UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) September 30, 2015

ICU Medical, Inc.

(Exact name of registrant as specified in its charter)

|

| | | | |

DELAWARE | | 0-19974 | | 33-0022692 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

|

| | | | |

| 951 Calle Amanecer, San Clemente, California | | 92673 | |

| (Address of principal executive offices) | | (Zip Code) | |

(949) 366-2183

Registrant's telephone number, including area code

N/A

(Former name or former address, if changed since last report)

|

| | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): |

| [ ] | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| [ ] | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| [ ] | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| [ ] | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

ICU Medical, Inc. (the “Company”) has announced that George A. Lopez, M.D., a member of the Board of Directors (the “Board”) and employee in our Research and Development Department, has terminated his employment with the Company effective September 30, 2015 (the “Termination Date”). In addition, Dr. Lopez and the Company have entered into a Buy-Out Agreement, dated as of September 30, 2015 (the “Buy-Out Agreement”), pursuant to which the Company will buy out Dr. Lopez’s right to employment under his existing Employment Agreement with the Company, dated October 21, 2013.

The Buy-Out Agreement provides that, subject to Dr. Lopez’s executing and not revoking a general release of claims in favor of the Company, Dr. Lopez will be entitled to, among other things, (1) a cash payment in the aggregate equal to $1,837,500, paid in equal monthly installments until December 31, 2020; (2) continued vesting of any unvested stock options and restricted stock units held by Dr. Lopez as of the Termination Date, subject to continued vesting unless Dr. Lopez is removed from the Board for cause; (3) a lump sum cash payment equal to $700,000 in the event a change in control of the Company occurs on or prior to January 31, 2016; (4) a continuation from his employment agreement of customary non-competition, non-solicitation and non-disparagement provisions; and (5) in Dr. Lopez’s capacity as a member of the Board, administrative type support services extended to Board members. While Dr. Lopez remains a member of the Board, Dr. Lopez has waived any annual retainer or meeting fees or equity payments made to non-employee members of the Board for their Board service.

The foregoing summary of the Buy-Out Agreement is qualified in its entirety by reference to the text of the Buy-Out Agreement attached as Exhibit 99.1 to this Current Report on Form 8-K and incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

|

| |

99.1 | Buy-Out Agreement, dated as of September 30, 2015, between the Company and George A. Lopez. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: October 1, 2015

ICU MEDICAL, INC.

/s/ SCOTT E. LAMB

Scott E. Lamb

Secretary, Treasurer and Chief Financial Officer

EXHIBIT INDEX

|

| | |

Exhibit | Description |

| |

99.1 | Buy-Out Agreement, dated as of September 30, 2015, between the Company and George A. Lopez. | |

Exhibit 99.1

Buy-OUT AGREEMENT

THIS BUY-OUT AGREEMENT, dated as of September 30, 2015 (this “Agreement”), is entered into by and between ICU Medical, Inc., a Delaware corporation (“Employer”), and George A. Lopez, M.D. (“Employee”). Employer and Employee are sometimes referred to herein as the “Parties”.

RECITALS

| |

1. | The Parties previously entered into that certain Employment Agreement dated October 21, 2013 (the “Employment Agreement”). |

| |

2. | The Parties previously entered into that certain 2013 Amended and Restated Retention Agreement dated October 21, 2013 (the “Retention Agreement”). |

| |

3. | The Employment Agreement provides Employee with a qualified right to employment by Employer until December 31, 2020 (the “Term”). |

| |

4. | Employer desires to buy out Employee’s qualified right to employment through the Term, and all related rights, including any rights under the Retention Agreement, and Employee desires to sell to Employer such rights on the terms set forth in this Agreement. |

| |

5. | Employee’s employment with the Company shall terminate effective September 30, 2015 (the “Termination Date”). |

| |

6. | Except as otherwise provided herein, capitalized terms used in this Agreement shall have the definitions set forth in the Employment Agreement. |

AGREEMENT

Accordingly, in consideration of the mutual covenants contained herein, the parties agree as follows:

Buy-Out Benefits. Subject to Employee executing and not revoking the general release of claims attached hereto as Exhibit A (the “Release”), Employee will be entitled to: (a) cash severance payment equal to an aggregate amount of $1,837,500.00, with such amount to be paid to Employee (or his estate) in accordance with the terms of the Employment Agreement in substantially equal monthly installments until December 31, 2020, with the first installment payable on (or within ten (10) days following) the sixtieth (60th) day following the Termination Date, less in each case any applicable taxes and withholding; (b) continued vesting of any unvested stock options or restricted stock units held by Employee as of the Termination Date, subject only to Employee’s removal from the Board for cause, with continued vesting in all other cases, including, without limitation, continued membership on the Board, termination from the Board voluntarily, death, disability, or any other reason not involving Employee’s removal for cause; (c) a lump sum cash payment in the amount of $700,000.00 less any applicable taxes and withholding, in the event a “change in control” of the Company (as defined in the Retention Agreement) occurs on or prior to January 31, 2016, with such payment to be made within 30 days following such change in control; (d) in his capacity as a director, Employee will remain entitled to periodic secretarial, computer, IT, email or similar support services, including the use and support of the Company’s email system to maintain his current email address, as provided to other non-employee

directors; and (e) Employee will be entitled to access to and use of the Company’s ice rink facilities at 991 Calle Amanecer, San Clemente, CA 92673 (“991 Calle Amanecer”) until December 31, 2020 (or such earlier time as the building at 991 Calle Amanecer is sold by the Company), and in the event the Company determines in its sole discretion to sell the building at 991 Calle Amanecer, it will provide Employee a right of first refusal to purchase such building at the same price and terms (in all material respects) as any other ready, willing and able buyer, with such right of first refusal to be on reasonable terms and conditions, including a review period for Employee to make such determination of not less than 30 days.

Waiver of Board Compensation. Employee waives entitlement to any annual retainer or meeting fees or equity payments made to non-employee members of the Board for their Board service to the extent Employee remains a member of the Board following the Termination Date; provided, however, Employee shall continue to be entitled to all services set forth in Section 1(e) above as well as reimbursement of expenses in accordance with the Company’s policies then in existence for other members of the Board.

Employment Agreement. Except as set forth herein, Sections 5.5, 6, 7 and 8 of the Employment Agreement shall continue in full force and effect from and after the Termination Date. This Agreement and the Employment Agreement constitute the full and entire understanding and agreement between the Parties with regard to the subjects hereof and thereof. In the event of any inconsistency or conflict between the Employment Agreement and this Agreement, the terms, conditions and provisions of this Agreement shall govern and control.

Retention Agreement. The Retention Agreement shall be of no further force and effect from and after the Termination Date.

Successors and Assigns. This Agreement shall be binding upon and inure to the benefit of the Parties and their respective successors, heirs, personal representatives and permitted assigns.

Counterparts. This Agreement may be signed in any number of counterparts and the signatures delivered by telecopy or email attachment, each of which shall be an original, with the same effect as if the signatures were upon the same instrument and delivered in person.

Amendment. Any provision of this Agreement may be amended or waived if, and only if, such amendment or waiver is in writing and signed in the case of an amendment, by all Parties to such agreement, or in the case of a waiver, by the Party against whom the waiver is to be effective.

[Signature page to follow]

IN WITNESS WHEREOF, the parties hereto have executed this Agreement as of the day and year first above written.

ICU MEDICAL, INC.

By: /s/ SCOTT E. LAMB

Title: CFO

/s/ GEORGE A. LOPEZ, M.D,

GEORGE A. LOPEZ, M.D.

EXHIBIT A

GENERAL RELEASE

George A. Lopez, M.D. (“you”) and ICU Medical, Inc. (the “Company”) have agreed to enter into this General Release (“Release Agreement”) on the following terms:

You acknowledge that your employment with the Company terminated effective September 30, 2015 (the “Termination Date”). You further acknowledge that you have received your final paycheck, which includes your final salary or wages and pay for any accrued but unused vacation or personal days through your last day of employment, less withholdings. The parties acknowledge that except as provided for in this Release Agreement, all benefits and perquisites of employment cease as of your last day of employment.

Further, if you execute this Release Agreement to the satisfaction of the Company and return this Release Agreement to the Company within twenty-one (21) days following the Termination Date, and do not revoke the Release Agreement as permitted below, the Company will provide you with the consideration in (i) through (v) below (“Buy-Out Benefits”):

| |

(i) | cash severance payment equal to an aggregate amount of $1,837,500.00, with such amount to be paid to you (or your estate) in equal monthly installments until December 31, 2020 with the first installment payable on (or within ten (10) days following) the sixtieth (60th) day following the Termination Date, less in each case any applicable taxes and withholding; |

| |

(ii) | continued vesting of any unvested stock options or restricted stock units held by you as of the Termination Date, subject only to your removal from the Board for cause, with continued vesting in all other cases, including, without limitation, continued membership on the Board, termination from the Board voluntarily, death, disability, or any other reason not involving your removal for cause; |

| |

(iii) | a lump sum cash payment in the amount of $700,000.00 less any applicable taxes and withholding, paid to you in the event a “change in control” of the Company (as defined in the Retention Agreement) occurs on or prior to January 31, 2016, with such payment to be made within 30 days following such change in control; |

| |

(iv) | in your capacity as a director, you will remain entitled to periodic secretarial, computer, IT, email or similar support services, including the use and support of the Company’s email system to maintain your current email address, as provided to other non-employee directors ; and |

| |

(v) | you will be entitled to access to and use of the Company’s ice rink facilities at 991 Calle Amanecer, San Clemente, CA 92673 (“991 Calle Amanecer”) until December 31, 2020 (or such earlier time as the building at 991 Calle Amanecer is sold by the Company), and in the event the Company determines in its sole discretion to sell the building at 991 Calle Amanecer, it will provide you a right of first refusal to purchase such building at the same price and terms (in all material respects) as any other ready, willing and able buyer, with such right of first refusal to be on reasonable terms and conditions, including a review period for you to make such determination of not less than 30 days. |

You understand and agree that you are not entitled to any compensation, benefits, remuneration, accruals, contributions, reimbursements, bonus, option grant, vesting, or vacation or other payments from

the Company other than those expressly set forth in this Release Agreement, and that any and all payments and benefits you may receive under this Release Agreement are subject to all applicable taxes and withholdings. You further understand and agree that your eligibility for any Buy-Out Benefits is subject to your compliance with the terms and conditions of this Release Agreement.

In exchange for the Buy-Out Benefits, which you acknowledge exceed any amounts to which you otherwise may be entitled under the Company’s policies and practices or applicable law, you and your representatives completely release from, and agree to not file, cause to be filed or pursue against, the Company, its affiliated, related, parent or subsidiary companies, and its present and former directors, officers, and employees (the “Released Parties”) all claims, complaints, grievances or charges of any kind, known and unknown, which you may now have or have ever had against any of them, or arising out of your relationship with any of them, including all claims for compensation and bonuses, attorneys’ fees, and all claims arising from your employment with the Company or the termination of your employment, whether based on contract, tort, statute, local ordinance, regulation or any comparable law in any jurisdiction (“Released Claims”). By way of example and not limitation, Released Claims shall include any claims arising under Title VII of the Civil Rights Act of 1964, the Americans with Disabilities Act, the Age Discrimination in Employment Act (“ADEA”), the federal Worker Adjustment Retraining Notification Act (“WARN Act”) under 29 U.S.C. § 2102 et seq., the California WARN Act, California Labor Code § 1400 et seq., and the California Fair Employment and Housing Act (or any comparable law in any jurisdiction). Finally, you agree that with the exception of your final wages, all other payments and benefits referenced in this Release Agreement are in excess of any amounts to which you otherwise are legally entitled, and that these amounts shall be offset against any state or federal WARN Act (or other) notice or pay in lieu of notice obligation, if any, that the Company may be found to have in the future.

You represent that you have not filed or initiated or caused to be filed or initiated any lawsuits, claims, complaints, administrative grievances or charges against any Released Party in any court or with any government agency. You expressly covenant and warrant that you have not assigned or transferred to any person or entity any portion of any claims that are waived, released and/or discharged herein.

In this paragraph, we provide you with specific information required under the ADEA. You acknowledge that you have received and reviewed any and all information required, if any, by the ADEA/Older Workers Benefit Protection Act pertaining to your termination from the Company. You agree that your release of claims in this Release Agreement includes a knowing and voluntary waiver of any rights you may have under the ADEA. You acknowledge that you have been given an opportunity to consider for twenty-one (21) days the terms of this Release Agreement, although you may sign beforehand, and that you are advised by the Company to consult with an attorney. You further understand that you can revoke your waiver of ADEA claims within seven (7) days of signing this Release Agreement, but that you will not be eligible for any Buy-Out Benefits if you revoke your waiver. Revocation must be made by delivering a written notice of revocation to President at the principal office of Company in the State of California. You acknowledge and agree that for the revocation to be effective, the written notice must be received no later than the close of business (5:00 p.m. P.S.T.) on the seventh (7th) day after you sign this Release Agreement. This Release Agreement will become effective and enforceable on the eighth (8th) day following your execution of this Release Agreement, provided you have not exercised your right, as described herein, to revoke this Release Agreement. You further agree that any change to this Release Agreement, whether material or immaterial, will not restart the twenty-one (21) day review period.

You also agree that because this release specifically covers known and unknown claims, you waive your rights under Section 1542 of the California Civil Code or any other comparable statute of any jurisdiction, which states as follows:

A GENERAL RELEASE DOES NOT EXTEND TO CLAIMS WHICH THE CREDITOR DOES NOT KNOW OR SUSPECT TO EXIST IN HIS OR HER FAVOR AT THE TIME OF EXECUTING THE RELEASE, WHICH IF KNOWN BY HIM OR HER MUST HAVE MATERIALLY AFFECTED HIS OR HER SETTLEMENT TO THE DEBTOR.

Notwithstanding the foregoing, the parties acknowledge and agree that you are not waiving any rights you may have under the Company Indemnification Agreement, any equity-based awards previously granted by the Company to you, to the extent that such awards continue after the termination of your employment with the Company in accordance with the applicable terms of such awards, any rights to continued medical and dental coverage that you may have under COBRA, any rights to payment of benefits that you may have under a retirement plan sponsored or maintained by the Company that is intended to qualify under Section 401(a) of the Internal Revenue Code of 1986, as amended, any rights to payment under Section 5 of the Employment Agreement. You are not waiving or being required to waive any right that cannot be waived as a matter of law, including the right to file a charge with or participate in an investigation by a governmental administrative agency; provided, however, that you hereby disclaim and waive any right to share or participate in any monetary award resulting from the prosecution of such charge or investigation. You further agree that, to the extent permissible by law, you will provide the Company at least five (5) days prior written notice of any such charge or investigation.

You and the Company agree that this Release Agreement is not an admission of guilt or liability on the part of you or the Company under any federal, state or local law, whether statutory or common law. Liability for any and all claims is expressly denied by you and the Company.

Unless otherwise required by applicable law, you and the Company also agree that neither you nor the Company will not make or publish, either orally or in writing, any disparaging statement regarding any Released Parties.

You agree not to disclose any confidential or proprietary information or know‑how belonging to the Company or acquired by you during your employment with the Company as described in your Confidentiality and Inventions Agreement (“CIA”). You acknowledge that the CIA that you signed upon your hire remains in effect after your employment with the Company ends.

You agree that, notwithstanding any other provision of this Release Agreement to the contrary, as a precondition of your eligibility for and receipt of the Buy-Out Benefits, you shall, on or before the Termination Date, return to the Company all Company documents (and all copies thereof) and other Company property that you have had in your possession at any time, including, but not limited to, CD’s, electronic files and/or storage devices, presentations; Company files, notes, drawings, records, business plans and forecasts, financial information, specifications, computer-recorded information, tangible property (including, but not limited to, computers, phones, credit cards, entry cards, identification badges and keys, but excluding your Company issued iPad which you may retain during your continued Board service; and any materials of any kind that contain or embody any proprietary or confidential information of the Company (and all reproductions thereof). Except for information and records deemed reasonably necessary for you to continue to fulfill your duties and responsibilities as a member of the Board, you shall retain no copies of Company records after the date hereof. Any such records have been or will be returned to Company. Upon the Company’s request, you also shall submit to the Company for review, with appropriate precautions taken to observe privacy of personal information, any computer, personal digital assistant, phone, tablet, or any USB drive or other storage device, including but not limited to cloud storage or servers, e.g., DropBox, or personal email, IM, or other communication accounts, whereby you accessed, sent or received, or conducted Company business during your employment.

The parties irrevocably submit to the exclusive personal jurisdiction of the federal courts sitting in the Central District of California in the County of Orange for the purposes of any action arising out of this Release Agreement or any of the transactions contemplated hereby; provided, however, that if such federal courts do not have jurisdiction over such action, such action shall be heard and determined exclusively in any California state court sitting in the County of Orange. The parties irrevocably and unconditionally waive any objection to the laying of venue of any such action in the federal courts sitting in the County of Orange; provided, however, that, if such federal courts do not have jurisdiction over such action, such action shall be heard and determined exclusively in any California state court sitting in the County of Orange, and the parties hereby further irrevocably and unconditionally waive any objection to the laying of venue in such state court and further irrevocably and unconditionally waive and agree not to plead or claim in any such federal or state court that any such action brought in any such court has been brought in an inconvenient forum.

Notwithstanding anything to the contrary in the Release Agreement, to the extent required to comply with Section 409A, no Buy-Out Benefits for which you may be eligible shall be paid or otherwise provided until you have had a “separation from service” within the meaning of Section 409A. Each installment of the Buy-Out Benefits shall be treated as a separate payment for purposes of Section 409A.

The Company shall delay the payment of any amounts under this Release Agreement to the extent necessary to comply with Section 409A(a)(2)(B)(i) of the Code (relating to payments made to certain “specified employees” of certain publicly-traded companies).

The benefits under this Release Agreement are intended to be exempt from or comply with the requirements of Section 409A so that none of the Buy-Out Benefits to be provided hereunder will be subject to the additional tax imposed under Section 409A, and any ambiguities herein will be so interpreted. You ultimately will be responsible for any of your own taxes or similar costs or payments.

This Release Agreement and the Buy-Out Agreement are the only agreements and understandings between you and the Company concerning the subject matters set forth herein and therein, they replace and supersede any and all prior agreements and understandings between us, and they may only be amended in writing signed by you and an authorized representative of the Company. It is agreed that this Release Agreement shall be governed by the laws of the State of California. If any provision of this Release Agreement or the application thereof to any person, place, or circumstance shall be held by a court of competent jurisdiction to be invalid, unenforceable, or void, the remainder of this Release Agreement and such provision as applied to other person, places, and circumstances shall remain in full force and effect.

Finally, by your signature below, you acknowledge each of the following: (a) that you have read this Release Agreement or have been afforded every opportunity to do so; (b) that you are fully aware of the Release Agreement’s contents and legal effect; and (c) that you have voluntarily chosen to enter into this Release Agreement, without duress or coercion, economic or otherwise, and based upon your own judgment and not in reliance upon any promises made by Company other than those contained in this Release Agreement and the Buy-Out Agreement.

[Signature page to the General Release]

UNDERSTOOD AND AGREED:

/s/ George A. Lopez, M.D. DATE: 9/29/15

George A. Lopez, M.D.

/s/ Scott E. Lamb / CFO DATE: 9/29/15

NAME & TITLE

ICU Medical, Inc.

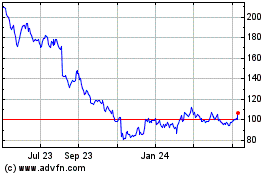

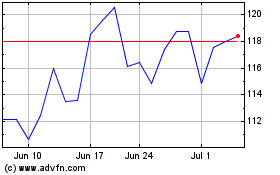

ICU Medical (NASDAQ:ICUI)

Historical Stock Chart

From Mar 2024 to Apr 2024

ICU Medical (NASDAQ:ICUI)

Historical Stock Chart

From Apr 2023 to Apr 2024