Although the markets have started the year on a solid note,

significant amounts of volatility remain in equities. Huge issues

hang over the market—be it in the form of job creation, Iranian

worries, or European woes—and any one of these problems could

derail growth later this year.

Thanks to this and the impressive pace of the market’s gains so

far this year, some investors may be considering dialing back

exposure to the broad markets, or at least taking a closer look at

more defensive choices instead. This strategy could be ideal for

those seeking to lock in some gains or those who are forecasting a

long slump or a return to more stable markets in the second quarter

(see more on ETFs in the Zacks ETF Center).

One way to accomplish this task while still maintaining exposure

to the broad markets is via the relatively new Trendpilot ETNs.

These innovative notes from RBS utilize a systematic

trend-following strategy which can help to cut down on losses,

assuming that trends hold.

Trendpilot ETN Methodology Explained

In essence, the strategy consists of two components; a broad

benchmark and a Treasury bond component. When the broad

benchmark—or main asset—is at or above its 200 day simple moving

average for five consecutive days, a positive trend is established.

When this takes place, the note will be fully allocated to the

broad benchmark or asset in question.

However, when the index is in a bearish trend—the benchmark is

trending below its 200 day simple moving average for five

consecutive days—the product will establish a more defensive

position. This means the product will cycle out of its stock index

or asset and focus in on T-Bills until a positive trend is once

again established (read Three Outperforming Active ETFs).

With this focus, the Trendpilot ETNs look to avoid the downtimes

in a particular market segment and only invest in a sector when it

is trending higher. This can help to avoid losses but sometimes the

five day level may be too quick of a time period for some trends to

develop.

ETN Ramifications

Investors should also note that the products are structured as

ETNs as opposed to exchange traded funds. This is an important

distinction for trend following products that cycle quickly in and

out of different asset classes (also read ETFs vs. ETNs: What’s The

Difference?).

Basically, ETNs don’t actually hold any securities; instead they

are unsecured senior debt obligations from the issuing institution.

This means that when the trend cycles from one product to another

it just shifts which index it is tracking, nothing is actually

bought or sold. Thanks to this, tracking error for these products

looks to be non-existent, something that cannot be said for

implementing a similar strategy on your own.

The main downsides to the technique are cost and volume.

Currently, of the five Trendpilots, not a single one has more than

$70 million in AUM while three have less than $10 million in

assets.

Additionally fees are quite high compared to similar non-trend

following products; depending on the asset being tracked fees can

reach 100 basis points and only go down to 50 basis points a year

when products are tracking T-Bills instead.

While the strategy certainly sounds interesting, it clearly has

it downsides as well. As a result, the real test for the Trendpilot

products should be when investors put them up against more

traditional rivals. Below, we take a look at the five Trendpilot

ETNs and see how they have done against their more popular

counterparts over the past 52 week period:

RBS Gold Trendpilot ETN (TBAR)

This ETN applies the Trendpilot methodology to gold, as measured

by the spot price of the afternoon gold fixing price for good

delivery in London. The ETN currently has $25 million in AUM and

sees trading volume of about 12,000 shares each day (see ETF

Investors: Beware The Coming ETN Backlash).

For comparison purposes, GLD is easily the most

popular fund tracking the pure gold space, although it is always

focused on the precious metal. This has proven to be a winning

strategy over the past 12 months as GLD has outperformed TBAR by a

little over 375 basis points. If you add in the fee differential,

it becomes even greater putting GLD’s outperformance over the 400

bps mark.

RBS NASDAQ-100 Trendpilot ETN (TNDQ)

For a more tech focused play using the Trendpilot methodology,

investors should take a closer look at TNDQ. The ETN cycles between

the Nasdaq-100 and T-Bills, either giving exposure to short-term

government debt or a tech focused index which includes the likes of

Apple (AAPL), Microsoft (MSFT),

and Google (GOOG).

An easy comparison between this ETN and a more traditional

product is that of QQQ. This ultra-popular ETF has

added about 21.3% in the past 52 weeks compared to a 19.4% return

for TNDQ in the same time period.

While QQQ has been the better choice over the long term, TNDQ

has actually outperformed over the past three month period. The

fund avoided a great deal of turmoil in early March and had a great

start to the year, allowing the note to outperform QQQ by about 480

basis points in the first quarter.

RBS Oil Trendpilot ETN (TWTI)

In order to play the crude oil market, investors can also

consider RBS’ TWTI. The note targets WTI Crude oil, focusing on the

12 contracts that are closest to expiration along the curve.

Investors should also note that this product has a slightly higher

expense ratio at 1.1% and that it looks at a trailing 100 level to

determine its baseline.

One of the more popular oil ETFs that could be a competitor is

the United States Oil Fund (USO). The product also

targets WTI crude, and over the past 52 weeks has gained just over

13.5%. This easily beats out TWTI’s 9.7% gain in the same time

frame, especially when factoring in expenses (see Is An Oil Sands

ETF On The Horizon?).

However, in the recent one month period TWTI has easily

outperformed USO and a similar trend took place over the past

quarter. Still, investors should note that over the past six

months, thanks to TWTI slowly cycling into crude oil, the product

missed out on a lot of gains and underperformed significantly from

this time frame (also, the product has outperformed

USL over the past three month period. Arguably,

this fund is a better comparison but hasn’t been around long enough

to do a full year study).

RBS US Large Cap Trendpilot ETN (TRND)

Easily the most popular Trendpilot product is TRND which focuses

in on large cap U.S. stocks that make up the S&P 500 index. The

product has accumulated nearly $70 million in AUM and trades a

respectable 20,000 shares a day.

For comparison purposes, investors can look to

SPY, the most popular ETF in the world. This fund

also focuses in on the S&P 500 but does not have the T-Bill

component like TRND. Although SPY has been much more volatile—and

was a bigger loser in the worst of 2011—the fund has come roaring

back and is now easily beating TRND over the past year, outgaining

the fund 5% to -1.9%.

RBS US Mid Cap Trendpilot ETN (TRNM)

The second most popular Trendpilot ETN is TRNM, a product with a

mid cap focus. This note looks to cycle between 3-month U.S.

Treasury bills and the S&P Mid Cap 400 Total Index, a benchmark

that comprises roughly 7% of the American equity market (see Mid

Cap ETF Investing 101).

A major non-trend following competitor of TRNM is iShares’

IJH. The product follows the S&P Mid Cap 400

and currently has over $10 billion in AUM. Much like other products

on this list, IJH has thoroughly crushed its Trendpilot

counterpart, losing 1.6% over the past year compared to a 12.6%

loss for TRNM. The note did have less of a total drawdown though,

so it could be a better choice for restless investors, although it

was a little late to the party when the market moved higher.

Thanks to these trends, investors should think twice about the

Trendpilot methodology. While the products are undoubtedly

interesting, the fees are quite high and they can lag in bull

markets. Yet, with that being said, bear markets and those with

clear trends seem to serve this strategy well, so if you believe

the market will face either of these situations, the segment could

be worth a closer look.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

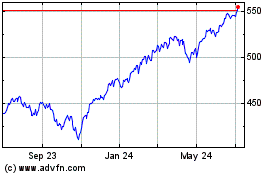

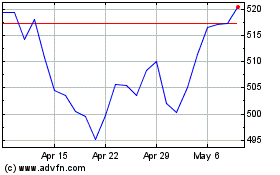

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

From Mar 2024 to Apr 2024

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

From Apr 2023 to Apr 2024