Cisco Results Top Expectations; Raises Dividend, Buyback -- Update

February 10 2016 - 7:47PM

Dow Jones News

By Don Clark

Cisco Systems Inc. posted a 31% jump in quarterly net profit on

Wednesday, but showed signs that weakening economic conditions have

taken a toll on the businesses that the networking equipment giant

serves.

The San Jose, Calif.-based company, whose results are closely

watched as an indicator of corporate technology demand, also

boosted its quarterly dividend and stock-buyback plan, and

projected stronger revenue for the current quarter than some

analysts had expected.

Its shares, off 17% since the beginning of 2016, rose 7% in

after-hours trading following the news.

Cisco's numbers for the period ended in January showed both

positive and negative signs, which the company attributed partly to

steady buying by telecom services and caution among other corporate

customers.

For example, the company said revenue grew 5% in a routing

equipment segment that had been shrinking lately, a category of

hardware largely purchased by communications carriers. Video

equipment purchased by carriers rose 37%. Security and

collaboration products also grew.

But sales of switching gear--Cisco's largest single

business--declined 4%, reversing a recent pattern. Revenue for

Cisco's data center group, led by sales of server systems, declined

3% after growing 24% in the period ending in October.

Chuck Robbins, Cisco's chief executive, said the company began

hearing signs of caution among some corporate customers in January,

toward the end of the quarter. In response to developments such as

declining stock prices, he said, companies began holding up orders

on nonessential purchases such as some types of the switching

systems used on corporate campuses.

"They were trying to adjust to what was going on," Mr. Robbins

said. "They just paused a bit."

On the other hand, Cisco seems to have gotten past a long-term

slide in its business in China. The company had been hurt there

both by suspicion that non-Chinese hardware could be used by spies

as well as the emergence of credible alternative products from

local suppliers such as Huawei Technologies Co. In November, Cisco

had reported a 40% jump in its orders in China. The company said

orders rose another 64% in the period ended in January, led by

demand for video equipment.

Cisco has faced an industrywide shift of some networking

functions to software from the hardware that has been its

specialty. Mr. Robbins and predecessor John Chambers, who gave up

the CEO job last summer, have responded by trying to build new

software and services that can generate recurring revenues.

To underscore Cisco's belief that it can weather the current

turbulence, the company on Wednesday raised its quarterly dividend

by 24% and increased its stock-buyback plan by $15 billion.

"I feel very confident," Mr. Robbins said.

In all, Cisco reported that net profit for the period ended Jan.

23 rose to $3.15 billion, or 62 cents a share, up from $2.4

billion, or 46 cents a share. On an adjusted basis that includes

items such as stock-based compensation and tax-related gains, the

company's per-share earnings rose to 57 cents from 53 cents a year

ago.

Total revenue slipped slightly to $11.93 billion from $11.94

billion a year ago. Excluding a video business that Cisco divested

in November, the company's revenue rose 2% to $11.8 billion.

Analysts surveyed by Thomson Reuters were expecting adjusted

earnings of 54 cents a share on revenue of $11.75 billion.

For its fiscal third quarter, Cisco projected per-share adjusted

earnings per share of between 54 cents and 56 cents, along with

revenue growth of between 1% and 4%. Analysts, on average, were

expecting earnings on a similar basis of 55 cents a share and

revenue to slide 1%, according to Thomson Reuters.

Write to Don Clark at don.clark@wsj.com

(END) Dow Jones Newswires

February 10, 2016 19:32 ET (00:32 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

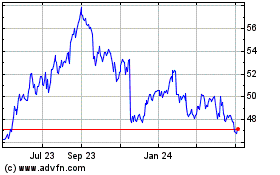

Cisco Systems (NASDAQ:CSCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

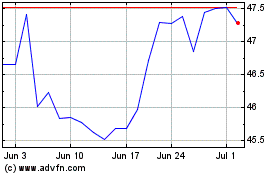

Cisco Systems (NASDAQ:CSCO)

Historical Stock Chart

From Apr 2023 to Apr 2024