TIDMAVON

RNS Number : 1296X

Avon Rubber PLC

04 May 2016

News Release

Strictly embargoed until 07:00 4 May 2016

AVON RUBBER p.l.c.

("Avon", the "Group" or the "Company")

Unaudited interim results for the six months ended 31 March

2016

31 March Increase

31 March 2016 2015

GBPMillions GBPMillions

REVENUE 66.3 62.8 5%

ADJUSTED EBITDA (*) 13.2 12.2 9%

ADJUSTED OPERATING PROFIT (*) 9.0 8.5 6%

ADJUSTED PROFIT BEFORE TAX (*) 8.8 8.4 5%

NET (DEBT)/CASH (8.4) 7.3

EARNINGS PER SHARE:

Adjusted basic (*) 28.7p 22.3p 29%

Adjusted diluted (*) 28.1p 21.7p 29%

INTERIM DIVIDEND 3.16p 2.43p 30%

FINANCIAL HIGHLIGHTS

-- Operating profit growth of 6%

-- Diluted earnings per share increased 29%

-- Return on sales (EBITDA divided by revenue) improved 0.5% from 19.4% to 19.9%

-- Continuing healthy conversion of operating profit to operating cash at 163%

-- Net debt reduced by GBP4.8m during H1 to GBP8.4m, after the

GBP3.5m cash acquisition of Argus

-- Dividend of 3.16p per share up 30%

OPERATIONAL HIGHLIGHTS

-- Acquisition of Argus in October 2015 broadened Protection & Defence product range

-- Successful integration of InterPuls and Argus into the organisation

-- Delivered 107,000 M50 mask systems under our long-term sole source DOD contract

-- Military order pipeline healthy, timing of receipt remains difficult to predict

-- Milkrite brand continues to grow in cyclically softer dairy market conditions

-- Cluster Exchange now servicing 446,000 cows on 1,411 farms

Rob Rennie, Chief Executive commented:

"Avon has enjoyed another positive half year, successfully

integrating our recent acquisitions which broaden our product range

and routes to market. In Dairy, whilst market conditions have, as

previously highlighted, reflected cyclically low milk prices, we

are encouraged that our own brand Milkrite products and Cluster

Exchange service have continued to gain market share.

Trading is normally second-half weighted in our Protection &

Defence business and we believe this will again be the case this

year. We have a strong forward order book for DOD M50s and a

growing pipeline of non-DOD opportunities.

The Board therefore expects to make progress as the year

develops and meet market expectations for the full year."

(*) Note:

The Directors believe that adjusted measures provide a more

useful comparison of business trends and performance. Adjusted

results exclude exceptional items, defined benefit pension scheme

costs and the amortisation of acquired intangibles. The term

adjusted is not defined under IFRS and may not be comparable with

similarly-titled measures used by other companies.

All profit and earnings per share figures in these interim

results relate to adjusted business performance (as defined above)

unless otherwise stated. A reconciliation of adjusted measures to

non-adjusted measures is provided below:

Statutory Adjustments Adjusted

--------------------------------------- ---------- ------------ ---------

Group EBITDA (GBPm) 12.5 0.7 13.2

--------------------------------------- ---------- ------------ ---------

Group operating profit (GBPm) 6.6 2.4 9.0

--------------------------------------- ---------- ------------ ---------

Other finance expense (GBPm) 0.4 (0.3) 0.1

--------------------------------------- ---------- ------------ ---------

Group profit before taxation (GBPm) 6.1 2.7 8.8

--------------------------------------- ---------- ------------ ---------

Taxation (GBPm) (0.4) 0.5 0.1

--------------------------------------- ---------- ------------ ---------

Group profit for the period (GBPm) 6.5 2.2 8.7

--------------------------------------- ---------- ------------ ---------

Basic earnings per share (pence) 21.6 7.1 28.7

--------------------------------------- ---------- ------------ ---------

Diluted earnings per share (pence) 21.2 6.9 28.1

--------------------------------------- ---------- ------------ ---------

Protection & Defence operating profit

(GBPm) 5.3 1.3 6.6

--------------------------------------- ---------- ------------ ---------

Dairy operating profit (GBPm) 2.6 0.8 3.4

--------------------------------------- ---------- ------------ ---------

The adjustments comprise:

-- exceptional items of GBP0.5m relating to acquisition integration costs

-- amortisation of acquired intangibles of GBP1.7m

-- defined benefit pension scheme costs which relate to a scheme

closed to future accrual and therefore do not relate to current

operations:

-- administrative expenses of GBP0.2m

-- other finance expense of GBP0.3m

-- tax effect of adjustments of GBP0.5m

Avon Rubber p.l.c.

-----------------------------------------------------------------

Rob Rennie, Chief Executive: 020 7067 0000 (until 12 noon today)

-----------------------------------------------------------------

Andrew Lewis, Group Finance Director: 01225 896 830

-----------------------------------------------------------------

Sarah Matthews-DeMers, Associate Group Finance Director: 01225

896 835

-----------------------------------------------------------------

Weber Shandwick Financial

-----------------------------------------------------------------

Nick Oborne: 020 7067 0000

-----------------------------------------------------------------

An analyst meeting will be held at 9.30am this morning at the

offices of Weber Shandwick Financial, 2 Waterhouse Square, 140

Holborn, London, EC1N 2AE.

NOTES TO EDITORS:

The Group has transformed itself over recent years into an

innovative design and engineering group, specialising in two core

markets, Protection & Defence and Dairy. With a strong emphasis

on research and development, we design, test and manufacture

specialist products from a number of sites in the US and Europe,

serving markets around the world. We achieve this through nurturing

the talent and aspirations of our employees to realise their

highest potential.

Avon Protection Systems is the recognised global market leader

in advanced Chemical, Biological, Radiological and Nuclear (CBRN)

respiratory protection systems for the world's military, homeland

security, first responder, fire and industrial markets. With an

unrivalled pedigree in mask design dating back to the 1920's, Avon

Protection Systems' advanced products are the first choice for

Personal Protective Equipment (PPE) users worldwide and are placed

at the heart of many international defence and tactical PPE

deployment strategies. Our expanding global customer base now

includes military forces, civil and first line defence troops,

emergency service teams and industrial, marine, mineral and oil

extraction site personnel. All put their trust in Avon's advanced

respiratory solutions to shield them from every possible threat

whether land, air or sea based.

Our world-leading Dairy supplies business and its Milkrite and

InterPuls brands have a global market presence. With a long history

of manufacturing liners and tubing for the dairy industry, we have

become the leading innovator and designer for products and services

right at the heart of milking. The acquisition of InterPuls in

2015, a specialist in electro-mechanical milking components, such

as pulsators, milk meters, automatic cluster removers, milking

clusters, washing systems, vacuum pumps, bucket milkers and

pipeline system components, has added significantly to our product

range, making us the complete milking point solutions provider.

Working with leading scientists and health specialists in the

global dairy industry, we continue to invest in technology to

further improve the milking process and animal welfare. Our

products provide exceptional results for both the animal and the

milker, making the milk extraction process more efficient. As our

market share and milking experience continue to improve, so does

our global presence.

For further information please visit the Group's website:

www.avon-rubber.com

Interim Management Report

Introduction

Avon has enjoyed another positive half year, successfully

integrating our recent acquisitions which broaden our product range

and routes to market.

In Protection & Defence revenues for the half year were, as

planned, weighted towards US Department of Defense (DOD) sales

under our ten year sole source contract against which we received

an additional order for 167,000 M50s, giving us a strong forward

order book for DOD mask systems. We also have a growing pipeline of

higher margin non-DOD opportunities in the Americas and the Middle

East for which the timing of order receipt remains unpredictable,

although we believe the time horizon for some of these

opportunities is shortening.

In Dairy, whilst market conditions have, as previously

highlighted, reflected cyclically low milk prices, we are

encouraged that our own brand Milkrite products and Cluster

Exchange service have continued to gain market share.

Group Results

(MORE TO FOLLOW) Dow Jones Newswires

May 04, 2016 02:00 ET (06:00 GMT)

Group revenue at GBP66.3m (2015: GBP62.8m) increased by 5% and

operating profit of GBP9.0m (2015: GBP8.5m) increased by 6%.

Earnings before interest, tax, depreciation and amortisation

('EBITDA') increased by 9% to GBP13.2m (2015: GBP12.2m)

representing a return on sales (defined as EBITDA divided by

revenue) of 19.9% (2015: 19.4%).

The impact of foreign exchange translation was a slight tailwind

of GBP0.4m as the $/GBP average rate of $1.46 was lower than the

$1.54 prevailing in the same period last year. This translation

benefit has, for the most part, been offset by transactional

losses, where Euro and US dollar transactions, covered by forward

contracts at rates higher than the period rate, have given rise to

mark to market foreign exchange losses of GBP0.3m at the period

end.

If the currently stronger US dollar were to prevail throughout

the remainder of the financial year, it would create further

translation tailwinds for the full year. Our sensitivity analysis

on the full year 2015 results showed that a 5c movement in the

$/GBP exchange rate would result in a GBP0.7m impact on annual

operating profit.

Profit before tax was GBP8.8m (2015: GBP8.4m) and after a tax

charge of GBP0.1m (2015: GBP1.7m), an effective rate of 1% (2015:

20%), the Group recorded a profit for the period after tax of

GBP8.7m (2015: GBP6.7m). The reduced tax rate reflects the

anticipated geographic split of taxable profits for 2016, the

finalisation of the 2015 tax returns and the positive outcome of

certain tax enquiries. Basic earnings per share were up 29% at

28.7p (2015: 22.3p) and fully diluted earnings per share were up

29% at 28.1p (2015: 21.7p).

Net Debt and Cashflow

Net debt at the half year was GBP8.4m, down from GBP13.2m at the

2015 year end and after the GBP3.5m cash payment to acquire Argus

in October 2015.

Operating cash conversion continues to be strong at 163% of

operating profit. Turning profits into cash has enabled us to

continue to invest in the future of the business with GBP3.8m of

capital investment, while increasing dividends to shareholders by

30%.

Our main bank facilities at 31 March 2016 totalled $40m. These

facilities are committed until 30 November 2018.

Protection & Defence

Performance

Revenue for the division was GBP45.7m (2015: GBP45.3m) and

operating profit was GBP6.6m (2015: GBP6.4m). EBITDA was up 3% at

GBP9.6m (2015: GBP9.4m) and return on sales, as defined above, was

21.1% (2015: 20.6%). The increase arose from the mix of product

shipped, an improvement in DOD pricing and operational

efficiencies.

As we have always highlighted, while predicting the timing of

non-DOD orders and sales is difficult, our long-term DOD contract

and manufacturing excellence affords us the flexibility to fulfil

non-DOD orders as and when they arise and to meet the DOD's demand

in periods when non-DOD orders are lower.

Markets

M50 respirator sales to the DOD were 107,000 (2015: 112,000)

mask systems. During the period we received a further order for

167,000 mask systems which means we exit the half year with mask

order coverage well into 2017, providing good visibility of revenue

under this sole source long-term contract.

We delivered 36,000 M61 filter pairs during the period (2015:

nil) and have secured an order for a further 85,000 pairs which we

expect to deliver in the second half. In the long term, we believe

the end user demand for this consumable product will grow as

fielding of the mask continues but we continue to recognise that,

in the current DOD procurement environment, obtaining short-term

visibility of future filter spares orders remains challenging.

Sales to foreign military, law enforcement and first responder

customers increased year on year as the underlying portfolio

continues to grow. In addition, we have been encouraged by the

level of international enquiries for our respiratory protection

products and, although the timing of converting some of the larger

opportunities has not been in the first half of the year, we

believe that the conversion timeline for some of these

opportunities is shortening.

We saw growth in sales to the Fire market following the

acquisition of Argus and the launch of the new Mi-TIC Storm thermal

imaging camera which has now received NFPA and CE approval.

Other DOD spares sales were higher than the same period last

year, reflecting normal variability in the timing of orders and

delivery schedules.

AEF has experienced a softer first half, reflecting the

variability in timing of certain DOD procurement programmes for

hovercraft skirt and fuel and water storage tanks.

Order intake for the first half totalled GBP55m (2015: GBP47m).

Of the closing order book of GBP30m, GBP22m is for delivery in the

second half of our financial year, giving good visibility for the

remainder of the year.

Opportunities

Our funded development programme with the US Air Force to design

and test the MM53 Joint Service Aircrew Mask (JSAM) has progressed

well. This will provide respiratory protection to a wide range of

operators on the DOD's fleet of fixed-wing aircraft. The testing

phase of this development contract is expected to conclude at the

end of our 2016 financial year and should lead to a production

contract commencing in 2017 which could be worth in excess of

$70m.

A number of other military opportunities exist in relation to

both new and existing products that provide long-term growth

potential.

Dairy

Performance

Revenue for the Dairy business was 18% higher at GBP20.6m (2015:

GBP17.5m) following the acquisition of InterPuls which offset

softer market conditions caused by low milk prices. An increasing

proportion of higher margin Milkrite product and service sales

contributed to an increased operating profit of GBP3.4m (2015:

GBP3.3m). EBITDA grew 17% to GBP4.5m (2015: GBP3.9m) and return on

sales, as defined above, was flat at 22.0% (2015: 22.1%).

Markets

Market conditions for dairy farmers, particulary in Europe, have

been weak as milk prices have been low. This typically cyclical

market dynamic has, as expected, reduced demand for our consumable

products as farmers extend the life through over using our

products. The capital nature of the InterPuls products makes the

replacement cycle longer, meaning InterPuls is more affected by the

cyclical market dynamics than Milkrite consumable products.

Our existing dairy business has become substantially less

dependent on original equipment manufacturers (OEMs) in recent

years as we continue to grow sales of our own higher margin

Milkrite branded products and services. In difficult market

conditions we are encouraged that our Milkrite market share

continues to increase, meaning that we will exit this cyclical

downturn with a more robust business.

In Europe, where Avon-manufactured liners have a 61% market

share, Milkrite's market share has increased to 23% due to growth

in traditional Milkrite products and the success of our Impulse Air

mouthpiece vented liner, first launched in Europe late in 2013.

This product continues to gain traction, with its market share

increasing to 4.0% (31 March 2015: 3.0%, 30 September 2015:

3.5%).

In the US, where Avon-manufactured liners have a 63% market

share, the Milkrite Impulse Air mouthpiece vented liner continued

to perform well, with its market share increasing to 28% (31 March

2015: 22%, 30 September 2015: 25%).

The take up by farms of our innovative Cluster Exchange Service,

launched in 2014, remains at encouraging levels in both North

America and Europe. By the end of the period it was servicing

446,000 cows on 1,411 farms in the US and Europe, up from 342,000

cows and 1,100 farms at the same time last year. This added-value

service enhances the value of each direct liner sale we make and

should lead to a more robust and sustainable business model, with

the potential to grow a significant recurring revenue stream in the

years to come, as more farms continue to sign up.

We are pleased with the integration of InterPuls, acquired in

August 2015, into the wider Dairy business and are on track to

realise the long-term strategic benefits that have been identified,

in particular the sales synergies available in the North American

market.

Opportunities

Plans for the rollout of InterPuls products to the US are

underway, with dealers being trained, samples being issued through

our extensive distributor network and products launched at the

recent World Agricultural Expo in Tulare, California, positioning

the business to start delivering additional revenue in our 2017

financial year.

In emerging markets, including China, Brazil and India, the

number of dairy cows being milked using automated milking processes

is growing rapidly. This is adding to the market potential for the

products we sell. The sales and distribution operations we have

opened in China and Brazil are progressing to plan as we build our

dealer and distributor networks in these regions.

Taxation

The statutory tax credit totalled GBP0.4m (2015: charge of

GBP1.7m) on a statutory profit before tax of GBP6.1m (2015:

GBP8.4m). The effective tax rate for the period reflects the charge

arising from the anticipated geographic split of taxable profits

for 2016, offset by credits in relation to the positive outcome of

certain tax enquiries and the finalisation of the 2015 tax returns

in which we were able to take the benefit of certain deductions

allowed by legislation enacted after our 2015 financial statements

were approved.

Retirement Benefit Obligations

The IAS 19 valuation of the Group's UK retirement benefit

obligations has moved from a deficit of GBP16.6m at 30 September

2015 to a deficit of GBP18.7m at 31 March 2016. This arose from a

strong asset performance from our return-seeking assets, offset by

a fall in AA corporate bond rates, which increased liabilities.

During the period the Group made cash contributions in respect

of deficit recovery payments and administration costs of GBP325,000

(2015: GBP275,000).

The last actuarial triennial valuation undertaken as at 31 March

2013 showed the scheme to be 98.0% funded.

(MORE TO FOLLOW) Dow Jones Newswires

May 04, 2016 02:00 ET (06:00 GMT)

Dividends

The final dividend for the 2015 financial year of 4.86p per

ordinary share was paid to shareholders on 18 March 2016 and

absorbed GBP1,473,000 of shareholders' funds.

For the current financial year the Board has declared an interim

dividend of 3.16p per ordinary share, an increase of 30% on the

2015 interim dividend. This will be paid on 5 September 2016 to

shareholders on the register on 8 August 2016. It is expected to

absorb GBP958,000 of shareholders' funds and there are no

corporation tax consequences.

Outlook

The Board remains confident that the Group will continue to make

progress as the year develops and maintain our record of strong

cash generation.

Trading is normally second-half weighted in our Protection &

Defence business and we believe this will again be the case this

year. We continue to see a number of higher margin export

opportunities and while, as always, the timing of order receipt

remains unpredictable, the DOD order we received late in the first

half affords us production flexibility to fulfil these as and when

they are received.

In Dairy, despite weak market conditions, the acquisition of

InterPuls and the encouraging gains in Milkrite market share

provide us with significant opportunity at the point milk prices

start to improve. This, together with the sales and distribution

platforms we have established in China and Brazil to service these

rapidly growing emerging markets, means we have a Dairy business

with excellent short and longer term growth prospects.

Rob Rennie Andrew Lewis

Chief Executive Group Finance Director

4 May 2016 4 May 2016

Statement of Directors' Responsibilities

The Directors confirm that this condensed consolidated interim

financial information has been prepared in accordance with

International Accounting Standard 34, 'Interim Financial Reporting'

as adopted by the European Union, and that the interim management

report herein includes a fair review of the information required by

DTR 4.2.7 and DTR 4.2.8, namely:

-- an indication of important events that have occurred during

the first six months and their impact on the condensed consolidated

interim financial information, and a description of the principal

risks and uncertainties for the remaining six months of the

financial year; and

-- material related party transactions in the first six months

and any material changes in the related party transactions

described in the last annual report.

The Directors are as listed on page 43 of the 2015 Annual

Report, except that Richard Wood retired from the Board on 26

January 2016, Rob Rennie was appointed on 1 December 2015 and Chloe

Ponsonby was appointed on 1 March 2016.

Forward--looking statements

Certain statements in this half year report are

forward--looking. Although the Group believes that the expectations

reflected in these forward--looking statements are reasonable, we

can give no assurance that these expectations will prove to have

been correct. Because these statements involve risks and

uncertainties, actual results may differ materially from those

expressed or implied by these forward--looking statements.

We undertake no obligation to update any forward--looking

statements whether as a result of new information, future events or

otherwise.

Company website

The interim statement is available on the Company's website at

www.avon--rubber.com. The maintenance and integrity of the website

is the responsibility of the Directors. Legislation in the United

Kingdom governing the preparation and dissemination of financial

statements may differ from legislation in other jurisdictions.

Miles Ingrey-Counter

Company Secretary

4 May 2016

Consolidated Statement of Comprehensive Income

Half year to 31 March

Half year to 31 March 2016 2015 Year to 30 Sep 2015

Statutory Adjustments Adjusted Statutory Adjustments Adjusted Statutory Adjustments Adjusted

Note GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------- ----- ---------- ------------ --------- -------------- ------------ ------------ ---------- ------------ ------------

Continuing

operations

Revenue 4 66,273 - 66,273 62,821 - 62,821 134,318 - 134,318

Cost of sales (41,882) - (41,882) (41,389) - (41,389) (88,618) (88,618)

---------------- ----- ---------- ------------ --------- -------------- ------------ ------------ ---------- ------------ ------------

Gross profit 24,391 - 24,391 21,432 - 21,432 45,700 - 45,700

Selling and

distribution

costs (8,238) - (8,238) (6,984) - (6,984) (13,007) - (13,007)

General and

administrative

expenses 5 (9,512) 2,375 (7,137) (5,540) (363) (5,903) (13,807) 1,329 (12,478)

Operating

profit 4 6,641 2,375 9,016 8,908 (363) 8,545 18,886 1,329 20,215

---------------- ----- ---------- ------------ --------- -------------- ------------ ------------ ---------- ------------ ------------

Operating

profit is

analysed as:

Before

depreciation

and

amortisation 12,491 718 13,209 12,662 (493) 12,169 26,981 286 27,267

Depreciation

and

amortisation (5,850) 1,657 (4,193) (3,754) 130 (3,624) (8,095) 1,043 (7,052)

---------------- ----- ---------- ------------ --------- -------------- ------------ ------------ ---------- ------------ ------------

Operating

profit 6,641 2,375 9,016 8,908 (363) 8,545 18,886 1,329 20,215

---------------- ----- ---------- ------------ --------- -------------- ------------ ------------ ---------- ------------ ------------

Finance income 6 8 - 8 9 - 9 45 - 45

Finance costs 6 (162) - (162) (51) - (51) (192) - (192)

Other finance

expense 6 (393) 318 (75) (453) 329 (124) (901) 654 (247)

---------------- ----- ---------- ------------ --------- -------------- ------------ ------------ ---------- ------------ ------------

Profit before

taxation 6,094 2,693 8,787 8,413 (34) 8,379 17,838 1,983 19,821

Taxation 7 449 (550) (101) (1,683) - (1,683) (2,672) (253) (2,925)

---------------- ----- ---------- ------------ --------- -------------- ------------ ------------ ---------- ------------ ------------

Profit for the

period

from

continuing

operations

Discontinued

operations 6,543 2,143 8,686 6,730 (34) 6,696 15,166 1,730 16,896

- loss for the

period 5 - - - - - - (1,500) 1,500 -

---------------- ----- ---------- ------------ --------- -------------- ------------ ------------ ---------- ------------ ------------

Profit for the

period 6,543 2,143 8,686 6,730 (34) 6,696 13,666 3,230 16,896

---------------- ----- ---------- ------------ --------- -------------- ------------ ------------ ---------- ------------ ------------

Consolidated Statement of Comprehensive Income (continued)

Half year to 31 March Half year to 31 March

2016 2015 Year to 30 Sep 2015

Statutory Adjustments Adjusted Statutory Adjustments Adjusted Statutory Adjustments Adjusted

Note GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------- ----- ---------- ------------ ------------------------- ------------ ------------ ---------- ------------ ------------ ---------

Other

comprehensive

income

Actuarial

(loss)/gain

recognised in

retirement

benefit scheme

(*) (1,824) - (1,824) 22 - 22 (1,040) - (1,040)

Deferred tax

relating

to retirement

benefit

scheme (*) 425 - 425 - - - 3,321 - 3,321

Net exchange

differences

offset in

reserves (**) 3,727 - 3,727 3,008 - 3,008 3,311 - 3,311

---------------- ----- ---------- ------------ ------------------------- ------------ ------------ ---------- ------------ ------------ ---------

Other

comprehensive

(MORE TO FOLLOW) Dow Jones Newswires

May 04, 2016 02:00 ET (06:00 GMT)

income

for the

period, net of

taxation 2,328 - 2,328 3,030 - 3,030 5,592 - 5,592

---------------- ----- ---------- ------------ ------------------------- ------------ ------------ ---------- ------------ ------------ ---------

Total

comprehensive

income

for the period 8,871 2,143 11,014 9,760 (34) 9,726 19,258 3,230 22,488

---------------- ----- ---------- ------------ ------------------------- ------------ ------------ ---------- ------------ ------------ ---------

Earnings per

share

Basic 9 21.6p 28.7p 22.4p 22.3p 45.4p 56.1p

Diluted 9 21.2p 28.1p 21.8p 21.7p 44.2p 54.6p

---------------- ----- ---------- ------------ ------------------------- ------------ ------------ ---------- ------------ ------------ ---------

Earnings per

share from

continuing

operations

Basic 9 21.6p 28.7p 22.4p 22.3p 50.4p 56.1p

Diluted 9 21.2p 28.1p 21.8p 21.7p 49.0p 54.6p

---------------- ----- ---------- ------------ ------------------------- ------------ ------------ ---------- ------------ ------------ ---------

* Items that are not subsequently reclassified to the income

statement

**Items that may be subsequently reclassified to the income

statement

Consolidated Balance Sheet

As at As at As at

31 Mar 16 31 Mar 15 30 Sep

15

Note GBP'000 GBP'000 GBP'000

--------------------------------------- ----- ---------- ---------- ---------

Assets

Non-current assets

Intangible assets 45,476 19,011 41,309

Property, plant and equipment 29,094 20,249 28,212

Deferred tax assets 4,607 - 4,574

79,177 39,260 74,095

--------------------------------------- ----- ---------- ---------- ---------

Current assets

Inventories 20,813 16,722 17,123

Trade and other receivables 15,111 15,630 17,023

Derivative financial instruments - - 3

Cash and cash equivalents 13 823 7,273 332

--------------------------------------- -----

36,747 39,625 34,481

--------------------------------------- ----- ---------- ---------- ---------

Liabilities

Current liabilities

Borrowings 13 438 - 2,350

Trade and other payables 18,048 17,947 17,150

Derivative financial instruments 297 284 -

Provisions for liabilities and

charges 10 1,360 689 855

Current tax liabilities 8,732 7,711 6,823

--------------------------------------- -----

28,875 26,631 27,178

--------------------------------------- ----- ---------- ---------- ---------

Net current assets 7,872 12,994 7,303

--------------------------------------- ----- ---------- ---------- ---------

Non-current liabilities

Borrowings 13 8,801 - 11,143

Deferred tax liabilities 9,996 2,716 9,734

Retirement benefit obligations 18,732 15,568 16,605

Provisions for liabilities and

charges 10 1,631 1,241 1,712

--------------------------------------- -----

39,160 19,525 39,194

---------- ---------- ---------

Net assets 47,889 32,729 42,204

--------------------------------------- ----- ---------- ---------- ---------

Shareholders' equity

Ordinary shares 11 31,023 31,023 31,023

Share premium account 11 34,708 34,708 34,708

Capital redemption reserve 500 500 500

Translation reserve 6,106 2,076 2,379

Accumulated losses (24,448) (35,578) (26,406)

--------------------------------------- -----

Total equity 47,889 32,729 42,204

--------------------------------------- ----- ---------- ---------- ---------

Consolidated Cash Flow Statement

Half year Half year Year

to to to

31 Mar 16 31 Mar 15 30 Sep

15

Note GBP'000 GBP'000 GBP'000

--------------------------------------- ----- ---------- ---------- ---------

Cash flows from operating activities

--------------------------------------- ----- ---------- ---------- ---------

Cash generated from continuing

operating activities before the

impact of exceptional items 14,712 11,828 24,053

Cash impact of exceptional items (357) (694) (1,192)

--------------------------------------- ----- ---------- ---------- ---------

Cash generated from continuing

operations 12 14,355 11,134 22,861

Cash used in discontinued operations - - (1,529)

--------------------------------------- ----- ---------- ---------- ---------

Cash generated from operations 14,355 11,134 21,332

Finance income received 8 9 45

Finance costs paid (162) (51) (192)

Retirement benefit deficit recovery

contributions (325) (275) (800)

Tax received/(paid) 1,682 (1,232) (3,270)

Net cash generated from operating

activities 15,558 9,585 17,115

--------------------------------------- ----- ---------- ---------- ---------

Cash flows from investing activities

Proceeds from sale of property,

plant and equipment - - 21

Purchase of property, plant and

equipment (1,962) (1,411) (3,222)

Capitalised development costs

and purchased software (1,788) (1,733) (2,961)

Acquisition of subsidiaries and

businesses (3,500) (25) (21,249)

Net cash used in investing activities (7,250) (3,169) (27,411)

--------------------------------------- ----- ---------- ---------- ---------

Cash flows from financing activities

Net movements in loans (4,601) - 10,605

Dividends paid to shareholders (1,473) (1,127) (1,859)

Purchase of own shares (1,812) (1,152) (1,152)

Net cash (used in)/generated

from financing activities (7,886) (2,279) 7,594

--------------------------------------- ----- ---------- ---------- ---------

Net increase/(decrease) in cash,

cash equivalents and bank overdrafts 422 4,137 (2,702)

Cash, cash equivalents and bank

overdrafts at beginning of the

period 332 2,925 2,925

Cash, cash equivalents and bank

overdrafts acquired on acquisitions - - 12

Effects of exchange rate changes 69 211 97

--------------------------------------- ----- ---------- ---------- ---------

Cash, cash equivalents and bank

overdrafts at end of the period 13 823 7,273 332

--------------------------------------- ----- ---------- ---------- ---------

Consolidated Statement of Changes

in Equity

Share Share Other Accumulated

capital Premium reserves losses Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------- -------- -------- --------- ------------ --------

At 30 September 2014 31,023 34,708 (432) (40,283) 25,016

Profit for the period - - - 6,730 6,730

Unrealised exchange differences

on overseas investments - - 3,008 - 3,008

(MORE TO FOLLOW) Dow Jones Newswires

May 04, 2016 02:00 ET (06:00 GMT)

Actuarial gain recognised in

retirement benefit scheme - - - 22 22

------------------------------------- -------- -------- --------- ------------ --------

Total comprehensive income for

the period - - 3,008 6,752 9,760

Dividends paid - - - (1,127) (1,127)

Movement in shares held by the

employee benefit trust - - - (962) (962)

Movement in respect of employee

share schemes 42 42

------------------------------------- -------- -------- --------- ------------ --------

At 31 March 2015 31,023 34,708 2,576 (35,578) 32,729

Profit for the period - - - 6,936 6,936

Unrealised exchange differences

on overseas investments - - 303 - 303

Actuarial loss recognised in

retirement benefit scheme - - - (1,062) (1,062)

Deferred tax relating to retirement

benefit scheme - - - 3,321 3,321

------------------------------------- -------- -------- --------- ------------ --------

Total comprehensive income for

the period - - 303 9,195 9,498

Dividends paid - - - (732) (732)

Movement in shares held by the

employee benefit trust - - - (9) (9)

Movement in respect of employee

share schemes - - - 43 43

Deferred tax relating to employee

share schemes - - - 675 675

------------------------------------- -------- -------- --------- ------------ --------

At 30 September 2015 31,023 34,708 2,879 (26,406) 42,204

Profit for the period - - - 6,543 6,543

Unrealised exchange differences

on overseas investments - - 3,727 - 3,727

Actuarial loss recognised in

retirement benefit scheme - - - (1,824) (1,824)

Deferred tax relating to retirement

benefit scheme - - - 425 425

------------------------------------- -------- -------- --------- ------------ --------

Total comprehensive income for

the period - - 3,727 5,144 8,871

Dividends paid - - - (1,473) (1,473)

Movement in shares held by the

employee benefit trust - - - (1,698) (1,698)

Movement in respect of employee

share schemes - - - 42 42

Deferred tax relating to employee

share schemes - - - (57) (57)

------------------------------------- -------- -------- --------- ------------ --------

At 31 March 2016 31,023 34,708 6,606 (24,448) 47,889

------------------------------------- -------- -------- --------- ------------ --------

Notes to the Interim Financial Statements

1. General information

The company is a limited liability company incorporated in

England and domiciled in the UK. The address of its registered

office is Hampton Park West, Semington Road, Melksham, Wiltshire,

SN12 6NB. The company has its primary listing on the London Stock

Exchange.

This unaudited condensed consolidated interim financial

information was approved for issue on 4 May 2016.

These interim financial results do not comprise statutory

accounts within the meaning of Section 434 of the Companies Act

2006. Statutory accounts for the year ended 30 September 2015 were

approved by the Board of Directors on 17 November 2015 and

delivered to the Registrar of Companies. The report of the auditors

on those accounts was unqualified, did not contain an emphasis of

matter paragraph and did not contain any statement under Section

498 of the Companies Act 2006.

2. Basis of preparation

This condensed consolidated interim financial information for

the half year ended 31 March 2016 has been prepared in accordance

with the Disclosure and Transparency Rules of the Financial

Services Authority and with IAS 34, 'Interim financial reporting'

as adopted by the European Union. These interim financial results

should be read in conjunction with the annual financial statements

for the year ended 30 September 2015, which have been prepared in

accordance with IFRSs as adopted by the European Union.

Having considered the Group's funding position, budgets for 2016

and three year plan, the Directors have formed a judgment that

there is a reasonable expectation that the Group has adequate

resources to continue in operational existence for the foreseeable

future. For this reason the Directors continue to adopt the going

concern basis in preparing the condensed consolidated interim

financial information.

3. Accounting policies

The accounting policies adopted are consistent with those of the

annual financial statements for the year ended 30 September 2015,

as described in those financial statements.

Recent accounting developments

The following standards, amendments and interpretations have

been issued by the International Accounting Standards Board (IASB)

or by the International Financial Reporting Interpretations

Committee (IFRIC). The Group's approach to these is as follows:

a) Standards, amendments and interpretations effective in 2016:

No new standards or amendments have been adopted in preparing

the condensed consolidated half-yearly financial information or

will be required to be adopted for the year ending 30 September

2016.

b) Standards, amendments and interpretations to existing

standards issued but not yet effective in 2016 and not adopted

early:

- IFRS 9, 'Financial instruments'

- IFRS 14, 'Regulatory Deferral Accounts'

- IFRS 15, 'Revenue from Customer Contracts'

- IFRS 16, 'Leases'

- Amendments to IAS 1, 'Disclosure Initiative'

- Amendments to IAS 7, 'Disclosure Initiative'

- Amendment to IFRS 10 and IAS 28, 'Sale or Contribution of

Assets between and Investor and its Associate or Joint Venture'

- Amendments to IFRS 10, IFRS 12 and IAS 28, 'Applying the consolidation exemption'

- Amendments to IFRS 11, 'Accounting for Acquisition Interests in Joint Operations'

- Amendments to IAS 12, 'Recognition of Deferred Tax Assets for Unrealised Losses'

- Amendments to IAS 16 and IAS 38, 'Clarification of Acceptable

Methods of Depreciation and Amortisation'

- Amendments to IAS 16 and IAS 41, 'Agriculture - Bearer Plants'

- Amendments to IAS 27, 'Equity Method in Separate Financial Statements'

- Annual improvements cycle 2012-2014

4. Segment information

Operating segments are reported in a manner consistent with

the internal reporting provided to the chief operating decision-maker.

The chief operating decision-maker, who is responsible for

allocating resources and assessing performance of the operating

segments, has been identified as the Group Executive team.

The Group has two clearly defined business segments, Protection

& Defence and Dairy, and operates out of Europe and the US.

Business segments

Half year to 31 March 2016

Protection

& Defence Dairy Unallocated Group

GBP'000 GBP'000 GBP'000 GBP'000

-------------------------------------------------------- ---------------- -------- ------------ --------

Revenue 45,689 20,584 - 66,273

--------------------------------------------------------

Segment result before depreciation,

amortisation, exceptional

items and defined benefit

pension scheme costs 9,643 4,526 (960) 13,209

Depreciation of property,

plant and equipment (1,915) (897) (20) (2,832)

Amortisation of intangibles (1,168) (189) (4) (1,361)

-------------------------------------------------------- ---------------- -------- ------------ --------

Segment result before amortisation

of acquired intangibles,

exceptional items and defined

benefit pension scheme costs 6,560 3,440 (984) 9,016

Amortisation of acquired

intangibles (786) (871) - (1,657)

Exceptional items (508) - - (508)

Defined benefit pension scheme

costs - - (210) (210)

-------------------------------------------------------- ---------------- -------- ------------ --------

Segment result 5,266 2,569 (1,194) 6,641

Finance income 8 8

(MORE TO FOLLOW) Dow Jones Newswires

May 04, 2016 02:00 ET (06:00 GMT)

Finance costs (162) (162)

Other finance expense (393) (393)

-------------------------------------------------------- ---------------- -------- ------------ --------

Profit before taxation 5,266 2,569 (1,741) 6,094

Taxation 449 449

--------------------------------------------------------

Profit for the period 5,266 2,569 (1,292) 6,543

-------------------------------------------------------- ---------------- -------- ------------ --------

Half year to 31 March 2015

Protection

& Defence Dairy Unallocated Group

GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------- ----------- -------- ------------ --------

Revenue 45,333 17,488 - 62,821

------------------------------------- ----------- -------- ------------ --------

Segment result before depreciation,

amortisation and defined

benefit pension scheme credit 9,358 3,872 (1,061) 12,169

Depreciation of property,

plant and equipment (1,724) (533) (26) (2,283)

Amortisation of intangibles (1,275) (61) (5) (1,341)

------------------------------------- ----------- -------- ------------ --------

Segment result before amortisation

of acquired intangibles and

defined benefit pension scheme

credit 6,359 3,278 (1,092) 8,545

Amortisation of acquired

intangibles (130) - - (130)

Defined benefit pension scheme

credit - - 493 493

------------------------------------- ----------- -------- ------------ --------

Segment result 6,229 3,278 (599) 8,908

Finance costs (42) (42)

Other finance expense (453) (453)

------------------------------------- ----------- -------- ------------ --------

Profit before taxation 6,229 3,278 (1,094) 8,413

Taxation (1,683) (1,683)

------------------------------------- ----------- -------- ------------ --------

Profit for the period 6,229 3,278 (2,777) 6,730

------------------------------------- ----------- -------- ------------ --------

Year to 30 September 2015

Protection

& Defence Dairy Unallocated Group

GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------- ----------- -------- ------------ --------

Revenue 98,843 35,475 - 134,318

------------------------------------- ----------- -------- ------------ --------

Segment result before depreciation,

amortisation, exceptional

items, acquisition costs

and defined benefit pension

scheme credit 21,632 7,707 (2,072) 27,267

Depreciation of property,

plant and equipment (3,513) (1,121) (50) (4,684)

Amortisation of intangibles (2,206) (153) (9) (2,368)

------------------------------------- ----------- -------- ------------ --------

Segment result before amortisation

of acquired intangibles,

exceptional items, acquisition

costs and defined benefit

pension scheme credit 15,913 6,433 (2,131) 20,215

Amortisation of acquired

intangibles (384) (659) - (1,043)

Exceptional items and acquisition

costs (209) (180) (215) (604)

Defined benefit pension scheme

credit - - 318 318

------------------------------------- ----------- -------- ------------ --------

Segment result 15,320 5,594 (2,028) 18,886

Finance income 45 45

Finance costs (192) (192)

Other finance expense (901) (901)

------------------------------------- ----------- -------- ------------ --------

Profit before taxation 15,320 5,594 (3,076) 17,838

Taxation (2,672) (2,672)

------------------------------------- ----------- -------- ------------ --------

Profit for the year from

continuing operations 15,320 5,594 (5,748) 15,166

Discontinued operations -

loss for the year (1,500) (1,500)

------------------------------------- ----------- -------- ------------ --------

Profit for the year 15,320 5,594 (7,248) 13,666

------------------------------------- ----------- -------- ------------ --------

Revenue by origin

Half year Half year Year

to to to

31 Mar 31 Mar 30 Sep

16 15 15

GBP'000 GBP'000 GBP'000

---------------------------------------------------------------- ------------- ---------- ----------

Europe 16,553 11,819 23,704

US 49,720 51,002 110,614

66,273 62,821 134,318

---------------------------------------------------------------- ------------- ---------- ----------

Segment assets in Europe and the US were GBP58.0m and GBP57.9m respectively

(30 September 2015: GBP52.8m and GBP55.8m, 31 March 2015: GBP17.3m

and GBP61.6m).

5. Adjustments and discontinued operations

Half year Half year Year

to to to

31 Mar 31 Mar 30 Sep

16 15 15

GBP'000 GBP'000 GBP'000

---------------------------------------------------------------- ------------- ---------- --------

Amortisation of acquired intangible

assets 1,657 130 1,043

Recruitment costs - - 215

Integration costs 508 - -

Acquisition costs - - 389

Defined benefit pension scheme administration

costs 210 175 350

Defined benefit pension scheme settlement

gain - (668) (668)

----------------------------------------------------------------- ------------- ---------- --------

2,375 (363) 1,329

---------------------------------------------------------------- ------------- ---------- --------

The tax impact of the above is a GBP0.1m reduction in tax

payable (31 March 2015: GBPnil, 30 September 2015: GBPnil). The

deferred tax impact gives rise to a credit to the income statement

of GBP0.45m (31 March 2015: GBPnil, 30 September 2015:

GBP0.25m).

The recruitment costs in 2015 relate to the recruitment of main

Board Directors.

The integration costs relate to the acquisition of the Argus

thermal imaging camera business and the relocation of the

manufacturing to our Melksham, UK site.

The acquisition costs in 2015 relate to legal and professional

fees on the acquisition of Hudstar Systems Inc. and InterPuls

S.p.A.

Defined benefit pension scheme costs relate to administrative

expenses of the scheme which is closed to future accrual and the

defined benefit pension scheme settlement gain arose following a

trivial commutation exercise, both of which impact operating

profit. GBP0.3m of other finance expense relating to the pension

scheme is also treated as an adjustment (31 March 2015: GBP0.3m, 30

September 2015: GBP0.7m).

(MORE TO FOLLOW) Dow Jones Newswires

May 04, 2016 02:00 ET (06:00 GMT)

The 2015 loss for the year from discontinued operations related

to dilapidations costs of former leased premises of a business

which was disposed of in 2006.

6. Finance income and costs

Half year Half year Year

to to to

31 Mar 31 Mar 30 Sep

16 15 15

GBP'000 GBP'000 GBP'000

------------------------------------------------------------------ ---- ---------- ---------- --------

Interest payable on bank loans and overdrafts (162) (51) (192)

Finance income 8 9 45

(154) (42) (147)

---- ---------- ---------- --------

Other finance expense

Half year Half year Year

to to to

31 Mar 31 Mar 30 Sep

16 15 15

GBP'000 GBP'000 GBP'000

------------------------------------------------------------------ ---- ---------- ---------- --------

Net interest cost: UK defined benefit

pension scheme (318) (329) (654)

Provisions: Unwinding of discount (75) (124) (247)

(393) (453) (901)

---- ---------- ---------- --------

7. Taxation

Half year Half year Year

to to to

31 Mar 31 Mar 30 Sep

16 15 15

GBP'000 GBP'000 GBP'000

------------------------------------------------------------------- --- ---------- ---------- --------

United Kingdom - - -

Overseas (449) 1,683 2,672

------------------------------------------------------------------- --- ---------- ---------- --------

(449) 1,683 2,672

Effect of exceptional items 550 - 253

------------------------------------------------------------------- --- ---------- ---------- --------

Adjusted tax charge 101 1,683 2,925

------------------------------------------------------------------- --- ---------- ---------- --------

The statutory effective tax rate for the period is a credit of 7%

(31 March 2015: charge of 20%, 30 September 2015: charge of 15%).

The adjusted effective tax rate, where the tax charge and the profit

before taxation are adjusted for exceptional items, the amortisation

of acquired intangibles and defined benefit pension scheme costs

is 1% (31 March 2015: 20%, 30 September 2015: 15%).

8. Dividends

On 29 January 2016, the shareholders approved a final dividend of

4.86p per qualifying ordinary share in respect of the year ended

30 September 2015. This was paid on 18 March 2016, absorbing GBP1,473,000

of shareholders' funds.

The Board of Directors has declared an interim dividend of 3.16p

(2015: 2.43p) per qualifying ordinary share in respect of the year

ended 30 September 2016. This will be paid on 5 September 2016 to

shareholders on the register at the close of business on 8 August

2016. In accordance with accounting standards, this dividend has

not been provided for and there are no corporation tax consequences.

It will be recognised in shareholders' funds in the year to 30 September

2016 and is expected to absorb GBP958,000 (2015: GBP732,000) of shareholders'

funds.

9. Earnings per share

Basic earnings per share is based on a profit attributable to ordinary

shareholders of GBP6,543,000 (2015: GBP6,730,000) and 30,248,000

(2015: 30,077,000) ordinary shares being the weighted average number

of shares in issue during the period.

Adjusted earnings per share is based on a profit attributable to

ordinary shareholders of GBP8,686,000 (2015: GBP6,696,000) after

adding back amortisation of acquired intangible assets, exceptional

items and defined benefit pension scheme costs.

The Company has 587,000 (1.9%) (2015: 824,000 (2.7%)) potentially

dilutive ordinary shares in respect of the Performance Share Plan.

10. Provisions for liabilities and charges

Property obligations

GBP'000

------------------------------ ---------------------

Balance at 30 September 2015 2,567

Receipts in the period 349

Unwinding of discount 75

------------------------------- ---------------------

Balance at 31 March 2016 2,991

------------------------------- ---------------------

Property obligations include an onerous lease provision and

obligations relating to former premises of the Group which are

subject to dilapidation risks. Property provisions are subject to

uncertainty in respect of the utilisation, non-utilisation, or

subletting of surplus leasehold property and the final negotiated

settlement of any dilapidation claims with landlords.

11. Share capital

Half year Half year Year

to to to

31 Mar 31 Mar 30 Sep

16 15 15

------------------------------ ---------- ---------- -------

Number of shares (thousands) 31,023 31,023 31,023

Ordinary shares (GBP'000) 31,023 31,023 31,023

Share premium (GBP'000) 34,708 34,708 34,708

------------------------------- ---------- ---------- -------

During the period 175,000 ordinary shares with a nominal value

of GBP1 each were purchased by the Avon Rubber p.l.c. Employer

Share Ownership Trust at a cost of GBP1,812,000 and 10,082 ordinary

shares of GBP1 each were awarded in relation to the 2015 annual

incentive plan.

12. Cash generated from operations

Half year Half year Year

to to to

31 Mar 31 Mar 30 Sep

16 15 15

GBP'000 GBP'000 GBP'000

--------------------------------------------------------- -------- ----------- ---------- ----------

Continuing operations

Profit for the period 6,543 6,730 15,166

Adjustments for:

Taxation (449) 1,683 2,672

Depreciation 2,832 2,283 4,684

Amortisation of intangible assets 3,018 1,471 3,411

Defined benefit pension scheme costs/(credit) 210 (493) (318)

Net finance expense 154 42 147

Other finance expense 393 453 901

Loss on disposal of intangible assets

and property, plant and equipment - - 7

Movements in working capital and

provisions 1,612 (1,077) (3,894)

Other movements 42 42 85

--------------------------------------------------------- -------- ----------- ---------- ----------

Cash generated from continuing operations 14,355 11,134 22,861

------------------------------------------------------------------- ----------- ---------- ----------

Analysed as:

Cash generated from continuing operations

prior to the effect of exceptional

operating items 14,712 11,828 24,053

Cash effect of exceptional operating

(MORE TO FOLLOW) Dow Jones Newswires

May 04, 2016 02:00 ET (06:00 GMT)

items (357) (694) (1,192)

------------------------------------------------------------------- ----------- ---------- ----------

Discontinued operations - loss for

the year - - (1,500)

Decrease in payables and provisions - - (29)

------------------------------------------------------------------- ----------- ---------- ----------

Cash used in discontinued operations - - (1,529)

------------------------------------------------------------------- ----------- ---------- ----------

Cash generated from operations 14,355 11,134 21,332

------------------------------------------------------------------- ----------- ---------- ----------

13. Analysis of net debt

As at Exchange As at

30 Sep Cash flow movements 31 Mar 16

15

GBP'000 GBP'000 GBP'000 GBP'000

---------------------------------------------- ------------------- ----------- ---------- ----------

Cash at bank and in hand 332 422 69 823

Debt due in less than 1 year (2,350) 2,052 (140) (438)

Debt due in more than 1 year (11,143) 2,549 (207) (8,801)

---------------------------------------------- ------------------- ----------- ---------- ----------

(13,161) 5,023 (278) (8,416)

---------------------------------------------- ------------------- ----------- ---------- ----------

Borrowing facilities As at As at As at

31 Mar 16 31 Mar 15 30 Sep 15

GBP'000 GBP'000 GBP'000

---------------------------------------------- ------------------- ----------- ---------- ----------

Total undrawn committed facilities 21,113 26,521 15,194

Bank loans and overdrafts

utilised 8,557 - 13,007

Utilised in respect of guarantees 280 370 362

Total Group facilities 29,950 26,891 28,563

---------------------------------------------- ------------------- ----------- ---------- ----------

All facilities are at floating interest rates.

On 9 June 2014 the Group agreed new bank facilities with Barclays

Bank and Comerica Bank. The combined facility comprises a revolving

credit facility of $40m and expires on 30 November 2018. This facility

is priced on the dollar LIBOR plus margin of 1.25% and includes

financial covenants which are measured on a quarterly basis. The

Group was in compliance with its financial covenants during 2016

and 2015.

InterPuls S.p.A has a fixed term loan of EUR2.5m which expires in

August 2020. This facility is priced on EURIBOR plus margin of 0.9%.

14. Exchange rates

The following significant exchange rates applied

during the period.

Average Closing Average Closing Average Closing

rate rate rate rate rate rate

H1 2016 H1 2016 H1 2015 H1 2015 FY 2015 FY 2015

------------------------ -------------------- --------- -------- ----------- ---------- ----------

US dollar 1.460 1.431 1.539 1.488 1.542 1.517

Euro 1.330 1.252 1.309 1.370 1.351 1.359

------------------------ -------------------- --------- -------- ----------- ---------- ----------

Fair value of financial instruments

The fair value of forward exchange contracts is determined by

using valuation techniques using period end spot rates, adjusted

for the forward points to the value date of the contract.

15. Acquisition

On 8 October 2015 the Group acquired the trade and assets of the

Argus thermal imaging business from e2v technologies plc for

consideration of GBP3.5m. Based in Chelmsford UK, Argus is a

leading designer and manufacturer of thermal imaging cameras for

the first responder and fire markets and further strengthens the

Group's product range and distribution capability in these

markets.

The book value of the assets acquired was GBP1.2m and after

accounting policy adjustments and provisional fair value

adjustments of GBP1.8m, goodwill of GBP0.5m was recognised

reflecting sales synergies from integration of distribution

channels, access to new markets and the workforce of the acquired

business.

Total

GBP'000

------------------------------------------------------ --------

Intangible assets recognised on acquisition 2,277

Deferred tax associated with the initial recognition

of intangible assets (455)

Other net assets 1,191

Goodwill 487

------------------------------------------------------- --------

Consideration 3,500

------------------------------------------------------- --------

16. Principal risks and uncertainties

The principal risks and uncertainties impacting the Group are

described on pages 28-31 of our Annual Report 2015 and remain

unchanged at 31 March 2016.

They include: market threat, product development, talent

management, business interruption - supply chain, acquisition

integration, quality risks and product recall, customer dependency

and non-compliance with legislation.

CORPORATE INFORMATION

REGISTERED OFFICE

Corporate Headquarters

Hampton Park West

Semington Road

Melksham

Wiltshire

SN12 6NB

Registered in England and Wales No. 32965

V.A.T. No. GB 137 575 643

BOARD OF DIRECTORS

David Evans (Chairman)

Pim Vervaat (Non-Executive Director)

Chloe Ponsonby (Non-Executive Director)

Rob Rennie (Chief Executive)

Andrew Lewis (Group Finance Director)

COMPANY SECRETARY

Miles Ingrey-Counter

INDEPENDENT AUDITORS

PricewaterhouseCoopers LLP

REGISTRARS & TRANSFER OFFICE

Capita Asset Services

The Registry

34 Beckenham Road

Beckenham

BR3 4TU

Tel: 0871 664 0300

(calls cost 10p per minute plus network extras,

lines are open 8.30am-5.30pm Mon-Fri)

BROKERS

Arden Partners plc

SOLICITORS

TLT LLP

PRINCIPAL BANKERS

Barclays Bank PLC

Comerica Inc.

CORPORATE FINANCIAL ADVISER

Arden Partners plc

CORPORATE WEBSITE

www.avon-rubber.com

Hampton Park West l Semington Road l Melksham l Wiltshire l SN12

6NB l England

Tel: +44 (0) 1225 896 800 l Fax: +44 (0) 1225 896 898 l e-mail: enquiries@avon-rubber.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR UOUNRNSAVRAR

(END) Dow Jones Newswires

May 04, 2016 02:00 ET (06:00 GMT)

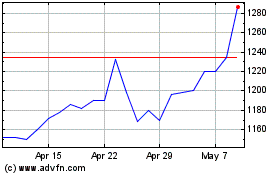

Avon Technologies (LSE:AVON)

Historical Stock Chart

From Aug 2024 to Sep 2024

Avon Technologies (LSE:AVON)

Historical Stock Chart

From Sep 2023 to Sep 2024