TIDMARC

RNS Number : 9335P

Arcontech Group PLC

24 February 2016

ARCONTECH GROUP PLC

("Arcontech" or the "Group")

INTERIM RESULTS FOR THE SIX MONTHS ENDED 31 DECEMBER 2015

Arcontech (AIM: ARC), the provider of products and services for

real-time financial market data processing and trading, is pleased

to report its unaudited results for the six months ended 31

December 2015.

Financial and business highlights:

-- Turnover increased by 9% to GBP1,132,246 (six months ended 31 December 2014: GBP1,041,599).

-- Operating profit increased by 78% to GBP205,889 (six months

ended 31 December 2014: GBP115,900).

-- Annual run-rate of recurring revenues at 31 December 2015

amount to GBP1.9 million (2014: GBP2.1 million) and cover 105% of

the cost base (2014: 112%).

-- Net cash of GBP1,538,519 as at 31 December 2015 (31 December 2014: GBP1,073,948).

Richard Last, Chairman of Arcontech Group, said:

"The Board is pleased to report continued progress by the Group

in delivering increasing levels of turnover and profitability.

Results for the current year ending 30 June 2016 remain on target

taking into account the reduced revenue from one of our clients in

Asia. Costs continue to be managed closely. With net cash balances

as at 22 February 2016 of GBP1.8m and a good sales pipeline, we are

increasingly positive about the Group's prospects."

Enquiries:

Arcontech Group plc

Richard Last, Chairman and

Non-Executive Director 07713 214484

020 7256

Matthew Jeffs, Chief Executive 2300

finnCap Ltd

020 7220

Carl Holmes/Simon Hicks 0569

To access more information on the Group please visit:

www.arcontech.com

The interim report will only be available to view online

enabling the Group to communicate in a more environmentally

friendly and cost effective manner.

Chairman's Statement

I am pleased to report that Arcontech has continued to grow

profits in the six months ended 31 December 2015. The operating

profit for the period was GBP205,889 compared to GBP115,900 in the

corresponding six month period ended 31 December 2014, an increase

of 78%. This was achieved by increasing turnover for the six month

period by 9% to GBP1.13 million (six month period ended 31 December

2014: GBP1.04 million) and by continued strict cost control. Of the

total revenue, GBP1.13 million relates to recurring annual licence

fees (six month period ended 31 December 2014: GBP1.04 million).

Fully diluted earnings per share increased by 42% to 0.02 pence per

share compared to 0.014 pence per share for the corresponding

period last year.

We continue to work towards making up for the termination of a

significant contract with an Asia focused bank (as announced on

26(th) March 2015) requesting the termination of its contract 18

months early, and which was agreed to take effect from 1 January

2016. Despite this loss, the annual run-rate of recurring revenues

at 31 December 2015 (excluding that contract) amounts to GBP1.9

million (2014: GBP2.1 million including that contract) and covers

105% of the cost base (2014: 112%).

The sales cycle continues to be longer than we would like. With

our strengthened pipeline of qualified prospects, along with the

additional offerings under development we believe the frequency of

new sales wins will improve. Our product development continues to

focus both on enhancing solutions for existing customers, as well

as developing new products and is showing good progress. We have

been working with several clients to broaden the appeal of

Excelerator as well as enhance our server-side systems to better

integrate with clients' infrastructure.

Financing

Arcontech has net cash balances at 31 December 2015 of

GBP1,538,519 (31 December 2014: GBP1,073,948). This has allowed

Arcontech to continue to maintain its level of product development

and further increase its sales capability. Cash balances at 22(nd)

February amount to GBP1,803,370.

Employees

I should like to thank our employees and my fellow directors for

their continuing hard work and dedication over the last six months,

without which we would not have been able to achieve the reported

results and to increase profitability.

Outlook

The Board is pleased to report continued progress by the Group

in delivering increasing levels of turnover and profitability.

Results for the current year ending 30 June 2016 remain on target

taking into account the reduced revenue from one of our clients in

Asia. Costs continue to be managed closely. With net cash balances

as at 22 February 2016 of GBP1.8m and a good sales pipeline, we are

increasingly positive about the Group's prospects.

Richard Last

Chairman and Non-Executive Director

GROUP INCOME STATEMENT AND STATEMENT OF COMPREHENSIVE INCOME

Six months Six months Year ended

ended ended 30 June

31 31

December December

2015 2014 2015

(unaudited) (unaudited) (audited)

GBP GBP GBP

Revenue 1,132,246 1,041,599 2,129,958

Administrative costs (926,657) (925,699) (1,890,242)

Operating profit 205,589 115,900 239,716

Finance income 4,071 1,032 3,944

Profit before taxation 209,660 116,932 243,660

Taxation 105,813 109,378 109,378

Profit for the period

after tax 315,473 226,310 353,038

Total comprehensive

income 315,473 226,310 353,038

Profit per share

(basic) 0.021p 0.015p 0.023p

Profit per share

(diluted) 0.020p 0.014p 0.023p

All of the results relate to continuing operations.

BALANCE SHEETS

31 December 31 December 30 June

2015 2014 2015

(unaudited) (unaudited) (audited)

GBP GBP GBP

Non-current assets

Goodwill 1,715,153 1,715,153 1,715,153

Property, plant

and equipment 49,840 15,531 41,605

Trade and other

receivables 141,750 - 141,750

Total non-current

assets 1,906,743 1,730,684 1,898,508

Current assets

Trade and other

receivables 589,294 757,616 478,402

Cash and cash equivalents 1,538,519 1,073,948 1,069,755

Total current assets 2,127,813 1,831,564 1,548,157

Current liabilities

Trade and other

payables (609,223) (609,224) (779,542)

Deferred income (1,306,273) (1,303,096) (877,001)

Total current liabilities (1,915,496) (1,912,320) (1,656,543)

Net current assets/(liabilities) 212,317 (80,756) (108,386)

Net assets 2,119,060 1,649,928 1,790,122

Equity

Share capital 1,536,672 1,536,672 1,536,672

Share premium account 9,430,312 9,430,312 9,430,312

Share option reserve 106,226 79,295 92,761

Retained earnings (8,954,150) (9,396,351) (9,269,623)

2,119,060 1,649,928 1,790,122

GROUP CASH FLOW STATEMENT

Six months Six months Year ended

ended ended 30 June

31 31

December December

2015 2014 2015

(unaudited) (unaudited) (audited)

GBP GBP GBP

Net cash generated from

operating activities 481,898 340,259 369,982

Investing activities

Interest received 4,071 1,032 3,944

Sales of plant and equipment - 166 167

Purchases of plant and

equipment (17,205) (1,185) (38,014)

Net cash (used in)/generated

from investing activities (13,134) 13 (33,903)

Net increase in cash

and cash equivalents 468,764 340,272 336,079

Cash and cash equivalents

at beginning of period 1,069,755 733,676 733,676

Cash and cash equivalents

at end of period 1,538,519 1,073,948 1,069,755

============ ============ ============================

(MORE TO FOLLOW) Dow Jones Newswires

February 24, 2016 02:00 ET (07:00 GMT)

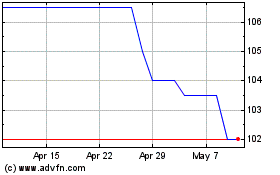

Arcontech (LSE:ARC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Arcontech (LSE:ARC)

Historical Stock Chart

From Apr 2023 to Apr 2024