American Tower Corporation (NYSE: AMT) today reported financial

results for the quarter ended September 30, 2011.

Jim Taiclet, American Tower’s Chief Executive Officer stated,

“Our company strives to be world class in two core competencies:

operating communications real estate assets to maximize growth and

efficiency and evaluating and successfully acquiring, constructing,

and integrating these types of assets on a global basis. Our third

quarter results again demonstrate our competitive advantage in both

of these areas. We delivered over 9% core organic leasing growth on

both of our domestic and international assets while adding 15%

growth due to the more than 12,000 sites we have added in nine

countries on four continents.

To further enhance our value to investors, we are preparing for

the final steps in our plan to reorganize the company to qualify as

a real estate investment trust (REIT) for U.S. federal income tax

purposes. Between now and year end, we plan to hold our special

meeting of stockholders to approve the reorganization, complete the

distribution of our accumulated earnings and profits, continue our

communications outreach to REIT investors, and prepare to introduce

a quarterly dividend to begin in early 2012.”

THIRD QUARTER 2011 OPERATING RESULTS OVERVIEW

American Tower generated the following operating results for the

quarter ended September 30, 2011 (unless otherwise indicated, all

comparative information is presented against the quarter ended

September 30, 2010).

Total revenue increased 22.8% to $630.4 million and total rental

and management revenue increased 23.0% to $614.8 million. Total

rental and management Gross Margin increased 18.3% to $458.9

million. Adjusted EBITDA increased 14.5% to $400.6 million, and the

Adjusted EBITDA Margin was 64%.

Total rental and management revenue Core Growth was 24.2%, which

excludes the positive impact of approximately 1.1% due to foreign

currency exchange rate fluctuations and the negative impact of

approximately 2.3% due to straight-line revenue recognition.

Core Growth in Adjusted EBITDA was 16.5%, which excludes the

positive impact of approximately 0.9% due to foreign currency

exchange rate fluctuations and the negative impact of approximately

3.0% due to straight-line revenue and expense recognition.

Operating income increased 7.0% to $228.3 million. Net loss

attributable to American Tower Corporation was $15.7 million, and

net loss attributable to American Tower Corporation per basic and

diluted common share were both $0.04. Net loss attributable to

American Tower Corporation was negatively impacted as a result of

unrealized non-cash losses of $145.1 million associated with

fluctuations in foreign currency exchange rates related to the

Company's intercompany loans and similar unaffiliated balances.

Recurring Free Cash Flow increased 5.1% to $240.4 million and

Recurring Free Cash Flow per Share increased 7.0% to $0.61.

The Company is introducing the following metrics, which are

widely recognized by REIT investors: Funds From Operations and

Adjusted Funds From Operations. These measures have been provided

on a pro forma basis as if the REIT conversion had occurred on

January 1, 2010. During the quarter, pro forma Funds From

Operations would have been $112.5 million and pro forma Adjusted

Funds From Operations would have been $262.0 million.

Cash provided by operating activities increased 12.6% to $290.7

million.

Segment Results

Domestic Rental and Management Segment – Domestic rental and

management segment revenue increased 9.1% to $436.8 million, which

represented 69% of total revenues. In addition, domestic rental and

management segment Gross Margin increased 8.8% to $345.7 million,

while domestic rental and management segment Operating Profit

increased 7.1% to $325.2 million.

International Rental and Management Segment – International

rental and management segment revenue increased 78.9% to $178.0

million, which represented 28% of total revenues. In addition,

international rental and management segment Gross Margin increased

61.4% to $113.2 million, while international rental and management

segment Operating Profit increased 60.2% to $91.5 million.

Network Development Services Segment – Network development

services segment revenue was $15.6 million, which represented 3% of

total revenues. Network development services segment Gross Margin

was $7.8 million, and network development services segment

Operating Profit was $5.9 million.

YEAR TO DATE 2011 OPERATING RESULTS OVERVIEW

American Tower generated the following operating results for the

nine months ended September 30, 2011 (unless otherwise indicated,

all comparative information is presented against the nine months

ended September 30, 2010).

Total revenue increased 24.5% to $1,790.3 million and total

rental and management revenue increased 24.7% to $1,745.3 million.

Total rental and management Gross Margin increased 21.6% to

$1,324.3 million. Adjusted EBITDA increased 18.8% to $1,166.8

million, and the Adjusted EBITDA Margin was 65%.

Operating income increased 15.7% to $672.4 million. Net income

attributable to American Tower Corporation was $191.4 million and

net income attributable to American Tower Corporation per basic and

diluted common share were $0.48. As previously noted, net income

attributable to American Tower Corporation was negatively impacted

as a result of unrealized non-cash losses of $101.5 million

associated with fluctuations in foreign currency exchange rates

related to the Company's intercompany loans and similar

unaffiliated balances.

Recurring Free Cash Flow increased 6.2% to $733.4 million and

Recurring Free Cash Flow per Share increased 7.6% to $1.83.

Pro forma Funds From Operations would have been $665.8 million

and pro forma Adjusted Funds From Operations would have been $789.2

million.

Cash provided by operating activities increased 9.7% to $850.0

million.

Segment Results

Domestic Rental and Management Segment – Domestic rental and

management segment revenue increased 11.7% to $1,279.3 million,

which represented 71% of total revenues. In addition, domestic

rental and management segment Gross Margin increased 12.5% to

$1,017.5 million, while domestic rental and management segment

Operating Profit increased 11.4% to $960.9 million.

International Rental and Management Segment – International

rental and management segment revenue increased 82.6% to $466.0

million, which represented 26% of total revenues. In addition,

international rental and management segment Gross Margin increased

66.2% to $306.8 million, while international rental and management

segment Operating Profit increased 61.2% to $246.2 million.

Network Development Services Segment – Network development

services segment revenue was $45.0 million, which represented 3% of

total revenues. Network development services segment Gross Margin

was $23.1 million, and network development services segment

Operating Profit was $17.9 million.

Please refer to Non-GAAP and Defined Financial Measures on page

6 for definitions of Gross Margin, Operating Profit, Adjusted

EBITDA, Adjusted EBITDA Margin, Recurring Free Cash Flow, Recurring

Free Cash Flow per Share, Funds From Operations, Adjusted Funds

From Operations and Core Growth. For additional financial

information, including reconciliations to GAAP measures, please

refer to the supplemental schedules of selected financial

information on pages 12 through 17.

THIRD QUARTER 2011 INVESTING OVERVIEW

Cash Paid for Capital Expenditures – During the third quarter of

2011, total capital expenditures of $160.5 million included $89.9

million for capital projects, including spending to complete the

construction of 57 communications sites domestically, 625

communications sites internationally, and the installation of

shared generators; $31.7 million to purchase land under our towers;

$14.4 million for the redevelopment of existing communications

sites to accommodate new customer equipment; and $24.5 million for

capital improvements and corporate capital expenditures.

Cash Paid for Acquisitions – During the third quarter of 2011,

total payments for acquisitions were approximately $328.0 million,

which included the purchase of 56 communications sites domestically

and 1,164 communications sites internationally.

Stock Repurchase Programs – During the third quarter of 2011,

the Company repurchased a total of 3.2 million shares of its Class

A common stock for approximately $168.4 million pursuant to its

previously announced stock repurchase programs. Between October 1,

2011 and October 21, 2011, the Company repurchased an additional

0.5 million shares of its Class A common stock for an aggregate of

$26.5 million.

Subsequent Event - Subsequent to the end of the third quarter,

the Company entered into a transaction to purchase property

interests under certain of its existing communications sites in the

United States for a total consideration of up to $86.0 million,

subject to customary closing conditions. The purchase of the

property interests is in accordance with its current land purchase

program.

YEAR TO DATE 2011 INVESTING OVERVIEW

Cash Paid for Capital Expenditures – During the nine months

ended September 30, 2011, total capital expenditures of $397.1

million included $221.9 million for capital projects, including

spending to complete the construction of 204 communications sites

domestically, 946 communications sites internationally, and the

installation of shared generators; $80.3 million to purchase land

under our towers; $37.3 million for the redevelopment of existing

communications sites to accommodate new customer equipment; and

$57.6 million for capital improvements and corporate capital

expenditures.

Cash Paid for Acquisitions – During the nine months ended

September 30, 2011, total payments for acquisitions were

approximately $1,220.6 million, which included the purchase of 135

communications sites domestically and 3,614 communications sites

internationally.

Stock Repurchase Programs – During the nine months ended

September 30, 2011, the Company repurchased a total of 7.6 million

shares of its Class A common stock for approximately $393.1 million

pursuant to its previously announced stock repurchase programs.

INVESTMENT UPDATE

On September 3, 2011, the Company entered into an agreement to

acquire interests in companies holding a portfolio of property

interests under approximately 1,800 communications sites in the

United States. The acquisition includes property interests under

the Company’s existing communications sites in accordance with its

current land purchase program, as well as property interests under

carrier customer and other third-party communications sites

providing complementary leasing and recurring cash flow. The

acquisition closed on October 14, 2011 for an aggregate purchase

price of approximately $500.0 million, which included the

assumption of approximately $200.0 million of existing

indebtedness.

The Company has the following pending acquisitions:

- Approximately 700 additional towers in

connection with the Company’s joint venture in Ghana, which are

expected to close by year end, subject to customary closing

conditions;

- Approximately 1,000 towers in

connection with the Company’s joint venture in Colombia, which are

expected to close by year end, with the balance of approximately

1,100 towers expected to close throughout 2012, subject to

customary closing conditions; and

- Approximately 80 existing towers from

the South Africa transaction, which are expected to close in

December 2011, and up to approximately 1,800 additional towers that

may be constructed over the next two years, subject to customary

closing conditions.

REAL ESTATE INVESTMENT TRUST UPDATE

The Company continues to be on track to elect REIT status for

the taxable year beginning January 1, 2012. On September 22, 2011,

the Company announced that its registration statement, which

outlines its plan to merge into American Tower REIT, Inc., was

declared effective by the Securities and Exchange Commission. The

Company also announced that it will hold a special meeting of

stockholders on November 29, 2011 to vote on the proposed merger.

Stockholders of record as of October 3, 2011 will be entitled to

vote at the special meeting.

The Company continues to focus its REIT readiness efforts on two

remaining work streams. First, the Company continues to make

progress with respect to finalizing the amount of its earnings and

profits (E&P), and continues to anticipate it will distribute

up to $200 million to stockholders using cash on hand during the

fourth quarter of 2011. Second, the Company continues to make

substantial progress on its operational readiness initiatives,

which include finalizing systems and process changes by year end.

The determination to elect REIT status is subject to final approval

by the Company’s Board of Directors. There is no certainty as to

the timing of a REIT election or whether the Company will make a

REIT election at all.

FULL YEAR 2011 OUTLOOK

The following estimates are based on a number of assumptions

that management believes to be reasonable and reflect the Company’s

expectations as of November 1, 2011. These estimates include the

impact of the Company’s recent land acquisitions, the construction

of 450 to 650 sites in the fourth quarter and a new master lease

agreement with one of the Company's major U.S. customers. Actual

results may differ materially from these estimates as a result of

various factors, and the Company refers you to the cautionary

language regarding “forward-looking” statements included in this

press release when considering this information.

($ in millions) (1) Full Year 2011

Total rental and management revenue (2) $2,360 to

$2,390 Adjusted EBITDA (3) 1,580 to 1,600 Income from continuing

operations 300 to 340 Cash provided by operating activities 1,110

to 1,130 Payments for purchase of property and equipment and

construction activities (4) 475 to 525

Total rental and management revenue growth is expected to be

approximately 22.7% based on the midpoint, and total rental and

management revenue Core Growth, which excludes the effect of

non-cash straight-line revenue recognition, fluctuations in foreign

currency exchange rates and material one-time items, is expected to

be approximately 21.8%, based on the midpoint.

Adjusted EBITDA growth is expected to be approximately 18.0%

based on the midpoint, and Adjusted EBITDA Core Growth, which

excludes the effect of non-cash straight-line revenue and expense

recognition, fluctuations in foreign currency exchange rates and

material one-time items, is expected to be approximately 16.0%,

based on the midpoint.

___

(1) The Company’s outlook is based on the following average

foreign currency exchange rates to 1.0 U.S. Dollar for the fourth

quarter 2011: (a) 1.75 Brazilian Reais; (b) 500.00 Chilean Pesos;

(c) 1,850.00 Colombian Pesos; (d) 1.60 Ghanaian Cedi; (e) 48.50

Indian Rupees; (f) 13.0 Mexican Pesos; (g) 2.70 Peruvian Soles; and

(h) 7.80 South African Rand. (2) Outlook includes an

estimated increase in non-cash straight-line revenue of

approximately $35 million and an increase in non-cash straight-line

expense of approximately $9 million in 2011 from the full year

2010. (For additional information on straight-line accounting,

please reference the information contained in the section entitled

“Revenue Recognition” of note 1, “Business and Summary of

Significant Accounting Policies” within the notes to the

consolidated financial statements of the Company’s Annual Report on

Form 10-K for the year ended December 31, 2010.) (3) See

Non-GAAP and Defined Financial Measures below. (4) Outlook

for capital expenditures reflects (a) $70 million to $80 million of

spending on capital improvements and corporate capital

expenditures; (b) $55 million for the redevelopment of existing

communications sites; (c) $110 million for ground lease purchases;

and (d) $240 million to $280 million for other discretionary

capital projects including the construction of approximately 1,600

to 1,800 new communications sites.

Conference Call Information

American Tower will host a conference call today at 8:00 a.m. ET

to discuss its financial results for the third quarter ended

September 30, 2011 and its outlook for the remainder of 2011.

Supplemental materials for the call will be available on the

Company’s website, www.americantower.com. The conference call

dial-in numbers are as follows:

U.S./Canada dial-in: (866) 740-9153 International dial-in: (706)

645-9644 Passcode: 18528941

When available, a replay of the call can be accessed until 11:59

p.m. ET on November 15, 2011. The replay dial-in numbers are as

follows:

U.S./Canada dial-in: (855) 859-2056 International dial-in: (404)

537-3406 Passcode: 18528941

American Tower will also sponsor a live simulcast and replay of

the call on its website, www.americantower.com.

About American Tower

American Tower is a leading independent owner, operator and

developer of broadcast and wireless communications sites. American

Tower currently owns and operates approximately 40,000

communications sites in the United States, Brazil, Chile, Colombia,

Ghana, India, Mexico, Peru and South Africa. For more information

about American Tower, please visit www.americantower.com.

Non-GAAP and Defined Financial Measures

In addition to the results prepared in accordance with generally

accepted accounting principles in the United States (GAAP) provided

throughout this press release, the Company has presented the

following non-GAAP and defined financial measures: Gross Margin,

Operating Profit, Adjusted EBITDA, Adjusted EBITDA Margin,

Recurring Free Cash Flow, Recurring Free Cash Flow per Share, Funds

From Operations, Adjusted Funds From Operations and Core Growth.

The Company defines Gross Margin as revenues less operating

expenses, excluding stock-based compensation expense. The Company

defines Operating Profit as Gross Margin less selling, general,

administrative and development expense, excluding stock-based

compensation expense and corporate expenses. For reporting

purposes, the international rental and management segment Operating

Profit and Gross Margin also include interest income, TV Azteca,

net. These measures of Gross Margin and Operating Profit are also

before interest income, interest expense, loss on retirement of

long-term obligations, other income (expense), net income

attributable to non-controlling interest, income (loss) on equity

method investments, income taxes and discontinued operations. The

Company defines Adjusted EBITDA as net income before income (loss)

from discontinued operations, net, income from equity method

investments, income tax provision (benefit), other income

(expense), loss on retirement of long-term obligations, interest

expense, interest income, other operating expenses, depreciation,

amortization and accretion, and stock-based compensation expense.

The Company defines Adjusted EBITDA Margin as the percentage that

results from dividing Adjusted EBITDA by total revenue. The Company

defines Recurring Free Cash Flow as Adjusted EBITDA before

straight-line revenue and expense, plus interest income, less

interest expense, cash paid for income taxes and cash payments

related to redevelopment, capital improvement and corporate capital

expenditures. The Company defines Recurring Free Cash Flow per

Share as Recurring Free Cash Flow divided by the diluted weighted

average common shares outstanding. The Company defines Funds From

Operations as net income before real estate related depreciation,

amortization and accretion. The Company defines Adjusted Funds From

Operations as Funds From Operations before straight-line (revenue)

expense, stock-based compensation expense, non-real estate related

depreciation, amortization and accretion, amortization of deferred

financing costs, debt discounts and capitalized interest, other

(income) expense, loss on retirement of long-term obligations,

other operating expense, less capital improvement capital

expenditures, and corporate capital expenditures. The Company

defines Core Growth in total rental and management revenue and

Adjusted EBITDA as the increase or decrease, expressed as a

percentage, resulting from a comparison of financial results for a

current period with corresponding financial results for the

corresponding period in a prior year, in each case, excluding the

impact of straight-line revenue and expense recognition, foreign

currency exchange rate fluctuations, and material one-time items.

These measures are not intended to replace financial performance

measures determined in accordance with GAAP. Rather, they are

presented as additional information because management believes

they are useful indicators of the current financial performance of

the Company’s core businesses. The Company believes that these

measures can assist in comparing company performances on a

consistent basis irrespective of depreciation and amortization or

capital structure. Depreciation and amortization can vary

significantly among companies depending on accounting methods,

particularly where acquisitions or non-operating factors, including

historical cost bases, are involved. Notwithstanding the foregoing,

the Company’s measures of Gross Margin, Operating Profit, Adjusted

EBITDA, Adjusted EBITDA Margin, Recurring Free Cash Flow, Recurring

Free Cash Flow per Share, Funds From Operations, Adjusted Funds

From Operations, and Core Growth may not be comparable to similarly

titled measures used by other companies.

Cautionary Language Regarding Forward-Looking

Statements

This press release contains "forward-looking statements"

concerning our goals, beliefs, expectations, strategies,

objectives, plans, future operating results and underlying

assumptions, and other statements that are not necessarily based on

historical facts. Examples of these statements include, but are not

limited to statements regarding our full year 2011 outlook, our

pending acquisitions, including anticipated closing dates and

expected purchase prices, foreign currency exchange rates, our

expected election of real estate investment trust status and

related preparation, the timing and effect of that election, the

form, timing, and amount of the special E&P distribution and

our expectation regarding the declaration of quarterly

distributions. Actual results may differ materially from those

indicated in our forward-looking statements as a result of various

important factors, including: (1) decrease in demand for our

communications sites would materially and adversely affect our

operating results and we cannot control that demand; (2) if our

tenants consolidate or merge with each other to a significant

degree, our growth, revenue and ability to generate positive cash

flows could be materially and adversely affected; (3) new

technologies or changes in a tenant’s business model could make our

tower leasing business less desirable and result in decreasing

revenues; (4) our expansion initiatives may disrupt our operations

or expose us to additional risk if we are not able to successfully

integrate operations, assets and personnel; (5) we could suffer

adverse tax and other financial consequences if taxing authorities

do not agree with our tax positions; (6) due to the long-term

expectations of revenue from tenant leases, we are sensitive to

changes in the creditworthiness and financial strength of our

tenants; (7) our foreign operations are subject to economic,

political and other risks that could materially and adversely

affect our revenues or financial position, including risks

associated with fluctuations in foreign currency exchange rates;

(8) we anticipate that we may need additional financing to fund

capital expenditures, to fund future growth and expansion

initiatives and to return capital to our stockholders; (9) a

substantial portion of our revenue is derived from a small number

of customers; (10) increasing competition in the tower industry may

create pricing pressures that may materially and adversely affect

us; (11) our business is subject to government regulations and

changes in current or future laws or regulations could restrict our

ability to operate our business as we currently do; (12) if we are

unable or choose not to exercise our rights to purchase towers that

are subject to lease and sublease agreements at the end of the

applicable period, our cash flows derived from such towers would be

eliminated; (13) if we are unable to protect our rights to the land

under our towers, it could adversely affect our business and

operating results; (14) our leverage and debt service obligations

may materially and adversely affect us; (15) restrictive covenants

in the loan agreements related to our Securitization, the loan

agreements for the credit facilities and the indentures governing

our debt securities could materially and adversely affect our

business by limiting flexibility; (16) we could have liability

under environmental laws; (17) our towers or data centers may be

affected by natural disasters and other unforeseen damage for which

our insurance may not provide adequate coverage; (18) our costs

could increase and our revenues could decrease due to perceived

health risks from radio emissions, especially if these perceived

risks are substantiated; (19) if we fail to qualify as a REIT or

fail to remain qualified as a REIT, we would be subject to tax at

corporate income tax rates and would not be able to deduct

distributions to stockholders when computing our taxable income;

(20) we may not realize the anticipated tax benefits from the REIT

conversion effective January 1, 2012 because the timing of the REIT

conversion is not certain; (21) as a REIT, failure to make required

distributions would subject us to federal corporate income tax;

(22) covenants specified in our existing and future debt

instruments may limit our ability to make required REIT

distributions; (23) our cash distributions may fluctuate; (24)

there are uncertainties relating to the estimate of our special

E&P distribution; (25) even if we qualify as a REIT, certain of

our business activities will be subject to corporate level income

tax and foreign taxes, which will continue to reduce our cash

flows, and we will have potential deferred and contingent tax

liabilities; (26) we may be required to borrow funds, sell assets

or raise equity to satisfy our REIT distribution requirements or

maintain the asset ownership tests; (27) complying with REIT

requirements may limit our flexibility or cause us to forego

otherwise attractive opportunities; (28) as a REIT, we will be

limited in our ability to fund distribution payments using cash

generated through our taxable REIT subsidiaries (TRSs); (29) our

planned extensive use of TRSs, in particular for our international

operations, may cause us to fail to qualify as a REIT; (30)

complying with REIT requirements may limit our ability to hedge

effectively and increase the cost of our hedging, and may cause us

to incur tax liabilities; (31) the current market price of our

Common Stock may not be indicative of the market price of American

Tower REIT common stock following the REIT conversion and the

special E&P distribution; (32) we have no experience operating

as a REIT, which may adversely affect our financial condition,

results of operations, cash flow, per share trading price of

American Tower REIT common stock and ability to satisfy debt

service obligations; and (33) legislative or other actions

affecting REITs could have a negative effect on us or our

stockholders. For additional information regarding factors that may

cause actual results to differ materially from those indicated in

our forward-looking statements, we refer you to the information

contained in Item 1A of our Form 10-Q for the six months ended June

30, 2011 and our Definitive Proxy Statement filed on October 11,

2011 under the caption "Risk Factors." We undertake no obligation

to update the information contained in this press release to

reflect subsequently occurring events or circumstances.

ADDITIONAL INFORMATION AND CAUTIONARY STATEMENT

This communication does not constitute an offer to sell or the

solicitation of an offer to buy securities or a solicitation of any

vote or approval. American Tower REIT, Inc. has filed with the

Securities and Exchange Commission (SEC) a registration statement

on Form S-4/A containing a proxy statement of American Tower

Corporation and a prospectus of American Tower REIT, Inc. with

respect to the proposed merger. The registration statement was

declared effective by the SEC on September 22, 2011. On October 11,

2011, notice of a special meeting and a definitive proxy

statement/prospectus were mailed to stockholders of American Tower

Corporation who held shares of Class A common stock of American

Tower Corporation on October 3, 2011. INVESTORS ARE URGED TO READ

THE FORM S-4/A AND PROXY STATEMENT (INCLUDING ALL AMENDMENTS AND

SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS THAT ARE

FILED WITH THE SEC BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION

ABOUT THE PROPOSED MERGER. You may obtain documents free of charge

at the website maintained by the SEC at www.sec.gov. In addition,

you may obtain documents filed with the SEC by American Tower

Corporation free of charge by contacting Corporate Secretary, 116

Huntington Avenue Boston, Massachusetts 02116.

American Tower, its directors and executive officers and certain

other members of management and employees may be deemed to be

participants in the solicitation of proxies from American Tower's

stockholders in connection with the merger. Information regarding

the persons who may, under the rules of the SEC, be considered

participants in the solicitation of proxies in connection with the

merger is included in the Form S-4/A and proxy statement.

Information about the directors and executive officers of American

Tower and their ownership of American Tower stock is set forth in

the proxy statement for American Tower's 2011 Annual Meeting of

Stockholders. Investors may obtain additional information regarding

the interests of such participants by reading the Form S-4/A and

proxy statement for the merger.

Investors should read the Form S-4/A and proxy statement

carefully before making any voting or investment decisions.

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS (In

thousands)

September 30, December

31, 2011

2010 (1)

ASSETS Current assets: Cash and cash equivalents $ 177,506 $

883,963 Restricted cash 50,221 75,972 Short-term investments and

available-for-sale securities 4,726 46,428 Accounts receivable, net

100,063 81,479 Prepaid and other current assets 228,590 145,599

Deferred income taxes 252,699 174,788

Total current assets 813,805 1,408,229

Property and equipment, net 4,125,887 3,685,105 Goodwill 2,673,631

2,514,539 Other intangible assets, net 2,208,387 1,880,466 Deferred

income taxes 177,423 93,300 Deferred rent asset 560,121 470,637

Notes receivable and other long-term assets 336,082

317,808 Total $ 10,895,336 $ 10,370,084

LIABILITIES: Current liabilities: Accounts payable

and accrued expenses $ 352,781 $ 289,809 Accrued interest 61,536

40,621 Current portion of long-term obligations 861,160 74,896

Unearned revenue 95,851 134,135 Total

current liabilities 1,371,328 539,461

Long-term obligations 4,970,502 5,512,492 Asset retirement

obligations 400,216 341,838 Other long-term liabilities

805,649 471,735 Total liabilities

7,547,695 6,865,526

STOCKHOLDERS'

EQUITY: Class A common stock 4,884 4,860 Additional paid-in

capital 8,665,807 8,577,093 Accumulated deficit (1,545,244 )

(1,736,596 ) Accumulated other comprehensive (loss) income (87,070

) 38,053 Treasury stock (3,775,087 ) (3,381,966 )

Total American Tower Corporation stockholders' equity 3,263,290

3,501,444 Noncontrolling interest 84,351 3,114

Total stockholders' equity 3,347,641

3,504,558 Total $ 10,895,336 $ 10,370,084

(1)

December 31, 2010 balances have been

revised to reflect purchase accounting measurement period

adjustments.

UNAUDITED CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS (In

thousands, except per share data)

Three Months Ended

Nine Months Ended September 30, September 30,

2011 2010

2011 2010 REVENUES: Rental and

management $ 614,808 $ 499,821 $ 1,745,302 $ 1,400,120 Network

development services 15,595 13,501

45,031 37,573 Total operating revenues

630,403 513,322 1,790,333

1,437,693 OPERATING EXPENSES: Costs of operations

(exclusive of items shown separately below) Rental and management

(including stock-based compensation expense of $853, $0, $853 and

$0, respectively) 160,265 115,390 432,454 321,587 Network

development services (including stock-based compensation expense of

$910, $0, $910 and $0, respectively) 8,668 7,583 22,884 20,054

Depreciation, amortization and accretion 142,113 115,383 411,902

336,621 Selling, general, administrative and development expense

(including stock-based compensation expense of $10,377, $13,353,

$34,422 and $40,146, respectively) 76,476 57,295 214,929 164,404

Other operating expenses 14,576 4,299

35,770 14,090 Total operating expenses

402,098 299,950 1,117,939

856,756 OPERATING INCOME 228,305

213,372 672,394 580,937 OTHER

(EXPENSE) INCOME: Interest income, TV Azteca, net 3,498 3,585

10,587 10,669 Interest income 1,822 1,954 6,837 3,150 Interest

expense (77,796 ) (62,904 ) (226,735 ) (177,395 ) Loss on

retirement of long-term obligations - - - (35 )

Other (expense) income (including

unrealized foreign currency (losses) gains of $(145,144),$8,933,

$(101,505) and $5,531, respectively)

(150,876 ) 8,236 (115,710 )

1,913 Total other expense (223,352 ) (49,129 )

(325,021 ) (161,698 ) INCOME FROM CONTINUING

OPERATIONS BEFORE INCOME TAXES AND INCOME ON EQUITY METHOD

INVESTMENTS 4,953 164,243 347,373 419,239 Income tax provision

(24,681 ) (70,649 ) (161,981 ) (129,390 ) Income on equity method

investments 2 6 14

24 (LOSS) INCOME FROM CONTINUING OPERATIONS (19,726 ) 93,600

185,406 289,873 Income from discontinued operations, net -

1 - 30 NET (LOSS)

INCOME (19,726 ) 93,601 185,406 289,903 Net loss (income)

attributable to noncontrolling interest 4,025

(162 ) 5,946 (481 ) NET(LOSS) INCOME

ATTRIBUTABLE TO AMERICAN TOWER CORPORATION $ (15,701 ) $ 93,439

$ 191,352 $ 289,422 NET (LOSS) INCOME

PER COMMON SHARE AMOUNTS: BASIC: (Loss) income from continuing

operations attributable to American Tower Corporation $ (0.04 ) $

0.23 $ 0.48 $ 0.72 Income from discontinued operations attributable

to American Tower Corporation - -

- - Net (loss) income

attributable to American Tower Corporation $ (0.04 ) $ 0.23

$ 0.48 $ 0.72 DILUTED: (Loss) income from continuing

operations attributable to American Tower Corporation $ (0.04 ) $

0.23 $ 0.48 $ 0.71 Income from discontinued operations attributable

to American Tower Corporation - -

- - Net (loss) income

attributable to American Tower Corporation $ (0.04 ) $ 0.23

$ 0.48 $ 0.71 WEIGHTED AVERAGE COMMON SHARES

OUTSTANDING: BASIC 395,183 400,602

396,507 401,887 DILUTED 395,183

403,455 400,467 405,053

UNAUDITED CONDENSED CONSOLIDATED STATEMENT OF CASH

FLOWS (In thousands)

Nine Months Ended

September 30, 2011

2010 CASH FLOWS FROM OPERATING ACTIVITIES: Net income

$ 185,406 $ 289,903 Stock-based compensation expense 36,185 40,146

Depreciation, amortization and accretion 411,902 336,621 Other

non-cash items reflected in statements of operations 287,286

144,674 Increase in net deferred rent asset (69,874 ) (49,404 )

Increase in restricted cash (825 ) (2,994 ) Increase in assets

(58,891 ) (56,555 ) Increase in liabilities 58,809

72,228 Cash provided by operating activities

849,998 774,619 CASH FLOWS FROM

INVESTING ACTIVITIES: Payments for purchase of property and

equipment and construction activities (397,088 ) (228,480 )

Payments for acquisitions (1,220,572 ) (584,270 ) Proceeds from

sale of short-term investments, available-for-sale securities and

other long-term assets 65,223 9,340 Payments for short-term

investments (20,412 ) (36,425 ) Deposits, restricted cash,

investments and other 13,218 (19,325 ) Cash

used for investing activities (1,559,631 ) (859,160 )

CASH FLOWS FROM FINANCING ACTIVITIES: Proceeds from

short-term borrowings 101,128 - Borrowings under credit facilities

280,014 457,153 Proceeds from issuance of senior notes - 699,160

Proceeds from other long-term borrowings 80,814 - Repayments of

notes payable, credit facilities and capital leases (207,120 )

(722,031 ) Purchases of Class A common stock (391,098 ) (350,452 )

Proceeds from stock options, warrants and stock purchase plan

60,926 122,342 Deferred financing costs and other financing

activities 79,601 (6,214 ) Cash provided by

financing activities 4,265 199,958

Net effect of changes in foreign currency exchange rates on

cash and cash equivalents (1,089 ) 9,168 NET

(DECREASE) INCREASE IN CASH AND CASH EQUIVALENTS (706,457 ) 124,585

CASH AND CASH EQUIVALENTS, BEGINNING OF PERIOD 883,963

247,293 CASH AND CASH EQUIVALENTS, END OF

PERIOD $ 177,506 $ 371,878 CASH PAID FOR

INCOME TAXES $ 48,808 $ 22,921 CASH PAID FOR INTEREST

$ 195,877 $ 144,239

UNAUDITED RESULTS FROM

OPERATIONS, BY SEGMENT (In thousands)

Three Months Ended, September 30, 2011

Rental and Management

NetworkDevelopmentServices

Total

Domestic International Total

Segment revenues $ 436,783 $ 178,025 $ 614,808 $ 15,595 $ 630,403

Segment operating expenses (1) 91,076 68,336 159,412 7,758 167,170

Interest income, TV Azteca, net - 3,498 3,498

- 3,498 Segment Gross Margin 345,707

113,187 458,894 7,837 466,731 Segment selling,

general, administrative and development expense 20,516

21,641 42,157 1,918 44,075 Segment

operating profit $ 325,191 $ 91,546 $ 416,737 $ 5,919 $ 422,656

Three Months Ended, September 30, 2010 Rental and

Management

NetworkDevelopmentServices

Total Domestic International Total

Segment revenues $ 400,319 $ 99,502 $ 499,821 $

13,501 $ 513,322 Segment operating expenses 82,449 32,941 115,390

7,583 122,973 Interest income, TV Azteca, net - 3,585

3,585 - 3,585 Segment Gross Margin

317,870 70,146 388,016 5,918 393,934

Segment selling, general, administrative and development expense

14,354 12,990 27,344 1,398

28,742 Segment operating profit $ 303,516 $ 57,156 $ 360,672 $

4,520 $ 365,192

Nine Months Ended, September 30, 2011

Rental and Management

NetworkDevelopmentServices

Total Domestic International Total

Segment revenues $ 1,279,315 $ 465,987 $ 1,745,302 $

45,031 $ 1,790,333 Segment operating expenses (1) 261,856 169,745

431,601 21,974 453,575 Interest income, TV Azteca, net -

10,587 10,587 - 10,587 Segment Gross

Margin 1,017,459 306,829 1,324,288

23,057 1,347,345 Segment selling, general, administrative

and development expense 56,528 60,619 117,147

5,130 122,277 Segment operating profit $ 960,931 $

246,210 $ 1,207,141 $ 17,927 $ 1,225,068

Nine Months

Ended, September 30, 2010 Rental and Management

NetworkDevelopmentServices

Total Domestic International Total

Segment revenues $ 1,144,970 $ 255,150 $ 1,400,120 $

37,573 $ 1,437,693 Segment operating expenses 240,427 81,160

321,587 20,054 341,641 Interest income, TV Azteca, net -

10,669 10,669 - 10,669 Segment Gross

Margin 904,543 184,659 1,089,202 17,519

1,106,721 Segment selling, general, administrative and

development expense 41,920 31,941 73,861

4,507 78,368 Segment operating profit $ 862,623 $

152,718 $ 1,015,341 $ 13,012 $ 1,028,353 (1) Excludes

stock-based compensation expense.

UNAUDITED SELECTED FINANCIAL

INFORMATION (In thousands, except where noted. Totals

may not add due to rounding.)

Selected Balance Sheet Detail: September 30, 2011

September 30, 2011 Long-term obligations summary,

including current portion Pro Forma (1)

Commercial Mortgage Pass-Through Certificates, Series 2007-1 $

1,750,000 $ 1,750,000 Senior Unsecured Revolving Credit Facility

375,000 275,000 Senior Unsecured Term Loan 325,000 325,000 4.625%

Senior Notes due 2015 599,452 599,452 7.000% Senior Notes due 2017

500,000 500,000 4.500% Senior Notes due 2018 999,288 999,288 7.250%

Senior Notes due 2019 295,725 295,725 5.050% Senior Notes due 2020

699,240 699,240 5.900% Senior Notes due 2021 - 499,290 South

African Bridge Loan (2) 85,889 85,889 Colombian short-term credit

facility (3) 73,057 73,057 Ghana Loan (4) 80,814 80,814 Other debt,

including capital leases

48,197

48,197 Total debt

$

5,831,662

$

6,230,952 Cash and cash equivalents 177,506

Net debt (Total debt less cash and cash equivalents)

$

5,654,156 (1 ) Pro forma for the Company's issuance of $500

million of 5.900% Senior Notes due 2021 in October 2011, and the

receipt of net proceeds of approximately $495.2 million, $100.0

million of which has been utilized for the repayment of a portion

of the Company’s Senior Unsecured Revolving Credit Facility. (2 )

The South African Bridge Loan is a short-term facility, denominated

in South African Rand. (3 ) The Colombian short-term credit

facility is denominated in Colombian Pesos. (4 ) The Ghana Loan is

denominated in U.S. Dollars and was entered into in connection with

the acquisition of towers through our joint venture in Ghana.

Three Months Ended Nine Months Ended Share

count rollforward: (in millions of shares)

September 30,

2011 September 30, 2011 Total shares, beginning of

period 396.0 398.7 Shares repurchased (3.2 ) (7.6 ) Shares issued

0.7 2.4 Total shares

outstanding, end of period (1) 393.5 393.5

(1 ) As of September 30, 2011, excludes (a) 4.2 million

potentially dilutive shares associated with vested and exercisable

stock options with an average exercise price of $33.49 per share,

(b) 2.9 million potentially dilutive shares associated with

unvested stock options, and (c) 2.2 million potentially dilutive

shares associated with unvested restricted stock units.

SELECTED STATEMENT OF OPERATIONS DETAIL: The following table

reflects the estimated impact of foreign currency exchange rate

fluctuations and straight-line revenue on total rental and

management revenue and Adjusted EBITDA:

Three Months

Ended Total rental and management revenue growth

components: September 30, 2011 Total rental and

management revenue Core Growth 24.2 % Estimated impact of

fluctuations in foreign currency exchange rates 1.1 % Impact of

straight-line revenue recognition (2.3 )% Reported total

rental and management revenue growth 23.0 %

Adjusted

EBITDA growth components: Adjusted EBITDA Core Growth 16.5 %

Estimated impact of fluctuations in foreign currency exchange rates

0.9 % Impact of straight-line revenue and expense recognition

(3.0 )% Reported Adjusted EBITDA growth 14.5 %

UNAUDITED

SELECTED FINANCIAL INFORMATION (In thousands. Totals may not

add due to rounding.)

Total rental

and management straight-line revenue and expense: In accordance

with GAAP, the Company recognizes consolidated rental and

management revenue and expense related to non-cancellable customer

and ground lease agreements with fixed escalations on a

straight-line basis, over the applicable lease term. As a result,

the Company’s revenue recognized may differ materially from the

amount of cash collected per customer lease, and the Company’s

expense incurred may differ materially from the amount of cash paid

per ground lease. Additional information regarding straight-line

accounting can be found in the Company’s Annual Report on Form 10-K

for the year ended December 31, 2010 in the section entitled

"Revenue Recognition," of note 1, "Business and Summary of

Significant Accounting Policies" within the notes to the

consolidated financial statements. A summary of total rental and

management straight-line revenue and expense, which represents the

non-cash revenue and expense recorded due to straight-line

recognition, is as follows:

Three Months Ended

Nine Months Ended September 30, September 30,

2011 2010 2011

2010 Total rental and management operations

straight-line revenue $ 32,687 $ 35,379 $ 92,999 $ 67,805 Total

rental and management operations straight-line expense 7,869 5,250

23,125 18,401

Three Months Ended Nine

Months Ended September 30, September 30,

Selling, general, administrative and development expense

breakout: 2011 2010

2011 2010 Total rental and management

overhead $ 42,157 $ 27,344 $ 117,147 $ 73,861 Network development

services segment overhead 1,918 1,398 5,130 4,507 Corporate and

development expenses 22,024 15,200 58,230 45,890 Stock-based

compensation expense 10,377 13,353

34,422 40,146 Total $ 76,476 $ 57,295 $

214,929 $ 164,404

SELECTED CASH FLOW DETAIL:

Three Months Ended Nine Months Ended September

30, September 30, Payments for purchase of property

and equipment and construction activities: 2011

2010 2011 2010

Discretionary capital projects $ 89,875 $ 54,305 $ 221,910 $

133,203 Discretionary ground lease purchases 31,726 23,276 80,280

49,842 Redevelopment 14,412 5,769 37,281 16,585 Capital

improvements 19,751 9,215 44,115 21,089 Corporate 4,744

3,405 13,503 7,761 Total $

160,508 $ 95,970 $ 397,088 $ 228,480

UNAUDITED SELECTED FINANCIAL

INFORMATION

(Totals may not add due to rounding.)

SELECTED PORTFOLIO

DETAIL - OWNED SITES: Three months ended September

30, 2011 Wireless Broadcast DAS

Total Beginning sites 37,335 467 246 38,048 New construction

670 - 12 682 Acquisitions 1,214 6 - 1,220 Adjustments/Reductions

(23 ) - - (23 ) Ending sites

39,196 473 258 39,927

As of September 30, 2011 Wireless Broadcast

DAS Total Domestic 20,935 274 252 21,461

International 18,261 199 6

18,466 Total sites 39,196 473

258 39,927

International Supplemental

Detail as of September 30, 2011 Wireless

Broadcast DAS Total Brazil 2,475 - 3 2,478

Chile 479 - - 479 Colombia 1,188 - - 1,188 Ghana 1,177 - - 1,177

India 8,414 - - 8,414 Mexico 2,765 199 3 2,967 Peru 475 - - 475

South Africa 1,288 - - 1,288

Total International sites 18,261 199

6 18,466

UNAUDITED RECONCILIATIONS TO GAAP

MEASURES AND THE CALCULATION OF DEFINED FINANCIAL MEASURES

(In thousands, except where noted. Totals may not add due to

rounding.) The reconciliation of

net income to Adjusted EBITDA and the calculation of Recurring Free

Cash Flow, Recurring Free Cash Flow per Share and Adjusted EBITDA

Margin are as follows:

Three Months Ended Nine

Months Ended September 30, September 30,

2011 2010 2011

2010 Net income ($19,726 ) $ 93,601 $

185,406 $ 289,903 Income from discontinued operations, net -

(1 ) - (30 ) Income from

continuing operations (19,726 ) 93,600

185,406 289,873 Income from equity method

investments (2 ) (6 ) (14 ) (24 ) Income tax provision 24,681

70,649 161,981 129,390 Other expense (income) 150,876 (8,236 )

115,710 (1,913 ) Loss on retirement of long-term obligations - - -

35 Interest expense 77,796 62,904 226,735 177,395 Interest income

(1,822 ) (1,954 ) (6,837 ) (3,150 ) Other operating expenses 14,576

4,299 35,770 14,090 Depreciation, amortization and accretion

142,113 115,383 411,902 336,621 Stock-based compensation expense

12,140 13,353 36,185

40,146 Adjusted EBITDA $ 400,632 $ 349,992

$ 1,166,838 $ 982,462 Adjusted EBITDA

(from above) $ 400,632 $ 349,992 $ 1,166,838 $ 982,462 Interest

expense (77,796 ) (62,904 ) (226,735 ) (177,395 ) Interest income

1,822 1,954 6,837 3,150 Cash paid for income taxes (20,513 )

(11,664 ) (48,808 ) (22,921 ) Straight-line revenue (32,687 )

(35,379 ) (92,999 ) (67,805 ) Straight-line expense 7,869 5,250

23,125 18,401 Redevelopment capital expenditures (14,412 ) (5,769 )

(37,281 ) (16,585 ) Capital improvement capital expenditures

(19,751 ) (9,215 ) (44,115 ) (21,089 ) Corporate capital

expenditures (4,744 ) (3,405 ) (13,503 )

(7,761 ) Recurring Free Cash Flow $ 240,420 $ 228,860

$ 733,359 $ 690,458 Divided by weighted

average diluted shares outstanding 395,183

403,455 400,467 405,053

Recurring Free Cash Flow per Share $ 0.61 $ 0.57 $

1.83 $ 1.70 Adjusted EBITDA (from above) $

400,632 $ 349,992 $ 1,166,838 $ 982,462 Divided by total revenue

630,403 513,322 1,790,333

1,437,693 Adjusted EBITDA Margin 64 %

68 % 65 % 68 %

UNAUDITED PRO FORMA REIT MEASURES

AND RECONCILIATIONS TO GAAP MEASURES (In thousands, except

where noted. Totals may not add due to rounding.)

Given the Company's preparation for potential

election of REIT status for the taxable year beginning January 1,

2012, two widely recognized metrics of operating performance for

REITs, Funds From Operations (FFO) and Adjusted Funds From

Operations (AFFO), are presented below on a pro forma basis as if

the REIT conversion had occurred on January 1, 2010. For more

information on the general nature of the pro forma adjustments, see

“Pro Forma Financial Information” in the Company’s Definitive Proxy

Statement, filed with the SEC on October 11, 2011. The unaudited

pro forma calculation of FFO is based on the definition as set

forth by the National Association of Real Estate Investment Trusts

(NAREIT). A reconciliation of net income to FFO and the calculation

of AFFO, which are non-GAAP financial measures, are also presented

below. The measures of FFO and AFFO may not be comparable to those

reported by REITs that do not compute these measures in accordance

with the NAREIT definitions, or that interpret those definitions

differently than the Company does. The pro forma adjustments, and

other estimates and assumptions set forth in the footnotes below,

are preliminary and have been made solely for the purposes of

developing the pro forma information. The unaudited pro forma

consolidated financial data is not necessarily indicative of the

financial position or operating results that would have been

achieved had the REIT conversion been completed as of the date

indicated, nor are they necessarily indicative of future financial

position or operating results. The unaudited pro forma consolidated

financial data does not reflect one-time transaction costs related

to the REIT conversion and the potential immaterial effect of lower

cash balances these transactions have on interest income, higher

borrowing costs or foregone investment opportunities.

Three Months Ended Nine Months Ended September

30, September 30, 2011 2010

2011 2010 Net

income $ (19,726 ) $93,601 $ 185,406 $ 289,903 Adjustment for pro

forma income taxes (1) 8,499 59,020

123,478 106,536 Pro-forma net income

(11,227 ) 152,621 308,885 396,440

Real estate related depreciation and amortization

123,715 103,422 356,948 301,695

Pro Forma Funds From Operations $ 112,488 $256,043

$ 665,833 $ 698,135

Three Months

Ended Nine Months Ended September 30,

September 30, 2011

2010 2011 2010

Pro Forma Funds From Operations (from above) $ 112,488 $

256,043 $ 665,833 $ 698,135 Straight-line revenue (32,687 ) (35,379

) (92,999 ) (67,805 ) Straight-line expense 7,869 5,250 23,125

18,401 Stock-based compensation expense 12,140 13,353 36,185 40,146

Non-real estate related depreciation, amortization and accretion

18,398 11,962 54,954 34,926 Amortization of deferred financing

costs, debt discounts and capitalized interest 2,813 1,840 8,278

6,224 Other expense (income) (2) 150,876 (8,236 ) 115,710 (1,913 )

Other operating expense (3) 14,576 4,299 35,770 14,090 Capital

improvement capital expenditures (19,751 ) (9,215 ) (44,115 )

(21,089 ) Corporate capital expenditures (4,744 )

(3,405 ) (13,503 ) (7,761 ) Pro Forma Adjusted Funds

From Operations $ 261,978 $ 236,512 $ 789,238

$ 713,354 (1 ) Adjustment reflects reduction to the

Company’s income tax provision, as a result of the assumed REIT

election on January 1, 2010. For more information, see Note (B) to

Unaudited Pro Forma Consolidated Financial Statements in the

Company’s Definitive Proxy Statement. As a result, on a pro forma

basis, income tax expense is lower by the amount of the adjustment.

(2 ) Primarily includes unrealized (gains)/losses on foreign

exchange. (3 ) Primarily includes impairments and transaction

related costs.

UNAUDITED RECONCILIATIONS OF OUTLOOK TO GAAP

MEASURES AND DEFINED FINANCIAL MEASURES (In millions, except

where noted. Totals may not add due to rounding.)

The reconciliation of Income from

continuing operations to Adjusted EBITDA outlook is as follows:

Full Year 2011 Net income $300 to $340

Interest expense 310 to 315 Depreciation, amortization and

accretion 540 to 550 Non-cash stock-based compensation expense 48

to 48 Other, including other operating expenses, interest income,

loss on retirement of long-term obligations, income (loss) on

equity method investments, other income (expense), income tax

provision and non-controlling interest in net earnings of

subsidiaries 382 to 347 Adjusted EBITDA $1,580 to $1,600

The calculation of Core Growth outlook is as follows:

Total Rental and Management Revenue Adjusted EBITDA

Outlook midpoint Core Growth 21.8% 16.0% Estimated impact of

fluctuations in foreign currency exchange rates 0.7% 0.6% Impact of

straight-line revenue and expense recognition 0.6% 0.9% Impact of

material one-time items (0.5)% 0.4% Outlook midpoint growth 22.7%

18.0%

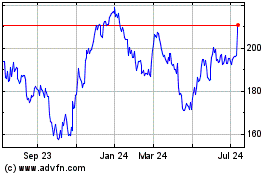

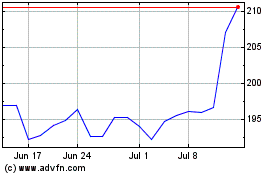

American Tower (NYSE:AMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

American Tower (NYSE:AMT)

Historical Stock Chart

From Apr 2023 to Apr 2024