TIDMARR

RNS Number : 7004P

Aurora Investment Trust PLC

09 June 2015

ANNUAL FINANCIAL REPORT ANNOUNCEMENT

AURORA INVESTMENT TRUST PLC

YEAR ENDED 28 FEBRUARY 2015

STRATEGIC REPORT

OBJECTIVE

Capital appreciation through investments listed mainly on the

London Stock Exchange.

POLICY

To invest primarily in equities, but with some exposure also to

Fixed Interest. The portfolio comprises a mix of large, mid and

smaller capitalised stocks. A distinctive feature is an emphasis on

investments in companies with exposure to economies growing at a

faster rate than the UK.

BENCHMARK

Performance is benchmarked against that of the overall London

market

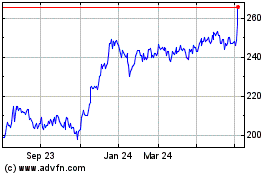

Five years

Year ended ended Since launch

28 February

28 February 2015 2015 (13/3/1997)

%% %

Net Asset Value per share (NAV)^ -10.64 -10.52 +75.26

Benchmark^ +2.12 +36.81 +73.66

--------------------------------- ---------------- ----------- ------------

^ capital-only return

* by reference to a starting value of 97.78p (net of launch expenses)

DIVIDEND

The Directors recommend an increased dividend of 3.85p per share

(2014: 3.80p) (18th consecutive annual increase).

CHAIRMAN'S STATEMENT

Once again events have transpired to nip in the bud what

appeared to be the turning point in the Company's fortunes. Slight

under-performance in the first half of the year was undermined by

the performance in the second half when the dramatic slump in the

price of oil and other forms of energy adversely affected holdings

that make up an important part of the Company's portfolio.

The result for the year as a whole was an underperformance of

12% relative to the Benchmark FTSE All-Share index. Unfortunately,

the good performance by the stocks in the portfolio with large

capitalisations was severely outweighed by that of the more

exciting smaller capitalisations, many of which have endured harsh

bear market conditions. It is to be hoped that their time is about

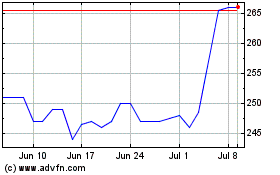

to arrive. It is encouraging that in the last three months the NAV

per share has recovered by an increase of 8.5% which compares very

favourably with the 0.95% rise in the FTSE All-Share Index.

Performance

Aurora (NAV per Share) Benchmark

% %

Since Launch 13/03/97 +75.26 +73.66

5 Years -10.52 +36.81

3 Years -20.23 +23.01

1 Year -10.64 +2.12

In recent months the focus of attention has been on the

timetable and extent of US interest rate increases and the effects

of the rise of the US Dollar. These factors have continued to

favour developed at the expense of emerging markets. China,

however, is performing as a developed market in this context, being

a beneficiary of falling commodity prices. The conditions likely to

lead to strong relative performance for the Company's investments

have also been deferred, despite their superior long-term

prospects.

The worldwide background for equities, although intermittently

threatened by regional political tensions (Syria, Ukraine etc.) has

been supported by strong cash flows and attractive yields in

comparison with those available from bonds. Further support has

been forthcoming from low rates of inflation and interest rates at

a time of a reasonably robust economic recovery in both the US and

UK. The Conservative victory in the General Election is construed

to be good for business. The Conservative victory also gives the

Government the opportunity for much needed economic and political

reforms.

Within the Eurozone, with the exception of Germany, there has

been little economic recovery. The consequence has been that youth

unemployment remains at unacceptably high levels and there are

growing worries over disinflation in the peripheral economies.

Recently, the ECB has belatedly embraced a programme of

Quantitative Easing in an attempt to address these issues, although

this is likely to be of little help to the real economies other

than via a weaker Euro.

Meanwhile China has continued to prove a conundrum for

investors. The attractions of its seemingly high but slowing

economic growth have been undermined by worries about the inherent

risks attached to the shadow banking system, possible excess

capital investment in certain areas and the overwhelming prevalence

of corporate governance issues. Nevertheless, led by the large

market capitalisations, the Chinese stock-market has been the best

performing of all the major stock-markets over the preceding twelve

month period. This wave of optimism did not, however, reach the

smaller capitalisations during the year under review.

Outlook

The anticipated eventual increase in US Dollar interest rates,

following a record period of exceptionally low rates, has to date

been greeted with equanimity in developed markets because the rise

is deferred and is expected to be very gradual; indeed, a number of

markets have recently reached new all-time peaks. Several emerging

markets, particularly those which link their currencies to the US

dollar, have suffered and performed poorly, despite their superior

economic performance. China, as already mentioned, has proved the

exception.

In view of the scale of the output gap which exists in most

economies, interest rates look set to remain relatively low for an

extended period. This is particularly relevant to the Eurozone

where there is the threat of deflation becoming entrenched.

Moreover the whole concept of the Eurozone is being threatened by

Greece's potential debt default and the likely shockwaves of such

an event.

At current levels of valuation most major stock markets are

anticipating a prolonged period of better economic and trading

conditions, which looks to be achievable. The UK recovery needs to

broaden out to demonstrate that it is not based solely on service

industries, government financed property price inflation and

excessive consumer borrowing, as in the past.

Currently the optimism permeating the Chinese stock-market is

starting to filter through to medium and smaller capitalisations in

the domestic market. The Chinese stocks quoted on the AIM market

remain at absurdly low levels, some of which are even trading at a

fraction of their holdings of net cash, as the result of prevailing

worries over perceived corporate governance issues. Hopefully, many

of these worries will abate and prove unfounded.

The Board believes that against this background there is

considerable scope for the performance of Aurora's current

portfolio to improve and reverse the disappointment of recent

periods which was exacerbated by the Company's 20% gearing.

Continuation

At last year's AGM shareholders approved the Company's

continuation for a further three years. The Board undertook to find

a resolution for the Company's future thereafter. I have since met

with ten interested parties. Most of the possible new arrangements

would appear to meet the objectives of the Board to provide an

attractive continuing vehicle and a cash alternative. We will start

to evaluate these next year.

Dividend

The Board has decided to propose a further (18th consecutive)

increase in the dividend from last year's level of 3.8p to 3.85p,

paid from the Company's revenue profit of GBP415,841.

AGM

I look forward to welcoming shareholders at the Company's AGM

which will be held at 12.00 noon on Friday 16 July 2015 at the

offices of Cavendish Administration Limited, 145-157 St John

Street, London EC1V 4RU.

Lord Flight

Chairman

9 June 2015

INVESTMENT MANAGER'S REVIEW AND OUTLOOK

Early one cold morning, a year ago, I engaged in conversation

with the BBC's attractive and capable, then current, economics

correspondent and asked her for her predictions for the coming

year. In a word 'Normalisation' was her quick reply. In one respect

she has been proved correct - China has, last year, re-emerged once

again (it lost its status in about 1820) as the world's most

powerful economy measured in parity of purchasing power terms.

In many other respects, the year has been marked by seismic and

unpredicted change. Not only has Hampshire and East Midlands

suffered from more powerful earthquakes than any caused by the

energy companies engaged in 'fracking' activities in the UK, but

the Swiss Franc and the price of oil, iron ore and copper have all

endured dramatic movements.

Two thirds of all European bonds now have negative yields, and

there is not a single issue in the UK gilt list priced below par

value (I think the phrase 'conservative recklessness' by

institutional managers is a highly appropriate criticism and, as

has been quipped a few times, these investments are no longer a

risk-free return, more a return-free risk). At the same time the

Nestle Company is now being paid to issue bonds - is this the first

case in history of successful alchemy? When will they pay me to eat

their chocolates I wonder? Moreover, an event unimaginable during

the lifetimes of a previous generation has occurred - War Loan has

been redeemed. Sadly the manager has not! At times I found the

market's trajectory as mysterious as that of the missing Malaysian

flight MH370.

The portfolio has suffered from a further severe

underperformance during the year on account of its high exposure to

Asia, materials and smaller companies. Would that I had benefited

from the same intuition in selecting stocks as Ms Philippa Langley,

who located the grave of King Richard III in a car park on her very

first visit to Leicester.

I feel highly frustrated because I have in the past correctly

forecast several macro-economic themes, namely the onset of

disinflation as early as the mid 1990's and the stupidity of the

construction of the Eurozone and how this would lead to areas of

high unemployment and little or slow growth leading to its eventual

breakup. My logical conclusion was that, at a time when organic

growth would become the scarcest of all commodities, the dynamism

of Asia would be re-rated by investors. How wrong I have been

proved. I under-estimated the lack of investor appetite for risk in

conjunction with the power of the regulator to cause fear in the

minds of the investment community and seek safety in preference to

'growth potential' acting with lemming style behaviour. I also

under estimated the propensity for Chinese companies to become

involved in scandals and the market's ability to tar both the good

and the bad with the same brush.

If the smaller capitalisations within the portfolio have fared

badly, the same is not true for the larger stocks. For most of the

year BTG was the largest holding in the portfolio. Its share price

continued to rise strongly for the first eleven months, spurred on

by a string of exciting announcements about its innovative new

medical products and treatments; this strength provided the

opportunity to take considerable profits.

In an era of increasing competitiveness, with margins under

pressure even in obvious renaissance industries such as UK motor

manufacturing, I found it difficult to find enthusiasm for new

holdings on account of the absence of the key ingredient of strong

relative pricing power. Once again I resorted to my old favourite,

the housebuilding sector, to which the government has introduced a

variety of new initiatives to stimulate the economy and help the

young onto the housing ladder. As a result, the figure for newly

constructed homes rose to 125,000. Although this represents an

uplift relative to the previous year, when viewed in comparison

with the figure for net immigration of 290,000 it is derisory; no

wonder the housing shortage persists and house prices look set to

continue to rise for many years to come.

Not only was an addition made to the existing holding of

Persimmon, but new holdings were taken in Berkeley Group and one

initiated in Barratt Developments. Both the prolific dividends

received from these holdings and also the share price performances

have exceeded my highest expectations.

The holding in Ashtead, the UK quoted but US based (currently

with the second largest market share in the USA) plant hire company

continues to thrive. Its profits growth, which arises from a

combination of infill acquisition, superior purchasing power and

structural change in the construction industry, has been propelled

upwards. Importantly, the prospect of a continuation of these

favourable conditions look set for several more years in view of

the high probability of an extended cycle. Eventually, however,

when the inevitable slowdown occurs, it has the ability to generate

huge amounts of surplus cash. In common with BTG, this stock is

predominantly a US $ earner, and thus a beneficiary of any sterling

weakness/dollar strength.

Aberdeen Asset Management's share price has suffered from an

extended period of fund outflows, such is the lack of appetite for

investing in Asia currently, with the sole exception of Prudential

whose share price prospered. Hopefully these flows will soon

reverse when investors see new highs in the Chinese, Hong Kong and

Indian markets appearing; so far this calendar year they have at

long last outperformed Developed markets by a considerable

margin.

Gresham Computing Plc, which is involved in the provision of

real-time financial transaction control software packages,

unfortunately had to issue a profits warning in the autumn, which

seriously knocked the share price; this was necessary due to the

length of time new customers took to adopt the systems and for a

revenue stream to start to flow. The company, however, is brimming

with confidence. Already this calendar year it has been able to

announce a series of newly won customers from a variety of sectors,

but also has been able to expand the size of existing contracts, on

account of the quality of its service. The immediate future

potential is enormous at a time of ever increasing regulation.

Igas Energy, a company which is producing one million barrels of

oil per year from conventional wells onshore within the UK, has

seen its share price collapse on the back of the dramatic fall in

the oil price, which few predicted. During the past year it has

increased its acreage of licences through the purchase of Dart

Energy and in all probability in the most recent licensing round,

where awards are still to be announced. Moreover it has drilled

several test bores in the exciting Bowland shale region in the

North West. The initial results have been indicated to be extremely

positive, although they are still undergoing further analysis.

Recently the company has done a significant "farm-out" deal with

Ineos (in addition to those done previously with Total) to help

fund a major drilling programme. Overall, it has $285 million of

funding available for this purpose. The recent win by the

Conservative Party should greatly facilitate this programme as well

as foster improved sentiment towards the company. As reported by

the British Geological Society, the reserve potential is

enormous.

The mining stocks in the portfolio have all performed badly

during the year on account of falling commodity prices. I had

wrongly assumed that these would have remained firmer as the

rapidly growing nations continue to devour huge quantities of

commodities to facilitate their continuing growth, even if the more

modest demand from Europe has stagnated. It is now evident that the

new sources of supply had been under estimated and at the same time

a degree of destocking by China has occurred; iron ore is the

obvious example.

Medusa Mining's share price suffered badly last year not only

from a lacklustre gold price but also from operational difficulties

during the installation of a new and larger crushing mill; in

addition there were other management failures. New management,

however, has since been appointed. In consequence, the outlook is

greatly improved as production now appears to be on course to

double and costs reduce as the problems are gradually being

surmounted. Importantly, there is a long visible future life for

this low cost mine as well as the high probability of a second mine

being commenced at a later date. Confidence in the shares should

therefore return soon, provided that the production continues to

expand as planned.

BSD Crown (formerly Emblaze) had mixed results from its court

case against Apple Inc. for unpaid royalties. The jury in Apple's

home town confirmed that there was a valid patent in place but,

rather curiously decided that Apple had not infringed this patent,

and so awarded no royalties. This news obviously was most

disappointing for loyal shareholders.

The company is now waiting to hear whether or not it can appeal

to a higher court. At a later date, it intends to bring a similar

case against Microsoft (which the company considers to be a softer

target).

Asian Citrus suffered from a third year of horrendous weather.

Severe frosts and a typhoon severely damaged one orange grove,

where many of the trees are now suffering from disease; the high

winds also destroyed all the newly planted banana trees. Not only

will the production be at a lower level for the next two years but

also the cost of replanting, combined with additional manure,

sprays and labour costs, will be heavy. Accordingly, it is highly

probable that the group may, during this difficult period, incur a

loss. Not surprisingly many investors have dumped their holdings

after such a string of bad news from this unlucky company, leaving

the share price at a miserably low fraction of the value of the

holding of net cash alone, thus making the company vulnerable to

any takeover attempt, possibly by a foreign (Brazilian) buyer. I,

however, remain resolutely confident that the plantations are being

well managed in exceptionally difficult circumstances.

Overall, in the longer term, the orange groves have the

potential to more than triple production as the trees mature,

moreover the fruit juice division, which has nearly doubled in size

to 100,000 tonnes p.a., should soon be operating at full capacity.

Hopefully, it will not take too long before the company once more

is spinning off prodigious amounts of cash and thereafter returns

to favour amongst investors - the company is after all well

positioned to benefit from the inevitable consumer boom, which the

Chinese government is planning to engineer as it re-orientates the

economy away from being investment led.

The share price of West China Cement has performed strongly in

recent months as a result of reductions in interest rates and

having been awarded a steady stream of contracts (high speed rail

and other infrastructure projects). The company is, however, still

suffering in the more competitive (lowland) half of its operating

area from excess capacity problems and depressed cement prices. It

is to be hoped that there are further stimulatory measures taken by

the government, which ameliorate the situation in terms of both

volume and pricing.

Unfortunately Naibu, a Chinese manufacturer and retailer of

sports shoes and clothing in tier 3 cities, which appeared

attractive on account of its high dividend yield, strong balance

sheet and attractive valuation, has encountered a governance

problem when the chief executive ceased to communicate with the

non-executive directors. The latter have wisely and appropriately

suspended the shares and an investigation is in progress. The

Company's holding has been valued at zero until there is an

announcement.

Sirius Minerals, which is proposing to exploit a massive deposit

in North Yorkshire of polyhalite (type of potash), is a small, new

entrant to the portfolio. The investment was made, supposedly on a

very short term basis, on the grounds that planning permission to

commence mining operations was projected to be granted at the turn

of the year; whereas it has now been postponed until the summer. In

addition to the considerable benefit to the nation's balance of

payments that full development of the project will bring, the

economic impact on this area of high unemployment is important.

Since the transport arrangements have been revised to minimise the

environmental impact, there is increased confidence that the

members on the North York Moors committee will look favourably on

this scheme of significant national importance.

Outlook

Led by the US economy the world-wide economic recovery

continues. Whilst the rate of US unemployment continues to fall

from month to month the level of wages has not yet started to rise.

Moreover manufacturing industry continues to fluctuate. In that

light, the Federal Reserve Board views the economy to be in

possession of plenty of spare capacity and remaining fragile.

Although commentators opine frequently about the date of an

impending rate rise, somehow that date keeps being delayed.

A major boost to the US economy is emanating from the huge fall

in the price of shale gas, resulting from the success of the

fracking industry; this provides the US with a major advantage over

the Far East competition where the price is three times higher.

On-shoring of the chemicals industry is accordingly occurring. A

further notable feature is the construction of seaboard export

terminals for LNG with the intention of flooding Europe with cheap

gas, thus making this continent less dependent on exports from

Russia.

In the Eurozone the outlook is much less healthy having been

adversely affected, inter alia, by sanctions against Russia. Only

Germany is prospering as a direct result of the weakness of the

euro which has aided its export trade. France and Italy are faring

less well. Greece is tottering on the brink of defaulting on its

debts while other peripheral countries are stagnating and suffering

from actual deflation. Signor Draghi has finally resorted, albeit

far too late, to the implementation of Q.E, which is starting to

have some effect on the markets. My suggestion is that he

immediately gives a consultancy to Robert Mugabe to help combat the

serious threat of deflation before it takes hold too strongly!

In Asia the various economies continue to expand, albeit not at

the rip-roaring pace prevalent prior to the financial crash. The

Japanese stock-market, aided by stimulatory measures, is achieving

new (but not all-time) highs accompanied by Hong Kong, India and

other markets.

During the last six months the Chinese government has not only

relaxed the reserve ratio requirements to boost the economy, but

has reduced the official rate of interest no less than three times.

It is therefore not surprising that the Chinese stock-market should

perform so well (indeed at a time of falling property prices)

against such a background, in fact more strongly than any other

major stock-market. Individuals are opening new accounts with

stockbrokers in record numbers having found an alternative outlet

to residential property for their savings. Hopefully, this

enthusiasm will feed through into the smaller capitalisations, to

which the portfolio is exposed and where the valuations are

derisory.

Rarely in history has the outlook for the British economy

changed so dramatically in the space of one minute, as it did at

22.01pm on 7th May on publication of the exit poll following the

general election. Prior to that moment a government hostile to

business had been universally predicted to take office. In

consequence of Mr Cameron having gained an overall, if slim,

majority there is now no longer the necessity for weeks of

horse-trading between the parties, in order to form a government,

which would have introduced much uncertainty.

There will also occur less state intervention and less

regulation and a lower degree of fear of rising taxation than if

the opposition had been victorious. The UK economy should therefore

regain momentum in the coming months, as investment programmes are

reinstated and consumer confidence continues to rise against a

background of record numbers employed, and falling unemployment,

despite wages not rising.

Furthermore, as appetite for risk-taking slowly and inevitably

increases, investor sentiment is likely to improve, which should

benefit at long last the holdings in the portfolio with the most

exciting prospects. Needless to say they are the smaller companies,

which hitherto have been deemed too illiquid, under-analysed and

too risky for the average investor, who has ignored them.

I very much hope and indeed expect much of this potential to be

realised over the coming twelve months after such a long delay.

James Barstow

Mars Asset Management Limited

9 June 2015

INVESTMENT POLICY AND PERFORMANCE

This report deals with the results of Aurora Investment Trust

plc and its subsidiary ("the Group").

Investment Policy

The Company's objectives are pursued through investments in

securities, the majority of which are listed on the London Stock

Exchange, predominantly comprising equities but allowing exposure

to fixed interest and equity related securities. The portfolio

comprises a mix of large, mid and smaller capitalised stocks. A

distinctive feature is an emphasis on investments in companies with

exposure to economies growing at a faster rate than the UK.

In pursuing this policy, the Investment Manager takes into

account the following considerations:

Distribution of the portfolio relative to the benchmark

An element of risk is inherent in investment undertaken on a

selective basis. The Company seeks to mitigate the degree of risk

by investing in securities in substantial organisations, normally

listed and traded on the London Stock Exchange, and by spreading

its investments across a range of such securities.

The benchmark is the FTSE All-Share Index, which is an index of

over 700 of the largest capitalised stocks quoted on the London

market. This Index is not only representative of the UK economy but

also includes a significant degree of international exposure,

because the London Stock Exchange has become the stock market of

choice for many of the emerging world's largest companies and,

furthermore, many of the largest stocks are multinational companies

with the majority of their revenues derived outside the UK.

Therefore, the Investment Manager can achieve the aim of exposure

to fast-growing economies while investing selectively in stocks

quoted on the London market. However, the Investment Manager makes

no attempt to replicate the benchmark and the weightings of the

portfolio to particular sectors may differ significantly from those

of the benchmark.

A performance fee is payable to the Investment Manager only if

the benchmark is beaten and a NAV is achieved that is greater than

the NAV at the time when the previous performance fee was paid.

Risk diversification

At 28 February 2015 the Company and its subsidiary held 43

stocks, spread across 9 main sectors.

The Board does not believe that it should normally or

continuously impose prescriptive limits on the Investment Manager

regarding the geographic breakdown or distribution by sector of the

portfolio. However, these matters are a subject of repeated

discussion between the Board and the Investment Manager and from

time to time particular informal limits are agreed between

them.

Gearing Policy

Borrowings are limited by the articles to a maximum of 30% of

NAV and by the Company's bank covenant to 25% of NAV. The Board has

adopted a policy whereby under normal circumstances borrowings are

to be kept to within approximately 20% of the Company's NAV, but

with the flexibility to rise for limited periods. This flexibility

is considered desirable to avoid the possibility of forced sales in

adverse market conditions.

The Board keeps the level of gearing and the extent, if any, of

borrowing in foreign currencies under close review.

Hedging

The Company does not use derivatives to hedge market or currency

exposure.

Objectives and key performance indicators (KPIs)

The Company's principal investment objective is to achieve

capital growth. The Company's ability to attain its objectives is

measured by reference to KPIs as follows:

(a) The Company seeks to achieve a positive total return over

the long-term. To measure its success, the Board compares

shareholders' returns from owning the shares (share price

appreciation and dividends) over one and five years and since

launch to the return on an appropriate gilt-edged security (without

reinvestment of dividends or interest). The Board considers

long-term performance to be of greater importance than short-term

and that the five-year comparison is the Company's Primary KPI.

(b) The Company's Benchmark is the FTSE All-Share Index, against

which the Net Asset Value (NAV) return (capital only) is compared.

After achieving the goal of making absolute returns for

shareholders, the next aim is to provide a better return from the

portfolio than from the market as measured by the Benchmark.

(c) The Company also seeks to outperform other companies that it

considers to be its Peer Group. The Company's one and five year

returns are therefore compared with those of the AIC UK Growth

Sector Weighted Average.

(d) The Company seeks to ensure that the operating expenses of

the Company as a proportion of NAV (the ongoing Charges Ratio) are

reasonable.

The Board has also sought to achieve a dividend rising in line

with inflation, although this is not defined as a KPI.

Performance

The Investment Manager is Mars Asset Management Limited (Mars),

which is regulated by the FCA. The main fund manager is James

Barstow (managing director of Mars). Mr Barstow reports in detail

upon the Company's activities in his Report.

The Company's performance relative to the KPIs described above

was as follows:

(a) Performance of share price vs. gilt edged security

Five

Year years

ended ended Since

28 February 28 February launch

2015 2015 (1997)

Share price and

dividends (8.85%) +3.79% +101.48%

Treasury 8% stock

2015 and interest +0.65% +15.12% +138.79%

The Company has not achieved this KPI in any of the periods.

(b) Performance of NAV vs. Benchmark

Five

Year years

ended ended Since

28 February 28 February launch

2015 2015 (1997)

Net Asset Value

per share (10.64%) (10.52%) +75.26%*

Benchmark +2.12% +36.81% +73.66%

All NAV figures are for capital-only performance

*by reference to a starting value of 97.78p (net of launch

expenses).

The Company has achieved this KPI since launch, but not over one

or five years.

(c) Performance vs. Peer Group

Five years

Year ended ended

28 February 28 February

2015 2015

Net Asset Value per

share (10.64%) (10.52%)

AIC UK Growth Sector

Weighted

Average (3.9%) +102.7%

The Company has not achieved this KPI over one or five

years.

(d) Ongoing Charges Ratio

Year ended Year ended

28 February 28 February

2015 2014

Ongoing Charges

Ratio 2.25% 2.18%

The ratio is calculated excluding finance costs but including

operating expenses charged to capital and applied to the average

NAV of the year. Expenses of a type not expected to recur under

normal circumstances are excluded from the calculation.

Increase in dividend

The Company has succeeded in achieving a steady increase in the

level of dividend paid over the past 17 years. Another modest

increase is proposed in respect of the year ended 28 February 2015.

The directors are recommending a dividend of 3.85p per share (2014:

3.80p per share).

Revenue result and dividend

The Group's revenue profit after tax for the period amounted to

GBP78,553 (2014: profit GBP1,208,986). The Company made a revenue

profit after tax of GBP415,841 (2014: GBP374,209).

At the Annual General Meeting on 16 July 2015, a resolution will

be proposed to approve a final dividend of 3.85p (2014: 3.80p) per

ordinary share, absorbing GBP400,287 (2014: GBP395,088). The final

dividend will be paid on 27 July 2015 to shareholders on the

register at 19 June 2015; the ordinary shares will go ex-dividend

on 18 June 2015. In accordance with International Financial

Reporting Standards this dividend is not reflected in the financial

statements for the year ended 28 February 2015.

Risk analysis

The Board considers that the principal risks faced by the

shareholders of the Company fall into two categories:

External Risks

Poor performance in the UK and/or world economies; poor

corporate profits and dividends.

Poor stock market performance caused by market-specific factors,

such as rising interest rates, the unwinding of "bubbles" or

disinvestment by institutions, superimposed on general economic

factors, or caused by shocks, wars, disease etc. The Board does not

consider, however, that short-term volatility represents a risk

that the Company seeks to avoid, since it regards long-term

performance to be of primary importance.

Internal Risks

Poor asset management, which may include poor stock selection,

excessive concentration of the portfolio, mistakes regarding

currency movements, speculation in shares of companies without

sound or established businesses and speculation in derivatives.

Poor control of borrowing, including borrowing at excessive

rates of interest relative to likely returns and borrowing

excessive amounts leading to the breach of covenants and possible

enforced sales of assets at disadvantageous prices.

Poor governance, compliance or administration, including

particularly the risk of loss of investment trust status.

All these and other risks can result in shareholders not making

acceptable returns from their investment in the Company.

Risk controls

External risks

Information on the mitigation of risk by diversification and by

control of gearing and hedging is given in the Investment Policy

section.

Further details concerning currency risks, liquidity risks and

interest rate risks are given in note 19.

Internal risks

The control of risks related to governance, compliance and

administration is dealt with in the report on Corporate

Governance.

Social, ethical, human rights and environmental matters

Being an investment company, with no staff, premises,

manufacturing or other operations of its own, the Company does not

have any direct influence on social, ethical, human rights and

environmental matters. The Company has no greenhouse gas emissions

to report from its operations, nor any responsibility for emission

producing sources. However, the Investment Manager bears in mind

such matters when choosing investments and aims to avoid investment

into companies that are found to perform badly in those areas.

Boardroom diversity

The Company has no employees other than the Directors. At 28

February 2015 the Company had four directors, all of whom were

male. The Company's policy is that the Board should have a broad

range of skills; while keeping this in mind, consideration is given

to the recommendations of the AIC Code and other guidance on

boardroom diversity.

Five year summary

The following data are all expressed as pence per share. They

are shown both as previously published and as adjusted by adding

back the final dividend for each year.

NAV Dividend in Share price

respect of

Year per share year (mid market)

2011 269.24 3.50 246.00

2012 214.84 3.55 175.75

2013 186.13 3.75 152.75

2014 191.78 3.80 166.00

2015 171.37 3.85 147.50

(At 18 May 2015 the NAV per share

was 185.99p.)

Outlook

The outlook for Aurora is discussed in the Chairman's Statement

and the Manager's Review and Outlook.

TOP TEN HOLDINGS - CONSOLIDATED

At 28 February 2015

All holdings are of ordinary shares, unless otherwise stated

Percentage

By valuation of

GBP'000 Portfolio

Persimmon 2,469,600 11.41

BTG 2,199,650 10.17

Ashtead Group 1,783,500 8.25

Berkeley Group 1,438,800 6.65

Aberdeen Asset Management 1,405,800 6.50

Royal Dutch Petroleum 1,323,300 6.12

Lloyds Bank 11.75%

PIBS 990,000 4.58

West China Cement 960,238 4.44

Gresham Computing 858,000 3.97

Prudential 814,500 3.77

14,243,388 65.86

Other holdings 7,385,085 34.14

Total investments

- consolidated 21,628,473 100.00

-------------------------- ------------ ----------

PORTFOLIO ANALYSIS

At 28 February 2015

Percentage

of

Portfolio

Information Technology

Services 6.47

Resources 15.48

General Industries 35.15

Consumer Goods 15.94

Cyclical Services 1.45

Pharmaceuticals 3.21

Financial Services 15.08

Fixed Interest 6.90

Transport 0.32

100.00

----------------------- ----------

ANALYSIS OF INVESTMENTS BY SECTOR - CONSOLIDATED BY MARKET

VALUE

At 28 FEBRUARY 2015

All holdings are of ordinary shares, unless otherwise

indicated

Company Subsidiary Total Percentage

Investments Investments Value of

Company GBP'000 GBP'000 GBP'000 Portfolio

Fixed income Amlin 6.5% Bond 502 - 502 2.32

Lloyds Bank 11.75% PIBS 990 - 990 4.58

1,492 - 1,492 6.90

Banks, Retail HSBC Holdings 409 - 409 1.89

Financial Services Charlemagne Capital 171 - 171 0.79

Aberdeen Asset Management 1,406 - 1,406 6.50

Hargreaves Lansdown 23 - 23 0.10

Jupiter Fund 41 - 41 0.19

1,641 1,641 7.58

Information Technology Gresham Computing 858 - 858 3.97

Services

B.S.D. Crown Limited 470 70 540 2.50

1,328 70 1,398 6.47

Insurance Amlin 397 - 397 1.83

Prudential 814 - 814 3.77

1,211 1,211 5.60

Mining Anglo Pacific 138 - 138 0.64

Antofagasta 345 - 345 1.60

Coal of Africa - 15 15 0.07

GCM Resources 198 10 208 0.97

Sirius Minerals 40 276 316 1.46

Medusa Mining Ltd 121 - 121 0.56

Rio Tinto 479 - 479 2.21

Glencore Xstrata 241 - 241 1.11

1,562 301 1,863 8.62

-------------------------------------------------- ----------- ----------- ------- ----------

Non-Cyclical

-------------------------- ----------- ----------- ------- ----------

Asian Citrus 439 - 439 2.03

-------------------------------------------------- ----------- ----------- ------- ----------

Consumer Goods

-------------------------- ----------- ----------- ------- ----------

BTG 2,200 - 2,200 10.17

-------------------------------------------------- ----------- ----------- ------- ----------

Purecircle Ltd 810 - 810 3.74

-------------------------------------------------- ----------- ----------- ------- ----------

Naibu Global 0 - 0 0.00

-------------------------------------------------- ----------- ----------- ------- ----------

3,449 3,449 15.94

-------------------------------------------------- ----------- ----------- ------- ----------

Pharmaceutical

-------------------------- ----------- ----------- ------- ----------

Glaxosmithkline 693 - 693 3.21

-------------------------------------------------- ----------- ----------- ------- ----------

Oil Exploration

&

-------------------------- ----------- ----------- ------- ----------

Petro Matad 28 - 28 0.13

-------------------------------------------------- ----------- ----------- ------- ----------

Production

-------------------------- ----------- ----------- ------- ----------

Premier Oil 135 - 135 0.62

-------------------------------------------------- ----------- ----------- ------- ----------

Royal Dutch Petroleum

'B' 1,323 - 1,323 6.12

-------------------------------------------------- ----------- ----------- ------- ----------

IGAS Energy 189 14 203 0.94

-------------------------------------------------- ----------- ----------- ------- ----------

1,675 14 1,689 7.81

-------------------------------------------------- ----------- ----------- ------- ----------

General Industrials

-------------------------- ----------- ----------- ------- ----------

Aggreko 597 - 597 2.76

-------------------------------------------------- ----------- ----------- ------- ----------

Transport

-------------------------- ----------- ----------- ------- ----------

China Chaintek 70 - 70 0.33

-------------------------------------------------- ----------- ----------- ------- ----------

Oil, Integrated

-------------------------- ----------- ----------- ------- ----------

BG Group 48 - 48 0.22

-------------------------------------------------- ----------- ----------- ------- ----------

Cyclical Services

-------------------------- ----------- ----------- ------- ----------

Ceres Power Holdings 258 - 258 1.19

-------------------------------------------------- ----------- ----------- ------- ----------

China New Energy 12 - 12 0.06

-------------------------------------------------- ----------- ----------- ------- ----------

Atlantis Resources 42 42 0.19

-------------------------------------------------- ----------- ----------- ------- ----------

312 - 312 1.44

-------------------------------------------------- ----------- ----------- ------- ----------

Basic Industries

-------------------------- ----------- ----------- ------- ----------

West China Cement 960 - 960 4.44

-------------------------------------------------- ----------- ----------- ------- ----------

Construction &

-------------------------- ----------- ----------- ------- ----------

Engineering Persimmon 2,470 - 2,470 11.41

-------------------------- ----------- ----------- ------- ----------

Barratt Development 103 - 103 0.48

-------------------------------------------------- ----------- ----------- ------- ----------

Berkeley Group 1,439 - 1,439 6.65

-------------------------------------------------- ----------- ----------- ------- ----------

4,012 - 4,012 18.54

-------------------------------------------------- ----------- ----------- ------- ----------

Support Services

-------------------------- ----------- ----------- ------- ----------

Ashtead Group 1,784 - 1,784 8.25

-------------------------------------------------- ----------- ----------- ------- ----------

Total Portfolio 21,243 385 21,628 100.00

-------------------------------------------------- ----------- ----------- ------- ----------

ANALYSIS BY TYPE, MARKET & CURRENCY - BY MARKET VALUE

GBP'000

Ordinary shares 20,136

Fixed interest securities 1,492

21,628

UK listed securities 18,436

Hong Kong listed security 960

AIM securities 2,232

21,628

Denominated in sterling 20,668

Denominated in Hong Kong

$ 960

21,628

-------------------------- -------

This Strategic Report was approved by the Board on 9 June

2015.

For and on behalf of the Board

Lord Flight

Chairman

9 June 2015

STATEMENT OF DIRECTORS' RESPONSIBILITIES FOR THE ANNUAL

REPORT

The Directors are responsible for preparing the Strategic

Report, the Directors' Report, the Remuneration Reports and the

financial statements in accordance with applicable law and

regulations.

Company law in the United Kingdom requires the directors to

prepare financial statements for each financial year. Under that

law the directors have to prepare the Group financial statements in

accordance with International Financial Reporting Standards (IFRSs)

as adopted by the European Union and Article 4 of the IAS

Regulation and have elected to prepare the Company financial

statements under IFRS as adopted by the European Union. Under

company law the directors must not approve the accounts unless they

are satisfied that they give a true and fair view of the state of

affairs and profit or loss of the Company and Group for that

period. In preparing these financial statements, the Directors are

required to:

-- select suitable accounting policies and then apply them consistently;

-- make judgements and accounting estimates which are reasonable and prudent;

-- state whether applicable IFRSs have been followed, subject to

any material departures disclosed and explained in the financial

statements;

-- prepare the financial statements on the going concern basis,

unless it is inappropriate to presume that the Company will

continue in business.

The Directors are responsible for keeping adequate accounting

records that are sufficient to show and explain the Company's

transactions and disclose with reasonable accuracy at any time the

financial position of the Company and enable them to ensure that

the financial statements and the Remuneration Report comply with

the Companies Act 2006 and Article 4 of the IAS Regulation. They

are also responsible for safeguarding the assets of the Company and

hence for taking reasonable steps for the prevention and detection

of fraud and other irregularities.

The Directors are responsible for the maintenance and integrity

of the corporate and financial information included on the website

used by the Company.

Legislation in the United Kingdom governing the preparation and

dissemination of financial statements may differ from legislation

in other jurisdictions.

Disclosure of information to auditor

The Directors confirm that:

-- so far as each Director is aware, there is no relevant audit

information of which the Company's auditor is unaware; and

-- the Directors have taken all the steps that they ought to

have taken as directors to make themselves aware of any relevant

audit information and to establish that the auditors are aware of

that information.

Statement under the Disclosure and Transparency Rules 4.1.12

The Directors confirm that to the best of their knowledge and

belief;

(a) This annual report includes a fair review of the development

and performance of the business and the position of the Company and

the undertakings included in the consolidation taken as a whole,

together with a description of the principal risks and

uncertainties that they face;

(b) the financial statements, prepared in accordance with

International Financial Reporting Standards, give a true and fair

view of the assets, liabilities, financial position and profit or

loss of the issuer and the undertakings included in the

consolidation taken as a whole; and

Having taken advice from the Audit Committee, the Directors

consider that the annual report and financial statements taken as a

whole are fair, balanced and understandable and provide the

information necessary for shareholders to assess the Company's

performance, business model and strategy.

For and on behalf of the Board

Lord Flight

Chairman

9 June 2015

FINANCIALS

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the year ended 28 February

2015 2015 2014

Revenue Capital Total Revenue Capital Total

Notes GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Losses on investments designated

at fair value

through profit or loss - (1,626) (1,626) - (49) (49)

(Losses)/gains of trading subsidiary

at fair value

through profit or loss (295) - (295) 906 - 906

Investment income 2 804 - 804 726 - 726

Total income 509 (1,626) (1,117) 1,632 (49) 1,583

Investment management fees 3 (85) (85) (170) (85) (85) (170)

Other expenses 3 (249) - (249) (243) - (243)

Profit/(loss) before finance costs

and tax 175 (1,711) (1,536) 1,304 (134) 1,170

Finance costs 6 (95) (95) (190) (98) (98) (196)

Profit/(loss) before tax 80 (1,806) (1,726) 1,206 (232) 974

Tax 7 (1) - (1) 3 - 3

Profit/(loss) and total comprehensive

income for the year 79 (1,806) (1,727) 1,209 (232) 977

Earnings per share 9 0.76p (17.37p) (16.61p) 11.63p (2.23p) 9.40p

The revenue and capital columns, including the revenue and

capital earnings per share data, are supplementary information

prepared under guidance published by the AIC. As permitted by S408

of the Companies Act 2006, the Company has not presented its own

Statement of Comprehensive Income. The amount of the Company's loss

for the financial year was GBP1,727,507 (2014: profit

GBP977,076).

All revenue and capital items in the above statement derive from

continuing operations. No operations were acquired or discontinued

during the period. All revenue is attributable to the equity

holders of the parent company. There are no minority interests.

The Board recommends a final dividend of 3.85p per share

(GBP400,287) out of the Company's revenue profit for the financial

year of GBP415,841.

CONSOLIDATED BALANCE SHEET

At 28 February 2015 2015 2014

Notes GBP'000 GBP'000

Non-current assets

Investments designated at fair value through

profit or loss 10 21,243 23,892

Current assets

Investments designated at fair value through

profit or loss (held by subsidiary) 385 170

Sales for future settlement - 180

Other receivables 112 84

Cash and cash equivalents 150 140

647 574

Total assets 21,890 24,466

Current liabilities

Other payables 73 74

Bank loan and overdraft 4,000 4,453

4,073 4,527

Total assets less current liabilities 17,817 19,939

Equity

Called up share capital 12 3,598 3,598

Capital redemption reserve 179 179

Share premium account 10,997 10,997

Investment holding losses 14 (6,733) (6,867)

Other capital reserves 14 10,866 12,806

Revenue reserve (1,090) (774)

Total equity 17,817 19,939

Net assets per ordinary share 171.37p 191.78p

--------------------------------------------- ----- ------- -------

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the year ended 28 February

2015 Capital Share Investment Other

Share redemption premium holding capital Revenue

capital reserve account losses reserves reserve Total

Notes GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Opening equity 3,598 179 10,997 (6,867) 12,806 (774) 19,939

Total comprehensive

income/(loss)

for the year - - - 134 (1,940) 79 (1,727)

Dividends paid 8 - - - - - (395) (395)

Closing equity 3,598 179 10,997 (6,733) 10,866 (1,090) 17,817

-------------------------------- ----- ------- ---------- ------- ---------- -------- ------- ------------

For the year ended 28 February

2014 Capital Share Investment Other

Share redemption premium holding capital Revenue

capital reserve account losses reserves reserve Total

Notes GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Opening equity 3,598 179 10,997 (7,081) 13,251 (1,592) 19,352

Total comprehensive (loss)/income

for the year - - - 214 (445) 1,208 977

Dividends paid 8 - - - - - (390) (390)

Closing equity 3,598 179 10,997 (6,867) 12,806 (774) 19,939

---------------------------------- ----- ------- ---------- ------- ---------- -------- ------- ------------

CONSOLIDATED CASH FLOW STATEMENT

For the year ended 28 February 2015 2015 2014

Notes GBP'000 GBP'000

Net cash flow from operating activities

Cash inflow from investment income and interest 785 757

Cash (outflow)/inflow from held for trading

current asset investments (510) 1,724

Cash (outflow) from management expenses (432) (424)

Payments to acquire non-current asset investments (6,468) (6,705)

Receipts on disposal of non-current asset

investments 7,671 4,947

Tax recovered - 3

Net cash flow from operating activities 16 1,046 302

Cash flows from financing activities

Dividends paid (395) (390)

(Decrease)/increase in bank borrowings (453) 300

Finance charges and interest paid (188) (192)

Net cash flow from financing activities (1,036) (282)

Increase in cash 10 20

Cash and cash equivalents at beginning of

year 140 120

Increase in cash 10 20

Cash and cash equivalents at end of year 150 140

COMPANY BALANCE SHEET

At 28 February 2015 2015 2014

Notes GBP'000 GBP'000

Non-current assets

Investments designated at fair value

through profit or loss 10 21,243 23,892

Investment in subsidiary 11 194 15

21,437 23,907

Current assets

Sales for future settlement - 180

Other receivables 308 239

Cash and cash equivalents 145 140

453 559

Total assets 21,890 24,466

Current liabilities

Other payables 73 74

Bank loan and overdraft 4,000 4,453

4,073 4,527

Total assets less current liabilities 17,817 19,939

Equity

Called up share capital 12 3,598 3,598

Capital redemption reserve 179 179

Share premium account 10,997 10,997

Investment holding losses 14 (8,505) (8,302)

Other capital reserves 14 10,866 12,806

Revenue reserve 682 661

Total equity 15 17,817 19,939

------------------------------------------------ ------------ ----------- -------

COMPANY STATEMENT OF CHANGES IN EQUITY

For the year ended 28 February

2015 Capital Share Investment Other

Share redemption premium holding capital Revenue

capital reserve account losses reserves reserve Total

Notes GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Opening equity 3,598 179 10,997 (8,302) 12,806 661 19,939

Total comprehensive

income/(loss)

for the year - - - (203) (1,940) 416 (1,727)

Dividends paid 8 - - - - - (395) (395)

Closing equity 3,598 179 10,997 (8,505) 10,866 682 17,817

------------------------------ ----- ------- ---------- ------- ---------- -------- ------- ------------

For the year ended 28 February

2014 Capital Share Investment Other

Share redemption premium holding capital Revenue

capital reserve account losses reserves reserve Total

Notes GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Opening equity 3,598 179 10,997 (9,350) 13,251 677 19,352

Total comprehensive income/(loss)

for the year - - - 1,048 (445) 374 977

Dividends paid 8 - - - - - (390) (390)

Closing equity 3,598 179 10,997 (8,302) 12,806 661 19,939

---------------------------------- ----- ------- ---------- ------- ---------- -------- ------- ------------

COMPANY CASH FLOW STATEMENT

For the year ended 28 February 2015 2015 2014

GBP'000 GBP'000

Net cash inflow from operating activities

Cash inflow from investment income and interest 785 755

Cash (outflow) from management expenses (432) (422)

Payments to acquire non-current asset investments (6,468) (6,705)

Receipts on disposal of non-current asset

investments 7,671 4,947

Tax (paid)/recovered - 3

Net cash inflow from operating activities 1,556 (1,422)

Cash flows from investing activities

(Increase)/decrease in loans advanced to subsidiary (515) 1,727

Cash flows from financing activities

Dividends paid (395) (390)

(Decrease)/increase in bank borrowings (453) 300

Finance charges and interest paid (188) (192)

Net cash flow from financing activities (1,036) (282)

Increase in cash 5 23

Cash and cash equivalents at beginning of

year 140 117

Increase in cash 5 23

Cash and cash equivalents at end of year 145 140

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

1. Accounting policies

Basis of Accounting

The financial statements of the Company and

the Group have been prepared in accordance

with International Financial Reporting Standards

(IFRS), which comprise standards and interpretations

approved by the IASB and International Accounting

Standards and Standing Interpretations Committee

interpretations approved by the IASC that

remain in effect, and to the extent that they

have been adopted by the European Union.

Under IFRS, the AIC Statement of Recommended

Practice "Financial Statements of Investment

Trust Companies and Venture Capital Trusts"

issued in January 2009 has no formal status,

but the Group adheres to the guidance of the

SORP.

The accounting policies are unchanged from

those used in the last annual financial statements

except where otherwise stated. The particular

accounting policies adopted are described

below:

(a) Accounting Convention

The accounts are prepared under the historical

cost basis, except for the measurement of

fair value of investments.

(b) Basis of Consolidation

The Group accounts consolidate the accounts

of the Company and of its subsidiary AIT Trading

Limited ("AIT"), both drawn up to either 28

or 29 February each year. Under IFRS 10, subsidiaries

that provide services that relate to the investment

company's investment activities are required

to be consolidated. The directors' view is

that AIT Trading Limited provides services

to Aurora and as such it has been consolidated.

As permitted by S408 of the Companies Act

2006, the Company has not presented its own

Statement of Comprehensive Income. The amount

of the Company's loss for the financial year

was GBP1,727,507 (2014: profit GBP977,076).

(c) Investments

As the Company's business is investing in

financial assets with a view to profiting

from their total return in the form of increases

in fair value, investments are designated

as fair value through profit or loss on initial

recognition in accordance with IAS 39. At

this time, fair value is the consideration

given, excluding material transaction or other

dealing costs associated with the investment.

After initial recognition such investments

are valued at fair value. For quoted investments

this is established by reference to bid, or

last, market prices depending on the convention

of the exchange on which the investment is

quoted. Gains or losses are recognised in

the capital column of the Statement of Comprehensive

Income. All purchases and sales of investments

are accounted for on a trade date basis.

The investment of the Company in AIT is stated

at cost less impairment. AIT's own investments

are managed and performance evaluated on a

fair value basis and accordingly are designated

by AIT as "at fair value through profit or

loss". The AIT investments in quoted securities

are valued at all times in accordance with

current market values that represent fair

value; at the time of acquisition they are

valued on the basis of trade date accounting.

Securities of companies whose prices are quoted

on the London Stock Exchange are valued by

reference to the Official List of the London

Stock Exchange at their bid market prices

at the close of the period.

(d) Income from Investments

Investment income from ordinary shares is

accounted for on the basis of ex-dividend

dates. Income from fixed interest shares and

securities is accounted for on an accruals

basis using the effective interest method.

Special Dividends are assessed on their individual

merits and are credited to the capital column

of the Statement of Comprehensive Income if

the substance of the payment is a return of

capital; with this exception all investment

income is taken to the revenue column of the

Statement of Comprehensive Income. Income

from gilts and bank interest receivable is

accounted for on an accruals basis using the

effective yield.

(e) Capital Reserves

The Company is not precluded by its Articles

from making any distribution of capital profits

by way of dividend, but the Directors have

no current plans to do so. Profits and losses

on disposals of investments are taken to the

gains on disposal reserve. Revaluation movements

are taken to the investment holding reserve

via the capital column of the Statement of

Comprehensive Income.

(f) Investment Management Fees, Finance Costs

and Other Costs

Finance costs and monthly management fees

are allocated between capital and revenue

according to the Board's expected long-term

split of returns between capital gains and

income; one-half of these costs are charged

to gains on disposal via the capital column

of the Statement of Comprehensive Income.

Performance-related fees are charged to gains

on disposal via the capital column of the

Statement of Comprehensive Income. Other costs

are normally charged to revenue, unless there

is a compelling reason to charge to capital.

Tax relief in respect of costs allocated to

capital is credited to capital via the capital

column of the Statement of Comprehensive Income

on the marginal basis.

(g) Taxation

Current income tax assets and/or liabilities

comprise those obligations to, or claims from,

fiscal authorities relating to the current

or prior reporting period, that are unpaid

at the balance sheet date.

Deferred income taxes are calculated using

the liability method on temporary differences.

Deferred tax is generally provided on the

difference between the carrying amounts of

assets and liabilities and their tax bases.

In addition, tax losses available to be carried

forward as well as other income tax credits

are assessed for recognition as deferred tax

assets.

Deferred tax assets and liabilities are calculated,

without discounting, at tax rates that are

expected to apply at their respective period

of realisation, provided they are enacted

or substantively enacted at the balance sheet

date. Deferred tax liabilities are always

provided for in full. Deferred tax assets

are recognised to the extent that it is probable

that they will be able to be offset against

future taxable income.

Changes in deferred tax assets or liabilities

are recognised as a component of tax expense

in the income statement, except where they

relate to items that are charged or credited

directly to equity.

(h) Foreign currency

The currency of the primary economic environment

in which the Group companies operate (the

functional currency) is pounds sterling ("Sterling"),

which is also the presentational currency

of the Group. Transactions involving currencies

other than Sterling are recorded at the exchange

rate ruling on the transaction date. At each

balance sheet date, monetary items and non-monetary

assets and liabilities, which are fair valued

and which are denominated in foreign currencies,

are retranslated at the closing rates of exchange.

Such exchange differences are included in

the Statement of Comprehensive Income and

allocated to capital if of a capital nature

or to revenue if of a revenue nature. Exchange

differences allocated to capital are taken

to gains on disposal or investment holding

losses, as appropriate.

(i) Cash and cash equivalents

Cash and Cash Equivalents in the Cash Flow

Statement comprise cash held at bank.

(j) Dividends payable to equity shareholders

Dividends payable to equity shareholders are

recognised in the Statement of Changes in

Equity when they are paid, or have been approved

by shareholders in the case of a final dividend.

2. Income

2015 2014

GBP'000 GBP'000

Income from investments

Dividends from UK listed or quoted

investments 645 488

Income from overseas dividends 58 136

Income from listed fixed interest

securities 101 102

804 726

3. Investment management fees

and other expenses

2015 2014

Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Investment management fees

- monthly 85 85 170 85 85 170

- performance - - - - - -

85 85 170 85 85 170

Other expenses

Administration fees 72 - 72 72 - 72

Registrar's fees 16 - 16 13 - 13

Directors' fees 80 - 80 79 - 79

Auditors' fees - audit of the

Company

and of the consolidated financial

statements 23 - 23 26 - 26

- audit of the subsidiary 2 - 2 2 - 2

- audit-related assurance services 6 - 6 6 - 6

Miscellaneous expenses 50 - 50 45 - 45

Total other expenses 249 - 249 243 - 243

All expenses include any relevant irrecoverable VAT. The amounts

excluding VAT paid or accrued for the audit of the Company are

GBP21,000 (2014: GBP22,000) and for the audit of the subsidiary

GBP1,500 (2014: GBP1,500).

4. Directors' fees

The fees paid or accrued were GBP74,750 (2014: GBP74,750). There

were no other emoluments. The gross figures shown for directors'

fees in note 3 above include employers' National Insurance charges

or VAT, as appropriate. Full details of the fees of each director

are given in the Directors' Remuneration Report on page 27.

5. Transaction charges

2015 2014

Group GBP'000 GBP'000

Transaction costs on purchases

of investments 37 41

Transaction costs on sales of

investments 15 8

Total transaction costs included in gains or losses

on investments at fair value through profit or

loss 52 49

6. Finance costs

2015 2014

Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Interest payable 55 55 110 55 55 110

Facility and arrangement fees

and other charges 40 40 80 43 43 86

95 95 190 98 98 196

7. Taxation

2015 2014

Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Overseas tax 1 - 1 (3) - (3)

Tax charge in respect of the

current year 1 - 1 (3) - (3)

Current taxation

The current taxation charge for the year is different from the

standard rate of corporation tax in the UK (21.17%). The

differences are explained below:

2015 2014

GBP'000 GBP'000

Total (loss)/profit before tax (1,726) 974

Theoretical tax at UK corporation tax rate of

21.17% (2014: 23.08%) (365) 225

Effects of:

Capital losses that are not taxable 382 (53)

UK dividends which are not taxable (137) (114)

Overseas dividends that are not taxable (12) -

Increase/(decrease) in excess tax losses 168 (16)

Expenses charged to capital account for which

a deduction is claimed (38) (42)

Overseas tax written off as irrecoverable/(recovered) 1 (3)

Actual current tax 1 (3)

The Company is an investment trust and therefore

is not charged to tax on capital gains.

Factors that may affect future tax charges

The Company has tax losses of GBP7,923,090 (2014: GBP7,647,046)

in respect of management expenses and of GBP1,575,043 (2014:

GBP1,384,429) in respect of loan interest. Its subsidiary has

trading losses carried forward of GBP2,054,918 (2014: GBP1,759,319)

and GBP196,293 (2014: GBP154,626) in respect of loan interest.

These losses are available to offset future taxable revenue. A

deferred tax asset has not been recognised in respect of those

expenses and will be recoverable only to the extent that the

Company has sufficient future taxable revenue.

8. Ordinary dividends

2015 2014

GBP'000 GBP'000

Dividends reflected in

the financial statements:

Final dividend paid for

the year 2014 at 3.80p

(2013: 3.75p) 395 390

Dividends not reflected

in the financial statements:

Proposed final dividend

for the year 2015

at 3.85p (2014: 3.80p) 400 395

9. Earnings per share

Earnings per share are based on the loss of GBP1,727,507 (2014:

profit GBP977,076) attributable to the weighted average of

10,397,059 (2014: 10,397,059) ordinary shares of 25p in issue

during the year, excluding shares held in Treasury.

Supplementary information is provided as follows: revenue

earnings per share are based on the consolidated revenue profit of

GBP78,553 (2014: profit GBP1,208,986); capital earnings per share

are based on the net capital loss of GBP1,806,060 (2014: loss

GBP231,910), attributable to 10,397,059 (2014: 10,397,059) ordinary

voting shares of 25p.

10. Investments designated at fair value through profit or

loss

2015 2014

GBP'000 GBP'000

UK listed or quoted securities 20,283 23,121

Hong Kong listed security 960 771

Total non-current investments 21,243 23,892

Movements during the year:

Opening balance of investments,

at cost 30,759 29,013

Additions, at cost 6,456 6,705

Disposals - proceeds received

or receivable (7,479) (4,697)

- add realised losses/less

realised profits (1,760) (262)

- at cost (9,239) (4,959)

Cost of investments at

28 February 27,976 30,759

Revaluation of investments

to market value:

Opening balance (6,867) (7,081)

Increase in unrealised

appreciation

debited to investment holding

reserve 134 214

Balance at 28 February (6,733) (6,867)

Market value of non-current

investments

at 28 February 21,243 23,892

11. Subsidiary

The Company has an investment in AIT Trading Limited (AIT), a

wholly owned subsidiary registered in England and Wales, which

comprises two ordinary shares of GBP1 each. AIT undertakes

purchases of investments for re-sale in the shorter term, with the

objective of achieving a trading profit. The loss before tax of AIT

for the year was GBP337,289 (2013: profit GBP834,777). The net

deficit of AIT at the Balance Sheet date was GBP1,771,916 (2014:

net deficit GBP1,434,627). No dividend was paid from AIT to the

Company (2014: GBPnil).

During the year the Company provided a short-term loan to AIT to

finance its trading operations and charged interest to AIT at the

same rate as was charged by Coutts to the Company. At 28 February

2015 the amount outstanding, excluding interest, was GBP1,966,375

(2014: GBP1,450,375) together with GBP196,113 of interest (2014:

GBP154,446).

The Company makes an impairment provision when AIT is in a net

deficit position, of an amount equal to the net deficit.

2014 Movement 2015

GBP'000 GBP'000 GBP'000

Loan to AIT 1,450 516 1,966

Provision for

impairment (1,435) (337) (1,772)

Net investment 15 179 194

12. Share capital

At 28 February 2015 2014

Authorised:

Ordinary shares

of 25p Number 40,000,000 40,000,000

GBP'000 10,000 10,000

Allotted, issued

and fully paid:

Ordinary shares

of 25p Number 14,391,389 14,391,389

GBP'000 3,598 3,598

During the year ended 28 February 2015 the Company did not

purchase any of its own shares (2014: Nil). No shares were

cancelled during the year (2014: Nil). At 28 February 2015, the

Company had 14,391,389 shares in issue, of which 3,994,330 (2014:

3,994,330) are held in Treasury; the number of voting shares in

issue is 10,397,059 (2014: 10,397,059).

13. Total equity

Total Equity includes, in addition to Share Capital, the

following reserves:

Capital Redemption Reserve. When any shares are redeemed or

cancelled, a transfer must be made to this reserve in order to

maintain the level of capital that is not distributable.

Share Premium Account. When shares are issued at a premium to

their nominal value, the "capital profit" arising on their

allotment must be held in a Share Premium Account, which is not

distributable in the ordinary course and may be utilised only in

certain limited circumstances.

Capital profits arising from the Company's investment

transactions are held as Capital Reserves, subdivided between Gains

on Disposal for profits arising upon sales of investments and

Investment Holding gains/losses for portfolio revaluations. The

movements on this account are analysed in note 14 below.

The Company's Revenue Reserves are the net profits that have

arisen from the Company's revenue income in the form of dividends

and interest, less operating expenses and dividends paid out to the

Company's shareholders.

14. Capital reserves

2015 2014

GBP'000 GBP'000

Investment holding gains/(losses):

Opening balance (6,867) (7,081)

Revaluation of investments

- listed 134 214

Balance of investment

holding (losses)

account at 28 February (6,733) (6,867)

Other capital reserves:

Opening balance 12,806 13,251

Net losses on realisation

of investments (1,759) (262)

Expenses of capital management:

management fees (85) (85)

finance costs (95) (98)

Net expenses (180) (183)

Exchange differences (1) -

Balance of other capital

reserves at 28 February 10,866 12,806

Total capital reserve

at 28 February 4,133 5,939

The capital reserves of the Company are identical to those of

the Group, except that a provision is made when necessary against

the Company's investment holding account for any amount loaned to

AIT Trading Limited that is not covered by the subsidiary's net

assets. At 28 February 2015 such a provision was made of

GBP1,771,916 (2014: GBP1,434,630).

15. Net assets per ordinary share

The figure for net assets per ordinary share is based on

GBP17,816,748

(2014: GBP19,939,345) divided by 10,397,059(2014: 10,397,059)

voting ordinary shares in issue at 28 February 2015, excluding

shares held in Treasury.

16. Reconciliation of profit before finance costs and tax to net

cash inflow from operating activities

2015 2014

Group GBP'000 GBP'000

(Loss)/profit before finance

costs and tax (1,536) 1,170

Decrease/(increase) in

non-current investments 2,649 (1,960)

(Increase)/decrease in

current investments (215) 818

Decrease in sales for

future settlement 180 250

(Increase)/decrease in

other receivables (28) 24

(Decrease) in other payables (3) (3)

Taxation (paid)/recovered (1) 3

Net cash inflow from operating

activities 1,046 302

2015 2014

Company GBP'000 GBP'000

(Loss)/profit before finance

costs and tax (1,536) 1,170

Decrease/(increase) in

non-current investments 2,648 (1,960)

Increase/(decrease) in provision

for losses of subsidiary 337 (834)

Decrease in sales for