TIDMCWK

RNS Number : 2764H

Cranswick PLC

30 November 2015

CRANSWICK plc: INTERIM RESULTS

Further strong commercial and strategic progress

Cranswick plc ("Cranswick" or "the Company" or "the Group"), a

leading UK food producer, today announces its unaudited results for

the six months ended 30 September 2015.

Financial Highlights:

-- Revenue ahead by 9.9% at GBP529.1m (2014: GBP481.5m)

-- Underlying(1) revenue up 6.5%

-- Adjusted Group operating margin(2) up 60 basis points to 6.0% (2014: 5.4%)

-- Adjusted profit before tax(2) increased 22.0% to GBP31.5m (2014: GBP25.8m)

-- Adjusted earnings per share(2) 25.3% higher at 51.5p (2014: 41.1p)

-- Dividend per share increased by 9.4% to 11.6p (2014: 10.6p)

-- Net debt 78.5% lower at GBP4.8m (2014: GBP22.4m)

-- Statutory profit before tax up 3.6% to GBP25.5m (2014: GBP24.6m)

-- Statutory earnings per share 2.0% higher at 40.0p (2014: 39.2p)

-- GBP4.6 million non-cash impairment of Sandwiches goodwill

Strategic progress:

-- Significant ongoing capital investment across the Group's

asset base to support future growth

-- Full and successful integration of Benson Park

-- Successful completion of Benson Park extension which doubles

capacity and improves efficiencies

-- Phase 2 upgrade to Norfolk primary processing facility, which

underpins drive for USDA accreditation, underway

-- Export sales to the Far East up 17%

Martin Davey, Cranswick's Chairman commented:

"The business performed strongly during the first half of the

year and recorded revenue slightly ahead of the Board's original

expectations.

"Alongside record first-half sales it is pleasing to report to

Shareholders that adjusted profit before tax for the period

increased 22.0 per cent to GBP31.5 million from GBP25.8 million in

the corresponding period last year. Adjusted earnings per share

rose 25.3 per cent to 51.5 pence compared to 41.1 pence

previously.

"The interim dividend is being increased by 9.4 per cent to 11.6

pence per share from 10.6 pence previously.

"The Company continues to work closely with its customers and to

maintain its focus on service, quality and innovation to deliver

attractive, competitively priced products in market conditions that

are expected to remain competitive through the second half of the

year. This approach, allied to a broadening product portfolio and

an anticipated strong Christmas trading period, means the business

remains very well placed to deliver further growth in this

financial year.

"With experienced management at all levels of the Group, a

strong range of products, a well invested asset base and a robust

financial position, the Board remains confident in the continued

long term success and development of the business."

-ends-

(1) underlying revenue excludes the contribution from Benson

Park in the current period and revenue from pig breeding, rearing

and trading activities in both the current and prior period.

(2) adjusted Group operating margin, adjusted profit before tax

and adjusted earnings per share exclude net IAS 41 valuation

movement on biological assets in both the current and prior period,

and the amortisation of customer relationship intangible assets and

the impairment of goodwill in the current period. These are the

measures used by the Board to assess the Group's underlying

performance.

Enquiries:

Cranswick plc

Mark Bottomley, Finance Director 01482 372 000

Powerscourt

Nick Dibden/ Sophie Moate/ Samantha Trillwood 020 7250 1446

Note to Editors:

Cranswick was formed in the early 1970s by farmers in East

Yorkshire to produce animal feed and has since evolved into a

business focused on the supply of food products to the UK food

retail and food service sectors. Well known for the production of

gourmet sausages the Company is involved in the breeding and

rearing of premium British pigs and also supplies fresh pork,

cooked meats, premium cooked poultry, air-dried bacon and gammon,

continental products, sandwiches and pastry products. Products are

sold primarily under retailers own labels including Sainsbury's

'Taste The Difference' and Tesco's 'Finest' as well as under a

number of brands such as 'Simply Sausages', 'The Black Farmer',

'Bodega' and 'Woodall's'. Sales in the year to March 2015 were

GBP1,003 million and have grown more than 200 per cent over ten

years.

Chairman's statement

The business performed strongly during the first half of the

year and recorded revenue slightly ahead of the Board's original

expectations.

Results

Total revenue in the period to 30 September 2015 of GBP529.1

million was 10 per cent ahead of the same period last year driven

by strong volume growth across most product categories and included

a positive contribution from Benson Park, acquired in October

2014.

Benson Park, based in Hull, is a leading producer of premium

British cooked poultry products serving the fast growing 'food to

go' sector. It has been fully and successfully integrated and

recently commissioned a major capital investment programme

significantly raising production capacity ahead of the peak

Christmas trading period.

Underlying sales were 7 per cent higher than the same period

last year, with corresponding volumes up 10 per cent as the Group's

customers and UK consumers continue to see the benefit of the

Group's lower input prices.

Alongside record first-half sales it is pleasing to report to

Shareholders that adjusted profit before tax for the period

increased 22.0 per cent to GBP31.5 million from GBP25.8 million in

the corresponding period last year. This reflects the contribution

from Benson Park, the focus on improved efficiencies across the

Group plus the returns from investments made in recent years to

increase capacity and broaden the product base.

Adjusted earnings per share rose 25.3 per cent to 51.5 pence

compared to 41.1 pence previously. Details of trading are covered

more fully in the Operational and Financial reviews.

Investments

During the period GBP13.4 million was invested in the asset base

of the business. Specific projects included redevelopment of the

Kingston Foods cooked meats facility, the Benson Park project and

various other initiatives across the Group to increase capacity and

drive further operating efficiencies. In addition, there are a

number of projects either underway or planned in the near term as

the Board seeks to maintain the quality of the Group's production

facilities, the efficiencies of its operations and its level of new

product development.

Financial position

Operating cash inflow increased to GBP35.5 million from GBP17.1

million in the same period last year and at the end of the period

net debt stood at GBP4.8 million, which compared to GBP22.4 million

a year earlier. The Company is in a sound financial position and

further details are provided in the Financial review.

Dividend

The interim dividend is being increased by 9.4 per cent to 11.6

pence per share from 10.6 pence previously. The dividend will be

paid on 29 January 2016 to Shareholders on the register at the

close of business on 11 December 2015. Shareholders will again have

the opportunity to receive the dividend by way of scrip issue.

Staff

The Group operates on a decentralised basis across product

categories supported by business-wide collaboration in key areas.

The Board considers this to be the most appropriate format for the

Company and acknowledges that the continued success of Cranswick

would not be possible without talented and motivated management

teams supported by skilful and enthusiastic colleagues at each

site. On behalf of the Board I thank all our colleagues for their

commitment and contribution.

Outlook

Cranswick has made further commercial and strategic progress

during the period.

The Company continues to work closely with its customers and to

maintain its focus on service, quality and innovation to deliver

attractive, competitively priced products in market conditions that

are expected to remain competitive through the second half of the

year. This approach, allied to a broadening product portfolio and

an anticipated strong Christmas trading period, means the business

remains very well placed to deliver further growth in this

financial year.

With experienced management at all levels of the Group, a strong

range of products, a well invested asset base and a robust

financial position, the Board remains confident in the continued

long term success and development of the business.

Martin Davey

Chairman

30 November 2015

Operating review

Reported revenue increased by 10 per cent to GBP529.1 million.

Growth was supported by the contribution from Benson Park which was

acquired in the second half of the last financial year. Underlying

revenue grew by 7 per cent, with corresponding volumes ahead 10 per

cent as the benefit of lower input prices continues to be passed on

to the Group's customers.

Adjusted Group operating profit increased by 21.4 per cent to

GBP31.8 million in the first half of the financial year and

adjusted Group operating margin improved by 60 basis points to 6.0

per cent of revenue. The improvement in Group operating margin

reflected the positive contribution from Benson Park, an improved

performance from the Pastry business and a tight focus on cost

control and operational efficiencies across the Group.

Pig prices remained relatively stable during the period compared

to the volatility experienced in the previous three years. The UK

pig price fell 2 per cent during the period and was on average 18

per cent lower than during the same period last year. Despite this

reduction, the UK price remains approximately 30 per cent higher

than its European equivalent reflecting on going high demand for

British pig meat.

(MORE TO FOLLOW) Dow Jones Newswires

November 30, 2015 02:00 ET (07:00 GMT)

The Wayland and Wold farming businesses supply approximately 20

per cent of the Group's British pig requirements. Cranswick is the

third largest pig producer in the UK and represents 6 per cent of

the total UK pig herd. More than 80 per cent of the pigs produced

from the two herds are bred outdoors providing a complete farm to

fork solution for the premium pork ranges of the Group's two

largest retail customers. Provenance and end-to-end supply chain

integrity are key differentiators enabling the Group to lock in key

long-term retail relationships. Improvements in productivity and

prolificacy together with lower feed costs helped offset the impact

of lower pig prices during the period.

Total export volumes grew by 18 per cent during the period.

Volume growth in Far Eastern markets of 31 per cent offset lower

volumes into the US and flat volumes into European markets. 1,000

tonnes of product are being shipped to the Far East each week with

Cranswick accounting for over 50 per cent of all pig meat exports

from the UK to this strategically important market. Further

opportunities are being explored and the range of products being

exported is continually being developed and broadened.

Fresh pork sales grew by 15 per cent in the period driven by the

recovery of business with one of the Group's principal retail

customers. Market data for the 52 weeks to 13 September shows UK

retail fresh pork sales have fallen 10 per cent year on year due

primarily to the fall in UK pig prices over the same period. We are

keen to see that the versatility and price competiveness of pork

compared to other meat proteins is advanced. The recent, hugely

successful AHDB pulled pork advertising campaign highlights the way

in which innovative and focused marketing can deliver positive

results. This initiative resulted in a 19 per cent year on year

increase in shoulder joint sales during the campaign. The next

phase of redevelopment of our Norfolk facility is now underway.

This GBP6 million investment to replace the existing abattoir will

increase capacity, improve efficiencies and will facilitate the

site's push for USDA accreditation.

Sausage sales were 5 per cent higher supported by strong volume

growth. The premium sector of the market is the main driver of

category growth as consumers are prepared to pay a modest premium

for a step change in quality and taste. Sales of premium beef

burgers were 24 per cent higher year on year. Further substantial

capital investment to upgrade mixing and filling equipment is

planned at the Lazenby's facility in Hull to support anticipated

growth in the sausage category.

Bacon sales were 21 per cent ahead as continued development of

the business' hand-cured, air-dried bacon was supported by strong

premium gammon sales. This growth was underpinned by gaining sole

supply status for premium bacon and gammon with one of the Group's

lead retail customers shortly before the previous half year end.

With further new product launches planned for both existing and new

customers in the run up to the peak Christmas trading period, the

business is well placed moving into the second half of the year.

The redevelopment and conversion of the former Kingston Foods site

in Milton Keynes into a gammon facility was recently completed.

This facility will enable the business to target a new sector of

the bacon and gammon market.

Cooked meat sales fell 6 per cent reflecting overall category

deflation and lower volumes to one retail customer. Further

substantial capital investment at the Sutton Fields facility will

upgrade staff amenities and refurbish both high and low risk

production areas to enable expansion into new categories with

existing customers and develop further capability to supply 'slow

cook' and 'food to go' ranges to manufacturing and food service

customers. A significant three year capital investment programme at

the Valley Park facility will refurbish the fabric of the site and

upgrade chilling and storage facilities to support future

growth.

Sales of premium poultry from Benson Park made a positive

contribution to overall Group performance in the first half. New

business wins during the period, both with existing and new

customers, leave the business well placed moving into the second

half of the year. The capital investment programme which was

underway when the business was acquired in October 2014, is now

complete. The enlarged factory footprint and new in-line spiral

cooking and cooling equipment was fully and successfully

commissioned ahead of the peak Christmas trading period. This GBP9

million investment programme has substantially increased capacity

and will improve operational efficiencies as well as enabling the

business to offer a broader product range.

Pastry sales were 45 per cent ahead of the prior year continuing

the positive development since this category was introduced.

Operational performance at the site continued the marked

improvement seen in the second half of the last financial year and

the category made a positive contribution to the overall Group

result. New product lines have recently been launched which,

coupled with a strong Christmas and seasonal promotional programme,

leaves the pastry business well placed to deliver further growth

during the remainder of the financial year.

Sales of continental products increased by 12 per cent

reflecting the UK consumer's growing appetite for speciality

continental products including charcuterie, cheeses, pasta and

olives. Category growth was supported by new product launches and

new retail contracts together with a continued focus on sourcing

new artisan products from across Europe. The extension of the

Guinness Circle facility to produce British cured meat products was

completed during the period, and will produce a range of premium

cured meats under both the Woodall's brand and retail customer own

label.

Sandwich sales grew by 5 per cent, supported by new contract

wins brought on stream part way through the first half of the last

financial year. Top line growth was supported by an improved

operational performance as the business continued to strip out

underperforming accounts and rationalise the product range.

However, the business has recently received confirmation that a key

account will not be extended beyond its current term and

consequently the outlook for the Sandwich category beyond the

current financial year end will be more challenging.

Cranswick is committed to delivering everyday great food

experiences to the UK consumer. This commitment is underpinned by a

constant focus on quality, value and a drive to innovate and bring

new and exciting products to market. The ongoing growth and

development of the Group is a testament to the continued efforts of

the highly skilled and committed people across the business.

Adam Couch

Chief Executive

30 November 2015

Financial review

The Group is presenting its interim financial information for

the six months to 30 September 2015 with comparative information

for the six months to 30 September 2014 and the year to 31 March

2015.

Revenue

Reported revenue at GBP529.1 million was 9.9 per cent ahead of

the same period last year, driven by strong volume growth across

most product categories and a positive contribution from Benson

Park, acquired in October 2014. Underlying revenue* was 6.5 per

cent higher than the prior year, with corresponding volumes up 10

per cent as the Group's customers and UK consumers continue to see

the benefit of the Group's lower input prices. Export sales to key

Far East markets increased by 17 per cent.

Adjusted Group operating profit

Adjusted Group operating profit of GBP31.8 million, including

the contribution from Benson Park, increased by 21.4 per cent.

Adjusted Group operating margin at 6.0 per cent of sales was 60

basis points higher than the 5.4 per cent reported in the same

period last year with the improvement underpinned by strong revenue

growth, the positive contributions from Benson Park and the Group's

pastry business along with an unstinting focus on product quality,

innovation and operational efficiency.

Finance costs

Net financing costs at GBP0.3 million were GBP0.1 million lower

than reported in the first half of the prior year, reflecting lower

average bank borrowings.

Adjusted profit before tax

Adjusted profit before tax was 22.0 per cent higher at GBP31.5

million (2014: GBP25.8 million).

Taxation

The tax charge as a percentage of profit before tax was 22.5 per

cent (2014: 22.0 per cent). The standard rate of corporation tax

was 20 per cent (2014: 21 per cent). The charge was higher than the

standard rate of corporation tax for both periods due to the impact

of disallowable expenses, including a goodwill impairment charge in

the current year, as referred to below.

Adjusted earnings per share

Adjusted earnings per share rose by 25.3 per cent to 51.5 pence

(2014: 41.1 pence) in the six months to 30 September 2015. The

average number of shares in issue was 49,464,000 (2014:

49,023,000).

Adjusted profit measures

The Group monitors performance principally through the adjusted

profit measures which exclude certain non-cash items including the

net IAS 41 valuation charge of GBP0.6 million on biological assets

(2014: GBP1.2 million), amortisation of acquired intangible assets

of GBP0.7 million (2014: GBPnil) and a goodwill impairment charge

of GBP4.6 million (2014: GBPnil). The statutory results, including

these items, show a 3.6 per cent increase in profit before tax to

GBP25.5 million (2014: GBP24.6 million), a 3.3 per cent increase in

Group operating profit to GBP25.8 million (2014: GBP25.0 million)

and a 2.0 per cent increase in earnings per share to 40.0 pence

(2014: 39.2 pence).

Goodwill impairment

Following a change in the customer base of the Sandwiches

category, an impairment review was performed on the Sandwiches cash

generating unit as at 30 September 2015. This resulted in the

recognition of a goodwill impairment charge of GBP4.6 million (note

8).

Cash flow and net debt

(MORE TO FOLLOW) Dow Jones Newswires

November 30, 2015 02:00 ET (07:00 GMT)

The net cash inflow from operating activities in the period was

GBP35.5 million (2014: GBP17.1 million) reflecting higher Group

operating profit and a working capital inflow of GBP0.9 million

(2014: outflow of GBP12.0 million). Net debt fell by GBP12.5

million in the six month period to GBP4.8 million, and was GBP17.6

million lower than at the previous half year end. Net debt was just

1 per cent of Shareholders' funds (2014: 7 per cent) as the Group's

balance sheet continues to be conservatively managed. The Group's

current bank facility of GBP120 million extends to July 2018 and

provides the business with generous headroom.

Pensions

The Group operates defined contribution pension schemes whereby

contributions are made to schemes administered by major insurance

companies. Contributions to these schemes are determined as a

percentage of employees' earnings. The Group also operates a

defined benefit pension scheme which has been closed to further

benefit accrual since 2004. The deficit on this scheme at 30

September 2015 was GBP5.0 million which compared to GBP5.6 million

at 31 March 2015. Cash contributions to the scheme during the

period, as part of the programme to reduce the deficit, were GBP0.7

million. The present value of funded obligations was GBP29.1

million and the fair value of plan assets was GBP24.1 million.

The valuation of the defined benefit pension liability is

dependent upon market conditions and actuarial methods and

assumptions (including mortality assumptions). Such changes in

actuarial assumptions and the performance of the funds may result

in changes to amounts charged or released through the income

statement and the Group may be required to pay increased pension

contributions in the future. The Board regularly reviews its

pension strategy with reference to the value of assets and

liabilities under the pension scheme as well as the potential

impact of changes in actuarial assumptions.

Principal risks and uncertainties

There are a number of risks and uncertainties facing the

business in the second half of the financial year. The Board

considers these risks and uncertainties to be the same as those

described in the Report & Accounts for the year ended 31 March

2015, dated 18 May 2015, a copy of which is available on the

Group's website at www.cranswick.plc.uk. The principal risks and

uncertainties which are set out in detail on pages 31 to 33 of the

Report & Accounts for the year ended 31 March 2015 are:

Strategic Commercial Financial risks Operational

risks risks * Interest rate, curren risks

* Consumer demand * Reliance on key customers cy, liquidity and credit ri * Business continuity

sks

* Competitor activity * Pig meat - pricing and availability of supply * Recruitment and retention of workforce

* Business acquisitions

* Health and safety

* Disease and infection within pig herd / poultry flock

* Food scares / product contamination

Forward looking information

This interim report contains certain forward looking statements.

These statements are made by the Directors in good faith based on

the information available to them at the time of their approval of

this report and such statements should be treated with caution due

to the inherent uncertainties, including both economic and business

risk factors, underlying any such forward looking information.

Going concern

The Group's business activities, together with the factors

likely to affect its future development, performance and position

are set out in the 'Operating review'. The financial position of

the Group, its cash flows, liquidity position and borrowing

facilities are described above. The Group has considerable

financial resources together with strong trading relationships with

its key customers and suppliers. As a consequence, the Directors

believe that the Group is well placed to manage its business risk

successfully.

After making enquiries, the Directors have a reasonable

expectation that the Group has adequate resources to continue in

operational existence for the foreseeable future. For this reason,

they continue to adopt the going concern basis in preparing the

condensed consolidated interim financial statements.

Mark Bottomley

Finance Director

30 November 2015

* Underlying revenue excludes the contribution from Benson Park

in the current period and revenue from the pig breeding, rearing

and trading activities in both the current and prior period

Cranswick plc: Group income statement (unaudited)

for the six months ended 30 September 2015

Half year Year to

------------------

31 March

2015 2014 2015

Notes GBP'000 GBP'000 GBP'000

Revenue 529,148 481,540 1,003,336

------------------------------- -------- -------- ----------

Adjusted Group operating

profit 31,799 26,192 58,653

Net IAS 41 valuation movement

on biological assets (637) (1,182) (4,245)

Amortisation of customer

relationship intangible

assets (698) - (671)

Impairment of goodwill 8 (4,635) - -

------------------------------- -------- -------- ----------

Group operating profit 4 25,829 25,010 53,737

Finance revenue - 1 -

Finance costs (301) (378) (901)

Profit before tax 25,528 24,633 52,836

Taxation 5 (5,752) (5,429) (11,584)

Profit for the period 19,776 19,204 41,252

------------------------------- -------- -------- ----------

Earnings per share (pence)

On profit for the period:

Basic 6 40.0p 39.2p 84.1p

Diluted 6 39.8p 39.0p 83.8p

------------------------------- -------- -------- ----------

On adjusted profit for

the period:

Basic 6 51.5p 41.1p 92.1p

Diluted 6 51.3p 40.9p 91.8p

------------------------------- -------- -------- ----------

Cranswick plc: Group statement of comprehensive income

(unaudited)

for the six months ended 30 September 2015

Year to

Half year 31 March

--------------------

Notes 2015 2014 2015

GBP'000 GBP'000 GBP'000

Profit for the period 19,776 19,204 41,252

----------------------------------------------------------------- --------- --------- ----------

Other comprehensive income

Other comprehensive income to

be reclassified to profit or loss

in subsequent periods:

Cash flow hedges

Losses arising in the period 9 (169) (163) (210)

Reclassification adjustments

for losses included in the income

statement 210 18 18

Income tax effect (8) 29 38

------------------------------------------------ --------------- --------- --------- ----------

Net other comprehensive income

to be reclassified to profit

or loss in subsequent periods 33 (116) (154)

------------------------------------------------ --------------- --------- --------- ----------

Items not to be reclassified

to profit or loss in subsequent

periods:

Actuarial gains/ (losses) on

defined benefit pension scheme 44 (148) (307)

Income tax effect (9) 29 61

------------------------------------------------ --------------- --------- --------- ----------

Net other comprehensive income

not being reclassified to profit

or loss in subsequent periods 35 (119) (246)

------------------------------------------------ --------------- --------- --------- ----------

Other comprehensive income, net

of tax 68 (235) (400)

------------------------------------------------ --------------- --------- --------- ----------

Total comprehensive income, net

of tax 19,844 18,969 40,852

------------------------------------------------ --------------- --------- --------- ----------

(MORE TO FOLLOW) Dow Jones Newswires

November 30, 2015 02:00 ET (07:00 GMT)

Cranswick plc: Group balance sheet (unaudited)

at 30 September 2015

As at

Half year 31 March

----------------------

Notes 2015 2014 2015

GBP'000 GBP'000 GBP'000

Non-current assets

Intangible assets 8 140,372 130,754 145,705

Property, plant and equipment 168,751 159,931 166,087

Biological assets 526 924 592

Total non-current assets 309,649 291,609 312,384

-------------------------------------- ------ ---------- ---------- ----------

Current assets

Biological assets 13,074 15,300 11,197

Inventories 50,616 54,041 49,125

Trade and other receivables 120,757 95,474 116,905

Cash and short-term deposits 10 14,623 11,720 3,941

-------------------------------------- ------ ---------- ---------- ----------

Total current assets 199,070 176,535 181,168

-------------------------------------- ------ ---------- ---------- ----------

Total assets 508,719 468,144 493,552

-------------------------------------- ------ ---------- ---------- ----------

Current liabilities

Trade and other payables (123,962) (104,238) (117,792)

Financial liabilities (169) (207) (210)

Provisions (60) - (196)

Income tax payable (4,848) (6,056) (7,046)

Total current liabilities (129,039) (110,501) (125,244)

-------------------------------------- ------ ---------- ---------- ----------

Non-current liabilities

Other payables (1,443) (426) (1,278)

Financial liabilities (23,657) (34,082) (25,427)

Deferred tax liabilities (3,837) (3,892) (3,457)

Provisions (1,395) (346) (150)

Defined benefit pension

scheme deficit (5,004) (6,078) (5,623)

-------------------------------------- ------ ---------- ---------- ----------

Total non-current liabilities (35,336) (44,824) (35,935)

-------------------------------------- ------ ---------- ---------- ----------

Total liabilities (164,375) (155,325) (161,179)

Net assets 344,344 312,819 332,373

-------------------------------------- ------ ---------- ---------- ----------

Equity

Called-up share capital 4,971 4,909 4,926

Share premium account 67,660 64,650 65,689

Share-based payments 11,415 8,939 10,242

Hedging reserve (136) (131) (169)

Retained earnings 260,434 234,452 251,685

-------------------------------------- ------ ---------- ---------- ----------

Equity attributable to owners

of the parent 344,344 312,819 332,373

-------------------------------------- ------ ---------- ---------- ----------

Cranswick plc: Group statement of cash flows (unaudited)

for the six months ended 30 September 2015

Year

Half year to 31

March

--------------------

Notes 2015 2014 2015

GBP'000 GBP'000 GBP'000

Operating activities

Profit for the period 19,776 19,204 41,252

Adjustments to reconcile Group

profit for the period to net

cash inflows from operating

activities:

Income tax expense 5,752 5,429 11,584

Net finance costs 301 377 901

(Gain)/loss on sale of property,

plant and equipment (113) (49) 149

Depreciation of property, plant

and equipment 9,435 8,753 18,349

Amortisation of intangibles 8 698 78 671

Impairment of goodwill 8 4,635 - -

Share-based payments 1,173 1,160 2,463

Difference between pension contributions

paid and amounts recognised

in the income statement (575) (598) (1,212)

Release of government grants (56) (18) (74)

Net IAS 41 valuation movement

on biological assets 637 1,182 4,245

Increase in biological assets (2,448) (2,689) (1,317)

(Increase)/decrease in inventories (1,491) (6,615) 491

(Increase)/decrease in trade

and other receivables (3,669) 2,485 (12,586)

Increase/(decrease) in trade

and other payables 8,486 (5,218) 2,226

------------------------------------------ ------ --------- --------- ---------

Cash generated from operations 42,541 23,481 67,142

Tax paid (7,045) (6,374) (12,750)

------------------------------------------ ------ --------- --------- ---------

Net cash from operating activities 35,496 17,107 54,392

------------------------------------------ ------ --------- --------- ---------

Cash flows from investing activities

Interest received - 1 -

Acquisition of subsidiary, net

of cash acquired - - (17,692)

Purchase of property, plant

and equipment (13,392) (11,022) (21,144)

Receipt of government grants 228 - 542

Proceeds from sale of property,

plant and equipment 193 198 244

Net cash used in investing activities (12,971) (10,823) (38,050)

------------------------------------------ ------ --------- --------- ---------

Cash flows from financing activities

Interest paid (255) (369) (880)

Proceeds from issue of share

capital 63 60 901

Proceeds from borrowings - 5,000 -

Issue costs of long term borrowings - (851) (851)

Repayment of borrowings 10 (2,000) - (8,000)

Dividends paid (9,651) (10,362) (15,350)

Repayment of capital element

of finance leases - (265) (444)

------------------------------------------ ------ --------- --------- ---------

Net cash used in financing activities (11,843) (6,787) (24,624)

------------------------------------------ ------ --------- --------- ---------

Net increase/(decrease) in cash

and cash equivalents 10 10,682 (503) (8,282)

Cash and cash equivalents at

beginning of period 10 3,941 12,223 12,223

------------------------------------------ ------ --------- --------- ---------

Cash and cash equivalents at

end of period 10 14,623 11,720 3,941

------------------------------------------ ------ --------- --------- ---------

Cranswick plc: Group statement of changes in equity

(unaudited)

for the six months ended 30 September 2015

Share Share Share- Hedging Retained Total

capital premium based reserve earnings equity

payments

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------------- --------- --------- ---------- --------- ---------- ---------

At 1 April 2015 4,926 65,689 10,242 (169) 251,685 332,373

-------------------------- --------- --------- ---------- --------- ---------- ---------

Profit for the period - - - - 19,776 19,776

Other comprehensive

income - - - 33 35 68

-------------------------- --------- --------- ---------- --------- ---------- ---------

Total comprehensive

income - - - 33 19,811 19,844

Share-based payments - - 1,206 - - 1,206

(MORE TO FOLLOW) Dow Jones Newswires

November 30, 2015 02:00 ET (07:00 GMT)

Scrip dividend 12 1,941 - - - 1,953

Share options exercised 33 30 (33) - - 30

Dividends - - - - (11,604) (11,604)

Deferred tax relating

to changes in equity - - - - (161) (161)

Corporation tax relating

to changes in equity - - - - 703 703

-------------------------- --------- --------- ---------- --------- ---------- ---------

At 30 September 2015 4,971 67,660 11,415 (136) 260,434 344,344

-------------------------- --------- --------- ---------- --------- ---------- ---------

At 1 April 2014 4,896 64,173 7,779 (15) 225,878 302,711

-------------------------- --------- --------- ---------- --------- ---------- ---------

Profit for the period - - - - 19,204 19,204

Other comprehensive

income - - - (116) (119) (235)

-------------------------- --------- --------- ---------- --------- ---------- ---------

Total comprehensive

income - - - (116) 19,085 18,969

Share-based payments - - 1,160 - - 1,160

Scrip dividend 3 427 - - - 430

Share options exercised 10 50 - - - 60

Dividends - - - - (10,792) (10,792)

Deferred tax relating

to changes in equity - - - - 113 113

Corporation tax relating

to changes in equity - - - - 168 168

-------------------------- --------- --------- ---------- --------- ---------- ---------

At 30 September 2014 4,909 64,650 8,939 (131) 234,452 312,819

-------------------------- --------- --------- ---------- --------- ---------- ---------

At 1 April 2014 4,896 64,173 7,779 (15) 225,878 302,711

-------------------------- --------- --------- ---------- --------- ---------- ---------

Profit for the year - - - - 41,252 41,252

Other comprehensive

income - - - (154) (246) (400)

-------------------------- --------- --------- ---------- --------- ---------- ---------

Total comprehensive

income - - - (154) 41,006 40,852

Share-based payments - - 2,463 - - 2,463

Scrip dividend 5 640 - - - 645

Share options exercised 25 876 - - - 901

Dividends - - - - (15,995) (15,995)

Deferred tax relating

to changes in equity - - - - 437 437

Corporation tax relating

to changes in equity - - - - 359 359

-------------------------- --------- --------- ---------- --------- ---------- ---------

At 31 March 2015 4,926 65,689 10,242 (169) 251,685 332,373

-------------------------- --------- --------- ---------- --------- ---------- ---------

Responsibility statement

The Directors confirm that to the best of their knowledge the

condensed set of financial statements has been prepared in

accordance with IAS 34 Interim Financial Reporting and includes a

fair review of the information required by DTR 4.2.7R (an

indication of important events during the first six months and a

description of the principal risks and uncertainties for the

remaining six months of the year) and by DTR 4.2.8R (a disclosure

of related party transactions and changes therein) of the

Disclosure and Transparency Rules. The Board of Directors that

served during the six months ended 30 September 2015, and their

respective responsibilities, can be found on pages 44 and 45 of the

2015 Annual Report & Accounts.

On behalf of the Board

Martin Davey Mark Bottomley

Chairman Finance Director

30 November 2015

Notes to the interim accounts

1. Basis of preparation

This interim report was approved by the Directors on 30 November

2015 and has been prepared in accordance with the Disclosure and

Transparency Rules of the UK's Financial Conduct Authority and the

requirements of IAS 34 Interim Financial Reporting as adopted by

the European Union. The information does not constitute statutory

accounts within the meaning of Section 435 of the Companies Act

2006. The statutory accounts for the year ended 31 March 2015

prepared under IFRS as adopted by the European Union have been

filed with the Registrar of Companies. The report of the auditors

on the statutory accounts was not qualified and did not contain a

statement under Section 498(2) or (3) of the Companies Act 2006.

The interim report is unaudited but has been subject to an

independent review by Ernst & Young LLP pursuant to the

Auditing Practices Board guidance contained in ISRE 2410 (UK and

Ireland) "Review of Interim Financial Information Performed by the

Independent Auditor of the Entity".

2. Accounting policies

The accounting policies applied by the Group in this interim

report are the same as those applied by the Group in the financial

statements for the year ended 31 March 2015.

Non-GAAP measures - Adjusted Group operating profit, adjusted

profit before tax and adjusted earnings per share

Adjusted Group operating profit, adjusted profit before tax and

adjusted earnings per share are defined as being before net IAS 41

valuation movement on biological assets, impairment charges and

other significant non-trading items (being amortisation of acquired

customer relationship intangibles, which became significant for the

first time during the year ended 31 March 2015 following the

acquisition of Benson Park Limited). These additional non-GAAP

measures of performance are included as the Directors believe that

they provide a useful alternative measure for Shareholders of the

trading performance of the Group. The reconciliation between Group

operating profit and adjusted Group operating profit is shown on

the face of the Group income statement.

The following accounting standards and interpretations became

effective, and were adopted by the Group, for the current reporting

period:

International Accounting Standards (IAS / Effective

IFRSs) date

Annual Improvements to IFRSs 2010-2012 Cycle 1 July

2014

Annual Improvements to IFRSs 2011-2013 Cycle 1 July

2014

The application of these standards has not had a material effect

on the net assets, results and disclosures of the Group.

The Group has not early adopted any other standard,

interpretation or amendment that has been issued but is not yet

effective.

3. Segmental analysis

IFRS 8 requires operating segments to be identified on the basis

of the internal financial information reported to the Chief

Operating Decision Maker ('CODM'). The Group's CODM is deemed to be

the Executive Directors on the Board, who are primarily responsible

for the allocation of resources to segments and the assessment of

performance of the segments.

The CODM assesses profit performance using adjusted profit

before taxation measured on a basis consistent with the disclosure

in the Group accounts.

The Group reported on just one reportable segment during the

period and the preceding financial year. The revenues of the Group

are not significantly impacted by seasonality.

Additions to property, plant and equipment during the period

totalled GBP12.2 million (2014: GBP12.3 million). Future capital

expenditure under contract at 30 September 2015 was GBP4.3 million

(2014: GBP3.1 million).

4. Group operating profit

Group operating costs comprise:

Year

Half year to

31 March

----------------------

2015 2014 2015

GBP'000 GBP'000 GBP'000

----------------------------------------- ---------- ---------- ----------

Cost of sales excluding net IAS

41 valuation movement on biological

assets 458,454 425,580 878,968

Net IAS 41 valuation movement

on biological assets* 637 1,182 4,245

------------------------------------------ ---------- ---------- ----------

Cost of sales 459,091 426,762 883,213

------------------------------------------ ---------- ---------- ----------

Gross profit 70,057 54,778 120,123

----------------------------------------- ---------- ---------- ----------

Selling and distribution costs 21,523 18,035 38,418

----------------------------------------- ---------- ---------- ----------

Administrative expenses excluding

amortisation of customer relationship

(MORE TO FOLLOW) Dow Jones Newswires

November 30, 2015 02:00 ET (07:00 GMT)

intangible assets and impairment

of goodwill 17,372 11,733 27,297

Amortisation of customer relationship

intangible assets 698 - 671

Impairment of goodwill 4,635 - -

----------------------------------------- ---------- ---------- ----------

Administrative expenses 22,705 11,733 27,968

----------------------------------------- ---------- ---------- ----------

Total operating costs 503,319 456,530 949,599

----------------------------------------- ---------- ---------- ----------

* This represents the difference between operating profit

prepared under IAS 41 and operating profit prepared under

historical cost accounting, which forms part of the reconciliation

of adjusted operating profit.

5. Taxation

The tax charge for the period was GBP5.8 million (2014: GBP5.4

million) and represents an effective rate of 22.5 per cent (2014:

22.0 per cent). The charge for the period was higher than the

standard rate of corporation tax due to the impact of disallowable

expenses including impairment of goodwill in the current

period.

Reductions to the standard rate of corporation tax were proposed

in the July 2015 Budget statement to reduce the rate from 20 per

cent to 19 per cent by 1 April 2017 and to 18 per cent by 1 April

2020. These changes had not been substantively enacted at the

balance sheet date and, therefore, are not included in this interim

consolidated financial information.

6. Earnings per share

Basic earnings per share are based on profit for the period

attributable to Shareholders and on the weighted average number of

shares in issue during the period of 49,464,032 (2014: 49,022,524).

The calculation of diluted earnings per share is based on

49,666,112 shares (2014: 49,223,926).

Adjusted earnings per share

The Directors consider it appropriate to present an adjusted

measure of earnings per share on the face of the income statement

which excludes certain non-cash items to provide a more meaningful

measure of the underlying performance of the business. These items

include impairment of goodwill, the amortisation of customer

relationship intangible assets, which became significant for the

first time during the year ended 31 March 2015 following the

acquisition of Benson Park Limited, and gains and losses from the

IAS 41 valuation movement on biological assets due to the

volatility of pig prices.

Adjusted earnings per share are calculated using the weighted

average number of shares for both basic and diluted amounts as

detailed above.

Adjusted profit for the period is derived as follows:

Year

Half year to

31 March

--------------------

2015 2014 2015

GBP'000 GBP'000 GBP'000

Profit for the period 19,776 19,204 41,252

Net IAS 41 valuation movement

on biological assets 637 1,182 4,245

Tax on net IAS 41 valuation movement

on biological assets (127) (236) (849)

Amortisation of customer relationship

intangible assets 698 - 671

Tax on amortisation of customer

relationship intangible assets (140) - (134)

Impairment of goodwill 4,635 - -

---------------------------------------- --------- --------- ----------

Adjusted profit for the period 25,479 20,150 45,185

---------------------------------------- --------- --------- ----------

7. Dividends - half year ended 30 September

Year

Half year to

31 March

--------------------

2015 2014 2015

GBP'000 GBP'000 GBP'000

---------------------------------------- --------- --------- ----------

Interim dividend for year ended

31 March 2015 of 10.6p per share - - 5,203

Final dividend for year ended

31 March 2015 of 23.4p (2014:

22.0p)

per share 11,604 10,792 10,792

11,604 10,792 15,995

---- ----------------------------------- --------- --------- ----------

The interim dividend for the year ending 31 March 2016 of 11.6

pence per share was approved by the Board on 30 November 2015 for

payment to Shareholders on 29 January 2016 and therefore has not

been included as a liability as at 30 September 2015.

8. Intangible fixed assets

Customer

Goodwill relationships Total

GBP'000 GBP'000 GBP'000

Cost

At 30 September 2014 135,239 795 136,034

On acquisition 9,359 6,185 15,544

----------------------------- --------- -------------- --------

At 31 March 2015 and at 30

September 2015 144,598 6,980 151,578

----------------------------- --------- -------------- --------

Amortisation and impairment

At 30 September 2014 4,924 356 5,280

Amortisation - 593 593

----------------------------- --------- -------------- --------

At 31 March 2015 4,924 949 5,873

Amortisation - 698 698

Impairment 4,635 - 4,635

----------------------------- --------- -------------- --------

At 30 September 2015 9,559 1,647 11,206

----------------------------- --------- -------------- --------

Net book value

----------------------------- --------- -------------- --------

At 30 September 2014 130,315 439 130,754

----------------------------- --------- -------------- --------

At 31 March 2015 139,674 6,031 145,705

----------------------------- --------- -------------- --------

At 30 September 2015 135,039 5,333 140,372

----------------------------- --------- -------------- --------

Impairment testing

Goodwill is subject to annual impairment testing. Goodwill

acquired through business combinations has been allocated for

impairment testing purposes to the following principal cash

generating units:

Year

Cash generating Half year to 31

unit March

------------------

2015 2014 2015

GBP'000 GBP'000 GBP'000

Fresh pork 12,231 12,231 12,231

Livestock 1,691 1,691 1,691

Cooked meats 90,167 90,167 90,167

Sandwiches 6,967 11,602 11,602

Continental Fine

Foods 10,968 10,968 10,968

Premium cooked

poultry 9,259 - 9,259

Other 3,756 3,656 3,756

-------------------- -------- -------- --------

135,039 130,315 139,674

------------------- -------- -------- --------

Following a change in the customer base of the Sandwiches

category, an impairment review was performed on the Sandwiches cash

generating unit as at 30 September 2015. This cash generating unit

has historically been the most sensitive to a reasonably possible

change in assumptions.

The recoverable amount for the Sandwiches cash generating unit

has been determined based on value in use calculations. The

projected cash flows were updated to reflect the latest Sandwiches

forecasts for the years ending 31 March 2016 and 31 March 2017 and

cash flow projections for the next three years. Forecast

replacement capital expenditure is included from forecasts and

thereafter capital spend is assumed to represent 100 per cent of

depreciation.

Subsequent cash flows are forecast to grow in line with an

assumed long-term industry growth rate of 3 per cent derived from

third party market information, including Kantar Worldpanel data. A

pre-tax discount rate of 7.7 per cent has been used (31 March 2015:

6.5 per cent) being management's estimate of the weighted average

cost of capital.

The calculation is most sensitive to the following

assumptions:

Sales volumes

Sales volumes are influenced by the growth of the underlying

food segment, the market shares of our customers, selling prices,

and the quality of our products and service. Historical volumes are

used as the base and adjusted over the projection period in line

with current growth rates.

Gross margin

Gross margin depends upon average selling prices, the cost of

raw materials and changes in the cost of production overheads.

Historical margins are used as the base, adjusted for management's

expectations derived from experience and with reference to

forecasts.

Discount rates

All calculations of this nature are sensitive to the discount

rate used. Management's estimate of the weighted average cost of

capital has been used.

(MORE TO FOLLOW) Dow Jones Newswires

November 30, 2015 02:00 ET (07:00 GMT)

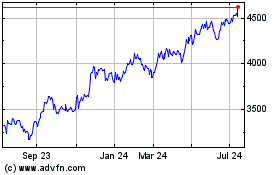

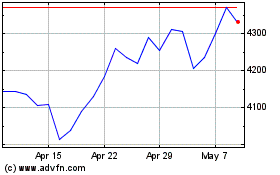

Cranswick (LSE:CWK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cranswick (LSE:CWK)

Historical Stock Chart

From Apr 2023 to Apr 2024