UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 11, 2014

FOSSIL GROUP, INC.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

0-19848 |

|

75-2018505 |

|

(State or other jurisdiction of |

|

(Commission File Number) |

|

(IRS Employer |

|

incorporation or organization) |

|

|

|

Identification No.) |

|

901 S. Central Expressway |

|

|

|

Richardson, Texas |

|

75080 |

|

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (972) 234-2525

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition.

On November 11, 2014, Fossil Group, Inc. (the “Company”) issued a press release announcing financial results for the fiscal quarter ended October 4, 2014. A copy of the press release is attached hereto as Exhibit 99.1. On November 11, 2014, the Company hosted a conference call to discuss these financial results. A recording of the conference call has been posted on the Company’s website at www.fossilgroup.com. A copy of the transcript from the call is attached hereto as Exhibit 99.2.

The information in this Current Report and the accompanying exhibit are being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), and are not incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof, except as shall be expressly set forth by specific reference to this Current Report in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

99.1 Press Release, dated November 11, 2014, announcing financial results for the fiscal quarter ended October 4, 2014.

99.2 Transcript of November 11, 2014 conference call.

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date: November 13, 2014 |

|

|

|

|

|

|

FOSSIL GROUP, INC. |

|

|

|

|

|

|

|

|

|

By: |

/s/ Dennis R. Secor |

|

|

|

Dennis R. Secor |

|

|

|

Executive Vice President and |

|

|

|

Chief Financial Officer |

3

EXHIBIT INDEX

|

Exhibit No. |

|

Description |

|

|

|

|

|

99.1 |

|

Press Release, dated November 11, 2014, announcing financial results for the fiscal quarter ended October 4, 2014. |

|

|

|

|

|

99.2 |

|

Transcript of November 11, 2014 conference call. |

4

Exhibit 99.1

FOSSIL GROUP, INC. REPORTS THIRD QUARTER 2014 RESULTS

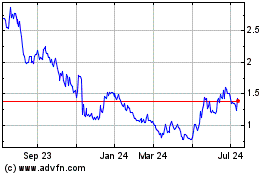

Third Quarter Net Sales Increase 10% to $894 Million; Diluted EPS Increases 24% to $1.96

Updates Full Year Guidance and Provides Fourth Quarter Guidance

Board of Directors Authorizes $1 Billion Share Repurchase Program

Richardson, TX. November 11, 2014 — Fossil Group, Inc. (NASDAQ: FOSL) (the “Company”) today reported its financial results for the third quarter ended October 4, 2014.

Third Quarter Highlights

· Net sales grew in all business segments:

· Wholesale net sales increased 10%, with increases in all wholesale segments

· Direct to consumer net sales increased 11%

· Global comparable store sales declined slightly, with a decrease in North America largely offset by increases in Europe and Asia Pacific

· Net sales of watches increased 12%

· Net sales of jewelry increased 23%

The Company reported net income for the third quarter of fiscal 2014 of $103.7 million, or $1.96 per diluted share, compared to $89.7 million or $1.58 per diluted share for the third quarter of fiscal 2013. The increase in diluted earnings per share resulted from operating income growth driven by increased sales and the benefit of a lower share base.

Kosta Kartsotis, Chief Executive Officer, commented on the results. “The third quarter marked another strong period for our company. We reported better-than-expected top and bottom line results, advanced many of the strategic initiatives that we expect will continue our favorable performance in the future and returned value to shareholders by capitalizing on our strong balance sheet and executing our share repurchase program. The quarter was highlighted by growth across our major geographies and driven by strength in our multi-brand watch portfolio, jewelry and our Fossil and Skagen lifestyle brands. We launched our Tory Burch watch collection — adding another powerful brand to our portfolio and furthering our Swiss watch initiative. We announced a partnership with Intel to support our wearable technology initiatives and just today, we announced the renewal of our licensing agreement with Michael Kors for ten years. Our overarching goal is to consistently deliver profitable top-line growth while investing in high return initiatives that can fuel our momentum over the long term and we believe fiscal 2014 is shaping up to represent a year of progress toward this objective.”

Mr. Kartsotis concluded, “Our consistent performance continues to demonstrate the strength of our portfolio of owned and licensed lifestyle brands, the innovation in our designs, the power of our global distribution model, and the disciplined execution of our growth strategies by our team. We continue to expect to capitalize on our strengths as we look to take advantage of the white space opportunities that exist for our company across geographies, categories, price points and channels of distribution. We also expect to drive efficiencies in our operating structure as we leverage the investments we have made over the past few years. All of this positions us well to consistently drive profitable growth into the future. Over the long term, we are very excited about our future and are well positioned to deliver sustained growth and outstanding returns for our shareholders.”

Operating Results

The translation impact of a weaker U.S. dollar increased the Company’s reported net sales by $2.8 million during the fiscal third quarter. The following discussion of the Company’s net sales is based on constant dollar performance.

Third quarter 2014 worldwide net sales rose 10% or $81.3 million, reflecting sales growth in each of the Company’s wholesale segments and direct to consumer segment. This sales increase was driven by strong growth in the Company’s multi-brand global watch portfolio as well as growth in the SKAGEN® and FOSSIL® brands. Jewelry sales increased significantly during the quarter, while sales of leathers declined.

Net sales from the North America wholesale segment increased 6%, or $19.1 million, compared to the third quarter of fiscal 2013. Growth in watches and jewelry drove the North American sales increase and were partially offset by a decline in leathers. Increases in wholesale shipments to major department store accounts and boutiques in the United States drove the regional performance.

Europe wholesale net sales rose 15%, or $30.5 million, compared to the third quarter of fiscal 2013. Strong high-teen growth in watches and jewelry drove the European sales increase and were partially offset by a decline in leathers. All European markets posted sales increases, with the strongest performance coming from the United Kingdom, France and Germany.

Asia Pacific wholesale net sales rose 11%, or $11.1 million, compared to the third quarter of fiscal 2013. Double digit growth in watches and a positive contribution from leathers drove the increase. The majority of markets contributed to the sales growth, with particularly strong growth in Japan and India.

Direct to consumer net sales for the third quarter of fiscal 2014 increased 11%, or $20.6 million, compared to the third quarter of fiscal 2013. The sales increase was primarily driven by the expansion of the global retail store base, as global comparable store sales declined slightly, with a decrease in North America largely offset by increases in Europe and Asia Pacific. Comparable sales were relatively flat in watches and jewelry with a slight decline in leathers.

During the third quarter of fiscal 2014, gross margin decreased 50 basis points to 56.9%, driven by the impact of increased promotional activity in the outlet channel, partially offset by the favorable impact of regional distribution mix given the growth in international markets.

The Company’s operating expenses increased during the third fiscal quarter due to the expansion of the Company’s retail store and concession base, advertising royalties, brand building, customer engagement activities and marketing. The Company’s operating expense rate decreased 40 basis points to 39.6% compared to 40.0% of net sales in the third quarter of fiscal 2013.

Operating income for the third quarter of fiscal 2014 increased 10%, or $13.9 million, compared to the prior fiscal year third quarter. Operating margin decreased 10 basis points to 17.3% of net sales, compared to 17.4% of net sales for the same period last fiscal year.

During the fiscal third quarter, interest expense increased $0.8 million to $3.8 million and other income increased $1.9 million to $2.2 million as a result of net gains on foreign currency contracts and account balances.

The Company’s effective income tax rate in the third quarter of fiscal 2014 was 30.6%, compared to 33.2% in the third quarter of fiscal 2013.

Share Repurchase

During the third quarter of fiscal 2014, the Company invested $133.8 million to repurchase 1.3 million shares of its common stock at an average price of $101 per share leaving $175 million remaining on its existing share repurchase authorizations at the end of the fiscal quarter. On November 10, 2014, the board of directors authorized a new $1 billion share repurchase program, which will expire in December 2018.

Sales and Earnings Guidance

For the full 2014 fiscal year, the Company now expects:

· Net sales to increase approximately 8.5% to 9.5%; including the impact of the additional week that occurred in the first fiscal quarter for the current 53-week year and the recent decline in foreign currency, primarily related to the Euro.

· Operating margin in a range of 15.8% to 16.4%

· Diluted earnings per share in a range of $7.00 to $7.30

For the fourth quarter of fiscal 2014, the Company expects:

· Net sales to increase approximately 3% to 6%, which includes an estimated negative 250 basis point growth rate impact due to foreign currency translation

· Operating margin in a range of 19.8% to 21.3%

· Diluted earnings per share in a range of $2.91 to $3.21

The Company’s guidance assumes that current foreign currency exchange rates that affect the Company’s financial results remain at prevailing levels, which includes the decline in the Euro that occurred at the end of the third quarter and an estimated $0.05 - $0.10 charge per diluted share associated with previously disclosed changes to its North American retail store portfolio. The Company’s fiscal 2014 includes 53 weeks compared to 52 weeks in fiscal 2013.

Safe Harbor

Certain statements contained herein that are not historical facts, including future earnings guidance, constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and involve a number of risks and uncertainties. The actual results of the future events described in such forward-looking statements could differ materially from those stated in such forward-looking statements. Among the factors that could cause actual results to differ materially are: changes in economic trends and financial performance, changes in consumer demands, tastes and fashion trends, lower levels of consumer spending resulting from a general economic downturn, shifts in market demand resulting in inventory risks, changes in foreign currency exchange rates, and the outcome of current and possible future litigation, as well as the risks and uncertainties set forth in the Company’s Annual Report on Form 10-K for the fiscal year ended December 28, 2013 filed with the Securities and Exchange Commission (the “SEC”).

About Fossil Group, Inc.

Fossil Group, Inc. is a global design, marketing and distribution company that specializes in consumer lifestyle and fashion accessories. The Company’s principal offerings include an extensive line of men’s and women’s fashion watches and jewelry sold under a diverse portfolio of proprietary and licensed brands, handbags, small leather goods, accessories and clothing. The Company’s products are sold to department stores, specialty retail stores and specialty watch and jewelry stores in the U.S. and in approximately 150 countries worldwide through approximately 25 Company-owned foreign sales subsidiaries and a network of over 60 independent distributors. The Company also distributes its products in over 580 Company-owned and operated retail stores, through its international e-commerce websites and through the Company’s U.S. e-commerce website at www.fossil.com. Certain press release and SEC filing information concerning the Company is also available at www.fossilgroup.com.

|

Investor Relations: |

Eric M. Cerny |

Allison Malkin |

|

|

FOSSIL GROUP, Inc. |

ICR, Inc. |

|

|

(855) 336-7745 |

(203) 682-8225 |

|

Consolidated Income |

|

For the 13

Weeks Ended |

|

For the 13

Weeks Ended |

|

For the 40

Weeks Ended |

|

For the 39

Weeks Ended |

|

|

Statement Data (in millions,

except per share data): |

|

October 4,

2014 |

|

September 28,

2013 |

|

October 4,

2014 |

|

September 28,

2013 |

|

|

Net sales |

|

$ |

894.5 |

|

$ |

810.4 |

|

$ |

2,444.8 |

|

$ |

2,197.5 |

|

|

Cost of sales |

|

385.5 |

|

345.4 |

|

1,047.9 |

|

945.2 |

|

|

Gross profit |

|

509.0 |

|

465.0 |

|

1,396.9 |

|

1,252.3 |

|

|

Gross margin |

|

56.9 |

% |

57.4 |

% |

57.1 |

% |

57.0 |

% |

|

Operating expense |

|

354.1 |

|

324.0 |

|

1,052.5 |

|

910.0 |

|

|

Operating expense (% of net sales) |

|

39.6 |

% |

40.0 |

% |

43.0 |

% |

41.4 |

% |

|

Operating income |

|

154.9 |

|

141.0 |

|

344.4 |

|

342.3 |

|

|

Operating margin |

|

17.3 |

% |

17.4 |

% |

14.1 |

% |

15.6 |

% |

|

Interest expense |

|

3.8 |

|

3.0 |

|

11.4 |

|

6.0 |

|

|

Other expense (income) — net |

|

(2.2 |

) |

(0.3 |

) |

(0.8 |

) |

(9.1 |

) |

|

Income before income taxes |

|

153.3 |

|

138.3 |

|

333.8 |

|

345.4 |

|

|

Tax provision |

|

46.9 |

|

45.9 |

|

103.3 |

|

108.6 |

|

|

Less: Net income attributable to noncontrolling interest |

|

2.7 |

|

2.7 |

|

7.9 |

|

7.2 |

|

|

Net income attributable to Fossil Group, Inc. |

|

$ |

103.7 |

|

$ |

89.7 |

|

$ |

222.6 |

|

$ |

229.6 |

|

|

Basic earnings per share |

|

$ |

1.97 |

|

$ |

1.59 |

|

$ |

4.16 |

|

$ |

3.95 |

|

|

Diluted earnings per share |

|

$ |

1.96 |

|

$ |

1.58 |

|

$ |

4.15 |

|

$ |

3.93 |

|

|

Weighted average common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

Basic |

|

52.7 |

|

56.5 |

|

53.5 |

|

58.2 |

|

|

Diluted |

|

52.9 |

|

56.7 |

|

53.7 |

|

58.4 |

|

|

Consolidated Balance Sheet Data (in |

|

October 4, |

|

September 28, |

|

|

millions): |

|

2014 |

|

2013 |

|

|

Assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

218.1 |

|

$ |

228.9 |

|

|

Accounts receivable-net |

|

395.8 |

|

360.6 |

|

|

Inventories |

|

695.2 |

|

656.6 |

|

|

Other current assets |

|

186.4 |

|

109.4 |

|

|

Total current assets |

|

$ |

1,495.5 |

|

$ |

1,355.5 |

|

|

|

|

|

|

|

|

|

Property, plant and equipment - net |

|

$ |

354.9 |

|

$ |

351.6 |

|

|

Goodwill |

|

201.0 |

|

205.0 |

|

|

Intangible and other assets - net |

|

185.5 |

|

178.1 |

|

|

Total long-term assets |

|

$ |

741.4 |

|

$ |

734.7 |

|

|

|

|

|

|

|

|

|

Total assets |

|

$ |

2,236.9 |

|

$ |

2,090.2 |

|

|

Liabilities and Stockholders’ Equity: |

|

|

|

|

|

|

Accounts payable, accrued expenses and other current liabilities |

|

$ |

477.8 |

|

$ |

422.6 |

|

|

Short-term debt |

|

15.2 |

|

14.6 |

|

|

Total current liabilities |

|

$ |

493.0 |

|

$ |

437.2 |

|

|

|

|

|

|

|

|

|

Long-term debt |

|

$ |

607.9 |

|

$ |

468.4 |

|

|

Other long-term liabilities |

|

174.7 |

|

145.8 |

|

|

Total long-term liabilities |

|

$ |

782.6 |

|

$ |

614.2 |

|

|

|

|

|

|

|

|

|

Stockholders’ equity |

|

$ |

961.3 |

|

$ |

1,038.8 |

|

|

|

|

|

|

|

|

|

Total liabilities and stockholders’ equity |

|

$ |

2,236.9 |

|

$ |

2,090.2 |

|

|

|

|

For the 13

Weeks Ended |

|

For the 13

Weeks Ended |

|

For the 40

Weeks Ended |

|

For the 39

Weeks Ended |

|

|

Business Segment Net Sales

(in millions) |

|

October 4,

2014 |

|

September 28,

2013 |

|

October 4,

2014 |

|

September 28,

2013 |

|

|

Wholesale: |

|

|

|

|

|

|

|

|

|

|

North America |

|

$ |

319.1 |

|

$ |

300.7 |

|

$ |

857.13 |

|

$ |

816.58 |

|

|

Europe |

|

242.2 |

|

209.5 |

|

650.2 |

|

554.2 |

|

|

Asia Pacific |

|

116.7 |

|

104.8 |

|

325.9 |

|

287.8 |

|

|

Total wholesale |

|

678.0 |

|

615.0 |

|

1,833.2 |

|

1,658.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Direct to consumer |

|

216.5 |

|

195.4 |

|

611.6 |

|

539.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total net sales |

|

$ |

894.5 |

|

$ |

810.4 |

|

$ |

2,444.8 |

|

$ |

2,197.5 |

|

Product Category Information

|

|

|

For the 13

Weeks Ended |

|

For the 13

Weeks Ended |

|

For the 40

Weeks Ended |

|

For the 39

Weeks Ended |

|

|

Product Sales

(in millions) |

|

October 4,

2014 |

|

September 28,

2013 |

|

October 4,

2014 |

|

September 28,

2013 |

|

|

Watches |

|

$ |

696.3 |

|

$ |

619.1 |

|

$ |

1,908.9 |

|

$ |

1,679.3 |

|

|

Leathers |

|

108.0 |

|

114.7 |

|

295.0 |

|

309.2 |

|

|

Jewelry |

|

70.7 |

|

57.3 |

|

183.4 |

|

146.7 |

|

|

Other |

|

19.5 |

|

19.3 |

|

57.5 |

|

62.3 |

|

|

Total net sales |

|

$ |

894.5 |

|

$ |

810.4 |

|

$ |

2,444.8 |

|

$ |

2,197.5 |

|

Store Count Information

|

|

|

October 4, 2014 |

|

September 28, 2013 |

|

|

|

|

North

America |

|

Other

International |

|

Total |

|

North

America |

|

Other

International |

|

Total |

|

|

Full price accessory |

|

119 |

|

167 |

|

286 |

|

115 |

|

162 |

|

277 |

|

|

Outlets |

|

137 |

|

94 |

|

231 |

|

115 |

|

73 |

|

188 |

|

|

Clothing |

|

30 |

|

2 |

|

32 |

|

30 |

|

2 |

|

32 |

|

|

Full price multi-brand |

|

6 |

|

26 |

|

32 |

|

6 |

|

22 |

|

28 |

|

|

Total stores |

|

292 |

|

289 |

|

581 |

|

266 |

|

259 |

|

525 |

|

Constant Currency Financial Information

The following table presents the Company’s business segment net sales on a constant currency basis. To calculate net sales on a constant currency basis, net sales for the current fiscal year period for entities reporting in currencies other than the U.S. dollar are translated into U.S. dollars at the actual effective rates during the comparable period of the prior fiscal year.

|

|

|

Net Sales

For the 13 Weeks Ended

October 4, 2014 |

|

Net Sales

For the 40 Weeks Ended

October 4, 2014 |

|

|

(in millions) |

|

As

Reported |

|

Impact of

Foreign

Currency

Exchange

Rates |

|

Constant

Currency |

|

As

Reported |

|

Impact of

Foreign

Currency

Exchange

Rates |

|

Constant

Currency |

|

|

Wholesale: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

North America |

|

$ |

319.1 |

|

$ |

(0.7 |

) |

$ |

319.8 |

|

$ |

857.1 |

|

$ |

(2.9 |

) |

$ |

860.0 |

|

|

Europe |

|

242.2 |

|

2.2 |

|

240.0 |

|

650.2 |

|

18.0 |

|

632.2 |

|

|

Asia Pacific |

|

116.7 |

|

0.7 |

|

116.0 |

|

325.9 |

|

(2.5 |

) |

328.4 |

|

|

Total wholesale |

|

678.0 |

|

2.2 |

|

675.8 |

|

1,833.2 |

|

12.6 |

|

1,820.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Direct to consumer |

|

216.5 |

|

0.6 |

|

215.9 |

|

611.6 |

|

2.8 |

|

608.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total net sales |

|

$ |

894.5 |

|

$ |

2.8 |

|

$ |

891.7 |

|

$ |

2,444.8 |

|

$ |

15.4 |

|

$ |

2,429.4 |

|

END OF RELEASE

Exhibit 99.2

Fossil Group, Inc. Third Quarter Earnings Release Conference Call

November 11, 2014

CORPORATE PARTICIPANTS

Eric Cerny Fossil Group Inc - IR

Kosta Kartsotis Fossil Group, Inc. - Chairman of the Board and CEO

Dennis Secor Fossil Group, Inc. - CFO

CONFERENCE CALL PARTICIPANTS

Erinn Murphy Piper Jaffray & Co. - Analyst

Omar Saad Evercore ISI Group - Analyst

Anna Andreeva Oppenheimer Capital - Analyst

Rick Patel Stephens Inc. - Analyst

Ike Boruchow Sterne, Agee & Leach, Inc. - Analyst

Dorothy Lakner Topeka Capital Markets - Analyst

Lorraine Hutchinson BofA Merrill Lynch - Analyst

Barbara Wyckoff CLSA - Analyst

John Kernan Cowen and Company - Analyst

Matt McClintock Barclays Capital - Analyst

Ed Yruma KeyBanc Capital Markets - Analyst

Randy Konik Jefferies & Company - Analyst

Laurent Vasilescu Macquarie Research Equities - Analyst

PRESENTATION

Operator

Good day and welcome to the Fossil Group Q3 earnings FY14 conference call. As a reminder, today’s conference is being recorded. At this time, I’d like to turn the conference over to Eric Cerny, Investor Relations.

Eric Cerny - Fossil Group Inc - IR

Thank you for joining us, and welcome to Fossil Group’s third quarter 2014 earnings conference call. I’d like to remind you that information made available during this conference call contains forward-looking information, and actual results could differ materially from those that will be projected during this call.

Fossil Group’s policy on forward-looking statements and additional information concerning a number of factors that could cause actual results to differ materially from such statements is readily available in our Form 10-K and 1 0-Q reports filed with the SEC. In addition, the Company assumes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by law.

Please note that you may listen to a live webcast or replay of this call by visiting FossilGroup.com under the Investors section. Now I would like to turn the call over to the Company’s Chairman and CEO, Kosta Kartsotis.

1

Kosta Kartsotis - Fossil Group, Inc. - Chairman of the Board and CEO

Thank you and good afternoon everyone. Joining us today is Dennis Secor, our Chief Financial Officer. We will begin today’s call with some prepared remarks and then open the call to answer any questions you have.

The third quarter marked another strong period for our Company. We reported better than expected top and bottom line results, advanced many of the strategic initiatives that we expect will continue our favorable performance in the future, and return value to shareholders by capitalizing on our strong balance sheet and executing our share repurchase program.

As you know, our overarching goal is to consistently deliver profitable top line growth while investing in high return initiatives that can fuel our momentum over the long term. We believe FY14 is shaping up to represent a year of progress toward this objective.

For the quarter, sales increased 10%, reflecting growth across all regions with Europe and Asia leading the way. Europe’s solid performance for the quarter reflected balanced growth with all major markets increasing over last year.

In our most mature market, North America, we were pleased with the sequential improvement in the growth rate for the region. Clearly, our unique assortments, creative designs and compelling brands all contributed to the performance and position us to achieve continued market share gains going forward.

Globally we continued to see the strongest gains in watches and jewelry. Once again, watches led our volume growth, increasing double digits in our FOSSIL and SKAGEN lifestyle brands as well as our multi-brand watch portfolio.

Across categories, jewelry delivered the highest growth rate, driven by Michael Kors, and it reflects our ability to continue with continuously innovate and capitalize on the growing importance of branded jewelry around the world. As we have mentioned previously, jewelry shares many of the characteristics of watches and is a category we can grow meaningfully, leveraging the synergies of our design, production and global distribution capabilities. We are focused on optimizing this important category for the coming years.

We were encouraged by the leather handbag performance for FOSSIL as the appeal of the new full priced women’s handbag assortment translated into improved performance for the category in our stores. SKAGEN benefited from the launch of a new handbag assortment, a newly redesigned website and two new high-profile retail locations opening during the quarter, resulting in a 24% growth for the brand for the quarter.

Operationally, we leveraged our strategic advantages and drove efficiencies in our structure, and through disciplined expense management, we leveraged expenses while still investing in customer-facing initiatives. Combined with sales that were better than planned and our continued commitment to share repurchase, we delivered earnings per share that exceeded our expectations and increased substantially over last year to $1.96 a share.

The quarter included many noteworthy highlights that we expect to build upon to enhance our growth in the fourth quarter and beyond. First, we grew our own lifestyle brands.

The FOSSIL brand grew modestly during the quarter, led by double-digit wholesale watch growth in all regions. FOSSIL’s strongest growth was once again in Asia, where we have been working hard to expand our distribution.

In Europe, we opened our first flagship store in Frankfurt, in a high-profile location with the largest opening day in the history of the brand. We think this store given the premier location in a major tourist destination will further advance our brand positioning in the region and incorporates new elements that will enhance the customer’s interaction with the brand.

Regarding our leathers business, while the overall category declined, we are seeing several positive indicators in our women’s handbags and believe the business is much healthier today than it was at this time last year. While we still have work to do to improve the total category, particularly in men’s and small leather goods, we are pleased with the traction we are gaining in the most significant segment of the category, women’s handbags, where we posted positive comps in our full-price accessory stores.

2

It is still early, the encouraging performance of the category reflects our elevated design aesthetic and more prominent placements in key department stores given the expansion of our shop-in-shop program. Our goal is to continue building on the positive performance during the holiday season with our updated collection that has been well received by our wholesale partners and customers alike.

We are very excited about SKAGEN, where our business accelerated in all regions during the quarter. Watches and jewelry posted strong double-digit gains, and we launched the brand’s first assortment of handbags with the performance exceeding our expectations in our SKAGEN retail stores.

We opened two new important stores, one in Frankfurt, Germany and the second in Times Square in New York City, both of which are off to a strong start. These stores along with the remodeled stores in London allow us to showcase the full array of product in an environment that represents the true image of the brand. We also launched our redesigned SKAGEN website which incorporates rich brand and lifestyle content, and increasing digital presence for SKAGEN is bringing greater awareness and interest to this contemporary Danish brand with a solid ROI.

Second, we saw continued strength in our multi-brand watch portfolio. We delivered a solid 12% increase for the quarter, benefiting from the performance of several brands within the portfolio.

The diversity of our portfolio, important lifestyle brands continues to be a very strong competitive advantage. The growth of the portfolio during the quarter continued to be balanced geographically with double-digit increases in Europe and Asia and solid growth in the Americas.

Michael Kors once again performed very well during the quarter as the brand continues to gain significant momentum in many of our international markets. In addition, Armani and Diesel were key contributors in the growth of the portfolio. Our goal is to continue to push all of our brands to reach their full potential.

And third, we continue to attract new brands and businesses that complement and extend our capabilities on a global basis. We are very excited about the launch of the Tory Burch collection during the quarter. The feedback has been tremendously positive since the launch, and given the brand already enjoys significant momentum, we are excited to be a part of the future growth of the brand and remain confident that it can be an exciting business for us.

Tory Burch is a great example of the fashion Swiss opportunity that we have as a Company. We think it can be a powerful tool to develop our international business and affords us the opportunity to combine the appreciation for Swiss-made craftsmanship with the lifestyle brands the customers connect with.

In addition, we renewed our Michael Kors licensing agreement for watches and jewelry for 10 years. We are very proud of what we have been able to accomplish through our partnership with their team., developing a tremendous accessories business for one of the most desirable lifestyle brands in existence today and becoming a disruptive force in the marketplace. This is a great partnership for both of us, fits well in our business model and we look forward to building on the success in the coming years.

On the wearable technology front, we announced a partnership with Intel during the quarter which will allow us to work with them to identify emerging technologies and to be involved with early-stage development of ideas and concepts that can be used in developing connected fashion accessories. This is a very exciting category that is rapidly evolving, and we are very excited about the potential for our brands to be actively involved in this space.

In addition to our work with Google, the relationship with Intel is another important element of our wearable technology strategy to partner with the best companies in the technology space in a way that enables us to integrate technology into our products to provide improved functionality and a unique branded experience for our fashion customer.

Finally, we achieved growth across all of our regions. The Americas grew 6% during the quarter with an increase in watch and jewelry shipments to major department stores and to boutiques driving the growth.

3

Our teams have been working with our wholesale partners to ensure that they have sufficient inventory levels to drive their sales plans. While we are encouraged with the trend during the quarter, we continue to be cautious regarding the current retail environment in the United States.

We continued our very strong performance in Europe, a region that is a great reflection of a business executing strategies well, leveraging the diversity of our brands, channels and categories. The 16% growth in the region was broadly based as we grew both watches and jewelry and expanded our business in all of our major markets.

In watches, FOSSIL and SKAGEN as well as our multi-brand watch portfolio delivered double-digit growth. Jewelry also increased double digits. We continue to be pleased with the trends we are seeing in our retail stores where comps have been positive in nearly all of our European markets despite the challenging traffic.

In Asia, sales grew 13% overall, and we saw double-digit gains in our larger markets of Japan and Australia. Our Korean business continued to be soft in the quarter, reflecting tepid market conditions in the country.

In China, while sales grew double digits during the quarter, including positive comps in the retail channel, the country is proving to be tougher than we originally thought from a distribution and brand awareness standpoint in addition to there being a softening retail environment. Having said that, we remain excited about the opportunity it represents over time, given the favorable market demographics.

As the middle class emerges and fashion brands begin to displace traditional watch brands, we believe that we are well positioned to take advantage of the opportunity. However, in the near term, we see growth being driven by other countries in the region with compelling demographics. India, a newer market for us that we continue to be increasingly excited about, is a great example of this type of market, and one where we saw growth of roughly 50% during the quarter.

In many Asia markets, we are investing in creating brand awareness for our brands to support years of future growth. The team is focused on cultivating high-quality distribution throughout the region and developing long-term initiatives such as fashion Swiss that can serve us well and fuel our advancement in the region.

Within our own stores, we have real opportunity to improve and drive our store productivity and profitability. We also have market penetration opportunity in underutilized channels such as digital and travel retail.

During the quarter, our team made excellent progress in our goal to create efficiencies in the more mature areas of our operating structure to create fuel to drive our growth. These efforts are vital to our future and create capacity for us to invest in our most important strategic opportunities to accelerate growth in FOSSIL and SKAGEN, build world-class digital capabilities and to leverage the relationships we are building to be a significant player in the wearable space.

As we prepare to enter the all-important holiday season, we feel we are on track to achieve our goals. Our consistent performance continues to demonstrate the strength of our portfolio of owned and licensed lifestyle brands, the innovation in our designs, the power of our global distribution model, and the disciplined execution of our growth strategies by our team.

We continue to expect to capitalize on our strengths as we look to take advantage of the white space opportunities that exist for our Company across geographies, categories, price points and channels of distribution. We also expect to drive efficiencies in our operating structure as we leverage the investments we’ve made over the last few years. All of this positions us well to consistently drive profitable growth into the future.

Over the long term, we are very excited about our future and are well positioned to deliver sustained growth and outstanding returns to our shareholders. Now I will ask Dennis to walk us through our performance and outlook before we take your questions.

4

Dennis Secor - Fossil Group, Inc. - CFO

Thanks, Kosta, and good afternoon, everyone. Third quarter net sales grew 10% to $894 million, exceeding our expectations and reflecting sales increases across all of our reported business segments despite a sharp decline in the Euro later in the quarter.

We exceeded our earnings expectations as strong sales and disciplined expense management offset lower gross margin as regional mix benefits were offset by outlet promotions. Sales growth during the quarter came from a very strong performance in Europe, a solid increase in Asia, and a sequential improvement in the Americas.

The FOSSIL brand grew 2% driven by a double-digit increase in watches, partially offset by declines in leathers and jewelry. In leathers, while the total category declined given last year’s higher clearance volumes, we are now in a much healthier inventory position. In fact, we continue to experience good reads on the new women’s handbag assortment as the business comped positively in our full price accessory stores.

Jewelry sales in the FOSSIL brand declined during the quarter, given our American distribution refinement and significant clearance activity last year in Europe. SKAGEN sales accelerated during the quarter, delivering 24% growth. All three regions drove solid double-digit growth with watches delivering the largest volume increase, jewelry delivering the largest rate increase, and we benefited from the launch of our handbag assortment.

Our recently remodeled stores in London continued to perform very well, and we incorporated many of our learnings from those stores in the two flagships we opened in the quarter. Our multi-brand watch portfolio remains very strong, growing 12% in the quarter with strong performances from key brands while some brands were down.

In North America wholesale, sales increased 6% to $319 million. Our US sales increase drove the region’s performance and grew as a result of increased shipments to major department stores and boutiques as well as successful launch of Tory Burch. We are pleased with the performance in the region during the quarter and are working hard to build on the momentum.

Sales to our off-price partners were relatively flat to last year. Our multi-brand watch portfolio delivered the greatest volume improvement for the quarter, and jewelry grew nearly 50%, while leathers declined.

In Europe wholesale, sales increased 16% to $242 million, which includes $2 million of favorable currency benefit. Our European growth was driven by high teen growth in both our multi-brand watch portfolio as well as the jewelry category. For FOSSIL, double-digit watch growth was more than offset by declines in leathers and jewelry.

Our growth continues to be balanced geographically as we posted gains in all of our major markets. We posted the strongest sales increases in the UK, France and Germany.

Sales from our Asia wholesale operations increased 11% to $117 million, which includes a small favorable currency translation impact. We posted gains in our owned brands as well as our multi-brand watch portfolio.

We drove growth across the majority of our markets with particular strength in Japan and India. Wholesale sales in Korea were down as market conditions there remained soft.

While we posted a strong increase in China, our growth rate decelerated from the second quarter as we did not achieve our sales goals in a softening retail environment. We continued to work to expand our distribution in China and develop relationships that we believe will best position us for growth in the region over time.

Sales growth in Asia was driven by increased sales in the wholesale channel, the largest channel in the region. Concession sales grew driven by door expansion, to a lesser extent than we anticipated, and we ended the quarter with 318 concessions in the region.

5

In our direct to consumer business, third quarter sales increased 11% to $217 million. Sales growth was driven by store expansion as overall comps were down slightly. Positive comp store sales results in Europe and Asia were offset by a modest decline in North America, primarily driven by the US stores where improved conversion rates were not enough to offset lower mall traffic.

Comp store sales in watches and jewelry were flat during the quarter, while sales of leathers decreased slightly. During the quarter we opened a net 23 stores, primarily international outlets where comps have been positive and key FOSSIL and SKAGEN flagships, bringing our Company-owned store count to 581 at quarter end.

In the third quarter, gross profit increased 9% to $509 million, compared to $465 million last year. While North American outlet promotions put the greatest pressure on our margins, we were able to offset much of that with the mix benefit that our strong international growth drove. That all resulted in a net 50 basis point decline to 56.9%.

We’re very pleased with our expense management during the quarter, as we leveraged operating expenses by 40 basis points, 39.6% of sales, compared to 40% last year. As we shared on our last call, our third quarter represented an important point in our investment cycle where we managed infrastructure spending tightly and drove leverage in more mature areas of our business, redeploying that capacity to invest in growth initiatives and customer-facing activities.

Our operating expenses increased $30 million, or 9% to $354 million. The increase was driven by our retail and concession expansion, advertising royalties, brand building for both FOSSIL and SKAGEN, marketing, and customer engagement such as our CRM program. Operating income increased 10% to $155 million for the quarter, while operating margin declined 10 basis points to 17.3%.

Interest expense increased $1 million to $4 million, given our higher debt levels. Other income, which relates to net currency contract and account balance gains, totaled $2 million.

Our effective income tax rate for the third quarter was 30.6%, compared to 33.2%. So overall, third quarter net income increased 16% to $104 million, as higher sales and expense leverage more than offset the modest decline in gross margin.

During the third quarter, we invested $134 million to repurchase 1.3 million shares of our common stock at an average price of about $101 per share. We ended the quarter with $175 million on our existing share repurchase authorization.

In addition to those, our Board of Directors has authorized a new $1 billion share repurchase program that will expire in late 2018. Third quarter earnings per share increased 24% to $1.96, from last year’s $1.58, as a result of operating income growth and the benefit of our lower share base.

Now turning to our cash flows and balance sheet. For the quarter, cash flow from operations increased $19 million to $40 million compared to $21 million a year ago. We ended the quarter with $218 million in cash compared to $229 million last year and debt of $623 million compared to $483 million a year ago.

We’re very pleased with our inventory management. We ended the quarter with inventory of $695 million, a 6% increase over last year. In constant currency, the growth was roughly 8%.

Our inventory growth was driven primarily by watches, where we have taken strong positions in our best performing brands. Accounts receivable increased by 10% to $396 million, and wholesale DSOs were in line with the prior year.

In the quarter, we invested $27 million in CapEx primarily to support new and remodeled stores, along with system investments. Depreciation and amortization expense totaled $25 million for the quarter.

Now moving to our outlook. We’re very pleased to have delivered a strong third quarter where sales exceeded our expectations, and we generally feel we are on track to meet our sales projections for the year.

6

Our results continue to demonstrate the value of operating a business model which is nicely diversified across multiple dimensions, geographies, categories, brands, channels and price points. That diversification positions us well to deliver strong results by leveraging the best performing aspects of our business.

With our compelling and differentiated products and brands, we continue to expect strong sales growth coming from our watch and jewelry businesses with both Europe and Asia poised to gain share. We remain encouraged by our most recent performance in the Americas, and we’re working hard to continue our momentum and maintain our full price stance in the watch category, particularly in department stores and our full priced accessory stores. Globally for the fourth quarter, we plan to manage our business tightly, control those things that are within our control and protect the long-term integrity of our brands and business.

Something that is beyond our control is currency valuations, and recent changes in the currency environment will likely affect our results. Since the last time we provided guidance, the Euro has declined sharply. What we had previously expected to be a fourth quarter tailwind will become a strong headwind instead, if currencies remain roughly at prevailing rates.

In addition to a sales headwind, it will also create pressure on gross margins. Partially offsetting those combined new headwinds will be lower US dollar expenses and nonoperating gains related to our hedge contracts.

All in, however, compared to our prior guidance, the net effect of currencies will be to reduce this year’s operating earnings, margin and EPS. And of course, if the rates stay where they are, we would expect the sales headwinds to persist for the first three quarters of 2015 and an even greater earnings headwind as current margin pressures would intensify and remain throughout the year.

Given our sales performance thus far this year and the current trends we see, we are expecting fourth quarter sales growth to be in the range between 3% and 6%. This includes the impact of the weaker currencies which alone represent about a 250 basis point growth rate headwind from last year.

Our sales expectations also assume a lower volume of off-price sales compared to last year, given our current inventory levels and the more significant volumes from a year ago. These assumptions would result in full year sales growth in the range between 8.5% to 9.5%, which includes the extra week from the first quarter.

With respect to gross margins, we do continue to expect strong international growth, and while we’re making great strides in our leathers business, we anticipate that the bulk of our sales growth will come from both watches and jewelry. These factors should affect our gross margins favorably though we don’t expect the fourth quarter mix tailwinds will be as strong as we did a quarter ago, given an updated sales mix among brands and categories.

We still expect that promotions will be necessary to compete in the outlets, and on top of that, currencies will also now likely represent a fourth-quarter margin headwind. In total, therefore, we’re now planning gross margins that are roughly flat to down for the fourth quarter, and flat to slightly down for the full year.

Regarding expenses, we’re very proud of the work our team has done to control expenses and drive efficiencies in order to fuel our investments in growth. Those efforts were certainly reflected in our third quarter results, and the entire organization is working tirelessly to continue to optimize our structure, to provide capacity for investments in brand building, customer engagement, marketing, demand creation, and advertising, both our own and our partners.

Just as we did for the third quarter, if fourth quarter sales align with our expectations, we expect to operate with an expense rate that is lower than a year ago. For the full year, given our first half expense rate increases, this would result in a full year expense rate that is higher than last year.

As we shared on our last call, we routinely evaluate our real estate portfolio and prune in order to optimize our store fleet. Last quarter we reported expected closures that would result in a $0.10 per share charge either in 2014 or 2015. We now have better visibility of the timing of that charge and estimate that at least $0.05 per share will be recorded in the fourth quarter.

7

We expect that any amount not recorded in Q4 will be recorded in 2015. Therefore, for the fourth quarter, we’re expecting operating margin in the range between 19.8% and 21.3%, and full year operating margin in the range between 15.8% and 16.4%. The lower of both these ranges assume we record a full real estate charge in 2014 while the upper end of the range assumes we record only half.

We continue to plan the year with a 31% tax rate. For the fourth quarter, we are expecting EPS in the range between $2.91 and $3.21. For the full year, we now expect EPS in the range between $7 and $7.30. These full year amounts reflect our strong third quarter performance and the impact of our significant third quarter share repurchases.

Our updated gross margin outlook, weaker currencies and our updated view on the timing of real estate charges will offset the benefit. We are assuming that currencies remain roughly at prevailing rates. Finally, we expect annual capital expenditures to be approximately $110 million, and annual depreciation and amortization will be roughly $96 million.

Before I turn the call back over to the operator for your questions, we’d like to take this opportunity to invite you to Dallas and join us for an Investor Day in early 2015. While we’re still finalizing our calendar, we anticipate this being held shortly after our fourth quarter release in mid-February. We will be providing additional information soon.

We look forward to sharing with you our expectations for 2015 as well as how we see the business and our opportunities over the coming years. As you have heard us say over the last year, the teams have been hard at work, working through strategies and identifying opportunities for the next phase of growth for the Company, and we’re excited to share our thoughts with you. So now, I will turn the call back over to the operator for your questions.

QUESTIONS AND ANSWERS

Operator

Thank you.

(Operator Instructions)

We will take our first question from Erinn Murphy with Piper Jaffray.

Erinn Murphy - Piper Jaffray & Co. - Analyst

Great. Thank you. Good afternoon and congratulations on the quarter.

I was hoping you could speak a little bit more about the North American segment. It’s great to see some reacceleration there in the third quarter. Could you maybe parse out a little bit more about what drove that improvement as you went throughout the third quarter? And what are your expectations in particular for this segment as we get into the fourth quarter?

Dennis Secor - Fossil Group, Inc. - CFO

Well, I will start with very pleased to be able to drive acceleration in the American business in the quarter. A lot, as we said on our prepared remarks, a lot of that was driven by stronger performance with our US wholesale department store partners, as well as sales in the boutiques. So that helped drive sales.

8

Some of that may have been helping to restore some of the inventory positions. As you remember, we talked about inventories at the end of the second quarter, but good progress with our teams working closely with our partners. Good progress that we’re making. You heard Kosta talk about the performance of women’s handbags, so we’re seeing some continued good, strong results there.

We still have work to do on other parts of the leathers business, but good traction there. So our goal is to continue the stronger performance in a pretty challenging environment. But we were very pleased with the performance.

Kosta Kartsotis - Fossil Group, Inc. - Chairman of the Board and CEO

We’ve always said North America would be a slower growth than the rest of the world for us. Having said that, we do have opportunities with as you see, we just launched Tory Burch, it’s doing very well.

There’s a large opportunity in the US for SKAGEN. We do have a long-term opportunity in wearables, and we think the FOSSIL business will grow in the US.

There is in addition to that a fashion Swiss opportunity that could manifest itself over the next coming years. We’re still optimistic on North America long term. It’s just going to be a slower growth rate.

Operator

We will take our next question from Omar Saad with Evercore ISI.

Omar Saad - Evercore ISI Group - Analyst

Thanks, great quarter. Congratulations.

Kosta Kartsotis - Fossil Group, Inc. - Chairman of the Board and CEO

Thank you.

Omar Saad - Evercore ISI Group - Analyst

Wanted to ask my one question on the 10-year license renewal with Michael Kors. Congratulations on that, as well. It’s obviously been a great relationship.

Can you help us understand maybe some of the underlying dynamics, especially since I think last quarter you had announced a renegotiation, a similar 10-year extension with Armani. That one, I think, had lapsed and was running month to month for a while whereas this one I think was a little more preemptive. Maybe help us understand the backdrop there. Are those situations really different or is it more of the same?

Kosta Kartsotis - Fossil Group, Inc. - Chairman of the Board and CEO

Well, we were very pleased to sign the 10-year agreement. As you know, Michael Kors has been a fantastic opportunity for us. Our two companies work very closely together.

We’ve got very strong business in the US. It’s growing very rapidly in Europe. Asia’s a huge potential.

9

There’s a follow-on jewelry opportunity that’s very significant. Men’s is going to grow and will become very important, especially as we get larger in Asia. We’re building shop-in-shops all over the world; could be a significant number of them.

There’s a long-term opportunity in travel retail, and wearable technology will follow on in there also. We have very close relationship, it’s very significant business for us and them, and we felt it was prudent for us to go ahead and get a contract signed, put it in there for 10 years.

There’s a significant amount of work and investment made by both parties for this. We felt it was better to get a deal signed early and go unencumbered after opportunity and get back to business. That’s why we did it.

Operator

We will go to our next question from Anna Andreeva from Oppenheimer.

Anna Andreeva - Oppenheimer Capital - Analyst

Great. Thanks so much and congratulations on a solid quarter.

Kosta Kartsotis - Fossil Group, Inc. - Chairman of the Board and CEO

Thank you.

Anna Andreeva - Oppenheimer Capital - Analyst

I was hoping we could talk about the FOSSIL brand. You’ve talked about the initiatives to drive brand awareness there through stepped up marketing. Maybe share with us the return on invested capital that you’re getting and how should we expect the marketing dollars into 2015.

And I guess as we look into next year, I think you said directionally to expect expense deleverage. What are some of the buckets behind that? Thanks.

Kosta Kartsotis - Fossil Group, Inc. - Chairman of the Board and CEO

As we’ve said in remarks and even in last call, we’re at an inflection point where we’re taking a hard look at our SG&A and reinventing as much of the Company as we possibly can, getting as efficient as we possibly can and investing in three big areas. One of those is omnichannel.

Our ability to do digital retail more efficiently, have it dovetail into our stores, get more customers engaged in the brand. As you know, traffic continues to become more and more of an issue in the United States.

So we’ve got a full-on effort in omnichannel really to change the direction of that, to get caught up and ahead in omnichannel, get the customers where they’re shopping on the Internet, et cetera. That’s a very big initiative for us.

We also are working on spending additional amounts on demand creation. There’s a small amount of additional money going into it right now. In the fourth quarter, on a test and learn basis, we will be measuring very closely the result of that. We will also be making some investments in wearable technology.

The FOSSIL business globally is a very strong and high profit, high return on capital business. We think we can turbo charge the sales and take advantage of the investments we’ve made around the world, including stores and retail locations and all our other investments.

10

We think we can leverage that and drive a higher sales number and profitability. So we feel it’s pretty good opportunity for us, and we’re going to be watching it very closely on the profitability side.

Operator

We will go next to Rick Patel with Stephens.

Rick Patel - Stephens Inc. - Analyst

Good afternoon everyone. I will add my congratulations as well.

Can you talk about the margin profile of your license multi-brand portfolio? You renewed Armani earlier in the year, now you’ve locked in Kors. As we think about the margins of this portfolio over the next three to five years, is it going to look similar as the last five years? Just curious what’s going to change if anything.

Thank you.

Dennis Secor - Fossil Group, Inc. - CFO

If you look at the margin profile over the next several years, there’s a lot of factors that you need to consider and opportunities and some headwinds. You see that there’s opportunities for us as we reduce cycle times, international growth becomes a big opportunity for us, channel mix becomes a lot.

So there’s a lot of opportunities in an overall portfolio of initiatives that we can use to drive margin, and the profile of the portfolio is one of those. Each contract has different dynamics, and so you can see some mix changes among the brands. But overall we think that there’s opportunities longer term for us to drive margin expansion, and like I say, the components of the individual contracts and brands are one element of that.

Operator

And we will take our next question from Ike Boruchow with Sterne Agee.

Ike Boruchow - Sterne, Agee & Leach, Inc. - Analyst

Hi, everyone. Congratulations on a good quarter. Thanks for taking my question.

Kosta Kartsotis - Fossil Group, Inc. - Chairman of the Board and CEO

Thank you.

Ike Boruchow - Sterne, Agee & Leach, Inc. - Analyst

Dennis, just a quick question on the guidance you gave for the holiday quarter. I’m having a little trouble reconciling the EPS number with the sales and the margin guidance that you gave us.

11

Is there something that we should keep in mind for the other segment on the FX hedges you have, on what number that could be? Because based on the tax rate, the 31% tax rate guidance for the year which you can back into, I’m just getting — I’m having trouble getting to the EPS range. Is there anything else you can help us with? Anything below the line?

Dennis Secor - Fossil Group, Inc. - CFO

What will happen as the mechanics of how currencies will operate is that you will see in a weakening Euro environment that you will start to see some pressure in the gross margins. That will to some extent be muted by our nonoperating income as effectively then the contracts that you have outstanding are in the money.

So many some of the economics shift away from gross margins and into the nonoperating income. So you need to consider that as you’re looking at the impact of those currencies.

But along the same lines of thinking about the fourth quarter and how some of the currency impacts may hit, probably equally important to think about how the currencies may impact next year. We talked about that in the prepared remarks.

But just to help people start thinking about that, if you focus on the Euro, some of the pressure on the margins right now are coming from what’s about a 7.5% decline in the Euro since a quarter ago. And we’ve got about $1.25 billion European business. The majority of that transacts in Euros.

So as you think about the impact on the operating model, there’s two things to consider. When the Euro declines as it has, you will see an immediate decrease in the full P&L as we translate that into US dollars, and that starts in sales, all the way down to the bottom line. And that’s the part in the guidance that you’re seeing, where we’re talking about sales headwinds of 2.5 points.

If the Euro stays where it is today, that headwind will persist through the first three quarters of next year, and then there’s an additional impact, which is a transactional side. And that’s because our European business, while they operate in Euros, they buy their inventory in US dollars, so as the dollar strengthens against the Euro, their cost of inventory increases, decreasing their margins. Though there is a lag on that, because you’re still working off inventory, say in the fourth quarter that you bought in the third and second in a more — in a stronger environment.

So again, you will see an accelerating impact on the margin as we get into 2015. So just think about that as well, and just to size it for you, while it’s still too early for us to talk specifically about 2015, if we were to recast 2014 at the current rates, you probably — there’s a lot of estimating and assumption in this number.

But you’d get roughly in the neighborhood of about a 2 point top line headwind and about a $0.30 per share impact, negative impact on EPS. So I suggest you also consider those impacts, as well.

Operator

And we will go next to Dorothy Lakner with Topeka Capital Markets.

Dorothy Lakner - Topeka Capital Markets - Analyst

Thanks. Good afternoon everyone, and congratulations on a great quarter.

Kosta Kartsotis - Fossil Group, Inc. - Chairman of the Board and CEO

Thank you.

12

Dorothy Lakner - Topeka Capital Markets - Analyst

Just to follow up on that for a second, on the currency headwinds, assuming the Euro stays where it is right now, you would, though, be getting a benefit on the expense side.

Dennis Secor - Fossil Group, Inc. - CFO

Right. You’d get benefit also because of P&L.

Dorothy Lakner - Topeka Capital Markets - Analyst

Because they’re buying inventory in US dollars, but expenses are also going to be in US dollars, as well.

Dennis Secor - Fossil Group, Inc. - CFO

Correct. Yes. That’s the first part of what I said. That’s the translation impact.

That’s the immediate impact of that. But you got to — you consider on our European business is profitable, so the net bottom line impact will be negative.

Dorothy Lakner - Topeka Capital Markets - Analyst

Right. Okay. And then just if I could, in terms of just the fashion Swiss opportunity, I wonder if you could elaborate a little bit on what you’ve done so far and what we can look forward to as we move into 2015.

Kosta Kartsotis - Fossil Group, Inc. - Chairman of the Board and CEO

Well, as you know, we’ve been doing Burberry Swiss for a number of years. We subsequent have added FOSSIL Swiss, doing well in our stores.

Tory Burch is Swiss, it launched this year. It is doing stream extremely well. The strong affinity for the craftsmanship of Swiss made is really prevalent in Asia, especially in China. We feel like we have an opportunity, a long-term, large opportunity to continue to add lifestyle brands, Swiss made into the Asian market, especially for the China customer.

The convergence of the customers growing in numbers, their affinity for watches and jewelry, their affinity for Swiss made and their affinity for lifestyle brands, we think puts us in a position where it’s a very significant long-term opportunity, and we will be benefiting from that. We also this year launched Armani Swiss. It is doing extremely well and it’s going to expand around the world, actually selling well not just in Asia, but in Europe and US, as well.

That’s another big opportunity for us. We think it’s a big long-term opportunity.

Operator

We will go next to Lorraine Hutchinson with Bank of America-Merrill Lynch.

13

Lorraine Hutchinson - BofA Merrill Lynch - Analyst

Thank you. Good afternoon.

Just wanted to follow up again on the comments around the Chinese business, and if you think it’s a brand issue, or if you think you have the wrong partners, or you need more marketing, or any strategies longer term to really get that business picking up.

Kosta Kartsotis - Fossil Group, Inc. - Chairman of the Board and CEO

I think it’s continuation of what we’ve said the last several markets, which is it’s just a very complex place to do business. And it’s probably going to continue to be somewhat choppy in terms of quarter to quarter and year to year.

We are as you know having to build our own distribution channel over there, so it’s concessions one at a time in a very fragmented market where there’s multiple owners and there’s not a consolidated retail environment. So it’s just a very complex environment.

So we are continuing to move forward. We’re building concessions. We’re moving along. We’re probably going to see some quarters that have outsized growth and some that don’t, and we just will continue to do that.

The fact remains, there’s literally hundreds of millions of people that will join the middle class in the next 10, 15 years. It’s a very compelling, long-term opportunity for us, and we’re building it out and some day it will be very significant. Is just probably will not be linear growth.

Having said that, what you’re seeing in this quarter in Asia, really in the rest of the Company, is the diversification, broad-based across the Company really helps us through spots like this. We’re going to see — if we could get every one of our businesses in every geography and every channel going at the same time, that would be incredible.

As a practical matter, the diversification works for us over a long period of time. There’s a lot of step by step blocking and tackling, putting building blocks in place, investing the right way, and we’re seeing even what you saw in the last quarter, some of the investments we made in the last several years are starting to pay off.

We had a very strong growth in India. Australia’s very strong. Some other parts of Asia are small now, but look like they’re going to grow.

There’s a very strong affinity for brands in the region, and that’s what we do. So we think long-term we’re in a good place.

Dennis Secor - Fossil Group, Inc. - CFO

I think what I’d just add to Kosta’s comments is the thing that excites us about China is just the raw opportunity that represents. Just to help size, it’s a growing market.

It’s a watch market that today alone is already bigger than the United States, forecasted to grow at a faster rate than the US. But the components of that market, if you look at the mid-tier market where we play, the fashion part of that market is tiny compared to the US.

It’s less than 10% of the market. That part of the market is made up of fashion brands. That number is over 50% in the United States.

So we believe that represents a significant opportunity for us as we and other fashion brands invest as the middle class emerges, as the distribution develops, that’s a big opportunity for us. There’s similar dynamics in other Asian markets. We’re very excited about the region. We think the demographics play can be a strong tailwind for us.

14

Operator

And we will go next to Barbara Wyckoff with CLSA.

Barbara Wyckoff - CLSA - Analyst

Hi, everyone. Congratulations. Great quarter.

Kosta Kartsotis - Fossil Group, Inc. - Chairman of the Board and CEO

Thank you.

Barbara Wyckoff - CLSA - Analyst

Can you talk about the possibility of licensing jewelry to other brands besides those in the watch portfolio? And can you update us on the status of FOSSIL jewelry, and then I have a couple follow-ups. Thanks.

Kosta Kartsotis - Fossil Group, Inc. - Chairman of the Board and CEO

Thanks, Barbara. We are, as you saw, we’re growing very quickly in jewelry, and our thesis has been that the jewelry business is actually much larger than the watch business globally. It’s just got a smaller component of it that is actually lifestyle branded. We expect that to change dramatically over the next several years.

So we’re ramping its up pretty quickly. We have a strong portfolio in place right now with FOSSIL, Kors, SKAGEN, Armani, Diesel, so we have a lot on our plate right now. We’re expanding production as much as we can and we’re getting prepared for much larger business and potentially will be adding additional licenses.

After as we’ve always said, jewelry is very similar to our watch business, largely the same characteristics in terms of timing, margin, same distribution channel. It’s actually a way of leveraging our entire global infrastructure. And it’s lifestyle branded and it fits into our global profile.

So one way to look at it, if the potential size of the Company with just watches is X, with jewelry it’s X plus and that’s the way we look at it. It is a long-term opportunity for us.

Operator

And we will go next to John Kernan with Cowen & Company.

John Kernan - Cowen and Company - Analyst

Hello. Congratulationss on a nice quarter.

Kosta Kartsotis - Fossil Group, Inc. - Chairman of the Board and CEO

Thanks, John.

15

John Kernan - Cowen and Company - Analyst

Just to circle back to Michael Kors, can you update us on, one, how the brand is performing in Europe, both from a watch and jewelry perspective, how big you think that business can be relative to what it already is here in the US. And then can you just confirm that the economics behind the Kors licensing agreement haven’t materially changed? Thank you.

Kosta Kartsotis - Fossil Group, Inc. - Chairman of the Board and CEO

In terms of Europe, the business is growing very quickly in Europe, both watches and jewelry, and it looks like it’s going to be a very significant business. And I would say the same thing about Asia, even though it’s a relatively small business now.

And in terms of the economics of the deal, it fits very well into our business model and where we focused on focusing on the business and growing it and putting major distribution around the world and monetizing the opportunity that’s in front of us.

Operator

And we will go next to Matt McClintock with Barclays.

Matt McClintock - Barclays Capital - Analyst

Yes, good afternoon, Kosta and congratulations on the quarter. As a follow-up to Erinn’s question earlier, you highlighted the boutique market. I’ve never really heard much about that channel.

Can you talk about what’s going on in that channel? Is that really just replenishment growth you’re seeing there or are you actually getting new distribution from new brands or other brands?

Kosta Kartsotis - Fossil Group, Inc. - Chairman of the Board and CEO

That’s typically the owned stores that our license partners operate themselves. So we sell into those stores and as they add distribution, that gives us additional distribution to fill in.

So what we did say on the last call was that part of our business was affected by holding very tight inventories in that channel. And our teams here worked very closely with their teams to really do everything we could to help drive sales and maximize the opportunity. And that we believe drove a big — some of our strong performance in the third quarter.

Operator

And we will go next to Ed Yruma with KeyBanc Capital Markets.

Ed Yruma - KeyBanc Capital Markets - Analyst

Hi, thanks very much for taking my question and congratulations. Maybe more specifically as a follow up to a question earlier, how should we think about that other line? I know you gave some of the puts and takes for FX, both top line and margin in the quarter and how we should think about next year. As your hedges change, how do we think about the impact in 4Q on that other line? Thanks.

16

Dennis Secor - Fossil Group, Inc. - CFO