Assura PLC Debt Redemption (4196F)

November 12 2015 - 2:00AM

UK Regulatory

TIDMAGR

RNS Number : 4196F

Assura PLC

12 November 2015

12 November 2015

Assura plc

Debt redemption

Assura plc ("Assura"), the UK's leading primary care property

investor and developer, today announces that, following its recent

equity raise, it has repaid GBP181 million of long term debt held

by Aviva Commercial Finance, with associated early repayment costs

of GBP34 million. The weighted average interest rate on the loans

redeemed was 5.4%. This repayment is in line with the debt

reduction plan announced in our Prospectus dated 24 September

2015.

Following the repayment, gross debt will be GBP330 million; a

reduction of 36% since 31 March 2015.

Further details will be provided with the financial results for

the six months ended 30 September 2015, which are due to be

released on 19 November 2015.

- Ends -

For more information, please contact:

Assura plc Tel: 01925 420660

Jonathan Murphy

Carolyn Jones

Finsbury Tel: 0207 251 3801

Gordon Simpson

Notes to Editors

Assura is a UK REIT and long-term investor in and developer of

primary care property. The company, headquartered in Warrington and

listed on the London Stock Exchange, works with GPs, health

professionals and the NHS to create innovative property solutions

in order to facilitate delivery of high quality patient care in the

community. At 31 March 2015, Assura's property portfolio was valued

at GBP931 million.

Further information is available at www.assuraplc.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCQFLFFEFFEFBE

(END) Dow Jones Newswires

November 12, 2015 02:00 ET (07:00 GMT)

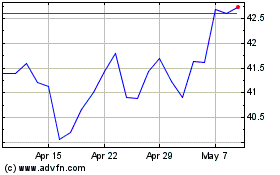

Assura (LSE:AGR)

Historical Stock Chart

From Mar 2024 to Apr 2024

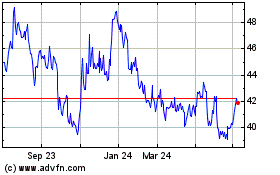

Assura (LSE:AGR)

Historical Stock Chart

From Apr 2023 to Apr 2024