- Revenue increased 10.2% to a fourth

quarter record of $479.9 million

- Gross profit increased 13.2% to $99.0

million

- Operating income increased 14.7% to

$52.7 million

- Diluted earnings per common share

increased 17.9% to $0.33

- Non-GAAP diluted earnings per common

share increased 19.4% to $0.37

- Acquired a quarterly record 24

independent animal hospitals

VCA Inc. (NASDAQ: WOOF), a leading animal

healthcare company in the United States and Canada, today reported

financial results for the fourth quarter ended December 31, 2014,

as follows: revenue increased 10.2% to a fourth quarter record of

$479.9 million, gross profit increased 13.2% to $99.0 million,

operating income increased 14.7% to $52.7 million, net income

increased 16.3% to $29.9 million, and diluted earnings per common

share increased 17.9% to $0.33. Non-GAAP diluted earnings per

common share, which excludes acquisition-related amortization,

increased 19.4% to $0.37.

We also reported our financial results for the twelve months

ended December 31, 2014, as follows: revenue increased 6.4% to $1.9

billion, gross profit increased 8.6% to $444.6 million, operating

income decreased 0.7% to $247.3 million, net income decreased 1.6%

to $140.7 million, and diluted earnings per common share increased

0.7% to $1.54. Our financial results for the twelve months ended

December 31, 2014, on a Non-GAAP basis, are as follows: gross

profit increased 8.7% to $465.4 million, operating income increased

9.6% to $295.3 million, net income increased 10.3% to $166.3

million, and Non-GAAP diluted earnings per common share increased

12.5% to $1.89.

Our financial results for the twelve months ended December 31,

2014, included a non-cash impairment charge of $27.0 million, $17.0

million net of tax, or $0.19 per diluted common share, related to

the write-down of goodwill and other long-lived assets in our

Vetstreet business, included in our All Other segments category.

Our results also included debt retirement costs of $1.7 million,

$1.0 million net of tax, or $0.01 per common share, related to the

refinancing of our senior credit facility. Our results for the

twelve months ended December 31, 2013, included charges of $3.8

million, $2.3 million net of tax, or $0.03 per diluted common

share, related to vacated properties that were consolidated into

the then newly constructed VCA West Los Angeles Animal Hospital, as

well as a non-cash inventory credit adjustment of $2.8 million,

$1.7 million net of tax, or $0.02 per diluted common share.

Bob Antin, Chairman and CEO, stated, “We had another terrific

quarter. We experienced solid internal revenue growth of 4.4% and

5.1% in our core Animal Hospital and Laboratory business segments,

respectively. Our same-store Animal Hospital gross profit margins

increased 80 basis points and our Laboratory gross profit margins

increased an impressive 170 basis points. The positive momentum in

our business has continued from the third quarter to the end of the

year and we are optimistic about our overall growth prospects in

2015.

“Animal Hospital revenue in the fourth quarter of 2014 increased

10.9% to $380.7 million, driven by acquisitions made in the past

twelve months and same-store revenue growth of 4.4%. Our same-store

gross profit margin increased to 13.5% from 12.7% and our total

gross margin increased to 13.2% from 12.5% in the prior-year

quarter. During the quarter, we acquired a record 24 independent

animal hospitals which had historical combined annual revenue of

$68.5 million, bringing our year to date total to $122.5

million.

“Laboratory internal revenue in the fourth quarter of 2014

increased 5.1% to $83.9 million, driven by an increase in the

average revenue per requisition of 5.2%. Our Laboratory gross

profit margin increased to 46.0% from 44.3% and our operating

margin increased to 35.8% from 34.4%.

“During the fourth quarter, we purchased 2.6 million shares of

our common stock for $112.8 million. Since the Board authorized our

share repurchase program, we have acquired 7.4 million shares of

our common stock for $278.5 million from April 2013 through

December 31, 2014."

2015 Financial Guidance

We provide the following financial guidance for the full year

2015:

- Revenue from $2.08 billion to $2.09

billion;

- Net income from $166 million to $175

million;

- Diluted earnings per common share from

$2.00 to $2.10; and

- Non-GAAP diluted earnings per common

share from $2.17 to $2.27.

Non-GAAP Financial Measures

We believe investors’ understanding of our total performance is

enhanced by disclosing Non-GAAP financial measures including

Non-GAAP net income, Non-GAAP gross profit, Non-GAAP operating

income and Non-GAAP diluted earnings per common share. We define

these adjusted measures as the reported amounts, adjusted to

exclude certain significant items and amortization of intangibles

acquired in acquisitions.

Management believes these adjusted measures are useful to

management and investors in evaluating the Company's operational

performance and their use provides an additional tool for

evaluating the Company's operating results and trends. As a result,

these Non-GAAP financial measures help to provide meaningful

comparisons of our overall performance from one reporting period to

another and meaningful assessments of related trends.

There is a material limitation associated with the use of these

Non-GAAP financial measures: our adjusted measures exclude the

impact of these significant items, and as a result, our computation

of adjusted diluted earnings per common share does not depict

diluted earnings per common share in accordance with GAAP.

To compensate for the limitations in the Non-GAAP financial

measures discussed above, our disclosures provide a complete

understanding of all adjustments found in Non-GAAP financial

measures, and we reconcile the Non-GAAP financial measures to the

GAAP financial measures in the attached financial schedules titled

“Supplemental Operating Data.”

Conference Call

We will discuss our fourth quarter 2014 financial results during

a conference call today, February 11th, at 9:00 a.m. Eastern Time.

A live broadcast of the call may be accessed by visiting our

website at investor.vca.com. The call may also be accessed by

dialing (877) 293-5492. Interested parties should call at least ten

minutes prior to the start of the call to register. Replay of the

webcast will be available for ninety days by visiting the company's

website.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. Among the forward-looking statements in this press release

are 2015 Financial Guidance and other statements addressing our

plans, expectations, future financial position and results of

operation. These forward-looking statements are not historical

facts and are inherently uncertain and out of our control. Any or

all of our forward-looking statements in this press release may

turn out to be wrong. They can be affected by inaccurate

assumptions we might make or by known or unknown risks and

uncertainties. Actual future results may vary materially. Among

other factors that could cause our actual results to differ from

this forward-looking information are: our ability to execute on our

growth strategy and to manage acquired operations; changes in

demand for our products and services; fluctuations in our revenue

adversely affecting our gross profit, operating income and margins;

and the effects of the other factors discussed in our Annual Report

on Form 10-K for the year ended December 31, 2013, reports on Form

10-Q and our other filings with the SEC.

About VCA Inc.

We own, operate and manage the largest network of freestanding

veterinary hospitals and veterinary-exclusive clinical laboratories

in the country, additionally we are the largest provider of online

communication, professional education and marketing solutions to

the veterinary community. We also supply diagnostic imaging

equipment to the veterinary industry.

VCA Inc.

Condensed, Consolidated Income

Statements

(Unaudited)

(In thousands, except per share

amounts)

Three Months EndedDecember 31, Twelve

Months EndedDecember 31, 2014

2013 2014 2013

Revenue: Animal hospital $ 380,694 $ 343,220 $ 1,514,878 $

1,417,908 Laboratory 84,004 79,806 360,396 344,831 All other 33,871

29,283 115,785 112,740 Intercompany (18,642 ) (16,856 ) (72,576 )

(72,110 ) 479,927 435,453 1,918,483 1,803,369

Direct costs 380,909 347,967 1,473,842 1,393,989

Gross profit: Animal hospital 50,128 42,976 230,801 209,127

Laboratory 38,661 35,378 175,808 163,879 All other 10,871 9,538

38,624 38,601 Intercompany (642 ) (406 ) (592 ) (2,227 ) 99,018

87,486 444,641 409,380 Selling,

general and administrative expense: Animal hospital 10,761 8,410

39,022 34,133 Laboratory 8,641 8,024 33,550 31,915 All other 9,674

8,368 33,456 32,941 Corporate 18,267 15,493 65,478

58,922 47,343 40,295 171,506 157,911 Impairment of

goodwill and other long-lived assets — — 27,019 — Net (gain) loss

on sale of assets (979 ) 1,268 (1,152 ) 2,455

Operating income 52,654 45,923 247,268 249,014 Interest expense,

net 5,215 4,110 17,779 18,549 Debt retirement costs — — 1,709 —

Other expense 41 203 219 90 Income

before provision for income taxes 47,398 41,610 227,561 230,375

Provision for income taxes 17,489 15,882 86,878

87,453 Net income 29,909 25,728 140,683 142,922 Net

income attributable to noncontrolling interests 1,550 1,011

5,245 5,411 Net income attributable to VCA

Inc. $ 28,359 $ 24,717 $ 135,438 $ 137,511

Diluted earnings per share $ 0.33 $ 0.28

$ 1.54 $ 1.53 Weighted-average shares

outstanding for diluted earnings per share 85,121 89,650

87,825 89,663

VCA Inc.

Condensed, Consolidated Balance

Sheets

(Unaudited)

(In thousands)

December 31, 2014 December 31,

2013 Assets Current assets: Cash and cash equivalents

$ 81,383 $ 125,029 Trade accounts receivable, net 60,482 59,900

Inventory 56,050 55,067 Prepaid expenses and other 36,924 25,417

Deferred income taxes 30,331 29,018 Prepaid income taxes 18,277

15,434 Total current assets 283,447 309,865 Property

and equipment, net 468,041 448,366 Other assets: Goodwill 1,415,861

1,321,234 Other intangible assets, net 88,175 86,671 Notes

receivable, net 2,807 3,454 Deferred financing costs, net 7,874

2,987 Other 65,815 55,632 Total assets $ 2,332,020

$ 2,228,209

Liabilities and Equity

Current liabilities: Current portion of long-term debt $ 19,356 $

51,087 Accounts payable 46,284 36,962 Accrued payroll and related

liabilities 64,359 57,337 Other accrued liabilities 67,219

58,762 Total current liabilities 197,218 204,148 Long-term

debt, less current portion 775,412 568,558 Deferred income taxes

103,502 93,082 Other liabilities 33,190 34,127 Total

liabilities 1,109,322 899,915 Redeemable noncontrolling interests

11,077 10,678 VCA Inc. stockholders’ equity: Common stock 83 89

Additional paid-in capital 155,802 384,797 Retained earnings

1,064,158 928,720 Accumulated other comprehensive loss (19,397 )

(6,190 ) Total VCA Inc. stockholders’ equity 1,200,646 1,307,416

Noncontrolling interests 10,975 10,200 Total equity

1,211,621 1,317,616 Total liabilities and equity $

2,332,020 $ 2,228,209

VCA Inc.

Condensed, Consolidated Statements of

Cash Flows

(Unaudited)

(In thousands)

Twelve Months EndedDecember 31, 2014

2013

Cash flows from operating activities: Net income $ 140,683 $

142,922 Adjustments to reconcile net income to net cash provided by

operating activities: Impairment of goodwill and other long-lived

assets 27,019 — Depreciation and amortization 79,427 77,409

Amortization of debt issue costs 1,391 1,245 Provision for

uncollectible accounts 6,248 7,360 Debt retirement costs 1,709 —

Net (gain) loss on sale of assets (1,152 ) 2,455 Share-based

compensation 17,200 14,104 Deferred income taxes 8,853 18,064

Excess tax benefit from stock based compensation (6,241 ) (3,446 )

Other 531 (377 ) Changes in operating assets and liabilities: Trade

accounts receivable (3,900 ) (11,048 ) Inventory, prepaid expense

and other assets (22,897 ) (7,134 ) Accounts payable and other

accrued liabilities 11,597 557 Accrued payroll and related

liabilities 6,782 6,502 Income taxes 2,960 7,759 Net

cash provided by operating activities 270,210 256,372

Cash flows from investing activities: Business acquisitions, net of

cash acquired (138,490 ) (52,688 ) Real estate acquired in

connection with business acquisitions (9,017 ) (5,328 ) Property

and equipment additions (72,948 ) (73,270 ) Proceeds from sale of

assets 3,904 7,096 Other (2,691 ) (2,541 ) Net cash used in

investing activities (219,242 ) (126,731 ) Cash flows from

financing activities: Repayment of debt (568,011 ) (41,129 )

Proceeds from issuance of long-term debt 600,000 — Proceeds from

revolving credit facility 135,000 — Payment of financing costs

(7,987 ) — Distributions to noncontrolling interest partners (5,009

) (4,866 ) Purchase of noncontrolling interest (326 ) (6,581 )

Proceeds from issuance of common stock under stock option plans

2,859 17,233 Excess tax benefit from stock based compensation 6,241

3,446 Repurchase of common stock (255,108 ) (39,367 ) Other (1,424

) (749 ) Net cash used in financing activities (93,765 ) (72,013 )

Effect of currency exchange rate changes on cash and cash

equivalents (849 ) (1,034 ) (Decrease) increase in cash and cash

equivalents (43,646 ) 56,594 Cash and cash equivalents at beginning

of period 125,029 68,435 Cash and cash equivalents at

end of period $ 81,383 $ 125,029

VCA Inc.

Supplemental Operating Data

(Unaudited - In thousands, except per

share amounts)

Table #1

Reconciliation of net income

attributable to VCA Inc., to Non-GAAP net income

attributable to VCA Inc.(1)

Three Months EndedDecember

31,

Twelve Months EndedDecember 31,

2014 2013 2014 2013 Net income

attributable to VCA Inc. $ 28,359 $ 24,717 $ 135,438 $ 137,511

Vacant property adjustments(2)

— — — 3,804

Tax benefit from vacant property

adjustments(2), (7)

— — — (1,489 )

Inventory adjustment(3)

— — — (2,808 )

Tax expense from inventory adjustment(3),

(7)

— — — 1,099

Impairment of goodwill and other

long-lived assets(4)

— — 27,019 —

Tax benefit on impairment charge(4),

(7)

— — (9,978 ) —

Debt Retirement costs(5)

— — 1,709 —

Tax benefit from debt retirement costs(5),

(7)

— — (669 ) —

Acquisitions related amortization(1)

5,434 4,781 21,039 20,934

Tax benefit from acquisitions related

amortization(1), (7)

(2,127 ) (1,871 ) (8,235 ) (8,194 )

Non-GAAP net income attributable to VCA

Inc. $ 31,666 $ 27,627 $ 166,323 $ 150,857

Table #2 Three Months

EndedDecember 31, Twelve Months EndedDecember

31,

Reconciliation of diluted earnings per

share to Non-GAAP diluted earnings per share(1)

2014 2013 2014 2013 Diluted

earnings per share $ 0.33 $ 0.28 $ 1.54 $ 1.53

Impact of vacant property adjustments, net

of tax(2)

— — — 0.03

Impact of inventory adjustment, net of

tax(3)

— — — (0.02 )

Impact of goodwill and other long-lived

assets impairment, net of tax(4)

— — 0.19 —

Impact of debt retirement costs, net of

tax(5)

— — 0.01 —

Impact of acquisitions related

amortization, net of tax(1)

0.04 0.03 0.15 0.14

Non-GAAP diluted earnings per share $ 0.37 $

0.31 $ 1.89 $ 1.68

Shares used for computing diluted earnings

per share

85,121 89,650 87,825 89,663

VCA Inc.

Supplemental Operating Data

(continued)

(Unaudited - In thousands, except per

share amounts)

Table #3

Reconciliation of consolidated gross

profit to Non-GAAP consolidated gross profit(1)

December 31,

December 31,

2014 2013 2014

2013 Consolidated gross profit $ 99,018

$ 87,486 $ 444,641 $ 409,380

Impact of vacant property

adjustments(2)

— — — 2,046

Impact of inventory adjustment(3)

— — — (2,808 )

Impact of rent expense adjustments(6)

— — — (1,396 )

Impact of acquisitions related

amortization(1)

5,374 4,718 20,780 20,753

Non-GAAP consolidated gross profit $ 104,392 $

92,204 $ 465,421 $ 427,975 Non-GAAP

consolidated gross profit margin 21.8 % 21.2 % 24.3 % 23.7 %

Table #4 Three Months EndedDecember 31,

Twelve Months EndedDecember 31,

Reconciliation of consolidated

operating income to Non-GAAP consolidated operating

income(1)

2014 2013 2014 2013 Consolidated

operating income $ 52,654 $ 45,923 $ 247,268 $ 249,014

Impact of vacant property

adjustments(2)

— — — 3,804

Impact of inventory adjustment(3)

— — — (2,808 )

Impact of goodwill and other long-lived

assets impairment(4)

— — 27,019 —

Impact of rent expense adjustments(6)

— — — (1,396 )

Impact of acquisitions related

amortization(1)

5,434 4,781 21,039 20,934

Non-GAAP consolidated operating income $ 58,088

$ 50,704 $ 295,326 $ 269,548 Non-GAAP

consolidated operating margin 12.1 % 11.6 % 15.4 % 14.9 %

_________________________________________________

(1)

Management believes that investors'

understanding of our performance is enhanced by disclosing adjusted

measures as the reported amounts, adjusted to exclude certain

significant items and acquisition-related amortization. Non-GAAP

net income, Non-GAAP diluted earnings per common share, Non-GAAP

consolidated gross profit and Non-GAAP consolidated operating

income measures are not, and should not be viewed as substitutes

for U.S. generally accepted accounting principles (GAAP) net

income, its components and diluted earnings per share.

(2)

During the first quarter of 2013, we

recorded a write-down to net realizable value of $1.8 million

related to a vacant property that was held for sale, and we accrued

costs totaling $2.0 million related to a vacant leased

property.

(3)

In the third quarter of 2013, we recorded

a non-cash physical inventory adjustment in our Animal Hospital

business segment which resulted in a $2.8 million credit adjustment

to direct costs.

(4) In the third quarter, we recognized a non-cash

impairment charge of $27.0 million related to the write-down of

goodwill and other long-lived assets in our Vetstreet business.

(5) Also in the third quarter, we incurred debt retirement

costs of $1.7 million related to the refinancing of our senior

credit facility. (6) In the second quarter of 2013, we

recorded a reduction in rent expense as a result of a capital lease

that was previously treated as an operating lease in our Animal

Hospital segment. (7) The rate used to calculate the tax

benefit is the statutory rate of the applicable year.

VCA Inc.

Supplemental Operating Data

(continued)

(Unaudited - In thousands, except per

share amounts)

As of Table #5 December 31, 2014

December 31, 2013 Selected

consolidated balance sheet data Debt: Senior term notes $

600,000 $ 556,914 Revolving credit 135,000 — Other debt and capital

leases 59,768 62,731 Total debt $ 794,768 $

619,645

Three Months EndedDecember

31, Twelve Months EndedDecember 31, Table

#6 Selected expense data 2014 2013

2014 2013 Rent expense $ 18,463 $

16,940 $ 69,747 $ 67,615

Depreciation and amortization included in

direct costs:

Animal hospital $ 15,822 $ 14,530 $ 60,395 $ 57,011 Laboratory

2,649 2,571 10,358 10,157 All other 824 1,519 5,731 5,122

Intercompany (514 ) (448 ) (1,931 ) (1,783 ) $ 18,781 $ 18,172 $

74,553 $ 70,507

Depreciation and amortization included in

selling, general and administrative expense

987 1,454 4,874 6,902 Total

depreciation and amortization $ 19,768 $ 19,626 $

79,427 $ 77,409 Share-based compensation

included in direct costs: Laboratory $ 216 $ 120 $ 653 $ 448

Share-based compensation included in

selling, general and administrative expense:

Animal hospital 721 306 2,132 1,723 Laboratory 440 319 1,513 1,198

All other 237 236 842 794 Corporate 3,352 2,783

12,060 9,941 4,750 3,644 16,547

13,656 Total share-based compensation $ 4,966 $ 3,764

$ 17,200 $ 14,104

VCA Inc.Tomas FullerChief Financial Officer(310) 571-6505

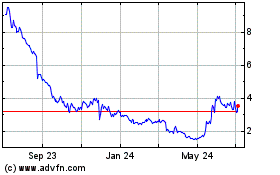

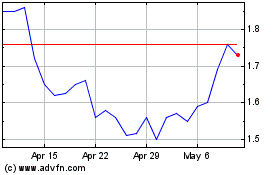

Petco Health and Wellness (NASDAQ:WOOF)

Historical Stock Chart

From Aug 2024 to Sep 2024

Petco Health and Wellness (NASDAQ:WOOF)

Historical Stock Chart

From Sep 2023 to Sep 2024