TIDMBAG

RNS Number : 7323Z

Barr(A.G.) PLC

22 September 2015

22 September 2015

A.G. BARR p.l.c.

INTERIM RESULTS FOR THE 6 MONTHS ENDED 25 JULY 2015

A.G. BARR p.l.c., the soft drinks Group, which produces and

markets some of the UK's leading brands, including IRN-BRU, Rubicon

and Strathmore, announces its interim results for the 6 months

ended 25 July 2015.

Key Points

-- Total turnover was GBP130.3m (2014: GBP135.7m). Adjusting for

the impact of discontinued business, turnover from ongoing

business, including the recently acquired Funkin Limited

("Funkin"), declined 2.8%

-- Adjusted* profit on ordinary activities before tax, interest

and exceptional items increased by 3.3% to GBP17.8m. Statutory

profit before tax decreased by 11.3% to GBP16.9m (2014:

GBP19.0m)

-- Free cash flow was GBP7.4m. Net debt stands at GBP19.9m

(representing a net debt/EBITDA ratio of 0.4 times)

-- The Funkin business is performing well against our pre-acquisition expectations

-- Investment in our Milton Keynes site continued during the

period with the successful commissioning of carton packaging

capability and the commencement of the warehouse capacity increase

project, due to be completed in early 2016

-- Interim dividend of 3.36p per share (2014: 3.11p), an increase of 8.0% on the prior year

Commenting on the results, Roger White, Chief Executive

said:

"We have delivered a number of significant system, business

process and operational improvement projects over the course of the

last 6 months, which will ensure we can successfully deliver our

long-term growth and efficiency ambitions. These important changes

have been made against a challenging backdrop of stretching prior

year comparatives, disappointing weather and tough market

conditions.

Our focus in the coming months will be to build our sales

momentum and continue our long-term brand investment strategy.

Market conditions across the first half have been difficult and

are forecast to remain so. The business is responding well to the

market challenges but the weather since we last updated the market

in July has been poor and, although we have recovered some sales

momentum, it is not yet at the run rate we have targeted. Assuming

a satisfactory trading performance in the key Christmas period, the

Board now expects the Company to deliver a full year result broadly

similar to that achieved last year.

As we look towards 2016 it is anticipated that the business will

return to growth and begin to see the benefits of our improved

operating platform."

For more information, please contact:

A.G. BARR 01236 852400 Instinctif Partners 020 7457 2020

Roger White, Chief Executive Justine Warren

Stuart Lorimer, Finance Matthew Smallwood

Director

*Adjusted profit is defined as statutory operating profit before

interest and tax and after adjusting for discontinued business

(GBP1.0m), income associated with the 2014 termination of the

Orangina franchise (GBP0.7m) and one-off transaction fees related

to the acquisition of the Funkin Cocktails business (GBP0.7m).

Interim Statement

A.G. BARR has been through an extremely demanding 6 months in

which we have delivered a substantial level of change and business

improvement. The period began with the closure of the Tredegar

factory and the subsequent successful clearance and sale of the

site which completed in September 2015. During the early part of

the year we also commissioned carton packaging capability at our

Milton Keynes site, increasing capacity and improving flexibility

in this important product format. The acquisition of the Funkin

cocktail mixer business also completed in the period and we are

pleased to report the business is meeting our high expectations.

Alongside all of these highly visible actions and activities we

have completed the planning and go-live of our Business Process

Redesign (BPR) project which means we are now operating our

business on a much more effective, modern and robust system and

business process platform, capable of supporting sustained future

growth.

As we reported in July, the go-live of our BPR project, despite

our significant efforts to reduce executional risk, proved to be

more challenging than anticipated. We experienced a period of

difficult internal operating conditions post go-live which

undoubtedly impacted our revenue performance and our customer

service. We have now stabilised our systems and our focus is to

realise the business benefits our new improved operating platform

offers.

Trading

The soft drinks market in the period has been impacted by

continued price deflation and very poor weather, especially in the

north of the UK. As expected, our relative revenue performance has

also been affected by the stretching prior year comparatives driven

by better than average weather, strong execution behind the Glasgow

2014 Commonwealth Games and specific brand promotional phasing

changes in the current year.

Total revenue for the period was GBP130.3m. Adjusting for the

impact of discontinued business, turnover from ongoing business,

including the recently acquired Funkin Limited ("Funkin"), declined

2.8%.

The total soft drinks market, as measured by Nielsen,

experienced a 0.6% decline in revenue during the period, with

modest growth of 1.4% in volume driven by strong performance in

water and the continued positive performance of the energy drinks

category.

We have maintained our long-term strategy of investing behind

our core brands with further significant marketing activity. The

prior year's activity was weighted to the first half in support of

the Glasgow 2014 Commonwealth Games. This year's marketing

programme sees a return to more normal phasing with greater

proportionate activity later in the year.

In the period we have continued to see gross margin improvement

benefiting from a combination of improved procurement conditions

and further delivery of supply chain savings. Operating margins

have been adversely impacted by a combination of lower volumes and

our commitment to maintaining brand and business investment.

Adjusted* profit increased by 3.3% to GBP17.8m. Statutory profit

before tax and exceptional items in the period was GBP16.9m.

In the period we have continued to support the long-term growth

of IRN-BRU, developing the brand across the UK as a whole, with

national TV and digital advertising and the development of an

exciting sponsorship plan with both the English Football League and

the Scottish Professional Football League.

The IRN-BRU brand continues to feature heavily in social media

and digital channels, with positive consumer engagement during both

our "Tartan Packs" promotion and our "Bru Planet" summer

initiative.

We announced in late August a GBP5m investment at our

Cumbernauld factory with the installation of new, high-speed glass

filling capability. The investment will lead to the discontinuation

of our returnable glass bottle system at the end of 2015. However

moving to non returnable, recyclable glass will support the

long-term development of this popular product format. The

investment will also facilitate a number of exciting brand

development projects in 2016.

In the period, we also announced phase 3 of the ongoing

investment at our Milton Keynes site. Our plans include the

building of increased warehouse capacity to improve operational

efficiency, flexibility and costs, as well as the purchase of 4

acres of development land adjacent to the site. The total expected

cost of this development phase, including the additional land for

future expansion, is GBP11m.

Our actions to drive efficiency, as well as our continued

investment in our asset base and brands, indicate our commitment to

building a platform which will effectively support significant

future growth across our whole business.

In the period we had no exceptional charges (2014: GBP2.5m).

Balance Sheet

Our balance sheet remains strong.

Intangible asset additions of GBP27.7m reflect the brand and

goodwill valuation associated with the Funkin acquisition and the

capitalisation of the investment in our BPR Project.

We also continue to invest in our tangible asset base. Cash

capital expenditure during the period amounted to GBP7.9m, a

combination of normal operational replacement and the acquisition

of additional land at our Milton Keynes site.

Working capital continues to be tightly managed. The impact of

lower receivables, a result of the Glasgow 2014 Commonwealth Games

impact on comparatives, has more than offset slightly higher

inventories.

The Group continues to benefit from strong cash-flow and low

leverage. Net debt at 25 July 2015 stood at GBP19.9m, having funded

the Funkin acquisition, the Milton Keynes land purchase and the BPR

project investment.

Free cash flow of GBP7.4m was generated in the 6 month period.

This was GBP3.8m less than in the comparable period in the prior

year, arising from the addition of Funkin, underlying trading

performance and slightly higher tax payments.

Dividend

The Board has declared an interim dividend of 3.36 pence per

share, payable on 16 October 2015 to shareholders on the register

on 2 October 2015. This represents an increase on the prior year of

8.0% and reflects the Board's confidence in the current financial

position and the future prospects of the Group.

Board Update

In April, we were very pleased to welcome David Ritchie, CEO of

Bovis Homes Group PLC, on to the Board as an independent

non-executive director and Chair of the Remuneration Committee.

Outlook

(MORE TO FOLLOW) Dow Jones Newswires

September 22, 2015 02:00 ET (06:00 GMT)

Having delivered significant internal change over the last 6

months our focus is to return the business to sales growth. Market

conditions across the first half have been difficult and are

forecast to remain so. The business is responding well to the

market challenges but the weather since we updated the market in

July has been poor and, although we have recovered some sales

momentum, it is not yet at the run rate we have targeted. Assuming

a satisfactory trading performance in the key Christmas period, the

Board now expects the Company to deliver a full year result broadly

similar to that achieved last year.

Despite the specific challenges of the current year, our

business is well placed and we remain confident in delivering

further on our growth potential and continuing to generate

long-term shareholder value. We expect to regain sales momentum and

to see the benefits of improved operational execution as we enter

2016.

John R. Nicolson Roger A. White

Chairman Chief Executive

22 September 2015

*Adjusted profit is defined as statutory operating profit before

interest and tax and after adjusting for discontinued business

(GBP1.0m), income associated with the 2014 termination of the

Orangina franchise (GBP0.7m) and one-off transaction fees related

to the acquisition of the Funkin Cocktails business (GBP0.7m).

Consolidated Condensed Income Statement

6 months

ended 25 July

2015 6 months ended 27 July 2014

---------------- ---------------------------------------------------------------

Before

exceptional

items

Restated

(note Exceptional items (note Total

Total 3(c)) 8) Restated (note 3(c))

Note GBP000 GBP000 GBP000 GBP000

------------------------ ----- ---------------- ------------- ------------------------ ----------------------

Revenue 6 130,260 135,703 - 135,703

Cost of sales (69,068) (74,362) (2,325) (76,687)

------------------------ ----- ================ ------------- ------------------------ ----------------------

Gross profit 6 61,192 61,341 (2,325) 59,016

Other income 8 - 747 - 747

Operating expenses (43,882) (42,923) (218) (43,141)

======================== ===== ================ ============= ======================== ======================

Operating profit 8 17,310 19,165 (2,543) 16,622

Finance income 26 46 - 46

Finance costs (460) (183) - (183)

------------------------ ----- ================ ------------- ------------------------ ----------------------

Profit before tax 16,876 19,028 (2,543) 16,485

Income tax expense 9 (3,538) (4,202) 532 (3,670)

------------------------ ----- ================ ------------- ------------------------ ----------------------

Profit attributable to

equity holders 13,338 14,826 (2,011) 12,815

------------------------ ----- ---------------- ------------- ------------------------ ----------------------

Earnings per share (p)

------------------------ ----- ---------------- ============= ======================== ======================

Basic earnings per

share 10 11.57 11.09

Diluted earnings per

share 10 11.50 11.03

------------------------ ----- ---------------- ------------- ------------------------ ----------------------

Ex-div date: 1 October 2015

Record date: 2 October 2015

Consolidated Condensed Income Statement

Year ended 25 January 2015

---------------------------------------------------

Before exceptional

items Exceptional Total

Restated (note items (note Restated

3(c)) 8) (note 3(c))

Note GBP000 GBP000 GBP000

======================== ======== ================= ============= ===============

Revenue 6 260,895 - 260,895

Cost of sales (140,996) (2,910) (143,906)

------------------------ -------- ----------------- ------------- ---------------

Gross profit 6 119,899 (2,910) 116,989

Other income 8 747 - 747

Operating expenses (78,513) (376) (78,889)

======================== ======== ================= ============= ===============

Operating profit 8 42,133 (3,286) 38,847

Finance income 103 - 103

Finance costs (322) - (322)

------------------------ -------- ----------------- ------------- ---------------

Profit before tax 41,914 (3,286) 38,628

Income tax expense 9 (9,318) 687 (8,631)

------------------------ -------- ----------------- ------------- ---------------

Profit attributable

to equity holders 32,596 (2,599) 29,997

------------------------ -------- ----------------- ------------- ---------------

Earnings per share

(p)

------------------------ -------- ----------------- ------------------- ---------

Basic earnings per

share 10 26.00

Diluted earnings per

share 10 25.86

------------------------ -------- ----------------- ------------------- ---------

Consolidated Condensed Statement of Comprehensive Income

6 months 6 months Year ended

ended 25 ended 27 25 January

July 2015 July 2014 2015

GBP000 GBP000 GBP000

===================================== =========== =========== ============

Profit for the period 13,338 12,815 29,997

Other comprehensive income

Items that will not be reclassified

to profit or loss

Remeasurements on defined

benefit pension plans (note

19) 4,600 (2,660) (19,770)

Deferred tax movements on

items taken direct to equity (1,434) 22 2,934

Current tax movements on items

taken direct to equity 514 544 1,121

Items that will be or have

been reclassified to profit

or loss

Effective portion of changes

in fair value of cash flow

hedges 114 (294) 67

Deferred tax movements on

items above (22) 59 (14)

Other comprehensive income

for the period, net of tax 3,772 (2,329) (15,662)

Total comprehensive income

attributable to equity holders

of the parent 17,110 10,486 14,335

------------------------------------- ----------- ----------- ------------

Consolidated Condensed Statement of Changes

in Equity

Share Share Cash flow

Share premium options hedge Retained

capital account reserve reserve earnings Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

================================ ========= ========== ========= ========== ========== =========

At 25 January 2015 4,865 905 2,318 (481) 148,930 156,537

Profit for the period - - - - 13,338 13,338

Other comprehensive income - - - 92 3,680 3,772

----------------------------------- --------- ---------- --------- ---------- ---------- ---------

(MORE TO FOLLOW) Dow Jones Newswires

September 22, 2015 02:00 ET (06:00 GMT)

Total comprehensive income

for the period - - - 92 17,018 17,110

Company shares purchased

for use by employee benefit

trusts (note 20) - - - - (1,976) (1,976)

Proceeds on disposal of shares

by employee benefit trusts

(note 20) - - - - 1,305 1,305

Recognition of share-based

payment costs - - 265 - - 265

Transfer of reserve on share

award - - (262) - 262 -

Deferred tax on items taken

direct to reserves - - (66) - - (66)

Dividends paid - - - - (10,402) (10,402)

----------------------------------- --------- ---------- --------- ---------- ---------- ---------

At 25 July 2015 4,865 905 2,255 (389) 155,137 162,773

----------------------------------- --------- ---------- --------- ---------- ---------- ---------

At 26 January 2014 4,865 905 1,826 (534) 148,174 155,236

Profit for the period - - - - 12,815 12,815

Other comprehensive income - - - (235) (2,094) (2,329)

----------------------------------- --------- ---------- --------- ---------- ---------- ---------

Total comprehensive income

for the period - - - (235) 10,721 10,486

Company shares purchased

for use by employee benefit

trusts (note 20) - - - - (1,214) (1,214)

Proceeds on disposal of shares

by employee benefit trusts

(note 20) - - - - 1,164 1,164

Recognition of share-based

payment costs - - 470 - - 470

Transfer of reserve on share

award - - (463) - 463 -

Deferred tax on items taken

direct to reserves - - 136 - - 136

Dividends paid - - - - (9,455) (9,455)

----------------------------------- --------- ---------- --------- ---------- ---------- ---------

As at 27 July 2014 4,865 905 1,969 (769) 149,853 156,823

----------------------------------- --------- ---------- --------- ---------- ---------- ---------

Consolidated Condensed Statement of Changes in Equity

Cash

Share Share flow

Share premium options hedge Retained

capital account reserve reserve earnings Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

================================ ========= ========= ========= ========= ========== =========

At 26 January 2014 4,865 905 1,826 (534) 148,174 155,236

Profit for the year - - - - 29,997 29,997

Other comprehensive income - - - 53 (15,715) (15,662)

-------------------------------- --------- --------- --------- --------- ---------- ---------

Total comprehensive income

for the year - - - 53 14,282 14,335

Company shares purchased

for use by employee benefit

trusts (note 20) - - - - (2,310) (2,310)

Proceeds on disposal of shares

by employee benefit trusts

(note 20) - - - - 1,301 1,301

Recognition of share-based

payment costs - - 893 - - 893

Transfer of reserve on share

award - - (534) - 534 -

Deferred tax on items taken

direct to reserves - - 133 - - 133

Dividends paid - - - - (13,051) (13,051)

-------------------------------- --------- --------- --------- --------- ---------- ---------

At 25 January 2015 4,865 905 2,318 (481) 148,930 156,537

-------------------------------- --------- --------- --------- --------- ---------- ---------

Consolidated Condensed Statement of Financial Position

As at 25 July 2015 As at 27 July 2014 As at 25 January 2015

Note GBP000 GBP000 GBP000

---------------------------------- ----- ------------------- ------------------- ----------------------

Non-current assets

Intangible assets 14 108,266 76,349 80,917

Property, plant and equipment 15 82,090 74,688 79,663

190,356 151,037 160,580

---------------------------------- ----- ------------------- ------------------- ----------------------

Current assets

Inventories 18,029 16,115 16,761

Trade and other receivables 64,988 74,535 51,899

Derivative financial instruments 16 20 - 66

Cash and cash equivalents 10,583 11,281 25,437

Assets held for sale 12 850 - -

94,470 101,931 94,163

---------------------------------- ----- ------------------- ------------------- ----------------------

Total assets 284,826 252,968 254,743

---------------------------------- ----- ------------------- ------------------- ----------------------

Current liabilities

Loans and other borrowings 18 - - 73

Trade and other payables 58,371 63,341 51,119

Derivative financial instruments 16 508 914 666

Provisions 17 112 1,100 1,009

Current tax 2,625 3,172 3,314

61,616 68,527 56,181

---------------------------------- ----- ------------------- ------------------- ----------------------

Non-current liabilities

Loans and other borrowings 18 30,402 14,931 14,944

Derivative financial instruments 16 4,500 47 -

Deferred tax liabilities 11,777 10,854 8,612

Retirement benefit obligations 19 13,758 1,786 18,469

60,437 27,618 42,025

---------------------------------- ----- ------------------- ------------------- ----------------------

Capital and reserves attributable to equity holders

Share capital 4,865 4,865 4,865

Share premium account 905 905 905

Share options reserve 2,255 1,969 2,318

Cash flow hedge reserve (389) (769) (481)

Retained earnings 155,137 149,853 148,930

162,773 156,823 156,537

---------------------------------- ----- ------------------- ------------------- ----------------------

Total equity and liabilities 284,826 252,968 254,743

---------------------------------- ----- ------------------- ------------------- ----------------------

Consolidated Condensed Cash Flow

Statement

6 months 6 months Year ended

ended 25 ended 27 25 January

July 2015 July 2014 2015

GBP000 GBP000 GBP000

======================================== =========== =========== ============

Operating activities

(MORE TO FOLLOW) Dow Jones Newswires

September 22, 2015 02:00 ET (06:00 GMT)

Profit for the period 16,876 16,485 38,628

Adjustments for:

Interest receivable (26) (46) (103)

Interest payable 460 183 322

Depreciation of property, plant

and equipment 3,593 3,347 6,739

Impairment of property, plant and

equipment - 1,365 1,483

Amortisation of intangible assets 343 126 253

Share-based payment costs 265 470 893

Loss / (gain) on sale of property,

plant and equipment 138 (35) (119)

Operating cash flows before movements

in working capital 21,649 21,895 48,096

Increase in inventories (611) (69) (715)

Increase in receivables (11,651) (27,060) (4,424)

Increase in payables 4,045 21,730 10,208

Difference between employer pension

contributions and amounts recognised

in the income statement (379) (963) (1,368)

----------------------------------------- ----------- ----------- ------------

Cash generated by operations 13,053 15,533 51,797

Tax on profit paid (3,689) (3,383) (7,031)

----------------------------------------- ----------- ----------- ------------

Net cash from operating activities 9,364 12,150 44,766

Investing activities

Acquisition of subsidiary (net of

cash acquired) (15,757) - -

Acquisition of intangible assets (4,757) (2,368) (7,063)

Purchase of property, plant and

equipment (7,941) (2,198) (11,493)

Proceeds on sale of property, plant

and equipment 87 487 585

Interest received 26 24 60

----------------------------------------- ----------- ----------- ------------

Net cash used in investing activities (28,342) (4,055) (17,911)

Financing activities

New loans received 47,000 15,000 15,000

Loans repaid (31,500) (15,000) (15,000)

Bank arrangement fees paid (55) (80) (80)

Purchase of Company shares by employee

benefit trusts (1,976) (1,214) (2,310)

Proceeds from disposal of Company

shares by employee benefit trusts 1,305 1,164 1,301

Dividends paid (10,402) (9,455) (13,051)

Interest paid (175) (161) (283)

----------------------------------------- ----------- ----------- ------------

Net cash generated by / (used in)

financing activities 4,197 (9,746) (14,423)

Net (decrease) / increase in cash

and cash equivalents (14,781) (1,651) 12,432

----------------------------------------- ----------- ----------- ------------

Cash and cash equivalents at beginning

of period 25,364 12,932 12,932

Cash and cash equivalents at end

of period 10,583 11,281 25,364

----------------------------------------- ----------- ----------- ------------

1. General information

A.G. BARR p.l.c. ('the Company') and its subsidiaries (together

'the Group') manufacture, distribute and sell soft drinks. The

Group has manufacturing sites in the U.K. and sells mainly to

customers in the U.K. with some international sales.

The Company is a public limited company, which is listed on the

London Stock Exchange and incorporated and domiciled in the U.K.

The address of its registered office is A.G. BARR p.l.c., Westfield

House, 4 Mollins Road, Cumbernauld, G68 9HD.

This consolidated condensed interim financial information does

not comprise statutory accounts within the meaning of section 434

of the Companies Act 2006. Statutory accounts for the year ended 25

January 2015 were approved by the board of directors on 24 March

2015 and delivered to the Registrar of Companies. The comparative

figures for the financial year ended 25 January 2015 are an extract

of the Company's statutory accounts for that year. The report of

the auditor on those accounts was unqualified, did not contain an

emphasis of matter paragraph and did not contain any statement

under section 498 (2) or (3) of the Companies Act 2006.

This consolidated condensed interim financial information is

unaudited but has been reviewed by the Company's Auditor.

2. Basis of preparation

This consolidated condensed interim financial information for

the six months ended 25 July 2015 has been prepared in accordance

with the Disclosure and Transparency Rules of the Financial Conduct

Authority (previously the Financial Services Authority) and with

IAS 34, 'Interim financial reporting' as adopted by the European

Union. The consolidated condensed interim financial information

should be read in conjunction with the annual financial statements

for the year ended 25 January 2015, which have been prepared in

accordance with IFRSs as adopted by the European Union.

Going concern basis

The Group meets its day-to-day working capital requirements

through its bank facilities. After making enquiries, the directors

have a reasonable expectation that the Group has adequate resources

to continue in operational existence for the foreseeable future.

The Group's forecasts and projections, taking account of reasonable

sensitivities, show that the Group should be able to operate within

available facilities. The Group therefore continues to adopt the

going concern basis in preparing its consolidated condensed interim

financial statements.

3. Accounting policies

The accounting policies applied are consistent with those of the

annual financial statements for the year ended 25 January 2015, as

described in those annual financial statements except as noted

below.

Changes in accounting policy and disclosures

(a) New and amended standards adopted by the Group

The following revised IFRSs have been adopted in this

consolidated condensed interim financial information. The

application of these revised IFRSs has not had any material impact

on the amounts reported for the current and prior periods.

-- Annual Improvements 2010-2012 Cycle, IFRS 2, IFRS 3, IFRS 8,

IFRS 13, IAS 16, IAS 38 and IAS 24

-- Amendments to IAS 19 Defined Benefit Plans relating to

employee contributions

-- Annual Improvements 2011-2013 Cycle, IFRS 1, IFRS 3, IFRS 13

and IAS 40

(b) New standards, amendments and interpretations issued but not

effective for the financial year beginning 26 January 2015 and not

adopted early

A number of new standards and amendments to standards and

interpretations are effective for future year ends, and have not

been applied in preparing these interim financial statements. These

standards and amendments are listed in the table below:

International Accounting Standards and Interpretations Effective date

IFRS 9 Financial Instruments (as amended in 2014) 1 January 2018

IFRS 9 (2014) supersedes IFRS 9 (2009), IFRS 9

(2010) and IFRS 9 (2013)

Amendment to IFRS 7 Financial Instruments: Disclosures When IFRS 9 is

relating to transition to IFRS 9 (or otherwise first applied

when IFRS 9 is first applied)

IFRS 14 Regulatory deferral accounts 1 January 2016

Amendments to IAS 39 Financial instruments - Continuation When IFRS 9 is

of hedge accounting first applied

Amendments to IFRS 11 - Accounting for acquisitions 1 January 2016

of Interests in Joint operations

1 January 2016

Amendments to IAS 16 and IAS 38 - Clarification

of acceptable methods of depreciation and amortisation

Amendments to IAS 16 and IAS 41 - Agriculture: 1 January 2016

Bearer plants

IFRS 15 - Revenue from contracts with customers 1 January 2018

Amendment to IAS 27 Separate Financial Statements 1 January 2016

(as amended in 2011) relating to reinstating the

equity method as an accounting option for investments

in subsidiaries, joint ventures and associates

in an entity's separate financial statements

Amendments resulting from September 2014 Annual 1 January 2016

Improvements to IFRS 5 Non-current Assets Held

for Sale and Discontinued Operations, IFRS 7 Financial

Instruments: Disclosures, IAS 19 Employee Benefits

and IAS 34 Interim Financial Reporting

Amendments to IFRS 10 and IAS 28 clarify that 1 January 2016

the recognition of the gain or loss on the sale

or contribution of assets between an investor

and its associate or joint venture depends on

whether the assets sold or contributed constitute

a business

Amendments to IFRS 10, IFRS 12 and IAS 28 regarding 1 January 2016

the application of the consolidation exception

IAS 1 Presentation of Financial Statements: Amendments 1 January 2016

resulting from the disclosure initiative

Management anticipates that the application of the above

Standards and Interpretations in future periods will have no

material impact on the consolidated financial statements of the

Group.

(c) Restatement of segment reporting

(MORE TO FOLLOW) Dow Jones Newswires

September 22, 2015 02:00 ET (06:00 GMT)

(i) In the segment reporting to 25 January 2015 a misstatement

has been noted between the gross profit for Carbonates and the

Other segments. An element totalling GBP2.3m of gross profit in

relation to Carbonates was reported within the Others segment. This

has been restated in the table below. There has been no change to

the total reported revenue or gross profit before exceptional items

or any other element of the financial statements.

(ii) In the six months to 25 July 2015 a new enterprise resource

planning system was implemented. This implementation included an

alignment of the internal management reporting and the statutory

reporting. The review concluded that some distribution costs

previously recorded within operating expenses would be more

appropriately recorded within cost of sales as this reflects more

accurately the costs incurred in manufacturing products. This has

resulted in a reduction in the gross profit of GBP3.4m in the year

to 25 January 2015 and a reduction of GBP1.8m in the six months to

25 July 2015. Operating expenses have reduced by an equivalent

amount in these periods with there being no change to the

previously reported operating profit. There has been no impact on

any other element of the financial statements.

6 months ended 27 July

2014

Still drinks

Carbonates and water Other Total

GBP000 GBP000 GBP000 GBP000

--------------- ---------------- ------------- --- ----------- --------------- ---------- ----------

Total revenue 102,612 31,638 1,453 135,703

Gross profit before exceptional

items as previously stated 53,189 9,495 490 63,174

Reclassification of distribution

costs (note ii) (2,515) 654 28 (1,833)

Restated gross profit before exceptional

items 50,674 10,149 518 61,341

------------------------------------------------ --- ----------- --------------- ---------- ----------

Year ended 25 January

2015

Still drinks

Carbonates and water Other Total

GBP000 GBP000 GBP000 GBP000

--------------- ---------------- ------------- --- ----------- --------------- ---------- ----------

Total revenue 198,249 58,218 4,428 260,895

Gross profit before exceptional

items as previously stated 102,235 17,349 3,729 123,313

Restatement of gross

profit (note i) 2,342 - (2,342) -

Reclassification of distribution

costs (note ii) (4,852) 1,338 100 (3,414)

Restated gross profit before exceptional

items 99,725 18,687 1,487 119,899

------------------------------------------------ --- ----------- --------------- ---------- ----------

4. Principal risks and uncertainties

The directors consider that the principal risks and

uncertainties which could have a material impact on the Group's

performance in the remaining 27 weeks of the financial year remain

substantially the same as those stated on pages 26-29 of the

Group's annual financial statements as at 25 January 2015, which

are available on our website, www.agbarr.co.uk.

5. Financial risk management and financial instruments

The Group's activities expose it to a variety of financial

risks: market risk (including foreign exchange risk, cash flow and

fair value interest rate risk and price risk), credit risk and

liquidity risk.

The condensed interim financial statements should be read in

conjunction with the Group's annual financial statements as at 25

January 2015 as they do not include all financial risk management

information and disclosures contained within the annual financial

statements. There have been no changes in the risk management

policies since the year end.

6. Segment reporting

The Group's management committee has been identified as the

chief operating decision-maker. The management committee reviews

the Group's internal reporting in order to assess performance and

allocate resources. The management committee has determined the

operating segments based on these reports.

The management committee considers the business from a product

perspective. This led to the operating segments identified in the

table below: there has been no change to the segments during the

period (after aggregation).

The performance of the operating segments is assessed by

reference to their gross profit before exceptional items.

Exceptional items are reported separately in note 8.

6 months ended 25 July

2015

Still drinks

Carbonates and water Other Total

GBP000 GBP000 GBP000 GBP000

---------------------- --- ----- --------- ----------- --------------- ------- --------

Total revenue 96,298 27,563 6,399 130,260

Gross profit before

exceptional items 50,150 8,196 2,846 61,192

--------------------------- --------------- ----------- --------------- ------- ========

6 months ended 27 July

2014

Still drinks

Carbonates and water Other Total

GBP000 GBP000 GBP000 GBP000

---------------------- --- ----- --------- ----------- --------------- ------- --------

Total revenue 102,612 31,638 1,453 135,703

Gross profit before exceptional

items (Restated - note 3 (c)) 50,674 10,149 518 61,341

--------------------------------------------- ----------- --------------- ------- --------

Year ended 25 January

2015

Still drinks

Carbonates and water Other Total

GBP000 GBP000 GBP000 GBP000

---------------------- --- ----- --------- ----------- --------------- ------- --------

Total revenue 198,249 58,218 4,428 260,895

Gross profit before exceptional

items (Restated - note 3(c)) 99,725 18,687 1,487 119,899

--------------------------------------------- ----------- --------------- ------- --------

There are no intersegment sales. All revenue is from external

customers.

Other segments represent the sale of Funkin cocktail solutions,

rental income for vending machines, the sale of ice-cream and other

soft drink related items. In the six months to 27 July 2014 this

segment also included income from water coolers for the Findlays 19

litre water business. This business was disposed of in the second

half of the year to 25 January 2015.

The gross profit before exceptional items from the segment

reporting is reconciled to the total profit before income tax as

shown in the consolidated condensed income statement.

All of the assets of the Group are managed by the management

committee on a central basis rather than at a segment level. As a

result no reconciliation of segment assets and liabilities to the

consolidated condensed statement of financial position has been

disclosed for any of the periods presented.

7. Seasonality of operations

Historically, approximately half the revenues and operating

profits are expected in each half of the year.

8. Operating profit

The following items have been charged to operating profit during

the period:

6 months ended 6 months Year ended

25 July 2015 ended 27 25 January

July 2014 2015

GBP000 GBP000 GBP000

---------------------- ------- --------------- ----------- ------------

Acquisition costs

(note 13) 667 - -

Inventory write down 20 51 134

Foreign exchange losses

recognised 563 351 1,063

Inventories are stated at the lower of cost and net realisable

value. Net realisable value is the estimated selling price in the

ordinary course of business less the estimated costs of completing

production and selling expenses.

During the six months to 27 July 2014 the contract for the

production and selling of Orangina was terminated by the recently

formed Lucozade Ribena Suntory Group. This resulted in compensation

of GBP0.7m being received by A.G. BARR p.l.c. This has been shown

on the consolidated condensed income statement as other income.

(MORE TO FOLLOW) Dow Jones Newswires

September 22, 2015 02:00 ET (06:00 GMT)

The following exceptional items have been charged or credited

before operating profit:

6 months 6 months Year ended

ended 25 ended 27 25 January

July 2015 July 2014 2015

GBP000 GBP000 GBP000

-------------------------------------------- ------------ ----------- ------------

Redundancy costs relating to the

closure of the Tredegar manufacturing

site - 960 1,427

Impairment charges relating to the

closure of the Tredegar manufacturing

site - 1,365 1,483

Total cost of sales - 2,325 2,910

---------------------------------------------- ---------- ----------- ------------

Pension curtailment - (523) (523)

Redundancy costs for finance, telesales,

distribution, demand and supply planning

reorganisation - 741 899

Total operating

costs - 218 376

---------------------------------------------- ---------- ----------- ------------

Total exceptional

costs - 2,543 3,286

---------------------------------------------- ---------- ----------- ------------

During the six months to 27 July 2014 A.G. BARR p.l.c. announced

the closure of its manufacturing site at Tredegar. This resulted in

an impairment charge of GBP1.4m in respect of buildings and plant

at the site with a further GBP0.1m charge in the second half of the

year ended 25 January 2015. GBP3,000 of redundancy related costs

were incurred in the six months to 27 July 2014 with a further

GBP1.0m of redundancy costs provided for. A further GBP0.5m was

incurred in the second half of the year to 25 January 2015.

Redundancy, recruitment and training costs in relation to the

finance, telesales, distribution, demand and supply planning

operations within England were incurred during the six months to 27

July 2014 and year ended 25 January 2015 and treated as

exceptional.

As a result of the finance, telesales, distribution, demand and

supply planning reorganisation, a curtailment in the Group's

retirement pension plan arose in the 6 months ended 27 July 2014

and year ended 25 January 2015. This resulted in an exceptional

credit arising from the reduction in the retirement benefit

obligation following a reduction in the number of employees

remaining with the scheme. The value of this credit was

GBP0.5m.

9. Tax on profit

The interim period tax charge is accrued based on the estimated

average annual effective income tax rate of 21.0% (six months ended

27 July 2014: 22.3%; year ended 25 January 2015: 22.3%).

The Chancellor announced in his Summer Budget on 8 July 2015

that the main rate of corporation tax will be reduced to 19% from 1

April 2017 and 18% from 1 April 2020 and the future current tax

charges will reduce accordingly. These changes are contained in the

Finance Bill 2015 which is not expected to be substantively enacted

until October 2015 and at that point the changes will be reflected

in the Company's deferred tax liabilities.

10. Earnings per share

Basic earnings per share have been calculated by dividing the

earnings attributable to equity holders of the parent by the

weighted average number of shares in issue during the year,

excluding shares held by the employee share scheme trusts.

6 months 6 months Year ended

ended 25 ended 27 25 January

July 2015 July 2014 2015

Profit attributable to equity

holders of the Company (GBP000) 13,338 12,815 29,997

Weighted average number of ordinary

shares in issue 115,280,958 115,516,417 115,377,541

--------------------------------------- ------------ ------------ ------------

Basic earnings per

share (pence) 11.57 11.09 26.00

---------------------------------------- ------------ ------------ ------------

For diluted earnings per share, the weighted average number of

ordinary shares in issue is adjusted to assume conversion of all

potentially dilutive ordinary shares. These represent share options

granted to employees where the exercise price is less than the

average market price of the Company's ordinary shares during the

period. The number of shares calculated as above is compared with

the number of shares that would have been issued assuming the

exercise of the share options.

6 months 6 months Year ended

ended 25 ended 27 25 January

July 2015 July 2014 2015

Profit attributable to equity

holders of the Company (GBP000) 13,338 12,815 29,997

Weighted average number of ordinary

shares in issue 115,280,958 115,516,417 115,377,541

Adjustment for dilutive

effect of share options 676,859 623,121 623,962

-------------------------------------- ------------ ------------ ------------

Diluted weighted average number

of ordinary shares in issue 115,957,817 116,139,538 116,001,503

Diluted earnings per

share (pence) 11.50 11.03 25.86

---------------------------------------- ------------ ------------ ------------

The underlying EPS figure is calculated by using profit

attributable to equity holders before exceptional items:

6 months 6 months Year ended

ended 25 ended 27 25 January

July 2015 July 2014 2015

Profit attributable to equity

holders of the Company before

exceptional items (GBP000) 13,338 14,826 32,596

Weighted average number of ordinary

shares in issue 115,280,958 115,516,417 115,377,541

---------------------------------------------- --- -------------- ------------ ------------

Underlying earnings

per share (pence) 11.57 12.83 28.25

--------------------------------------------------- -------------- ------------ ------------

This measure has been included in the financial statements as it

provides a closer guide to the underlying financial performance as

the calculation excludes the effect of exceptional items.

11. Dividends paid

6 months 6 months 6 months

6 months ended ended ended Year ended

ended 25 27 July 25 July 27 July 25 January

July 2015 2014 2015 2014 2015

------------

Year ended

25 January

2015 per

per share per share share

(p) (p) (p) GBP000 GBP000 GBP000

--------------------- ----------- ---------- ------------ --------- -------------- ------------

Paid final dividend 9.01 - - 10,402 - -

Paid first interim

dividend - - 3.11 - - 3,596

Paid second interim

dividend - 8.19 8.19 - 9,455 9,455

9.01 8.19 11.30 10,402 9,455 13,051

--------------------- =========== ---------- ------------ ========= -------------- ============

An interim dividend of 3.36p (an increase of 8% on last year)

per share was approved by the board on 22 September 2015 and will

be paid on 16 October 2015 to shareholders on record as at 2

October 2015.

12. Held for sale assets

The property, plant and equipment related to the manufacturing

site at Tredegar have been presented as held for sale following the

decision to close the site. The property, plant and equipment was

sold during September 2015 (note 22).

13. Acquisition of subsidiary

On 2 February 2015, the Group acquired 100% of the share capital

of Funkin Limited ('Funkin'), a company which offers a broad range

of premium cocktail solutions including fruit purées, cocktail

mixers and syrups.

In the six months to 25 July 2015, Funkin contributed revenue of

GBP4.9m and an operating profit of GBP0.7m to the Group's results.

Had Funkin been consolidated from 26 January 2015, the consolidated

condensed income statement for the six months ended 25 July 2015

would not be materially different.

Consideration transferred

(MORE TO FOLLOW) Dow Jones Newswires

September 22, 2015 02:00 ET (06:00 GMT)

The following table summarises the acquisition-date fair value

of each major class of consideration transferred:

GBP000

-------------------------- -------

Cash 17,511

Contingent consideration 4,500

Total consideration 22,011

-------------------------- -------

Contingent consideration

The Group has agreed to pay the former owners of Funkin a

contingent consideration based on achievement of certain financial

targets by Funkin in the two years from the date of its acquisition

by the Group. The potential undiscounted amount of all future

payments that the Group could make under the acquisition agreement

is between GBPnil and GBP4.5m.

The fair value of the contingent consideration arrangement of

GBP4.5m was estimated by assessing the expected growth of Funkin

over the two years trading post acquisition. No discount rate has

been applied to the fair value estimate of the contingent

consideration as due to the short time period the effect of

discounting has a negligible effect on the fair value.

The fair value of trade and other receivables is GBP1.4m and

includes trade receivables with a fair value of GBP1.2m. The gross

contractual amount for trade receivables due is GBP1.3m of which

GBP0.1m is expected to be uncollectible.

The fair value of the acquired identifiable intangible assets of

GBP7.2m, is provisional pending receipt of the final valuations for

those assets. A deferred tax liability of GBP1.5m has been provided

in relation to these fair value adjustments in relation to

intangible assets.

Acquisition-related costs

The Group incurred acquisition-related costs of GBP0.7m relating

to external legal fees and due diligence costs. These costs have

been included in operating costs in the consolidated condensed

income statement.

Recognised amounts of identifiable assets acquired and

liabilities assumed

GBP000

------------------------------- --------

Cash and cash equivalents 1,754

Funkin brand 6,800

Customer list 414

Property, plant and equipment 13

Inventories 657

Trade and other receivables 1,438

Trade and other payables (3,167)

Current tax liability (149)

Deferred tax liabilities (1,470)

Total identifiable net assets 6,290

------------------------------- --------

Goodwill 15,721

------------------------------- --------

None of the goodwill arising on the acquisition is expected to

be deductible for tax purposes.

The goodwill of GBP15.7m arises from a number of factors

including expected synergies through combining an experienced

senior team and obtaining greater production efficiencies through

knowledge transfer; marketing expertise; obtaining economies of

scale by cost reductions from purchasing efficiencies; price

reductions and greater volume rebates from suppliers; sales

synergies arising from introducing Funkin to A.G. BARR's route to

market and sales channels; and unrecognised assets such as the

workforce.

14. Intangible assets

6 months 6 months Year ended

ended 25 ended 27 25 January

July 2015 July 2014 2015

GBP000 GBP000 GBP000

------------------ ----------- ----------- ------------

Opening net book

value 80,917 74,107 74,107

Additions 27,692 2,368 7,063

Amortisation (343) (126) (253)

Closing net book

value 108,266 76,349 80,917

------------------- ----------- ----------- ------------

The additions for periods presented represent goodwill and other

intangible assets acquired as part of the acquisition of Funkin

(note 13), internally generated software development costs and

third party consultancy costs incurred in relation to the Business

Process Redesign project.

The amortisation charge for the six months to 25 July 2015

represents GBP0.2m (six months ended 27 July 2014: nil; year ended

25 January 2015: nil) of charges in relation to the Business

Process Redesign project, GBP0.1m (six months ended 27 July 2014:

GBP0.1m; year ended 25 January 2015: GBP0.3m) of charges for the

Rubicon customer list and GBP34,000 of charges for the Funkin

customer list.

15. Property, plant and equipment

6 months 6 months Year ended

ended 25 ended 27 25 January

July 2015 July 2014 2015

GBP000 GBP000 GBP000

------------------------------------------ ----------- ----------- ------------

Opening net book value 79,663 76,314 76,314

Additions 7,082 3,538 12,037

Additions acquired during acquisition

(note 13) 13 - -

Disposals (225) (452) (466)

Property, plant and equipment classified

as held for sale (note 12) (850) - -

Impairment of property, plant

and equipment - (1,365) (1,483)

Depreciation (3,593) (3,347) (6,739)

Closing net book value 82,090 74,688 79,663

------------------------------------------- ----------- ----------- ------------

The closing balance includes GBP0.6m (as at 27 July 2014:

GBP2.5m; as at 25 January 2015: GBP6.7m) of assets under

construction.

16. Financial instruments

Current assets of GBP20,000 (at 27 July 2014: GBPnil; 25 January

2015: GBP0.1m) relate to forward foreign currency contracts with a

maturity of less than 12 months and are classified as fair value

through the cash flow hedge reserve.

Current liabilities of GBP0.5m (at 27 July 2014: GBP0.9m; 25

January 2015: GBP0.7m) represents forward foreign currency

contracts with a maturity of less than 12 months and are classified

as fair value through the cash flow hedge reserve.

Non-current liabilities of GBPnil (at 27 July 2014: GBP47,000;

25 January 2015: GBPnil) relate to forward foreign currency

contracts with a maturity of more than 12 months and are classified

as fair value through the cash flow hedge reserve.

Fair value hierarchy

IFRS 7 requires all financial instruments carried at fair value

to be analysed under the following levels:

Level quoted prices (unadjusted) in active markets for identical

1: assets or liabilities

Level inputs other than quoted prices included within Level

2: 1 that are observable for the asset or liability, either

directly (i.e. as prices) or indirectly (i.e. derived

from prices)

Level inputs for the asset or liability that are not based

3: on observable market data

The fair value of financial instruments that are not traded in

an active market (for example, over-the-counter derivatives) is

determined by using valuation techniques. These valuation

techniques maximise the use of observable market data where it is

available and rely as little as possible on entity specific

estimates. The fair value of the forward foreign exchange contracts

is determined using forward exchange rates at the date of the

statement of financial position, with the resulting value

discounted accordingly as relevant.

All financial instruments carried at fair value are Level 2.

Fair values of financial assets and financial liabilities

The table below sets out the comparison between the carrying

amount and fair value of all of the Group's financial instruments,

with the exception of trade and other receivables and trade and

other payables.

Carrying amount Fair value

---------------------------------------------------------

Other

financial

Fair value liabilities

- hedging Loans at amortised Level

instruments and receivables cost Total 2

As at 25 July 2015 GBP000 GBP000 GBP000 GBP000 GBP000

------------------------------- ------------- ----------------- -------------- ------- -----------

Financial assets not measured

at fair value

Cash and cash equivalents - 10,583 - 10,583 10,583

- 10,583 - 10,583 10,583

------------------------------- ------------- ----------------- -------------- ------- -----------

Financial assets measured

at fair value

Foreign exchange contracts

used for hedging - current 20 - - 20 20

20 - - 20 20

------------------------------- ------------- ----------------- -------------- ------- -----------

Financial liabilities measured

at fair value

Foreign exchange contracts used

for hedging - current 508 - - 508 508

Contingent consideration - - 4,500 4,500 4,500

508 - 4,500 5,008 5,008

(MORE TO FOLLOW) Dow Jones Newswires

September 22, 2015 02:00 ET (06:00 GMT)

------------------------------------ ---- ------- ------- -------

Financial liabilities not measured

at fair value

Unsecured bank borrowings -

non-current - - 30,500 30,500 30,402

- - 30,500 30,500 30,402

------------------------------------ ---- ------- ------- -------

Carrying amount Fair value

---------------------------------------------------------

Other

financial

Fair value liabilities

- hedging Loans at amortised Level

instruments and receivables cost Total 2

As at 27 July 2014 GBP000 GBP000 GBP000 GBP000 GBP000

--------------------------------- ------------- ----------------- -------------- ------- -----------

Financial assets not measured

at fair value

Cash and cash equivalents - 11,281 - 11,281 11,281

- 11,281 - 11,281 11,281

--------------------------------- ------------- ----------------- -------------- ------- -----------

Financial liabilities measured

at fair value

Foreign exchange contracts

used for hedging - current 914 - - 914 914

Foreign exchange contracts

used for hedging - non-current 47 - - 47 47

961 - - 961 961

--------------------------------- ------------- ----------------- -------------- ------- -----------

Financial liabilities not

measured at fair value

Unsecured bank borrowings

- non-current - - 14,931 14,931 14,931

- - 14,931 14,931 14,931

--------------------------------- ------------- ----------------- -------------- ------- -----------

Carrying amount Fair value

---------------------------------------------------------

Other

financial

Fair value liabilities

- hedging Loans at amortised Level

instruments and receivables cost Total 2

As at 25 January 2015 GBP000 GBP000 GBP000 GBP000 GBP000

-------------------------------- ------------- ----------------- -------------- ------- -----------

Financial assets not measured

at fair value

Foreign exchange contracts

used for hedging 66 - - 66 66

Cash and cash equivalents - 25,437 - 25,437 25,437

66 25,437 - 25,503 25,503

-------------------------------- ------------- ----------------- -------------- ------- -----------

Financial liabilities measured

at fair value

Foreign exchange contracts

used for hedging 666 - - 666 666

666 - - 666 666

-------------------------------- ------------- ----------------- -------------- ------- -----------

Financial liabilities not

measured at fair value

Unsecured bank borrowings

- current - - 73 73 73

Unsecured bank borrowings

- non-current - - 14,944 14,944 14,944

- - 15,017 15,017 15,017

-------------------------------- ------------- ----------------- -------------- ------- -----------

The carrying value of non-current borrowings is disclosed before

the deduction of the unamortised arrangement fee of GBP0.1m.

The fair values of the non-current borrowings are based on cash

flows discounted using the current variable interest rate charged

on the borrowings of 1.50% and a discount rate of 1.50%.

17. Provisions

6 months 6 months Year ended

ended 25 ended 27 25 January

July 2015 July 2014 2015

GBP000 GBP000 GBP000

--------------------------------- ----------- ----------- ------------

Opening provision 1,009 396 396

Provision created in the period - 1,469 1,469

Provision released during the

period - (36) (97)

Provision utilised during the

period (897) (729) (759)

Closing provision 112 1,100 1,009

---------------------------------- ----------- ----------- ------------

18. Borrowings and loans

Movements in borrowings are analysed as follows:

6 months 6 months Year ended

ended 25 ended 27 25 January

July 2015 July 2014 2015

GBP000 GBP000 GBP000

----------------------------------------- ----------- ----------- ------------

Opening loan balance 15,073 15,000 15,000

Borrowings made 47,000 15,000 15,000

Bank overdrafts - - 73

Repayments of borrowings and

overdrafts (31,573) (15,000) (15,000)

========================================== =========== =========== ============

Closing loan balance before arrangement

fees 30,500 15,000 15,073

Unamortised arrangement fee (98) (69) (56)

Closing loan balance 30,402 14,931 15,017

------------------------------------------ ----------- ----------- ------------

The reconciliation to net debt is as follows:

As at

As at 25 27 July As at 25

July 2015 2014 January 2015

GBP000 GBP000 GBP000

========================================= ----------- --------- --------------

Closing loan balance before arrangement

fees 30,500 15,000 15,073

Cash and cash equivalents (10,583) (11,281) (25,437)

Net debt 19,917 3,719 (10,364)

------------------------------------------ ----------- --------- --------------

The undrawn facilities at 25 July 2015 are as follows:

Total facility Drawn Undrawn

GBP000 GBP000 GBP000

----------------------------- --------------- ------- --------

Revolving credit facilities 45,000 30,500 14,500

Overdraft 5,000 - 5,000

50,000 30,500 19,500

----------------------------- --------------- ------- --------

During the six months to 25 July 2015, the Group renegotiated a

GBP35m revolving credit facility.

A total arrangement fee of GBP0.1m was incurred and will be

amortised over the life of the loan facility. The revolving credit

facility will expire in January 2018. A further GBP10m revolving

credit facility was arranged in the year to 26 January 2014 and

will expire in March 2017.

The directors confirm that the Group has sufficient headroom to

enable it to meet the covenants on its existing borrowings. There

are sufficient working capital and undrawn funding facilities

available to meet the Group's ongoing requirements.

19. Retirement benefit obligations

(MORE TO FOLLOW) Dow Jones Newswires

September 22, 2015 02:00 ET (06:00 GMT)

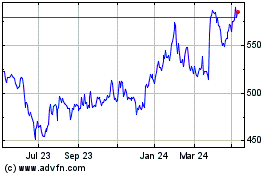

Barr (a.g.) (LSE:BAG)

Historical Stock Chart

From Aug 2024 to Sep 2024

Barr (a.g.) (LSE:BAG)

Historical Stock Chart

From Sep 2023 to Sep 2024