Albion Ven Cap Trust Albion Venture Capital Trust Plc: Half-yearly Report

November 25 2015 - 9:40AM

UK Regulatory

TIDMAAVC

Albion Venture Capital Trust PLC

As required by the UK Listing Authority's Disclosure and Transparency

Rule 4.2, Albion Venture Capital Trust PLC today makes public its

information relating to the Half-yearly Financial Report (which is

unaudited) for the six months to 30 September 2015. This announcement

was approved by the Board of Directors on 25 November 2015.

The full Half-yearly Financial Report (which is unaudited) for the

period to 30 September 2015, will shortly be sent to shareholders.

Copies of the full Half-yearly Financial Report will be shown via the

Albion Ventures LLP website by clicking

www.albion-ventures.co.uk/ourfunds/AAVC.htm.

Investment objective and policy

The investment strategy of Albion Venture Capital Trust PLC (the

"Company") is to manage the risk normally associated with investments in

smaller unquoted companies whilst maintaining an attractive yield,

through allowing investors the opportunity to participate in a balanced

portfolio of asset-backed businesses. The Company's investment portfolio

will thus be structured to provide a balance between income and capital

growth for the longer term.

This is achieved as follows:

-- qualifying unquoted investments are predominantly in specially-formed

companies which provide a high level of asset backing for the capital

value of the investment;

-- the Company invests alongside selected partners with proven experience in

the sectors concerned;

-- investments are normally structured as a mixture of equity and loan

stock. The loan stock represents the majority of the finance provided and

is secured on the assets of the portfolio company. Funds managed or

advised by Albion Ventures LLP typically own 50 per cent. of the equity

of the portfolio company;

-- other than the loan stock issued to funds managed or advised by Albion

Ventures LLP, portfolio companies do not normally have external

borrowings.

The Company offers tax-paying investors substantial tax benefits at the

time of investment, on payment of dividends and on the ultimate disposal

of the investment.

Background to the Company

The Company is a venture capital trust which raised a total of GBP39.7

million through an issue of Ordinary shares in the spring of 1996 and

through an issue of C shares in the following year. The C shares merged

with the Ordinary shares in 2001. The Company has raised a further

GBP15.2 million under the Albion VCTs Top Up Offers since 2011.

On 25 September 2012, the Company acquired the assets and liabilities of

Albion Prime VCT PLC ("Prime") in exchange for new shares in the

Company. Each Prime shareholder received 0.8801 shares in the Company

for each Prime share that they held at the date of the Merger.

Financial calendar

Record date for second dividend 11 December 2015

Payment date for second dividend 31 December 2015

Financial year end 31 March 2016

Financial highlights

Unaudited six Unaudited six Audited year

months ended months ended ended

30 September 2015 30 September 2014 31 March 2015

(pence per share) (pence per share) (pence per share)

Dividends paid 2.50 2.50 5.00

Revenue return 0.95 0.92 2.07

Capital return 2.74 0.18 3.26

Net asset value 72.65 69.92 71.62

Total shareholder return since launch to Ordinary shares

30 September 2015 (pence per share)

Dividends paid during the year ended : 31 March 1997 2.00

31 March 1998 5.20

31 March 1999 11.05

31 March 2000 3.00

31 March 2001 8.55

31 March 2002 7.60

31 March 2003 7.70

31 March 2004 8.20

31 March 2005 9.75

31 March 2006 11.75

31 March 2007 10.00

31 March 2008 10.00

31 March 2009 10.00

31 March 2010 5.00

31 March 2011 5.00

31 March 2012 5.00

31 March 2013 5.00

31 March 2014 5.00

31 March 2015 5.00

Dividends paid in the six months to

30 September 2015 2.50

Total dividends paid since launch to

30 September 2015 137.30

Net asset value as at 30 September 2015 72.65

Total shareholder return since launch to

30 September 2015 per 100 pence invested 209.95

The financial summary above is for the Company, Albion Venture Capital

Trust PLC Ordinary shares only. Details of the financial performance of

the C shares and Albion Prime VCT PLC, which have been merged into the

Company, can be found at the end of this announcement.

In addition to the dividends summarised above, the Directors have

declared a second dividend for the year to 31 March 2016 of 2.50 pence

per share, to be paid on 31 December 2015 to shareholders on the

register as at 11 December 2015.

Notes

-- Dividends paid before 5 April 1999 were paid to qualifying shareholders

inclusive of the associated tax credit. The dividends for the year to 31

March 1999 were maximised in order to take advantage of this tax credit.

-- All dividends paid by the Company are free of income tax. It is an H.M.

Revenue & Customs requirement that dividend vouchers indicate the tax

element should dividends have been subject to income tax. Investors

should ignore this figure on their dividend voucher and need not disclose

any income they receive from a VCT on their tax return.

-- The net asset value of the Company is not its share price as quoted on

the official list of the London Stock Exchange. The share price of the

Company can be found in the Investment Companies - VCTs section of the

Financial Times on a daily basis. Investors are reminded that it is

common for shares in VCTs to trade at a discount to their net asset

value.

Interim management report

Introduction

The results for Albion Venture Capital Trust PLC (the "Company") for the

six months to 30 September 2015 showed a total return of 3.7 pence per

share, up from 1.1 pence per share for the same period last year. This

positive return was a result of uplifts in the third party professional

valuations of our hydroelectric schemes and of Radnor House School, as

well as an offer received for Kensington Health Clubs Limited. The net

asset value for the half year was 72.7 pence per share compared to 71.6

pence per share at 31 March 2015.

Investment performance, progress and prospects

During the period, just under GBP2 million was invested in qualifying

investments including GBP1.3m in two of the three new care homes that we

are currently building and GBP460,000 into Radnor House to help purchase

Combe Bank School in Sevenoaks, Kent. Further sums were invested after

the half year to fund the further construction of the care homes.

GBP550,000 was received back from our investee companies in the form of

loan stock repayments during the period.

Looking forwards, the main focus of our investment activity will be the

further construction costs of our three care home projects in Oxford,

Reading and Hillingdon (West London), all of which are proceeding

according to plan. They are due to open between March and June of next

year and we are currently optimistic for their prospects.

In terms of trading progress, the sentiment across the portfolio is

generally positive. The Stansted Holiday Inn Express is currently

trading at strong levels, while our renewable energy portfolio has been

boosted by the two new hydroelectric schemes in Scotland which are

trading above budget. Meanwhile, Radnor House, which recorded good GCSE

results, saw a continued increase in the number of pupils to 390, while

Combe Bank is trading in line with expectations.

Split of portfolio by valuation as at 30 September 2015

Set out at the bottom of this announcement is the sector diversification

of the investment portfolio as at 30 September 2015. At that date

healthcare and renewable energy investments accounted for approximately

14 per cent. and 21 per cent. of the Company's portfolio including cash.

Changes in VCT legislation

The July budget introduced a number of changes to VCT legislation,

including restrictions over the age of investments, a prohibition on

management buyouts or the purchase of existing businesses and an overall

lifetime investment cap of GBP12m from tax-advantaged funds into any

portfolio company. While these changes are significant, the Company has

been advised that had they been in place previously they would have

affected only a relatively small minority of the investments that we

(MORE TO FOLLOW) Dow Jones Newswires

November 25, 2015 09:40 ET (14:40 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

Albion Venture Capital (LSE:AAVC)

Historical Stock Chart

From Aug 2024 to Sep 2024

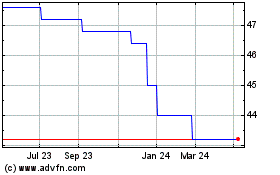

Albion Venture Capital (LSE:AAVC)

Historical Stock Chart

From Sep 2023 to Sep 2024