TIDMARC

RNS Number : 1140V

Arcontech Group PLC

05 August 2015

ARCONTECH GROUP PLC

("Arcontech", the "Company" or the "Group")

Final Results for the Year Ended 30 June 2015

Arcontech (AIM: ARC), the provider of products and services for

real-time financial market data processing and trading, is pleased

to announce its final audited results for the year ended 30 June

2015.

Financial highlights

-- Revenue increased 8% to GBP2.13m (2014: GBP1.98m)

-- Profit before tax of GBP243,660 (2014: loss of GBP35,565)

-- Cash balance of GBP1.07m (2014: GBP733,676)

-- Basic earnings per share of 0.023p (2014: 0.004p)

Operational highlights

-- Expanded customer base with a new business from a U.S based

international investment bank and a regional German bank

-- Growth in revenues from existing clients by building new

solutions and improving some existing ones

-- Continued investment in R&D to develop new solutions for existing and new clients

Commenting on the results, Richard Last, Chairman of Arcontech

said: "Arcontech has a healthy pipeline of qualified prospects and

although the lead time to a sale continues to be unpredictable,

once a sale is completed we invariably have a long and positive

relationship supported by annual recurring licence fees. Despite

the challenges presented in the year under review, with a

broadening product range and customer base, we are both positive

and confident as to Arcontech's prospects."

Enquiries:

Arcontech Group plc

Richard Last, Chairman and

Non-Executive Director 07713 214484

020 7256

Matthew Jeffs, Chief Executive 2300

finnCap Ltd (Nomad & Broker)

020 7220

Carl Holmes/Simon Hicks 0500

To access more information on the Group please visit:

www.arcontech.com

Chairman's Statement

I am pleased to report that Arcontech Group plc ("Arcontech")

has moved into profit for the year ended 30 June 2015, reporting a

profit before taxation of GBP243,660 compared to a loss before

taxation of GBP35,565 for the year ended 30 June 2014. After taking

the benefit of the Research and Development tax credit of

GBP109,378 (2014: GBP100,251) which the company receives due to the

amount it has invested in qualifying product design and

development, Arcontech achieved a profit after tax of GBP353,038

(2014: GBP64,686).

Turnover for the year increased by 8% to GBP2,129,958 (2014:

GBP1,981,375) largely reflecting new business from existing

customers. Recently the customer base was expanded, with new

business from a U.S. based international investment bank and a

regional German bank. The termination of a material product

agreement with an Asia focused bank (as announced on 4 June 2015)

was disappointing, but it is encouraging that we are continuing to

provide solutions to this group.

Staff changes during the year resulted in cost savings which

contributed to the improvement in profit. Although we do not expect

the same uplift from cost savings in the current year, we will

continue to keep a tight rein on costs whilst we invest in our

products and sales capability.

Arcontech has not been able to declare a dividend due to its

negative distributable reserves. It is our intention to seek court

approval to re-designate our reserves and thereby enable the

company to pay dividends.

Financing

As at 30 June 2015 Arcontech had no debt and cash balances of

GBP1,069,755 (2014: GBP733,676), reflecting increased profitability

and additional contract wins, bearing in mind that the majority of

our agreements are recurring in nature and paid annually in

advance. The company, therefore, remains capable of funding, from

its own resources, any demands for additional product development

and sales and marketing.

Employees

Once again I would like to thank our employees who are the core

of the business. They have continued to respond positively to the

challenges presented by the competitive market place in which we

operate to produce this excellent result.

Outlook

Arcontech has a healthy pipeline of qualified prospects and

although the lead time to a sale continues to be unpredictable,

once a sale is completed we invariably have a long and positive

relationship supported by annual recurring licence fees. Despite

the challenges presented in the year under review, with a

broadening product range and customer base, we are both positive

and confident as to Arcontech's prospects.

Richard Last

Chairman

Chief Executive's Review

I am happy to report that during the year, our continued focus

on streamlining costs whilst bringing the sales pipeline forward,

has led to Arcontech moving firmly into profit.

We achieved revenue growth similar to that of last year at 8%

which, along with a reduction in costs of 5%, had a significant and

positive impact to our bottom line to generate a profit before tax

of GBP243,660.

To build on this profitability we are now fully targeted on

growing our business with existing clients and acquiring new ones.

In the period under review we secured both a major U.S. investment

bank and a regional German bank as new clients. Both these clients

performed extensive due diligence and testing on our solutions and

I am pleased to say we were appointed notwithstanding the

competition.

We also managed to grow revenues with our existing clients by

both expanding the use of existing solutions and deploying

additional ones. We did this by adjusting or building out solutions

to better meet their requirements.

In consultation with several existing clients we have also been

working on the development of new product offerings to meet

identified market needs. We hope to roll these out initially with

those same clients and then to a wider client base during the

coming year.

The year, however, was not without its challenges. We

successfully maintained momentum through some staff changes,

negotiated and resolved an issue with a major client and

successfully moved to new office premises which are a significant

improvement over the previous location.

With the initial milestone of moving into solid profitability

accomplished, our goal is to continue to increase the rate of

revenue growth organically and, if a suitable opportunity is

identified, through focused acquisitions.

Matthew Jeffs

Chief Executive

Group Income Statement and Statement of Comprehensive Income

For the year ended 30 June 2015

2015 2014

GBP GBP

Revenue 2,129,958 1,981,375

Distribution costs - (31,439)

Administrative costs (1,890,242) (1,989,156)

Operating profit/(loss) 239,716 (39,220)

Finance income 3,944 3,655

-------------------------------------------- ------------------------------ ------------

Profit/(loss) before taxation 243,660 (35,565)

Taxation 109,378 100,251

Profit for the year after tax 353,038 64,686

-------------------------------------------- ------------------------------ ------------

Total comprehensive income for the year 353,038 64,686

-------------------------------------------- ------------------------------ ------------

Profit per share (basic) 0.023p 0.004p

-------------------------------------------- ------------------------------ ------------

Profit per share (diluted) 0.023p 0.004p

-------------------------------------------- ------------------------------ ------------

All of the results relate to continuing operations.

Statement of Changes in Equity

For the year ended 30 June 2015

Group:

Share Share Retained Total

capital premium Share option reserve earnings equity

GBP GBP GBP GBP GBP

Balance at 30 June 2013 1,531,315 9,428,169 253,234 (9,886,696) 1,326,022

Profit for the year - - - 64,686 64,686

Total comprehensive income for the year - - - 64,686 64,686

Issue of shares 5,357 2,143 - - 7,500

Share-based payments - - 18,677 - 18,677

Share-based payments reserve released - - (199,349) 199,349 -

Balance at 30 June 2014 1,536,672 9,430,312 72,562 (9,622,661) 1,416,885

Profit for the year - - - 353,038 353,038

Total comprehensive income for the year - - - 353,038 353,038

Share-based payments - - 20,199 - 20,199

Balance at 30 June 2015 1,536,672 9,430,312 92,761 (9,269,623) 1,790,122

------------------------------------------ ---------- ---------- --------------------- ------------ ----------

Company:

Share Share Retained Total

capital premium Share option reserve earnings equity

GBP GBP GBP GBP GBP

Balance at 30 June 2013 1,531,315 9,428,169 253,234 (7,755,508) 3,457,210

Profit for the year - - - 23,186 23,186

----------------------------------- ---------- ---------- --------------------- ------------ ----------

Total comprehensive income for

the year - - - 23,186 23,186

Issue of shares 5,357 2,143 - - 7,500

Share-based payments - - 18,677 - 18,677

Share-based payments reserve

released - - (199,349) 53,091 (146,258)

Balance at 30 June 2014 1,536,672 9,430,312 72,562 (7,679,231) 3,360,315

Loss for the year - - - (118,454) (118,454)

----------------------------------- ---------- ---------- --------------------- ------------ ----------

Total comprehensive expense for

the year - - - (118,454) (118,454)

Share-based payments - - 20,199 - 20,199

Balance as at 30 June 2015 1,536,672 9,430,312 92,761 (7,787,685) 3,262,060

----------------------------------- ---------- ---------- --------------------- ------------ ----------

Balance Sheets

As at 30 June 2015

Group Group Company Company

2015 2014 2015 2014

GBP GBP GBP GBP

Non-current assets

Goodwill 1,715,153 1,715,153 - -

Property, plant

and equipment 41,605 19,112 - -

Investments in

subsidiaries - - 2,017,373 2,017,373

Trade and other

receivables 141,750 - - -

Total non-current

assets 1,898,508 1,734,265 2,017,373 2,017,373

---------------------------------- ------------ ------------ ------------ ------------

Current assets

Trade and other

receivables 478,402 361,016 806,382 1,510,725

Cash and cash equivalents 1,069,755 733,676 649,907 37,854

---------------------------------- ------------ ------------ ------------ ------------

Total current assets 1,548,157 1,094,692 1,456,289 1,548,579

---------------------------------- ------------ ------------ ------------ ------------

Current liabilities

Trade and other

payables (1,656,543) (1,412,072) (211,602) (205,637)

---------------------------------- ------------ ------------ ------------ ------------

Total current liabilities (1,656,543) (1,412,072) (211,602) (205,637)

---------------------------------- ------------ ------------ ------------ ------------

Net current (liabilities)/assets (108,386) (317,380) 1,244,687 1,342,942

---------------------------------- ------------ ------------ ------------ ------------

Net assets 1,790,122 1,416,885 3,262,060 3,360,315

---------------------------------- ------------ ------------ ------------ ------------

Equity

Called up share

capital 1,536,672 1,536,672 1,536,672 1,536,672

Share premium account 9,430,312 9,430,312 9,430,312 9,430,312

Share option reserve 92,761 72,562 92,761 72,562

Retained earnings (9,269,623) (9,622,661) (7,797,685) (7,679,231)

---------------------------------- ------------ ------------ ------------ ------------

1,790,122 1,416,885 3,262,060 3,360,315

---------------------------------- ------------ ------------ ------------ ------------

Group Cash Flow Statement

For the year ended 30 June 2015

2015 2014

GBP GBP

Net cash generated from/(used in) operating activities 369,982 (151,013)

-------------------------------------------------------- ---------- ----------

Investing activities

Interest received 3,944 3,655

Purchases of plant and equipment (38,014) (5,270)

Sales of plant and equipment 167 -

Net cash invested in investing activities (33,903) (1,615)

-------------------------------------------------------- ---------- ----------

Financing activities

Issue of shares - 7,500

-------------------------------------------------------- ---------- ----------

Net cash generated from financing activities - 7,500

-------------------------------------------------------- ---------- ----------

Net increase/(decrease) in cash and cash equivalents 336,079 (145,128)

Cash and cash equivalents at beginning of year 733,676 878,804

-------------------------------------------------------- ---------- ----------

Cash and cash equivalents at end of year 1,069,755 733,676

-------------------------------------------------------- ---------- ----------

Company Cash Flow Statement

For the year ended 30 June 2015

2015 2014

GBP GBP

Net cash generated from/(used

in) operating activities 609,347 (24,652)

------------------------------------ -------- ---------

Investing activities

Interest received 2,706 189

------------------------------------ -------- ---------

Net cash generated from investing

activities 2,706 7,689

------------------------------------ -------- ---------

Financing activities

Issue of shares - 7,500

------------------------------------ -------- ---------

Net cash generated from financing

activities - 7,500

------------------------------------ -------- ---------

Net increase/(decrease) in

cash and cash equivalents 612,053 (16,963)

Cash and cash equivalents at

beginning of year 37,854 54,817

------------------------------------ -------- ---------

Cash and cash equivalents at

end of year 649,907 37,854

------------------------------------ -------- ---------

Notes to the Financial Statements

For the year ended 30 June 2015

1. Accounting policies

The principal accounting policies are summarised below. They

have all been applied consistently throughout the period covered by

these financial statements.

Reporting entity

Arcontech Group PLC ("the Company") is a company incorporated in

the United Kingdom. The consolidated financial statements

incorporate the financial statements of the Company and its

subsidiaries (together referred to as "the Group").

Basis of preparation

These financial statements have been prepared in accordance with

International Financial Reporting Standards ("IFRS") endorsed by

the European Union and with those parts of the Companies Act 2006

applicable to companies reporting under IFRS.

On the basis of current projections, confidence of future

profitability and cash balances held, the Directors have adopted

the going concern basis in the preparation of the financial

statements.

The financial statements have been prepared under the historical

cost convention.

Accounting standards and interpretations adopted during the

period

IFRS 10: Revision to accounting for groups to provide additional

guidance on when and how to consolidate group interests and related

disclosures and IFRS 12: Disclosure of interests in other entities

were adopted in the year but have only had a presentation and

disclosure impact on these financial statements.

Other than this, there have only been minor improvements to

existing International Financial Reporting Standards and

interpretations that are effective for the first time in the

current financial year that have been adopted by the Group. These

have had no impact on its consolidated results or financial

position.

Standards, amendments and interpretations that are expected to

be effective for periods beginning on or after 1 July 2015 for

standards, amendments subject to EU endorsement:

Standards, interpretations and amendments to existing standards

that have been published, and are mandatory to accounting periods

beginning on or after 1 July 2015 or later periods and that have

not been early adopted by the Group or the Company include the

following:

Effective EU adopted

date (periods

beginning

on or after)

-------------------- --------------- -----------

IFRS 9 Financial 1 January No

Instruments 2018

-------------------- --------------- -----------

IFRS 15 Revenue 1 January No

from Contracts 2018

with Customers

-------------------- --------------- -----------

Annual Improvements 1 January No

to IFRSs 2012-2014 2016

Cycle

-------------------- --------------- -----------

A number of other interpretations and amendments to existing

standards have been made by the IASB and IFRIC but are not

considered relevant to the Group's operations.

The directors are considering the impact of the above new

standards and amendments on the reported results of the Group and

Company.

Basis of consolidation

The Group financial statements incorporate the financial

statements of the Company and entities controlled by the Company

(its subsidiaries) prepared to 30 June 2015. Control is achieved

where the Company has the power to govern the financial and

operating policies of an investee entity so as to obtain benefits

from its activities.

The results of subsidiaries acquired or disposed of during the

year are included in the consolidated income statement from the

effective date of acquisition or up to the effective date of

disposal, as appropriate.

Where necessary, adjustments are made to the financial

statements of subsidiaries to bring the accounting policies used

into line with those used by the Group.

All intra-group transactions, balances, income and expenses are

eliminated on consolidation.

Business combinations and goodwill

On acquisition, the assets and liabilities and contingent

liabilities of subsidiaries are measured at their fair value at the

date of acquisition. Any excess of cost of acquisition over the

fair values of the identifiable net assets acquired is recognised

as goodwill. Any deficiency of the cost of acquisition below the

fair values of the identifiable net assets acquired (i.e. discount

on acquisition) is credited to the income statement in the period

of acquisition. Goodwill arising on consolidation is recognised as

an asset and reviewed for impairment at least annually. Any

impairment is recognised immediately in the income statement and is

not subsequently reversed.

Revenue recognition

Revenue is measured at the fair value of the consideration

received or receivable and represents amounts receivable for

services provided in the normal course of business, net of

discounts, VAT and other sales related taxes.

Revenue arising from the provision of services is recognised

when and to the extent that the Group obtains the right to

consideration in exchange for the performance of its contractual

obligations as follows:

Software development and licence fee income - recognised evenly

over the contracted licence period.

Taxation

The tax charge/(credit) represents the sum of the tax

payable/(receivable) and any deferred tax.

The tax payable/(receivable) is based on the taxable result for

the year. The taxable result differs from the net result as

reported in the income statement because it excludes items of

income or expense that are taxable or deductible in other years and

it further excludes items that are never taxable or deductible. The

Company's liability for current tax is calculated using tax rates

that have been enacted or substantially enacted by the balance

sheet date.

Deferred tax is the tax expected to be payable or recoverable on

differences between the carrying amounts of assets and liabilities

in the financial statements and the corresponding tax bases used in

the computation of taxable profit, and is accounted for using the

balance sheet liability method. Deferred tax liabilities are

generally recognised for all taxable temporary differences and

deferred tax assets are recognised to the extent that it is

probable that taxable profits will be available against which

deductible temporary differences can be utilised. Such assets and

liabilities are not recognised if the temporary difference arises

from goodwill or from the initial recognition (other than in a

business combination) of other assets and liabilities in a

transaction that affects neither the taxable profit nor the

accounting profit.

Deferred tax liabilities are recognised for taxable temporary

differences arising on investments in subsidiaries, except where

the Group is able to control the reversal of the temporary

difference and it is probable that the temporary difference will

not reverse in the foreseeable future.

The carrying amount of deferred tax assets is reviewed at each

balance sheet date and reduced to the extent that it is no longer

probable that sufficient taxable profits will be available to allow

all or part of the asset to be recovered.

Deferred tax is calculated at the tax rates that are expected to

apply in the period when the liability is settled or the asset

realised. Deferred tax is charged or credited to the income

statement, except when it relates to items charged or credited

directly to equity, in which case the deferred tax is also dealt

with in equity.

Deferred tax assets and liabilities are offset when there is a

legally enforceable right to set off current tax assets against

current tax liabilities and when they relate to income taxes levied

by the same taxation authority and the Group intends to settle its

current assets and liabilities on a net basis.

Share-based payments

The cost of share-based employee compensation arrangements,

whereby employees receive remuneration in the form of shares or

share options, is recognised as an employee benefit expense in the

income statement.

The total expense to be apportioned over the vesting period of

the benefit is determined by reference to the fair value (excluding

the effect of non market-based vesting conditions) at the date of

grant. Fair value is measured by the use of the Black-Scholes

model. The expected life used in the model has been adjusted, based

on management's best estimate, for the effects of the

non-transferability, exercise restrictions and behavioural

considerations. A cancellation of a share award by the Group or an

employee is treated consistently, resulting in an acceleration of

the remaining charge within the consolidated income statement in

the year of cancellation.

Impairment of tangible and intangible assets

The carrying amounts of the Group's and Company's tangible and

intangible assets are reviewed at each year end date to determine

whether there is any indication of impairment. If any such

indication exists, the asset's recoverable amount is estimated.

For goodwill the recoverable amount is estimated at each year

end date, based on value in use. The recoverable amount of other

assets is the greater of their net selling price and value in

use.

In assessing value in use, the estimated future cash flows are

discounted to their present value using a pre-tax discount rate

that reflects current market assessments of the time value of money

and the risks specific to the asset.

For an asset that does not generate largely independent cash

inflows, the recoverable amount is determined for the cash

generating unit to which the asset belongs.

An impairment loss is recognised in the income statement

whenever the carrying amount of an asset or its cash-generating

unit exceeds its recoverable amount. Impairment losses recognised

in respect of cash-generating units are allocated first to reduce

the carrying amount of any goodwill allocated to cash-generating

units and then to reduce the carrying amount of the other assets in

the unit on a pro rata basis.

A cash generating unit is the smallest identifiable group of

assets that generates cash inflows that are largely independent of

the cash inflows from other assets or groups of assets.

Property, plant and equipment

Property, plant and equipment are stated at cost less

accumulated depreciation and any recognised impairment loss.

Depreciation is charged so as to write off the cost of assets,

over their estimated useful lives, on the following bases:

Leasehold property - over the period of the lease

Computer equipment - 33% - 40% on cost

- 20% - 25% on cost or reducing

Office furniture and equipment balance

Investments in subsidiaries

Investments in subsidiaries are stated at cost less any

provision for impairment.

Financial instruments

Financial assets and financial liabilities are recognised on the

balance sheet when the Group becomes a party to the contractual

provisions of the instrument.

Financial liabilities and equity instruments issued by the Group

are classified in accordance with the substance of the contractual

arrangements entered into and the definitions of a financial

liability and an equity instrument.

An equity instrument is any contract that evidences a residual

interest in the assets of the Group after deducting all of its

liabilities. Equity instruments issued by the Company are recorded

at the proceeds received, net of direct issue costs.

Trade and other receivables

Trade and other receivables are measured at initial recognition

at fair value, and are subsequently measured at amortised cost

using the effective interest method. A provision is established

when there is objective evidence that the Group will not be able to

collect all amounts due. The movement on any provision is

recognised in the income statement.

Trade and other payables

Trade and other payables are initially measured at fair value,

and are subsequently measured at amortised cost, using the

effective interest rate method.

Cash and cash equivalents

Cash and cash equivalents comprise cash held by the Group and

short-term bank deposits with an original maturity of three months

or less.

Leasing commitments

Rentals payable under operating leases are charged to income on

a straight-line basis over the term of the relevant lease.

Research and development

Research costs are charged to the income statement in the year

incurred. Development expenditure is capitalised to the extent that

it meets all of the criteria required by IAS 38, otherwise it is

charged to the income statement in the year incurred.

Pension costs and other post-retirement benefits

The Group makes payments to employees' personal pension schemes.

Contributions payable for the year are charged in the income

statement.

Foreign currencies

Transactions denominated in foreign currencies are translated

into sterling at the exchange rate ruling when the transaction was

entered into. Foreign currency monetary assets and liabilities are

translated into sterling at the exchange rate ruling at the balance

sheet date. Exchange gains or losses are included in operating

profit.

Segment reporting

Operating segments are reported in a manner consistent with the

internal reporting provided to the chief

operating decision-maker as required by IFRS 8 "Operating Segments". The chief operating decision-maker responsible for allocating resources and assessing performance of the operating segments has been identified as the Board of Directors. The accounting policies of the reportable segments are consistent with the accounting policies of the group as a whole. Segment profit/(loss) represents the profit/(loss) earned by each segment without allocation of foreign exchange gains or losses, gains or losses on the disposal of available-for sale investments, investment income, interest payable and tax. This is the measure of profit that is reported to the Board of Directors for the purpose of resource allocation and the assessment of segment performance. When assessing segment performance and considering the allocation of resources, the Board of Directors review information about segment assets and liabilities. For this purpose, all assets and liabilities are allocated to reportable segments with the exception of cash and cash equivalents, available-for-sale financial assets and current and deferred tax assets and liabilities.

2. Revenue

An analysis of the Group's revenue is as follows:

2015 2014

GBP GBP

Software development and licence fees 2,129,958 1,981,375

---------------------------------------- ---------- ----------

All of the Group's revenue relates to continuing activities.

3. Operating profit/(loss) for the year is stated after charging:

2015 2014

GBP GBP

Depreciation of plant and equipment 8,682 10,736

Loss on disposal of fixed assets 6,673 465

Staff costs (see note 7) 1,352,295 1,476,944

Operating lease rentals - land and buildings (see note 21) 88,789 79,000

Research and development 592,185 736,867

------------------------------------------------------------- ---------- ----------

4. Profit per share

2015 2014

GBP GBP

Earnings

Earnings for the purpose of basic and diluted earnings per share being net profit

attributable

to equity shareholders 353,038 64,686

353,038 64,686

-------------------------------------------------------------------------------------------- -------- -------

No. No.

Number of shares

Weighted average number of ordinary shares for the purpose of basic earnings per

share 1,536,672,013 1,531,505,672

Number of dilutive shares under option 15,602,384 13,314,419

---------------------------------------------------------------------------------- -------------- --------------

Weighted average number of ordinary shares for the purposes of dilutive earnings

per share 1,552,274,847 1,544,820,092

---------------------------------------------------------------------------------- -------------- --------------

The calculation of diluted earnings per share assumes conversion

of all potentially dilutive ordinary shares, all of which arise

from share options. A calculation is done to determine the number

of shares that could have been acquired at fair value, based upon

the monetary value of the subscription rights attached to

outstanding share options.

5. Dividends

There were no dividends paid or proposed during the period

(2014: GBPNil).

6. Annual General Meeting

The Annual general meeting of Arcontech Group PLC will be held

at the Company's offices, 1st Floor, 11-21 Paul Street, London EC2A

4JU on 29 September 2015 at 10 a.m.

7. Annual report and accounts

Copies of the annual report and accounts will be sent to

shareholders shortly and will be available from the Company

Secretary at the Company's registered office at 1st Floor, 11-21

Paul Street, London, EC2A 4JU or from the Company's website at

www.arcontech.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR PKQDDBBKBKFK

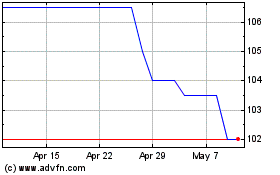

Arcontech (LSE:ARC)

Historical Stock Chart

From Aug 2024 to Sep 2024

Arcontech (LSE:ARC)

Historical Stock Chart

From Sep 2023 to Sep 2024