UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): December 17, 2014

APOGEE ENTERPRISES, INC.

(Exact name of registrant as specified in its charter)

|

| | | | |

| | | | |

Minnesota | | 0-6365 | | 41-0919654 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| |

4400 West 78th Street, Suite 520, Minneapolis, Minnesota | | 55435 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (952) 835-1874

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| |

¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

|

| |

ITEM 2.02 | RESULTS OF OPERATIONS AND FINANCIAL CONDITION |

On December 17, 2014, Apogee Enterprises, Inc. issued a press release announcing its financial results for the third quarter of fiscal 2015. A copy of this press release is furnished (not filed) as Exhibit 99.1 to this Current Report on Form 8-K, and is incorporated herein by reference.

|

| |

ITEM 9.01 | FINANCIAL STATEMENTS AND EXHIBITS |

(d) Exhibits.

Exhibit 99.1 Press Release issued by Apogee Enterprises, Inc. dated December 17, 2014.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

| | |

| | |

APOGEE ENTERPRISES, INC. |

| |

By: | | /s/ James S. Porter |

| | James S. Porter Chief Financial Officer |

Dated: December 18, 2014

EXHIBIT INDEX

|

| | | | | | |

| | | | | |

Exhibit Number | | Description | | | |

99.1 |

| | Press Release issued by Apogee Enterprises, Inc. dated December 17, 2014. |

APOGEE REPORTS SIGNIFICANT FISCAL 2015 Q3 SALES, EARNINGS GROWTH

| |

• | Operating income up 62 percent |

| |

• | Backlog grew to $494 million, up 65 percent |

| |

• | FY15 EPS outlook raised to $1.64 to $1.72 |

MINNEAPOLIS, MN (December 17, 2014) – Apogee Enterprises, Inc. (Nasdaq:APOG) today announced fiscal 2015 third-quarter results. Apogee provides distinctive solutions for enclosing commercial buildings and framing art.

FY15 THIRD QUARTER VS. PRIOR-YEAR PERIOD

| |

• | Revenues of $244.4 million were up 23 percent. |

| |

• | Operating income of $20.6 million was up 62 percent. |

| |

• | Earnings per share of $0.47 were up 42 percent. |

| |

◦ | Prior year benefitted from a lower tax rate. |

| |

• | Backlog of $493.9 million was up 65 percent, or $194 million. |

| |

• | Cash and short-term investments were $34.3 million. |

COMMENTARY

“I am pleased that Apogee again achieved another quarter of outstanding revenue and earnings growth,” said Joseph F. Puishys, Apogee chief executive officer. “In our third quarter, all four segments had double-digit revenue growth, while all but one segment had strong earnings growth.

“Architectural glass operating income tripled, and the architectural framing systems and large-scale optical segments each saw approximately 30 percent growth in operating income,” he said. “Operating income in the architectural services segment was impacted by writedowns on a few projects, issues of which were resolved.

“During the quarter, Apogee improved gross margin by 140 basis points and operating margin by 200 basis points,” said Puishys. He added, “At 8.4 percent, our operating margin is at its highest level in five years. Overall Apogee converted 21 percent of incremental organic growth to operating margin.

“At the same time, our backlog grew sequentially and year on year to its highest level in six years, as we continue to win future work at improving margins,” he said.

- MORE -

Apogee Enterprises, Inc. • 4400 West 78th Street • Minneapolis, MN 55435 • (952) 835-1874 • www.apog.com

Apogee Enterprises, Inc.

Page 2

“We are expecting a strong finish to fiscal 2015 and have raised the bottom end of our earnings per share outlook and now expect to earn $1.64 to $1.72 per share for the year,” Puishys said.

FY15 THIRD-QUARTER SEGMENT AND OPERATING RESULTS VS. PRIOR-YEAR PERIOD

Architectural Glass

| |

• | Revenues of $90.3 million were up 23 percent. |

| |

• | Operating income grew to $5.8 million, compared to $1.6 million. |

| |

◦ | Operating margin expanded 430 basis points to 6.5 percent, compared to 2.2 percent. |

| |

• | As the U.S. non-residential sector continues to strengthen, the architectural glass segment is benefitting from operating leverage on volume growth and improved pricing. |

Architectural Services

| |

• | Revenues of $56.2 million were up 10 percent. |

| |

• | Operating income was $0.3 million, compared to $0.4 million. |

| |

◦ | Operating margin was 0.6 percent, compared to 0.7 percent. |

| |

◦ | Operating results were impacted by writedowns on a few projects, issues of which were resolved. |

Architectural Framing Systems

| |

• | Revenues of $80.4 million were up 36 percent, with organic growth of 19 percent excluding the Canadian acquisition in the third quarter of fiscal 2014. |

| |

◦ | U.S. businesses in the segment had double-digit growth. |

| |

• | Operating income of $7.6 million was up 31 percent from $5.8 million. |

| |

◦ | Operating margin was 9.4 percent, compared to 9.8 percent. |

| |

◦ | Good operational performance in the segment was offset by higher aluminum costs and charges related to the acquisition of Custom Window assets in fiscal 2014. |

Large-Scale Optical Technologies

| |

• | Revenues of $25.5 million were up 13 percent, driven by strong orders for all channels, particularly in retail. |

| |

• | Operating income of $7.9 million was up 30 percent from $6.1 million. |

| |

◦ | Operating margin expanded 410 basis points to 30.8 percent, compared to 26.7 percent. |

| |

◦ | Segment results benefitted from a richer product mix. |

Consolidated Backlog

| |

• | Backlog of $493.9 million increased from $480.2 million in the second quarter and $299.9 million in the prior-year period. |

| |

◦ | Approximately $182 million, or 37 percent, of the backlog is expected to be delivered in fiscal 2015, and approximately $312 million, or 63 percent, in fiscal 2016 and beyond. |

Financial Condition

| |

• | Debt was $22.6 million, compared to $20.7 million in the prior-year period. Almost all the debt is long-term, low-interest industrial revenue bonds. |

| |

• | Cash and short-term investments totaled $34.3 million, compared to $28.7 million at the end of fiscal 2014 and $22.5 million in the prior-year period. |

- MORE -

Apogee Enterprises, Inc. • 4400 West 78th Street • Minneapolis, MN 55435 • (952) 835-1874 • www.apog.com

Apogee Enterprises, Inc.

Page 3

| |

• | Non-cash working capital was $98.5 million, compared to $77.3 million at the end of fiscal 2014 and $72.1 million in the prior-year period. |

| |

• | Capital expenditures year to date were $18.7 million, compared to $17.3 million in the prior-year period. |

| |

• | Depreciation and amortization year to date was $21.6 million. |

OUTLOOK

“We are confident about the fourth quarter and have raised our outlook for the full year to earnings of $1.64 to $1.72 per share, from $1.62 to $1.72 per share,” said Puishys. “We continue to expect revenue growth of at least 20 percent for fiscal 2015.

“Our backlog for fiscal 2016 and beyond is strong, and with our robust bidding and quoting activity, we believe our backlog will again grow sequentially in the fourth quarter,” he said. “The strength we are seeing in our architectural business combined with positive forecasts for our commercial construction markets give us continued confidence in sustained growth for Apogee.

“Regarding our architectural services segment, we expect that the full year will show improvement in operating margin compared to fiscal 2014. We anticipate that the segment’s fourth quarter operating margin will improve significantly from the third quarter, but will be down slightly compared to the prior-year period based on expected project timing,” he said.

“We expect that capital spending for fiscal 2015 will be approximately $35 million, including capacity expansions underway in architectural glass and architectural finishing,” he said. “We again expect to be free cash flow positive after this level of investments.” He added that the fiscal 2015 gross margin is anticipated to be approximately 22 percent.

“Our strategies to grow through new geographies, new products and new markets along with our focus on productivity and operational improvements are delivering results,” Puishys said. “We have extended our long-term outlook to fiscal 2018 expectations for revenues of $1.3 billion at 12 percent operating margin.”

TELECONFERENCE AND SIMULTANEOUS WEBCAST

Apogee will host a teleconference and webcast at 9 a.m. Central Time tomorrow, December 18. To participate in the teleconference, call 1-877-703-6108 toll free or 857-244-7307 international, access code 20304620. The replay will be available from noon Central Time on December 18 through midnight Central Time on January 9, 2015, by dialing 1-888-286-8010, access code 83682857. To listen to the live conference call over the internet, go to the Apogee web site at http://www.apog.com and click on “investor relations” and then the webcast link at the top of that page. The webcast also will be archived on the company’s web site.

ABOUT APOGEE ENTERPRISES

Apogee Enterprises, Inc., headquartered in Minneapolis, is a leader in technologies involving the design and development of value-added glass products and services. The company is organized in four segments, with three of the segments serving the commercial construction market:

| |

▪ | Architectural Glass segment consists of Viracon, the leading fabricator of coated, high-performance architectural glass for global markets. |

| |

▪ | Architectural Services segment consists of Harmon, Inc., one of the largest U.S. full-service building glass installation and renovation companies. |

- MORE -

Apogee Enterprises, Inc. • 4400 West 78th Street • Minneapolis, MN 55435 • (952) 835-1874 • www.apog.com

Apogee Enterprises, Inc.

Page 4

| |

▪ | Architectural Framing Systems segment businesses design, engineer, fabricate and finish the aluminum frames for window, curtainwall and storefront systems that comprise the outside skin of buildings. Businesses in this segment are: Wausau Window and Wall Systems, a manufacturer of custom aluminum window systems and curtainwall; Tubelite, a fabricator of aluminum storefront, entrance and curtainwall products; Alumicor, a fabricator of aluminum storefront, entrance, curtainwall and window products for Canadian markets; and Linetec, a paint and anodizing finisher of window frames and PVC shutters. |

| |

▪ | Large-Scale Optical segment consists of Tru Vue, a value-added glass and acrylic manufacturer primarily for the custom picture framing market. |

USE OF NON-GAAP FINANCIAL MEASURES

In addition to financial measures prepared in accordance with generally accepted accounting principles (GAAP), this news release also contains non-GAAP financial measures. Specifically, Apogee has presented backlog, free cash flow, non-cash working capital and organic growth. Backlog is defined as the dollar amount of revenues Apogee expects to recognize in the future from firm contracts or orders received, as well as those that are in progress. Free cash flow is defined as net cash flow provided by operating activities, minus capital expenditures. Non-cash working capital is defined as current assets, excluding cash and short-term available for sale securities, short-term restricted investments and current portion of long-term debt, less current liabilities. The organic growth rate is defined as growth excluding that from Alumicor, Apogee’s Canadian storefront business. Apogee believes that use of these non-GAAP financial measures enhances communications as they provide more transparency into management’s performance with respect to cash, current assets and liabilities, and revenue growth without the extraordinary effect of recent acquisitions. Non-GAAP financial measures should be viewed in addition to, and not as an alternative to, the reported operating results or cash flows from operations or any other measure of performance prepared in accordance with GAAP.

FORWARD-LOOKING STATEMENTS

The discussion above contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements reflect Apogee management’s expectations or beliefs as of the date of this release. The company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. All forward-looking statements are qualified by factors that may affect the operating results of the company, including the following: (A) operational risks: i) the cyclical nature and market conditions of the North American and Latin American commercial construction industries, which impact our three architectural segments; ii) consumer confidence and the conditions of the U.S. economy, which impact our large-scale optical segment; iii) actions of competitors or new market entrants; iv) ability to fully and efficiently utilize production capacity; v) product performance, reliability, execution or quality problems; vi) installation project management issues that could result in losses on individual contracts; vii) changes in consumer and customer preference, or architectural trends and building codes; and viii) dependence on a relatively small number of customers in certain business segments; (B) financial risks: i) revenue and operating results that are volatile; and ii) financial market disruption, which could impact company, customer and supplier credit availability; (C) self-insurance risk related to a material product liability or other event for which the company is liable; (D) cost of compliance with environmental regulations; (E) potential impact on financial results if one or more senior executives were no longer active with the company; and (F) integration of two recent acquisitions. The company cautions investors that actual future results could differ materially from those described in the forward-looking statements, and that other factors may in the future prove to be important in affecting the company’s results of operations. New factors emerge from time to time and it is not possible for management to predict all such factors, nor can it assess the impact of each such factor on the business or the extent to which any factor, or a combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. For a more detailed explanation of the foregoing and other risks and uncertainties, see Item 1A of the company’s Annual Report on Form 10-K for the fiscal year ended March 1, 2014.

- MORE -

Apogee Enterprises, Inc. • 4400 West 78th Street • Minneapolis, MN 55435 • (952) 835-1874 • www.apog.com

Apogee Enterprises, Inc.

Page 5

(Tables follow)

- MORE -

Apogee Enterprises, Inc. • 4400 West 78th Street • Minneapolis, MN 55435 • (952) 835-1874 • www.apog.com

Apogee Enterprises, Inc.

Page 6

|

| | | | | | | | | | | | | | | | | | | | | |

Apogee Enterprises, Inc. & Subsidiaries |

Consolidated Condensed Statement of Income |

(Unaudited) |

| Thirteen | | Thirteen | | | | Thirty-nine | | Thirty-nine | | |

| Weeks Ended | | Weeks Ended | | % | | Weeks Ended | | Weeks Ended | | % |

Dollar amounts in thousands, except for per share amounts | November 29, 2014 | | November 30, 2013 | | Change | | November 29, 2014 | | November 30, 2013 | | Change |

| | | | | | | | | | | |

Net sales | $ | 244,410 |

| | $ | 199,430 |

| | 23 | % | | $ | 687,238 |

| | $ | 557,028 |

| | 23 | % |

Cost of goods sold | 187,757 |

| | 156,042 |

| | 20 | % | | 539,826 |

| | 438,719 |

| | 23 | % |

Gross profit | 56,653 |

| | 43,388 |

| | 31 | % | | 147,412 |

| | 118,309 |

| | 25 | % |

Selling, general and administrative expenses | 36,028 |

| | 30,681 |

| | 17 | % | | 103,474 |

| | 90,129 |

| | 15 | % |

Operating income | 20,625 |

| | 12,707 |

| | 62 | % | | 43,938 |

| | 28,180 |

| | 56 | % |

Interest income | 243 |

| | 206 |

| | 18 | % | | 706 |

| | 593 |

| | 19 | % |

Interest expense | 357 |

| | 228 |

| | 57 | % | | 774 |

| | 973 |

| | (20 | )% |

Other (expense) income, net | (16 | ) | | 107 |

| | N/M |

| | 1,461 |

| | 72 |

| | 1,929 | % |

Earnings before income taxes | 20,495 |

| | 12,792 |

| | 60 | % | | 45,331 |

| | 27,872 |

| | 63 | % |

Income tax expense | 6,759 |

| | 3,124 |

| | 116 | % | | 8,703 |

| | 7,924 |

| | 10 | % |

Net earnings | $ | 13,736 |

| | $ | 9,668 |

| | 42 | % | | $ | 36,628 |

| | $ | 19,948 |

| | 84 | % |

| | | | | | | | | | | |

Earnings per share - basic | $ | 0.47 |

| | $ | 0.34 |

| | 38 | % | | $ | 1.27 |

| | $ | 0.70 |

| | 81 | % |

Average common shares outstanding | 28,725,412 |

| | 28,483,460 |

| | 1 | % | | 28,758,986 |

| | 28,439,421 |

| | 1 | % |

Earnings per share - diluted | $ | 0.47 |

| | $ | 0.33 |

| | 42 | % | | $ | 1.25 |

| | $ | 0.68 |

| | 84 | % |

Average common and common equivalent shares outstanding | 29,357,729 |

| | 29,376,301 |

| | — | % | | 29,349,533 |

| | 29,308,095 |

| | — | % |

Cash dividends per common share | $ | 0.1000 |

| | $ | 0.0900 |

| | 11 | % | | $ | 0.3000 |

| | $ | 0.2700 |

| | 11 | % |

| | | | | | | | | | | |

- MORE -

Apogee Enterprises, Inc. • 4400 West 78th Street • Minneapolis, MN 55435 • (952) 835-1874 • www.apog.com

Apogee Enterprises, Inc.

Page 7

|

| | | | | | | | | | | | | | | | | | | | | |

Business Segments Information |

(Unaudited) |

| Thirteen | | Thirteen | | | | Thirty-nine | | Thirty-nine | | |

| Weeks Ended | | Weeks Ended | | % | | Weeks Ended | | Weeks Ended | | % |

| November 29, 2014 | | November 30, 2013 | | Change | | November 29, 2014 | | November 30, 2013 | | Change |

Sales | | | | | | | | | | | |

Architectural Glass | $ | 90,268 |

| | $ | 73,365 |

| | 23 | % | | $ | 254,138 |

| | $ | 218,142 |

| | 17 | % |

Architectural Services | 56,178 |

| | 51,167 |

| | 10 | % | | 167,146 |

| | 139,820 |

| | 20 | % |

Architectural Framing Systems | 80,411 |

| | 58,981 |

| | 36 | % | | 221,369 |

| | 152,877 |

| | 45 | % |

Large-scale Optical | 25,546 |

| | 22,699 |

| | 13 | % | | 64,969 |

| | 61,917 |

| | 5 | % |

Eliminations | (7,993 | ) | | (6,782 | ) | | (18 | )% | | (20,384 | ) | | (15,728 | ) | | (30 | )% |

Total | $ | 244,410 |

| | $ | 199,430 |

| | 23 | % | | $ | 687,238 |

| | $ | 557,028 |

| | 23 | % |

Operating income (loss) | | | | | | | | | | | |

Architectural Glass | $ | 5,836 |

| | $ | 1,641 |

| | 256 | % | | $ | 11,935 |

| | $ | 3,782 |

| | 216 | % |

Architectural Services | 323 |

| | 351 |

| | (8 | )% | | 2,279 |

| | (1,401 | ) | | N/M |

|

Architectural Framing Systems | 7,596 |

| | 5,782 |

| | 31 | % | | 16,974 |

| | 13,026 |

| | 30 | % |

Large-scale Optical | 7,879 |

| | 6,058 |

| | 30 | % | | 15,990 |

| | 16,072 |

| | (1 | )% |

Corporate and other | (1,009 | ) | | (1,125 | ) | | 10 | % | | (3,240 | ) | | (3,299 | ) | | 2 | % |

Total | $ | 20,625 |

| | $ | 12,707 |

| | 62 | % | | $ | 43,938 |

| | $ | 28,180 |

| | 56 | % |

| | | | | | | | | | | |

Consolidated Condensed Balance Sheets | | | | | | | | |

(Unaudited) | | | | | | | | |

| | | | | | | | | | | |

| November 29, 2014 | | March 1, 2014 | | | | | | | | |

Assets | | | | | | | | | | | |

Current assets | $ | 276,084 |

| | $ | 242,792 |

| | | | | | | | |

Net property, plant and equipment | 192,053 |

| | 193,946 |

| | | | | | | | |

Other assets | 123,993 |

| | 128,619 |

| | | | | | | | |

Total assets | $ | 592,130 |

| | $ | 565,357 |

| | | | | | | | |

Liabilities and shareholders' equity | | | | | | | | | | | |

Current liabilities | $ | 143,351 |

| | $ | 136,834 |

| | | | | | | | |

Long-term debt | 22,505 |

| | 20,659 |

| | | | | | | | |

Other liabilities | 52,074 |

| | 55,234 |

| | | | | | | | |

Shareholders' equity | 374,200 |

| | 352,630 |

| | | | | | | | |

Total liabilities and shareholders' equity | $ | 592,130 |

| | $ | 565,357 |

| | | | | | | | |

| | | | | | | | | | | |

N/M = Not meaningful | | | | | | | | | | | |

- MORE -

Apogee Enterprises, Inc. • 4400 West 78th Street • Minneapolis, MN 55435 • (952) 835-1874 • www.apog.com

Apogee Enterprises, Inc.

Page 8

|

| | | | | | | | | |

Apogee Enterprises, Inc. & Subsidiaries |

Consolidated Condensed Statement of Cash Flows |

(Unaudited) |

| | | Thirty-nine | | Thirty-nine |

| | | Weeks Ended | | Weeks Ended |

Dollar amounts in thousands | | November 29, 2014 | | November 30, 2013 |

| | | | | |

Net earnings | | | $ | 36,628 |

| | $ | 19,948 |

|

Depreciation and amortization | | | 21,558 |

| | 19,576 |

|

Stock-based compensation | | | 3,705 |

| | 3,471 |

|

Proceeds from new markets tax credit transaction, net of deferred costs | | | — |

| | 7,752 |

|

Other, net | | | (4,387 | ) | | (5,515 | ) |

Changes in operating assets and liabilities | | | (20,424 | ) | | (2,526 | ) |

Net cash provided by operating activities | | | 37,080 |

| | 42,706 |

|

Capital expenditures | | | (18,659 | ) | | (17,255 | ) |

Proceeds on sale of property | | | 204 |

| | 733 |

|

Acquisition of businesses, net of cash acquired | | | — |

| | (52,806 | ) |

Net sales of restricted investments | | | 2,067 |

| | 2,768 |

|

Net sales of marketable securities | | | 805 |

| | 23,617 |

|

Investments in life insurance | | | (739 | ) | | — |

|

Net cash used in investing activities | | | (16,322 | ) | | (42,943 | ) |

Proceeds from issuance of debt | | | 1,946 |

| | — |

|

Payments on debt | | | (38 | ) | | (10,068 | ) |

Shares withheld for taxes, net of stock issued to employees | | | (3,615 | ) | | (961 | ) |

Repurchase and retirement of common stock | | | (6,894 | ) | | — |

|

Dividends paid | | | (8,875 | ) | | (7,868 | ) |

Other, net | | | 2,520 |

| | 1,663 |

|

Net cash used in financing activities | | | (14,956 | ) | | (17,234 | ) |

Increase (decrease) in cash and cash equivalents | | | 5,802 |

| | (17,471 | ) |

Effect of exchange rates on cash | | | (200 | ) | | (443 | ) |

Cash and cash equivalents at beginning of year | | | 28,465 |

| | 37,767 |

|

Cash and cash equivalents at end of period | | | $ | 34,067 |

| | $ | 19,853 |

|

|

| |

Contact: | Mary Ann Jackson |

| Investor Relations |

| 952-487-7538 |

| mjackson@apog.com |

- MORE -

Apogee Enterprises, Inc. • 4400 West 78th Street • Minneapolis, MN 55435 • (952) 835-1874 • www.apog.com

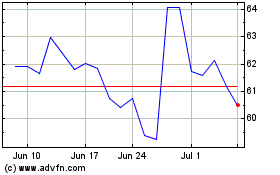

Apogee Enterprises (NASDAQ:APOG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Apogee Enterprises (NASDAQ:APOG)

Historical Stock Chart

From Apr 2023 to Apr 2024