AXT, Inc. Announces First Quarter 2017 Financial Results

April 26 2017 - 4:10PM

AXT, Inc. (Nasdaq:AXTI), a leading manufacturer of compound

semiconductor substrates, today reported financial results for the

first quarter, ended March 31, 2017.

First Quarter 2017 Results

Revenue for the first quarter of 2017 was $20.6

million, compared with $20.3 million in the fourth quarter of

2016.

Gross margin was 30.5 percent of revenue for the

first quarter of 2017, compared with 37.1 percent of revenue in the

fourth quarter of 2016. This decline was largely the result

of product mix, foreign exchange and recovery efforts from the

short circuit electrical fire in March of 2017.

Operating expenses were $4.9 million in the

first quarter of 2017, compared with $5.2 million in the fourth

quarter of 2016.

Operating profit for the first quarter of 2017

was $1.4 million compared with operating profit of $2.3 million in

the fourth quarter of 2016.

Interest and other, net for the first quarter of

2017 was a loss of $0.8 million, compared with a loss of $0.3

million in the fourth quarter of 2016.

Net profit in the first quarter of 2017 was $0.7

million, or $0.02 per diluted share, compared with a net profit of

$2.2 million or $0.06 per diluted share in the fourth quarter of

2016.

Management Qualitative

Comments

“Q1 was a busy and productive quarter,” said

Morris Young, chief executive officer. “We are seeing encouraging

progress in the adoption of several emerging technologies and are

continuing to invest in our product development, production

capacity, and customer engagement and support capabilities in order

to position ourselves for coming business opportunities. In

addition, we recently completed a successful secondary offering,

helping to ensure that AXT is well capitalized for both business

expansion and the future relocation of our gallium arsenide

production line. And finally, we experienced, and then quickly and

effectively recovered from, a short-circuit electrical fire at our

Beijing facility. I am proud of the way our team pulled together

with a shared sense of purpose to support all of our key

stakeholders, including our customers, investors, and fellow

employees. 2017 will likely be an important year for AXT, and I

believe we are taking the correct steps to ready our business for

our next phase of growth.”

Conference Call

The company will host a conference call to discuss these results

today at 1:30 p.m. PT. The conference call can be accessed at (844)

892-6598 (passcode 95615587). The call will also be simulcast on

the Internet at www.axt.com. Replays will be available at (855)

859-2056 (passcode 95615587) until May 2, 2017. Financial and

statistical information to be discussed in the call will be

available on the company's website immediately prior to

commencement of the call. Additional investor information can be

accessed at http://www.axt.com or by calling the company's

Investor Relations Department at (510) 438-4700.

About AXT, Inc.

AXT designs, develops, manufactures and distributes

high-performance compound and single element semiconductor

substrates comprising indium phosphide (InP), gallium arsenide

(GaAs) and germanium (Ge) through its manufacturing facilities in

Beijing, China. In addition, AXT maintains its sales,

administration and customer service functions at its headquarters

in Fremont, California. The company’s substrate products are

used primarily in lighting display applications, wireless

communications, fiber optic communications and solar cell

applications. Its vertical gradient freeze (VGF) technique for

manufacturing semiconductor substrates provides significant

benefits over other methods and enabled AXT to become a leading

manufacturer of such substrates. AXT has manufacturing facilities

in China and invests in joint ventures in China producing raw

materials. For more information, see AXT’s website at

http://www.axt.com.

Safe Harbor Statement

The foregoing paragraphs contain forward-looking

statements within the meaning of the Federal securities laws,

including, for example, statements regarding the market demand for

our products, our market opportunity, and our expectations with

respect to our business prospects. These forward-looking statements

are based upon assumptions that are subject to uncertainties and

factors relating to the company’s operations and business

environment, which could cause actual results to differ materially

from those expressed or implied in the forward-looking statements

contained in the foregoing discussion. These uncertainties and

factors include but are not limited to: overall conditions in the

markets in which the company competes; global financial conditions

and uncertainties; policies and regulations in China; market

acceptance and demand for the company’s products; the impact of

factory closures or other events causing delays by our customers on

the timing of sales of our products; our ability to control costs,

our ability to utilize our manufacturing capacity; product yields

and their impact on gross margins; and other factors as set forth

in the company’s annual report on Form 10-K, quarterly reports on

Form 10-Q and other filings made with the Securities and Exchange

Commission. Each of these factors is difficult to predict and

many are beyond the company’s control. The company does not

undertake any obligation to update any forward-looking statement,

as a result of new information, future events or otherwise.

FINANCIAL TABLES TO FOLLOW

|

|

| AXT, INC. |

| CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS |

| (Unaudited, in thousands, except per share data) |

| |

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

| |

|

March 31, |

|

| |

|

2017 |

|

|

2016 |

|

|

| |

|

|

|

|

|

| Revenue |

|

$ |

20,616 |

|

|

$ |

18,713 |

|

|

| Cost of revenue |

|

|

14,328 |

|

|

|

13,460 |

|

|

| Gross profit |

|

|

6,288 |

|

|

|

5,253 |

|

|

| Operating

expenses: |

|

|

|

|

|

|

|

| Selling,

general, and administrative |

|

|

3,793 |

|

|

|

3,374 |

|

|

| Research

and development |

|

|

1,124 |

|

|

|

1,381 |

|

|

| Total

operating expenses |

|

|

4,917 |

|

|

|

4,755 |

|

|

| Income from

operations |

|

|

1,371 |

|

|

|

498 |

|

|

| Interest income,

net |

|

|

98 |

|

|

|

98 |

|

|

| Equity in loss of

unconsolidated joint ventures |

|

|

(933 |

) |

|

|

(456 |

) |

|

| Other income, net |

|

|

48 |

|

|

|

190 |

|

|

| Income before provision

for income taxes |

|

|

584 |

|

|

|

330 |

|

|

| Provision for income

taxes |

|

|

159 |

|

|

|

397 |

|

|

| Net income (loss) |

|

|

425 |

|

|

|

(67 |

) |

|

| Less: Net

loss attributable to noncontrolling interests |

|

|

240 |

|

|

|

109 |

|

|

| Net income attributable

to AXT, Inc. |

|

$ |

665 |

|

|

$ |

42 |

|

|

| Net income (loss)

attributable to AXT, Inc. per common share: |

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.02 |

|

|

$ |

(0.00 |

) |

* |

|

Diluted |

|

$ |

0.02 |

|

|

$ |

(0.00 |

) |

* |

| Weighted average number

of common shares outstanding: |

|

|

|

|

|

|

|

|

Basic |

|

|

34,210 |

|

|

|

32,002 |

|

|

|

Diluted |

|

|

35,624 |

|

|

|

32,002 |

|

|

|

|

|

|

|

|

|

|

|

|

|

__________________________

* Net loss to AXT, Inc. per common share resulted due to the

accrual of preferred dividend liquidation preference during the

three months ended March 31, 2016

| |

| AXT, INC. |

| CONDENSED CONSOLIDATED BALANCE

SHEETS |

| (Unaudited, in thousands) |

| |

|

|

|

|

| |

|

March 31, |

|

December 31, |

| |

|

2017 |

|

|

2016 |

|

| |

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

| Cash and

cash equivalents |

|

$ |

56,512 |

|

|

$ |

36,152 |

|

|

Short-term investments |

|

|

20,483 |

|

|

|

11,415 |

|

| Accounts

receivable, net |

|

|

17,649 |

|

|

|

14,453 |

|

|

Inventories |

|

|

39,195 |

|

|

|

40,152 |

|

| Related

party notes receivable – current |

|

|

159 |

|

|

|

— |

|

| Prepaid

expenses and other current assets |

|

|

4,663 |

|

|

|

5,114 |

|

| Total

current assets |

|

|

138,661 |

|

|

|

107,286 |

|

| Long-term

investments |

|

|

9,762 |

|

|

|

6,156 |

|

| Property, plant and

equipment, net |

|

|

27,141 |

|

|

|

27,805 |

|

| Related party notes

receivable – long-term |

|

|

— |

|

|

|

157 |

|

| Other assets |

|

|

11,853 |

|

|

|

12,842 |

|

| Total

assets |

|

$ |

187,417 |

|

|

$ |

154,246 |

|

| LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

|

| Accounts

payable |

|

$ |

8,159 |

|

|

$ |

6,691 |

|

| Accrued

liabilities |

|

|

7,906 |

|

|

|

9,260 |

|

| Total

current liabilities |

|

|

16,065 |

|

|

|

15,951 |

|

| Long-term portion of

royalty payments |

|

|

431 |

|

|

|

575 |

|

| Other long-term

liabilities |

|

|

232 |

|

|

|

330 |

|

| Total

liabilities |

|

|

16,728 |

|

|

|

16,856 |

|

| Stockholders’

equity: |

|

|

|

|

|

|

| Preferred

stock |

|

|

3,532 |

|

|

|

3,532 |

|

| Common

stock |

|

|

38 |

|

|

|

33 |

|

|

Additional paid-in-capital |

|

|

227,159 |

|

|

|

194,177 |

|

|

Accumulated deficit |

|

|

(64,320 |

) |

|

|

(64,985 |

) |

|

Accumulated other comprehensive income |

|

|

550 |

|

|

|

253 |

|

| Total

AXT, Inc. stockholders’ equity |

|

|

166,959 |

|

|

|

133,010 |

|

|

Noncontrolling interests |

|

|

3,730 |

|

|

|

4,380 |

|

| Total

stockholders’ equity |

|

|

170,689 |

|

|

|

137,390 |

|

| Total

liabilities and stockholders’ equity |

|

$ |

187,417 |

|

|

$ |

154,246 |

|

|

|

|

|

|

|

|

|

|

|

Contact:

Gary Fischer

Chief Financial Officer

(510) 438-4700

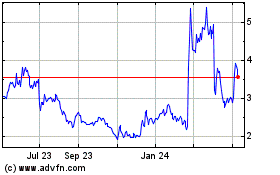

AXT (NASDAQ:AXTI)

Historical Stock Chart

From Mar 2024 to Apr 2024

AXT (NASDAQ:AXTI)

Historical Stock Chart

From Apr 2023 to Apr 2024