TIDMBKIR

RNS Number : 6109W

Bank of Ireland(Governor&Co)

28 April 2016

The Governor and Company of the Bank of Ireland (the

"Group")

Interim Management Statement - Q1 2016 update

28 April 2016

Trading

The Group continues to trade in line with expectations.

The macroeconomic environments in Ireland and the UK, which are

our key markets, have remained favourable. In Ireland, the export

sector continued to expand and domestic activity increased as

improving labour market conditions and other factors positively

impact consumer spending. In the UK, where our businesses are

primarily focussed on the domestic sector, the economy expanded in

Q1, notwithstanding some uncertainty relating to the upcoming EU

referendum. Our regulatory capital ratios are substantially hedged

from currency translation impacts. However, given that sterling

weakened by 7% during the first quarter vis-a-vis our Euro

reporting currency, this has impacted reported balance sheet assets

and liabilities as well as items in the profit and loss

account.

On a constant currency basis, our net interest income has

performed in line with our expectations during the first quarter.

Customer loan asset spreads remain in line with H2 2015 levels and

we are continuing to take actions to reduce the cost of our

funding. Liquid asset volumes are higher than anticipated, due to

underlying deposit and current account volume growth. Liquid asset

spreads reflected the ongoing very low interest rate environment

and bond sales that were completed in the early part of the year,

with related additional gains benefitting non-interest income. As a

consequence of these factors, our net interest margin averaged

2.11% during the period.

Other non-interest income and fees are largely in line with the

second half of 2015, notwithstanding the backdrop of a more

volatile market environment. The Group has continued to maintain

tight control over our cost base, while making appropriate

investments in our businesses, infrastructure and people. As

anticipated, regulatory charges and levies of c.EUR50 million were

accounted for during the period.

Asset Quality

Asset quality trends have continued to improve in line with our

expectations. Our non-performing loan volumes have fallen by EUR0.9

billion since December 2015 to EUR11.1 billion at the end of March

2016, with reductions across all asset classes. Our defaulted loans

have reduced by EUR0.8 billion during the same period to EUR9.8

billion. These reductions reflect our ongoing progress with

resolution strategies that include appropriate and sustainable

support to customers who are in financial difficulty, the positive

economic environment and the ongoing recovery in collateral values.

We expect the level of non-performing loans to continue to

reduce.

Balance Sheet

Loan book dynamics continue to be broadly in line with our

expectations.

The balance sheet was impacted by the translation impact of

sterling assets and liabilities with customer loan volumes reducing

to EUR81 billion in Euro reported terms at the end of March 2016

and customer deposits to EUR79 billion, resulting in a loan to

deposit ratio of 104%. The decrease in the value of sterling

accounted for c.EUR3 billion of the movement in customer loan

volumes. New lending volumes were higher than in the same period

last year and, notwithstanding some large individual transaction

specific redemptions in our Corporate business and a broadly

similar pattern to the same period last year of redemptions across

our other businesses, our core loan books (i.e. excluding

non-performing loans, Irish tracker mortgages and legacy run-down

books) continue to grow. Wholesale funding was EUR14 billion at the

end of March 2016.

Capital

At the end of March 2016, the Group's fully loaded CET 1 ratio

was 11.2%, in line with the December 2015 position. The Group's

continuing organic capital generation was offset by an increase in

the IAS 19 accounting standard defined benefit pension deficit to

EUR0.9 billion. At March 2016, the Group's transitional CET1 and

Total Capital ratios were 13.1% and 17.7% respectively and reflect,

inter alia, the further phase in of CRD IV items since 1 January

2016.

Ends

For further information please contact:

Bank of Ireland

Andrew Keating Group Chief Financial Officer +353 (0)766 23

5141

Mark Spain Director of Group Investor Relations +353 (0)766 23

4850

Pat Farrell Head of Group Communications +353 (0)766 23 4770

Forward-Looking Statement

This document contains certain forward-looking statements within

the meaning of Section 21E of the US Securities Exchange Act of

1934 and Section 27A of the US Securities Act of 1933 with respect

to certain of the Bank of Ireland Group's (the 'Group') plans and

its current goals and expectations relating to its future financial

condition and performance, the markets in which it operates, and

its future capital requirements. These forward looking statements

often can be identified by the fact that they do not relate only to

historical or current facts. Generally, but not always, words such

as 'may,' 'could,' 'should,' 'will,' 'expect,' 'intend,' 'estimate,

' 'anticipate,' 'assume,' 'believe,' 'plan,' 'seek,' 'continue,'

'target,' 'goal', 'would,' 'can,' 'might,' or their negative

variations or similar expressions identify forward-looking

statements, but their absence does not mean that a statement is not

forward looking. Examples of forward-looking statements include

among others, statements regarding the Group's near term and longer

term future capital requirements and ratios, level of ownership by

the Irish Government, loan to deposit ratios, expected impairment

charges, the level of the Group's assets, the Group's financial

position, future income, business strategy, projected costs,

margins, future payment of dividends, the implementation of changes

in respect of certain of the Group's pension schemes, estimates of

capital expenditures, discussions with Irish, United Kingdom,

European and other regulators and plans and objectives for future

operations.

Such forward-looking statements are inherently subject to risks

and uncertainties, and hence actual results may differ materially

from those expressed or implied by such forward-looking statements.

Such risks and uncertainties include, but are not limited to, the

following:

geopolitical risks, which could potentially adversely impact the

markets in which the Group operates; concerns on sovereign debt and

financial uncertainties in the EU and the potential effects of

those uncertainties on the financial services industry and on the

Group; general and sector specific economic conditions in Ireland,

the United Kingdom and the other markets in which the Group

operates;

the ability of the Group to generate additional liquidity and

capital as required; property market conditions in Ireland and the

United Kingdom; the potential exposure of the Group to credit risk

and to various types of market risks, such as interest rate risk,

foreign exchange rate risk; the impact on lending and other

activity arising from emerging macro prudential policies; the

performance and volatility of international capital markets; the

effects of the Irish Government's stockholding in the Group

(through the Ireland Strategic Investment Fund) and possible

changes in the level of such stockholding; changes in applicable

laws, regulations and taxes in jurisdictions in which the Group

operates particularly banking regulation by the Irish and United

Kingdom Governments together with the operation of the Single

Supervisory Mechanism and the establishment of the Single

Resolution Mechanism; the impact of the continuing implementation

of significant regulatory developments such as Basel III, Capital

Requirements Directive (CRD) IV, Solvency II and the Recovery and

Resolution Directive; the exercise by regulators of powers of

regulation and oversight in Ireland and the United Kingdom; the

introduction of new government policies or the amendment of

existing policies in Ireland or the United Kingdom; the outcome of

any legal claims brought against the Group by third parties or

legal or regulatory proceedings more generally, that may have

implications for the Group; the development and implementation of

the Group's strategy, including the Group's ability to achieve net

interest margin increases and cost reductions; the inherent risk

within the Group's life assurance business involving claims, as

well as market conditions generally; potential further

contributions to the Group sponsored pension schemes if the value

of pension fund assets is not sufficient to cover potential

obligations; the Group's ability to address weaknesses or failures

in its internal processes and procedures including information

technology issues and equipment failures and other operational

risks; the Group's ability to meet customer' expectations in

mobile, social, analytics and cloud technologies which have enabled

a new breed of 'digital first' propositions, business models and

competitors; uncertainty relating to the forthcoming UK 'In / Out'

referendum; failure to establish availability of future taxable

profits, or a legislative change in quantum of deferred tax assets

currently recognised; and difficulties in recruiting and retaining

appropriate numbers and calibre of staff.

(MORE TO FOLLOW) Dow Jones Newswires

April 28, 2016 02:01 ET (06:01 GMT)

Nothing in this document should be considered to be a forecast

of future profitability or financial position and none of the

information in this document is or is intended to be a profit

forecast or profit estimate. Any forward-looking statement speaks

only as at the date it is made. The Group does not undertake to

release publicly any revision to these forward-looking statements

to reflect events, circumstances or unanticipated events occurring

after the date hereof. The reader should however, consult any

additional disclosures that the Group has made or may make in

documents filed or submitted or may file or submit to the US

Securities and Exchange Commission.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCEASLPADPKEEF

(END) Dow Jones Newswires

April 28, 2016 02:01 ET (06:01 GMT)

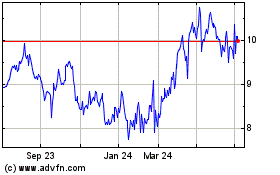

Bank Of Ireland (LSE:BIRG)

Historical Stock Chart

From Aug 2024 to Sep 2024

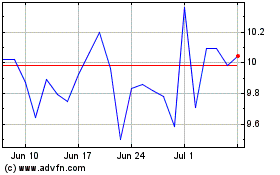

Bank Of Ireland (LSE:BIRG)

Historical Stock Chart

From Sep 2023 to Sep 2024