UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

May 6, 2015

ROYAL GOLD, INC.

(Exact name of registrant as specified in

its charter)

| Delaware |

|

001-13357 |

|

84-0835164 |

| (State or other jurisdiction |

|

(Commission |

|

(IRS Employer |

| of incorporation) |

|

File Number) |

|

Identification No.) |

| 1660 Wynkoop Street, Suite 1000, Denver, CO |

|

80202-1132 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: 303-573-1660

(Former name or former address, if changed

since last report.)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| |

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 7.01 | Regulation FD Disclosure. |

On May 7, 2015, Royal

Gold, Inc. (the “Company”) announced that its wholly owned subsidiary RGLD Gold AG (“RGLD Gold”) entered

into a $130 million gold stream transaction with a wholly-owned subsidiary (“Golden Star”) of Golden Star Resources

Ltd., pursuant to which RGLD Gold will advance financing to Golden Star, subject to certain conditions, for development projects

at certain mines in Ghana, and in return for which Golden Star will sell and deliver gold to RGLD Gold. Separate from the stream

transaction and subject to certain conditions, the Company will provide a $20 million, 4-year term loan to Golden Star and will

receive warrants to purchase 5 million shares of Golden Star Resources Ltd. common stock. The press release dated May 7, 2015 is

furnished as Exhibit 99.1 hereto.

The information furnished

under this Item 7.01, including the exhibit, shall not be deemed “filed” for purposes of Section 18 of the Securities

Exchange Act of 1934, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, except as

shall be expressly set forth by reference to such filing.

As discussed above

under Item 7.01, RGLD Gold entered into a $130 million gold stream transaction with Golden Star on May 6, 2015. Pursuant to the

stream transaction and subject to certain conditions, RGLD Gold will make $130 million in advance payments to Golden Star in stages,

including a $55 million upfront payment and the balance on a pro rata basis with spending on the Wassa and Prestea underground

projects, which RGLD Gold expects to make in five quarterly payments of approximately $15 million each beginning September 1, 2015.

Golden Star will deliver to RGLD Gold 8.5% of gold produced from the Wassa, Bogoso, and Prestea projects, until 185,000 ounces

have been delivered, 5.0% until an additional 22,500 have been delivered, and 3.0% thereafter. RGLD Gold will pay Golden Star a

cash price equal to 20% of the spot price for each ounce delivered at the time of delivery until 207,500 ounces have been delivered,

which cash price shall increase to 30% of the spot price for each ounce delivered thereafter. The difference between the cash price

and spot price at delivery will be applied against the $130 million advance payment. RGLD Gold will hold a first priority security

interest in all the assets comprising the Wassa and Prestea projects, as well as charges over the equity of Golden Star and all

affiliates of Golden Star holding a direct or indirect interest in the projects until the advance payment has been fully applied.

RGLD Gold will subordinate its security over assets and charges over equity in support of up to $25 million in additional financing

for the projects.

In a separate transaction,

the Company will provide a $20 million, four-year term loan to Golden Star, subject to certain conditions. Interest under the loan

will be due quarterly at a rate equal to 62.5% of the average daily gold price for the relevant quarter divided by 10,000, but

not to exceed 11.5%. The loan will be subject to mandatory prepayments that will range between 25-50% of excess cash flow after

the development period for the projects. Golden Star Resources Ltd. will also grant warrants to the Company to purchase 5 million

shares of Golden Star Resources Ltd. common stock. The warrants will have a term of four years and an exercise price equal to a

30% premium to Golden Star Resources Ltd.’s weighted average share price for the ten-day period ending two days prior to

announcement of the transaction.

| Item 9.01 | Financial Statements and Exhibits. |

Exhibit

No. |

|

Description |

| 99.1 |

|

Press Release dated May 7, 2015 regarding Golden Star Transactions. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act

of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Royal Gold, Inc. |

| |

(Registrant) |

| |

|

|

| Dated: May 11, 2015 |

By: |

/s/ Bruce C. Kirchhoff |

| |

|

Name: |

Bruce C. Kirchhoff |

| |

|

Title: |

Vice President, General Counsel and Secretary |

EXHIBIT INDEX

Exhibit

No. |

|

Description |

| 99.1 |

|

Press Release dated May 7, 2015 regarding Golden Star Transactions. |

Exhibit 99.1

Royal Gold Acquires Gold Streams on Wassa,

Bogoso and Prestea

from Golden Star Resources

Transaction provides immediate cash flow

from well-established operator

DENVER, COLORADO. MAY

7, 2015: ROYAL GOLD, INC. (NASDAQ:RGLD; TSX: RGL) (“RGI”) announces that its wholly owned subsidiary RGLD

Gold AG (“Royal Gold” or the “Company”) has entered into a $130 million gold stream transaction

with a wholly owned subsidiary (“Golden Star”) of Golden Star Resources Ltd. that will finance underground development

projects at the Wassa and Prestea mines in Ghana. Separate from the stream transaction, RGI will provide a $20 million, four-year

term loan to Golden Star, and Golden Star Resources Ltd. will issue warrants to purchase 5 million shares of its common stock to

RGI.

Stream Transaction Details

| · | Royal Gold will make $130 million in advance payments to Golden Star in stages, including

a $55 million upfront payment, subject to certain conditions, and the balance on a pro rata basis with spending on the Wassa and

Prestea underground projects, which Royal Gold expects to make in five, $15 million payments quarterly beginning September 1, 2015,

and ending on September 1, 2016; |

| · | Golden Star will deliver to Royal Gold 8.5% of gold produced from Wassa, Bogoso and Prestea until

185,000 ounces have been delivered, 5.0% until an additional 22,500 ounces have been delivered, and 3.0% thereafter; and |

| · | Royal Gold will pay Golden Star 20% of the spot price at the time of delivery until 207,500 ounces

have been delivered, and 30% of the spot price thereafter. |

Transaction Highlights for Royal

Gold

| · | Gold stream applies to all production from April 1, 2015; |

| · | Estimated average annual deliveries of approximately 15,000-20,000 gross gold ounces; |

| · | Investment supporting brownfield expansion of established deposits with excellent exploration potential; |

| · | Proven and probable reserves of 1.9 million gold ounces across both deposits, and Measured and

indicated resources of 3.5 million ounces at Wassa and 3.1 million ounces at Bogoso and Prestea; |

| · | Stable political jurisdiction with strong history of gold mining in the Ashanti Gold belt; and |

| · | Experienced management team with 15 years of production history in Ghana. |

Loan Details

| · | Subject to certain conditions, RGI will provide a $20 million, four-year term loan to Golden Star; |

| · | Golden Star will pay interest to RGI quarterly, at an interest rate calculated at 62.5% of the

average daily gold price for the relevant quarter divided by 10,000 (for example, 7.5% at US$1200), but not to exceed 11.5%; and |

| · | The loan will be subject to mandatory prepayments that will range between 25-50% of excess cash

flow after the development period for the projects. |

Warrants

| · | Subject to certain conditions, RGI will be granted warrants to purchase 5 million shares of Golden

Star Resources Ltd. common stock at a price equal to a 30% premium on the weighted average share price for the 10 day period ending

two days prior to announcement of the transaction; and |

| · | The warrants will have a four-year term. |

About Wassa, Bogoso and Prestea

The Wassa mine is located

150km west of Accra and has operated continuously since 2005. Golden Star Resources Ltd. forecasts calendar 2015 production of

113,000 ounces of gold from the single Wassa open pit. Open pit proven and probable reserves are 831,000 ounces at 1.39 grams per

tonne. Royal Gold’s investment will fund development of the Wassa underground deposit, which has 746,000 ounces of proven

and probable gold reserves at 4.27 grams per tonne. Golden Star Resources Ltd. estimates $41 million of capital investment will

be needed for the underground development. Processing will leverage the existing Wassa plant. Golden Star Resources Ltd. forecasts

first underground gold production from Wassa in the first half of 2016.

Bogoso and Prestea

are located 200km west of Accra and have produced over 9 million ounces from both open pit and underground sources over the last

100 years. Underground development on the Prestea underground is already well advanced and Golden Star Resources Ltd. plans to

modify the Bogoso plant to process Prestea material. Golden Star Resources Ltd. expects to spend $40 million of capital investment

on Prestea, which includes hoist and shaft upgrades, electrical infrastructure, ventilation and a process plant upgrade. Once in

full production, Golden Star Resources Ltd. expects annual production of approximately 75,000 ounces from Prestea, with estimated

life of mine production of 620,000 ounces. Golden Star Resources Ltd. forecasts first underground gold production from the Prestea

underground in the second half of 2016.

About the Purchase and Sale Agreement

between Royal Gold and Golden Star

| · | Royal Gold will make $130 million in advance payments to Golden Star in stages, including a $55

million upfront payment, subject to certain conditions, and the balance on a pro rata basis with spending on the Wassa and Prestea

underground projects, which Royal Gold expects to make in five, $15 million payments quarterly beginning September 1, 2015, and

ending on September 1, 2016; |

| · | Until the advance payment is offset against deliveries of physical gold, Royal Gold will hold a

first priority security interest in all the assets of Golden Star Resources Ltd.’s two operating companies that own the Wassa

and Prestea mines, as well as charges over the equity of all associated holding companies; |

| · | Royal Gold will subordinate its security over assets and charges over equity in support of up to

US$25 million in financing for the projects; and |

| · | Golden Star may offer to repurchase up to 50% of the tail stream percentage after 207,500 ounces

have been delivered; Royal Gold retains the right to either accept the repurchase offer or pay the same amount for an increase

of up to 50% in the stream percentage. |

Tony Jensen and Chris

M.T. Thompson, who serve as directors of both RGI and Golden Star Resources Ltd., and in the case of Mr. Jensen, President and

CEO of RGI, recused themselves from the transaction process.

CORPORATE PROFILE

Royal Gold, Inc. is

a precious metals royalty and stream company engaged in the acquisition and management of precious metal royalties, streams, and

similar production based interests. The Company owns interests on 196 properties on six continents, including interests on

38 producing mines and 23 development stage projects. Royal Gold, Inc. is publicly traded on the NASDAQ Global Select Market

under the symbol “RGLD,” and on the Toronto Stock Exchange under the symbol “RGL.” The Company’s

website is located at www.royalgold.com.

About Golden Star Resources

Golden Star Resources

Ltd. (NYSE MKT: GSS; TSX: GSC; GSE: GSR) is an established gold mining company that holds a 90% interest in the Wassa, Prestea

and Bogoso gold mines in Ghana. In 2014, Golden Star Resources Ltd. produced 261,000 ounces of gold and is expected to produce

250,000 – 275,000 ounces in 2015. They are pursuing brownfield development projects at its Wassa and Prestea mines

that are expected to transform these mines into lower cost producers from 2016 onwards. As such, Golden Star Resources Ltd.

offers investors leveraged exposure to the gold price in a stable African mining jurisdiction with significant development upside

potential.

Qualified Person

Information on reserves

and resources were published in Golden Star Resources, Ltd.’s press release dated March 26, 2015. The technical contents

of that press release were reviewed and approved by S. Mitchel Wasel, BSc Geology, a Qualified Person pursuant to NI 43-101.

Mr. Wasel is Vice President Exploration for Golden Star Resources Ltd. and an active member of the Australasian Institute of Mining

and Metallurgy. The 2014 estimates of Mineral Resources were prepared under the supervision of Mr. Wasel. The 2014

estimates of Mineral Reserves were prepared under the supervision of Dr. Martin Raffield, Senior Vice President Technical Services

for Golden Star Resources. Dr. Raffield is a "Qualified Person" as defined by NI 43-101.

For further information, please

contact:

Karli Anderson

Vice President Investor Relations

(303) 575-6517

Cautionary

“Safe Harbor” Statement Under the Private Securities Litigation Reform Act of 1995: With the exception of historical

matters, the matters discussed in this press release are forward-looking statements that involve risks and uncertainties that could

cause actual results to differ materially from projections or estimates contained herein. Such forward-looking statements include

statements about the Company’s stream and RGI’s loan transactions with Golden Star and Golden Star Resources Ltd.,

and Golden Star Resources Ltd.’s expectations concerning development, production and mine life at the projects. Factors that

could cause actual results to differ materially from the projections include, among others, precious metals prices; actual tax

rates; performance of and production at the properties subject to our royalty and stream interests; decisions and activities of

the operators of these properties; operators’ delays in securing or inability to secure necessary governmental permits; changes

in operators’ project parameters and timelines as plans continue to be refined; economic and market conditions; unanticipated

grade, geological, metallurgical, processing, regulatory and legal or other problems that the operators of mining properties may

encounter; completion of feasibility studies; the ability of the various operators to bring projects into production as expected;

and other subsequent events, as well as other factors described in the Company's Annual Report on Form 10-K, Quarterly Reports

on Form 10-Q, and other filings with the Securities and Exchange Commission. Most of these factors are beyond the Company’s

ability to predict or control. The Company disclaims any obligation to update any forward-looking statement made herein. Readers

are cautioned not to put undue reliance on forward-looking statements.

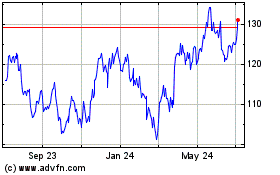

Royal Gold (NASDAQ:RGLD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Royal Gold (NASDAQ:RGLD)

Historical Stock Chart

From Apr 2023 to Apr 2024