |

| | |

| | | | | | | |

Diluted Earnings per Share (GAAP) | $ | 1.17 |

| | | | $ | 1.03 |

| | |

Less: Fraud-Related Recovery, net of tax | — |

| | | | (0.07 | ) | | |

Add-back: Special Charge, net of tax | 0.15 |

| | | | — |

| | |

Adjusted Diluted Earnings per Share (Non-GAAP) | $ | 1.32 |

| | | | $ | 0.96 |

| | |

Exhibit 99.2

Acuity Brands, Inc.

1170 Peachtree Street, NE

Suite 2300

Atlanta, GA 30309

Tel: 404 853 1400

Fax: 404 853 1430

AcuityBrands.com

Company Contact:

Dan Smith

Acuity Brands, Inc.

(404) 853-1423

ACUITY BRANDS

DECLARES QUARTERLY DIVIDEND

ATLANTA, January 7, 2015 - The Board of Directors of Acuity Brands, Inc. (NYSE: AYI; "Company") today declared a quarterly dividend of 13 cents per share. The dividend is payable on February 2, 2015 to shareholders of record on January 21, 2015

About Acuity Brands

Acuity Brands, Inc. is a North American market leader and one of the world's leading providers of lighting solutions for both indoor and outdoor applications. With fiscal year 2014 net sales of $2.4 billion, Acuity Brands employs approximately 7,000 associates and is headquartered in Atlanta, Georgia with operations throughout North America, and in Europe and Asia. The Company’s lighting solutions are sold under various brands, including Lithonia Lighting®, Holophane®, Peerless®, Gotham®, Mark Architectural Lighting™, Winona® Lighting, Healthcare Lighting®, Hydrel®, American Electric Lighting®, Carandini®, Antique Street Lamps™, Sunoptics®, RELOC® Wiring Solutions, Acculamp®, eldoLED® and Acuity Controls.

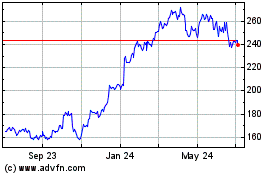

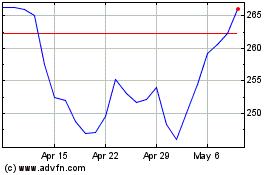

Acuity Brands (NYSE:AYI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Acuity Brands (NYSE:AYI)

Historical Stock Chart

From Apr 2023 to Apr 2024